07 2011 Health insurance without single crossing: why healthy people have

advertisement

Research Paper

Also available as TILEC DP 2011-037 | http://ssrn.com/abstract=1914473

07

Jan Boone | Christoph Schottmüller

2011

Health insurance without single

crossing: why healthy people have

high coverage

Health Insurane without Single Crossing:

why healthy people have high overage

∗

†

Jan Boone and Christoph Shottmüller

July 7, 2011

Abstrat

Standard insurane models predit that people with high (health) risks have high insurane

overage. It is empirially doumented that people with high inome have lower health risks and

are better insured. We show that inome dierenes between risk types lead to a violation of

single rossing in the standard insurane model. If insurers have some market power, this an

explain the empirially observed outome. This observation has also poliy impliations: While

risk adjustment is traditionally viewed as an intervention whih inreases eieny and raises the

utility of low health agents, we show that with a violation of single rossing a trade o between

eieny and solidarity emerges.

Keywords: health insurane, single rossing, risk adjustment

JEL lassiation: D82, I11

∗

We gratefully aknowledge nanial support from the Duth National Siene Foundation (VICI 453.07.003)

†

Boone:

Department of Eonomis, University of Tilburg, P.O. Box 90153, 5000 LE, Tilburg, The Netherlands;

Tile, CentER and CEPR, email: j.booneuvt.nl. Shottmüller: Department of Eonomis, Tile and CentER, Tilburg

University, email: hristophshottmuellergooglemail.om.

1

1. Introdution

A well doumented problem in health insurane markets with voluntary insurane (like the US) is

1 Standard insurane models (inspired

that people either have no insurane at all or are underinsured.

by the seminal work of Rothshild and Stiglitz (1976) (RS) and Stiglitz (1977)) predit that healthy

people have less than perfet insurane or in the extreme no insurane at all. However, both popular

aounts like Cohn (2007) and aademi work like Shoen, Collins, Kriss, and Doty (2008) show that

2 We

people with low health status are overrepresented in the group of uninsured and underinsured.

develop a model to explain why sik people end up with little or no insurane. We do this by adding

two empirial observations (disussed below) to the RS model: (i) riher people tend to be healthier

and (ii) health is a normal good. Tehnially speaking, introduing the latter two eets an lead to

a violation of single rossing in the model.

Another indiation that the standard RS framework (with single rossing) does not apture reality

well is the following.

The empirial literature that is based on RS does not unambiguously show

that asymmetri information plays a role in health insurane markets. One would expet people to

be better informed about their health risks than their insurers think for example of preonditions,

medial history of parents and other family members or life style.

However, some papers, like for

example Cardon and Hendel (2001) or Dowd, Feldman, Cassou, and Finh (1991), do not nd evidene

of asymmetri information while others do, e.g.

Bajari, Hong, and Khwaja (2006) or Munkin and

Trivedi (2010). The test for asymmetri information employed in these papers is the so alled positive

orrelation test, i.e. testing whether riskier types buy more overage.

We show that the RS model with a violation of single rossing is apable of explaining why healthy

people have better insurane (in equilibrium) than people with a low health status. In partiular the

positive orrelation property no longer holds if single rossing is violated.

Consequently, testing for

this positive orrelation an no longer be viewed as a test for asymmetri information. As mentioned,

we use two well doumented stylized fats to motivate this violation of single rossing in the market

for health insurane.

First, riher people fae lower health risks, see for example Frijters, Haisken-DeNew, and Shields

(2005), Gravelle and Sutton (2009) or Munkin and Trivedi (2010).

1

Potential explanations for this

In empirial studies, underinsurane is dened using indiators of nanial risk.

To illustrate, one denition of

underinsurane used by Shoen, Collins, Kriss, and Doty (2008) is out-of-poket medial expenses for are amounted

to 10 perent of inome or more. In our theoretial model, underinsurane refers to less than soially optimal/eient

insurane.

2

In the words of Shoen, Collins, Kriss, and Doty (2008, pp. w303): underinsurane rates were higher among adults

with health problems than among healthier adults.

2

orrelation between inome and health inlude the following. High inome people are better eduated

and hene know the importane of healthy food, exerise et. Healthy food options tend to be more

expensive and therefore better aordable to high inome people.

Or (with ausality running in the

other diretion) healthy people are more produtive and therefore earn higher inomes.

Aording

to standard insurane models, this would imply that rih people buy less generous health insurane

(ompared to poor people). However, riher people have more generous health insurane, for example,

in the form of lower dedutibles or higher overage.

Evidene for this an be found in Munkin and

Trivedi (2010), Finkelstein and MGarry (2006), Kuttner (1999) or DeNavas-Walt, Protor, and Smith

(2008) where the extreme form of underinsurane is emphasized: Low inome itizens are more likely

to have no health insurane at all.

The seond stylized fat is that health is a normal good. The eet of inome on treatment hoie

is well doumented in the medial literature.

The main emphasis in this literature is that patients

with low inome annot aord treatment even if they have a presription by their dotor.

Piette,

Heisler, and Wagner (2004b, p. 384) for instane report that from a sample of hronially ill diabetes

patients A total of 19% of respondents reported utting bak on mediation use in the prior year due

to ost [. . . ℄. Moreover, 28% reported forgoing food or other essentials to pay mediation osts. By

extrapolating from their sample to the US population Piette, Heisler, and Wagner (2004a, p. 1786)

onlude that 2.9 million of the 14.1 million Amerian adults with asthma (20%) may be utting bak

on their asthma mediation beause of ost pressures. They also doument for a number of hronial

onditions that people from low inome groups are muh more likely to report foregoing presribed

treatment due to osts.

3 Further examples an, for instane, be found in Goldman, Joye, and Zheng

(2007).

For the eet of insurane overage on treatment hoie, Shoen, Collins, Kriss, and Doty (2008,

pp. w305) report that [b℄ased on a omposite aess indiator that inluded going without at least one

of four needed medial are servies, more than half of the underinsured and two-thirds of the uninsured

reported ost-related aess problems. A similar piture emerges in the international omparison by

Shoen, Osborn, Squires, Doty, Pierson, and Applebaum (2010).

4 Hene, low inome people with high

opayments will tend to forego treatment or hoose heaper treatment options.

Single rossing means that people with higher health risks have a higher willingness to pay for

3

For most hroni diseases people with inome less than $ 20000 are roughly 2 (5) times more likely to forego presribed

treatment due to osts than people with an inome between $ 20000 and $ 40000 (more than $ 60000); see table 3 in

Piette, Heisler, and Wagner (2004a) for details.

4

Li and Trivedi (2010) also show that marginal utility of health insurane overage is inuened by both inome and

risk fators.

3

marginally inreasing overage, e.g.

reduing opayments.

If this property holds for all possible

overage levels, a given indierene urve of a high risk type an ross a given indierene urve of a

low risk type at most one. To see why the stylized fats above an lead to a violation of single rossing,

onsider the following. At full overage (indemnity insurane that pays for all medial osts) high risk

(low health) types will tend to spend more on treatments than low risk types. Hene a small redution

in overage, leads to a bigger loss in utility for high risk types. Now onsider health insurane with

low overage where the insured faes substantial opayments. Beause health is a normal good, it is

possible that the rih-healthy type spends more on treatment than the low inome, low health type.

In that ase, a small hange in overage has a bigger eet on the utility of the healthy type than of

the low health agent. The healthy type will therefore have a higher willingness to pay for a marginal

inrease in overage than the low health type. This violates single rossing.

We show that in insurane models without single rossing higher health risks are not neessarily

assoiated with more overage while this predition is inevitable with single rossing. Not only leads

this to preditions that are loser to empirial observations (as doumented above), it also has lear

poliy impliations. We illustrate this with risk adjustment.

Risk adjustment is used by the sponsor (government or employer) of a health insurane sheme to

redue expeted ost dierenes between types. Based on observable harateristis (like age, gender

5 the health insurer is subsidized (taxed/subsidized less) for ustomers with high (low) expeted

et.)

osts. This is used in a number of ountries like Australia, Canada, Germany, Ireland (until 2008),

The Netherlands, South Afria and the USA (see Ellis (2007) and Armstrong, Paolui, MLeod, and

Van de Ven (2010)) in both mandatory state insurane and voluntary private insurane. The two main

goals of risk adjustment are eieny and fairness (or solidarity); see Van de Ven and Ellis (2000) for

an overview of the literature on risk adjustment and the way it is used in pratie.

Indeed, in the

standard RS model, these two goals go in hand in hand. Starting from zero risk adjustment, inreasing

the subsidy to the high risk onsumer inreases both eieny and the utility of people with low health

status. Hene the sponsor of the health insurane sheme does not need to hoose between these two

objetives. As we show below, this is no longer the ase with a violation of single rossing.

