S&P Telecom Services Sector STOCK PRESENTATION Pravin Talreja

advertisement

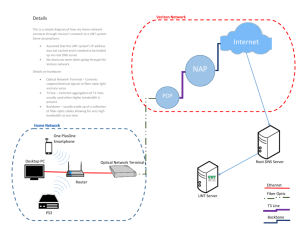

S&P Telecom Services Sector STOCK PRESENTATION Pravin Talreja Agenda 1. 2. 3. 4. 5. 6. Sector Review Stock Recommendation Verizon AT&T T-Mobile Summary Agenda 1. 2. 3. 4. 5. 6. Sector Review Stock Recommendation Verizon AT&T T-Mobile Summary Sector Size: S&P 500 and SIM • Total Telecommunication Sector Market Cap: $1.8 trillion • S5TELS Market Cap: $416.4 billion = 2.27% of S&P 500 • The only telecom holding: VZ @ $279.7 thousand = 2.77% of SIM – overweight by 0.50% SIM S&P 500 Utilities, 2.82% Telecom, Materials, 3.13% 2.27% Energy, 7.78% Consumer Staples, 9.43% Industrials, 10.09% Info Tech, 19.63% Financials, 16.63% Health Care, 15.42% Utilities, Telecom, Materials, 2.77% 2.16% 2.89% Receivables, Cash, 3.06% 0.07% Energy, 7.10% Info Tech, Consumer 20.01% Staples, Financials, 8.07% 17.10% Health Industrials, 9.06% Consumer Discretionary, 12.80% Consumer Discretionary, 12.14% Care, 15.56% UPDATED Sector Size: S&P 500 and SIM • DirecTV bought out by AT&T – now a subsidiary SIM Utilities, Telecom, Materials, 2.77% 2.16% 2.89% Receivables, Cash, 3.06% 0.07% Energy, 7.10% Info Tech, Consumer 20.01% Staples, Financials, 8.07% 17.10% Health Care, 15.56% Industrials, 9.06% Consumer Discretionary, 12.14% SIM - Post DTV Deal Cash, 3.74% Utilities, Materials, 2.89% 2.16% Receivables, 0.07% Telecom, 4.57% Energy, 7.10% Info Tech, 20.01% Consumer Staples, 8.07% Financials, 17.10% Health Care, 15.56% Industrials, 9.06% Consumer Discretionary, 9.66% Sector Weight Recommendation Equal Weight Reduce SIM weight to equal S&P 500 = 2.27% • Highly contested market; aggressive tactics by competitors • Interest rates still expected to go higher: – Already lowered expectations at last meeting – China and Greece remain a concern • High leverage could impose strain on cash available for capital expenditures (especially coupled with increasing interest rates) • IoT provides an exciting opportunity for market expansion (connected cars on the rise) • Stable dividends provide support for prices, given modest economic recovery Agenda 1. 2. 3. 4. 5. 6. Sector Review Stock Recommendation Verizon AT&T T-Mobile Summary Stock Recommendation • DirecTV: HOLD (Converts to AT&T = 1.80% of SIM) • Verizon: SELL • AT&T: BUY (to max SIM weight of 2.27%) • T-Mobile: Review opportunity but leave out Wireless Wars: T vs. VZ • It’s all about content! • Regulatory Environment favors content companies (NFLX, GOOG, etc.) T VZ • Unified content bundle regardless of platform • Maintain Wireless Network as source of competitive advantage • Diversify internationally • Double down on Wireless • Leverage DirecTV subscriber base for broadband and wireless products (Quad Play) • AOL acquisition was strategic: Negotiating power with media content providers • • – – Ad-Tech Content delivered through mobile Diversify into mobile advertising revenues Agenda 1. 