Document 11015681

advertisement

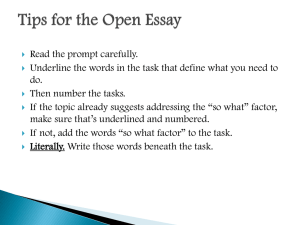

SIM Equity Research Gilead Sciences (NASDAQ: GILD) November 14, 2014 Gilead Sciences (GILD) Recommendation: BUY Target Price: $123.94 Current Price: $102.06 that develops and produces medical treatments for life-threatening illness. Gilead primarily focuses on HIV, chronic hepatitis virus and oncology conditions. Through product innovations and a series of acquisitions, Gilead keeps adding new lines of products into its existing portfolio. Upside: 21.4% Investment Thesis: I recommend a “BUY” with a target price of $123.94. Since last year, Gilead has passed phase III clinical trials of “Sovaldi”, “Tybost” and “Stribild”. With the new approval of “Harvoni” for treating liver disease in October 2014, Gilead’s revenue consensus is $24 billion comparing to $11 billion from the last fiscal year. Gilead’s HIV and liver disease franchises lead the market share, and continue bringing in strong quarterly results. Under the big picture of healthcare reform, more affordable patients will drive extra revenue for drug treatments. Fund Manager: Gilead Sciences is a biopharmaceutical company Ohio State University SIM Analyst: lu.925@osu.edu (617) 838-5625 Drug denials from FDA Underestimation of drug demands Operations inefficiency Pharmaceutical price changes Patent war General economic slow-down Royce West, CFA Company Summary Price: $102.06 Date of Price: 11/14/2014 Sector: Health Care Industry: Biopharmaceutical 52-Week Range: $63.50 - $116.83 Market Cap (Billion): $151.53 Shares O/S (Billion): 1.51 Financial Summary Risks: • • • • • • Hao Lu EBITDA (Billion): $4.9 EBIT (Billion): $4.5 ROA: 36.7% ROE: 76.9% Asset Turnover: 0.8 Debt/Assets: Dividend Yield: 29.8% N/A 52-­‐Week Stock Performance Opportunities: • Licensing internationally • Product diversification • Affordability in emerging markets • Increased demand as a result of the Affordable Care Act Gilead Sciences (GILD) Equity Research Report Hao Lu Table of Contents Company Overview…………………………………………………………………………….. 3 Business Segments………………………………………………………....…………………… 3 Product Research and Development………………………........………………………… 3 Mergers & Acquisitions……………………………………………………....………….. 4 Market Outlook………………………………………………………………………………..... 5 Comparative Analysis…..…………………………………………………………………6 Recent News……………………………………………………………………………… 7 External Analysis……………………………………………………………………………….. 8 Financial Analysis……………………………………………………………………………..... 9 2014 Q3 Results………………………………………............………………………….. 9 Profitability Analysis……………………………………………………………………. 10 Liquidity Analysis………………………………………………………………………. 10 Efficiency Analysis……………………………………………………………………... 11 Valuations……………………………………………………………………………………… 12 Trend Valuation…………………………………………………………………………. 12 Relative Valuation………………………………………………………………………. 13 Multiple Valuation……………………………………………………………………… 13 DCF Valuation………………………………………………………………………….. 14 Sensitivity Analysis……………………………………………………………………...14 Investment Summary…………………………………………………………………………. 15 Appendix A: Income Statement Forecast………………………………...……………….…. 16 Appendix B: DCF Valuation………………………………………………………………….. 17 Works Cited……………………………………………………………………………………. 18 Page 2 Gilead Sciences (GILD) Equity Research Report Hao Lu Company Overview Gilead Sciences, founded in 1987, is a biopharmaceutical company that develops and commercializes drugs for HIV, liver diseases, oncology/inflammation and severe cardiovascular and respiratory conditions. Gilead went public in 1992 with ticker “GILD” traded in NASDAQ Stock Exchange. Gilead currently has 6,100 employees and is headquartered in Foster City, California1. See Exhibit 1 for Gilead’s drug approval timeline. Exhibit 1: Gilead’s product approval timeline associated with its stock price movement. 