In partiular, when single rossing is violated, risk adjustment will either inrease eieny (by

reduing o-payments for high risk types) or inrease the utility of high risk types; but not both.

Hene when designing the risk adjustment sheme, the sponsor needs to be expliit whether the goal is

eieny or solidarity. In other words, with a violation of single rossing there is a trade o between

eieny and equity.

5

Clearly, observable harateristis are not a perfet preditor of risk type. Glazer and MGuire (2000) show how the

imperfetion of the signals should be taken into aount when designing the risk adjustment sheme.

4

The literature on violations of single rossing is relatively sare. There are three papers analyzing

perfetly ompetitive insurane markets with

2×2

types: People dier in two dimensions and both

dimensions an either take a high or a low value. In Smart (2000) the two dimensions are risk and risk

aversion. Netzer and Sheuer (2010) model an additional labor supply deision and the two dimensions

are produtivity and risk. Wambah (2000) models both wealth and risk. All papers have a pooling

result, i.e. if single rossing does not hold two of the four types an be pooled. Our paper ontributes

by deviating from the perfet ompetition assumption.

We show that under imperfet ompetition

types annot only be pooled but high risk types might get even less overage in equilibrium than low

risk types.

Jullien, Salanie, and Salanie (2007) take a dierent approah to answer the question why high risk

types might have lower overage in general insurane markets. They use a model where types dier

in risk aversion and single rossing is satised. Hene, types with higher risk aversion will have more

overage in equilibrium. At the same time more risk averse agents might engage more in preventive

behavior. If types are still separated in equilibrium and risk aversion dierenes remain the driving

fore, high risk aversion types will exhibit less risk (due to prevention) and higher overage. Similar

lines of reasoning an be found in Hemenway (1990) and De Meza and Webb (2001).

Sine risk in the health setor is exogenously dierent for dierent persons (e.g. due to genetis),

we follow RS and take a dierent starting point than Jullien, Salanie, and Salanie (2007). We assume

risk dierenes instead of risk aversion dierenes. The result that high risk people have low overage

is in our paper not the result of low risk aversion. The driving fore is the violation of single rossing

aused by empirially doumented inome dierenes between high risks and low risks.

Finally, our paper is related to the industrial eonomis literature on non-linear priing in oligopoly

(see, for instane, Armstrong and Vikers (2001), Stole (1995) and Stole (2007)). This literature fouses

on the welfare eets of non-linear priing in imperfetly ompetitive markets. Our ontribution to

this literature is to do omparative stati analysis with respet to risk adjustment. In other words, our

paper has positive (testable) impliations for non-linear priing in oligopoly. Moreover, whereas the

insurane papers mentioned above fous on either perfet ompetition or monopoly, we atually analyze

all three ases: perfet ompetition, monopoly and oligopoly. As one would expet, the assumptions

on the ompetitive situation matter for the results.

In the following setion, the model is introdued and illustrated with an example. Then equilibrium

in monopoly and oligopoly is derived. Thereafter we introdue risk adjustment and show the trade o

between eieny and solidarity in ase single rossing is violated. We onlude with the impliations

of our model for so alled advantageous seletion. Proofs are relegated to the appendix.

5

2. Insurane model

This setion introdues a general model of health insurane that allows us to onsider both the ase

where single rossing (SC) is satised and the ase where it is not satised (NSC). The setion onludes

with a model where SC is not satised beause of inome dierenes between onsumer types. Whereas

the RS model predits that people with high expeted health are expenditures have generous overage

in their insurane, we allow for the ase that these people annot aord suh generous insurane.

Following RS, we onsider an agent with utility funtion

6

or generosity of her insurane ontrat,

θ ∈ {θ l , θ h }

with

θh > θl > 0

u(q, p, θ) where q ∈ [0, 1]

p ≥ 0 denotes the prie of insurane (insurane

denotes the type of onsumer.

q h = q l = 1;

sense of higher expeted osts (in ase

denotes overage

7 Higher

θ

premium) and

denotes a higher risk in the

see below). This ould, for instane, be the ase

due to hroni illness or higher risk due to a geneti preondition. We make the following assumptions

on the utility funtion.

Assumption 1

0.

The utility funtion

We dene the indierene urve

u(q, p, θ) is ontinuous

p(q, u, θ)

and dierentiable. It satises

uq > 0, up <

as follows:

u(q, p(q, u, θ), θ) ≡ u

We assume that these indierene urves

p(q, u, θ)

(1)

are dierentiable in

q

and

u

with

pq = −uq /up >

0, pu = 1/up < 0.

Further, the rossing at

q=1

satises:

pq (1, uh , θ h ) > pq (1, ul , θ l )

for all

ul ≥ ūl = u(0, 0, θ l ), uh ≥ ūh = u(0, 0, θ h ).

In words, utility

For given type

θ

u

is inreasing in overage

and utility level

yield the same utility.

u,

q

and dereasing in the premium

the indierene urve

Beause higher

q

requires a lower prie. Thus, raising

Apart from literal overage where

1/(1 + dedutible).

u

1−q

p(q, u, θ)

leads to higher utility,

Hene, indierene urves are upward sloping in

6

(C1)

(q, p)

p

p

paid for insurane.

maps out ombinations

(q, p)

that

inreases to keep utility onstant.

spae (pq

> 0).

Inreasing

shifts an indierene urve downwards (pu

denotes the agent's opayments

q

u

(for given

q)

< 0).

ould, for example, be interpreted as

Note that in models without moral hazard both parameters are similar in the sense that high risk

types dislike o-payments and dedutibles more relative to low risk types.

7

We follow RS and muh of the risk adjustment literature in assuming that there are only two types. For an analysis

of a violation of single rossing with a ontinuum of types

θ,

6

see Araujo and Moreira (2010) and Shottmüller (2011).

k ∈ {h, l}

Type

buys insurane if it leads to a higher utility than her outside option

outside option is given by the empty insurane ontrat:

This

q = p = 0.

q = 1 a marginal redution in q should be ompensated by a bigger derease in p for θ h ompared

At

to

ūk .

θl.

This reets the fat that the

θh

type faes higher expeted health are expenditures. At

q = 1,

i.e. at full overage, other fators like willingness to pay for treatment (whih ould be dierent for

dierent types) play no role. In this sense, this assumption denes what higher

higher

θ

means: at

q = 1,

types fae higher expeted osts. With the same idea we assume that expeted osts for the

insurer of a ontrat with

all

θ

uh ≥ ūh , ul ≥ ūl .

q=1

is higher for the

u

Intuitively,

θh

than for the

θl

type:

c(1, uh , θ h ) > c(1, ul , θ l )

for

should not matter for health are onsumption at full overage and

the high risk type will use the insurane more.

To allow for inome eets (for instane, in treatment hoie; see below) the ost funtion depends

on

u.

However, we assume two regularity onditions.

Assumption 2

For eah type

• cu (q, uk , θ k ) ≥ 0

for

k ∈ {h, l}

and

q ∈ [0, 1]

we assume that

uk ≥ ūk ,

• c(1, uk , θ k ) = c(1, ũk , θ k ),

for

uk , ũk ≥ ūk .

In words, as the inome of the agent inreases (whih eteris paribus leads to higher utility), the

agent has more money to spend on treatment. As the insurer pays a fration

q ≥ 0 of these treatments,

this leads to (weakly) higher osts for the insurer. Seond, osts at full overage (q

in utility.

Intuitively, if

q = 1

uk ≥ ūk .8

Beause of (C1), the single rossing ondition reads

9

pq (q, uh , θ h ) > pq (q, ul , θ l ) > 0

uh ≥ ūh , ul ≥ ūl

suh that

an indierene urve of type

do not vary

treatments are for free for the agent and there is no reason to forgo

treatments, irrespetive of the level of

and

= 1)

θh

for all

p(q, uh , θ h ) = p(q, ul , θ l ).

q ∈ [0, 1]

The intuition is the following.

intersets with an indierene urve of type

Then (SC) implies that the slope of the

θh

(SC)

θl

Suppose

in some point

(p, q).

indierene urve will be higher. It follows that these two

indierene urves an interset only one.

We onsider both the ase where (SC) is satised and the ase where it is violated (denoted by

NSC). In both the SC and NSC ases, we maintain the assumption that

level (EI) for eah type

8

q = 1 is the eient

insurane

θ ∈ {θ l , θ h }.

By assumption 3 full overage is soially desirable.

Hene we do not onsider the ase where insurane leads to

ineieny by induing over-onsumption of treatments.