2. 3. 4. 5. 6. Sector Review Stock Recommendation Verizon AT&T T-Mobile Summary Verizon Snapshot • Verizon Communications, LLC offers voice, data, and video services and solutions on its wireless and wireline networks. • Two business segments: – – Wireless Wireline • Q2 2015 earnings beat consensus, but revenue, owing to increased competition and market saturation • Lowered revenue guidance for 2015 • Recent Relevant news: AOL Acquisition Key Statistics Industry Sector Current Price (7/24/2015) 52-week Price Range Average Daily Volume Market Cap (7/24/2015) Enterprise Value P/E (TTM) Est. P/E (CY) Dividend Yield Share Outstanding Telecom Sector Diversified Telecom $46.04 $45.09 - $52.15 15.027 million $187.77 billion $298.55 billion 12.58 11.78 4.78% 3.981 billion Verizon Operating Metrics 100000 90000 80000 70000 60000 50000 40000 30000 20000 10000 0 • Revenue growth has been primarily due to strong connections growth in wireless • Wireline is in decline – endemic to the industry • However, ARPA has started to decline after resistance to competitive pressures • Post-paid connections per account on rise as tablet connections drive growth (less profitable than smartphone, but stickier business) 130000 125000 120000 115000 Wireless 110000 Wireline 105000 TOTAL 100000 95000 2010 2011 2012 2013 2014 $165 3.25 3.15 3.05 2.95 2.85 2.75 2.65 2.55 2.45 2.35 2.25 $160 $155 $150 $145 $140 $135 $130 $125 $120 '10 '11 '12 '13 '14 Q2 '15 Retail postpaid ARPA Retail postpaid connections per account Verizon: AOL Acquisition • Verizon purchased AOL for $4.4 billion in an allcash deal • 2015 AOL revenue expected to be $2.7 billion • However, AOL’s ad-tech appears to be motivation • US Mobile ad spend: Est. $28 billion in 2015 • Recent win: Microsoft 10-yr agreement • AOL revenue grew by 9% in 2014 and expected to grow 8% in 2015 – 16% growth in Third Part Properties – premium properties, including video Verizon: DCF Analyst: Pravin Talreja 7/24/2015 Year Terminal Disc. Rate = 8.5% Terminal FCF Growth = 1.5% 2015E 2016E 2017E 2018E 2019E 2020E 2021E 20122E 2023E 2024E 2025E 130,877 2.99% 132,898 1.5% 133,112 0.2% 133,778 0.5% 134,580 0.6% 135,522 0.7% 136,878 1.0% 138,520 1.2% 140,459 1.4% 142,566 1.5% 144,705 1.5% EBT EBT Margin 20,214 15.4% 21,264 16.0% 20,923 15.7% 20,334 15.2% 20,187 15.0% 20,057 14.8% 19,847 14.5% 20,085 14.5% 20,367 14.5% 20,672 14.5% 20,982 14.5% Taxes Tax Rate 4,649 23.0% 4,891 23.0% 4,812 23.0% 4,677 23.0% 4,643 23.0% 4,613 23.0% 4,565 23.0% 4,620 23.0% 4,684 23.0% 4,755 23.0% 4,826 23.0% Net Income % Growth 15,565 16,373 5.2% 16,111 -1.6% 15,657 -2.8% 15,544 -0.7% 15,444 -0.6% 15,282 -1.0% 15,466 1.2% 15,682 1.4% 15,918 1.5% 16,156 1.5% Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales 16,300 12.5% (23) 0.0% 16,500 12.6% 