Document 11015349

advertisement

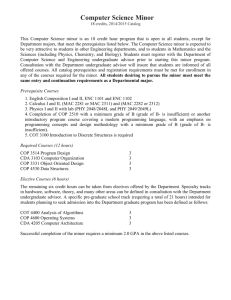

Energy Sector Stock Presentation Gengyuan Cao Chun-Ning Chen Troy Evans Holly Fisher Agenda ¡ Overview ¡ Chevron ¡ ConocoPhillips ¡ National Oilwell Varco Inc. ¡ ExxonMobil ¡ Recommendation Sector Weight S&P 500 vs. SIM Sector Weight in S&P 500 SIM Weight S&P 500 TELECOM SERV IDX Consumer DiscreIonary S&P 500 UTILITIES INDEX S&P 500 MATERIALS INDEX 2% 3% 3% 20% 10% 10% 15% 13% 9% 23% S&P 500 CONS STAPLES IDX S&P 500 INDUSTRIALS IDX Energy 3% 3% 0% 0% S&P 500 ENERGY INDEX 8% 16% Consumer Staples 1% Financials 10% 8% 8% 16% 19% Health Care Industrials S&P 500 CONS DISCRET IDX InformaIon Technology S&P 500 HEALTH CARE IDX Materials S&P 500 FINANCIALS INDEX TelecommunicaIon Services S&P 500 INFO TECH INDEX UIliIes Sector Performance vs. S&P 500 Crude Oil Price -Brent Crude Oil Price -WTI Energy Stocks in SIM Weights ¡ CVX 3.54% ¡ COP 2.47% ¡ NOV 1.24% ¡ XOM 0% Chevron Business Overview Market Data Ticker CVX Market Cap 198.7B # of Shares 1.89B Beta 1.11 Dividend Yield 4.08% 52 Week Range 98.88-135.10 P/E (ttm) 10.70 ROE 12.60% ROA 4.74% D/E 0.15 ¡ An integrated oil and gas company headquartered in San Ramon, California ¡ Third largest energy company in the world ¡ Active in more than 180 countries ¡ Business divisions: Upstream and Downstream CVX vs. SPX (1 year) CVX EPS compared to oil prices Historical data shows a high correlation of .92 between Chevron’s EPS and crude oil prices CVX Drivers | Risks Drivers Risks ¡ LNG projects starting production in 2015-16 ¡ Price risk ¡ Strong dividend history ¡ Deepwater projects in Gulf of Mexico ¡ Increasing in refining helps offset low oil prices ¡ Continued Spending on exploration ¡ Environmental risks ¡ Natural disasters and extreme weather conditions ¡ Geopolitical risks ¡ Climate policy changes CVX Financial Analysis Chevron Corp., Net Profit Margin Dec 31, 2014 Selected Financial Data (USD $ in millions) Net income attributable to Chevron Corporation Sales and other operating revenues Ratio Net profit margin Benchmarks Net Profit Margin, Competitors BP PLC ConocoPhillips Exxon Mobil Corp. Royal Dutch Shell PLC Net Profit Margin, Sector Integrated Oil & Gas Net Profit Margin, Industry Oil & Gas Source: Based on data from Chevron Corp. Annual Reports Dec 31, 2013 Dec 31, 2012 Dec 31, 2011 Dec 31, 2010 19,241 200,494 21,423 220,156 26,179 230,590 26,895 244,371 19,024 198,198 9.60% 9.73% 11.35% 11.01% 9.60% 1.07% 13.08% 8.25% 3.53% 6.19% 16.83% 7.74% 3.63% 3.08% 14.54% 9.90% 5.69% 6.84% 5.08% 8.79% 6.58% -1.25% 6.00% 8.23% 5.47% 5.44% 6.75% 7.43% 7.60% 5.43% 5.14% 6.93% 7.37% 7.54% 5.60% CVX Valuation Analysis Target price is $114.82. Sum of Parts Analysis CVX Segments Petroleum -upstream Competitors P/S ratios Sales per segment P/S Ratio XOM 69,825 Petroleum -Downstream 177,846 Total 247,671 Date of price 4/1/2015 Current Stock Price $104.79 Number of diluted shares Target Price % return to target Target P/S Segment 1,883 $114.82 9.57% DVN 0.9 BP 1.44 SU 0.34 IMO RDS.A