Oshkosh Corporation RECOMMENDED ACTION

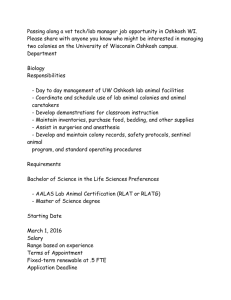

advertisement

Oshkosh Corporation RECOMMENDED ACTION Current Price: YE2010 Target Price: Projected Return*: $37.97 $42.35 +11.54% Recommendation: HOLD Report Date: 11.20.2009 ANALYST INFORMATION Analyst: Melissa Hickey Fisher College of Business Contact: Email: (614) 406-1207 hickey_75@fisher.osu.edu Fund: Manager: OSU SIM Royce West, CFA STOCK INFORMATION Sector (S&P): Industry (S&P): Market Cap: Shares Outstanding: Avg Daily Volume: YTD Return: 52 Week Range: Dividend Yield: Beta: Industrials Trucking 3.5B 89.4M 2.2M 327.11% $3.85 - $40.74 None 2.91 *includes dividend yield NYSE: OSK Investment Thesis The one-year target price for Oshkosh Corporation is $42.35 based on its competitive position within the Trucking industry, current macro-economic factors, its continued contract wins, and its strategy to grow in both domestic and international markets. The valuation is based on a Discounted Cash Flow (DCF) and Absolute Valuation Models. The HOLD recommendation is due to the fact that Oshkosh has a diversified portfolio of products which assists in mitigating lulls as they impact some segments harder than others on a macroeconomic level. Oshkosh has an expected stock appreciation of 11.54%. Stock Catalysts In addition to gaining a significant number of military contracts, it is likely that that this positive momentum will continue in the next few months due to recent wins on delivery timing. It is my belief that the benefits of said contracts are already priced in the stock, however, there is upside in this stock as Oshkosh continues to focus on innovation and efficiency. Oshkosh continues to be a global leader in specialty vehicles with top brands and leading market share in key markets. I predict a solid near term outlook for the Defense segment and long term growth in the Access Equipment segment. In addition, Oshkosh’s superior distribution and service network with both government and commercial customers combined with the company’s reduced cost structure positions Oshkosh to be successful. The experienced management team has done significant work on reducing the outstanding debt balance and continue to improve the capital structure of Oshkosh Corporation. Key Risks Defense contract risk Reduction in U.S. military spending will result in a significant loss of revenue Protests by competitors for recently won contracts may pose risk Obama’s pending decision on the future US involvement in Afghanistan OSK continues to carry a heavy amount of debt, inherent risk of default Execution of current delivery schedule Integrating acquisitions could be costly if not done efficiently Slow global recession recovery Foreign risk and rate adjustments OSK 12-Month Price Movement Table of Contents Table of Contents Company Overview ...................................................................................................................................... 3 Oshkosh Corporation ................................................................................................................................ 3 Business Segments Overview .................................................................................................................... 4 Business Segments Operating Results ...................................................................................................... 5 Competitive Advantage............................................................................................................................. 6 Recent Events & Acquisitions .................................................................................................................... 7 Sector Analysis.............................................................................................................................................. 8 Industry Analysis .......................................................................................................................................... 9 Investment Thesis....................................................................................................................................... 10 Fundamental Drivers ............................................................................................................................... 11 Business Analysis ..................................................................................................................................... 12 Financial Ratios ....................................................................................................................................... 13 Income Statement Projections................................................................................................................ 14 Multiples Valuation ................................................................................................................................. 15 Discounted Cash Flow & Sensitivity Analysis .......................................................................................... 16 Key Risks ..................................................................................................................................................... 17 Downside................................................................................................................................................. 17 Upside ..................................................................................................................................................... 18 Recommendation ....................................................................................................................................... 19 Resources .................................................................................................................................................... 