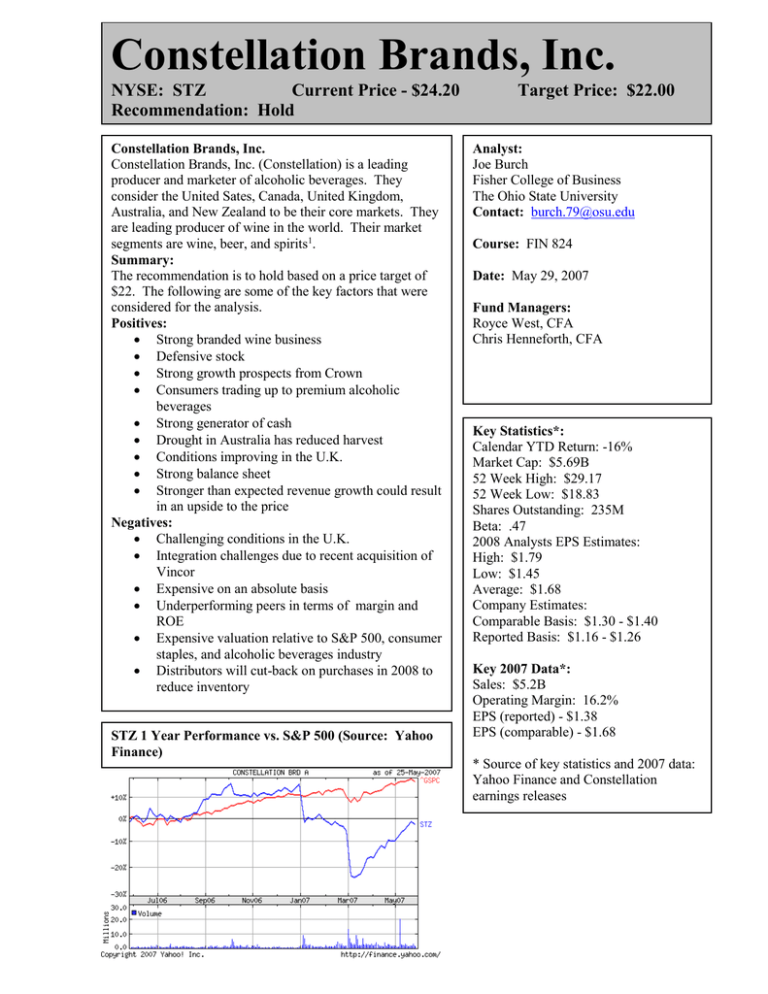

Constellation Brands, Inc. NYSE: STZ Current Price - $24.20

advertisement

Constellation Brands, Inc.

NYSE: STZ

Current Price - $24.20

Recommendation: Hold

Constellation Brands, Inc.

Constellation Brands, Inc. (Constellation) is a leading

producer and marketer of alcoholic beverages. They

consider the United Sates, Canada, United Kingdom,

Australia, and New Zealand to be their core markets. They

are leading producer of wine in the world. Their market

segments are wine, beer, and spirits1.

Summary:

The recommendation is to hold based on a price target of

$22. The following are some of the key factors that were

considered for the analysis.

Positives:

Strong branded wine business

Defensive stock

Strong growth prospects from Crown

Consumers trading up to premium alcoholic

beverages

Strong generator of cash

Drought in Australia has reduced harvest

Conditions improving in the U.K.

Strong balance sheet

Stronger than expected revenue growth could result

in an upside to the price

Negatives:

Challenging conditions in the U.K.

Integration challenges due to recent acquisition of

Vincor

Expensive on an absolute basis

Underperforming peers in terms of margin and

ROE

Expensive valuation relative to S&P 500, consumer

staples, and alcoholic beverages industry

Distributors will cut-back on purchases in 2008 to

reduce inventory

STZ 1 Year Performance vs. S&P 500 (Source: Yahoo

Finance)

Target Price: $22.00

Analyst:

Joe Burch

Fisher College of Business

The Ohio State University

Contact: burch.79@osu.edu

Course: FIN 824

Date: May 29, 2007

Fund Managers:

Royce West, CFA

Chris Henneforth, CFA

Key Statistics*:

Calendar YTD Return: -16%

Market Cap: $5.69B

52 Week High: $29.17

52 Week Low: $18.83

Shares Outstanding: 235M

Beta: .47

2008 Analysts EPS Estimates:

High: $1.79

Low: $1.45

Average: $1.68

Company Estimates:

Comparable Basis: $1.30 - $1.40

Reported Basis: $1.16 - $1.26

Key 2007 Data*:

Sales: $5.2B

Operating Margin: 16.2%

EPS (reported) - $1.38

EPS (comparable) - $1.68

* Source of key statistics and 2007 data:

Yahoo Finance and Constellation

earnings releases

Table of Contents

Company Overview ......................................................................................................................... 3

Segments ..................................................................................................................................... 3

Wines .......................................................................................................................................... 3

Beers ........................................................................................................................................... 3

Spirits .......................................................................................................................................... 4