9

This is also alled sorting, onstant sign or Spene-Mirrlees ondition (Fudenberg and Tirole (1991, pp. 259)).

7

Assumption 3

For a given utility level

uk ,

welfare (and therefore prots) are maximized at full ov-

erage, i.e.

max p(q, uk , θ k ) − c(q, uk , θ k )

(EI)

q∈[0,1]

is maximized by

q=1

for eah

k ∈ {h, l}

and

uk ≥ ūk .

This basially means that the insurane motive, i.e. transferring risk from a risk averse agent to a

risk neutral insurer, is not overruled by other onsiderations. To illustrate, we do not assume that the

low inome agent's preferene for health/treatment is so low that foregoing insurane would be soially

optimal. Put dierently, we assume that full insurane is soially desirable. Underinsuranewith no

insurane as extreme aseresults therefore not from rst best but from informational distortions and

prie disrimination motives.

Our motivation for making this assumption is twofold. First, this assumption simply normalizes

the soially eient insurane level in the same way as in RS. Hene, we only deviate from the RS

set up by allowing for both SC and NSC. Seond, we want to argue that under realisti assumptions,

θh

types have less than full insurane. If the optimal insurane level is atually below one, than this

result would follow rather trivially.

10 We show that with the

The literature on insurane models onsiders mostly perfet ompetition.

assumptions made so far, perfet ompetition implies

market power on the insurane side is needed to get

qh = 1

q h < 1.

(even if (SC) is not satised). Hene,

Following the RS denition of the perfet

ompetition equilibrium, we require that (i) eah oered ontrat makes nonnegative prots and (ii)

given the equilibrium ontrats there is no other ontrat yielding positive prots.

Proposition 1

If an equilibrium exists under perfet ompetition then

q h = 1.

As is well known, existene of equilibrium in the RS framework is not guaranteed. Equilibrium does

not exist if the only possible (separating) equilibrium is broken by a pooling ontrat. If the fration

of

θh

type agents in the population is high enough, then suh a deviation to a pooling ontrat is not

protable and an equilibrium exists. If an equilibrium exists, it has

q h = 1.

The proposition shows that even with violations of single rossing, high risk types will get (weakly)

higher overage than low risk types. Hene we need to deviate from perfet ompetition to get

qh < ql .

This proposition is in some sense reminisent of Wambah (2000), Smart (2000) and Netzer and Sheuer

(2010): these papers analyze perfetly ompetitive insurane markets and a reverse order, i.e. riskier

types have less overage, is impossible in these papers.

10

See Jak (2006) and Olivella and Vera-Hernández (2007) for exeptions using a Hotelling model to formalize market

power on the insurer side of the market. These papers assume that (SC) is satised and hene nd eient insurane

for the

θh

type.

8

Corollary 1

Whenever

qh < ql

is observed, insurers have market power.

Although previous models of insurane markets assume perfet ompetition, reent researh for

the US (see Dafny (2010)) shows that health insurers do have market power. More generally, in most

ountries where health insurane is provided by private ompanies, these rms tend to be big (due to

eonomies of sale in risk diversiation). Hene one would expet them to have some market power.

In order to analyse the ontrats oered by insurers with market power, we expliitly introdue the

inentive ompatibility (IC) onstraints for eah type

p(q l , ul , θ l ) ≥ p(q l , uh , θ h )

(ICh )

p(q h , uh , θ h ) ≥ p(q h , ul , θ l )

The rst onstraint implies that the ontrat intended for

θh

(weakly) lower indierene urve for

That is, the inequality implies

(ICl )

θh

(q h , p(q h , uh , θ h )))

(i.e.

than the ontrat that is meant for the

u(q h , ph , θ h ) ≥ u(q l , pl , θ h )

Similarly, the seond inequality implies that

where

θl

type

pi = p(q i , ui , θ i )

lies on a

(q l , p(q l , ul , θ l )).

i ∈ {h, l}.

with

u(q l , pl , θ l ) ≥ u(q h , ph , θ l ).

Irrespetive of the mode of ompetition and whether (SC) holds, we have the following result that

we use below.

Lemma 1

sheme

At least one type has full overage. If the types are separated under the optimal ontrat

(q l , pl ), (q h , ph )

with

q l 6= q h ,

then at most one inentive onstraint binds.

We onlude this setion with a model where SC is violated due to dierenes in inome between

types. The idea of the model is that for

q < 1 people have

to nane part of the osts of treatment out

of their own poket and low inome agents may deide to hoose heaper treatment or forgo treatment

altogether. This eet is doumented in the medial literature, see for example Piette, Heisler, and

Wagner (2004b), Piette, Heisler, and Wagner (2004a) or Goldman, Joye, and Zheng (2007).

In partiular, we assume that a type

(density) funtion

F (s|θ)(f (s|θ)).

no treatment. Lower health states

worse health than the

low

s

θl

We take

s

set

H(s)

where

is ompat and

s=1

H(s)

s ∈ [0, 1]

as the state in whih the agent is healthy and needs

θh

then for the

s<1

θl

F (s|θ h ) > F (s|θ l )

for eah

for eah

s ∈ h0, 1i.

she an inrease her health by treatment

h ∈ H(s)

lead to higher health states than not falling ill. If

and eah

H(s)

9

θh

type has

In words,

type.

denotes the set of possible treatments in state

s+h ≤ 1

with distribution

orrespond to worse health. The assumption that the

One an agent reeives a health shok

s + h,

onsumer faes health shok

type an now be stated as

states are more likely for the

health level

θ

s ∈ [0, 1].

s.

h ∈ H(s)

to

We assume that the

That is, treatment annot

is a singleton, the onsumer has no treatment

hoie. If the set

q < 1,

H(s)

has more than one element, low inome onsumers with partial insurane, i.e.

may deide to hoose heaper treatment than if they have full insurane, i.e.

h̄(s) = max{h ∈ H(s)}

as the best possible treatment and assume that

This means that a less aited agent (high

an agent who is more seriously ill (low

Let

w(θ)

s).

s < 1)

If

We dene

is non-inreasing in

s.

annot inrease his health by treatment more than

0 ∈ H(s),

denote the wealth (or inome) of a type

u(q, p, θ) =

h̄(s)

q = 1.

θ

an agent an forgo treatment altogether.

agent. Then we write

1

Z

{v(w(θ) − p − (1 − q)h(s, q, θ), s + h(s, q, θ))}dF (s|θ)

0

where

h(s, q, θ)

(2)

is dened as:

h(s, q, θ) = arg max v(w(θ) − p − (1 − q)h, s + h)

h∈H(s)

where

v(y, h)

is the utility funtion of an agent whih depends on onsumption of other goods (y ) and

health (h). We assume that

vhy ≥ 0.

v(y, h)

satises

vy , vh > 0, vyy , vhh < 0

and that health is a normal good:

That is, utility inreases in both health and onsumption of other goods at a dereasing rate.

As inome inreases, people's preferene for health inreases as well. Further, we assume that inome

and health status are negatively orrelated:

w(θ h ) ≤ w(θ l ).

This negative orrelation is empirially

doumented, for example, in Frijters, Haisken-DeNew, and Shields (2005), Gravelle and Sutton (2009)

or Munkin and Trivedi (2010).

Using this notation we an write

c(q, u, θ) = q

Z

1

h(s, q, θ)dF (s|θ)

(3)

0

The rst order ondition for an interior solution

h(s, q, θ) ∈ H(s)

an be written as

(1 − q)vy (w(θ) − p − (1 − q)h(s, q, θ), s + h(s, q, θ)) = vh (w(θ) − p − (1 − q)h(s, q, θ), s + h(s, q, θ))

(4)

To see the impliations of this model for single rossing, onsider the slope of the indierene urves

in

(q, p)-spae:

uq

pq (q, u, θ) = −

=

up

In words, the slope

on state

s

pq

R1

0

vy (w(θ) − p − (1 − q)h(s, q, θ), s + h(s, q, θ))h(s, q, θ)dF (s|θ)

R1

0 vy (w(θ) − p − (1 − q)h(s, q, θ), s + h(s, q, θ))dF (s|θ)

equals the weighted average of treatment

h(s, q, θ)

over the states

vy (w(θ) − p − (1 − q)h(s, q, θ), s + h(s, q, θ))f (s|θ)

R1

0 vy (w(θ) − p − (1 − q)h(s, q, θ), s + h(s, q, θ))dF (s|θ)

(where the weights integrate to 1).

10

s

(5)

with weight

(6)

s + h̄(s) = 1

To illustrate (C1) assume that

(treatment makes a patient healthy again),

11 then it is

routine to verify that

R1

0

pq (1, u, θ) =

vy (w(θ) − p, 1)h̄(s)dF (s|θ)

=

R1

0 vy (w(θ) − p, 1)dF (s|θ)

where the last equality follows from the fat that

h(s, 1, θ) = h̄(s)

that

for both types. If treatment is free (q

is high) ompared to

θl.

