tements eport & financial sta annual r Irish Food Board

advertisement

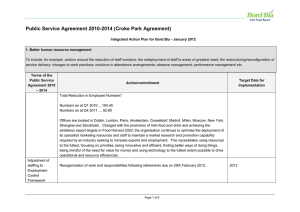

annual report & financial statements Irish Food Board To the Minister for Agriculture, Food and Don Aire Talmhaíochta, Bia agus Rural Development Forbatha Tuaithe In accordance with Section 22 of An Bord Bia De réir Alt 22 den Acht um an mBord Bia Act 1994, the Board is pleased to submit to the 1994, tá áthas ar an mBord a Thuarascáil Minister its Annual Report and Accounts for the Bhliantúil don bhliain dar críoch 31 Nollaig 12-month period ended 31 December 1999. 1999 a chur faoi bhráid an Aire. Philip Lynch Michael Duffy Philib Ó Loingsigh Micheál Ó Dufaigh Chairman Chief Executive An Cathaoirleach An Príomhfheidhmeannach Contents Chairman’s Statement 2 Aitheasc an Chathaoirligh 6 Chief Executive’s Review 10 Corporate Statement 20 Board Membership 23 Organisation Structure 26 European Union 28 Report of the Comptroller & Auditor General 29 Statement of Accounting Policies 30 Income & Expenditure Account 32 Balance Sheet 33 Cash Flow Statement 34 Notes forming part of the Financial Statements 35 Irish Food Board 1659 1660 1667 Dairy & Ingredients Irish Food & Drink Exports (IR£m) 1997 1998 1999 974 1012 1027 Beef Prepared Consumer Foods 733 894 975 Exports by Sector 1999 550 Beverages 616 630 Poultry & Other Meats 2% Pigmeat 4% 221 227 206 Mariculture Edible Horticulture Lamb 3% 305 287 285 Pigmeat, Poultry Lamb Dairy & Ingredients 33% Beef 20% Edible Horticulture 2% 148 143 136.5 Mariculture 4% Beverages 12% 113 122 120 Prepared Consumer Foods 19% 1 ■ The total value of the Irish food & drink industry in 1999 was over £10 billion (e612.6 billion) or 6.5 per cent of national output (10 per cent GDP). ■ Irish food and drink exports were £5.2 billion (e6.6 billion) in 1999, which accounts for 9.4 per cent of total exports. ■ There are 700 Irish food & drink companies, over half employ fewer than 50 people. ■ 176,000 people are directly employed in the agriculture and food industry. ■ Food & drink companies provide 25 per cent of manufacturing employment. Annual Report & Financial Statements 1999 2 Chairman’s Statement To succeed everybody involved in the food industry needs to respond to the changing needs of consumers and retailers – from the type of products developed to the livestock produced on Irish farms. This applies to all routes to market – retail, foodservice and ingredients. Each route demands an innovative approach and a concerted effort to understand and meet the different challenges each Philip Lynch Chairman presents. But the basic prerequisite to exploit opportunities fully is a better understanding Bord Bia completed its fifth year of operation of consumer and shopping behaviour. in 1999. In that time, food exports have grown to £5.2 billion pounds and output to over £10 Continuing consumer demand for convenience billion. The sector is Ireland’s largest indigenous will drive prepared consumer foods. Food safety industry, accounting for half of all exports from and quality will continue to be key issues and Irish-owned companies and almost 30 per all involved in the Irish food and drink industry cent of net foreign trade earnings. Its unique must take responsibility to ensure that we are economic importance is emphasised through never exposed to the disastrous consequences its regional, largely rural base and that it has of a food scare. The publication of the European an exceptionally high level of expenditure White Paper on food safety reflects the priority within the Irish economy. Bord Bia has worked ascribed to Commissioner David Byrne’s in partnership with food and drink companies portfolio of consumer affairs and food safety to contribute to this growth. and is an assurance that these important matters will remain high on the European There can be no question but that the Irish agenda. A considered European approach to food and drink industry is operating in one of food standards and production will benefit the most consumer driven and competitive consumers, and assure buyers in all member business environments. Every week in the UK, states that imported food and drink meets approximately 130 new products are launched their national standards. on supermarket shelves. Bord Bia completed its fifth year of operation in 1999. In that time, food exports have grown to £5.2 billion pounds and output to over £10 billion. 3 The Euro has not had a major impact on Irish food and drink companies will have to consumers in its year of introduction and indeed work closely with their customers to adapt the trade impact has yet to be seen in coming to this changed environment. years, apart from providing stability in exchange rates. The decline of the Euro against sterling The Board is fully committed to ensuring in particular has had a positive effect on Irish that Bord Bia’s activities and programmes export earnings, given the importance of the satisfy current and future needs of the UK market. Retailers in Europe are already food industry. Many Irish companies have preparing for changes in price points and as developed their own sophisticated marketing prices become more transparent to consumers approaches. Bord Bia must continue to look across markets, there will be greater pressure to the future, to ways to add value and to standardise them. anticipate the challenges ahead. The Euro is one element in the increasingly globalised environment in which the Irish food and drink industry must compete. Continuing mergers among European retailers are also accelerating the switch to a single market. Information technology is making a difference. The Internet, like the Euro, will make prices more transparent to consumers. Retailers are already demanding that suppliers are equipped for on-line purchasing, while e-business is emerging as a new route to market, whether through sales direct to consumers or through supplying retailers’ on-line operations. Highlighting the convenience of 10 minute lamb. 4 Because of this, and because 1999 was the The challenges are there – but so too are concluding year of the first Market Development opportunities. Strategy, the Board undertook a detailed review of