120 100 10/27/1999 Tamiflu approved 80 10/26/2001 Viread (for HIV) approved 10/10/2014 Harvoni approved 7/2/2003 Emtriva approved 7/12/2006 Atripla approvied 60 12/6/2013 Sovaldi approved 40 20 0 4/10/2008 Lexiscan 2/22/2010 approved Cayston approved 6/27/1996 Vis.de approved 8/2/2004 Truvada (for HIV) approved 9/20/2002 Hepsera approved 8/11/2008 6/15/2007 Viread (for 8/27/2012 Letairis HBV) 8/10/2011 Stribild approved approved Complera approved approved Business Segments Product Research and Development HIV program continues to be the substantial revenue driver for Gilead. The company’s long-term goal is to ensure patients to have the options to choose a suitable single tablet regimen, which helps the suppressive therapy courses4. So far, Gilead has three types of single tablet regimens available including Stribild, Compera/Eviplera and Atripla. Tenofovir Alafenamide (TAF), a new drug for HIV treatment, has been submitted to FDA on November 6 based on the positive results from Phase III trial. The successful sales of Sovaldi brought in tremendous revenues for Gilead (Exhibit 2). However, the liver disease industry continues to be dim because of the restraints of treatment, with that only a small number of patients are identified, and even fewer patients are treated5. Typically, a patient with genotype infections needs Sovaldi treatments with duration of 12 weeks, and for Page 3 Gilead Sciences (GILD) Equity Research Report Hao Lu people waiting for liver transplantation, the treatment duration can be over 48 weeks. Gilead’s long-term goal is to develop an oral therapy for all HCV patients. The fix-dose GS-5816 is currently under Phase II trial. Gilead has been improving its oncology treatments through researches and developments over the past 5 years. In 2013, Gilead acquired GS-0387 as a result of merging YM Biosciences. Currently, the company’s GS-1101, also known as “Idelalisib” for the treatment of iNHL and CLL, is under Phase III trial. Gilead keeps product innovation as the company’s primary competitive advantage. Exhibit 2: Gilead’s marketed products Drug Name Sovaldi Atripla Truvada Complera Stribild Viread Harvoni Letairis Ranexa AmBisome Zydelig Indication Hepatitis C HIV HIV HIV HIV HIV, Hepatitis B Hepatitis C PAH Chronic Angina Fungal Infection Blood Cancer % of U.S. Patent E.U. Patent Total Sales Expiration Expiration 49.6% 2029 2028 14.8% 2021 2018 14.2% 2021 2018 5.1% 2023 2022 4.7% 2029 2027 4.3% 2018 2018 0.1% N/A N/A 2.4% 2018 2020 2.1% 2019 2023 1.7% 2016 2008 0.0% N/A N/A Mergers & Acquisitions Through a series of acquisitions in recent years, Gilead quickly expands its product lines and improves its research capabilities (Exhibit 3). In 2006, Gilead’s purchase of Myogen and Corus Pharma allowed its entry into cardiovascular and respiratory therapeutic areas6. Besides that, Gilead has been focusing on acquiring drugs from other pharmaceutical companies that were experiencing Phase II and III trials, and Gilead took the risk of merging that company before its drugs got approved. As a result, the successful acquisitions boosted Gilead’s product development. Especially, the acquisition of Pharmasset introduced sofosbuvir to support Gilead’s new drug “Harvoni”, which was a crucial component in the combination. Page 4 Gilead Sciences (GILD) Equity Research Report Hao Lu Exhibit 3: Acquisitions made by Gilead Sciences since 2010 Year Acquired Company Price Financing Method Cash 2013 YM BioSciences $510 Million 2012 Pharmasset $11 Billion 2011 Oceanside Clinical Plant N/A Cash, Bank Debt and Senior Notes N/A 2011 Calistoga Pharmaceuticals 2011 Arresto Biosciences $375 Million Cash $225 Million Cash 2010 CGI Pharmaceuticals $120 Million Cash Details Acquired YM's lead drug andicate CYT387 and the Janus Kinase (JAK) family Expand Gilead's chronic hepatitis C (HCV) product line by acquiring sofosbuvir Expand m anufacturing and process development Expand Gilead's HIV product line by acquiring Calistoga's PI3K Expand research and development expertise in cancer Expand inflammatory disease product line Market Outlook Gilead continues to grow market shares in HIV, liver diseases and oncology/inflammation