1

(1 − s)dF (s|θ)

0

vy (w(θ) − p, 1) is onstant in s.

= 1)

θh

(h̄(s)). The stohasti dominane assumption implies that

h̄(s) = 1 − s

Z

Note that we use here

eah agent uses the highest treatment

puts more weight on low

s

states (where

Hene under these assumptions, ondition (C1) is satised.

(SC) is satised if there are no wealth dierenes between types, i.e.

w(θ h ) = w(θ l ),

and

H(s)

satises some regularity ondition.

The idea is that without wealth dierenes, (4) yields for both

types the same optimal treatment.

Put dierently,

h(s, q, θ)

is independent of

θ.

If patients hoose

θh

more treatment in worse health states, single rossing will be satised: due to stohasti dominane,

s states with high h(s).

types have higher weight (6) on low

types for all

q ∈ [0, 1].

s

is onvex for eah

Treatment

h(s, q, θ)

and non-inreasing in

Hene

pq

in (5) is higher for

is indeed non-inreasing in

s.12

s

if

H(s)

θh

than for

is well behaved:

θl

H(s)

It then follows from equation (4) using the impliit

funtion theorem that

(−(1 − q)2 vyy + 2(1 − q)vyh − vhh )

Hene from the assumptions on

v

it follows that

dh

= vhh − (1 − q)vyh

ds

h(s, q, θ)

(7)

is non-inreasing in

s.

As

H(s)

is non-

inreasing, this also holds true for boundary solutions where the impliit funtion theorem annot be

used.

However, if

w(θ h ) < w(θ l )

then

q <1

an imply that

h(s, q, θ h ) < h(s, q, θ l ).

This follows from

equation (4), sine

−(1 − q)vyy + vhy

dh

=

>0

dw

−(1 − q)2 vyy + 2(1 − q)vyh − vhh

Hene, if

h(s, q, θ l ) ∈ H(s)

In words, sine a fration

θh

is an interior maximum, the

1−q

type tends to hoose lower treatment

Alternatively, we an assume that

h̄′ (s) ∈ h−1, 0i

suh that

θl

type (as health is a normal good). Sine

s + h̄(s)

is inreasing in

ill, treatment does not bring bak full health. Then a suient ondition for (C1) is

that

′

h̄ (s) = 0,

h̄(s2 ) ≤ h̄(s1 )

then

for

pq (1, ·)

would be the same for both types.

s1 ≤ s2 ). vyyh ≥ 0

12

We say that the set

exists

′

h ∈ H(s1 )

guarantees that

vy

′

h̄ (s) < 0

s.

In words, if an agent falls

vyyh ≥ 0:

Suppose it were the ase

will now put more weight on low states (as

is inreasing less in

l

s

for the high type. Hene, putting more

h

vy is low aets the θ type less than the θ type. Consequently, (C1) is satised.

H(s) is non-inreasing in s if for eah s1 , s2 with s1 ≤ s2 we have that for eah h ∈ H(s2 )

weight on low states where

suh that

′

h ≥ h.

h.

of the treatment ost has to be paid by the insured, a low inome

patient may hoose heaper treatment than the riher

11

θh

(8)

As a speial ase this inludes the possibility that

′

h (s) < 0.

11

H(s) = h(s)

there

is a singleton, with

he does not utilize the insurane as muh as the (rih) low risk type, type

willingness to pay for insurane overage (for

q

q

θh

has a lower marginal

lose to zero). However, for high levels of overage, i.e.

lose to 1, wealth dierenes matter less in the treatment hoie beause the patient does not have

to pay (muh) for the treatment. Consequently, although (C1) is satised with

w(θ h ) < w(θ l ),

(SC)

an be violated.

h ∈ H(s)

Hene, this model where agents dier in inome and treatment hoie

is endogenous

an generate the violation of (SC) mentioned above. In the next setion, we give a numerial example

where (SC) is indeed violated.

3. Example

As an example of an utility funtion that satises the assumptions (C1) and (EI) above and violates

(SC), onsider the following mean-variane utility set up.

There are two states of the world:

of falling ill is denoted by

F h = 0.07 > 0.05 = F l .

13

An agent either falls ill or stays healthy.

F h (F l < F h )

for type

θ h (θ l ).

The probability

In the numerial example, we hoose

One an agent falls ill, the set of possible treatments is denoted by

The utility of an agent of type

i = h, l

with treatment hoie

h ∈ {h, h̄}

H = {h, h̄}.

is written as:

u(q, p, θ i ) = F i (v(h, θ i ) − (1 − q)h) + (1 − F i )v(1, θ i ) − p

− 12 r i F i (1

where

v(h, θ i )

denotes the utility for type

i

i

− F )(v(1, θ ) − v(h, θ ) + (1 − q)h)

i = h, l

of having health

h

and

ri > 0

risk aversion. Hene an agent's utility is given by the expeted utility minus

u

denotes the degree of

1 i

2 r times the variane in

the agent's utility. This is a simple way to apture that the agent is risk averse.

Along an indierene urve where

(9)

2

i

14

is xed, we nd the following slope:

dp

= F i h(q, θ i ) + r i F i (1 − F i )(v(1, θ i ) − v(h(q, θ i ), θ i ) + (1 − q)h(q, θ i ))h(q, θ i )

dq

13

For the Python ode used to generate this example, see:

http://sites.google.om/site/janboonehomepage/home/webappendies .

14

When an agent of type i buys a produt at prie p that gives utility v ,

utility of inome for agent

i

α

(10)

i.

First, overall utility an be written as

an dier. Low inome types are then modelled to have high

an write

i

v − αp

formalization with

where

α = 1.

α

i

α

there are two ways to apture the marginal

i

v−αp

where

v

is the same for eah type

i

; high marginal utility of inome. Alternatively, one

is the same for all types. Then low inome types have low

vi .

We have hosen the latter

The assumption that treatment is a normal good is then implemented by assuming that

v(h̄, θh ) − v(h, θh ) < v(h̄, θl ) − v(h, θl ).

12

and

where

h(q, θ i )

h

is the solution for

solving

max v(h, θ i ) − (1 − q)h

h∈{h,h̄}

In words, one an agent falls ill, she deides whih treatment to hoose based on the benet

and the out-of-poket expenses

v(h, θ i )

(1 − q)h.

With the parameter values that we onsider below, it is the ase that

r h F h (1 − F h )(v(1, θ h ) − v(h̄, θ h ))h̄ = r l F l (1 − F l )(v(1, θ l ) − v(h̄, θ l ))h̄

In words, at

dp/dq

q=1

(where both types hoose the highest treatment

type equal

θh

h̄ = 0.6, h = 0.2

v(1, θ h ) = 0.9, v(h̄, θ h ) = 0.7, v(h, θ h ) = 0.45

1.1, v(h̄, θ l ) = 0.9, v(h, θ l ) = 0.5.

the

θl

θl

and the assoiated utilities for the

and similarly for the

type hooses

h̄

even if

θl

q=0

for low values of

the value for

q

q.

suh that the

In partiular, for

θh

θl

type as

q

q=0

type ompared

θh

type. Sine

q > 0).

This

does not aet treatment hoie and higher

we have

θh

type hooses

h̄

v(h̄, θ h ) − h̄ < v(h, θ h ) − h.

type is indierent between treatment

h̄

and

if

q =1

Let

q̃

h(q, θ h ) = h̄.

θh

Then inreasing overage

hene (EI) is satised for

q > q̃ .

q

h:

(12)

type, we proeed in two steps. First, onsider

q > q̃

redues the variane in utility for the risk averse

Now onsider

q < q̃

suh that

h(q, θ h ) = h.

but

denote

v(h̄, θ h ) − (1 − q̃)h̄ = v(h, θ h ) − (1 − q̃)h

To verify that (EI) is satised for the

θh

v(1, θ l ) =

type:

(and the inequality is strit for

leads to more insurane (provided by a risk neutral insurer). The

h

θl

type is willing to spend more on treatment than the

implies that ondition (EI) is satised for the

prefers

F h h̄ > F l h̄.