COP Multiple Value 0.995 69,476 1.3 1.2 1.03 PBR 0.4 0.3 1.4 Total Market Cap 0.825 146,723 216,199 CVX Valuation Analysis Target price is $108.27. Chevron (CVX) Analyst: Troy Evans 2/10/2015 Terminal Discount Rate = Terminal FCF Grow th = Year 2015E Revenue 154,168 % Grow th 17.9% Operating Income 13,104 Operating Margin 8.5% Taxes 4,849 Tax Rate 37.0% Net Income 8,256 % Grow th 3,120 % of Sales 2.0% Plus/(minus) Changes WC 633 % of Sales 0.4% Subtract Cap Ex 3,004 Capex % of sales 1.9% Free Cash Flow 9,005 % Grow th 11.8% 7,899 37.0% 13,450 3,634 2.0% 3,571 2.0% 3,634 2.0% 17,021 89.0% NPV of Cash Flow s NPV of terminal value Projected Equity Value Free Cash Flow Yield 119,104 86,384 205,488 4.30% Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 25.4 24.9 13.8 13.6 Shares Outstanding Debt Cash Cash/share 21,349 62.9% Add Depreciation/Amort Current Price Implied equity value/share Upside/(Dow nside) to DCF 2016E 181,692 1,898.0 $ $ 110.38 108.27 -1.9% 27,818 12,785 6.74 2017E 213,671 17.6% 29,551 13.8% 10,934 37.0% 18,617 38.4% 4,273 2.0% 4,352 2.0% 4,273 2.0% 22,969 34.9% 58% 42% 100% 2018E 220,615 3.3% 30,445 13.8% 11,265 37.0% 19,180 3.0% 4,412 2.0% 0 0.0% 4,412 2.0% 19,180 -16.5% 2019E 227,785 3.3% 31,434 13.8% 11,631 37.0% 19,804 3.3% 4,556 2.0% 0 0.0% 4,556 2.0% 19,804 3.3% 11.15% 2.0% 2020E 232,341 2.0% 32,063 13.8% 11,863 37.0% 20,200 2.0% 4,647 2.0% 0 0.0% 4,647 2.0% 20,200 2.0% 2021E 236,988 2.0% 32,704 13.8% 12,101 37.0% 20,604 2.0% 4,740 2.0% 0 0.0% 4,740 2.0% 20,604 2.0% 2022E 241,728 2.0% 33,358 13.8% 12,343 37.0% 21,016 2.0% 4,835 2.0% 0 0.0% 4,835 2.0% 21,016 2.0% 2023E 246,562 2.0% 34,026 13.8% 12,589 37.0% 21,436 2.0% 4,931 2.0% 0 0.0% 4,931 2.0% 21,436 2.0% 2024E 251,494 2.0% 34,706 13.8% 12,841 37.0% 21,865 2.0% 5,030 2.0% 0 0.0% 5,030 2.0% 21,865 2.0% Terminal Value Free Cash Yield 15.6 15.3 9.0 8.8 11.3 11.0 6.6 6.5 2025E 256,523 2.0% 35,400 13.8% 13,098 37.0% 22,302 2.0% 5,130 2.0% 0 0.0% 5,130 2.0% 22,302 2.0% 248,614 8.97% Terminal P/E 11.1 Terminal EV/EBITDA 6.5 CVX Target Price Price Target Sum of Parts DCF Price 114.82 108.27 Weight 25% 75% Final Target Price 109.91 Current Price (4/15/2015) 110.38 Upside/Downside Potential -0.43% Recommendation: HOLD ConocoPhillips Business Overview Market Data Ticker COP Market Cap 85044.7M # of Shares 1.23B Beta 1.24 Dividend Yield 4.2% 52 Week Range 60.57-87.09 P/E (ttm) 13.1 Forward P/E 25.36 ROE 43.5% ROA 9.90% D/E 0.167 ¡ Headquartered in Houston, Texas ¡ world’s largest independent exploration and production (E&P) company, based on proved reserves and production of liquids and natural gas. ¡ Business divisions: pure player in oil and gas exploration and production COP vs. SPX (1 year) COP Drivers | Risks Drivers Risks ¡ Market Factor ¡ Volatile crude oil price ¡ Exchange Rate ¡ Instability of Politics ¡ Interest Rate ¡ World Economy COP Financial Analysis COP Financial Analysis COP Financial Analysis COP Valuation Analysis COP Valuation Analysis Target price is $67.65. Year Revenue % G rowth 2015E 48,101 2016E 