20 2 Company Overview Type: Founded: Headquarters: Oshkosh Corporation Employees: Oshkosh Corp. is a designer, manufacturer and marketer of a range of specialty vehicles and vehicle bodies. The Company operates in four segments: Access Equipment, Defense, Fire & Emergency, and Commercial. Oshkosh maintains several major brands that are considered leaders in the market including: Oshkosh, JLG, Pierce, McNeilus, IMT, Medtec, Jerr-Dan, CON-E-CO and London. Oshkosh is a global enterprise that has driven revenue from $1.3 billion in fiscal 2000 to a peak of $7.14 billion* in fiscal 2008. This financial performance is the result of the company’s diversified business model and focused growth strategies: Embrace operational excellence - Oshkosh's manufacturing philosophy of mass customization delivers highly specialized vehicles, while its large-scale manufacturing operations provide significant economies of scale. Lead in product innovation - Oshkosh seeks to introduce more new products and technologies than its competitors in each end market, giving the company a distinct competitive advantage. Oshkosh is at the forefront of robotic vehicle development, diesel-electric drive technology, and independent suspension systems. Commercialize through acquisitions- Oshkosh has a proven record of completing strategic acquisitions, and then driving organic growth and cost reductions. Since 1996, the company has completed 15 acquisitions. Oshkosh Corporation has manufacturing operations in 10 U.S. states and in Australia, Belgium, Canada, Germany, France, The Netherlands, Romania, Sweden and the United Kingdom. According to the OSK 10-K filing, sales to the U.S. government comprised approximately 52% of the Company’s net sales in fiscal 2009. No other single customer accounted for more than 10% of the Company’s net sales for this period. In addition, About 84% of F2009 revenues were generated in the United States (up from69% in F2008 as Defense revenues grew significantly), with about 10% generated in Europe, Africa, and the Middle East. Oshkosh Corporation’s primary competitors are: BAE Systems Land & Armaments L.P. (privately held) Federal Sign Corp (FSS) Terex Corp. (TEX) Public (NYSE: OSK) 1917 2307 Oregon St. Oshkosh, WI 54902 12,400 Chairman & CEO: Robert G. Bohn EVP & CFO: David M. Sagehorn Website: http://www.oshkoshcorporation.com/ Factors currently driving sales : Presence of government contracts Strong market position The price of steel and iron Innovative and proprietary components Flexible and Efficient Manufacturing Currency exchange rates Factors driving sales in the future: Global growth and profitability Introduction of new and improved products Capitalizing on old products in new markets Providing superior quality and service Focusing on lean operations "People who run our trucks and truck bodies do important work – protecting freedom, fighting fires, roadside response, building infrastructure, handling waste. They deserve and receive nothing less than our best effort." — Robert G. Bohn Chairman and Chief Executive Officer 3 Company Overview Business Segments Overview Access Equipment Aerial work platforms and telehandlers used in a wide variety of construction, industrial, institutional and general maintenance applications to position workers and materials at elevated heights. Access equipment customers include equipment rental companies, construction contractors, manufacturing companies, home improvement centers and the U.S. military. Defense Heavy- and medium-payload tactical trucks and supply parts and services sold to the U.S. military and to other militaries around the world. Fire & Emergency Custom and commercial firefighting vehicles and equipment, aircraft rescue and firefighting vehicles, snow removal vehicles, ambulances, wreckers, carriers and other emergency vehicles primarily sold to fire departments, airports, other governmental units and towing companies in the U.S. and abroad, mobile medical trailers sold to hospitals and third-party medical service providers in the U.S. and Europe and broadcast vehicles sold to broadcasters and TV stations in North America and abroad. Commercial Concrete mixers, refuse collection vehicles, mobile and stationary compactors and waste transfer units, portable and stationary concrete batch plants and vehicle components sold to ready-mix companies and commercial and municipal waste haulers in North America, Europe and other international markets and field service vehicles and truck-mounted cranes sold to mining, construction and other companies in the U.S. and abroad. 4 Oshkosh Corporation is comprised of four business segments: Access Equipment, Defense, Fire & Emergency, and Commercial . A brief description from the Oshkosh Corporation website is provided in the boxes to the right. The following information was consolidated from the Oshkosh Corporation website and the FY09 Annual Report and the J.P. Morgan Initiation Report. Revenue by Line of Business FY09 15% Access equipment 42% 17% Defense Fire & emergency Commercial 26% Company Overview Business Segments Operating Results Defense This is currently the most important segment. Operating income increased 52.1% to $403.3 million, or 15.5% of sales, in fiscal 2009 compared to $265.2 million, or 14.0% of sales, in fiscal 2008. The increase in operating income as a percent of sales compared to fiscal 2008 reflected better absorption of fixed costs, lower material costs, improved performance on service work and favorable LIFO inventory adjustments of $8.7 million as compared with a charge of $5.7 million in fiscal 2008. Between 20001 and 2008 (pre-M-ATV) OSK’s Defense segment reported 28% per year revenue growth and has delivered average operating margins of 14% with significant volatility. Access Equipment The access equipment segment incurred an operating loss of $1,105.6 million, including $892.5 million in pre-tax, non-cash impairment charges for goodwill and other long-lived assets, in fiscal 2009 compared to operating income of $360.1 million in fiscal 2008. In addition to the noncash impairment charges, the decline in operating income was due to the impact of sharply lower sales volume, sale of units comprised of higher cost materials purchased in fiscal 2008 when steel costs were high, and an increase in the provision for credit losses. The impact of these factors was reduced by lower operating expenses as a result of aggressive cost reduction efforts. Fire &Emergency This segment incurred an operating loss of $14.7 million, including $123.0 million in pre-tax, non-cash impairment charges for goodwill and other long-lived assets, in fiscal 2009 compared to operating income of $93.9 million in fiscal 2008. The impairment charges offset otherwise favorable operating results for the segment due to a favorable product mix and improved performance at the Company’s domestic fire apparatus and airport product businesses as well as lower operating expenses throughout the segment as a result of cost reduction initiatives. This segment represented 22% of revenues and 51% of EBIT in F2009. From F2003 to F2009 the segment delivered average operating margins of 9.2%. Commercial This segment incurred an operating loss in fiscal 2009 of $183.7 million, including $184.3 million in pre-tax, non-cash impairment charges for goodwill and other long-lived assets, compared to operating income of $4.7 million in fiscal 2008. The decrease in operating results was the result of the non-cash impairment charges and the impact of sharply lower concrete placement products sales volume, offset in part by reductions in operating expenses due to cost reduction efforts and a LIFO inventory benefit of $5.9 million due to significant reductions in inventory levels. 