Economic/Macro ............................................................................................................................. 4

Sector/Industry/Sub-Industry .......................................................................................................... 5

Sector - Consumer Staples .......................................................................................................... 5

Industry/Sub Industry - Alcoholic Beverages/Distillers & Vintners........................................... 5

Wine Industry.............................................................................................................................. 6

Growth Drivers/Catalysts/Positives/Issues ...................................................................................... 6

Critical Initiatives from 2006 ...................................................................................................... 6

Capitalizing on the Trend of Trading up ..................................................................................... 7

Operational Improvements .......................................................................................................... 7

Inventory buildup at the distributors ........................................................................................... 7

Company Management ............................................................................................................... 7

Pricing ......................................................................................................................................... 8

Risk/Concerns ............................................................................................................................. 8

Financials......................................................................................................................................... 8

Income Statement ........................................................................................................................ 8

Sales ........................................................................................................................................ 8

Positive sales outlooks ............................................................................................................ 8

Margins ................................................................................................................................... 9

SG&A ..................................................................................................................................... 9

Balance Sheet ............................................................................................................................ 10

Working Capital.................................................................................................................... 10

Other Balance Sheet Ratios .................................................................................................. 10

Cash Flow ................................................................................................................................. 11

DCF Assumptions:................................................................................................................ 11

DCF Target Price .................................................................................................................. 11

Performance Relative to Alcoholic Beverage Industry ........................................................ 12

Valuation ....................................................................................................................................... 12

Absolute Valuation Chart.......................................................................................................... 13

Absolute Valuation Table ......................................................................................................... 13

Relative to S&P 500 Table........................................................................................................ 14

Relative to Consumer Staples Sector Table .............................................................................. 14

Relative to Alcoholic Beverages Industry Table....................................................................... 14

Conclusion ..................................................................................................................................... 15

Endnotes ........................................................................................................................................ 16

Supporting Tables and Charts ....................................................................................................... 17

Income Statement and Income Statement Ratios ...................................................................... 17

Balance Sheet and Balance Sheet Ratios .................................................................................. 18

Cash Flow Statement ................................................................................................................ 19

Discounted Cash Flow .............................................................................................................. 20

Income Statement ...................................................................................................................... 21

Constellation Relative to S&P 500 ........................................................................................... 22

Constellation Relative to Consumer Staples ............................................................................. 23

Consumer Staples Relative to Alcoholic Beverages ................................................................. 24

2

Company Overview

The following is an overview of Constellation Brands (Constellation) verbatim from the

company website.

“Constellation Brands, Inc. (NYSE: STZ, ASX: CBR ), headquartered in Fairport, New

York, is a leading international producer and marketer of beverage alcohol brands with a

broad portfolio across the wine, imported beer (into the United States) and spirits

categories. Constellation is the largest wine company in the world by volume; the largest

multi-category supplier of beverage alcohol in the United States and Canada; a leading

producer and exporter of wine from Australia, New Zealand and Canada; and both a

major producer and independent drinks wholesaler in the United Kingdom.”2

Segments

Constellation categories their business segments as wines (branded and

wholesale), beers, and spirits. The following charts show the revenue by segment and the

year-over-year organic growth (2007 vs. 2006) on a constant currency basis.3

Revenue by Segm ent

Spirits

6%

Imported

Beers

20%

Branded

Wine

53%

Organic Sales Change

(Constant Currency)

Branded Wine

4%

Wholesale Wine

4%

Imported Beers

15%

Spirits

1%

Total

6%

2376

1062

1044

329

4811

Wholesale

Wine

21%

Wines

Wine is Constellations largest segment in terms of revenue with the combination

of branded wine and wholesale wine making up 74% of revenues. They hold nearly a

20% share of the US according to their company website. Constellation Wines U.S.

consists of 4 businesses: Icon Estates, Centerra Wine Company, Pacific Wine Partners,

and North Lake Wines. Their Australian division, Hardy Wine Company, is Australia’s

largest wine producer. Constellations Europe Ltd is one of the largest premium drink

companies in Europe. In June of 2006 Constellation acquired Vincor, the top Canadian

wine company. Some well known brands produced and distributed by the Constellation

brands include Robert Mondavi, Arbor Mist, Cook’s, and 3 blind moose.2

Beers

Beers made up 20% of constellation revenue in 2007. Constellation participates

in the Beer market through a joint venture Crown Imports LLC formed with Grupo

Modelo on January 2, 2007. Their focus is on importing and marketing beer in the U.S.

3

The Crown Imports portfolio includes well known brands such as Corona Extra, Corona

Light, Modelo Especial, and St. Pauli Girl.2

Spirits

The spirits segment made-up 6% of company revenues in 2007. Constellation’s

spirits division, Barton Brands, is a leader in the American value market but is looking to

grow in the premium sector. Their purchase of SVEDKA during fiscal 2007

demonstrates their growth strategy into the premium market. SVEDKA is the fastest

growing major spirits import brand with an 8% market share in the imported Vodka

category in the US (source 3/19/07 press release).2

Economic/Macro

Since Constellation is part of a defensive sector, I did not expect the price to be

highly correlated with economic data. A regression of 10 years of percent price changes

versus 10 years of GPD and Interest rate percent changes supported my hypothesis. The

p-value indicates no statistical significance. Consumer staples will not be significantly

impacted by rising interest rates and reduced GDP as other more cyclical sectors would.

