Comcast Corporation Investment Thesis

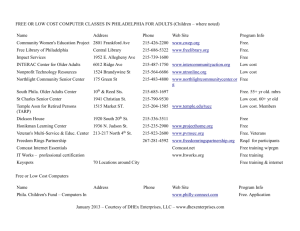

advertisement