2017E 2018E 51,540 51,442 58,129 7.2% -­‐0.2% 13.0% 2019E 2020E 2021E 2022E 2023E 2024E 2025E ##### 69,058 73,201 76,861 80,704 83,933 87,290 10.0% 8.0% 6.0% 5.0% 5.0% 4.0% 4.0% Income from continuing operations before income taxes Margin of Total Revenue 10,779 13,189 13,082 6,976 7,673 8,287 8,784 9,223 9,685 10,072 10,475 22.4% 25.6% 25.4% 12.0% 12.0% 12.0% 12.0% 12.0% 12.0% 12.0% 12.0% Income from discontinued operations* (after tax) % of Sales 1,056 1,079 1,088 1,229 1,352 1,461 1,548 1,626 1,707 1,775 1,846 2.2% 2.1% 2.1% 2.1% 2.1% 2.1% 2.1% 2.1% 2.1% 2.1% 2.1% Provision for income taxes Tax Rate 4,023 5,350 5,727 2,829 3,112 3,361 3,562 3,740 3,927 4,084 4,248 37.3% 40.6% 43.8% 40.6% 40.6% 40.6% 40.6% 40.6% 40.6% 40.6% 40.6% Net income 7,813 Less: net income attributable to noncontrolling interests (62) (67) (70) Net Income Attributable to ConocoPhillips % G rowth 7,751 Add Depreciation/Amort % of Sales Plus/(minus) Changes W C % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow % G rowth 8,919 8,443 5,376 5,914 6,387 6,770 7,109 7,464 7,763 8,073 (68) (68) (68) (68) (68) (68) (68) (68) 8,852 8,373 5,308 5,846 6,319 6,702 7,041 7,396 7,695 8,005 14.2% -­‐5.4% -­‐36.6% 10.1% 8.1% 6.1% 5.1% 5.0% 4.0% 4.0% 6,407 13.3% (359) -­‐0.7% 11,500 23.9% 6,236 12.1% (1,281) -­‐2.5% 12,000 23.3% 5,762 11.2% (33) -­‐0.1% 12,295 23.9% 6,511 11.2% 0 0.0% 6,917 11.9% 7,162 11.2% 0 0.0% 7,609 11.9% 7,734 11.2% 0 0.0% 8,218 11.9% 8,199 11.2% 0 0.0% 8,711 11.9% 8,608 11.2% 0 0.0% 9,147 11.9% 9,039 11.2% 0 0.0% 9,604 11.9% 9,400 11.2% 0 0.0% 9,988 11.9% 9,776 11.2% 0 0.0% 9,776 11.9% 2,298 1,807 -­‐21.4% 1,807 0.0% 4,901 171.3% 5,398 10.1% 5,835 8.1% 6,190 6.1% 6,503 5.1% 6,831 5.1% 7,107 4.0% 8,006 12.6% NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 30,247 53,499 83,746 2.84% Current P/E Projected P/E Current EV Projected EV 10.4 10.8 98,455.1 101,249.1 Shares Outstanding 1,238.0 Current Price Implied e quity value/share Upside/(Downside) to DCF ¥ 65.39 ¥ 67.65 3.5% 36% 64% 100% Terminal Value 138,763 Free Cash Yield 9.1 9.5 98,455.1 101,249.1 9.7 10.0 98,455.1 101,249.1 5.77% Terminal P/E 17.3 Terminal EV 156,266.2 COP Sensitivity Analysis Sensitivity Analysis ¥ 67.65 8% 9% Terminal Discount 10.0% Rate 11% 12% 2% 78.14 65.58 56.22 48.99 43.26 Terminal FCF Growth 3% 4.0% 5% 88.93 105.10 132.06 72.67 82.59 97.48 61.12 67.65 76.79 52.51 57.02 63.04 45.85 49.09 53.25 6% 185.97 122.29 90.50 71.46 58.80 COP Target Price Price Target Relative Valuation DGM DCF Price 75.15-108.18 31.78 67.65 Weight 20% 30% 50% Final Target Price 66.87 Current Price (4/16/2015) 69.01 Downside Potential -3.1% Recommendation: HOLD National Oilwell Varco Business Overview Market Data Ticker NOV Market Cap 21.6B # of Shares 409.94M Beta 1.37 Dividend Yield 3.50% 52 Week Range 46.08-86.55 P/E (ttm) 9.34 ROE 11.39% ROA 6.80% ¡ Headquartered in Houston, Texas ¡ Business divisions: rig systems, rig aftermarket, wellbore technologies, and completion and production solutions NOV vs. SPX (1 year) NOV vs. SPX Correlation