SUMMARY OUTPUT

Fed Funds % Change Line Fit Plot

Price %

Change

Regression Statistics

Multiple R

0.124302717

R Square

0.015451165

Adjusted R Square

-0.010458014

Standard Error

0.164348138

Observations

40

-0.5

1

0.5

0

-0.5 0

Price % Change

0.5

1

Predicted Price %

Change

Fed Funds % Change

ANOVA

df

Regression

Residual

Total

Intercept

Fed Funds % Change

1

38

39

SS

0.016107834

1.026391793

1.042499628

MS

F

Significance F

0.016107834 0.596358725

0.444747268

0.02701031

Coefficients

Standard Error

0.055238157

0.026103747

-0.095517236

0.123688112

t Stat

P-value

2.116100667 0.04094502

-0.772242659 0.444747268

Lower 95%

Upper 95% Lower 95.0% Upper 95.0%

0.002393884 0.10808243 0.002393884

0.10808243

-0.345910726 0.154876253 -0.345910726 0.154876253

SUMMARY OUTPUT

Price %

Change

GDP % Change Line Fit Plot

Regression Statistics

Multiple R

0.033575252

R Square

0.001127298

Adjusted R Square

-0.025158826

Standard Error

0.165539343

Observations

40

1

0.5

0

-0.01 -0.5 0

Price % Change

0.01

0.02

Predicted Price %

Change

GDP % Change

ANOVA

df

Regression

Residual

Total

Intercept

GDP % Change

1

38

39

SS

0.001175207

1.04132442

1.042499628

Coefficients

Standard Error

0.045425912

0.04625385

1.094166998

5.283571641

MS

F

Significance F

0.001175207 0.042885652

0.837046479

0.027403274

t Stat

P-value

0.982100121 0.332262376

0.207088514 0.837046479

Lower 95%

Upper 95% Lower 95.0% Upper 95.0%

-0.048210112 0.139061935 -0.048210112 0.139061935

-9.601864505 11.7901985 -9.601864505

11.7901985

4

Sector/Industry/Sub-Industry

Constellation falls under the consumer staples sector. They are a member of the

alcoholic beverages industry and their specific sub-industry is distillers and vintners.

Brown-Foreman Corporation is the only other S&P500 company in this specific sub

industry. Therefore, I look to the more broad alcoholic beverages sector for some

comparisons.

Sector - Consumer Staples

Consumer staples consist of household necessities that people use on a daily

basis. These items represent a small portion of an individual’s personal income.

The companies tend to be in the mature stage of their lifecycle and usually exhibit

slow growth.

Staples companies are generally considered defensive (non-cyclical) stocks. As

opposed to cyclical stocks which can fluctuate significantly with changes in the

economic cycle, staples companies are relatively immune to changes in the

economic cycle. Consumers tend to purchase the products regardless of the state

of the economy. For this reason, the demand for the products is considered stable

and inelastic. And therefore, the sales and earnings of the companies tend to be

constant.

Due to the mature nature, the sector tends to be highly competitive with large

branded players as well as generic providers fighting for their piece of the

consumer’s expenditure.

Furthermore, brand is extremely important. A strong brand will allow a company

in the staples sector to demand higher prices, thus, generating higher margins

which can be reinvested for product innovation and growth.

The slow growth nature of the staples sector also leads companies to look

internationally for sales. International sales are a positive in today’s environment

both due to the pure market size of the global market as well as the week status of

the dollar. For example, a US company generating sales internationally can

convert those foreign dollars to a larger amount of US dollars.

Staples companies tend to generate large amounts of cash. Furthermore, they tend

to pay high dividend yields.

Staples companies can be a good edge against economic downturn. Growth

opportunities exist when institutional investors move large amounts investment

away from cyclical stocks and into staple in tough economic times.

Staples companies become less desirable when economic growth is strong and

investors prefer to invest in stocks that can generate higher returns

Industry/Sub Industry - Alcoholic Beverages/Distillers & Vintners

Constellation is consistent with the broader staples sector in many ways. Similar to

necessities, consumers are going to continue to spend money on alcoholic beverages

regardless of the state of the economy. Constellation is looking internationally for

growth. Brand is extremely important for constellation as a means to earn higher

margins. Constellation like other staples companies generates large amount of cash.

Constellation has used aggressive acquisition as a way to grow their business and create

5

economies of scale. Constellation is different from the broader staples sector in that it

does not pay a dividend.

Key trends in the alcoholic beverage industry include consolidation among importers,

producers, distributors, and retailers. In addition, the growth of imported alcoholic

beverages is exceeding domestic growth. Finally, consumers are trading up to premium

brands (source: Standard and Poor’s).4

Wine Industry

Competitive Conditions in the U.K.