treatments. Gilead’s marketshare is 36.4% by the end of third quarter in the biopharmaceutical industry, which is increased from last fiscal year’s 23.4% (Exhibit 4). Gilead still dominates the majority of HIV medicine by holding 61.7%, which is slightly declined from last fiscal year’s 62.4% (Exhibit 5). For liver disease treatments, Gilead holds 9.1% of market share while facing heavy competitions. It is notable that Gilead’s Sovaldi dictates NS5B polymerase inhibitors in HCV treatments. Gilead keeps expanding its oncology research and development by a list of acquisitions including buying Calistoga Pharmaceuticals. Several developing drugs for oncology treatments are currently under Phase II & III trials. Exhibit 4: Industry market share (2014 Q3) UTHR MDCO ALXN CELG AMGN BIIB GILD Exhibit 5: HIV drug market share JNJ BMS GILD GSK Page 5 Gilead Sciences (GILD) Equity Research Report Hao Lu Comparative Analysis The environment for biopharmaceutical companies is highly competitive. Companies try pushing their drugs to pass FDA trials in order to create market dominations. Product innovation is still the key to become relatively competitive in the industry. Gilead keeps a high profitability while maintaining a moderate level of sales growth (Exhibit 6). In the HIV field, Gilead leads its market share with three types of drugs; however, GlaxoSmithKline and Bristol-Meyers Squibb have similar drugs on testing trials, and sooner or later they will sell them. Until now, Gilead only has one type of regimen for HIV on testing trial. The peer pressure cannot be ignored. The competitions within liver diseases and non-antivirals are emerging. Vertex, Johnson & Johnson and Merck split the pie with Gilead. However, Gilead has 10 HCV drugs on testing trials at present. According to Gilead’s elevated drug approval rate, the future of Gilead’s HCV field should be affirmative. Exhibit 6: ROE and revenue growth rate for Gilead Sciences and its main competitors 1.0 0.8 GSK GILD ROE 0.6 0.4 CELG 0.2 AMGN 0.0 BIIB ALXN UTHR 0.0 REGN 0.3 0.6 % Revenue Growth in One Year Page 6 Gilead Sciences (GILD) Equity Research Report Hao Lu Recent News Gilead’s new developed drug “Harvoni” was approved by FDA on October 10, which would be the first once-daily single tablet regimen for curing chronic hepatitis C genotype 1 infections. This new product will enhance Gilead’s market in the HCV treatment market. On the other hand, Gilead is kind of stagnant with its HIV drug development (Exhibit 7). During Phase II trial of “Simtuzumab”, the data showed that this drug didn’t significantly improve the survival rate of previously untreated pancreatic cancer2. The previously approved HIV drugs still dominate Gilead’s existing HIV portfolio, and the growth of HBV and HCV drugs has surpassed the progress of HIV development. Internationally, Gilead has been successful expanding licensing and patent controls in developing countries. On September 15, Gilead signed a licensing agreement with seven Indian pharmaceutical companies to expand their access to Gilead’s HCV medicine; on July 24, Gilead signed an agreement with Medicines Patent Pool (MPP) to expand their access to Gilead’s tenofovir alafenamide (TAF) for HIV and HBV drugs. These settlements allowed Gilead to expand its market in developing countries while under the supervision of U.S. regulatory, which helps Gilead gain first-mover advantage. One emerging problem with Gilead’s “Harvoni” is that it hasn’t been granted a patent. AbbVie (NYSE: ABBV) has ambushed Gilead by receiving five U.S. patents that specifically claimed the use of sofosbuvir and ledipasvir that are relative to “Harvoni” Combination3. AbbVie isn’t able to commercialize “Harvoni”, but the company can harm Gilead with royalty payments. Exhibit 7: Gilead Sciences product pipeline Page 7 Gilead Sciences (GILD) Equity Research Report Hao Lu External Analysis Under the rollout of The Affordable Care Act, it is projected that over 30 million people will enjoy health