Bord Bia’s services to the food industry, and looked at the likely operating environment of both the Board and the industry in the next seven years. Extensive consultation with client companies was undertaken so that their feedback could form part of the decision-making process. The intention is to refine Bord Bia’s activities even further, to ensure that the organisation develops to meet the evolving needs of the dynamic Irish food and drink industry while delivering best value for money. Evaluation showed that by targeting all routes to market – retail, food ingredients and the rapidly growing foodservice sector – Bord Bia is enabling companies to explore opportunities outside their current customers. The linkage it provides with buyers and governments around the world is very valuable. Its work in representing Ireland and promoting Irish food and drink in international marketplaces is highly regarded. Bord Bia and its industry partners will approach the next stage of development with the same enthusiasm and focus as displayed over the past five years. The objective is to increase consumption of Irish food and drink worldwide. Appreciation and Acknowledgements 1999 was a year characterised by the hard work, commitment and dedication of a great many people without whose contributions our collective achievements would not have been possible. I thank the Government and Government Departments for their assistance and support. In particular I thank the Minister for Agriculture, Food & Rural Development, Mr Joe Walsh, TD, and Ministers of State, Mr Ned O’Keeffe and Mr Noel Davern, and their officials for their unstinting support and assistance without which we could not have made such progress. Other members of the public service to whom I would like to pay tribute are the Irish Ambassadors and their staff with whom we work closely in overseas markets. We also value the support and financial assistance of the European Union and I thank the Commission and its officials for their assistance. Bord Bia works closely with the members of the food industry across all the sectors and I want to thank all of them and their representative organisations – producers, processors, retailers, Chairman’s Statement Bord Bia and its industry partners will approach the next stage of development with the same enthusiasm and focus as displayed over the past five years. 5 butchers, consumers, employers and exporters – for their continued support and for their contribution to the Irish food industry’s success story. I would like to thank Agnes Aylward and Jean Cahill, who have left the Board since the last Report, for their contributions to Bord Bia. I would like to congratulate my colleagues who were re-appointed to the Board (Michael Dowling, Denis Lucey, Sara White, John Duggan, Maura Nolan and Tom Parlon) and to congratulate and welcome the new members (Joseph O’Sullivan, Michael Kilcoyne and Margo Monaghan) with whom I look forward to embarking on our next period of development 2000 to 2006. In conclusion, I am pleased once again to thank Michael Duffy the Chief Executive, Management and Staff and my fellow Board and Subsidiary Board members whose generous dedication and commitment I greatly value and without which we could not continue to record such significant progress. Philip Lynch Chairman Annual Report & Financial Statements 1999 6 Ráiteas an Chathaoirligh Sa bhliain 1999 bhí an Bord Bia cúig bliana ar Bíonn cur chuige nuálach agus comhiarracht an saol. Le linn na mblianta sin tháinig fás ar riachtanach do gach slí margaíochta chun onnmhairí bia go dtí £5.2 billiún punt – agus ar tuiscint a fháil ar na dúshláin atá i gceist agus an soláthar go dtí níos mó ná £10 míle milliún. chun aghaidh a thabhairt orthu. Ach is é an Is í an earnáil seo an tionscal dúchasach is mó in réamhriachtanas is tábhachtaí a bhaineann le Éirinn Is ionann í agus leath na n-onnmhairithe leas iomlán a bhaint as na deiseanna atá ar fáil ó chuideachtaí atá in úinéireacht de chuid na ná tuiscint níos fearr ar iompar tomhaltóirí agus hÉireann agus beagnach 30% d’ioncam coigríoch ar shiopadóireacht. glan. Feictear tábhacht shainiúil an Bhoird sa bhonn réigiúnach tuaithe a bhaineann leis Is é éileamh na dtomhaltóirí ar an éascaíocht agus sa leibhéal ard caiteachais a bhaineann an ní a mbeidh tionchar aige ar bhianna leis taobh istigh de chóras eacnamaíochta na réamhullmhaithe tomhaltóirí. Beidh tábhacht hÉireann. D'oibrigh an Bord Bia i bpáirtíocht lárnach ag baint le sábháilteacht agus cáilíocht le cuideachtaí bia agus dí chun an fás sin a bia agus beidh freagracht ar dhaoine atá bhaint amach. páirteach sa tionscal bia agus dí in Éirinn, féachaint chuige nach mbeimid ciontach as na Níl amhras ar bith ach go bhfuil an tionscal bia torthaí tubaisteacha a bhaineann le himní bia. agus dí in Éirinn ag feidhmiú i dtimpeallacht gnó Is léiriú é foilsiú Pháipéar Bán na hEorpa ar atá á stiúradh go mór ag na tomhaltóirí agus shábháilteacht bia an tosaíocht a bhaineann atá fíor-iomaíoch. Gach aon seachtain sa Ríocht le portfolio chúrsaí tomhaltóireachta agus Aontaithe, cuirtear thart ar 130 táirge nua ar sábháilteacht bia an Choimisinéara David Byrne sheilfeanna ollmhargaí. Le dul chun cinn a agus tugann siad le fios dúinn go mbeidh dhéanamh caithfidh gach aon duine a bhfuil tábhacht leo ó thaobh chlár oibre na hEorpa. baint aige leis an tionscal bia freastal ar Déanfaidh cur chuige tomhaiste na hEorpa riachtanais tomhaltóirí agus mhiondíoltóirí – maidir le caighdeáin agus táirgeadh bia agus tá na riachtanais sin ag síorathrú – idir na leas na dtomhaltóirí agus cinnteoidh sé sin cineálacha táirgí a fhorbraítear agus an stoc a do cheannaitheoirí sna ballstáit go léir go tháirgtear ar fheirmeacha na hÉireann. Baineann gcomhlíonfaidh bianna agus deochanna sé seo leis na slite margaíochta ar fad– allmhairithe a gcuid caighdeán náisiúnta. miondíolachán, seirbhísí bia agus comhábhair. Sa bhliain 1999 bhí an Bord Bia cúig bliana ar an saol. Le linn na mblianta sin tháinig fás ar onnmhairí bia go dtí £5.2 billiún punt – agus ar an soláthar go dtí níos mó ná £10 míle milliún. 