Correlation: 0.314 NOV Drivers | Risks Drivers Risks ¡ Demand for oil and gas drilling ¡ Volatile crude oil price ¡ Price of crude oil and natural gas ¡ Capital spending by drilling contractors ¡ Inventory levels of oil and natural gas ¡ Regulatory and political risks NOV Valuation Analysis Target price is $24.30. Analyst: Holly Fisher 3/7/2015 Terminal Discount Rate = Terminal FCF Growth = Year 2015E Revenue 20,154 % Grow th 2016E 19,146 -5.0% Operating Income 2,620 Operating Margin 13.0% Interest Interest % of Sales Taxes Tax Rate Net Income Plus/(minus) Changes WC % of Sales -5.0% 2,183 12.0% 17,279 -5.0% 2,074 12.0% 2019E 16,674 -3.5% 2,001 12.0% 2020E 16,091 -3.5% 1,931 12.0% 2021E 16,252 1.0% 1,788 11.0% 2022E 16,414 1.0% 1,806 11.0% 2023E 16,743 2.0% 1,842 11.0% 2024E 17,245 3.0% 1,897 11.0% 2025E 17,848 3.5% 1,963 11.0% 12 12 12 12 11 11 11 11 11 12 12 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 790 693 659 626 604 583 540 545 556 573 593 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 1,843 % of Sales 12.0% 18,189 2018E 0.1% % Grow th Add Depreciation/Amort 2,298 2017E 12.0% 3.5% 1,617 1,537 1,460 1,409 1,359 1,259 1,272 1,297 1,336 1,383 -12.2% -5.0% -5.0% -3.5% -3.5% -7.4% 1.0% 2.0% 3.0% 3.5% 645 613 582 518 500 483 488 492 502 517 535 3.2% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 57 (428) (500) (346) (333) (322) (325) (328) (335) (345) (357) 0.3% -2.2% -2.7% -2.0% -2.0% -2.0% -2.0% -2.0% -2.0% -2.0% -2.0% Subtract Cap Ex (584) (555) (527) (501) (484) (467) (471) (476) (486) (500) (518) Capex % of sales -2.9% -2.9% -2.9% -2.9% -2.9% -2.9% -2.9% -2.9% -2.9% -2.9% -2.9% Free Cash Flow 1,845.84 % Grow th -32.5% Shares Outstanding Current Price Implied equity value/share Upside/(Downside) to DCF 1,246.11 419.0 $ $ 52.70 24.30 -53.9% 1,091.09 -12.4% 1,131.39 3.7% 1,091.79 -3.5% 1,053.58 -3.5% 950.36 -9.8% 959.86 1.0% 979.06 2.0% 1,008.43 3.0% 1,043.72 3.5% NOV Sensitivity Analysis NOV Target Price Price Target Relative Valuation DCF Price 26.71 24.30 Weight 30% 70% Final Target Price 25.02 Current Price (4/2/2015) 52.70 Upside/Downside Potential -51% Recommendation: SELL NOV Peer Comparison Ticker P/E TTM P/S TTM P/B P/CF TTM EV/ EBITDA TTM Average 15.86 1.12 1.97 9.07 7.56 Natl Oilwell Varco 9.56 1.00 1.14 7.72 5.24 Schlumberger 21.03 2.2 2.8 10.96 10.25 Halliburton 17.56 1.07 2.16 7.27 7.36 Cameron Intl 11.11 .8 1.84 8.15 7.53 Weatherford Intl 10.94 .57 1.08 4.71 5.58 Baker Hughes 24.6 1.04 1.37 8.21 7.42 FMC Technologies 13.39 1.14 3.37 9.99 7.74 XOM vs. SPX (1 year) XOM Target Price Price Target Relative Valuation DCF Price 75.5 86.52 Weight 30% 70% Final Target Price 83.21 Current Price (4/2/2015) 84.46 Upside/Downside Potential -1.5% Recommendation: HOLD Final Recommendation Company Price Target Current Weight Change Recommended Upside/ Downside Potential CVX 109.91 354 bps HOLD 354 bps -0.43% COP 66.87 247 bps HOLD 247 bps -3.1% NOV 25.02 124 bps SELL 124 bps 0 bps -51% XOM 83.21 0 bps HOLD 0 bps -1.5% Weight Thank you for your attention! Q&A