Industrials Sector Recommendation Wes Faulkenberry, Matt Landy, Jerid Linkhart & Michael McLelland

advertisement

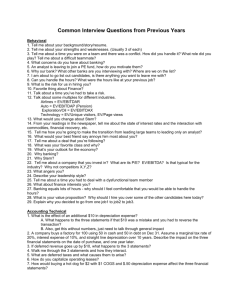

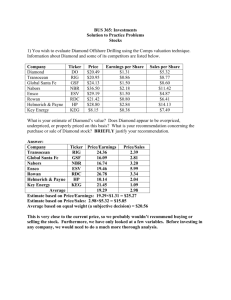

IndustrialsSector Recommendation WesFaulkenberry,MattLandy,JeridLinkhart& MichaelMcLelland BUSFIN7225-SIM Agenda Sector Overview Stock Analysis & Valuation Recommendation Sector Overview Sector Consumer-Discretionary Consumer-Staples Energy Financials Health Care Industrials IT Materials Telecommunications Utilities Cash Dividend Receivables Total ©2014. All rights reserved SIM S&P 10/30/15 10/30/15 11.88% 13.15% 9.33% 9.69% 6.99% 7.11% 15.49% 16.19% 13.09% 14.58% 10.39% 10.19% 21.75% 20.84% 2.91% 2.95% 2.28% 2.37% 2.44% 2.93% 3.31% 0.00% 0.12% 0.00% 100.00% 100.00% Weight vs S&P Over/(Under) (1.27%) (0.36%) (0.12%) (0.70%) (1.49%) 0.20% 0.91% (0.04%) (0.09%) (0.49%) 3.31% 0.12% (0.00%) 3 Sector Overview ©2014. All rights reserved 4 Sector Overview • ©2014. All rights reserved Placeholder 5 Sector Overview Industrials Sector (S5INDU) Absolute Basis High P/E 20 P/B 3.9 P/S 1.7 P/EBITDA 10.1 Low 7.3 1.6 0.6 3.8 Median 17.1 3.0 1.4 8.7 Current 16.3 3.6 1.5 8.5 P/E P/B P/S P/EBITDA High 24 3.0 1.8 10.3 Low 11.9 1.6 0.7 4.4 Median 16.6 2.4 1.4 7.2 Current 18.1 2.7 1.8 10.1 Relative to SP500 High Low Median Current P/E P/B P/S P/EBITDA 0.83 1.30 0.94 0.98 0.61 1.0 0.86 0.86 1.03 1.25 1.0 1.21 0.90 1.33 0.83 0.84 6 Absolute Basis (SPX) ©2014. All rights reserved Sector Overview Stock Boeing (BA) Eaton (ETN) Fluor (FLR) Hertz (HTZ) ©2014. All rights reserved Current Price (11/18/15) $148.28 $56.88 $48.39 $16.66 % of SIM Portfolio (10/30/15) 2.40% 4.02% 3.97% 0.00% Recommendation BUY BUY SELL BUY 7 • Boeing is the world’s largest and leading aerospace company. They manufacture and sell commercial airplanes, defense, space and security systems. They have customers in 150 countries and employ over 165,000 people in 65 countries. Segments: • • • • Commercial Airplanes Defense, Space & Security Boeing Capital ©2014. All rights reserved Stock Ticker BA Recommendation BUY Current SIM % 2.40% Recommended Sim % 3.14% Current Price $148.15 Target Price $167 Dividend Yield 2.76% Projected Return 12.4% Forward P/E 15.86 P/B 14.86 P/Sales 1.03 P/EBITDA 14.18 8 ©2014. All rights reserved 9 Historical Performance Strengths • 2012 2013 2014 • Revenue $81,698 $86,623 $90,762 Op Margin $6,311 $6,562 $7,473 OM % ROE 7.7% 7.6% 8.2% 83.14% 44.21% 46.27% Weaknesses • • ©2014. All rights reserved Double-digit growth in Commercial Airlines leads strong revenue growth Gross and Operating margins have settled at levels above historical averages Government spending cuts have dragged on Defense, Space & Security segment COGS as a percentage of sales continues to rise year over year 10 Opportunities Risks • • • • Global economic growth will stimulate additional demand for commercial aircraft as more passengers utilize airlines and air cargo volume increases