7 Ní raibh tionchar ró-mhór ag an Euro ar dhíol díreach le tomhaltóirí nó trí sholáthar a thomhaltóirí ina chéad bhliain ar an saol agus, dhéanamh do mhiondíoltóirí ar an idirlíon. Beidh ar ndóigh, ní fheicfear a thionchar trádála go ar chuideachtaí bia agus dí in Éirinn comhoibriú ceann roinnt blianta, ach amháin, go gcruthóidh go dlúth lena gcustaiméirí le dul i dtaithí ar an sé seasmhacht sna rátaí malartaíochta. Bhí timpeallacht athraithe seo. tionchar dearfach ag meath an Euro i gcoinne an phuint sterling ach go háirithe ar ioncam na Tá an Bord tiomanta go hiomlán ar fhéachaint n-onnmhairithe Éireannacha ag glacadh tábhacht chuige go gcomhlíonfaidh gníomhaíochtaí agus mhór na Ríochta Aontaithe san áireamh. Tá cláir an Bhord Bia riachtanais thionscal an bhia miondíoltóirí san Eoraip ag ullmhú cheana féin san am i láthair agus san am atá le teacht. Tá d'athruithe i bpraghasphointí, agus, de réir mar a dul chun cinn mór déanta ag go leor cuideachtaí éiríonn praghsanna níos follasaí do thomhaltóirí Éireannacha maidir le cur chuige sofaisticiúil ar na margaí éagsúla, is mó brú a bheidh ann iad margaíochta. Caithfidh an Bord leanúint de a chaighdeánú. bheith ag féachaint chun tosaigh – faoi mar atá déanta aige go dtí seo – féachaint le bealaí a Is eilimint amháin é an Euro i dtimpeallacht atá aimsiú chun breis luacha a thairiscint agus le á cruthú ar bhonn domhanda agus caithfidh bheith réidh do na dúshláin atá fós le teacht. tionscal bia agus dí na hÉireann dul in iomaíocht sa timpeallacht sin. Tá cumaisc leanúnacha i Dá bharr sin agus toisc gurbh í 1999 bliain measc miondíoltóirí Eorpacha ag brostú an dheireanach na Straitéise Forbartha Margaidh, athraithe go margadh aonair chomh maith. rinne an Bord athbhreithniú mion ar sheirbhisí Tá tionchar mór ag teicneolaíocht an eolais air an Bhord Bhia do thionscal an bhia agus seo chomh maith. Fearacht an Euro, is follasaí rinneadh iniúchadh ar an timpeallacht a bheidh praghsanna do thomhaltóirí de bharr feidhmiúcháin is dóigh a n-oibreoidh an Bord thionchar an idirlín. agus an tionscal inti go ceann seacht mbliana. Glacadh comhairle leathan le cuideachtaí cliant Tá miondíoltóirí ag éileamh cheana féin go ionas go mbeadh a gcuid aiseolais ina chuid mbeidh soláthróirí in ann ceannach ar an idirlíon den phróiseas déanta cinní. Is é an aidhm atá agus, ag an am céanna, tá e-ghnó ag dul chun ag an mBord ná gníomhaíochtaí an Bhord Bia cinn mar bhealach nua margaidh, cibé acu mar a dhéanamh níos cruinne, lena chinntiú go Annual Report & Financial Statements 1999 8 dtiocfaidh forbairt ar an eagraíocht chun freastal ar riachtanais an tionscail bia agus dí in Éirinn, riachtanais a bhíonn ag athrú seasta agus ag an am céanna an luach is fearr ar airgead a chur ar fáil. Is léir ón measúnú a rinneadh go dtí seo, má dhírítear ar na slite margaíochta go léir – miondíolachán, comhábhair bhia agus an earnáil seirbhísí bia atá ag fás to tapa – go bhfuil an Bord Bia ag cur ar chumas cuideachtaí deiseanna a thapú taobh amuigh de na custaiméirí atá acu i láthair na huaire. Is fiú go mór an nasc a chruthaíonn an Bord le ceannaitheoirí agus le rialtais ar fud an domhain. Tá dea-cháil ar a chuid oibre i dtaca le bheith ag feidhmniú ar son na hÉireann agus bianna agus deochanna na hÉireann a chur chun cinn ar na margaí idirnáisiúnta. Leanfaidh an Bord Bia agus a pháirtnéirí gnó leis an gcéad chéim eile den fhorbairt seo leis an díogras agus leis an bhfócas céanna a léirigh siad le cúig bliana anuas. Is é an aidhm atá aige cur le tomhailt bia agus deochanna na hÉireann ar fud an domhain. Tá na dúshláin ann – ach tá na deiseanna ann chomh maith. Buíochas Ní bheadh na héachtaí móra a rinneadh le linn na bliana 1999 indéanta mura mbeadh an iarracht mhór, an dúthracht agus an díogras a léirigh cuid mhór daoine agus iad i mbun na hoibre. Gabhaim mo bhuíochas leis an Rialtas agus leis na Ranna Rialtais as ucht a gcuid cabhrach agus a gcuid tacaíochta. Gabhaim mo bhuíochas go speisialta leis an Aire Talmhaíochta, Bia agus Forbairt Tuaithe, an tUasal Joe Walsh, TD, agus leis na hAirí Stáit, an tUasal Ned O'Keefe agus an tUasal Noel Davern, agus lena gcuid oifigeach as ucht a gcuid síorthacaíochta agus cúnaimh. Gan an cúnamh agus an tacaíocht sin ní éireodh linn mórán dul chun cinn a dhéanamh. Tá comhaltaí eile den tseirbhís phoiblí ar mhaith liom iad a mholadh, ina measc Ambasadóirí na hÉireann agus a gcuid foirne, a chomhoibríonn go mór linn ar mhargaí thar lear. Is mór is fiú dúinn chomh maith an tacaíocht agus an chabhair airgid a chuireann an tAontas Eorpach ar fáil dúinn agus gabhaim mo bhuíochas leis an gCoimisinéir agus lena chuid oifigeach i ngeall ar an gcúnamh sin. Ráiteas an Chathaoirligh Ní bheadh na héachtaí móra a rinneadh le linn na bliana 1999 indéanta mura mbeadh an iarracht mhór, an dúthracht agus an díogras a léirigh cuid mhór daoine agus iad i mbun na hoibre. 9 Bíonn comhoibriú maith idir an Bord agus baill Mar fhocal scoir, is mór an chúis áthais dom an tionscail bia sna hearnálacha go léir agus ba arís mo bhuíochas a ghabháil le Michael Duffy, mhaith liom mo bhuíochas a ghabháil le gach an Príomhfheidhmeannach, leis an mBainistíocht aon duine acu agus lena gcuid eagraíochtaí agus lena bhFoireann Oibre agus le mo uiríolla – táirgeoirí, próiseálaithe, miondíoltóirí, Chomhbhaill Bhoird agus Fho-Bhoird as ucht a búistéirí, tomhaltóirí, fostóirí agus lucht gcuid díograise agus dúthrachta. Is mór an meas onnmhairithe – as ucht a gcuid síorthacaíochta atá agam ar an obair a dhéanann siad agus, agus as ucht a gcuid cabhrach maidir le dul murach iad, ní éireodh linn dul chun cinn chomh chun cinn an tionscail bia in Éirinn. héifeachtach sin a dhéanamh. Ba mhaith liom mo bhuíochas a ghabháil le hAgnes Aylward agus le Jean Cahill, a d'imigh Philib Ó Loingsigh ón mBord ó d'eisíomar an tuairisc dheireanach, Cathaoirleach as ucht na tacaíochta a thug siad don Bhord Bia. Ba mhaith liom comhghairdeas a dhéanamh le mo chomhghleacaithe a hathcheapadh ar an mBord (Micheal Dowling, Denis Lucey, Sara White, John Duggan, Maura Nolan agus Tom Parlon). Tréaslaím agus fáiltím roimh na baill nua (Joe O'Sullivan, Micheal Kilcoyne agus Margo Monaghan) agus beidh mé ag súil go mór le bheith ag obair in éineacht leo agus an chéad tréimhse eile forbartha idir lámha againn ón mbliain 2000 go dtí an bhliain 2006. 