Oshkosh Corporation RECOMMENDED ACTION Current Price:

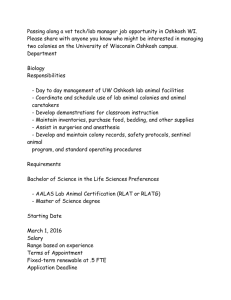

advertisement

Oshkosh Corporation RECOMMENDED ACTION Investment Thesis Oshkosh Corporation is a leading manufacturer of industrial trucking equipment, generating over $6 billion in revenues from four operating segments. The company’s adoption of lean manufacturing principles, as well as its focus on new product development is what gives Oshkosh its sustainable competitive advantage. As a result, Oshkosh maintains a significant operating margin advantage over its competition, and I believe that this company is extremely undervalued at this time. I feel that the current macroeconomic environment will yield moderate growth for the Industrials sector as a whole, with Oshkosh performing better than the overall sector. With the substantial amount of downward pressure the stock has recently experienced, I believe there is very little downside risk in owning this stock. 260 2007 2006 2005 2003 Recommendation: BUY Updated: 8/12/08 Analyst: Michael Leesburg Fisher College of Business Contact: Email: (740) 464-1077 leesburg.3@osu.edu Sector (S&P): Industry (S&P): 2006 Industrials Trucking Market Cap: 1.3B Shares Outstanding: 73.9M Avg Daily Volume: 1.4M YTD Return: 52 Week High: 52 Week Low: Beta: 161 110 2007 $44.71 STOCK INFORMATION 2,262 1,926 2004 Target Price: Net Incom e (m illions) 204 3,427 2,960 $16.59 Fund: OSU SIM Managers: Royce West, CFA Chris Henneforth, CFA I have assigned Oshkosh a one-year price target of $44.71. The following are key assumptions in supporting this: • The US economy will resume normal growth rates in 1Q 2009 • The Industrials Sector will perform in-line relative to the S&P 500 over the next year • The dollar will slowly weaken through FY 2009, but oil will settle out around $120/barrel • Discounted Cash Flow, Comparative Multiples, and Sum of Parts Analysis support this target price, suggesting that Oshkosh’s intrinsic value is ~120% higher than its current trading price Revenue (m illions) Current Price: ANALYST INFORMATION Summary 6,307 NYSE: OSK 2005 2004 80 2003 -64.1% $63.55 $15.19 2.78 EPS - Diluted (dollars/share) 3.48 2.75 2.18 1.55 1.14 2007 2006 2005 2004 2003 Table of Contents Company Overview……………………………………………………………………...2 Access Equipment……………………………………………………………….3 Defense…………………………………………………………………………..3 Fire and Emergency……………………………………………………………...4 Commercial………………………………………………………………………4 Sector Analysis…………………………………………………………………………...5 Comparative Multiples Evaluation……………………………………………….5 Macroeconomic Factors…………………………………………………………..6 Outlook…………………………………………………………………………...7 Industry Analysis…………………………………………………………………………7 Five Forces Analysis……………………………………………………………...7 Barriers to Entry…………………………………………………………..7 Substitutes…………………………………………………………………7 Buyer Power………………………………………………………………8 Supplier Power……………………………………………………………8 Rivalry…………………………………………………………………….9 Company Analysis………………………………………………………………………...9 Strategy……………………………………………………………………………9 Competitors………………………………………………………………………11 Competitive Advantage………………………………………………………….11 Equity Valuation: Comparitive Multiples………………………………………..12 Absolute Valuation………………………………………………………12 Company vs. Sector Valuation…………………………………………..13 Equity Valuation: Sum of Parts Analysis……………………………………….13 Equity Valuation: Discounted Cash Flow Model……………………………….14 Summary and Recommendations………………………………………………………..14 Key Drivers………………………………………………………………………15 Sensitivity analysis……………………………………………………………….15 Exhibit 1: Exhibit 2: Exhibit 3: Exhibit 4: Oshkosh Products…………………………………………………………….17 Oshkosh Acquisitions………………………………………………………..18 Sum of Parts Analysis………………………………………………………..19 Discounted Cash Flow……………………………………………………….20 1 Company Overview 1 Founded in 1917, Oshkosh Corporation has engaged the engineering, design, and marketing of commercial trucks and other industrial vehicles. The Company is headquartered in Oshkosh, Wisconsin, and in 2006 changed its name from Oshkosh Truck Corporation to de-scope its product lines and better define the Corporation. Oshkosh has completed 15 acquisitions since 1996, and now has four operating segments from which the company generates over $6 billion in annual revenue. Figure 1 shows the breakdown of Oshkosh’s revenues by operating segment for FY 2007: Figure 1: Oshkosh Revenue by Segment Commercial 20% Access Equipment 40% Fire and Emergency 18% Defense 22% Oshkosh maintains a global presence, with operations in the United States, Mexico, and Europe to serve customers all over the world. Table 1 describes the breakdown of revenues by geographic location: 2 Table 1: Sales by Geographic Region (in millions) for FY 2007 United States Other North America Europe, Africa, Middle East Rest of World Total 4745.5 212.8 1083.7 265.3 6307.3 A sample of products that are offered by Oshkosh Corporation can be seen in Exhibit 1. Access Equipment The largest and youngest of the four segments, Access Equipment offers a wide variety of manlifts, aerial work platforms, scissor lifts, and other general maintenance equipment to account for 40% of the company’s sales. This segment was added with the purchase of JLG Industries in 2006, which almost doubled Oshkosh’s revenues. The Access Equipment segment boasts strong operating margins (>10%), but growth is expected to reverse in 2009. Defense The fastest growing segment within Oshkosh is the Defense segment. Tactical trucks, comprised of hauling tanks, missile systems, ammunition, fuel, and cargo for combat units are provided to the Department of Defense. 