16,600 12.5% (42) 0.0% 16,800 12.6% 16,900 12.7% (64) 0.0% 17,000 12.8% 17,124 12.8% (67) -0.1% 17,124 12.8% 17,092 12.7% (67) -0.1% 17,092 12.7% 17,211 12.7% (68) -0.1% 17,211 12.7% 17,247 12.6% (68) -0.1% 17,247 12.6% 17,315 12.5% (69) -0.1% 17,315 12.5% 17,276 12.3% (70) -0.1% 17,276 12.3% 17,393 12.2% (71) -0.1% 17,393 12.2% 17,365 12.0% (72) -0.1% 17,365 12.0% Free Cash Flow % Growth 15,341 16,131 5.1% 15,947 -1.1% 15,590 -2.2% 15,477 -0.7% 15,376 -0.6% 15,214 -1.1% 15,397 1.2% 15,612 1.4% 15,846 1.5% 16,084 1.5% Terminal Value 233,217 Free Cash Yield 6.90% Terminal P/E 14.4 Revenue % Growth NPV of Cash Flows 102,883 50% NPV of terminal value Projected Equity Value 103,148 206,031 50% 100% Free Cash Flow Yield 8.37% Current P/E Projected P/E 11.8 13.2 11.2 12.6 11.4 12.8 Current EV/EBITDA Projected EV/EBITDA 6.9 7.4 6.8 7.4 6.8 7.3 Shares Outstanding Current Price Implied equity value/share Upside/(Downside) to DCF Debt Cash Cash/share Terminal EV/EBITDA 3,981.0 $ $ 46.04 51.75 12.4% 113,271 10,598 2.66 $ 51.83 Consensus Target Price 8.8 AOL: DCF Analyst: Pravin Talreja 7/24/2015 Year Terminal Disc. Rate = 10.50% Terminal FCF Growth = 4.5% 2015E 2016E 2017E 2018E 2019E 2020E 2021E 20122E 2023E 2024E 2025E Revenue % Growth 2,724 2,868 5.3% 3,006 4.8% 3,150 4.8% 3,301 4.8% 3,460 4.8% 3,626 4.8% 3,800 4.8% 3,979 4.7% 4,166 4.7% 4,357 4.6% EBT EBT Margin 224 8.2% 257 9.0% 295 9.8% 315 10.0% 330 10.0% 346 10.0% 363 10.0% 380 10.0% 398 10.0% 417 10.0% 436 10.0% 56 25.0% 64 25.0% 74 25.0% 79 25.0% 83 25.0% 86 25.0% 91 25.0% 95 25.0% 99 25.0% 104 25.0% 109 25.0% 171 196 14.9% 225 14.9% 236 4.8% 248 4.8% 259 4.8% 272 4.8% 285 4.8% 298 4.7% 312 4.7% 327 4.6% 65 2.4% (42) -1.6% 76 2.8% 67 2.3% (29) -1.0% 75 2.6% 69 2.3% (28) -0.9% 75 2.5% 72 2.3% (32) -1.0% 76 2.4% 76 2.3% (33) -1.0% 76 2.3% 76 2.2% (35) -1.0% 76 2.2% 76 2.1% (36) -1.0% 76 2.1% 76 2.0% (38) -1.0% 76 2.0% 76 1.9% (40) -1.0% 76 1.9% 75 1.8% (42) -1.0% 75 1.8% 78 1.8% (44) -1.0% 78 1.8% 117 159 36.1% 191 19.9% 202 5.5% 215 6.4% 225 4.8% 236 4.8% 247 4.8% 259 4.7% 271 4.7% 283 4.6% Terminal Value 4,933 Free Cash Yield 5.74% Terminal P/E 15.1 Taxes Tax Rate Net Income % Growth Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow % Growth NPV of Cash Flows 1,314 42% NPV of terminal value Projected Equity Value 1,817 3,131 58% 100% Free Cash Flow Yield 2.82% Current P/E Projected P/E 24.3 18.3 21.2 16.0 18.4 13.9 Current EV/EBITDA Projected EV/EBITDA 13.7 10.2 12.2 9.1 10.9 8.1 Shares Outstanding 83.0 VZ Offered Price Implied equity value/share Premium Debt Cash Cash/share $ $ 50.00 37.73 32.5% 307 489 5.89 AOL price on May 7 was $39.39 (premium of 27%) Terminal EV/EBITDA 9.2 VZ Combined: DCF Analyst: Pravin Talreja 7/24/2015 Year Terminal Disc. Rate = 8.75% Terminal FCF Growth = 1.75% 2015E 2016E 2017E 2018E 2019E 2020E 2021E 20122E 2023E 2024E 2025E 133,601 135,766 1.6% 