10 Chief Executive’s Review The past year was one of further progress for the food industry, cementing our development in some sectors and markets, while exploring opportunities and trying new approaches in others. The UK remains Ireland’s single largest market for food and drink, and given strong trading relationships and geographical proximity this is likely to remain the case. It is a sign of the capability of the Irish industry that it has succeeded in this highly sophisticated retail environment. The focus now must be on developing and consolidating this bridgehead while at the same time expanding this knowledge to secure more business with European retailers, especially in the major markets of France, Germany and Italy. The structural changes that have taken place in the UK and Irish retail sector will see an increase in the need for scale and adaptability. Irish suppliers will have to meet the demands of these customers in terms of increased demands being made on the supply chain to achieve the efficiency levels required to remain competitive on the home and export markets. Export performance varied across sectors in 1999, with value added value products making greater progress in another year of limited market returns in the major meat and dairy sectors. Prepared Consumer Foods The PCF sector has continued the growth pattern that had already seen strong performances in 1997 and 1998 with exports of almost £1 billion in 1999. This is now firmly established as the third largest sector of the food industry. Despite the continuing consolidation of suppliers on the part of the UK multiple retailers, this very varied sector, which covers a wide range of convenience foods in frozen, chilled and ambient form, has achieved growth estimated at nine per cent in 1999. Within the sector, ready meals and convenience foods demonstrate the highest percentage growth of any food category, while confectionery also performed well. Dairy and Food Ingredients The overall slight rise in earnings to £1.67 billion by the dairy and food ingredients sector is attributable to a substantial increase in nondairy food ingredient exports. The dairy and dairy ingredients sector maintained its 1998 position in 1999, which can be considered an achievement in difficult market conditions where world prices for dairy products fell to their lowest levels since the start of the decade. The poor level of export demand was caused mainly by the continued absence of Russia from the world market. Irish milk prices declined by about Ready meals and convenience foods demonstrate the highest percentage growth of any food category. 11 three per cent and many products remained Beef exports to International markets (non-EU) at intervention price levels, particularly in the at 300,000 tonnes were up marginally on 1998 first half of the year. There was an increase in levels. They represent, however, just 55 per cent production of Irish butter, casein, cheese and of the total compared to 58 per cent in 1998. whole milk powder but a decrease in skimmed Egypt, Russia and the Gulf remain the most milk powder. significant destinations. Beef Live exports more than doubled in 1999, rising 1999 was a record year for beef production and from 171,000 to 410,000 head. The greatest live exports accounting for 2.46 million head increase occurred in sales of weanlings to EU – an all-time high. Beef exports amounted to markets. Spain, Italy and the Netherlands took 545,000 tonnes, with a value of £1.03 billion. over 80 per cent. The Lebanon continued as This represents a strong export performance in the only International market outlet with a total commercial sales, up eight per cent on 1998 of 70,000 head this year compared to 29,000 levels although lower market returns resulted head in 1998. in an increase of 1.5 per cent in export earnings. The UK remains the principal EU market for Irish beef. Exports to both Northern Ireland and Britain improved to a total of 95,000 tonnes, a 12 per cent increase on 1998 levels. An extra 20,000 tonnes of beef were sold to continental EU markets this year bringing the total to 150,000 tonnes, up 15 per cent in the year. The strongest performances were to Holland, Italy and France, with exports increasing by at least 5,000 tonnes to each. These markets have been identified in Michael Duffy Chief Executive the Bord Bia Strategy as core target markets for future growth. Annual Report & Financial Statements 1999 Chief Executive’s Review 12 Pork and Bacon It was an exceptionally difficult year for pig producers due to supply pressures in world markets and huge downward pressure on prices. As a result of increased supplies, Irish pork and bacon exports were four per cent higher at 130,000 tonnes product weight. Pork’s share of total exports continues to increase, accounting for over 80 per cent of the total. The price of pigmeat however continued to be adversely affected by world oversupply and export earnings were down two per cent to £200 million. Sales to International markets were boosted by the strong import demand in Japan and South Korea and the provision of financial assistance by the IMF to Russia. Exports to international markets increased two and a half fold to 20,000 tonnes. Japan was the best performer and accounted for about two-thirds of the total value and half of the volume at 10,000 tonnes up to £35 million. Lamb Lamb exports in 1999 at 53,450 tonnes were four per cent ahead of last year. France remains The UK continues to be the priority market for the principal market at 41,000 tonnes, similar Irish pigmeat, accounting for 72,000 tonnes or to 1998. The growth in exports was to Spain, 55 per cent of total exports. It is the principal Italy and Portugal which returned strongly this outlet for Irish bacon which accounts for 40 per year. Exports to the UK and Germany were cent of this trade. Exports to Continental Europe maintained at 1998 levels of 3,000 tonnes fell by 20 per cent. Germany remained the and 4,500 tonnes, respectively. principal destination. Export earnings fell by 4.5 per cent during 1999 to £137 million. Returns were adversely affected by poor demand for imported lamb in France, strong supplies of competing meats and no recovery in lamb skin prices. Light lamb exports to Mediterranean markets increased 65 per cent as import demand approached 1995 levels. Food Expo - Cairo April 1999 The continued change in multiple retailing and the evolution of new specialist retail and foodservice formats in Ireland and Britain augurs well for speciality food and drink. 