insurance coverage7. The increased government spending on healthcare will lift the sales of prescribed drugs (Exhibit 8). First of all, insured people tend to seek medical screenings such as HIV, and they are more likely to purchase brand-labeled medicine since their bills are covered. Second, the government doesn’t have the right to negotiate drug price with pharmaceutical companies directly, which releases the pressure of companies like Gilead. Without the government’s intervention, Gilead has more power in the market. On the other hand, pharmaceutical companies endure the national burden for its profit-booming industry, so the general public asks for more rebates and more benefit to the uninsured population. Gilead’s “Atripla Patient Access Program” is an example. Exhibit 8: Annual growth rates of national health expenditure and prescription drug expenditure8 The aging population also has effects on the biotechnology industry. The baby boomers are entering the retirement stage, and their accumulated wealth allows them to access expensive medical treatments. Furthermore, people aged 65 and above will hold 20.7% of the entire population by 2050 according to U.S. Consensus Bureau’s projection (Exhibit 9). It gives biopharmaceutical companies time to develop and sell specific medicine for the elderly group. A population heavily driven by seniors will escalate branded drug prescriptions. Exhibit 9: Projections of percentage of population aged 65 and above9 Page 8 Gilead Sciences (GILD) Equity Research Report Hao Lu Financial Analysis 2014 Q3 Results Gilead Sciences announced its third quarter earnings results on September 30, 2014. Gilead reported a 117.1% increase in revenue for the three-month period comparing to the same period last year, which beats the analysts’ estimate of 116.5%. Income has over-tripled and EPS is increased by 255% comparing to last year’s results (Exhibit 10). Gilead’s turnover ratio overdoubled the figure from last year. Since last year’s launch, Sovaldi’s sales have been skyrocketing, which generates more than $5.75 billion of revenue; at the same time, Gilead’s HIV drugs Stribild and Eviplera added sales of $550 million and $484 million. As for product development, Gilead has reduced its R&D expenses by nearly triple times, mainly due to the slow-down of HIV drug development. In conclusion, Gilead has been beating its quarterly earnings with its exceptional HCV and HIV sales growth and a list of new-drug approvals over time. For the upcoming quarter, Gilead seeks to continue growing with its diversified revenue stream. Exhibit 10: Key financials for Gilead’s third quarter earnings results10 (In thousands, except EPS) Product Sales Total Revenue Net Income (GAAP) Net Income (Non-­‐GAAP) Diluted EPS (GAAP) Diluted EPS (Non-­‐GAAP) R&D Expenses (GAAP) R&D Expenses (Non-­‐GAAP) Operating Margin (GAAP) Operating Margin (Non-­‐GAAP) Three Months Ended September 30 2014 2013 $5,968,208 $2,709,652 $6,041,832 $2,782,833 $2,731,274 $3,013,691 $788,606 $879,081 $1.67 $1.84 $0.47 $0.52 $630,466 $586,325 $546,244 $488,535 57.6% 62.6% 41.2% 45.2% Nine Months Ended September 30 2014 2013 $17,252,119 $7,760,505 $17,575,731 $8,081,862 $8,614,277 $2,283,397 $9,431,033 $2,520,749 $5.18 $1.35 $5.68 $1.49 $1,809,368 $1,567,778 $1,686,104 $1,436,282 62.2% 41.2% 67.2% 44.9% Page 9 Gilead Sciences (GILD) Equity Research Report Hao Lu Profitability Analysis Gilead’s profit margins have been declining over the past five years (Exhibit 11). Legislative and regulatory changes as well as the patent wars against other biopharmaceutical firms can potentially affect Gilead’s profitability. Since December 2009, Gilead’s stock has been increasing exponentially from around $23 to $102.06 today while ROE slides a bit year after year, and this indicates the profit has been increasing at a relatively fast pace although it hasn’t caught up with the growth of stock holders’ equity. Also, due to higher costs to produce and promote new products