Chinese growth offers the. opportunity to develop in a market that is expected to grow substantially in the coming years. Low oil prices further drive demand for additional aircraft as both passenger and cargo levels rise ©2014. All rights reserved • • The global economy may slow down, causing catalytic drivers to slow and reduce demand. Growth in China may slow even further, representing a loss in potential revenue. U.S. federal budget cutbacks may negatively impact the revenue of the Defense, Space & Security segment. 11 Key Ratios Boeing High Low Average Current Forward P/E 21.70 13.33 16.94 16.80 P/B 17.35 6.27 10.70 14.71 P/S 1.20 0.67 0.92 1.06 P/EBITDA 12.39 6.41 8.98 10.11 Forward P/E 20.20 13.18 17.85 17.89 P/B 3.21 2.41 2.84 2.78 P/S 1.41 0.85 1.20 1.29 P/EBITDA 10.35 6.91 9.03 8.71 Competitors ©2014. All rights reserved 12 DCF Valuation ©2014. All rights reserved 13 Eaton Corp. plc is a power management company providing energy efficient solutions to help effectively manage electrical, hydraulic, and mechanical power. The company operates under four business segments: • Electrical Products • Hydraulic • Vehicle • Aerospace Headquartered in Cleveland, Ohio. Incorporated in Dublin, Ireland. Eaton Employs nearly 99,000 with customers in nearly 175 countries. ©2014. All rights reserved Stock Ticker ETN Recommendation BUY Current SIM % 4.02% Recommended Sim % 4.25% Current Price $57.22 Target Price $64.00 Dividend Yield 3.93% Projected Return 12.00% Forward P/E 12.09x P/B 1.72x P/Sales 1.3x P/EBITDA 10.4x 14 ©2014. All rights reserved 15 Historical Performance Strengths • 2013 2014 2015 Doubled revenue over past 5 years ( partially due to Cooper Industries acquisition) • Revenue $21.9B $22.6B $22.1B Op Margin $1.88B $1.76B $2.11B OM % 8.6% 7.8% 9.5% • Company wide restructuring project aimed at increasing Operating Margins to 15% company-wide. 14.5% in Q3 Earnings Report. Electrical segment posting 18.5%. Weaknesses ROE 11.7% 11.0% 12.7% • • ©2014. All rights reserved Smaller revenue gains partially due to FX. Will be hedging more in future. Auto segment only 9% OM 16 Opportunities Risks • • • • • Companywide restructuring program to increase company and segment OM to 15%. Over $1 Billion of capital to deploy in 2016 with a focus on stock buybacks. Increased worldwide focus on power generation practices specifically in US which makes up about 50% of sales. High dividend yield. ©2014. All rights reserved • • Interest rate increases raising the cost to borrow which could decrease spending on new machinery. Relatively correlated with oil prices which are expected to stay lower in the near future. Continued strengthening of dollar. 