One of the most critical issues that Constellation faced during fiscal year 2007

was the challenging competitive conditions in the U.K. market. These conditions made it

difficult for Constellation to cover their costs in the market.3

The UK situation was highlighted by CEO Richard Sands during the fiscal 2007

earnings call. A huge over supply of grapes from the 2006 harvest in Australia has

resulted in an oversupply of bulk wine shipped from Australia to the U.K. In addition,

the large grocers have consolidated in the U.K. The combination of these two conditions

has enabled the large grocers to quickly bring low cost private label wine to the U.K.

market. The high availability and low price of the private label brands has created

pricing pressure and reduced the margins of the Constellation branded wines sold in the

U.K.5

Magnifying the challenges in the UK, was a duty increase that came in higher

than expected during 2006. This puts the wines being imported into the UK at a

disadvantage.5

Many feel that the conditions in Australia and the U.K. will improve. In an article

from Wall Street Journal on May 25, 2007, Susan Murdoch explains how Australia’s

worst drought in 100 years as well as some damage related to frost has resulted in a

reduction in this year’s harvest.6 The Constellation earnings release indicated that the

drought and frost could reduce the 2007 harvest by 25-30 percent.3

While Constellation highlighted the positive impact of the drought conditions,

some analyst, such as David Cooke from ABN Amro, believe that in the extreme case the

drought conditions could potentially have serious detrimental impact on the wine

industry. Cooke believes that if the drought conditions continue for years, the significant

grape shortage would offset any benefits achieved in the form of higher prices.6

Based on the expert’s findings, I believe the reduction the 2007 and 2008 harvest

will have a positive impact on Constellation’s wine revenues and profits in the U.K. I am

not concerned about the long-term impact of the drought at this time.

Growth Drivers/Catalysts/Positives/Issues

Critical Initiatives from 2006

CEO Robert Sands identified 4 key activities in 2007 that will position the

business for Growth: The acquisition of Vincor in June of 2006, the formation of Crown

Imports in January 2007, the acquisition of SVEDKA completed in March 2007, and the

organizational and operational improvement initiative.5

6

Capitalizing on the Trend of Trading up

A key strategy highlighted by the executive team is to invest more in the higher

end wines, beers, and spirits. The team highlighted the trend, especially in the US, of

consumers trading up to premium brands. This is good for Constellation because it lines

up with their strategy. The higher end bands generate higher margins for Constellation.

The benefit of this trend is that these products represent higher margins. They have taken

several actions during the past year to capitalize on this trend.5

With the purchase of SVEDKA in 2006, Constellation now controls the fastest

growing premium spirits brand in the US. On the 2007 earnings call they reported that

this brand had 60% growth in 2006.5

The purchase of Vincor in 2006 also created an opportunity for Growth. CEO

Robert Sands said that the purchase has allowed them entrance into a 5th market –

Canada. He also highlighted that fact that the acquisition will enhance the premium

product portfolio.5

I see the trend of consumers trading up having a positive impact on revenue and

margin growth in 2008 and beyond.

Operational Improvements

Sands emphasized that Constellation is not sitting idle waiting for the conditions

in the UK to improve. They have launched a restructuring effort in the UK to reduced

cost and improve operational efficiencies. Constellation is building a new bottling

facility in the UK. Among other benefits, they are expecting reduced costs and improved

asset utilization. The project will begin to have an impact on earnings in 2009. The new

facility will allow Constellation to close multiple warehouses. In addition, it will allow

for the shipment of more bulk (rather than bottled) wine into the UK. This is expected to

generate significant ocean freight savings.5

Inventory buildup at the distributors

Constellation has kicked off a program to allow their distributors to reduce

inventory during 2008. This will mean reduced sales for Constellation as they allow the

inventories to deplete. On the positive side, Constellation believes that the distributors

will use the savings from the reduced inventory, to invest in marketing and distributing

the Constellation brands.5 I do not anticipate positive impacts from this initiative until

2009.

Company Management

A key change was jut completed when 10-year CFO Tom Summer retired and

was replaced by Robert Ryder.

Constellation talked in their earnings conference about a realignment of global

reporting structure that they believe preserves their decentralized operating model

while ensuring optimal import, export, operation capabilities, and resource

utilization.5

7

Pricing

Pricing pressures have been significant in the U.K. However, I expect these

pressures to relax slightly in 2008 and more so in 2009.

Constellation is currently raising prices on their wholesale brands.5 This could

put downward pressure on revenues if volumes decrease as a result.

Risk/Concerns

Integration Risk: Constellation will be faced with execution challenges as they

continue to integrate Vincor into their portfolio.

Challenging UK market: While I believe that conditions will improve the UK, it

could take longer than expected.

Regulatory: Increase duties in the UK market.

Change of consumer tastes. A change in the economy could lead to a slow down

in the trade up trend.

There is risk that the cost savings from restructuring efforts will be less than

expected or take longer than expected to materialize.