Hene, having high health is more important for the

type. This implies that

0.9 − 0.6 ≥ 0.5 − 0.2

q

the variane terms in the slope

(equation (10)) are equalized. Hene assumption (C1) is satised beause

For the numerial example we assume

to the

h̄)

(11)

θh

suh that

type and

In order to satisfy (EI), it

must be the ase that prots (prie minus expeted osts) when oering full overage are higher than

prots when oering a partial overage ontrat yielding the same utility. This an be written as:

F h (v(h̄, θ h ) − h̄) + (1 − F h )v(1, θ h ) − uh − 12 r h F h (1 − F h )(v(1, θ h ) − v(h̄, θ h )2 ≥

F h (v(h, θ h ) − h) + (1 − F h )v(1, θ h ) − uh − 21 r h F h (1 − F h )(v(1, θ h ) − v(h, θ h ) + (1 − q)h)2

Note that the right hand side of this inequality inreases in

example, we hoose

satised for all

15

rh

q ≤ q̃

Given this value of

q and hene is highest at q̃ .

suh that the inequality holds with equality at

and hene (EI) is satised.

rh , rl

is hosen to satisfy equation (11).

13

q = q̃ .15

In our numerial

This implies that it is

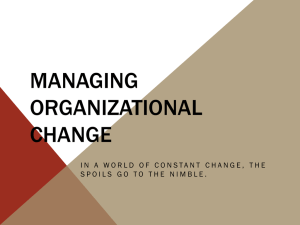

With the parameter values above, it is routine to verify that (SC) is violated. Figure 1 below shows

two indierene urves for the

indierene urve for the

θl

θl

type (in red) and one for the

type is steeper than for the

type buys the expensive treatment

the

θh

type happens at

q̃

where the

while the

θh

θh

type (in blue). Indeed, for

type buys

h.

θl

type swithes from the heap to the more expensive treatment.

θh

are worth more to the

fat, the gure shows that for

q > q̃ ,

the indierene urve for the

θl

the

The kink in the indierene urve for

q > q̃

the

q < q̃

type. This is due to the fat that the

for

Hene small inreases in

q

h̄

θh

θh

type than small inreases in

θh

q < q̃ .

In

type is steeper than the one for

type. This is the violation in single rossing.

Hene in a simple mean-variane utility framework, it is straightforward and intuitive to generate

a violation of (SC).

4. Insurane market monopoly

This setion derives a simple result in a monopoly setting within the general redued form framework

of setion 2. The motivation for analyzing the monopoly ase is proposition 1: An equilibrium with

qh < ql

an only exist if insurane ompanies have market power.

Although the extreme ase of a

monopoly is not very realisti, it allows to derive a lear ut result and gives some intuition for the

more realisti ase of an oligopoly whih will be analyzed in the following setion.

Proposition 2

highest

The type with the highest willingness to pay for full overage, i.e. the type

p(1, ūk , θ k ),

obtains a full overage ontrat in an insurane monopoly.

θk

with

Either his inentive

ompatibility or his individual rationality onstraint is binding (or both). The other type's individual

rationality onstraint is binding.

Let

θk

denote the type with the highest willingness to pay for full overage. It follows from the

proposition that

θk

obtains a ontrat

(q, p) = (1, pk )

outome is now pinned down by the hoie of

onstraints are binding.

If

pk = p(1, ū−k , θ −k ),

separates the types and

In this ase, type

pk .

θ −k

both types are pooled.

θ −k

If

for some

pk ≤ p(1, ūk , θ k ).

pk = p(1, ūk , θ k ),

then both individual rationality

might be exluded, i.e.

If

The monopoly

θ −k

gets the ontrat

pk ∈ hp(1, ū−k , θ −k ), p(1, ūk , θ k )i,

(0, 0).

the equilibrium

gets an insurane ontrat with partial overage. The optimal level of

is determined by the share of

θk

pk

types in the population.

A diret impliation of proposition 2 is that high risk types will always have full overage if single

rossing is satised.

To see this, note that the indierene urve orresponding to

individual rationality onstraint) goes through the origin

14

(p, q) = (0, 0)

ūk

(that is the

for both types. With (SC) the

indierene urve of the high risk type is steeper and lies therefore above the individual rationality

onstraint of the low risk type for all overage levels.

Without single rossing this is no longer the ase. Figure 1 shows indeed that in our numerial

example the low risk type has a higher willingness to pay for full overage than the high risk type.

Therefore, a monopolist will give full overage to low risk types in our example.

separated, we nd that

If the types are

q h < q l = 1.

5. Insurane market oligopoly

This setion haraterizes equilibrium in a duopoly insurane market. Again the general redued form

model introdued in setion 2 is used. We illustrate with the example from setion 3 that equilibria

with

qh < ql

exist if single rossing is violated.

There are three reasons why we hoose to onsider an oligopoly insurane market. First, proposition

1 shows that with perfet ompetition it is impossible to have

q h < 1.

Seond, as mentioned above,

assuming a monopoly market is not very realisti. We are not aware of a ountry where health insurane

is provided privately by a monopolist. Third, in ountries like Germany or the Netherlands, insurane

is mandatory and the government runs a risk adjustment sheme. The next setion analyzes the eets

of risk adjustment on eieny and solidarity. If there is mandatory insurane, risk adjustment has

no eet on the outome at all in ase of monopoly. The reason is that the monopolist serves all types

and hene risk adjustment is a lump sum transfer for a monopolist insurer. As we show below, risk

adjustment (even if the whole market is served, as with mandatory insurane) does aet the market

outome in ase of oligopoly.

The demand share of insurer

[0, 1].

j ∈ {a, b}'s

produt on market

i ∈ {h, l}

is written as

D(uij , ui−j ) ∈

This funtion is the same for both types. That is, agents only dier in expeted health are

osts and inome, not in their preferenes over insurers.

16 We make the following natural assumption

on demand.

Assumption 4

D1 (uij , ui−j ) > 0, D2 (uij , ui−j ) < 0

An insurer gains market share if it oers onsumers higher utility and loses market share if its opponent

oers higher utility. Let

16

φ ∈ [0, 1]

denote the share of

θh

See Bijlsma, Boone, and Zwart (2011) for an analysis where

15

θh

types in the population.

and

θl

have dierent demand elastiities.

When insurer

b

hooses

uhb , qbh , ulb , qbl ,

the maximization problem for insurer

a

an be written as

max φD(uh , uhb )(p(q h , uh , θ h ) − c(q h , uh , θ h ))

uh ,q h ,ul ,q l

+ (1 − φ)D(ul , ulb )(p(q l , ul , θ l ) − c(q l , ul , θ l ))

l

l

l

l

h

(Puh ,ul )

b

h

b

+ µh (p(q , u , θ ) − p(q , u , θ ))

+ µl (p(q h , uh , θ h ) − p(q h , ul , θ l ))

We fous on a symmetri pure strategy equilibrium of this problem where

ulb = ul , qah = qbh = q h

(Puh ,ul ) with

b

b

uhb = uh

and

and

qal = qbl = q l .

ulb = ul .

That is,

(uh , q h , ul , q l )

We assume that problem

is haraterized by the rst order onditions for

uha = uhb = uh , ula =

is a solution to

(Puh ,ul )

(Puh ,ul ):

problem

is onave suh that a solution

q h , q l , uh , ul :17

∂p(q h , uh , θ h ) ∂p(q h , ul , θ l )

∂(p(q h , uh , θ h ) − c(q h , uh , θ h ))

+

µ

(

−

)=0

l

∂q h

∂q h

∂q h

∂(p(q l , ul , θ l ) − c(q l , ul , θ l ))

∂p(q l , ul , θ l ) ∂p(q l , uh , θ h )

(1 − φ)D(ul , ul )

+

µ

(

−

)=0

h

∂q l

∂q l

∂q l

∂(p(q h , uh , θ h ) − c(q h , uh , θ h ))

φD1 (uh , uh )(p(q h , uh , θ h ) − c(q h , uh , θ h )) + φD1 (uh , uh )

∂uh

∂p(q l , uh , θ h )

∂p(q h , uh , θ h )

−µh

+

µ

=0

l

∂uh

∂uh

∂(p(q l , ul , θ l ) − c(q l , ul , θ l ))

(1 − φ)D1 (ul , ul )(p(q l , ul , θ l ) − c(q l , ul , θ l )) + (1 − φ)D(ul , ul )

∂ul

l

l

l

∂p(q , u , θ )

∂p(q l , uh , θ l )

+µh

−

µ

=0

l

∂ul

∂ul

φD(uh , uh )

(13)

(14)

(15)

(16)

It follows from lemma 1 together with the assumption that (Puh ,ul ) is onave that in any separating

b

b

equilibrium, exatly one IC onstraint is binding. Hene either

µh > 0

µ = 0

l

or

µh = 0

µ > 0

l

and

p(q l , ul , θ l ) = p(q l , uh , θ h )

(17)

h h h

and p(q , u , θ )

≥

p(q h , ul , θ l )

and

p(q l , ul , θ l ) ≥ p(q l , uh , θ h )

and

p(q h , uh , θ h ) = p(q h , ul , θ l )

(18)

We dene the following three ases as solutions to equations (13)-(16):

h

l

l

(H) (uh

H , qH , uH , qH )

h

l

l

(L) (uh

L , q L , uL , q L )

17

solves (13)-(16) with

solves (13)-(16) with

µh > 0, µl = 0,

µh = 0, µl > 0

and

The onavity assumption an be stated in terms of the bordered Hessian of problem (Puh ,ul ). However, it is more

b

b

onveniently stated after some more notation is introdued. This is done in equations (30) and (33) below.