13 Beverages Speciality Foods Building on the successes of previous years, Sales from Ireland’s small and speciality food in 1999 the Irish beverages sector continued businesses continued to show growth during its steady development. In value terms, 1999, both in Ireland and in export markets. beverage exports grew by two per cent in This niche is performing well in line with the 1999 to £630 million. Irish companies are continued upward trend in consumer spend now developing new and innovative products on speciality food and drink, boosted also by and packaging concepts and successfully growth in the gift food market in preparation introducing these to key international markets. for the Millennium. The categories showing increased growth were beer, cream liqueurs, spirits, mineral water The continued change in multiple retailing and and soft drinks. the evolution of new specialist retail and foodservice formats in Ireland and Britain augurs The effects of the abolition of duty-free sales well for speciality food and drink from Ireland has been felt by all manufacturers resulting in as many retail and foodservice formats include reduced sales and companies are dealing with speciality items in selected outlets and menus. this by developing different pricing strategies in this segment of the market. Horticulture Irish mushroom companies continued to supply the UK fresh mushroom industry with approximately 50 per cent of their retail sales. Fresh mushrooms maintained volume in a shrinking market although the price pressure felt by suppliers to the UK, due to price competition among retailers, has reduced export earnings by almost two per cent. With the move to more ready prepared and convenience products, customers are purchasing prepared mushrooms as an ingredient. The total value of horticulture exports in 1999 was £120 million. Féile Bia - promoting through foodservice sector Chief Executive’s Review 14 Bord Bia Core Products Over the past five years, Bord Bia has structured its services to buyers and Irish companies along five core products or services. By 1999, these had become well-established, while continuing to adapt to demands from industry and the marketing environment. Food Promotion The main thrust of Bord Bia’s promotional work is to continue to build and strengthen the “Ireland the Food Island” brand, which is used in all marketing activities for all sectors and products. In 1999 a new corporate identity was developed for marketing materials, and began to be implemented. This reinforces the Ireland the Food Island brand values by representing landscape, people and food. Bord Bia’s promotional objectives are to secure maximum exposure at trade level in priority markets for Ireland as a consistent supplier of high quality food and drink products, and secondly to raise the profile of Irish food among consumers. In 1999, Bord Bia’s public relations activities were accelerated in markets including UK, France, Italy, Germany, Spain, Sweden, Netherlands, North Africa, Middle East, USA, Russia and CEEC. More than 80 journalists visited Ireland on 63 separately organised itineraries while 125 attended Bord Bia press conferences in the markets during the year. The European Commission held an Irish Week in its 11 restaurants in Brussels, serving 6,000 staff and visitors each day. Bord Bia used this opportunity to showcase Irish food to European decision-takers and policy-makers. Carrefour, France’s largest retailer, carried out a nationwide campaign for identified Irish lamb. A consumer advertising campaign was organised under the EQB programme in six Italian cities in March. Outdoor poster sites, a tram, and regional and national press were used together with in-store promotions. Sales increased 25 per cent during the campaign and were sustained at 15 per cent in following weeks. Research shows that consumers have an increasingly positive attitude towards Irish beef, with 44 per cent of Milanese respondents buying Irish beef regularly, an increase of six per cent on 1998. More than 200 in-store tastings were organised for Irish food in Italy in 1999. The first ever consumer advertising campaign for Irish beef took place in the UK. This followed an extensive consumer public relations programme and is preparing the way towards the launch of identified Irish beef in the British market. Ireland has been supplying the market for hundreds of years, and had a significant presence on There can be no question but that the Irish food and drink industry is operating in one of the most consumer driven and competitive business environments. 15 supermarket shelves until 1997 when was a significant increase in the number of nationalisation of the market followed British households buying bacon – up from 72 to 79.7 farming’s economic difficulties after BSE. per cent. Spring and summer beef campaigns However, a consumer franchise was not built were targeted at younger consumers. Three up as the beef was sold under the retailer’s lamb promotions highlighted the product’s eating own label. In 1999 retail penetration of Irish quality. In the iron nutrition programme, 150,000 beef had recovered to eight per cent while leaflets were distributed to health professionals, exports grew 12 per cent. consumers and new mothers. Promotional campaigns in Ireland focused on Irish specialities are performing well in Britain demonstrating convenience and meal appeal supported by Bord Bia’s promotional backing for meat and eggs through an integrated trade in conjunction with London’s Fortnum and and media programme. Time efficient meal Mason and Harvey Nichols Food Halls. The solutions were developed and communicated quality of Ireland’s food and drink received to consumers through media, consumer events further endorsement during 1999, when more and point of sale material. These