5 “When hell and back is a daily commute, you want to be in an Oshkosh truck!” Company Overview ~ quote from an 11/11/09 investor presentation Competitive Advantage According to the OSK FY2009 annual report, the competitive cost structure, strategic global purchasing capabilities, engineering expertise, product quality, and global distribution and service systems have enabled Oshkosh to compete effectively. The following is a list of competencies that comprise the strength Oshkosh Corporation which it requires to remain competitive. Strong Market Positions. Oshkosh has developed strong market positions and brand recognition in its core businesses, which it attributes to its reputation for quality products, advanced engineering, innovation, vehicle performance, reliability, customer service and low total product life cycle costs. Oshkosh maintains leading market shares in most of its businesses and is the sole-source supplier of a number of vehicles to the DoD, including M-ATVs. Diversified Product Offering. Oshkosh believes its broad product offerings and target markets serve to diversify its sources of revenues, mitigate the impact of economic cycles and provide multiple platforms for potential internal growth and acquisitions. For each of its target markets, OSK has developed or acquired a broad product line in an effort to become a single-source provider of specialty vehicles, vehicle bodies, parts and service and related products to its customers. In addition, OSK has established an extensive domestic and international distribution system for specialty vehicles and vehicle bodies tailored to each market. Quality Products and Customer Service. OSK has developed strong brand recognition among its products as a result of its commitment to meet the stringent product quality and reliability requirements of its customers and the specialty vehicle and vehicle body markets it serves. OSK also achieves high quality customer service through its extensive parts and service support programs, which are available to domestic customers 365 days a year in all product lines throughout the Company’s distribution systems. Innovative and Proprietary Components. Oshkosh’s advanced design and engineering capabilities have contributed to the development of innovative and/or proprietary, severe-duty components that enhance vehicle performance, reduce manufacturing costs and strengthen customer relationships. Oshkosh’s advanced design and engineering capabilities have also allowed it to integrate many of these components across various product lines, which enhances its ability to compete for new business and reduces its costs to manufacture its products compared to manufacturers who simply assemble purchased components. Flexible and Efficient Manufacturing. Over the past 13 years, the Company has significantly increased manufacturing efficiencies. The Company believes it has competitive advantages over larger vehicle manufacturers in its specialty vehicle markets due to its manufacturing flexibility, vertical integration, purchasing power in specialty vehicle components and custom fabrication capabilities. In addition, the Company believes it has competitive advantages over smaller vehicle and vehicle body manufacturers due to its relatively higher volumes of similar products that permit the use of moving assembly lines and which allow it to leverage purchasing power opportunities across product lines. The Company believes its plan to meet the aggressive delivery requirements for M-ATVs under the recently awarded DoD contract is an example of its robust manufacturing capability. In addition to the Company’s existing defense truck manufacturing facilities in Oshkosh, Wisconsin, the Company is assembling M-ATV crew capsules and complete M-ATVs at its JLG manufacturing facility in McConnellsburg, Pennsylvania. Strong Management Team. The Company is led by Chairman and Chief Executive Officer, Robert G. Bohn, and President and Chief Operating Officer, Charles L. Szews, who have been employed by the Company since 1992 and 1996, respectively. Messrs. Bohn and Szews are complemented by an experienced senior management team that has been assembled through internal promotions, new hires and acquisitions. The management team has successfully executed a strategic reshaping and expansion of its business since 1996, which has positioned the Company to significantly improve its financial and operating performance. 6 Company Overview Recent Events & Acquisitions Oshkosh consistently shows up in the news. The following are key news events which have taken place and were highlighted in a recent investor presentation. • M-ATV – Oshkosh announced as single source winner ($1.1bn contract for 2,244 vehicles) on June 30, 2009 – Awarded total of 5,219 MATVs thru November 9, 2009 (contract currently valued at ~ $2.8 billion; including spares) • FMTV – Oshkosh announced as single source winner on August 26, 2009 with order for $281 million – Test quantities scheduled for mid-calendar 2010, production deliveries planned for early FY 2011 – Contract duration extends to FY 2014 deliveries – Losing bidders have protested; GAO decision expected on December 14, 2009 • MRAP Retrofits with TAK-4 suspension systems – Shipping and installing TAK-4 on MRAPs in Kuwait • Test & evaluation continues for various MRAPs (~16,000 in fleet) and other tactical vehicles Additional near term business opportunities discussed in the news: Australia Land 121 Aftermarket parts and services M-ATV follow-on requirements from U.S. and other governments Acquisition History 1996 – Pierce Manufacturing Inc. 1997 – Nova Quintech 1998 – McNeilus Companies Inc. 1999 – Kewaunee Fabrications LLC 1999 – Viking Truck & Equipment 2000 – Medtec Ambulance Corp. 2001 - TEMCO 2004 – Jerr-Dan Corporation 2005 – CON-E-CO 2005 – London Machinery Inc. 2006 – AK Specialty Vehicles 2006 – IMT 2006 – JLG Industries Oshkosh Acquisitions Since 1996, Oshkosh has selectively pursued strategic acquisitions to enhance its product offerings and diversify its business. Oshkosh has focused its acquisition strategy on providing a full range of products to customers in specialty vehicle and vehicle body markets that are growing and where it can develop strong market positions and achieve acquisition synergies. In addition to acquisitions, the government contracts will facilitate growth for Oshkosh. Acquisitions and dispositions completed during the past years are in the beige box above. 