16

h

l

l

(P) (uh

P , q P , uP , q P )

solves (13)-(16) with

µh = µl = 0.

It is straightforward to verify that in ase of pooling (P) we have

are interested in the ase where

q h 6= q l

q < 1.

However, we

(as this is the relevant ase in pratie). Further, below we

onsider the role of risk adjustment to enhane eieny.

for one type we have

qPh = qPl = 1.

This is only relevant for the ase where

Hene we will ignore the pooling ase from here onwards and fous on

separating equilibria (H) and (L).

The following proposition derives suient onditions for an (H) and (L) equilibrium.

Proposition 3

With single rossing, solution (H) is a symmetri equilibrium and we have

qh = 1 > ql .

If single rossing is not satised and

•

the solution

h , ul , q l )

(uhH , qH

H H

p(1, uhH , θ h )

under (H) above satises

p(1, ulH , θ l )

−

=

1

Z

(pq (q, uhH , θ h ) − pq (q, ulH , θ l ))dq ≥ 0

l

qH

then this solution is a symmetri equilibrium and we have

•

the solution

(uhL , qLh , ulL , qLl )

p(1, ulL , θ l )

(19)

qh = 1 > ql

under (L) above satises

−

p(1, uhL , θ h )

=

Z

1

h

qL

(pq (q, ulL , θ l ) − pq (q, uhL , θ h ))dq ≥ 0

then this solution is a symmetri equilibrium and we have

(20)

ql = 1 > qh.

The ondition (19) [(20)℄ in the (H) [(L)℄ outome makes sure that (ICl ) [(ICh )℄ is satised as

well. If (SC) is satised, equation (ICl ) is automatially satised for the following reason. Beause of

inentive ompatibility, the two equilibrium indierene urves have to ross somewhere. Under (SC)

the high type's indierene urve is steeper there (and onsequently above the low type's urve for

slightly higher

q ).

By (SC) there is no other intersetion and therefore the high type's indierene

urve is above the low type's also at

the

for

θh

q

q = 1.

Hene ondition (19) is satised. Without single rossing,

indierene urve is less steep than the

θl

indierene urve for low

q

and the other way around

lose to 1. In that ase, we need to hek expliitly in the solution whether the IC onstraint that

was ignored is indeed satised.

To prove existene of the (H) and (L) equilibria in an oligopoly framework, it is suient to give

an example for eah. The existene of (H) equilibria in oligopoly is already established in the literature

through models satisfying the single rossing assumption, see for example Olivella and Vera-Hernández

(2007).

Here we give an example using the utility setup of setion 3 to demonstrate existene of a

(L) equilibrium with oligopoly. Reall from proposition 1 that there is no (L) equilibrium with perfet

ompetition.

17

Example

On the supply side we assume that there are two insurers loated at the end

(ont.)

points 0 and 1 of a Hotelling line. Agents are uniformly distributed over the

at position

x ∈ [0, 1]

inurs transportation ost

insurer oers a menu of ontrats

θh

type, the seond for the

θl

xt ((1 − x)t)

{(q h , ph ), (q l , pl ), (0, 0)}

[0, 1]

interval. An agent

when buying from insurer

a (b).

Eah

where the rst ontrat is intended for the

type and the third ontrat denotes the agent's outside option of not

buying insurane at all (whih will not be used in equilibrium).

We will show that it is straightforward to nd examples with a (L) equilibrium. The easiest way to do

this is to nd parameter values suh that the individual rationality (IR) urve (that is, the indierene

urve

p(q, ū, θ))

for the

θl

type lies everywhere above the IR urve for the

θh

type. As shown in gure 1

this is the ase for the parameter values hosen in setion 3. Clearly the Hotelling equilibrium ontrats

have to lie on or below the relevant IR urves.

φ = 0.

First, assume that

θl

In words, there are only

(beause of assumption 3) and the Hotelling equilibrium prie on the

This ontrat is denoted

θ l 's

ontrat lies below

φ = 0)

in the gure) and

θ l -market

(1, pl )

ontrat:

ulhotel. = u(1, pl , θ l ).

Contrat

is dened by the intersetion of indierene urve

θ h 's

equals

in gure 1 for the parameter values in setion 3 and

IR urve it is, indeed, the equilibrium outome. Let

level assoiated with the

by anyone as

(1, pl )

ql = 1

types. Then it is routine to verify that

IR urve. This is the best ontrat on

θ h 's

ulhotel.

(q h , ph )

pl = F l h̄ + t.18

t = 0.018.

denote

As this

θ l 's

utility

(although not bought

p(q, ulhotel. , θ l )

(dashed urve

θ l 's

IR urve that satises

inentive

ompatibility onstraint.

φ

Now inrease

ql = 1 > qh.

slightly to

φ > 0

(but small).

For this to be an equilibrium we need that the indierene urve for the

lies above the indierene urve for the

for the

θh

urve at

θ l 's indierene

q = 1.

small hanges in

above

θh

type at

h

h

type (p(q, uhotel , θ )) annot lie above

equilibrium is that

IR

We laim that this results in a (L) equilibrium with

θ h 's IR

φ

urve

q = 1.

θ h 's

θl

type at

q=1

Note that the equilibrium indierene urve

IR urve. Hene a suient ondition for a (L)

p(q, ulhotel. , θ l )

at the new Hotelling equilibrium lies above

θ h 's

We formally show that this is the ase in lemma 3 in the appendix. Intuitively,

will lead to small hanges in the indierene urve

urve at

q=1

in ase

φ = 0,

it will be above

θ h 's IR

p(q, ulhotel. , θ l ).

As this urve is

urve for small positive values of

φ.

Hene a straightforward way to generate (L) equilibria is to nd examples where the

for the

and

θl

φ>0

type lies above the

IR

onstraint for the

θh

type for eah

q ∈ h0, 1].

IR onstraint

Then there exist

t>0

suh that the example has an (L) equilibrium.

Having proved the existene of a (L) equilibrium, we move to the poliy impliations of suh an

18

Reall that in a Hotelling model with onstant marginal osts

instane, Tirole (1988, pp. 280).

18

c,

the equilibrium prie is given by

c + t.

See, for

0.07

h

p(q, ū

h

,

)

l

l

p(q, ū ,

l

l

(1,p )

)

p(q,uhotel.,

l

)

p

0.00

h

(q

0.0

h

,p

0.2

)

0.4

0.6

0.8

1.0

q

Figure 1: Example with parameter values in setion 3 and

t = 0.018

equilibrium.

6. Risk adjustment

Above we have shown that an equilibrium an exist where

θh

types have less than full insurane. This

is in line with the empirial ndings mentioned in the introdution where people with low inome and

low health status have less generous insurane than people with high inome and good health. In this

setion, we show what the poliy impliations are of an equilibrium with

q h < 1.

In partiular, risk

adjustment is often presented as a win-win poliy: Starting from a separating equilibrium it inreases

both the utility of people with bad health (solidarity with those unluky enough to be born this way)

19

and it inreases equilibrium overage (eieny).

That is, when it omes to risk adjustment, there is no trade o between eieny and distributional

objetives for the government. The papers and ountry poliies surveyed in Van de Ven and Ellis (2000)

see risk adjustment as serving both eieny and fairness or solidarity. We show below that under a

19

The underlying assumption is that the

θh

type was born with, say a hroni disease like diabetes. Hene

θh 's

high

expeted health are osts are exogenously given. Then fairness or solidarity onsiderations an lead the planner to give

a higher weight than

λ

to the

θh

type in the objetive funtion. Alternatively, high health are osts an be endogenous

due to, for example, smoking behavior, food habits, drug use et. See Van de Ven and Ellis (2000) for a disussion of

the limits to solidarity due to suh moral hazard eets.

19

20 However, in the NSC

relatively mild assumption, this result holds in an oligopoly model with SC.

ase, the same assumption implies that there is a trade o between eieny and solidarity. In that

qh

ase it is not possible for risk adjustment to inrease both

ase (with

q h < 1),

and

uh .

