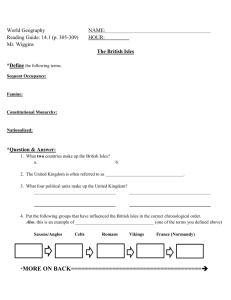

TTIP impact in Ireland This report is prepared for the

advertisement