136,118 0.3% 136,928 0.6% 137,882 0.7% 138,982 0.8% 140,503 1.1% 142,320 1.3% 144,438 1.5% 146,732 1.6% 149,062 1.6% EBT EBT Margin 20,438 15.3% 21,521 15.9% 21,219 15.6% 20,649 15.1% 20,517 14.9% 20,403 14.7% 20,210 14.4% 20,465 14.4% 20,764 14.4% 21,089 14.4% 21,418 14.4% Taxes Tax Rate 4,705 23.0% 4,955 23.0% 4,886 23.0% 4,756 23.0% 4,726 23.0% 4,700 23.0% 4,656 23.0% 4,715 23.0% 4,784 23.0% 4,859 23.0% 4,935 23.0% Net Income % Growth 15,736 16,569 5.3% 16,336 -1.4% 15,894 -2.7% 15,792 -0.6% 15,704 -0.6% 15,554 -1.0% 15,751 1.3% 15,981 1.5% 16,230 1.6% 16,483 1.6% Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales 16,365 12.2% (66) 0.0% 16,576 12.4% 16,667 12.3% (71) -0.1% 16,875 12.4% 16,969 12.5% (92) -0.1% 17,075 12.5% 17,196 12.6% (98) -0.1% 17,199 12.6% 17,168 12.5% (100) -0.1% 17,168 12.5% 17,287 12.4% (102) -0.1% 17,287 12.4% 17,323 12.3% (105) -0.1% 17,323 12.3% 17,391 12.2% (107) -0.1% 17,391 12.2% 17,352 12.0% (110) -0.1% 17,352 12.0% 17,468 11.9% (113) -0.1% 17,468 11.9% 17,443 11.7% (116) -0.1% 17,443 11.7% Free Cash Flow % Growth 15,459 16,290 5.4% 16,138 -0.9% 15,792 -2.1% 15,691 -0.6% 15,601 -0.6% 15,450 -1.0% 15,644 1.3% 15,871 1.5% 16,117 1.6% 16,367 1.6% Terminal Value 237,908 Free Cash Yield 6.88% Terminal P/E 14.4 Revenue % Growth NPV of Cash Flows 103,178 50% NPV of terminal value Projected Equity Value 102,829 206,007 50% 100% Free Cash Flow Yield 8.43% Current P/E Projected P/E 11.6 13.1 11.1 12.4 11.2 12.6 Current EV/EBITDA Projected EV/EBITDA 7.9 8.5 7.6 8.2 7.6 8.2 Shares Outstanding VZ Offered Price Implied equity value/share Upside/(Downside) to DCF Debt Cash Cash/share 3,981.0 $ $ 46.04 51.75 12.4% 113,578 6,687 1.68 Terminal EV/EBITDA 8.9 Verizon Combined: Sensitivity Analysis Discount Rate Growth Rate $ 51.75 7.50% 7.75% 8.00% 8.25% 8.50% 8.75% 9.00% 9.25% 9.50% 9.75% 10.00% 0.75% $ 57.19 $ 55.16 $ 53.26 $ 51.50 $ 49.85 $ 48.30 $ 46.84 $ 45.47 $ 44.18 $ 42.96 $ 41.81 1.00% $ 58.41 $ 56.27 $ 54.28 $ 52.42 $ 50.69 $ 49.08 $ 47.56 $ 46.13 $ 44.79 $ 43.53 $ 42.33 1.25% $ 59.73 $ 57.46 $ 55.36 $ 53.42 $ 51.60 $ 49.91 $ 48.32 $ 46.84 $ 45.44 $ 44.13 $ 42.89 1.50% $ 61.16 $ 58.76 $ 56.54 $ 54.48 $ 52.57 $ 50.80 $ 49.14 $ 47.58 $ 46.13 $ 44.76 $ 43.47 1.75% $ 62.71 $ 60.16 $ 57.80 $ 55.63 $ 53.62 $ 51.75 $ 50.01 $ 48.38 $ 46.86 $ 45.43 $ 44.09 2.00% $ 64.41 $ 61.68 $ 59.17 $ 56.87 $ 54.74 $ 52.77 $ 50.94 $ 49.23 $ 47.64 $ 46.15 $ 44.75 2.25% $ 66.26 $ 63.34 $ 60.66 $ 58.21 $ 55.96 $ 53.87 $ 51.94 $ 50.15 $ 48.48 $ 46.92 $ 45.46 2.50% $ 68.31 $ 65.16 $ 62.29 $ 59.67 $ 57.27 $ 55.06 $ 53.02 $ 51.13 $ 49.37 $ 47.74 $ 46.21 2.75% $ 70.56 $ 67.16 $ 64.07 $ 61.26 $ 58.70 $ 56.35 $ 54.18 $ 52.19 $ 50.33 $ 48.61 $ 47.01 Consensus Target: $51.83 Verizon Recommendation • My Rating: Hold – – – – • IoT growth Mobile Ad sales Stable & attractive dividend yield Network still a competitive advantage Recommend: SELL – – – – AT&T presents a better investment opportunity High leverage levels in an increasing interest rate environment Verizon starting to see competitive pressures Revenue mix high on Wireless – saturated market S&P 500 S5TELS VZ T 17.82 22.42 11.78 13.41 P/B 2.80 1.94 16.40 2.05 P/S 1.80 0.99 1.47 1.34 Div. Yld. 2.2% 4.8% 4.8% 5.5% Est. PE (CY) Agenda 1. 