in the competitive business environment, along with the expenditures in R&D, these costs have driven down Gilead’s profit growth. Exhibit 11: Profitability indexes of Gilead Sciences from 2009 to 2013 Year 2009 2010 2011 2012 2013 Return on Equity 50.11 47.44 44.49 32.30 29.74 Return on Assets 31.53 27.25 19.41 13.45 14.06 Gross Margin 77.24 76.48 74.67 74.53 74.48 Operating Mergin 50.34 49.84 45.2 41.33 40.39 EBT Margin 49.95 49.23 43.54 37.23 37.57 Liquidity Analysis Gilead’s liquidity ratios have been falling from 2009 to 2013 (Exhibit 12). The acquisitions taken place have reduced cash on the balance sheet; on the other hand, Gilead has been taking more short-term debt in order to produce and market new drugs, which results in the decline of both current and quick ratios. Although both ratios are coming down, Gilead never suffers from a liquidity crunch. The high sales of HIV and HCV drugs give the company enough room to pay back its debt. Exhibit 12: Efficiency index charts of Gilead Sciences from 2009 to 2013 10.00 Quick Ra.o 5.00 Current Ra.o 0.00 2009 2010 2011 2012 2013 Page 10 Gilead Sciences (GILD) Equity Research Report Hao Lu Efficiency Analysis As the nature of biopharmaceutical industry, a large part of the sales are credit sales. Gilead’s accounts receivable ratio has rebounded to its 2009 high rate due to the growing sales from new drugs; with a moderate asset turnover rate, Gilead always has assets under efficient control (Exhibit 13). Sizable sales of Sovaldi require more inventory stocks, and despite Gilead has expanded its warehousing capabilities through acquisitions, the inventory turnover ratio finally came down in 2013. Exhibit 13: Efficiency indexes of Gilead Sciences from 2009 to 2013 Year 2009 2010 2011 2012 2013 1.61 1.66 1.64 1.58 1.50 226.43 220.14 222.82 231.5 242.66 A/R Turnover 5.81 5.28 4.69 5.24 5.82 Asset Turnover 0.84 0.75 0.58 0.5 0.51 Inventory Turnover Days Inventory Page 11 Gilead Sciences (GILD) Equity Research Report Hao Lu Valuations Trend Valuation Exhibit 14: Gilead Sciences 10-year stock price with exponential moving average, NASDAQ, and S&P 50011 GILD GILD Moving Average Nasdaq S&P 500 Based on the ten-year trend of Gilead’s share price, it has jumped over ten times with twice 2:1 stock splits (Exhibit 14). It outperforms both NASDAQ and S&P 500 indexes. Throughout the years, Gilead has often surprised investors with its earnings followed by new drug approvals. It can be seen that Gilead’s moving average has been flat until its takeoff in mid-year 2011. In October 2014, Gilead suffered from the worst week of the year, and it dropped from $108.87 to $96.16 by 11.7%, but it kicked right back in two weeks at $113.45. Although Gilead experiences high volatility, it has enough strength to endure market down time and keeps its way to outperform. Page 12 Gilead Sciences (GILD) Equity Research Report Hao Lu Relative Valuation Currently, Gilead is trading below the industry average multiples, which means Gilead is undervalued. As an alternative to P/E ratio, Gilead’s low EV/EBITDA shows that it is less levered than its peers. Gilead’s market cap surpassed the main industry competitors, and that gives the company the ability to expand through acquisitions in order to gain market share. Exhibit 15: Comparative multiples including Gilead and its peer companies Multiples Market Cap (Billion) EV/EBITDA EV/MC P/FCF P/S P/E GILD $151.53 8.70 1.01 15.23 7.42 17.77 Industry Average $37.14 114.54 0.99 55.02 48.38 60.93 BIIB $71.42 12.63 0.96 27.30 7.92 29.24 CELG AMGN $83.35 $121.05 17.08 12.45 1.00 1.04 24.64 16.96 7.81 6.11 35.76 22.65 VTRX $26.85 917.47 0.96 N/A 33.05 N/A ALXN $37.04 26.04 0.95 77.95 17.78 74.74 Multiple Valuation Considering the fact that Gilead has low multiples in the industry as well as its expected EPS quadruples the current EPS, I estimate that Gilead’s target multiples will increase by roughly 10% - 17% over time (Exhibit 16). The reason for a higher P/B multiple is that