Information Technology: Stock Presentation SPR I NG 20 13

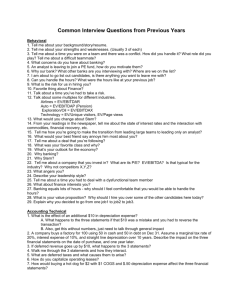

advertisement

Information Technology: Stock Presentation SPR I NG 20 13 A L E X LO WMA N PR I S CI LLA FLO R IN DI WU ME NG TI AN CAO NICK MCCR E A R Y Agenda • Sector Review • Qualcomm • Corning • Oracle • Intel • Apple • Google • Conclusion Sector Review 16 Industries in the Info Technology Sector Application Software Internet Software and Services Communications Equipment IT Consulting and Services Computer Storage and Peripheral Office Electronics Computer Hardware Semiconductor Equipment Electronic Component Semiconductors Electronic Equipment Services-Data Proc Electronic Manufacturing Services Systems Software Home Entertainment Software Technology Distribution Largest Companies in the Sector and SIM Five Largest Sector Companies Market Capitalization (Billions) *Apple Inc. (AAPL) 427.95 *Google (GOOG) 266.30 Int. Business Machines Corp. (IBM) 237.62 Microsoft Corporation (MSFT) 235.37 *Oracle Corporation (ORCL) 170.62 SIM Companies Market Capitalization (Billions) *QUALCOMM Incorporated (QCOM) 110.92 *Intel Corporation (INTC) 105.15 *Corning Inc. (GLW) 18.92 Info technology as a portion of S&P and SIM S&P 500 SIM Telecom Services 3.02% Telecom Services 0.82% Utilities Cash Materials 3.27% 3.38% 2.63% Utilities 3.44% Materials 3.46% Information Technology 18.20% Consumer Discretionary 11.52% Consumer Staples 10.88% Energy 11.08% Industrials 10.22% Health Care 12.32% Consumer Discretionary 12.28% Information Technology 18.14% Consumer Staples 12.59% Energy 9.83% Industrials 9.99% Financials 15.85% Health Care 12.07% Financials 14.99% Information Technology Sector Breakdown Percent of Assets Oracle Corp. Apple Inc. Corning Inc. Qualcomm Inc. Google Intel Team Recommendation • SIM Portfolio is currently underweight .46% relative to the S&P • Currently weighted at 17.56% in SIM Portfolio vs 18.02% in S&P 500 • Team Recommendation: Hold with a reweighting of individual industries • Class Decision: Add 50 BPS Qualcomm QUALCOMM Incorporated (BUY) • Founded in 1985 – 1000% growth since 1991 IPO • Communication Equipment Industry • Design, develop, manufacture, and market digital communication products and services • Operates in four segments • CDMA Technologies (QCT) • Technology Licenses (QTL) • Wireless and Internet (QWI) • Strategic Initiatives (QSI) One Year Price and Volume History Market Data Market Cap $112.0B 52-Week High $68.57 52-Week Low $53.09 Beta 1.17 Avg. Vol. (M) 11.2M Shares Out (B) 1.72B Annual Div. $1.00 Dividend Yield 1.5% QUALCOMM Business Outlook CATA LYSTS RISKS • No signs of slowing global growth in products/services • Dependent on technology adoption and licensee sales • High industry entry barriers • Rapid technological change • Selling the right technology • Significant portion of QCT revenue from customers • Unique approach to innovation snapdragon • Intellectual