2. 3. 4. 5. 6. Sector Review Stock Recommendation Verizon AT&T T-Mobile Summary AT&T Snapshot • AT&T, Inc. offers voice, data, and video services and solutions on its wireless and wireline networks. • Three business segments: – – – Wireless Wireline International • Q2 2015 earnings beat consensus and revenue was in line • Strong growth in connected car strategy (IoT) • Recent Relevant news: DirecTV Acquisition Key Statistics Industry Sector Current Price (7/24/2015) 52-week Price Range Average Daily Volume Market Cap (7/24/2015) Enterprise Value P/E (TTM) Est. P/E (CY) Dividend Yield Share Outstanding Telecom Sector Diversified Telecom $34.29 $32.07 - $36.63 33.432 million $178.07 billion $276.46 billion 13.69 13.41 5.45% 5.221 billion AT&T Operating Metrics 80000 134000 75000 132000 70000 • Revenue growth has been primarily due to strong connections growth in wireless • Wireline is in decline – endemic to the industry • ARPU has stabilized after declining in 2014 (succumbed to competition), but is on the rise • Strong growth in connected devices – including connected cars 130000 65000 128000 Wireless 126000 Wireline 60000 55000 124000 50000 45000 122000 40000 120000 2010 2011 2012 2013 TOTAL 2014 25000 24000 23000 22000 21000 20000 19000 18000 17000 16000 15000 69 68 67 66 65 Connected Devices 64 ARPU 63 62 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 AT&T: Merger with DirecTV • • Combined with AT&T’s recent acquisition of Lusacell and Nextel Mexico, DirecTV adds to AT&T’s diversification strategy in content distribution Bundled services to bring cost and revenue synergies • Take advantage of the growing Latin American Market • Increased negotiation leverage with media content providers AT&T Old Revenue Mix International, 1.5% Wireline, 43.1% Wireless, 55.4% AT&T New Revenue Mix International, 5.2% Sport Networks, 0.1% Wireless, 44.5% Wireline, 50.2% AT&T: Latin America Growth Opportunity • Mexico market has reached 86% penetration, as opposed to ~ 98% in US. • Even more significant opportunity for mobile broadband. OECD: only 13% on standard or dedicated mobile data plan. • 40% Pay-TV penetration rates in Latin America • DirecTV Latin American operations serve Brazil, Argentina, Chile, Columbia, Ecuador, Peru, Puerto Rico, and Venezuela AT&T: DCF Terminal Analyst: Pravin Talreja 7/24/2015 Year Terminal 2015E Revenue % Growth 134,759 1.7% EBT EBT Margin 18,296 13.6% Taxes Tax Rate 6,330 Net Income % Growth 14,516 34.6% 2016E 2017E Disc. Rate = FCF Growth = 8.50% 