7 Sector Analysis Industrials Sector S&P500 (SPX) Energy (XOM.S) Material (DD.S) Industrials (GE.S) Consumer Discretionary (TGT.S) Consumer Staples (PG.S) Healthcare (MRK.S) Financials (JPM.S) Information Technology (MSFT.S) Return YTD 15.2% 4.6% 32.5% 9.5% 25.4% 6.5% 6.4% 17.6% 41.3% Return QTD -1.6% -1.3% -2.5% -2.2% -1.9% -.2% -1.4% -1.3% -2.4% Telecom (VZ.S) Utilities (EXC.S) -4.1% -.8% -1.1% -1.5% Multiples Valuation – indicates that the Industrials sector is currently undervalued High Low P/Forward E P/B P/S P/CF 26.9 5.9 1.9 16.7 9.2 1.4 0.6 4.9 High Low 1.2 0.8 1.0 1.0 P/B 1.4 0.9 1.1 1.2 9% P/S P/CF 1.1 1.2 0.8 0.7 1.0 1.1 0.9 0.7 -10% -36% Relative to SP500 P/Forward E Median Current % Current to LT Median Absolute Basis 17.8 3.3 1.5 11.9 16.9 2.5 0.9 7.3 Median Current -5% -24% -40% -39% % Current to LT Median 0% Industrials Sector Economic & Business Analysis Economic: The Industrials sector is strongly correlated with the S&P 500, real GDP, commercial and industrial loans, and durable goods orders. The Industrials sectors appears to be correlated to Capital Spending with the sector acting as a leading indicator by approximately 6 months. There is a lag associated with the Industrials sector so while the economy is in recovery mode, it will still take some time for business to pick up again. Business: According to the Morningstar Q4 Outlook from September, 30 2009, the outlook for U.S. Industrial activity is much better for the rest of ’09 and into ’10. An ISM purchasing managers survey indicates that the ratio of new orders to inventories indicates industrial production will be materially higher in the coming months. Additionally, that ratio is at it’s highest point in 30 years and has only been at this level only 10 out of 740 months measured. The Fed Beige Book offers mixed expectations for near-term outlook on manufacturing (10/21/09). That being said, I expect slight gains and modest economic growth in the short term. Companies are still deferring projects and maintenance to conserve capital. According to Thomson Baseline, the economy has now emerged from recession (at least on a GDP basis) and is beginning a very slow recovery fueled in the short –term by government stimulus spending. Given the increasing optimism leading to more new hires and increased spending on capital goods, I anticipate the end of the global recession to positively impact the Industrials sector. 8 Key economic data points important to this industry GDP, Implicit Price Deflator/CPI, Industrial Production and Capacity Utilization, New Construction, Industrial Production and Consumer Prices of Major Industrial Countries, U.S. International Trade In Goods and Services, U.S. International Transactions, Federal Receipts (Revenue), Federal Outlays (Expenses), Federal Debt Industry Analysis Trucking Oshkosh is in the Trucking industry. According to Hoover.com, demand for machinery depends on overall industrial activity and on the health of sectors such as agriculture, construction, and power generation. The profitability of individual companies depends on engineering expertise and efficient production. Large companies have economies of scale in purchasing. Small companies can compete effectively by specializing. The US Heavy Truck and Bus Manufacturing is highly concentrated with the top 20 companies accounting for about 95% of revenue. Purchased materials and parts are approximately 83% of sales. The heavy truck industry is subject to volatile demand swings as economic conditions change. Heavy truck demand is driven by growth in agriculture, manufacturing, construction, and retail sectors. The profitability of individual companies depends on volume and sales of high margin options. The industry is capital intensive. After market sale of parts comprises approximately 10% of industry revenues. According to IBIS World Truck and Bus Manufacturing Industry Report, in today's connected and global age, local, interstate and international freight movements are at the core of keeping the wheels of the world economy turning. Truck and bus manufacturers rely heavily on activity in the freight sector for new and replacement sales of trucks. In 2009, the US economy will be suffering one of the worst recessions it has seen in years, which negatively affected just about every corner of the economy: from the farmer whose harvest will not need to be transported anymore, to the independent trucker who will face unemployment due to the slowdown in industrial production. In 2009, industrial production is forecast to contract, while the trucking sector's revenue will fall by an estimated 23.3% on the previous year. Over the five years to 2009, industry revenue will contract by 9.2% annually to $14.29 billion. These factors indicate a slow recovery for players in this industry and tough competition until the economy fully recovers. 