property future Qualcomm (QCOM) Analyst: Alex Lowman Date: 2/12/2013 Year 2013E Revenue 23,964 % Grow th Terminal Discount Rate = Terminal FCF Growth = 2014E 27,600 15.2% Operating Income 7,259 Operating Margin 30.3% Interest and Other 959 Interest % of Sales 4.0% Taxes 1,643 Tax Rate 20.0% Net Income 6,574 % Grow th 8,196 29.7% 1,104 4.0% 1,860 20.0% 7,440 13.2% Add Depreciation/Amort 1,438 % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex 1,218 4.0% 1,983 20.0% 7,934 6.6% 1,675 9,213 27.5% 1,340 4.0% 2,111 20.0% 8,442 6.4% 1,843 36,181 8.0% 9,407 26.0% 1,447 4.0% 2,171 20.0% 8,684 2.9% 1,881 38,352 2020E 40,270 6.0% 42,082 5.0% 9,588 1,534 1,611 4.0% 2,224 2,416 20.0% 8,898 9,665 2.5% 1,918 1,933 20.0% 11,288 5.7% 1,936 2,935 20.0% 10,854 6.2% 4.0% 2,822 20.0% 10,268 8.6% 1,893 4.0% 2,713 20.0% 27.0% 1,821 4.0% 2,567 20.0% 12,781 27.0% 1,751 4.0% 4.0% 12,289 27.0% 1,683 4.0% 47,337 4.0% 11,817 26.5% TERMINAL 2023E 45,516 4.0% 11,152 26.0% 2022E 43,765 4.5% 10,470 25.0% 2021E 11,739 4.0% 1,926 4.0% 1,912 1,893 5.2% 5.0% 4.8% 4.6% 4.4% 4.2% (247) (218) (171) (136) (118) (94) (82) (77) (71) (74) (77) -1.0% -0.8% -0.6% -0.4% -0.3% -0.2% -0.2% -0.2% -0.2% -0.2% -0.2% 1,104 0.04 7,773 14.2% 56,371 68,752 125,123 6.08% 17.0 19.0 12.4 13.9 Shares Outstanding 28.6% 10.0% 2019E 5.5% 6,806 Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 8,699 33,501 2018E 5.5% % Grow th NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 10.3% 2017E 6.0% 0.04 Free Cash Flow 30,456 2016E 6.0% 959 Capex % of sales 1,656 2015E 10.50% 4.0% 1,218 0.04 8,219 5.7% 1,340 4.0% 8,809 7.2% 1,447 4.0% 9,000 2.2% 1,534 1,611 4.0% 1,683 4.0% 9,188 9,905 2.1% 1,751 4.0% 1,821 4.0% 10,444 7.8% 4.0% 11,305 4.9% 45% 55% 100% 1,893 4.0% 10,958 5.4% 4.0% 11,662 3.2% 3.2% Terminal Value 186,600 Free Cash Yield 15.0 16.8 10.9 12.3 14.1 15.8 10.4 11.6 6.25% Terminal P/E 15.9 Terminal EV/EBITDA 12.4 1,700 Implied Equity Value/Share Sensitivity to Discount Rate and FCF Growth Rate Current Price Implied equity value/share Upside/(Downside) to DCF Debt Cash Cash/share Total Assets Debt/Assets Working Capital % of Growth $ $ 65.86 73.60 11.8% 4,293 2.53 17,103 0.0% -4% Discount FCF Grwth 74 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 9.0% $ 81.26 $ 85.30 $ 90.09 $ 95.83 $ 102.85 $ 111.63 $ 122.91 9.5% $ 75.26 $ 78.60 $ 82.48 $ 87.07 $ 92.59 $ 99.32 $ 107.74 $ $ $ $ $ $ $ 10.0% 70.08 72.85 76.05 79.78 84.18 89.47 95.94 $ $ $ $ $ $ $ 10.5% 65.54 67.87 70.53 73.60 77.18 81.41 86.49 $ $ $ $ $ $ $ 11.0% 61.55 63.52 65.76 68.31 71.26 74.70 78.76 $ $ $ $ $ $ $ 11.5% 58.00 59.68 61.58 63.72 66.18 69.01 72.31 $ $ $ $ $ $ $ 12.0% 54.83 56.28 57.89 59.71 61.77 64.13 66.85 Multiple Valuation Absolute Valuation High A. P/Forward E P/S P/B P/EBITDA P/CF Statistic Low B. C. 37.9 16.5 8.0 40.12 39.9 14.0 5.0 2.7 11.67 12.6 Median Current D. 20.2 8.1 4.4 19.97 20.8 E. 14.5 5.5 3.2 11.80 14.3 Valuation Weight DCF $73.60 