Hene in the empirially relevant

the sponsor has to hoose expliitly whether the goal is eieny or solidarity.

Risk adjustment annot promote both goals.

We model risk adjustment as follows. The sponsor, say the government, of the health insurane

sheme pays an insurer

ρh (ρl )

for eah of its ustomers that are of type

government an perfetly observe eah ustomer's type.

In ase (H), we write the prots of insurer

a

θ h (θ l ).

We assume that the

21

as follows:

Π(uha , ula , ρ, uhb , ulb ) = φD(uha , uhb )(π(uha , θ h ) + ρh ) + (1 − φ)D(ula , ulb )(π(ula , uha , θ l ) + ρl )

where we use the following denition of the funtions

prot margins on the

θh

and

θl

π

(21)

(with a slight abuse of notation) apturing the

markets resp.:

π(uh , θ h ) = p(1, uh , θ h ) − c(1, uh , θ h )

(22)

π(ul , uh , θ l ) = p(q l (ul , uh ), ul , θ l ) − c(q l (ul , uh ), ul , θ l )

with

q l (ul , uh ) the value of q l that solves equation (ICh ) with equality.

If (SC) is satised, dierentiating

the binding (ICh ) yields

dq l

pq (q l , ul , θ l ) − pq (q l , uh , θ h )

= −pu (q l , ul , θ l )

dul

and hene

dq l

<0

dul

(23)

sine the left hand side is negative by (SC) and the right hand side is positive by assumption 1 (pu

< 0).

Using a similar derivation, one an show in this ase that

dq l

>0

duh

In words, inreasing

Inreasing

20

21

ul

uh

(24)

relaxes the (ICh ) onstraint thereby allowing for higher

does the opposite and hene leads to lower

ql

(for given

ql

(for given

ul ).

uh ).

Selden (1998) makes this point using a model with perfet ompetition where single rossing holds.

This assumption is usually justied by assuming that the government has (ex post) more information than the insurer

ex ante. Hene the insurer is not able to (expliitly) selet risks ex ante but the government an perfetly risk adjust ex

post. Alternatively, the insurer has the relevant information but is prevented by law to at upon this information. To

illustrate, in the Netherlands an insurer annot refuse a ustomer who wants to buy a ertain insurane ontrat. As

mentioned, Glazer and MGuire (2000) show how optimal risk adjustment an work with imperfet signals of ustomers'

types. In the latter ase, the government annot perfetly observe eah ustomer's type.

20

In ase (L) we have:

Π̃(uha , ula , ρ, uhb , ulb ) = φD(uha , uhb )(π̃(uha , ula , θ h ) + ρh ) + (1 − φ)D(ula , ulb )(π̃(ula , θ l ) + ρl )

where we use the following denition of the funtions

(25)

π̃ :

π̃(ul , θ l ) = p(1, ul , θ l ) − c(1, ul , θ l )

(26)

h

l

h

h

h

l

h

h

h

h

l

h

h

π̃(u , u , θ ) = p(q (u , u ), u , θ ) − c(q (u , u ), u , θ )

with

q h (uh , ul )

being the value of

urve is steeper than the

θh

qh

that solves equation (ICl ) with equality.

indierene urve at

qh,

If the

θl

indierene

we nd with a similar derivation as above that

dq h

<0

duh

dq h

>0

dul

In this ase, raising

Let

Πi

ul

(27)

qh

relaxes the (ICl ) onstraint and hene allows for higher

denote the derivative of

Π

with respet to its

i-th

argument.

(for given

uh ).

Then for the (H) ase, a

symmetri equilibrium (fousing on an interior maximum) is haraterized by

Π1 = Π2 = 0

whih we

write as

φD1 (uh , uh )(π(uh , θ h ) + ρh ) + φD(uh , uh )π1 (uh , θ h ) + (1 − φ)D(ul , ul )π2 (ul , uh , θ l ) = 0

(1 − φ) D1 (ul , ul )(π(ul , uh , θ l ) + ρl ) + D(ul , ul )π1 (ul , uh , θ l ) = 0

(28)

(29)

together with the seond order onditions:

Π11 < 0, Π22 < 0

(30)

Π11 Π22 − Π212 > 0

The interpretation of the rst order ondition with respet to

inreasing

uha

slightly, insurer

earns the margin

π h + ρh .

leads to lower prots (π1

the rm an raise

ql

a

On the inframargin, however, inreasing

< 0).

Finally, there is the eet of

The rst order ondition with respet to

θl

(equation (28)) is as follows.

inreases the demand for its produt on the

and still satisfy (ICh ). Hene

marginal eets on the

uha

ul

uh

uh

uh

on the

θh

By

market on whih it

(or equivalently reduing

ph )

θl

uh ,

market. By inreasing

aets the prots on the

θl

market.

(equation (29)) only features the marginal and infra-

market.

In the (L) ase, we have

Π̃1 = Π̃2 = 0

whih we write as

φD1 (uh , uh )(π̃(uh , ul , θ h ) + ρh ) + φD(uh , uh )π̃1 (uh , ul , θ h ) = 0

(1 − φ) D1 (ul , ul )(π̃(ul , θ l ) + ρl ) + D(ul , ul )π̃1 (ul , θ l ) + φD(uh , uh )π̃2 (uha , ula , θ h ) = 0

21

(31)

(32)

together with the seond order onditions:

Π̃11 < 0, Π̃22 < 0

(33)

Π̃11 Π̃22 − Π̃212 > 0

The interpretation of the rst order onditions with respet to

equilibrium. The only dierene is that in this ase

ul

uh

and

ul

is the same as in the (H)

has the additional eet on the

θh

market via

the (ICl ) onstraint.

We use the following assumption that we disuss below.

Assumption 5

Assume that both markets are fully overed:

D(uij , ui−j ) + D(ui−j , uij ) = 1

for

i = h, l.

Consider hanges in risk adjustment with a xed budget:

φ

dρh = dρ, dρl = − 1−φ

dρ

suh

that

φdρh + (1 − φ)dρl = 0

Then we assume that in symmetri equilibrium

uh (ρ), ul (ρ)

(34)

it is the ase that

duh (ρ) dul (ρ)

<0

dρ

dρ

(35)

Health insurane is a produt of whih one buys one unit or zero. In fat, it is often not allowed

to buy more than one insurane ontrat due to moral hazard problems (see Pauly (1974)). We follow

the literature on ompetition with prie disrimination and assume that both markets are fully overed

(this is alled full sale ompetition by Shmidt-Mohr and Villas-Boas (1999) and pure ompetition

by Stole (1995)).

When risk adjustment is implemented at the ountry level, it usually goes hand

in hand with mandatory insurane (e.g.

as in the Netherlands).

Indeed, if insurane would not be

mandatory, a ross subsidy (due to risk adjustment) may indue the net payers to forgo insurane

thereby reduing the eieny of the insurane market.

If risk adjustment is organized at the rm

level (as, for instane, in the US with big employers) the sheme is usually so attrative (due to tax

breaks) that the assumption of full sale ompetition is not an unreasonable one. The advantage of

making this assumption is that the budget onstraint for hanges in risk adjustment an simply be

written as (34).

Assumption (35) states that if an inrease in

assumption: as

less for

θl

ρh

ρ

l

raises

uh ,

then it dereases

ul .

inreases (ρ dereases) one expets insurers to ompete more for

types) and hene

uh

inreases (u

This is a natural

θh

types (ompete

l dereases). We are espeially interested here in the (L)

22

equilibrium. Lemma 4 in the appendix veries that for the example above this assumption is indeed

22

satised.

We further motivate this assumption in two ways. The rst is to assume that the planner hoosing

ρ

has an objetive funtion

f (uh (ρ), ul (ρ))

that is inreasing in both

solution to this optimization problem with respet to

f1

hene

ρ

uh

and

ul

(i.e.

A

is haraterized by

duh (ρ)

dul (ρ)

+ f2

=0

dρ

dρ

duh (ρ)

dul (ρ)

and

have opposite signs. In words, the planner hooses a value of

dρ

dρ

insurane on the Pareto frontier in

f1 , f2 > 0).

(uh , ul )

spae. Put dierently, if a hange in

ρ

ρ

that plaes the

an raise the utility

of both types, the planner exhausts suh possibilities. Then, at the margin, there is trade o between

uh

and

ul .

The seond way to motivate inequality (35) is in terms of equilibrium seletion.

assumption 5 rules out that there exists another equilibrium lose by in whih both

In partiular,

uh

and

ul

are

lower.