Financials

Income Statement

Sales

Over the past 5 years, revenue has grown from $2.7B to $5.2B. Year-over-year

growth has ranged from 48% in 2003 to 13% in 2007. The largest driver of revenue

growth has been acquisitions. While overall revenue was up13% in 2007, organic growth

on a constant currency basis was 7%.3 I expect Constellation to continue to look for

opportunities to increase revenues through acquisitions. I also expect them to invest in

the marketing of their current brands to accelerate the revenue growth. Constellation is

projecting low single digit sales growth in 2008. While this looks like a negative trend,

Sands explained that after accounting for the distributor inventory reduction initiative and

the equity approach to reporting Crown imports, Constellation is actually going to be

achieving strong growth in 2008.5

The inventory reduction initiative will results in a reduction of $160-190M of

sales (3-3.5% of 2007 revenue). Reporting Crown and Matthew Clark Wholesale

business as equity investments will also reduce top line sales. However, the free cash

flow generated from Crown and Matthew Clark will be distributed to its partners and

entered into the income statement on the equity earnings line. Due to these accounting

changes, Constellation projects a 30-32% decrease in revenue.5 Excluding the impact of

the accounting change, I expect sales to increase 4% in 2008.

Positive sales outlooks

Constellation expects low single digit growth in branded wine, branded

spirits, and wholesale.5

Branded wine in the US and Canada are expected to show high growth.5

8

Constellation expects strong performance from Crown.

The following chart illustrates the revenue growth at Constellation during the past 10

years.

Dollars (Millions)

10-Year Revenue Trend

6000

5000

4000

3000

2000

1000

0

Revenues ($ Mil)

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

year

Margins

While gross margins and operating margins improved from 2006 to 2007, pre-tax

profit remained roughly flat. I expect margins to remain flat in 2008. Restructuring

efforts and synergies from the Vincor acquisition and increased sales of premium

products in the US will provide upward pressure on margins, while continued price

pressures in the U.K. will put downward pressure on margins. The following chart shows

the 5-year margin analysis.5

Margin Analysis

35

30

Percentage

25

Gross Prof it Margin (%)

20

Operating Prof it Margin

EBITDA (%)

15

Pre-Tax Prof it Margin

(%)

10

5

0

2003

2004

2005

2006

2007

Ye ar

SG&A

SG&A as a percent of sales has increased from 12.9% in 2003 to 14.7% in 2007.

Constellation attributed this increase to a change in the reporting method of stock

compensation expense.5 I expect SG&A as a percent of sales to level off in 2008 and

then decrease slightly in 2009 as a result of restructuring, lay-offs, and synergies from the

Vincor acquisition.

9

Balance Sheet

Working Capital

The five year trend in working capital causes some concerns. Specifically, days

of inventory has risen from 151 days in 2003 to 192 days in 2007. This equates to less

than two inventory turns per year. Inventory as a % of sales has also increased during the

past several years.

Working capital will continue to be at high levels during 2008 as Constellation

allows their distributors to reduce their inventories. Sands explained that while they are

allowing their distributors to reduce their inventories, Constellation inventories will grow.

While fewer purchases from the distributors will result in lower accounts receivable,

Sands explained that the negative impact of increased inventories at Constellation will

more than offset the positive working capital benefit of lower accounts receivable.5

I project that constellation will begin achieving inventory reductions in 2009.

This will help them to reduce their working capital.

The following chart shows that accounts receivable and accounts payable have

remained roughly level as a percent of sales between 2006 and 2007. I project that they

will remain level as a percentage of sales going forward.

Inventory, AR, AP

0.45

0.4

0.35

0.3

Inventory as % of sales

0.25

0.2

Accounts receivable as

% of sales

0.15

0.1

Accounts payable as %

of sales

0.05

0

2003

2004

2005

2006

2007

Other Balance Sheet Ratios

The quick ratio has decreased over the past several years. Rising inventories have

likely played a factor. However, I am not concerned about Constellations ability to meet

their short term obligations. The 2007 current ratio is also at a healthy level.

Constellation has made more productive use of their plant in equipment in recent years

resulting in an increase in the plant and equipment turnover. Asset turnover has remained

flat.

Overall, Constellation has a healthy balance sheet. The biggest area for

improvement is the management and reduction of inventory.

10

5

4.5

4

Quick Ratio

3.5

Current Ratio

3

2.5

Asset Turnover

2

1.5

Plant & Equipment

Turnover

1

0.5

0

2003

2004

2005

2006

2007

Cash Flow

DCF Assumptions:

A terminal growth rate of 4% was used because a company cannot continue to

achieve higher than market growth in the long-term.

A discount rate of 9.0% was used. A defensive company such as STZ is going to

have lower than average risk. This is reflected in the low beta as measured by

analysts such as The Street.com (.51)9 and Ford Equity Research (.80)10 and

Standard and Poor’s (.51)4

Margins are projected to remain roughly flat going forward for the reasons

described earlier.

Due to Crown and Matthew Clark converting to an equity method of reporting,

Constellation net sales will be down 30-32% in fiscal 2008 based on company

guidance. However, organic sales are expected to grow in the low single digits.7

Therefore, I increased equity earnings on the income statement to offset the sales

decrease.

