Document 11015341

advertisement

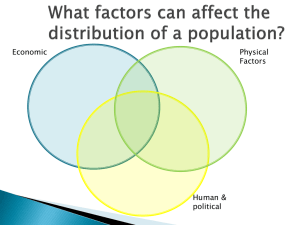

Consumer Discre-onary Ziwei(Evelyn) An | Ryan Bayonnet | Jonathan Conley Agenda • Overview • Business Analysis • Economic Analysis • Financial Analysis • Valua-on Analysis • Recommenda-on Overview Industries | Size | Key Companies | Performance Industries • Total sector market cap: 9.05T • Industries: § Retailing (S&P500 4.72%) § Media (S&P500 3.62%) § Consumer services (S&P500 1.76%) § Consumer durables and apparel (S&P500 1.36%) § Automobiles and components (S&P500 1.10%) Size SIM 8.40% Underweight 4.15% S&P 500 12.55% UTILITIES 2.93% MATERIALS 3.26% CONS DISCRET 12.55% INDUSTRIALS 10.28% FINANCIALS 16.18% CONS STAPLES 9.70% TELECOM SERV 2.30% ENERGY 8.03% HEALTH CARE 14.82% INFO TECH 19.95% UTILITIES MATERIALS 0.00% 2.79% INDUSTRIALS 8.14% FINANCIALS 19.10% CONS STAPLES 9.32% TELECOM SERV 2.90% CONS DISCRET 8.40% CASH & DIV REC & NA 4.26% ENERGY 7.41% HEALTH CARE 14.60% INFO TECH 23.08% Key Companies Public Member Companies Mkt Cap Revenue WALT DISNEY CO 180.90B 48.81B AMAZON.COM INC 172.09B 88.99B HOME DEPOT INC 151.31B 83.18B COMCAST CORP-­‐A 149.90B 68.78B MCDONALDS CORP 92.60B 27.44B NIKE INC -­‐CL B 82.77B 27.80B LOWE'S COS INC 72.15B 56.22B TWENTY-­‐FIRST C-­‐A 71.50B 31.87B STARBUCKS CORP 69.95B 16.45B TIME WARNER INC 69.84B 27.36B Performance(Quarterly 10Y) Performance(YTD) Business Analysis Sector Fluctua-ons | Demand | Porter’s Five Forces Sector Fluctua-ons vs. S&P 500 • Over performs: During expansion and recovery • Underperforms: During contrac-on or recession Business Analysis: Demand • Consists of businesses that sell nonessen-al goods and services. • Retailers, media companies, consumer services companies, consumer durables and apparel companies, and automobiles and components companies. • Highly cyclical – Very Sensi-ve Porter’s Five Forces • Barriers to Entry – Medium • Much advantage for established companies • New compe--on can enter on smaller level and more niche areas. • Use preexis-ng networks for beier deals. • Large overhead costs in some industries. • Buyer Power –Strong • Consumer has many op-ons, companies must compete with each other and leisure ac-vi-es. • Supplier Power – Weak • Manufacturing and auto industries may have increasing produc-on costs. • Weaker for industries with a strong union presence, ex. Auto and Movie. • Subs-tutes – High • Industries can easily be subs-tuted based on consumer preference • Many alterna-ves with similar products. • Compe--on – Medium / High • Very high for retail, restaurant, and apparel companies. • Oligopoly compe--on in industries dominated by fewer firms (Automobile industry). Economic Analysis Retail Sales| Personal Income | CPI | Nominal GDP | Unemployment | Underemployment |UM Consumer Sen-ment Retail Sales Personal Income CPI YoY Nominal GDP US Vs. Europe Unemployment Rate Underemployment UM Consumer Sen-ment Financial Analysis Sales Growth Rate | Net Profit Margin | ROE |FCF Sales Growth Rate(Sector) • Plummeted in 2009 and leapt in 2013 20.00% 15.96% 15.00% 10.00% 5.00% 0.00% -­‐5.00% -­‐10.00% 10.13% 8.34% 6.52% 6.04% 4.15% 3.93% CY 2008 CY 2009 CY 2010 4.79% 8.48% 2.53% CY 2007 CY 2011 4.40% 3.31% 4.33% -­‐0.44% CY 2012 CY 2013 CY 2014 CY 2015 Est -­‐2.20% -­‐8.76% -­‐15.00% -­‐20.00% 6.51% -­‐18.10% COND S&P 500 6.08% 5.63% CY 2016 Est Sales Growth