22% of the Company’s revenues come from this segment, and this share is expected to increase over the next few years. This segment looks to be the most promising of the four over the next few years, with forecasted growth rates of ~15% YOY. Operating margins are also very strong in this segment, with consistent 13+% performance. 3 Commercial Refuse collection vehicles for the waste services industry, front and rear discharge concrete mixers, and portable and stationary concrete batch plants for the ready-mix concrete industry are the primary products offered by the Commercial segment. This segment also provides lease financing to concrete mixer customers, concrete batch plant customers, and commercial waste haulers. Combined, this offering of products and services provides 20% of the Company’s revenues. Sales and margins are expected to retract significantly over the upcoming years, and this segment also took a non-cash write-down of goodwill impairment of $175 million in 3Q 2008. Fire and Emergency Fire and Emergency, the smallest and most diverse of the four segments, provides custom and commercial fire equipment and emergency vehicles to its customers. The product line includes pumpers, aerial and ladder trucks, tankers, rescue vehicles, rough terrain response vehicles, mobile command and control centers, and bomb squad and HAZMAT control vehicles. Towing and recovery equipment, airport snow removal vehicles, custom ambulances, mobile medical vehicles, and custom vehicles for the broadcast and communications industry round out the products and services offered by this operating segment. F&E expects a slight contraction in sales in the near future, and margins in this segment are in the neighborhood of 8%. 4 Sector Analysis2 Oshkosh Corporation is a member of the Industrials Sector, as defined by Standard and Poor’s (S&P). This sector currently looks to be fairly valued from a multiples comparison standpoint. There are several macroeconomic factors that must be considered as well. The performance of this sector is heavily dependent on oil prices, the domestic and global economy, the Department of Defense budget, and commodity prices. Comparative Multiples Evaluation The Industrials Sector shows a mixed level of attractiveness when looking at historical ratios and compared with the S&P 500. A ten year time horizon was used for the Comparative Multiples analysis. The sector appears to be somewhat expensive when looking from a Price/Sales and Price/Book standpoint. However, from a Price/forward Earnings, Price/EBITA, and Price/Cash Flow perspective, the sector looks to be trading at a slight discount. Overall, the sector appears to be fairly valued and boasts a Return on Equity that is currently 20% higher than the SP500 (a 10yr high). Table 2 shows the Comparative Multiples breakdown: Table 2: Industrial sector multiples relative to SP500 Relative to SP500 P/Forward E P/S P/B P/EBITDA P/CF Average High Low Mean Current 1.16 1.13 1.25 1.40 1.18 0.78 0.68 0.78 0.98 0.77 1.00 0.96 1.05 1.18 1.05 0.98 1.03 1.15 1.16 1.02 5 Comparison to Mean -2.00% 7.29% 9.52% -1.69% -2.86% 2.05% Valuation In-line Expensive Expensive In-line In-line In-line Macroeconomic Factors Performance in the Industrials Sector is heavily dependent on a number of macroeconomic factors. Oil prices can have a very large effect on profitability in this sector. Heavy equipment manufacturing requires the transport of very large quantities of raw materials (steel, coal for electricity, etc.) to the operating facilities, and fuel surcharges are a way that the raw material suppliers can pass the increasing shipping costs on to the customers. Typically, the manufacturers can also pass these increasing costs on the end users of the products they sell; however, since the manufacturers will book sales several months in advance, there is always a time lag before the manufacturers are able to see the benefits of such price increases. The health of the domestic economy also plays a large part in the profitability of the sector. As budgets are cut, expenditures on heavy equipment that are not absolutely necessary will likely be pushed out to subsequent years. Low predicted growth in the overall economy in the next year also puts downward pressure on the value of companies in the sector. While I do believe that the economy will experience slowing growth through early 2009, I feel that the domestic economy will recover substantially quicker than consensus. The strength of the dollar also affects companies in the Industrials sector. The dollar’s current weak standing makes goods manufactured in the United States look significantly cheaper than those manufactured in countries with stronger currencies. This effect is much more prevalent with companies that have a greater percentage of sales outside the United States. 