Due to the 30-32% projected decrease in net sales, I could no longer tie inventory

to percentage of sales. I assumed a slight increase in inventories in 2008 based on

company guidance.

Capital expenditures will remain roughly level at 3% of sales, but will decrease

slightly to converge with depreciation and amortization.

Depreciation and amortization will remain level at approximately 2.7% of sales.

The tax rate of 40% was used based on company guidance.7 I assumed this rate

would continue for the next 10 years.

DCF Target Price

From the DCF, my target price of $23. The following sensitivity analysis shows the

various target prices that would obtained with different sales growth and discount rate

assumptions.

11

Sale

Growth

6%

7%

8%

8.5%

$25

$27

$28

Discount Rate

9.0%

9.5%

$23

$21

$24

$22

$25

$23

Performance Relative to Alcoholic Beverage Industry

I looked a Constellations performance relative to the alcoholic beverage industry.

I found that they are currently underperforming on a pre-tax margin basis. Over the past

10 years they have averaged a pre-tax margin of 89% of that of the industry. They

currently have a pre-tax margin of 84% of that of the industry. They are also

underperforming the industry on a return on equity basis. Over the past 10 years they

have been averaging a ROE of 95% of that of the industry. They currently have a ROE

of 87% of that of the industry. The comparison of pre-tax margin and ROE illustrates

that Constellation is underperforming compared to how they have historically performed

relative to the industry.8

Valuation

I looked at the valuation of Constellation in terms of price/forward earnings, price/sales,

price/earnings before interest, taxes, depreciation, and amortization (EBITDA), and

price/cash flow.

12

Absolute Valuation Chart

Absolute valuation reveals that Constellation is expensive on a P/Forward E and

P/CF basis, but cheap on a P/EBITDA basis and in-line on a price/sales basis. From the

absolute valuation, I conclude that Constellation is expensive. I put most weight on

P/Forward E. Constellation is currently trading at 16.7 times forward earnings. This is

relatively expensive compared to their 5 year-average. Reversion to the man would

indicate that the stock will eventually revert to a P/E of 14.4.

Absolute Valuation Table

Ratio

High

Low

Mean

P/Forward

E

P/S

16.7

9.0

14.4

1.67

.76

1.12

P/EBITDA

10.3

4.2

7.1

P/CF

17.1

7.8

11.1

Current Target

Target

Multiple E,S,B/share

16.7

14.4

1.34

(from DCF)

1.11

1.4

15

(From DCF)

6.2

7.1

3.9

{(P/S)

/(P/EBITDA)}

11.7

11.1

2.07

{(P/S)/(P/CF)

Target

Price

19.30

21

27.69

22.98

13

To arrive at the multiples I assumed reversion to the mean for all ratios except for

P/S. Constellation sales will be down 30-32% in 2008 because more of their earning will

be coming from equity investments. This decrease in sales should not result in a decrease

in earnings or share price. Therefore, I expect them to have a higher P/S multiple in the

future. Based on absolute valuation and multiples, my target price is $20.

Relative to S&P 500 Table

Ratio

P/Forward E

P/S

P/EBITDA

P/CF

High

1.40

1.11

1.39

1.47

Low

.55

.52

.56

.71

Mean

.75

.75

.91

.97

Current

1.10

.81

.80

.99

Constellation normally trades at a P/ Forward E factor of .75 compared to the

S&P 500. However, they are currently trading a factor of 1.10. They are relatively

expensive on a P/Forward E and P/S basis, cheap on a P/EBITDA basis, and in-line on a

P/CF basis. Overall, I consider Constellation to be expensive relative to the S&P500.

Relative to Consumer Staples Sector Table

Ratio

P/Forward E

P/S

P/EBITDA

P/CF

High

1.20

1.45

1.07

1.22

Low

.52

.62

.45

.55

Mean

.80

.95

.68

.78

Current

.94

.98

.62

.85

Constellation normally trades at a P/ Forward E factor of .80 compared to the

consumer staples sector. However, they are currently trading a factor of .94. They are

relatively expensive on a P/Forward E and P/CF basis, slightly cheap on a P/EBITDA

basis, and relatively in-line on a P/S basis and. I consider Constellation to be expensive

relative to the consumer staples sector.

Relative to Alcoholic Beverages Industry Table

Ratio

P/Forward E

P/S

P/EBITDA

P/CF

High

1.32

1.31

1.49

1.62

Low

.59

.51

.52

.67

Mean

.90

.85

.83

1.07

Current

1.07

.62

.66

.98

Constellation normally trades at a P/ Forward E factor of .90 compared to the

alcoholic beverages industry. However, they are currently trading a factor of 1.07. They

are relatively expensive on a P/Forward E but relatively cheap based on the other ratios.

Since I put must weight on the P/Forward E ratio, I consider Constellation to be

expensive relative to the alcoholic beverages industry.

14

Conclusion

Based on a valuation target price of $20 and a DCF target price of $23, my final

target price is $22. My target represents a 9% downside potential. The following is a

summary of the positive and negative issues impacting the performance of the stock that

have led to may decision to hold.