2019E 2020E 2018E 2.0% 2021E 20122E 2023E 2024E 137,523 138,047 138,737 140,125 142,226 144,644 147,537 150,488 153,498 2.1% 0.4% 0.5% 1.0% 1.5% 1.7% 2.0% 2.0% 2.0% 2025E 156,568 2.0% 19,532 14.2% 20,159 14.6% 20,256 14.6% 20,458 14.6% 20,623 14.5% 20,973 14.5% 21,245 14.4% 21,670 14.4% 22,104 14.4% 22,546 14.4% 6,758 34.6% 6,975 34.6% 7,008 34.6% 7,079 34.6% 7,136 34.6% 7,257 34.6% 7,351 34.6% 7,498 34.6% 7,648 34.6% 7,801 34.6% 16,046 10.5% 16,258 1.3% 13,247 -18.5% 13,380 1.0% 13,487 0.8% 13,717 1.7% 13,894 1.3% 14,172 2.0% 14,456 2.0% 14,745 2.0% Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales 18,500 13.7% (20) 0.0% 17,000 12.6% 18,200 13.2% (47) 0.0% 17,200 12.5% 18,100 13.1% (48) 0.0% 17,400 12.6% 17,897 12.9% (55) 0.0% 17,620 12.7% 17,656 12.6% (56) 0.0% 17,516 12.5% 17,494 12.3% (57) 0.0% 17,494 12.3% 17,647 12.2% (58) 0.0% 17,647 12.2% 17,704 12.0% (59) 0.0% 17,704 12.0% 17,758 11.8% (60) 0.0% 17,758 11.8% 17,959 11.7% (61) 0.0% 17,959 11.7% 18,005 11.5% (63) 0.0% 18,005 11.5% Free Cash Flow % Growth 15,996 17,000 6.3% 16,910 -0.5% 13,469 -20.4% 13,464 0.0% 13,430 -0.2% 13,659 1.7% 13,835 1.3% 14,112 2.0% 14,394 2.0% 14,682 2.0% Terminal Value 230,399 Free Cash Yield 6.37% Terminal P/E 15.6 NPV of Cash Flows NPV of terminal value Projected Equity Value 96,162 49% 101,902 198,064 51% 100% Free Cash Flow Yield 8.93% Current P/E Projected P/E 12.3 13.6 11.2 12.3 11.0 12.2 Current EV/EBITDA Projected EV/EBITDA 6.3 6.7 6.1 6.6 6.1 6.5 Shares Outstanding Current Price Implied equity value/share Upside/(Downside) to DCF Debt Cash Cash/share Terminal EV/EBITDA 5,221.0 $ $ 34.29 37.94 10.6% 82,067 8,603 1.65 $ 37.54 Consensus Target 7.5 DTV: DCF Analyst: Pravin Talreja 7/24/2015 Year 2015E Revenue % Growth 34,611 EBT EBT Margin 4,545 Taxes Tax Rate 1,636 Net Income % Growth 2,909 2016E 35,978 Terminal Disc. Rate = 10.50% Terminal FCF Growth = 3.5% 2019E 2020E 2017E 37,407 2018E 38,866 40,343 41,916 2021E 43,593 20122E 45,206 2023E 46,788 2024E 48,426 2025E 50,121 4.0% 4.0% 3.9% 3.8% 3.9% 4.0% 3.7% 3.5% 3.5% 3.5% 13.1% 4,892 13.6% 5,162 13.8% 5,364 13.8% 5,567 13.8% 5,743 13.7% 5,929 13.6% 6,148 13.6% 6,363 13.6% 6,537 13.5% 6,766 13.5% 36.0% 1,761 36.0% 1,858 36.0% 1,931 36.0% 2,004 36.0% 2,067 36.0% 2,134 36.0% 2,213 36.0% 2,291 36.0% 2,353 36.0% 2,436 36.0% 3,131 3,304 3,433 3,563 3,675 3,794 3,935 4,072 4,184 4,330 7.6% 5.5% 3.9% 3.8% 3.1% 3.2% 3.7% 3.5% 2.7% 3.5% Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales 3,011 8.7% (77) -0.2% 3,300 9.5% 3,094 8.6% (27) -0.1% 3,250 9.0% 3,142 8.4% (64) -0.2% 3,200 8.6% 3,226 8.3% (78) -0.2% 3,187 8.2% 3,268 8.1% (81) -0.2% 3,268 8.1% 3,311 7.9% (84) -0.2% 3,311 7.9% 3,357 7.7% (87) -0.2% 3,357 7.7% 3,390 7.5% (90) -0.2% 3,390 7.5% 3,369 7.2% (94) -0.2% 3,369 7.2% 3,390 7.0% (97) -0.2% 3,390 7.0% 3,408 6.8% (100) -0.2% 3,408 6.8% Free Cash Flow % Growth 2,543 2,948 