Rate(Industry) 30.00% • Auto & Compo industry had plummeted in sales since 2007, and rebounded in 2013 • Media industry remained rela-vely high growth rate in the sector • Retailing industry remained stable in sales growth rate 20.00% 10.00% 0.00% -­‐10.00% CY 2007 CY 2008 CY 2009 CY 2010 CY 2011 CY 2012 CY 2013 CY 2014 CY 2015 CY 2016 Est Est -­‐20.00% -­‐30.00% -­‐40.00% -­‐50.00% -­‐60.00% S5AUCO S5HOTR S5MEDA S5CODU S5RETL Net Profit Margin • Underperformed the market 8.51 % 8.00 0.00 6.21 2.35 7.68 9.59 9.2 9.16 6.51 6.95 7.11 6.93 4.14 1.04 -­‐1.2 -­‐4.00 -­‐8.00 8.33 6.45 7.11 4.00 8.88 -­‐4.01 -­‐6.07 -­‐6.36 CY 2007 CY 2008 -­‐2.31 -­‐2.3 CY 2009 CY 2010 Underperformed CY 2011 COND -­‐1.82 CY 2012 S&P 500 -­‐2.64 CY 2013 -­‐2.09 -­‐2.23 CY 2014 Current ROE • Has outperformed the market since 2009 and remain a slightly increasing trend % 25.00 22.41 19.65 20.00 15.00 22.3 21.81 15.31 14.44 14.38 CY 2013 CY 2014 Current 13.53 24.21 11.96 14.22 14.93 15.4 15.5 CY 2010 CY 2011 13.57 CY 2015 Est CY 2016 Est 11.02 3.1 4.21 0.00 CY 2007 CY 2008 CY 2009 CY 2012 -­‐5.00 -­‐10.00 -­‐15.00 22.62 17.34 10.00 5.00 21.71 -­‐14.67 COND S&P 500 FCF % 60.00 40.00 20.00 0.00 -­‐20.00 CY 2007 CY 2008 CY 2009 CY 2010 CY 2011 CY 2012 CY 2013 CY 2014 Current CY 2015 CY 2016 Est Est -­‐40.00 -­‐60.00 -­‐80.00 -­‐100.00 S5COND S5RETL S5MEDA S5CODU S5HOTR S5AUCO Valua-on Analysis Mul-ple Valua-on | Sector Rela-ve to S&P 500 | Industry Mul-ples Mul-ple Valua-on(10Y) Absolute Basis High Low Median Current P/E 436.1344 13.2769 23.1095 22.1629 P/B 4.9983 1.4222 2.9722 4.9983 P/S 1.5487 0.3805 1.0070 1.5477 P/EBITDA 11.1036 3.6741 7.5266 10.6440 P/CF 21.5346 4.2031 11.0491 13.9983 High Low Median Current P/E 26.3133 0.9494 1.551 1.1798 P/B 1.7271 0.7699 1.243 1.7211 P/S 0.9066 0.4903 0.7109 0.8426 P/EBITDA P/CF 1.2434 2.6695 0.8763 0.4277 1.047 1.134 1.0707 1.2201 RelaZve to S&P 500 Sector rela-ve to S&P 500 P/B P/E 42.45 17.64 18.26 17.07 17.73 13.28 20.83 20.82 21.5 19.62 2.55 17.1 2.5 2.46 2 2.16 2.77 17.36 16.32 18.44 15.11 17.22 18.41 18.51 17.55 15.54 12.91 14.1 CY 2007 CY 2008 CY 2009 CY 2010 CY 2011 CY 2012 CY 2013 CY 2014 Current CY 2015 CY 2016 Est Est COND 2.89 2.95 2.18 2.06 S&P 500 1.34 1.23 0.89 0.79 1.09 1.03 1.19 1.8 1.81 1.82 1.71 2.14 2.83 2.86 2.64 4.1 2.46 S&P 500 18.43 1.44 1.46 1.52 11.39 1.46 1.38 8.19 7.65 8.42 5.61 0.52 CY CY CY CY CY CY CY CY Current CY CY 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Est Est COND 2.58 4.52 3.53 COND 1.34 0.91 4.91 P/CF 1.68 1.23 4.67 CY CY CY CY CY CY CY CY Current CY CY 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Est Est P/S 1.54 4.36 S&P 500 9.72 8.27 9.09 6.89 10.68 8.39 13.49 13.42 13.79 12.73 9.26 11.42 11.24 11.28 12.13 10.95 CY CY CY CY CY CY CY CY Current CY CY 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Est Est COND S&P 500 Industry Mul-ples P/B P/E 30 10 25 8 20 6 15 4 10 2 5 0 0 CY 2010 CY 2011 CY 2012 CY 2013 CY 2014 RETL MEDA CODU Current HOTR CY 2010 CY 2011 CY 2012 CY 2013 CY 2014 CY 2015 CY 2016 Est Est RETL AUCO MEDA CODU Current HOTR CY 2015 CY 2016 Est Est AUCO P/CF P/S 25 3.5 3 20 2.5 2 15 1.5 10 1 5 0.5 0 0 CY 2010 CY 2011 CY 2012 CY 2013 CY 2014 Current RETL MEDA CODU HOTR CY 2015 CY 2016 Est Est AUCO CY 2010 CY 2011 CY 2012 CY 2013 CY 2014 RETL MEDA CODU Current HOTR CY 2015 CY 2016 Est Est AUCO Recommenda-on Underweight Thank You!