50% P/Forward E $73.53 10% P/S $77.55 10% P/B $73.50 10% P/EBITDA $64.05 10% P/CF $72.00 10% My Valuation #Your Target Multiple $72.86 F. 19.0 5.5 3.5 15.0 18.0 *Your Target E, S, B, etc/Share G. 3.87 14.1 21 4.27 4.0 Your Target Price (F x G) H. 73.53 77.55 73.50 64.05 72.00 Price Target = $72.86 Current Price = $65.86 One Year Upside = 10.63% Recommendation = BUY Increase by 100 BPs Corning Corning Inc. (buy) • Established since 1851, originally focusing on glass business. Business line sales earnings Display Technology 40% 97% - Display Technology Telecommunications 26% 3.2% - Telecommunications Environment Technologies 12.5% 1.4% - Environment Technologies Specialty Materials 13.5% -1% - Specialty Materials Life Sciences 7.5% 2% • Five business segments: - Life Sciences Corning Corning GLW Current price 13.35 Beta 1.03 52 Week Range 10.62 – 14.58 Volume 11,858,351 Market Cap 19.66B P/E 11.61 EPS 1.15 Div&Yield 0.36 (2.7%) Corning Inc Catalysts Risks • Long history with well-known brand name • The industry is over supply • Strong in R&D • Majors business line (Display Technology) sales is • New technology products will increase sales for Gorilla Glass decaling - tablets and smartphones • - windows 8 will positively affect the sales • Heavily rely on several major customers such as • New innovation on the fiber-optic networks this year. • Low debt to equity ratio which is 0.16. high pressure from oversea competitors Samsung DCF Multiples Target Price 16.52 Current Price 13.35 Potential Upside 20% Recommend to buy Oracle Oracle (ORCL) Overview • Third largest software company by sales • Products range from servers to application software • Heavily diversified with subsidiaries in over 67 countries and more than 48% of sales outside of the U.S. Market Data Market Capitalization (USD) Shares Outstanding (diluted) Dividend Yield Dividend (USD) 52 Week Price Range (USD) 154.25B 4,812M .7% .24 25.33-36.43 Financial Data (FY 2012) Revenue (USD) Revenue Growth Operating Margin Earnings Per Share (diluted) Price to Earnings 37,121M 4.2% 36.9% 1.96 16.33 Mar-13 Feb-13 Jan-13 Dec-12 Nov-12 Oct-12 Sep-12 Aug-12 Jul-12 Jun-12 May-12 Apr-12 Mar-12 Oracle 12-month Price Performance (USD) 40 35 30 25 20 15 10 5 0 Oracle Overview A DVA N TAG E S RISKS • Diversification/Acquisition • New Segments • High Cap/Market Leader • Acquisition Success • Holding $14,955 million in cash • Brand Equity • Global Growth and Diversity • Java • Increase in Capital Spending • IBM vs. Oracle • Software and Equipment • Limited Growth Opportunities Oracle Discounted Cash Flow Valuation Terminal Discount Rate = Year Revenue 10.5% 2013E 38,728 % Grow th Operating Income Operating Margin Oracle Discounted Cash Flow Analysis Interest and Other Interest % of Sales Taxes Tax Rate Net Income % of Sales Plus/(minus) Changes WC % of Sales 2014E 40,816 5.4% 13,609 14,295 2015E 42,880 5.1% 15,200 3.20% 2016E 45,453 6.0% 16,363 2017E 47,952 