6 Outlook I expect the value of the dollar to fall further through Q1 2009. While this will put upward pressure on the price of oil, I believe that demand destruction and slowing consumption growth will mitigate this pressure, and oil will hold fairly constant around $120/barrel. The end result for the Industrials sector is lower than forecast manufacturing costs and higher than forecast sales outside the United States. Industry Analysis Five Forces Analysis Barriers to Entry The Industrial Trucking industry offers significant barriers to entry, which is a negative for a company looking to get into the industry, but a positive for well-established companies such as Oshkosh. Capital costs are very high to build operating facilities, and development of infrastructure to serve a variety of customers would be very time and resource intensive. Substitutes The fact that there are essentially no substitutes for the products offered by the Trucking industry will prove to be advantageous. While planes and tanks may be considered substitutes for the Defense segment, the military will continue to require mobile vehicles to haul equipment and personnel. Stationary manlifts could be substituted for mobile manlifts in a few select industrial applications; however this type of equipment does not offer the flexibility that mobile units offer. As for commercial, fire, and emergency vehicles, the state-of-the-art products offered by the industrial trucking industry will 7 always be a necessity for fire departments, emergency response, and waste collection services. Buyer Power Buyer power is relatively strong in the industrial trucking industry. Switching costs are relatively low, meaning that when the time comes for a customer to purchase a new vehicle, he/she can easily switch based on quality, price, or technology advancements. The industry appears to maintain a relatively firm pricing strategy (evidenced by margin sustainability), not undercutting the competition to gain market share. This strategy has deterred price wars, which could be devastating to the industry. Supplier Power Supplier power is somewhat weak in this industry. Many of raw materials that are used in the manufacture of industrial trucks are commodity-type materials. Much of the steel, plastics, and small parts can be easily substituted for lower cost options. Multiple sourcing is used in many cases to leverage purchasing power. While there are several components that are not commodity-type (ie. new technologies and control systems), due to the customization aspect of the industry, the manufacturers are capable of passing the cost of these higher priced components on to the customer. Rivalry Rivalry is quite low in the industrial trucking industry. While there are several competitors in the industry, there is not an aggressive pursuance to gain market share with pricing. Margins have been strong and relatively stable over the past several years, and the big players in the industry are growing through acquisitions. 8 Outlook The industrial trucking industry as a whole looks to be attractive for well-established companies in the industry. Strong barriers to entry make it difficult for new companies to set up the infrastructure to compete domestically and globally. There are very few adequate substitute products in this industry, and weak supplier power gives large corporations in the industry purchasing advantages. While buyer power is somewhat strong, the companies in the industry are able to differentiate their products and services to increase their products’ value to the customers. Finally, rivalry is relatively low within the industry and companies are able to maintain profit margins. Company Analysis3 Oshkosh Corporation is a leading manufacturer and marketer of specialty vehicles from four business groups: Access Equipment, Defense, Fire & Emergency, and Commercial. The company maintains several major brands that are considered leaders in the market. These brands include Oshkosh, Pierce, JLG, McNeilus, Medtec, Geesink, Norba, JerrDan, CON-E-CO, London, IMT, and Frontline. Oshkosh maintains a corporate strategy of acquisition, product innovation, and operational efficiency through lean manufacturing. The company is currently undervalued in the market, and all