17 Key Ratios Eaton High Low Average Current Forward P/E 14.2 6.29 11.47 12.09 P/B 2.43 1.54 1.97 1.72 P/S 1.64 .77 1.26 1.25 P/EBITDA 14.47 5.68 9.44 8.03 Competitors Schneider Electric Mitsubishi Electric Wabco Holdings Rockwell Collins Forward P/E 14.2 12.53 16.78 16.06 P/B 1.65 1.61 7.82 6.61 P/S 1.26 .66 2.33 2.38 P/EBITDA 8.60 6.13 16.99 9.90 ©2014. All rights reserved 18 DCF Valuation Eaton (ETN) Analyst: Wes Faulkenberry Terminal Discount Rate = Terminal FCF Grow th = Year 2015E Revenue 22,168 % Grow th Operating Income 2016E 22,362 0.9% 2,487.23 Operating Margin 22,879 2.3% 2,608.23 23,451 2.5% 2,744 24,061 2.6% 2,815 377 184 92 94 96 1.7% 0.8% 0.4% 0.4% 0.4% 58 196 138 128 131 2.8% 8.0% 5.5% 4.5% 4.5% Taxes Tax Rate 2,052 % Grow th 2,258 2,378 11.7% 2019E 11.8% Interest % of Sales 11.4% 2018E 11.2% Interest and Other Net Income 2,638.75 2017E 2,710 11.7% 2,780 2020E 24,735 2.8% 2,894 11.7% 2021E 25,452 2.9% 2,927 2022E 26,216 3.0% 3,015 2023E 26,976 2.9% 3,102 2024E 27,677 2.6% 3,183 11.5% 99 153 157 162 111 113 0.4% 0.6% 0.6% 0.6% 0.4% 0.4% 135 139 143 147 148 152 4.5% 4.5% 4.5% 4.5% 4.5% 4.5% 2,858 961 3.8% 4.1% 4.3% 4.0% 4.2% 4.0% 3.9% 4.0% 98 166 127 (117) (120) (124) (51) (52) 54 55 0.4% 0.7% 0.6% -0.5% -0.5% -0.5% -0.2% -0.2% 0.2% 0.2% Subtract Cap Ex (411) 205 236 Capex % of sales -1.9% 4.5% 4.8% Free Cash Flow 3,448 % Grow th -9.7% NPV of Cash Flow s NPV of terminal value Projected Equity Value Free Cash Flow Yield 17,040 13,331 30,370 12.90% Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 13.0 14.8 11.7 12.7 Shares Outstanding Current Price Implied equity value/share Upside/(Dow nside) to DCF Debt Cash Cash/share 3,113 3,139 0.8% 56% 44% 100% 4.9% 2,405 -23.4% 1,131 4.7% 2,564 6.6% 1,138 4.6% 2,586 0.9% 1,069 4.2% 2,890 11.8% 1,036 1,049 4.0% 2,964 2.5% 2.9% 3,145 869 1,069 3.0% 3,117 4.0% 989 2.9% 3,029 894 1,149 2.8% 2,941 4.0% % of Sales 1,052 1,052 3.9% 3,171 7.0% 0.9% 1,107 1,107 4.0% 3,201 0.9% Terminal Value Free Cash Yield 11.8 13.4 11.1 12.2 11.2 12.8 11.3 12.4 3,262 11.5% 887 Plus/(minus) Changes WC 2.5% 11.5% 13.9% 1,035 28,369 11.5% 5.3% % of Sales 2025E 11.5% 10.0% Add Depreciation/Amort 2.6% 11.0% 2.5% 3,224 2.5% 1,163 4.1% (85) -0.3% 1,163 4.1% 3,139 -1.9% 37,851 8.29% Terminal P/E 11.7 Terminal EV/EBITDA 11.4 474 $ $ 56.36 64.06 13.7% 13,379 781 1.65 ©2014. All rights reserved 19 • Fluor Corporation is a global engineering, procurement, and construction (EPC) firm that designs and builds some of the world’s most complex projects. The company creates and delivers innovative and integrated solutions for its clients with engineering, procurement, fabrication, construction, maintenance, and project management services. ©2014. All rights reserved Stock Ticker FLR Recommendation SELL Current SIM % 3.97% Recommended Sim % 0% Current Price $48.15 Target Price $50.64 Dividend Yield 1.71% Projected Return 6.88% Forward P/E 10.51 P/B 2.28 P/Sales 0.36 P/EBITDA 9.4 20 ©2014. All rights reserved 21 Historical Performance Strengths • $ (thousands) 2013 2014 2015 Continued “backlog” revenue growth ($42.5B at FY ‘14 end vs. $34.9B at FY ‘13 end) Strong cash position ($2B) Steady operating margin % despite revenue contraction Diversified across multiple industries 27,352 