Lemma 2

Assume that

D1 (u, u)

Let

uh , ul

is independent from the level of

u

denote a symmetri equilibrium. Dene the following set

Bε (uh , ul ) =

q

ũh < uh , ũl < ul | (uh − ũh )2 + (ul − ũl )2 < ε

If assumption 5 holds, then for

ε > 0

small enough, the set

Bε (uh , ul )

(36)

does not ontain another

symmetri equilibrium.

The assumption implies that in symmetri equilibrium the slope of a rm's demand funtion is not

aeted by the level of

u.

This assumption is satised in the Hotelling example that we use in this

paper.

The lemma exludes the possibility that lose to the symmetri equilibrium

another equilibrium with lower values for both

uh

and

ul .

uh , ul

there would be

Clearly, suh an equilibrium would be more

protable for both insurers beause a rst order Taylor expansion implies that

Π(ũh , ũl , ρ, ũh , ũl ) = Π(uh , ul , ρ, uh , ul ) + (Π1 (uh , ul , ρ, uh , ul ) + Π4 (uh , ul , ρ, uh , ul ))(ũh − uh )

+ (Π2 (uh , ul , ρ, uh , ul ) + Π5 (uh , ul , ρ, uh , ul ))(ũl − ul )

= Π(uh , ul , ρ, uh , ul ) − Π4 (uh , ul , ρ, uh , ul )(uh − ũh ) − Π5 (uh , ul , ρ, uh , ul )(ul − ũl )

> Π(uh , ul , ρ, uh , ul )

22

The proof of lemma 4 is given after the proof of lemma 2 below to avoid dupliation. That is, we rst derive some

general results in the ontext of lemma 2 and then apply these to the example in lemma 4.

23

ũh,l

for

lose enough to

Π4 , Π5 < 0.

uh,l ;

Π1 = Π2 = 0

where we have used the stationarity onditions

And similarly for prot funtion

Π̃.

and

In this sense, assumption 5 rules out a loal multipliity

of equilibria leading to a oordination problem between insurane providers.

Now we an show the following.

Proposition 4

Let

uh , ul

denote the utility levels for type

p(q, uh , θ h )

that the indierene urves

between

uh

and

p(q, ul , θ l )

θh, θl

in a symmetri equilibrium. Assume

have one point of intersetion. Then the relation

and eieny is as follows:

•

if

q h = 1,

a hange in

ρ

whih raises

ql

also inreases

•

if

q l = 1,

a hange in

ρ

whih raises

qh

redues

uh ;

uh .

The assumption that the indierene urves orresponding to the equilibrium values of

one is by denition satised if (SC) holds.

uh , ul

ross

SC implies that any indierene urves ross at most

one. In the NSC ase, we need a bit more struture. In gure 1 the assumption is satised. In fat,

the following reasoning shows that a model with more than one intersetion point will not be very

intuitive.

that

In the (L) equilibrium, (20) implies that

pq (1, ul , θ l ) < pq (1, uh , θ h ).

pq (q h , uh , θ h ).

pq (q, uh , θ h )

p(1, ul , θ l ) > p(1, uh , θ h ).

Hene, at the rst intersetion point (at

for

q < qh.

Hene, in the ase where

θl

q

lose to zero, the low inome

θh

qh = 1

deides to put relatively more weight on the

in suh a way that both

uh

and

23

we nd that (at the margin) solidarity (with the unluky

l

ql

θh

type (i.e.

f1

f (uh , ul )

θh

type)

above: if the planner

inreases relatively to

f2 ),

she will hange

inrease.

However, if single rossing is violated and we have

q h < 1,

then it is not possible to raise both

uh

In other words, in this ase there is a trade o between solidarity and eieny.

The violation of (SC) is vital to get this result: At

steeper than the slope of the indierene urve of

23

pq (q, ul , θ l ) <

type deides to spend more on

type. This does not seem very reasonable.

and eieny (q ) go hand in hand. In terms of the objetive funtion

qh.

pq (q h , ul , θ l ) >

As the slope is related to the treatment hoie in our model with inome

treatment than the high inome

and

we have

To generate another intersetion point, we need again a swith in slopes

dierenes, this would imply that for

ρ

qh)

Further, (C1) implies

θh.

(ph , q h )

the slope of

one intersetion point and then strengthen assumption 3 to read that

in an (H) equilibrium and

q.

indierene urve is

qh

(eieny) is valued

Therefore, an inrease in

Another way to put more struture on outomes in the NSC ase is the following.

rms will hoose the intersetion point with highest

θ l 's

k

k

One an allow for more than

k

p(q, u , θ ) − c(q, u , θk )

It is routine to verify that this gives

pq (q h , ul , θl ) > pq (q h , uh , θh )

is inreasing in

l

h

h

q.

Then

l

pq (q , u , θ ) > pq (q , ul , θl )

in an (L) equilibrium. Under this assumption, the results in

proposition 4 hold as well.

24

1

A

B

p

q > 0

0

0

Figure 2:

higher by the

θl

1

q

A hange in risk adjustment whih inreases

type. Consequently, the utility of

θh

q.

qh

an only be inreased if

is redued as otherwise

inentive ompatibility fails.

Figure 2 illustrates this graphially. The lines

and

θh

A

and

B

denote parts of indierene urves of a

type. The intersetion of these lines gives the overage

q

of the type that has less than full

overage. Given assumption (35), a hange in risk adjustment that inreases

downwards and the

urve of the

determines

θh

ql .

B

urve upwards. In the (H) equilibrium, the (steeper)

type. The

B

urve is the indierene urve of the

Hene inreasing

ql

and

uh

qh

A

θh

A

has to shift the

A urve

urve is the indierene

type. The point of intersetion

urve is the indierene urve of the

then requires that the indierene urve

utility for the

θl

q

go hand in hand.

However, in the (L) equilibrium the steeper

reasing

θl

B

for the

θh

θl

type. In-

type shifts upwards. That is, the

type falls.

7. Conlusion

Standard insurane models, e.g.

Rothshild and Stiglitz (1976) or Stiglitz (1977), predit higher

overage for agents with higher risks. We show that this predition no longer holds if single rossing

is violated and rms have market power.

In the health are setor agents with higher inome have lower risks and more insurane.

Put

dierently, the preditions of the standard insurane model with single rossing are ontradited by

25

the data.

We show that the negative orrelation between inome and risk an ause a violation of

single rossing. With a violation of single rossing, the empirial ndings in the health literature an

be reoniled with a standard insurane model.

We show the poliy impliation of suh a violation of single rossing for risk adjustment.

The

traditional insurane model (with single rossing) views risk adjustment as a measure inreasing eieny as well as solidarity, i.e. overage levels are loser to rst best and low health agents are better

o. Without single rossing there is a trade o between these two poliy goals. This implies that the

sponsor of the health insurane sheme has to be expliit about the goals of risk adjustment.

From an empirial point of view, our paper asts doubt on the positive orrelation test: Given our

result that separating equilibria exist in whih agents with higher risk have less overage (negative

orrelation), it is evident that the results of suh a test have to be interpreted with are. In partiular

suh a test annot be used to test for the presene of asymmetri information when single rossing is

violated.

We onlude with a disussion of advantageous seletion. This an be modeled by assuming that

people dier in their preferenes for risks.

If high risk individuals are less risk averse than low risk

people, it an happen that onsumers who are willing to pay the most for health insurane are people

with low expeted health are osts. Hene oering health insurane with high overage is espeially

attrative for agents with low expeted osts: advantageous seletion.

The impliation of some ad-

vantageous seletion models is that poliies that stimulate insurane overage are welfare reduing. In

fat, there may be over-insurane in equilibrium. See Einav and Finkelstein (2011) for a reent review

of advantageous seletion and empirial papers doumenting this in health are markets.

In our model (in the (L) equilibrium), we also see that at the margin low risk types are willing

to pay more for insurane than high risk types. This is aused by the fat that at less than perfet

overage, low inome, high risk types tend to redue expenditure on treatments. Basially, they annot

aord the treatments that they need. Hene, although the equilibrium is an advantageous seletion

equilibrium, in our model stimulating insurane overage (e.g. through mandatory insurane at full

overage) is eient (beause of assumption 3).

26

Referenes

Araujo, A.,

and

H. Moreira (2010):

Adverse Seletion Problems without the Spene-Mirrlees

Condition, Journal of Eonomi Theory, 145(5), 11131141.

Armstrong, J., F. Paolui, H. MLeod,

and

W. Van de Ven (2010): Risk equalisation in

voluntary health insurane markets: a three ountry omparison, Health Poliy, 98, 3949.

Armstrong, M.,

and

J. Vikers (2001):

Competitive prie disrimination, RAND Journal of

Eonomis, 32(4), 579605.

Bajari, P., H. Hong,

and

A. Khwaja (2006): Moral hazard, adverse seletion and health expen-