campaigns than 50 Irish food products were awarded Great included two major campaigns for bacon with Taste Awards by the UK’s premier food writers 400 multiple retail outlets involved. A quarter and gourmet food buyers. of a million recipe leaflets was distributed. Independent evaluation of the campaign showed that 40 per cent of all respondents were aware of bacon advertising over the past two months. An additional four processing plants joined the Quality Assurance Scheme and a number of multiple retailers switched to sourcing Quality Assured Bacon due to the emphasis of the campaign on the Quality Assurance Schemes. During the period of the promotion the volume of bacon/ham/rasher purchased increased by nine per cent on the month earlier and there Annual Report & Financial Statements 1999 Chief Executive’s Review 16 Trade Development In 1999, Bord Bia organised 741 buyer meetings in overseas markets, 81 buyer events and 137 buyer presentations. Buyer events included the annual June launch of the Irish lamb season in France, the Dutch/Irish evening in Amsterdam and a major reception in the Irish Embassy in London, building on the work of the Export Council. Over 160 trade visitors came to Ireland on Bord Bia-organised and initiated itineraries. The 12th World Meat Congress was hosted by Bord Bia in May. This was the first time this major international event was held in Ireland. Over 600 delegates from the meat industry attended to hear the views of 25 experts, including Commissioner Franz Fischler, Minister Joe Walsh and US Secretary for Agriculture, Dan Glickman. A main objective for Bord Bia in securing the event for Ireland was to communicate positive messages about our meat industry through the international trade press. This was successful, with 70 journalists attending the three days of the Congress. Seventy Irish food and drink companies participated in the Retail and Food Service Development Programmes. In the UK buyer contact events were held with Booker, the NHS and Compass. The UK Guild of Fine Food Retailers attended a Bord Bia seminar on Irish speciality foods in Adare, with 50 Irish companies. In 1999, a programme of evaluating opportunities for Irish food and drink in Central and Eastern European markets included six market visits. A seminar was organised to inform Irish companies about the long-term approach needed to these markets. Bord Bia’s trade show programme continued to grow, with 19 events in total. Ninety Irish companies participated on the Bord Bia Ireland stands, 36 of them for the first time. This is particularly welcome as it indicates the growing involvement of the food and drink industry in building the “Ireland the Food Island” brand. Involvement at shows has both a trade contact dimension for companies and a broader promotional aspect for the Ireland brand. In a new development, three specialist drinks fairs were attended, and special marketing materials were produced to introduce buyers to Ireland’s smaller drinks companies. World Meat Congress In 1999, Bord Bia organised 741 buyer meetings in overseas markets, 81 buyer events and 137 buyer presentations. 17 Market Information In 1999, the Information Services Department received and responded to 3,764 enquiries, excluding those handled by overseas offices. Publications during the year were related to programmes such as Food Service and Private Label. Bord Bia continued to subscribe to and analyse on behalf of industry material on the retail sales of mushrooms in the UK and of meat in Ireland. Work was carried out on the Irish beef being relaunched on the Belgian market development of web shopping in Britain. Research was also carried out among British Industry study tours were organised to the US consumers to determine the propensity of for consumer food companies to examine the those with Irish associations to purchase Irish private label sector in America and a pork and products. Bord Bia has been working with bacon tour to Canada and the US. eight chocolate companies on opportunities to promote Irish chocolates in the UK. In 1999 a programme was developed to communicate information about European Extensive consumer research was carried out market requirements to beef producers. This in the UK, France, Germany, Italy and Belgium. included a special farmer newsletter, a series It included taste tests of Irish beef. The results of farmer meetings, articles in the agriculture were very positive in consumer acceptance of media, the Eurosuckler competition and a Irish product and wholesome associations with special exhibit of cattle suitable for Britain, naturalness and a clean environment. This France, Netherlands and Italy at the National research was the basis for on-going dialogue Ploughing Championships. Many of these with retailers, and the positive results led to Irish activities were organised in cooperation beef being relaunched on the Belgian market. with Teagasc and meat plants. Further research is planned for the UK and France. Annual Report & Financial Statements 1999 Chief Executive’s Review 18 Marketing Finance Bord Bia concluded its Marketing Improvement Assistance and Strategic Market Development programmes under the 1994-99 EU Operational Programme for Industrial Development. Bord Bia’s assistance helped companies develop their marketing capability, introduce enhanced quality controls, develop e-commerce, participate at trade fairs, conduct market research and develop designs for new products. In 1999 214 companies benefited from Bord Bia’s assistance and £4.2m in grants were approved under these programmes. To assist client companies through the grants process, marketing finance clinics were held around the country. Quality Assurance Bord Bia has been operating Quality Assurance programmes in the beef and pigmeat sectors for a number of years and a scheme in the egg sector was introduced in 1999. These schemes enable industry to demonstrate best practice to customers and ultimately to consumers across a broad range of criteria. In 1999 membership of the Beef Quality requirements of retail and foodservice customers and was instrumental in assisting the beef industry gain new retail business in 1999. The