15.9% 3,182 7.9% 3,394 6.7% 3,482 2.6% 3,591 3.1% 3,707 3.2% 3,844 3.7% 3,979 3.5% 4,087 2.7% 4,230 3.5% Terminal Value 62,546 Free Cash Yield 6.76% Terminal P/E 14.4 NPV of Cash Flows 21,265 48% NPV of terminal value Projected Equity Value 23,045 44,310 52% 100% Free Cash Flow Yield 5.25% Current P/E Projected P/E 16.7 15.2 15.5 14.2 14.7 13.4 Current EV/EBITDA Projected EV/EBITDA 8.2 7.7 7.8 7.2 7.5 7.0 Shares Outstanding AT&T Offered Price Implied equity value/share Premium Debt Cash Cash/share 510.0 $ $ 95.00 86.88 9.3% 17,058 4,284 8.40 - This was a 10% premium on DTV's closing price on May 16th. Terminal EV/EBITDA 7.4 DTV: Terms of Deal • Deal size: $49 billion ($67.1 billion including debt) • $95 per share: • 1.892 AT&T shares for each DTV share • $28.50 cash ($14.5 billion) • Funded by a combination of cash at hand, sale of certain assets, and financing • Assumption: • $4 billion cash used • $Finance $8 billion AT&T Combined: DCF Analyst: Pravin Talreja Terminal Disc. Rate = 9.25% Terminal FCF Growth = 2.5% 2019E 2020E 7/24/2015 Year Revenue 2015E 169,370 % Growth EBT EBT Margin Taxes Tax Rate Net Income % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow 173,502 2.4% 22,841 13.5% 7,967 34.9% 14,874 % Growth Add Depreciation/Amort 2016E 24,424 14.1% 8,519 34.9% 15,905 6.9% 21,511 12.7% (97) -0.1% 20,300 21,294 12.3% (74) 0.0% 20,450 2017E 175,454 1.1% 25,321 14.4% 8,833 34.9% 16,488 3.7% 21,242 12.1% (112) -0.1% 20,600 2018E 177,603 1.2% 25,619 14.4% 8,939 34.9% 16,680 1.2% 21,123 11.9% (133) -0.1% 20,807 180,467 1.6% 26,026 14.4% 9,083 34.9% 16,943 1.6% 20,923 11.6% (137) -0.1% 20,783 184,143 2.0% 26,365 14.3% 9,203 34.9% 17,163 1.3% 20,805 11.3% (141) -0.1% 20,805 2021E 188,237 2.2% 26,902 14.3% 9,391 34.9% 17,511 2.0% 21,003 11.2% (145) -0.1% 21,003 20122E 192,743 2.4% 27,393 14.2% 9,564 34.9% 17,829 1.8% 21,095 10.9% (149) -0.1% 21,095 2023E 197,276 2.4% 28,033 14.2% 9,789 34.9% 18,245 2.3% 21,126 10.7% (154) -0.1% 21,126 2024E 201,923 2.4% 28,641 14.2% 10,001 34.9% 18,640 2.2% 21,349 10.6% (158) -0.1% 21,349 2025E 206,688 2.4% 29,312 14.2% 10,237 34.9% 19,075 2.3% 21,413 10.4% (163) -0.1% 21,413 12.0% 11.8% 11.7% 11.7% 11.5% 11.3% 11.2% 10.9% 10.7% 10.6% 10.4% 15,988 16,675 17,018 16,863 16,946 17,022 17,366 17,680 18,091 18,482 18,912 AT&T Combined: DCF (Cont.) Free Cash Flow % Growth 15,988 16,675 4.3% 17,018 2.1% 16,863 -0.9% 16,946 0.5% 17,022 0.4% 17,366 2.0% 17,680 1.8% 18,091 2.3% 18,482 2.2% 18,912 2.3% Additional Interest Expense 380 380 380 380 380 380 380 380 380 380 380 Cost synergy 100 -1000 -2500 -2500 -2500 -2500 -2500 -2500 -2500 -2500 -2500 (167) 216 740 740 740 740 740 740 740 740 740 15,676 17,079 18,398 18,243 18,326 18,402 18,746 19,060 19,471 19,861 20,292 Terminal Value 308,139 Free Cash Yield 6.59% Terminal P/E 16.2 (Reduced) Additional Tax Revised Fee Cash Flow NPV of Cash Flows 117,941 