5.5% 17,742 2018E 50,350 5.0% 18,630 2019E 52,616 4.5% 18,942 2020E 54,720 4.0% 19,152 2021E 2022E 56,690 58,618 3.6% 3.4% 19,842 19,344 2023E 60,494 3.2% 19,358 35.1% 35.0% 35.4% 36.0% 37.0% 37.0% 36.0% 35.0% 35.0% 33.0% 32.0% (680) (635) (644) (682) (720) (756) (790) (821) (851) (880) (908) -1.8% -1.6% -1.5% -1.5% -1.5% -1.5% -1.5% -1.5% -1.5% -1.5% -1.5% 2,844 22.0% 10,085 % Grow th Add Depreciation/Amort Terminal FCF Growth = 2,937 21.5% 10,723 6.3% 3,088 3,367 3,130 21.5% 11,427 6.6% 3,203 3,371 21.5% 12,309 7.7% 3,182 3,660 21.5% 13,363 8.6% 2,877 3,843 21.5% 14,031 5.0% 2,518 3,903 21.5% 14,249 1.6% 2,105 3,941 21.5% 14,390 1.0% 1,642 4,083 3,970 21.5% 21.5% 14,908 14,494 3.6% 1,134 3,967 21.5% 14,483 -2.8% -0.1% 586 605 8.0% 8.2% 7.5% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 1.0% (564) (359) (355) (212) (205) (195) (184) (170) (158) (155) (150) -1.5% -0.9% -0.8% -0.5% -0.4% -0.4% -0.3% -0.3% -0.3% -0.3% -0.2% Subtract Cap Ex 775 816 858 682 719 755 526 547 567 586 605 Capex % of sales 2.0% 2.0% 2.0% 1.5% 1.5% 1.5% 1.0% 1.0% 1.0% 1.0% 1.0% Free Cash Flow 11,531 % Grow th 12,536 8.7% NPV of Cash Flows 85,923 NPV of terminal value 74,793 47% Projected Equity Value 160,715 100% Free Cash Flow Yield Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA Shares Outstanding 4.3% 15.2 14.3 15.0 14.1 9.7 9.2 8.8 9.5 9.0 8.7 Implied equity value/share $ 31.54 -1.5% 14,979 5.5% 15,327 2.3% 15,403 0.5% 15,155 -1.6% 15,246 14,366 0.6% -5.8% Free Cash Yield 15.9 $ 32.03 8.6% 14,359 -0.1% Terminal Value 202,994 16.2 5,095 14,203 53% 7.07% Current Price Upside/(Downside) to DCF 13,074 7.07% Terminal P/E 14.0 Terminal EV/EBITDA 10.1 Debt 13,524 Cash 14,955 Cash/share Total Assets 2.94 78,327 Debt/Assets 17.3% Working Capital % of Growth 8% Oracle Valuation Analysis Oracle Company Valuation Relative to Industry Price/Trailing Earnings Price/Forward Earnings Price/Book Price/Sales Price/Cash Flow Relative to S&P 500 Price/Trailing Earnings Price/Forward Earnings Price/Book Price/Sales Price/Cash Flow High 1.3 1.3 2.5 1.7 1.5 Low Median Current 0.8 1 1.1 0.8 0.98 1.2 0.8 1.1 1.1 0.7 1.3 1.4 0.9 1.1 1.1 High 1.7 1.7 4.2 5.5 2.8 Low Median Current 0.8 1.1 0.9 0.8 1 0.87 1.4 2.1 1.5 3 4.2 3.3 1 1.5 1.1 Source: Thomson Reuters Baseline. Feb. 17, 2013 Oracle Company Valuation Absolute Valuation High Price / Forward Earnings Price / Sales Price / Book Price / EBITDA Price / Cash Flow Low 29.6 7.8 11.5 19.61 27.6 Source: Thomson Reuters Baseline. Feb. 17, 2013 10.3 3.4 3 7.92 8.7 Target Target Median Current Multiple Value/Share 15.1 5.5 5.3 13.5 15.3 12.4 4.5 3.5 8.48 10.8 15.95 4.33 3.65 9.96 10.75 1.98 7.59 8.64 3.14 2.93 Target Price $ $ $ $ $ 31.54 32.88 31.51 31.32 31.51 Oracle Price Target Recommendation: SELL Oracle Company Valuation Metric Target Price Discounted Cash Flow Price / Forward Earnings Price / Sales Price / Book Price / EBITDA Price / Cash Flow $ $ $ $ $ $ 31.54 31.54 32.88 