indications show the intrinsic value of the company to be more than double its current valuation. Strategy Over the past twelve years, Oshkosh has adopted a diversified business model and focused growth strategies to achieve a CAGR for revenues of approximately 23%. The strategies that Oshkosh has adopted consist of the following key drivers: 9 • • • Commercialize through acquisition Lead in product innovation Embrace lean manufacturing Oshkosh has proven that it is capable of completing acquisitions, successfully integrating the company into the business, and driving growth and cost reductions. Exhibit 2 describes the acquisitions that Oshkosh has completed since 1996. Oshkosh maintains rigid acquisition requirements when evaluating prospective buyout opportunities. These criteria are as follows: • • • • Manufacturers of capital equipment that hold the #1 or #2 position in growing markets Companies that can enhance the current corporate culture and deliver synergies in purchasing, manufacturing, distribution, and product development Companies that are capable of being accretive within the first year of ownership Looking to extend existing product lines to offer a broader selection of products to customers. Product innovation is taken very seriously by Oshkosh Corporation. The company looks to introduce more new products and technologies than its competitors. Oshkosh is a frontrunner in robotic vehicle development, diesel-electric drive technology, and independent suspension systems. The third piece of Oshkosh’s core strategy is to continuously improve operational efficiencies by embracing lean manufacturing. The company launched a lean initiative in FY 2004 in order to enhance its overall cost structure and improve returns on invested capital. 10 Competitors There are only a handful of competitors in the industrial trucking industry. In the commercial segment, Terex is the primary competitor, along with PACCAR and Navistar. Federal Signal competes with the Fire and Emergency segment. Northrup Grumman is a major player in the Defense segment for Oshkosh, and Ingersoll-Rand competes with the company’s Access Equipment segment. While each of these companies competes with Oshkosh in one or two segments, none is as well diversified within the industry as Oshkosh. Competitive Advantage Oshkosh relies on its core strategies to give the company a competitive advantage. Focusing on new products allows the company to be on the leading edge of technology development, and its well-established customer base gives the company quick-entry ability with new technologies. The adoption of lean manufacturing principles allows the company to maximize its cost control and maintain high margins during periods of economic downturns, and its vision of strategic acquisitions allow Oshkosh to leverage synergies to provide continuously increasing stakeholder value. From an operating margin standpoint, Oshkosh also maintains a substantial advantage over its competition, as can be seen in Table 3: 11 Table 3: 2007 Operating Margins Company Oshkosh Ingersoll-Rand Terex Federal Signal Navistar Northrop Grumman PACCAR Operating Margin 9.4% 8.4% 6.7% 5.1% -1.0% NA NA Equity Valuation: Comparative Multiples Absolute Valuation When looking at the multiples (P/E, PS, etc.) and how they compare to historical values, Oshkosh’s stock price looks very attractive. For this analysis, it is assumed that the multiples will revert to the mean. These target prices based on the four multiples were then averaged to develop an Absolute Valuation Target Price of $47.27. The contribution of the absolute valuation to the overall target price will be 30%. While reversion to the mean is a solid assumption, timing is not factored into this analysis, thus making it less accurate than DCF valuation. Table 4 describes the absolute valuation of Oshkosh, along with the target price based on mean reversion: Table 4: Valuation based on Comparative Multiples Absolute Valuation High Low Mean Current Target Multiple P/Forward E P/S P/B P/EBITDA Average 24.00 1.46 5.20 13.90 5.00 0.19 0.80 1.60 13.50 0.60 2.60 7.20 5.00 0.19 0.80 1.60 13.50 0.60 2.60 7.20 12 Target E,S,B, etc per share 3.23 92.80 21.00 4.89 Target Price $43.61 $55.68 $54.60 $35.21 $47.27 Company vs. Sector Valuation When comparing Oshkosh to other companies in the sector, Oshkosh’s current stock price appears very inexpensive. All of the multiples are at their 10 year lows compared with the Industrials Sector as a whole. Table 5 shows how the multiples of Oshkosh compare to the Industrials Sector: Table 5: Oshkosh stock vs. Industrials Sector Stock vs. Sector Valuation P/Forward E P/S P/B P/EBITDA P/CF Average High Low Mean Current 1.41 0.87 1.57 1.60 1.53 0.29 0.13 0.30 0.24 0.31 0.72 0.41 0.78 0.80 0.99 0.40 0.15 0.30 0.24 0.31 Comparison to Mean -44.44% -63.41% -61.54% -70.00% -68.69% -61.62% Valuation Cheap Cheap