Pigmeat Quality Assurance Scheme which was substantially revised and updated in 1998 was operated in 1999 by 25 plants approved under the scheme. The scheme was the basis of the two major bacon promotional campaigns carried out in 1999. In 1999 Bord Bia and an expert group representing the egg sector and the regulatory authorities developed an Egg Quality Assurance Scheme. This was developed in response to safety concerns in the egg sector and describes the essential quality assurance requirements from egg production through packing to final despatch, which are necessary to meet customer needs. The scheme has been widely adopted by the egg industry, and 18 packing centres, representing over 80 per cent of Irish production, are now participating in the scheme. Organisational Development Assurance Scheme was maintained at 42 plants Recognising the importance of our staff, Bord with 20,000 farmers involved. The scheme is Bia continued to invest in upgrading skills in recognised as meeting the quality assurance application of technology and in how Bord Bia The food and drink industry continues to demonstrate its ability to succeed in highly competitive and demanding market environments. 20 does its business in specific marketing and project management courses. Almost 95 per cent of staff participated in training courses during 1999, proof of the commitment to further development throughout the organisation. This comprehensive training programme is complemented by an effective Performance Management Programme. The food and drink industry continues to demonstrate its ability to succeed in highly competitive and demanding market environments. The coming years will make even greater demands. As the Chairman has said earlier in this report, the challenges are great – but so too are the opportunities. Success will depend on the ability to formulate appropriate strategies and to respond to emerging trends. Our aim is to position ourselves to anticipate these trends and maximise our support to the Irish industry to assist it to reach its full potential. This is the reason for our existence and our energies will continue to be geared and focused accordingly. The food industry has demonstrated its capability in succeeding in all sectors, across the world. Michael Duffy Chief Executive Annual Report & Financial Statements 1999 20 Corporate Statement Statement of Board Responsibilities Section 21 of An Bord Bia Act 1994 requires the Board to “keep in such form and in respect of such accounting periods as may be approved by the Minister, with the consent of the Minister for Finance, all proper and usual accounts of monies received or expended by it, including an Income and Expenditure Account, a Cash Flow Statement and a Balance Sheet, and, in particular, shall keep in such form as aforesaid all such special accounts as the Minister may, or at the request of the Minister for Finance shall, from time to time direct and the Board shall ensure that separate accounts shall be kept and presented to the Board by any Subsidiary Board that may be established by the Board under this Act and these accounts shall be incorporated in the general statement of account of the Board.” In preparing these financial statements the Board is required to: 1 2 3 4 Prepare the financial statements on the going concern basis unless it is inappropriate to presume that the Board will continue in operation. The Board has overall responsibility for the organisation’s system of internal controls and has delegated responsibility for implementation of this to Executive Management. This system includes financial controls which enable the Board to meet its responsibilities for the integrity and accuracy of the organisation’s accounting records, which disclose, with reasonable accuracy at any time, the financial position of Bord Bia. The Board’s system of internal controls is designed to provide reasonable assurance that transactions are executed in accordance with Board policy and management authorisation and within statutory parameters and guidelines. The Board is also responsible for safeguarding the assets of the company and hence for taking reasonable steps for the prevention and detection of fraud or other irregularities. Select suitable accounting policies and then apply them consistently There is an Audit Committee of the Board to Make judgements and estimates that are which the internal auditor and the external reasonable and prudent auditor have full and unrestricted access. State whether applicable accounting standards have been followed, subject to any material departures disclosed and explained in the financial statements 21 Corporate Governance The Board is committed to maintaining the Safety, Health and Welfare at Work highest standards of corporate governance Bord Bia is committed to implementing the and best practice, including in relation to the provisions of the Safety, Health and Welfare at Government Guidelines for State Bodies and Work Act 1989. The company’s Safety Statement the Ethics in Public Office Act 1995. The Act’s and Policy Document was reviewed and updated provisions are being implemented in Bord Bia, during the year as part of the Board’s on-going and the Board monitors this implementation. policy in this area. The Secretary is responsible to the Board for ensuring that procedures are implemented and that relevant legislation, regulations and guidelines are complied with. Extending Bilingualism in the Public Sector Bord Bia is committed to making every effort Equal Opportunities Bord Bia is an equal opportunities employer. It is committed to ensuring equality of opportunity and its personnel and staff development programmes are geared towards this objective. Bord Bia is also committed to possible to implement the Guidelines for Action Programmes in the State Sector in relation to the use of Irish. Philip Lynch Joseph O’Sullivan Chairman Board Member the implementation of Government policy in relation to the employment of disabled people in the public service. Annual Report & Financial Statements 1999 Prompt Payment of Accounts Bord Bia has systems and procedures to ensure full implementation of the provisions of the Prompt Payment