9 Potential catalysts for the Trucking Industry Government contracts, Patents, Release/announcement of new innovation/technologies. This is a cyclical business so when the economy is good, the stock is good to have. Key sensitivities in the Trucking Industry The price of metals such as steel, the Industrials Production Index which measures the level of output of the manufacturing, mining, and utility sectors, legislative compliance requirements. Key success factors in this industry Effective cost control, establishment of export markets, a motivated workforce, access to updated technology, optimum capacity utilization, and a portfolio with high quality assets. Cost Structure, Truck & Bus Manufacturing Purchases (83%) Wages (6.9% Depreciation (4.8%) Rent (2%) Utilities (.3%) Other (1%) Profit (2%) Investment Thesis Fundamental Drivers Strengths: Oshkosh’s ability to continue to beat the competition from the government’s contracts will be a huge driver. Oshkosh's relationship with the U.S. military dates back more than 80 years, helping the firm establish itself as a proven supplier. This relationship should bode well for future contract wins. he FMTV contract alone could be worth up to $3 billion during the next 10 years. The M-ATV contract guarantees $1.06 billion in revenue over the next two years. Some optimists predict more contracts valuing up to $12 billion in the next decade. Any future additional deployment of U.S. troops will have a positive impact on the business for Oshkosh. Oshkosh DARPA Challenge TerraMax™ 10 Weaknesses: As Oshkosh continues to lock down contracts with new customers, some analysts fear capacity constraints could become in issue which will directly impact the profitability of these contracts. It is important that Oshkosh position itself be able to meet or exceed all orders in a timely fashion or they risk losing future business. Potential upset by BAE Systems and Navistar NAV competitors in the contest for the FMTV contracts may lead to the loss of future government contracts. In the worse case scenario, the Government Accountability Office could recommend awarding the contract to one of these competitors which would cause loss of future revenue. The ability to execute profitable acquisitions as a way to grow market size and product offering. The JLG acquisition still shows evidence of Oshkosh’s overpayment. Oshkosh could do much damage to the company in the future by continuing to pay too much for acquired businesses. Oshkosh still faces a large debt burden which requires attention in the near term. This could be burdensome to innovation if capital has to be filtered to debt. The access equipment segment is still very exposed to the U.S. residential construction spending, which is expected to be weak in the near term. Investment Thesis Government Outlays for Defense Procurement Correlation: .46 New Private Commercial Construction Correlation: .88, 9 month lag Business Analysis In order to assess the drivers of Oshkosh Corporation, it was necessary to analyze the correlation of Oshkosh’s stock price to several economic indicators. The below list includes the economic indicators which had an impact on the OSK stock price. There were several categories of indicators that could potentially impact the OSK stock price such as Business Spending, GDP, Government Spending, Interest Rates, Labor Markets, Prices & Costs, Production, Trade and Currency, and Transportation. Oshkosh Correlation to Key Economic Driveres As you can see on the graph to the right, the range of the correlations is from .02 (government spending) to .9 (CPI: Gas and Electricity). Group Business Spending GDP & Contributions Government Spending Government Spending Government Spending Interest Rates & Money Labor Markets Prices & Costs Prices & Costs Prices & Costs Prices & Costs Prices & Costs Prices & Costs Production Production Trade & Currencies Transportation Economic Indicator Capital Spending: Industrial Equipment Nominal GDP New Public Construction: Highways Government Outlays for Defense Procurement Real Government Defense Purchases Commercial and Industry Loans Employment CPI: Gas & Electricity PPI: Rail Freight PPI: Construction Machinery GDP Price Index Price Producer Index CPI Capacity Utilization Industrial Production Dollar per Euro Railroad: Total Intermodal Traffic Origin Real Government Defense Purchases Nominal GDP Correlation Lag (months) 0.60 2 0.33 0 0.85 12 0.70 12 0.02 12 0.76 9 0.41 3 0.90 12 0.89 12 0.84 12 0.72 11 0.52 5 0.45 5 0.58 5 0.37 3 0.81 12 0.66 3 11 Industrial Production Employment CPI Price Producer Index Capacity Utilization Capital Spending: Industrial Equipment Railroad: Total Intermodal Traffic Origin Government Outlays for Defense Procurement GDP Price Index Commercial and Industry Loans Dollar per Euro PPI: Construction Machinery New Public Construction: Highways PPI: Rail Freight CPI: Gas & Electricity 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 0.80 0.90 1.00 Profitability Investment Thesis Tax Rate Net Margin Return on Assets Financial Leverage (Average) Return on Equity Financial Ratios 2004 37.30% 4.99% 8.90% 2.28 19.53% 2005 39.30% 5.41% 10.11% 2.1 22.02% 2006 37.30% 6.00% 10.73% 1.99 21.86% 2007 34.20% 4.25% 6.30% 4.59 21.84% 2008 62.00% 1.11% 1.27% 4.38 5.70% 2009 1.70% -20.75% -20.26% 9.27 --- 2004 2005 2006 2007 2008 2009 17.50% 14.20% 30.80% 17.50% 15.80% 18.90% 84.00% 29.30% 13.20% 30.00% -25.80% 18.50% 39.60% 18.80% 48.10% 22.20% 22.00% 27.10% 81.10% 39.70% -31.20% 25.80% ----- 44.90% 21.20% 39.30% 24.10% 26.60% 29.90% 29.70% 32.90% -70.40% -0.40% ----- 2005 1.23 0.53 2.1 0 2006 1.14 0.39 1.99 0 2007 1.42 0.74 4.59 2.14 2005 100.00% 16.70% 9.00% 8.80% 2006 100.00% 17.70% 9.50% 9.50% 2007 100.00% 17.50% 9.40% 6.30% 2005 11.1 5.8 16.4 1.9 2006 11.5 5.2 16.1 1.8 2007 9.1 6.9 19.1 1.5 Growth The following section provides a look at key financial ratios that should be considered when valuing Oshkosh Corporation. Profitability Since businesses create wealth for shareholders by investing capital at a rate of return that is greater than the cost of capital, return on equity is an extremely important benchmark. Oshkosh has reached an all time low in FY08 ROE due to a very strong negative trend in operations (pretax return) and a strong negative trend in non−operating factors. This unfavorable trend in operating performance was driven by lower asset turnover and lower margin. The productivity of Oshkosh’s assets declined over the full period. Reinforcing this trend, pretax margin experienced a very strong overall downtrend that accelerated very sharply from the 2006 level. Non operating factors had a significant negative influence on ROE. The tax rate was extremely high in 2008. Financial leverage has also accelerated very sharply since the JLG acquisition in 2006. Revenue Growth Year over Year 5-Year Average Operating Income Year over Year 5-Year Average EPS Year over Year 5-Year Average Liquidity/Financial Health Growth On average , Oshkosh has grown revenues at about 13% per year (excluding JLG) since 2001. During this time revenue growth has been driven by the high growth in the company’s defense business (513% increase since 2001) and secondly by the Fire & Emergency business (152% increase since 2001). Over the last