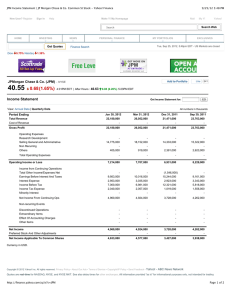

FISHER SIM PROGRAM Equity Research JPMorgan Chase & Co. (JPM)

advertisement