Positives:

Strong branded wine business

Defensive stock

Strong growth prospects from Crown

Consumers trading up to premium alcoholic beverages

Strong generator of cash

Drought in Australia has reduced harvest

Conditions improving in the U.K.

Strong balance sheet

Stronger than expected revenue growth could result in an upside to the price

Negatives:

Challenging conditions in the U.K.

Integration challenges due to recent acquisition of Vincor

Expensive on an absolute basis

Underperforming peers in terms of margin and ROE

Expensive valuation relative to S&P 500, consumer staples, and alcoholic

beverages industry

Distributors will cut-back on purchases in 2008 to reduce inventory

15

Endnotes

1. Constellation 10-k.

2. Constellation website, http://www.cbrands.com.

3. Constellation fiscal 2007 year-end earnings press release, “Constellation

Brands Reports Record Net Sales, EPS for Fiscal 2007,” April 5, 2007.

4. Standard and Poor’s Stock Report, May 19, 2007.

5. Constellation Fiscal 2007 Earnings Conference Call, April 5, 2007.

6. Susan Murdoch, “Drought Crops 2007 Grape Harvest,” Wall Street Journal,

May 25, 2007.

7. Constellation press release, “Constellation Brands Announces U.K. Joint

Venture for Matthew Clark Wholesale Business,” April 17, 2007.

8. StockVal

9. TheStreet.com Ratings, April 9, 2007.

10. Ford Equity Research, May 18, 2007.

16

Supporting Tables and Charts

Income Statement and Income Statement Ratios

17

Balance Sheet and Balance Sheet Ratios

18

Cash Flow Statement

19

Discounted Cash Flow

Terminal Discount Rate 9.0%

=

Terminal FCF Growth = 4.0%

2008E

2009E

2010E

2011E

2012E

2013E

2014E

2015E

2016E

Terminal

2017E Value

3651

3870

6.00%

4102

6.00%

4,349

6.00%

4,610

6.00%

4,886

6.00%

5,179

6.00%

5,490

6.00%

5,819

6.00%

6,169

6.00%

Operating Income

Operating Margin

639

17.50%

677

17.50%

738

18.00%

783

18.00%

830

880

932

988

1048

1110

18.00% 18.00% 18.00% 18.00% 18.00% 18.00%

Interest and Other- net

Interest % of Sales

-301

-8.25%

-310

-8.00%

-328

-8.00%

-304

-7.00%

-323

-7.00%

Year

Revenue

% Growth

Taxes

-215

Tax Rate

-40.00%

Equity Income, net

200

% of sales

5.47%

Equity Income Growth Assumption

Net Income

% Growth

Add Depreciation/Amort

% of Sales

% of Capex

Plus/(minus) Changes WC

% of Sales

Subtract Cap Ex

Capex % of sales

Free Cash Flow

YOY growth

-232

-254

-40.00% -40.00%

212

224

5.47%

5.47%

-293

-6.00%

-311

-6.00%

-275

-5.00%

-291

-5.00%

-308

-5.00%

-191

-203

-235

-249

-285

-303

-321

-40.00% -40.00% -40.00% -40.00% -40.00% -40.00% -40.00%

238

252

267

283

300

318

337

6.00%

6.00%

6.00%

304

352

6.00% 15.64%

6.00%

6.00%

6.00%

6.00%

373

428

6.00% 14.83%

454

6.00%

481

6.00%

322

348

7.80%

381

9.54%

287

-24.61%

97

2.67%

0.00%

-61

-1.67%

110

3.00%

103

2.67%

0.00%

-28

-0.74%

116

3.00%

110

2.67%

0.00%

-30

-0.74%

123

3.00%

116

2.67%

0.00%

-32

-0.74%

130

3.00%

123

2.67%

0.00%

-34

-0.74%

133

2.89%

130

2.67%

0.00%

-36

-0.74%

141

2.89%

138

2.67%

0.00%

-38

-0.74%

150

2.89%

147

2.67%

0.00%

-41

-0.74%

147

2.67%

155

2.67%

0.00%

-43

-0.74%

155

2.67%

165

2.67%

0.00%

-46

-0.74%

165

2.67%

249

306

23%

337

10%

240

-29%

260

8%

305

17%

323

6%

388

20%

411

6%

436

6%

Terminal

P/E

NPV of free cash flows

NPV of terminal value

Projected Equity Value

Free Cash Flow Yield

$1,944.1

$3,510.5

5,454.6

4.57%

Shares Outstanding

241.0

Current Price

24.17

Implied equity value/share

22.63

Upside/(Downside) to DCF

-6.4%

Free Cash Yield

20

9,058.5

18.826667

4.81%

Income Statement

Sales

COGS

SG&A

Acquisition-Related Integration Costs

Restructuring and Related Charges

Operating Income

Interest Expense

Gain on change in fair value of derivative instruments

Equity in earnings of equity method investees

Earnings from Cont Ops before Taxes

Income Tax

Net Earnings from continuing ops

Discontinued Operations (net of taxes)