21,532 19,818 • • Op Margin 1,191 1,216 973 • OM % 4.4% 5.6% 4.9% Weaknesses Revenue • ROE 18.6% 14.4% 20.8% • ©2014. All rights reserved Significant revenue contraction each of the past two years Lagging sector and competition in key ratios 22 Opportunities Risks • • • Acquisitions Enhance focus on aligning best practices within business units • • • ©2014. All rights reserved Commodity prices (oil and natural gas) Oil refining capacity utilization (lowest since 2011 at 93%) Large % of revenue comes from two clients (15% from ExxonMobil and 11% from U.S. government) Not all backlog revenue is guaranteed 23 Key Ratios Fluor High Low Average Current Forward P/E 15.48 10.15 12.92 11.76 P/B 3.76 1.97 2.86 2.25 P/S 0.62 0.33 0.43 0.37 P/EBITDA 17.43 4.88 9.20 5.58 Competitors AECOM Hyundai Jacobs KBR Forward P/E 9.63 363.24 13.63 13.47 P/B 1.16 0.41 1.26 2.84 P/S 0.26 0.10 0.45 0.51 P/EBITDA 6.14 8.01 9.28 27.19 ©2014. All rights reserved 24 DCF Valuation ©2014. All rights reserved 25 • Hertz Global Holdings, Inc. (NYSE:HTZ) is a leading provider of rental cars, equipment, and fleet leasing/management. The company owns the Hertz, Dollar, Thrifty, and Firefly car rental brands and provides equipment rental services to more than 350 countries worldwide. International and domestic airport car rental services provide the majority of sales ($5.998 billion) for Hertz. ©2014. All rights reserved Stock Ticker HTZ Recommendation BUY Current SIM % 0.00% Recommended Sim % 3.00% Current Price $16.04 Target Price $18.84 Dividend Yield 0.00% Projected Return 17.5% Forward P/E 11.11 P/B 1.59 P/Sales 0.63 P/EBITDA 1.83 26 ©2014. All rights reserved 27 Historical Performance Strengths • ($100,000s) 2012 2013 2014 Revenue 9,013 10,775 11,046 365 603 (23) Op Margin OM % 4.05% 5.60% -0.21% ROE 10.25% 11.90% -3.26% • Weaknesses • • ©2014. All rights reserved One of the most recognized brands in the world. HTZ has the largest market share in the secondary passenger vehicle rental service. Numerous awards recognizing stellar customer service (best-inclass awards) Accounting issues from 2012-13 have weakened Wall Streets opinion of them Slow to begin their “car-sharing” business line as opposed to competitors 28 Opportunities Risks • • • Surge of demand in international markets due to wealth creation has increased global tourism at large. Hertz has an opportunity to be the first car rental company for many of these consumers and establish a loyalty. Technological advancements keep the industry fragmented, and Hertz needs to significantly increase R&D in order to stay competitive ©2014. All rights reserved • A decrease in industrial production would have an adverse effect on Hertz’s equipment rental services Airport car rentals account for 72% of Hertz’s US Car Rental revenue and 55% of the International Car Rental Revenue. A decrease in global tourism and/or business travel would have an adverse effect on a vast amount of Hertz’s net revenue. 