31.51 31.32 31.51 Projected Target Price Current Price (April 6, 2013) Potential Downside $ 31.60 $ 32.02 -1.32% Weight 75% 5% 5% 5% 5% 5% Intel Company Overview “Chip Maker”: Designs and manufactures digital technology platforms that consist of microprocessors and chipsets Develops and sells software and services Five operating segments: • PC Client Group • Data Center Group • Other Intel Architecture • Software and Services • All Other Segments Business Organization Stock Information • Current price: $21.09 • 52-week range: $19.23-$29.27 • Current weight: 1.54% • Target price from DCF: $22.66 (+7.4%) • Target price from DCF and Multiples: $22.95 (+8.8%) • Target weight: • Bull: $27.63 (+31%) • Bear: $20.45 (-3%) • Recommendation: HOLD Revenue Forecast PC Client Group Data Center Group Other Intel Architecture Software and Services Forecasted Revenue Breakdown Forecasted Income Statement DCF Model DCF Model - Bull DCF Model - Bear Multiple Analysis High Low Median Current Target Multiple Target E, S, B/Share Target Price P/ Forward E 35.7 8.4 17.2 11 13 2.0 26.0 P/S 8.3 1.8 3.3 1.9 2.5 10.9 27.2 P/B 6.2 1.8 3 2.1 2.4 8.5 20.4 P/EBITDA 23.1 4.31 9.21 4.59 6.5 2.7 17.5 P/CF 25.5 5.1 10.4 5.6 6.5 3.9 25.2 Approach Valuation Weight Weighted valuation DCF $22.66 50% $11.33 P/E $26.00 10% $2.60 P/S $27.18 10% $2.72 P/B $20.36 10% $2.04 P/EBITDA $17.46 10% $1.75 P/CF $25.18 10% $2.52 100% $22.95 Final price target Catalysts • Strong R&D, more new products and services • Strategic collaboration with PC, smartphone and tablets makers • Tap the potential of emerging markets: China, Brazil, Africa • Balance Sheet • Stock repurchase plan Risks • Declining PC market • Falling behind in mobile market; competition from Qualcomm and ARM in mobile chip • Poor performance of Other IA operating segment • Lower selling price and shrinking margin Worldwide Devices Shipment by Segment (Thousands of Units) Source: Gartner (April 2013) Market Consensus Source: Financial Times Recap Target price: $22.66 Recommendation: Hold • Slightly undervalued • Lots of uncertainties going forward, not sure whether Intel can catch up in mobile market • Blue-chip stock, growing dividends: 11.2% increase in 2012 Apple Apple (Buy) • Hardware Producer • Segments: • America’s (~37%) • Europe (~23%) • China (~14) • Japan and Asia Pac both (~7%) • Retail (12%) Current Price : $523.30 Apple (Buy) • Current Weight: 3.08% • Desired Weight: 4.5% • Target Price: $559 (33% upside) • Bear: $390 (8% down) • Bull: $670 (56% up) • Consensus Mid: $590 • Low: $420 High: $888 Analysts Recommendation (Apple) • Marketwatch DCF Mid Ye a r Re ve nue 2012 156,508 % Grow th Ope ra ting Income Operating Margin Inte re st a nd Othe r Interes t % of Sales Ta x e s Tax Rate Ne t Income 16.7% 55,241 % of Sales Plus/(minus) Cha nge s W C % of Sales Subtra ct Ca p Ex Capex % of s ales Fre e Ca sh Flow 29.7% 522 523 0.3% 0.3% 14,030 26.0% 41,733 14,263 