some of Gilead’s R&D are not capitalized in its book value. As a result of my estimations, Gilead’s share price will be within $117.01 - $124.79. Exhibit 16: Multiple Valuation for Gilead’s stock price Multiples P/E P/B P/S P/EBITDA Current 17.77 11.36 8.4 20.83 Target/ Current 1.15 1.16 1.17 1.10 Target Multiple 20.40 13.15 9.80 22.95 Expected EPS 7.99 Target Price $122.79 $123.81 $124.79 $117.85 Page 13 Gilead Sciences (GILD) Equity Research Report Hao Lu DCF Valuation Appendix A presents my income statement forecast of Gilead Sciences for the next three years. Revenues are identical to analysts’ estimates. The tremendous revenue growth in 2014 is mainly due to the sales of new drug “Harvoni” and the continued success of “Solvadi”; alternatively, several competitors’ new HCV drugs are set to release next year, which will downgrade Gilead’s market share, and it will lead to a moderate revenue growth for Gilead in 2015 and 2016. EPS estimates are slightly below analysts’ estimates. I think that boosted revenue will largely impact Gilead’s net earnings, but at the same time, rising costs of goods sold, inventory holding costs and transportation costs will bring down net earnings. As a result, I set EPS at a more conservative level comparing to analysts. Besides that, I believe Gilead’s R&D expenses will continually grow fast in order to produce more innovative drugs for HIV, HCV and oncology/inflammation. Appendix B illustrates the DCF valuation for Gilead Sciences. With considering inflation rate at 1.7% and 10-year treasury yield at 2.37%, I set the terminal discount rate at 9% with a terminal FCF growth rate at 4.5%. Also, biopharmaceutical industry has a low correlation with the market and peer competitors are highly correlated to each other, this is another reason for the moderate indicators. The implied value for Gilead is $123.94 with an upside of 21.4%, which corresponds to the estimation from the previous Multiple Valuation. Sensitivity Analysis Exhibit 17 shows the sensitivity analysis for Gilead Sciences. It is clear that a minor variation of the growth rate has a large change on price. Exhibit 17: Sensitivity Analysis for Gilead’s implied share price Page 14 Gilead Sciences (GILD) Equity Research Report Hao Lu Investment Summary With the projected target price of $123.94 and the potential upside of 21.9%, I recommend a “BUY” in Gilead Sciences (GILD). The share price currently remains undervalued at $102.06. Opportunities for Gilead include continuous growing sales, successful approvals of new drugs, continued large government spending on healthcare industry, increased demand for HIV and liver disease treatments and international expansion; conversely, risks associated contain FDA denials, rising costs, legislation and business environment changes, patent wars and geopolitical concerns. Ultimately, the growing number of insured people will purchase more branded drugs under the big picture of healthcare reform. Valuations: • • • • DCF Valuation: Gilead has a target price of $123.94 with an upside of 21.9%. Multiple Valuation: Gilead should be traded at $117.01 - $124.79. Relative Valuation: Gilead is undervalued. Trend Valuation: Gilead has a upward potential as a result of its uprising moving average and comparisons to market indexes Page 15 Gilead Sciences (GILD) Equity Research Report Hao Lu Appendix A: Income Statement Forecast Page 16 Gilead Sciences (GILD) Equity Research Report Hao Lu Appendix B Page 17 Gilead Sciences (GILD) Equity Research Report Hao Lu Works Cited 1 Yahoo Finance. 2 Gilead Sciences News Release 3 Seaking Alpha: http://seekingalpha.com/article/2674915-gilead-sciences-gets-ambushed-by-thepatent-troll-abbvie 4 2013 Gilead Sciences Form 10-K 5 2013 Gilead Sciences Form 10-K 6 Gilead Sciences News Release 7 The Heritage Foundation Research Reports 8 Centers for Medicare & Medicaid Services 9 United States Consensus Bureau 10 Gilead Sciences Third Quarter 2014 Financial Results 11 Yahoo Finance Page 18