29 Key Ratios Hertz High Low Average Current Forward P/E 883.20 2.44 25.16 11.11 P/B 5.13 0.39 2.69 1.59 P/S 1.20 0.12 0.69 0.63 P/EBITDA 3.14 0.32 1.81 1.83 Competitors Penske Avis Sonic AutoNation Forward P/E 10.04 10.24 11.00 14.83 P/B 1.63 1.15 1.59 2.89 P/S 0.19 0.42 0.12 0.33 P/EBITDA 7.23 1.40 4.33 7.99 ©2014. All rights reserved 30 DCF Valuation Hertz Global Holdings, Inc. HTZ Analyst: Michael McLelland 10/4/2015 (000s) Year Terminal Discount Rate = Terminal FCF Growth = 2015E Revenue 10,692,528 % Grow th 283,352 Operating Margin 2.7% Taxes 113,341 Tax Rate 40.0% Net Income 170,011 % Grow th 728,995 6.6% 291,598 40.0% 437,397 157.3% Add Depreciation/Amort 3,090,141 % of Sales 28.9% Plus/(minus) Changes WC 14,448 % of Sales 0.1% Subtract Cap Ex 3,100,833 Capex % of sales 29.0% Free Cash Flow 173,767 % Grow th 3,192,115 28.9% (21,171) -0.2% 3,258,388 29.5% 349,954 101.4% NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 3,872,082 4,681,814 8,553,896 2.39% Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 42.8 50.3 8.2 8.6 Shares Outstanding Debt Cash Cash/share 11,045,381 3.3% Operating Income Current Price Implied equity value/share Upside/(Downside) to DCF 2016E 2017E 11,579,978 2018E 12,442,686 4.8% 648,479 7.5% 858,545 5.6% 259,392 6.9% 343,418 40.0% 389,087 40.0% 515,127 -11.0% 3,346,614 32.4% 3,595,936 28.9% 83,724 28.9% 37,328 0.7% 3,358,194 0.3% 3,608,379 29.0% 461,231 29.0% 540,013 31.8% 45% 55% 100% 17.1% 2019E 13,506,536 8.6% 985,977 7.3% 394,391 40.0% 591,586 14.8% 3,903,389 28.9% 40,520 0.3% 3,916,895 29.0% 618,599 14.6% 10.25% 4.25% 2020E 14,830,176 9.8% 1,171,584 7.9% 468,634 40.0% 702,950 18.8% 4,263,676 28.8% 44,491 0.3% 4,271,091 28.8% 740,026 19.6% 2021E 16,276,119 9.8% 1,334,642 8.2% 533,857 40.0% 800,785 13.9% 4,679,384 28.8% 48,828 0.3% 4,687,522 28.8% 841,475 13.7% 2022E 17,789,798 9.3% 1,378,709 7.8% 551,484 40.0% 827,226 3.3% 5,114,567 28.8% 53,369 0.3% 5,123,462 28.8% 871,700 3.6% 2023E 19,319,720 2024E 20,633,461 8.6% 1,304,081 521,632 21,665,134 6.8% 1,279,275 6.8% 2025E 5.0% 1,083,257 6.2% 5.0% 511,710 40.0% 782,449 433,303 40.0% 40.0% 767,565 -5.4% 5,554,420 5,932,120 28.8% 57,959 649,954 -1.9% -15.3% 6,239,559 28.8% 28.8% 61,900 0.3% 5,564,079 0.3% 5,942,437 28.8% 830,748 64,995 0.3% 6,239,559 28.8% 28.8% 819,148 -4.7% 714,949 -1.4% Terminal Value -12.7% 12,422,246 Free Cash Yield 16.6 19.6 7.1 7.4 18.7 22.0 7.0 7.3 5.76% Terminal P/E 19.1 Terminal EV/EBITDA 4.5 454,000 $ $ 16.04 premarket after preannouncement 18.84 17.5% 21,592,000 1,060,000 2.33 ©2014. All rights reserved 31 Recommendation Stock Current Price Expected Price Dividend Yield Projected Return Current Weight Recommended Weight Basis Points Change Boeing (BA) $148.28 $167.00 2.76% 12.40% 2.40% 3.14% +74 BP Eaton (ETN) $56.88 $64.00 3.90% 12.00% 4.02% 4.25% +23 BP Fluor (FLR) $48.39 $50.64 1.71% 6.88% 3.97% 0.00% -397 BP Hertz (HTZ) $16.66 $18.84 N/A 17.50% 0.00% 3.00% +300 BP ©2014. All rights reserved 32