26.0% 40,595 -2.7% 2,817 1.8% 12,119 7.7% 1,003 0.64% 54,347 % Grow th 3,288 1.8% 2,723 1.5% 2,740 1.50% 43,557 -19.9% NPV of Ca sh Flow s 271,989 NPV of te rmina l va 263,791 lue Proje cte d Equity Va 535,780 lue Fre e Ca sh Flow Yie13.51% ld Curre nt P/E 9.6 Projected P/E 5.8 Curre nt EV/EBITDA (3.0) Projected EV/EBITDA (3.0) Sha re s Outsta nding 54,335 35.3% % Grow th Add De pre cia tion/ Amort 2013E 182,662 941 Curre nt Price $ 427.72 Implie d e quity va $ lue 569.68 /sha re Upside /(Dow nside ) to 33.2% DCF 2014E 209,368 14.6% 58,879 28.1% 2015E 239,726 14.5% 55,137 23.0% 2016E 263,699 10.0% 60,651 23.0% 2017E 284,795 8.0% 65,503 23.0% 2018E 296,187 4.0% 68,123 23.0% 2019E 308,034 2020E 318,815 4.0% 70,848 3.5% 73,328 23.0% 23.0% 2021E 329,974 3.5% 72,594 22.0% 3.5% 75,135 22.0% 524 527 580 627 652 678 701 726 751 0.25% 0.22% 0.22% 0.22% 0.22% 0.22% 0.22% 0.22% 0.22% 15,445 26.0% 43,958 8.3% 3,769 1.8% 4,161 2.0% 3,141 1.50% 48,294 10.9% 0.50765 0.49235 1.0 14,473 26.0% 41,192 -6.3% 4,315 15,920 26.0% 45,311 10.0% 4,747 17,194 26.0% 48,936 8.0% 5,126 17,881 26.0% 50,893 4.0% 5,331 18,597 19,248 26.0% 52,929 26.0% 54,781 4.0% 5,545 3.5% 5,739 19,063 26.0% 54,257 -1.0% 5,940 26.0% 56,156 3.5% 6,147 1.8% 1.8% 1.8% 1.8% 1.8% 1.8% 1.8% (6,038) (4,580) (3,957) (2,058) (2,140) (1,938) (2,006) (2,076) -2.5% -1.7% -1.4% -0.7% -0.7% -0.6% -0.6% 4,315 1.8% 35,726 -26.0% 4,747 1.8% 41,164 15.2% 5,126 1.8% 45,353 10.2% 5,331 1.8% 49,030 8.1% 5,545 5,739 1.8% 50,991 1.8% 53,027 4.0% 4.0% 5,940 1.8% 52,441 -1.1% Te rmina l Va lue 9.2 5.5 (2.8) (2.8) 19,730 1.8% Fre e Ca sh Yie ld 9.9 6.0 (3.1) (3.1) 2022E 341,523 -0.6% 6,147 1.8% 54,276 3.5% 749,013 7.25% Te rmina l P/E 13.3 Te rmina l EV/EBITDA 7.9 DCF Bear Ye a r Re ve nue 2012E 156,508 % Grow th Ope ra tin g Income 55,241 522 Interes t % of Sales 0.3% Ta x e s Tax Rate Ne t Income 14,030 26.0% 41,733 % Grow th Add De pre cia tion/Amo rt % of Sales Plus/(min us) Cha nge s WC % of Sales 178,419 14.0% Operating Margin 35.3% Inte re st a nd Othe r 2013E 54,335 30.5% 523 0.3% 14,263 26.0% 40,595 -2.7% 2,817 1.8% 12,119 7.7% Subtra ct Ca p Ex 1,003 Capex % of s ales 0.64% Fre e Ca sh Flow 54,347 % Grow th 3,288 1.8% 2,723 1.5% 2,740 1.54% 43,557 -19.9% 2014E 198,045 11.0% 58,879 29.7% Sha re s Outsta nd ing 9.9 4.1 (3.1) (3.1) 941 Curre nt Price $ 427.72 Implie d e quity $ 389.76 va lue /sha re Upside /(Dow ns -8.9% ide ) to DCF 213,889 8.0% 42,778 20.0% 2016E 223,514 4.5% 44,703 20.0% 2017E 233,572 4.5% 46,714 20.0% 2018E 242,915 4.0% 48,583 20.0% 2019E 250,202 2020E 257,708 3.0% 45,036 3.0% 46,388 18.0% 18.0% 2021E 265,440 3.0% 47,779 18.0% 2022E 273,403 3.0% 46,478 17.0% 524 428 447 467 486 500 515 531 547 0.26% 0.20% 0.20% 0.20% 0.20% 0.20% 0.20% 0.20% 0.20% 15,445 26.0% 43,958 8.3% 3,769 1.9% 4,161 2.1% 3,141 1.59% 48,294 10.9% NPV of Ca sh 214,632 Flow s 0.585508 NPV of te rmina 151,942 l va lue 0.414492 Proje cte d Equity 366,574 Va lue 1 Fre