48% NPV of terminal value Projected Equity Value 127,213 245,155 52% 100% Free Cash Flow Yield 7.39% Current P/E Projected P/E 14.3 16.5 13.3 15.4 12.9 14.9 Current EV/EBITDA Projected EV/EBITDA 6.8 7.6 6.6 7.4 6.5 7.2 Shares Outstanding Current AT&T Price Implied equity value/share Premium Debt Cash Cash/share 6,185.9 $ $ 34.29 39.63 15.6% 99,125 8,887 1.44 Terminal EV/EBITDA 7.9 AT&T Combined: Sensitivity Analysis Discount Rate Growth Rate $ 39.63 8.00% 8.25% 8.50% 8.75% 9.00% 9.25% 9.50% 9.75% 10.00% 10.25% 10.50% 1.50% $ 43.91 $ 42.28 $ 40.76 $ 39.35 $ 38.03 $ 36.80 $ 35.65 $ 34.56 $ 33.54 $ 32.58 $ 31.67 1.75% $ 44.92 $ 43.19 $ 41.60 $ 40.11 $ 38.73 $ 37.44 $ 36.23 $ 35.10 $ 34.04 $ 33.04 $ 32.10 2.00% $ 46.01 $ 44.18 $ 42.49 $ 40.93 $ 39.47 $ 38.12 $ 36.86 $ 35.67 $ 34.57 $ 33.52 $ 32.55 2.25% $ 47.20 $ 45.25 $ 43.46 $ 41.81 $ 40.27 $ 38.85 $ 37.52 $ 36.28 $ 35.13 $ 34.04 $ 33.02 2.50% $ 48.50 $ 46.42 $ 44.51 $ 42.75 $ 41.13 $ 39.63 $ 38.24 $ 36.94 $ 35.73 $ 34.59 $ 33.53 2.75% $ 49.92 $ 47.69 $ 45.65 $ 43.78 $ 42.06 $ 40.47 $ 39.00 $ 37.64 $ 36.36 $ 35.18 $ 34.07 3.00% $ 51.48 $ 49.08 $ 46.90 $ 44.90 $ 43.07 $ 41.38 $ 39.83 $ 38.39 $ 37.05 $ 35.80 $ 34.64 3.25% $ 53.21 $ 50.61 $ 48.26 $ 46.12 $ 44.16 $ 42.37 $ 40.72 $ 39.20 $ 37.79 $ 36.48 $ 35.25 3.50% $ 55.13 $ 52.30 $ 49.76 $ 47.45 $ 45.36 $ 43.44 $ 41.69 $ 40.07 $ 38.58 $ 37.20 $ 35.91 Consensus Target: $37.54 (This might be prior to DTV Impact) AT&T Recommendation • My Recommendation: BUY – Connected Devices growth (connected cars on the rise) – Diversified strategy – growth opportunity in Latin America – Bundled packaging – Quad Play – Better leverage ratio (Total Debt / Total Equity: 129.91%; Verizon is 882.95%) S&P 500 S5TELS VZ T 17.82 22.42 11.78 13.41 P/B 2.80 1.94 16.40 2.05 P/S 1.80 0.99 1.47 1.34 Div. Yld. 2.2% 4.8% 4.8% 5.5% Est. PE (CY) • Risk – Political instability and currency fluctuations in Latin American nations Agenda 1. 2. 3. 4. 5. 6. Sector Review Stock Recommendation Verizon AT&T T-Mobile Summary T-Mobile • Controlling company: Deutsche Telekom • Healthy subscriber and revenue growth – less reliance on Tablet sales • Margins have suffered – disruptive price competition Revenue at the low end of the market Net Income NI % • Deutsche Telekom CEO: Current model not sustainable • Analysts estimate ~ 13.5% acquisition premium potential on current price • Deutsche Telekom looking for cash offers. Potential suitors: Sprint (merger), Dish, Comcast 2010 4,069 193 4.7% 2011 4,847 301 6.2% * Merged with Metro PCS 2012 5,101 394 7.7% 2013* 24,420 35 0.1% 2014 29,564 247 0.8% Agenda 1. 2. 3. 4. 5. 6. Sector Review Stock Recommendation Verizon AT&T T-Mobile Summary Summary • SELL all stake in VZ • DirecTV shares will convert to AT&T: 1.8% SIM weighting based on 7/24/2015 stock price • BUY AT&T to bring SIM Telecom weight to 2.27% (Equal to S&P 500) QUESTIONS?