Earnings of discont ops

Gain on sales of discont ops

Net earnings from discont ops

2010

2009

2008

2007

4102.5 3870.3

3651.2 5216.0

(2830.7) (2670.5) (2519.3) (3692.5)

(533.3) (522.5) (492.9) (768.8)

0.0

0.0

0.0

(23.6)

0.0

0.0

0.0

(32.5)

738.4

677.3

639.0

698.6

(328.2) (309.6) (301.2) (268.7)

0.0

0.0

0.0

55.1

224.3

211.6

199.6

49.9

634.5

579.3

537.3

534.9

(253.8)

380.7

(231.7)

347.6

(214.9)

322.4

(203.4)

331.5

2006

4603.4

(3278.9)

(612.4)

(16.8)

(29.3)

666.0

(189.7)

0.0

0.8

477.1

2005

4087.6

(2947.0)

(555.7)

(9.4)

(7.6)

567.9

(137.7)

0.0

1.8

432.0

2004

3552.4

(2576.6)

(457.3)

0.0

(31.1)

487.4

(144.7)

1.2

0.5

344.4

(152.0)

325.1

(155.5)

276.5

(124.0)

220.4

Average of

2003 historic values

2731.6

(1970.9)

(351.0)

0.0

(10.0)

(4.8)

(21.1)

404.9

(105.4)

23.1

15.9

12.2

13.0

334.8

424.6

(131.6)

203.2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

Net Earnings

380.7

347.6

322.4

331.5

325.1

276.5

220.4

203.2

Diluted EPS

Continuing ops

Discont ops

Net EPS/share-diluted

Diluted shares

1.58

0.00

1.58

241.0

1.44

0.00

1.44

241.0

1.34

0.00

1.34

241.0

1.38

0.00

1.38

240.6

1.36

0.00

1.36

238.7

1.19

0.00

1.19

233.1

1.03

0.00

1.03

213.9

1.10

0.00

1.10

184.8

33.5

10.9

17.6

37.1

13.8

Cash & Equiv

Trade Receivables

% of sales

Inventories

% of sales

Prepaid Expenses and other

% of sales

Accts Payable

% of sales

Change in Working Capital

697.4

657.9

17.00% 17.00%

2200.0 2200.0

Sales Growth

Gross Margin

Chg YoY

SG&A to Sales

Chg YoY

Operating Margin

Chg YoY

Interest Expense to sales

Other income (expense) to sales

Tax Rate

Capex (purchase of PP&E)

% of sales

620.7

881.0

17.00% 16.89%

2200.0 1948.1

37.35%

109.5

160.7

3.00% 3.08%

255.6

376.1

7.00% 7.21%

(61.0) (236.5)

771.9

16.77%

1704.4

37.02%

213.7

4.64%

312.8

6.79%

(6.2)

849.6

20.78%

1607.7

39.33%

259.0

6.34%

345.3

8.45%

(607.0)

635.9

17.90%

1261.4

35.51%

137.0

3.86%

270.3

7.61%

(618.8)

6.00%

31.00%

0.00%

13.00%

-0.50%

18.00%

0.50%

8.00%

0.68%

40.00%

6.00% -30.00% 13.31%

31.00% 31.00% 29.21%

0.00%

1.79% 0.44%

13.50% 13.50% 14.74%

0.00% -1.24% 1.44%

17.50% 17.50% 13.39%

0.00%

4.11% -1.07%

8.00%

8.25% 5.15%

0.68%

0.68% 2.01%

40.00% 40.00% 38.03%

12.62%

28.77%

0.87%

13.30%

-0.29%

14.47%

0.57%

4.12%

0.02%

31.86%

15.07%

27.90%

0.44%

13.59%

0.72%

13.89%

0.17%

3.37%

0.04%

36.00%

30.05%

27.47%

-0.38%

12.87%

0.02%

13.72%

-1.10%

4.07%

0.05%

36.00%

-123.1

-3.00%

-116.1

-3.00%

-109.5

-3.00%

-192.0

-3.68%

-132.5

-2.88%

-119.7

-2.93%

-105.1

-2.96%

-71.6

-2.62%

Depreciation and Amortization

% of sales

109.5

2.67%

103.3

2.67%

97.5

2.67%

139.3

2.67%

128.1

2.78%

103.7

2.54%

102.0

2.87%

60.1

2.20%

Percent Increase in Equity Investments

6.00%

6.00% 300.00%

123.1

3.00%

287.2

7.00%

(30.2)

116.1

3.00%

270.9

7.00%

(28.5)

399.1

14.61%

819.9

30.02%

97.3

3.56%

171.1

6.26%

27.85%

12.85%

14.82%

3.86%

1.29%

39.31%

21

17.39%

35.85%

4.30%

7.27%

17.76%

28.24%

0.34%

13.47%

0.47%

14.06%

-0.36%

4.11%

0.68%

36.24%

Constellation Relative to S&P 500

22

Constellation Relative to Consumer Staples

23

Consumer Staples Relative to Alcoholic Beverages

24