e Ca sh Flow 13.51% Yie ld Curre nt P/E 9.6 Projected P/E 4.0 Curre nt EV/EBITDA (3.0) Projected EV/EBITDA (3.0) 2015E 11,233 26.0% 31,972 -27.3% 3,850 11,739 26.0% 33,411 4.5% 4,023 12,267 26.0% 34,914 4.5% 4,204 12,758 26.0% 36,311 4.0% 4,372 11,840 12,195 26.0% 33,697 26.0% 34,708 -7.2% 4,504 3.0% 4,639 12,561 26.0% 35,749 3.0% 4,778 26.0% 34,799 -2.7% 4,921 1.8% 1.8% 1.8% 1.8% 1.8% 1.8% 1.8% 1.8% (2,972) (1,747) (1,826) (1,688) (1,304) (1,343) (1,383) (1,425) -1.4% -0.8% -0.8% -0.7% -0.5% -0.5% -0.5% 3,850 1.8% 29,281 -39.4% 4,023 1.8% 31,829 8.7% 4,204 1.8% 33,262 4.5% 4,372 1.8% 34,783 4.6% 4,504 4,639 1.8% 32,517 1.8% 33,492 -6.5% 3.0% 4,778 1.8% 34,497 3.0% Te rmina l Va lue Fre e Ca sh Yie ld 9.2 3.8 (2.8) (2.8) 12,227 -0.5% 4,921 1.8% 33,509 -2.9% 431,427 7.77% Te rmina l P/E 12.4 Te rmina l EV/EBITDA 6.4 DCF Bull Ye a r Re ve nue 2012E 156,508 % Grow th Ope ra ting Income Operating Margin Inte re st a nd Othe r Interes t % of Sales Ta x e s Tax Rate Ne t Income 18.0% 55,241 % of Sales Plus/(minus) Cha nge s W C % of Sales Subtra ct Ca p Ex Capex % of s ales Fre e Ca sh Flow 29.4% 522 523 0.3% 0.3% 14,030 26.0% 41,733 14,263 26.0% 40,595 -2.7% 2,817 1.8% 12,119 7.7% 1,003 0.64% 54,347 % Grow th 3,288 1.8% 2,723 1.5% 2,740 1.48% 43,557 -19.9% NPV of Ca sh Flow s 308,017 NPV of te rmina l va 322,810 lue Proje cte d Equity Va 630,827 lue Fre e Ca sh Flow Yie13.51% ld Curre nt P/E 9.6 Projected P/E 6.9 Curre nt EV/EBITDA (3.0) Projected EV/EBITDA (3.0) Sha re s Outsta nding 54,335 35.3% % Grow th Add De pre cia tion/ Amort 2013E 184,679 941 Curre nt Price $ 427.72 Implie d e quity va $ lue 670.74 /sha re Upside /(Dow nside ) to 56.8% DCF 2014E 214,228 16.0% 58,879 27.5% 2015E 248,505 16.0% 64,611 26.0% 2016E 273,355 10.0% 71,072 26.0% 2017E 300,691 10.0% 78,180 26.0% 2018E 318,732 6.0% 79,683 25.0% 2019E 337,856 2020E 353,060 6.0% 84,464 4.5% 88,265 25.0% 25.0% 2021E 368,947 4.5% 88,547 24.0% 3.8% 91,912 24.0% 524 608 669 736 780 826 864 903 937 0.24% 0.24% 0.24% 0.24% 0.24% 0.24% 0.24% 0.24% 0.24% 15,445 26.0% 43,958 8.3% 3,769 1.8% 4,161 1.9% 3,141 1.47% 48,294 10.9% 0.48827 0.51173 1 16,957 26.0% 48,262 9.8% 4,473 18,653 26.0% 53,088 10.0% 4,920 20,518 26.0% 58,397 10.0% 5,412 20,920 26.0% 59,542 2.0% 5,737 22,176 23,173 26.0% 63,115 26.0% 65,955 6.0% 6,081 4.5% 6,355 23,257 26.0% 66,193 0.4% 6,641 26.0% 68,708 3.8% 6,893 1.8% 1.8% 1.8% 1.8% 1.8% 1.8% 1.8% (6,906) (4,748) (5,223) (3,322) (3,521) (2,760) (2,884) (2,528) -2.8% -1.7% -1.7% -1.0% -1.0% -0.8% -0.8% 4,473 1.8% 42,010 -13.0% 4,920 1.8% 48,790 16.1% 5,412 1.8% 53,669 10.0% 5,737 1.8% 56,535 5.3% 6,081 6,355 1.8% 59,927 1.8% 63,457 6.0% 5.9% 6,641 1.8% 63,582 0.2% Te rmina l Va lue 9.2 6.5 (2.8) (2.8) 24,141 1.8% Fre e Ca sh Yie ld 9.9 7.1 (3.0) (3.1) 2022E 382,967 -0.7% 6,893 1.8% 66,420 4.5% 916,593 7.25% Te rmina l P/E 13.3 Te rmina l EV/EBITDA 8.2 Multiples Valuation (10yr) Forward P/E High Low Median current Your