decade the Defense segment accounted for ~64% of OSK’s revenue growth. In addition, OSK’s acquisition of JLG added an incremental $6.76 billion in revenues over the last three years. Going into the next cycle I expect the company’s Defense segment to continue to drive most of the revenue growth until we see a recovery in the Access segment core business. Current Ratio Quick Ratio Financial Leverage Debt/Equity 2004 1.05 0.42 2.28 0.01 2008 1.47 0.74 4.38 1.93 2009 1.29 0.66 9.27 3.94 Margins (% of Sales) Financial Health Oshkosh’s financial health has been largely endangered during this economic recession due to a $3.2 billion acquisition of JLG in 2006. JLG is the company’s largest acquisition and was financed with a $3.5 billion credit facility. However, with the addition of several military contracts and ability to pay off debt and raise equity, Oshkosh was able to vastly improve the balance sheet by the end of FY09. Margins Revenue Gross Margin Operating Margin EBT Margin 2004 100.00% 16.10% 8.00% 7.80% 2008 100.00% 16.60% 5.70% 2.70% 2009 100.00% 13.30% -18.70% -22.50% Efficiency Strong revenue growth helped Oshkosh expand margins to 5.41% in 2006 from 3.42% in 2002. Poor performance in the firm's refuse truck subsidiary forced down operating margins to 6% in 2008. Receivables Turnover Inventory Turnover Fixed Asset Turnover Asset Turnover Efficiency Oshkosh has show steady improvement in terms of efficiency. This is important since Oshkosh will be relying on productive inventory to drive margins in the coming fiscal year. 12 2004 10.9 6.2 14.4 1.8 2008 6.9 6.4 16.2 1.1 2009 6.8 5.3 12.3 1.0 Oshkosh FMTV: Best Value for the U.S. Army Investment Thesis Income Statement Fiscal 2009 Review During fiscal 2009, Oshkosh was severely impacted by the worldwide recession. Sales for Oshkosh decreased 23.7% from $7.1B to $5.3B. This was a result of revenue growth in the Defense segment and share gains at several businesses. Operating income decreased 66.3% to $207.8 million*. There was $0.05 EPS from continuing operations* for the year; driven by $0.63 fourth quarter EPS from continuing operations. The strengthening of the Defense business was as a result of M-ATV deliveries to DoD being ahead of schedule in addition to units already in Afghanistan. Further, Oshkosh Defense was the winner of the U.S. Army’s FMTV competition for deliveries from FY11 to FY14. See the box to the right on how this was won. Even though Oshkosh Corporation faced a tough economy, Oshkosh maintained a strong capital structure. By reducing their debt by $726 million in FY09, executing a $358 million equity offering in August 09, Oshkosh now has significant room under financial covenants. As of August 2009, Oshkosh received a credit rating by S&P to B+/Stable. Oshkosh expects further reduction in debt in FY10 and is looking forward to benefits regarding performance based payments for the MATV program. Fiscal 2010 Outlook The outlook for 2010 has improved. OSK should see significant growth in the Defense segment due to M-ATV related sales and minimal FMTV volume. OSK is predicting continued weak access equipment and concrete placement products demand. Weaker municipal spending environment will have a negative impact on the fire & emergency segment, but this is considered to be offset by growth in the access equipment segment. According to the annual report, Oshkosh anticipates increasing Capital Expenditures from $90 to $100 million. There will be a continued focus on cost reduction and debt repayment. The following information was gathered from an investor presentation on how Oshkosh won the FMTV competition for deliveries from FY11 to FY14 Experienced, capable defense truck manufacturer FMTV is not a complicated truck for Oshkosh to manufacture – again Significant excess capacity; JLG capable to cover any M-ATV production overlap, if needed Ample time in critical path Extremely low major defects per unit relative to peers Excellent, very low risk manufacturer Outstanding reputation building medium and heavy payload vehicles The tactical wheeled vehicle technology leader Oshkosh offered a compelling, credible price: Bid to be profitable Strong commonality of suppliers between FMTV and FHTV, with Oshkosh’s strong and proven purchasing power Experienced, vertical integration creates competitive advantage 80+ year experience in price-based competitions OSHKOSH CORP Fiscal Year Ended September 30 Income Statement #'s in millions Net sales Access equipment Defense Fire & emergency Commercial Intersegment eliminations NET SALES (Total Consolidated) Consensus Total Operating Expense Opera ti ng Expens e a s % to Revenue Operating Income Interest Income (expense) Other (net) Net Income Before Taxes Provision from Income Taxes Tax % Net Income After Taxes Minority Interest Equity In Affiliates Net Income Before Extraordinary Items Basic Weighted Average Shares Basic EPS Excluding Extraordinary Items Consensus Guidance 2011E 2010E 2009 1,139 3697.59 1519.70 600.00 1,139 4930.12 1519.70 600.00 1,139 2594.80 1169.00 590.00 (100) (39) (198) 6,857 6,520 8,150 8,480 5,295 2008 3,086 1,892 1,193 1,037 (69) 7,138 2007 2,540 1,417 1,142 1,248 (39) 6,307 2006 $-- 2005 $-- 1,317 962 1,190 (42) 3,427 2004 $-- 1,061 841 1,086 (28) 2,960 2,262 6,171.02 90% 7,334.80 90% 5,087.20 96% 6,557.30 92% 5,717.00 91% 3,101.46 90% 685.67 814.98 208.00 581.00 590.30 325.94 (250.00) 10.00 445.7 169.35 38% 276.31 276.31 (250.00) 10.00 575.0 218.49 38% 356.49 356.49 -213.00 -1188.00 (1,193.0) -20.00 98% (1,173.00) -1173.00 -205.00 -172.00 204.0 118.10 42% 85.90 0.70 6.30 92.90 -201.00 14.00 403.3 135.20 66% 268.10 0.30 7.30 275.70 -7.00 8.00 326.9 121.19 63% 205.75 -0.50 2.28 207.53 -8.00 4.00 263.2 102.27 61% 160.93 -0.57 2.92 163.28 -6.00 4.00 178.4 65.89 63% 112.52 -0.07 2.22 114.67 89.39 3.09 3.02 89.39 3.99 3.93 3.11 89.39 -13.12 74.01 1.07 73.56 3.64 73.16 2.81 71.29 2.25 68.39 1.65 * Figures in text exclude $1.2 Billion of non-cash charges to operating income for asset impairment in fiscal 2009. This charge is included in the income statement under “other (net)”. 