Cheap Cheap Cheap Cheap Equity Valuation: Sum of Parts Analysis Sum of Parts analysis is used to generate a target price based on the P/S ratios of other companies within similar industries. Competitors used for this analysis include Terex, Navistar, and PACCAR for the commercial segment, Federal Signal for the F&E segment, Northrop Grumman for the defense segment, and Ingersoll-Rand for the access equipment segment. Using this method, a target price of $61.48 has been generated for Oshkosh. This analysis will only account for 20% of the contribution to the overall target price, due to the fact that there are few companies that only focus on one of the four segments that Oshkosh operates in, and the diversity within the companies causes this method to be less accurate than the other valuation methods. Also, this particular sum of parts analysis only looks at sales. The Sum of Parts analysis can be viewed in Exhibit 3. 13 Equity Valuation: Discounted Cash Flow The Discounted Cash Flow model (DCF) is used to generate a target price for Oshkosh based on expected future earnings. Several key assumptions were made in the model and are outlined as follows: • • • • • • The overall domestic economy will remain weak through 1Q 2009, but will return to normal levels of growth The global economy will continue with normal growth rates through 2009. Discount rate of 12.0% - this is set higher than typical discount rates due to higher inherent risk associated with the company Sales in the Access Equipment segment will drop in 2009, but not to the extent of the consensus estimates Growth in Defense segment will continue through 2009 (in-line with consensus) F&E and Commercial segments will see slight retraction in sales through 2009 Using these assumptions, I get a target price for Oshkosh of $36.47. This presents a 120% upside for the stock. The DCF component will make up the largest portion of the overall target stock price (50%). Summary and Recommendations I believe that Oshkosh Corporation is tremendously undervalued in the market. From a macroeconomic standpoint, several of the key economic issues appear to favor the sector and the company. Oil prices have relaxed in the past month, and due to demand destruction and slowing consumption growth, will continue to push downward in the future. While a weakening dollar will put upward pressure on oil, it will not be enough to overcome the slowing rate of demand growth. Oshkosh is well positioned within the industry to take advantage of growing worldwide demand, as well as growing domestic demand in mid-2009 that will be supported by the weakening dollar. Based on these 14 economic conditions, as well as the target price of $44.71 visible in Table 6, I am placing a BUY rating on Oshkosh Corporation. Table 6: Final Target Price for Oshkosh Corporation Target Price Category Discounted Cash Flow Comparative Multiples Sum of Parts Final Target Price Target Price $36.47 $47.27 $61.48 % Contribution 50% 30% 20% Contribution $18.24 $14.18 $12.30 $44.71 Key Drivers The key drivers for the stock include the macroeconomic factors previously discussed, as well as the company’s ability to generate sales growth outside of the US and maintain operating margins. Oshkosh maintains the highest margins in the industry, thus they have more flexibility in making strategic decisions. If sales are present, operating margins will come naturally. However, if sales stagnate, the company may have to take measures such as market related downtime at some operating facilities in order to keep margins elevated. In any event, I feel that Oshkosh will generate the necessary sales and will successfully overcome challenges that may arise. Sensitivity Analysis An in-depth look at sales growth and operating margins reveals that it would take large decreases in growth rates and operating margins to lower the intrinsic value of the company to its current level. Table 7 describes the various target stock prices for different combinations of revenue growth and operating margins in FY 2008. It is 15 evident that it would take 0% revenue growth and 6% operating margin to achieve the intrinsic value for which the stock is currently trading. The same assumptions for 2009 and beyond were used for this analysis as were used in the prior DCF model. While there are many factors that could influence this sensitivity matrix, the table shows that it would take a substantial negative move in these two key areas to devalue the company to its current trading price. Table 7: Effect of Revenue Growth and Margins on DCF Value Revenue Growth Margins 10% 9% 8% 7% 6% 4% $50.96 $43.82 $36.68 $29.54 $22.40 3% $47.30 $40.64 $33.97 $27.31 $20.64 2% $43.92 $37.70 $31.47 $25.25 $19.03 1% $40.79 $34.98 $29.17 $23.37 $17.56 0% $37.90 $32.48 $27.06 $21.64 $16.22 References 1 from oshkoshcorporation.com data from StockVal 3 from oshkoshcorporation.com 2 16