Target Multiple Your Per share Target Price 81.6 9.4 26.1 9.4 13.5 44.64 602.64 66.33 6.76 22.88 6.76 10.5 58.43 613.515 P/S 8.3 0.9 4 2.4 3.5 165.55 579.425 P/CF 82.6 8.7 29.8 8.7 10.5 57.79 606.795 P/B 11.9 1.2 5.5 3.4 3.75 187.2 702 P/EBITDA Based on the Multiple Valuation the price target is around $600 which is right above consensus. Apple • Catalysts: • Product Lines • China and Japan Expansion • Retail Expansion • Balance Sheet • Tablet Market • Risks: • Exchange Rate Changes slowing sales growth in Japan • Chinese regulation • Global Economy • Shrinking Margins/ Increased Rivalry • Cannibalization of product lines Closing Remarks • I believe that Apple long term will struggle with margins shrinking and slowed growth in Revenues. That I do believe and I believe margins will shrink even more than what analysts believe. This is the reason for my lower price targets. • The big caveat here is that I will buy anything at the right price. • Reasons for low Price • Growth Investors Turned Away • Bad Press • Innovation slowdown (This is for every company in the sector why is Apple the one taking the full hit.) Closing Remarks • Reasons to Buy: • Great Historical multiple valuations (at lows) • Even with a more bearish outlook than analysts still massive upside. • Stock has a lot of bad news baked in • Now is starting to look like a value investor play and should be bought in that realm of MF’s and ETF’s. Google Multiple Valuation: Internet Software and Services Absolute Basis P/Trailing E P/Forward E P/B P/S P/CF Relative to SP500 P/Trailing E P/Forward E P/B P/S P/CF High 173.9 104 11.3 24.4 92.0 Low 14.1 13.7 2.6 2.8 10.8 Median 30.1 24.7 5.2 6.2 20.6 Current 20.4 18.1 3.5 4.2 15.9 High 9 6.1 3.6 15.5 8.1 Low 1.2 1.1 1.3 3 1.3 Median 1.9 1.7 2 4.5 2 Current 1.4 1.3 1.5 3.1 1.6 Multiple Valuation: Google Absolute Valuation A. P/Forward E P/S P/B P/EBITDA P/CF High Low Median Current B. 61.2 29. 56.3 108.32 167.7 C. 12.9 4.6 2.9 12.27 12.6 D. 21. 7.6 5.5 19.81 20.4 E. 17.2 5. 3.8 13.38 16 Relative to Industry P/Trailing E P/Forward E P/B P/S P/CF High Low Median Current 1.3 1.9 5.7 3.1 3.6 .92 .62 .9 .6 .9 1.1 .97 1.4 1.6 1.3 .96 .95 1.1 1.2 1.0 Relative to S&P 500 P/Trailing E P/Forward E P/B P/S P/CF High Low Median Current 6.4 3.7 17.7 19.2 15.1 1.1 .99 1.3 3.6 1.4 1.5 1.4 2.6 6.7 2.2 1.3 1.2 1.6 3.6 1.6 Target Multiple F. 23.5 5.25 3.8 16.5 23 Value/ Share G. 32.21 152.5 217.33 49.48 32.63 Target Price H. 756.93 800.63 825.00 816.42 750.49 Recommendation: HOLD • Current Price: $774.85 • Price Target: $790 • Potential Upside/Downside: 2% Conclusion Recommendation Security Oracle Corp. Apple Inc. Corning Inc. Qualcomm Inc. Unit Cost $ 31.81 $ 288.75 $ 16.77 $ 62.93 Market Price Quantity Unrealized Gain/Loss % of Assets $ 32.33 13,300 $ 6,889 3.75% $ 442.66 800 $ 123,132 30.80% $ 13.33 16,200 $ (55,668) 1.88% $ 66.94 4,700 $ 18,833 2.74% Recommendation -375 BPS +142 BPS +133 BPS +100 BPS