13 2,693 91% 774 600 907 (19) 267.20 2,082 92% 180.41 Investment Thesis Multiples Valuation: For this analysis, it was assumed that OSK prices would revert to the median so the median price was used as the Target Multiple. Multiples Valuation When looking at the absolute valuation of Oshkosh, the stock looks expensive relative to the forward P/E and P/EBITDA multiples. The P/CF and P/B indicate that the OSK is undervalued and the P/S tells a neutral story. Overall, the Absolute Valuation averages a Target Price of $41.30 for Oshkosh which is very close but slightly below the DCF Target Price of $42.70. Oshkosh Absolute Valuation Absolute Valuation High Low Median Current Target Multiple Target E, S, B, etc/Share Target Price P/Forward E 38.1 2.7 14.8 9.8 14.8 3.99 $59.02 P/S 1.5 0.1 0.6 0.6 0.6 91.17 $54.70 P/B 25.7 0.4 2.8 6.7 2.8 1.51 $4.22 P/EBITDA 13.42 3.93 9.67 6.14 9.67 4.42 $42.74 P/CF 32.8 1.3 12.4 32.8 14 3.27 $45.83 In comparing OSK to the Sector, Industry, and S&P 500, Oshkosh appears to have components that are both under and overvalued. The P/E is high relative to the industry and low relative to the Sector and the S&P 500. The P/S is slightly underpriced relative to the industry, but overvalued compared to the S&P and Sector. The average Target Price for multiples valuation: $41.30 Oshkosh vs. Sector Valuation Oshkosh vs. Industry Valuation Oshkosh vs. S&P Valuation Absolute Valuation High Low Median Current Target Multiple Absolute Valuation High Low Median Current Target Multiple Absolute Valuation High Low Median Current Target Multiple P/Forward E 3.5 0.3 0.8 0.5 0.8 P/Forward E 2.9 0.28 1.0 2.8 1.0 P/Forward E 3.0 0.22 0.92 0.57 0.92 P/S 1 0.1 0.5 0.7 0.5 P/S 1.6 0.1 0.9 0.7 0.9 P/S 1.0 0.1 0.5 0.6 0.5 P/B 12.8 0.2 0.9 2.6 0.9 P/B 10.1 0.2 1.0 1.9 1.0 P/B 13.1 0.2 1.0 3.0 1.0 P/EBITDA 1.82 0.2 1.01 1.76 1.01 P/EBITDA 2.4 0.24 1.3 1.71 1.3 P/EBITDA 2.25 0.23 1.22 1.69 1.22 P/CF 3.4 0.2 1.1 3.4 1.1 P/CF 3.2 0.2 1.5 3.2 1.5 P/CF 3.1 0.2 1.2 3.1 1.2 14 Sensitivity Analysis The following two tables demonstrate the sensitivity of the discount rate and growth rate used. By changing the discount rate, the Target Price range goes from $31.28 - $48.86. A change in growth rate changes the Target Price anywhere from $40.19-67.11. This indicates there is still potential upside to OSK and limited downside as the discount rate and growth rate are adjusted. Investment Thesis Discounted Cash Flow & Sensitivity Analysis In addition to a multiples valuation, a discounted cash flow was calculated to determine a Target Price for Oshkosh Corporation. Several assumptions were made to create this cash flow statement: The economy has recovered and will continue to improve The correct discount rate for Oshkosh is 10.5% and growth rate is 3% The debt OSK is currently carrying will not impact it’s ability to grow S e ns it iv it y M a t rix - D is c o unt R a t e Oshkosh Corporation (OSK) Analyst: Melissa Hickey 11/20/2009 Year Revenue 2009 5,295 % Grow th EBT EBT Margin Interest Interest % of Sales Taxes Tax Rate Net Income Terminal Discount Rate = Terminal FCF Growth = 10.5% 3.0% 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 8,150 6,857 7,097 7,345 7,565 7,792 8,026 8,267 8,515 8,770 53.9% -15.9% 3.5% 3.5% 3.0% 3.0% 3.0% 3.0% 3.0% 575 446 632 661 696 779 883 909 937 965 -22.5% 7.1% 6.5% 8.9% 9.0% 9.2% 10.0% 11.0% 11.0% 11.0% 11.0% (213) (250) (250) (284) (294) (303) (312) (321) (331) (341) (351) -4.0% -3.1% -3.6% -4.0% -4.0% -4.0% -4.0% -4.0% -4.0% -4.0% -4.0% (20) (1,173) % Grow th 218 169 132 140 149 178 213 220 226 233 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 356 276 216 228 244 290 348 359 370 381 -22.5% -22.0% 5.6% 7.1% 18.8% 20.2% 3.0% 3.0% 3.0% -130.4% G ro wt h R ate NP V of C a s h F lo ws T e rm ina l V a lue NP V of t e rm ina l v a lue Im plie d e quit y v a lue / s ha re $ 48.86 -1.00% 9.50% 3.00% $ 2,119 $ 5,573 2249 -0.75% 9.75% 3.00% $ 2,098 $ 5,367 2117 $ 47.15 -0.50% 10.00% 3.00% $ 2,078 $ 5,175 1995 $ 45.56 -0.25% 10.25% 3.00% $ 2,058 $ 4,996 1883 $ 44.08 10.50% 3.00% $ 2,038 $ 4,830 1780 $ 42.70 0.25% 10.75% 3.00% $ 2,018 $ 4,674 1684 $ 41.41 0.50% 11.00% 3.00% $ 1,999 $ 4,528 1595 $ 40.20 0.75% 11.25% 3.00% $ 1,980 $ 4,391 1512 $ 39.07 1.00% 11.50% 3.00% $ 1,962 $ 4,262 1435 $ 38.00 2.00% 12.50% 3.00% $ 1,891 $ 3,813 1174 $ 34.29 3.00% 13.50% 3.00% $ 1,824 $ 3,450 972 $ 31.28 C ha nge D is c o unt R ate G ro wt h R ate NP V of C a s h F lo ws T e rm ina l V a lue NP V of t e rm ina l v a lue Im plie d e quit y v a lue / s ha re $ 40.19 S e ns it iv it y M a t rix - G ro wt h R a t e 3.0% (1,193) 38.0% C ha nge D is c o unt R ate -1.00% 10.50% 2.00% $ 2,038 $ 4,220 1555 -0.75% 10.50% 2.50% $ 2,038 $ 4,506 1660 $ 41.37 -0.50% 10.50% 3.00% $ 2,038 $ 4,830 1780 $ 42.70 -0.25% 10.50% 3.50% $ 2,038 $ 5,200 1916 $ 44.23 10.50% 4.00% $ 2,038 $ 5,627 2073 $ 45.99 0.25% 10.50% 4.50% $ 2,038 $ 6,125 2257 $ 48.04 0.50% 10.50% 5.00% $ 2,038 $ 6,714 2474 $ 50.47 152 57 34 35 37 38 39 40 41 43 44 0.75% 10.50% 5.50% $ 2,038 $ 7,421 2734 $ 53.38 2.9% 0.7% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 1.00% 10.50% 6.00% $ 2,038 $ 8,284 3052 $ 56.94 502 65 116 (23) (24) (25) (26) (26) (27) (28) (29) 9.5% 0.8% 1.7% -0.3% -0.3% -0.3% -0.3% -0.3% -0.3% -0.3% -0.3% 2.00% 10.50% 6.50% $ 2,038 $ 9,364 3450 $ 61.39 (62) (78) (61) 35 37 38 39 40 41 43 44 3.00% 10.50% 7.00% $ 2,038 $ 10,752 3961 $ 67.11 Capex % of sales -1.2% -1.0% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% Free Cash Flow 853 Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex % Grow th 556 488 192 203 219 264 322 332 341 352 -34.7% -12.3% -60.6% 5.9% 7.6% 20.7% 21.8% 3.0% 3.0% 3.0% The Target Price calculated using DCF is $42.70 15 Investment Thesis Stock Performance & Dividends The following table presents the stock prices reflecting actual sales of the Common Stock as reported on the NYSE and dividends paid for the periods indicated. According to the annual report, Oshkosh suspended the payment of dividends on its Common Stock effective April 2009. The payment of future dividends is at the discretion of Oshkosh’s Board of Directors and will depend upon, among other things, future earnings and cash flows, capital requirements, the Company’s general financial condition, general business conditions or other factors. In addition, the Company’s credit agreement limits the amount of dividends it may pay. Fiscal 2009 Quarter Ended High Low Fiscal 2008 Dividends High Low Dividends September 30 $ 34.99 $ 17.80 — $ 20.95 $ 9.05 $ 0.10 June 30 $ 15.76 $ 6.35 — $ 42.59 $ 19.75 $ 0.10 March 31 $ 12.23 $ 4.74 $ 0.10 $ 48.21 $ 35.00 $ 0.10 December 31 $ 13.09 $ 3.85 $ 0.10 $ 63.55 $ 44.85 $ 0.10 As the 5 year stock price shows chart, from early 2005 until mid 2008, OSK stock was increasing. As the global credit crisis and recession became an issue in late 2008-2009, OSK stock price dropped significantly. This is because the acquisition of JLG had cost the company a lot of debt and with increasing tightening around the credit market, the market was concerned with whether or not OSK would be able to make it’s debt payments. Recently, as government contracts have become prevalent, OSK stock is rising. I do not anticipate big future increases because I believe the current stock price includes the benefits of the military contracts it has received. Further, it is important to note the three of the five major individual holders of Oshkosh stock are on the Oshkosh Executive team which implies they have incentive to act in the best interest of OSK shareholders. 16 5Y OSK Moving Price Key Risks Downside There are several downside risks which must be considered when evaluating Oshkosh. The following are the key downside risks for Oshkosh Corporation. Defense contract risk: Reduction in U.S. military spending will result in a significant loss of revenue. In addition, The FMTV contract is still being protested by competitors. Under the formal protest process the government is required to make a decision by December 14, 2009. And finally, President Obama’s pending decision on the future U.S. involvement in Afghanistan may provide upside or downside to my estimate. Debt: OSK continues to carry a heavy amount of debt. This presents a general risk of default which is seen in the company’s beta of 2.91. Execution of deliver schedule: The M-ATV contract is a high profile and urgent priority for the DoD, which requires a significant and rapid increase in the rate of production of these vehicles. If Osk is not able to meet the required delivery schedule for this contract, our ability to secure future military business may be materially adversely impacted Integrating acquisitions: Execution risk given the lack of Defense experience at JLG and the company’s leveraged balance sheet could result in weaker-than-expected earnings and disappointing de-leveraging of the balance sheet. In general, integrating acquisitions could be costly if not done efficiently. Slow world economic recovery: This includes sensitivity to state and local budget. The Commercial and Fire & Emergency segments will likely continue to face tough headwinds as state and local budgets tend to lag an economic recovery by at least 12 months; as such, these businesses may not recover as quickly as we are anticipating. Foreign risk and rate: Oshkosh has a dependency on contracts foreign government agencies in addition to those in the U.S. which are always subject to risk. Foreign rate adjustments also pose potential risk. 17 Key Risks Upside In addition to the downside risks, there are also several upside risks to Oshkosh as well. The following are key upside risks which should be considered for Oshkosh Corporation. Defense contract potential: President Obama is expected to make a decision on a strategy for Afghanistan in the near term so this would provide for a significant increase in troop deployment to Afghanistan. Should he decide that a significant increase in troop deployment is necessary, it could result in further orders for M-ATVs which will directly impact the top line for Oshkosh. Additional contract awards: Additional defense contracts, such as the FHTV program, may be awarded over the next few months. This also could provide to accelerate top line growth. Upside to spare parts shipments: The long term impact of spare parts shipments is also correlated to additional contracts. In addition, given the harsh terrain the U.S. army is exposed to in Afghanistan, there may be upside in the number of spare parts required to maintain the M-ATV’s Oshkosh has shipped. Quick world economic recovery: Sooner-than-expected economic recovery will have an immediate positive impact on all segments, especially the construction segment . Until the economic recovery arrives, Oshkosh construction will still struggle. 18 Recommendation My recommended action is to HOLD Oshkosh Corporation. By weighting my valuation 75% to the DCF and 25% Multiples, the Target Price is $42.35 which presents an upside of approximately 11.54%. Key Risks Defense contract risk Reduction in U.S. military spending will result in a significant loss of revenue Protests by competitors for recently won contracts may pose risk Obama’s pending decision on the future US involvement in Afghanistan OSK continues to carry a heavy amount of debt, inherent risk of default Execution of current delivery schedule Integrating acquisitions could be costly if not done efficiently Slow global recession recovery Foreign risk and rate adjustments Key Drivers Global leader in specialty vehicles Top brands and leading market share in our key markets Innovation leader / technological advantages Improved near term outlook Solid near-term outlook for defense Long-term growth expected for access equipment Reduced cost structure for improved profitability Superior distribution and service network with longstanding customer relationships Strong and improved capital structure Significant room under financial covenants Track record of significant free cash flow Proven, experienced management team 19 Resources Websites: Oshkosh Corporation, http://www.oshkoshcorporation.com IBIS World Industry Reports: Truck & Bus Manufacturing in the US: 33612, August 13, 2009 , http://www.ibisworld.com/industry/default.aspx?indid=818 Wall Street Journal Online , http://online.wsj.com/quotes/key_facts.html?mod=2_0470&symbol=OSK&news-symbol=OSK Yahoo Brand Edgar-Online, http://yahoo.brand.edgar-online.com/displayfilinginfo.aspx?FilingID=6253244-180987-202266&type=sect&dcn=0000897069-08-001739 Yahoo Finance, http://finance.yahoo.com/q?s=osk About.com – Economic Indicators, http://economics.about.com/cs/businesscycles/a/economic_ind.htm Morningstar, http://www.morningstar.com/ Bloomberg.com, http://www.bloomberg.com/apps/news?pid=20601068&sid=aoD4vl4j6Kg4 R.W. Baird Investor Presentation, November 11, 2009, http://phx.corporateir.net/External.File?item=UGFyZW50SUQ9MzU4ODcxfENoaWxkSUQ9MzUxNDAwfFR5cGU9MQ==&t=1 Hoover.com Truck and Bus Manufacturing Industry Report, http://hoovers.com/truck-and-bus-manufacturing/--ID__326--/free-ind-fr-profile-basic.xhtml Other: FY08 & FY09 Oshkosh Annual Report J.P. Morgan Initiation Report, November 23, 2009 Morningstar Q4 Outlook, September, 30 2009 Thomson Baseline 20