of Accounts Act 1997. Specific procedures are in place to enable the tracking of all transactions and payments in accordance with the terms of the Act and the relevant outputs from the accounting system are kept under continuous review. The Board’s procedures which conform to accepted best practice provide reasonable, but not absolute, assurance against non-compliance; it is also Bord Bia’s practice to review and to take appropriate action in relation to any instances of non-compliance that 22 subject to a Tax Clearance Certificate (if appropriate) being furnished in advance of the invoice and subject to stated conditions in relation to the invoicing process being met; during the period under review all payment transactions were governed by these conditions. The total number of late payments in the year ended 31 December 1999 was 312. The value of these payments was £128,797. The average number of days by which payments were late was 11 days. The overall proportion which late payments constituted of total payments made by Bord Bia was 0.9 per cent. The amount of interest payable in respect of the year ended 31 December 1999 was £337. might arise. Under Bord Bia’s terms, payment is made within 45 days of receipt of invoice, or of date of supply, Report of Comptroller and Auditor General pursuant to Section 13 of the Prompt Payment of Accounts Act, 1997 Responsibilities of the Board and of the Comptroller and Auditor General The Board is obliged to comply with the Act and, Philip Lynch Joseph O’Sullivan Chairman Board Member Basis of Opinion My examination included a review of the payment systems and procedures in place and checking, on a test basis, evidence relating to the operation of the Act by the board during the year. I obtained all the information and explanations which I considered necessary for the exercise of my function under Section 13 of the Act. in particular, is required to As a result of my examination it was established that pay its suppliers by the appropriate payment date An Bord Bia did not pay interest on late payments during if payment to a supplier is late, include the the year ended 31 December 1999. After the year end, appropriate penalty interest with the payment however, the Board undertook an exercise to identify together with the information required by Section 6 and calculate the interest due on any late payments. As a result of this exercise interest of £337 was paid disclose its payment practices in the period in the in 2000 in respect of late payments in 1999. appropriate way Under section 13 of the Act, it is my responsibility, Opinion as Auditor of An Bord Bia, to report on whether, in Apart from the above, it is my opinion that the Board all material respects, the Board has complied with complied in all material respects with the provisions of the provisions of the Act. the Act during the year ended 31 December 1999. John Purcell Comptroller and Auditor General 31 July 2000 Board Membership as at 31/12/99 Chairman Chief Executive Secretary Mr Philip Lynch Mr Michael Duffy Mr Seamus Kenny Chief Executive, IAWS Group Changes during 1999 Members Dr Noel Cawley Managing Director, Irish Dairy Board Mr Michael Dowling Company Director & Visiting Professor UCC Ms Maura Nolan Head of Food Division, Department of Agriculture, Food & Rural Development Appointed 26/1/99: Mr Michael Dowling (re-appointed) Mr Denis Lucey (re-appointed) Mr Joseph O’Sullivan Mr Tom O’Dwyer Ms Sara White (re-appointed) Irish Creamery Milk Suppliers’ Association (ICMSA) Resigned 7/4/99: Ms Jean Cahill, Mr John Duggan Chairman, Glanbia Mr William O’Kane Managing Director O’Kane Poultry Ltd Appointed 2/6/99: Mr Joseph O’Sullivan Term Expired 15/11/99: Chief Executive, Drinagh Co-Operative Society Ltd Mr Tom Parlon Mr Michael Hanrahan Chairman, Kerry Group Mr Michael Kilcoyne Chairman, Consumers’ Association of Ireland Mr Denis Lucey Chief Executive, Dairygold Co-Operative Society Ltd Ms Margo Monaghan Principal Officer Department of Enterprise Trade & Employment Consumers’ Association of Ireland Mr Michael Kilcoyne Term Expired 28/11/99: Mr Tom Parlon Mr Michael Kilcoyne President, Irish Farmers’ Association (IFA) Term Expired 30/11/99: Ms Agnes Aylward Ms Mary White Joint Managing Director Lir Chocolates Ltd Principal Officer, Deparrtment of Tourism, Sport & Recreation Mr John Duggan Ms Maura Nolan Ms Sara White Appointed 1/12/99: Assistant Secretary Department of the Marine & Natural Resources Mr John Duggan (re-appointment) Mr Michael Kilcoyne (re-appointment) Ms Margo Monaghan Ms Maura Nolan (re-appointment) Mr Tom Parlon (re-appointment) 23 Meat & Livestock Subsidiary Board as at 31/12/99 24 Chairman Changes during 1999 Mr Denis Lucey Appointed 17/2/99: Chief Executive, Dairygold Co-Operative Society Ltd. Mr Denis Lucey Term Expired 25/4/99: Members Mr Sean Buckley President, Associated Craft Butchers of Ireland Mr Michael Holmes, IFA Mr Liam McGreal Managing Director, Kepak Mr Eugene Kierans Dr Pat Mulvehill Mr Paul Clarke National Executive of the Livestock Trade Director General, Irish Poultry Processors Association Ms Brid O’Connor Chairman, National Sheep Committee, IFA Assistant Director, Office of the Director of Consumer Affairs Mr Eddie Keane Mr Raymond O’Malley Mr Frank Corcoran Mr Eddie Keane Mr Liam McGreal Resigned 29/4/99: Mr Edward Power Irish Pigmeat Processors Association Appointed 2/6/99: National Poultry Committee, IFA Chairman, National Livestock Committee, IFA Mr Michael Kenny Mr Liam Ryan Chief Executive, Glanbia Chilled Foods Chairman, National Pigs Committee, IFA Mr Tom McAndrew Mr Nicholas Ryan Chairman IMA and Managing Director Eurowest Foods Ltd. National Council, Irish Creamery Milk Suppliers’ Association (ICMSA) Mr Sean Buckley Appointed 27/9/99: Mr Frank Corcoran Mr Eddie Keane (re-appointment) Mr Michael Kenny Mr Liam McGreal (re-appointment) Mr Liam Ryan (re-appointment) Consumer Foods Subsidiary Board as at 31/12/99 Chairman Changes during 1999 Mr Michael Dowling Re-appointed 17/2/99: Company Director & Visiting Professor, UCC Mr Michael Dowling Resigned 7/4/99: Ms Jean Cahill Consumers’ Association of Ireland Members Ms Darina Allen Ms Maura O’Donovan Term Expired 1/6/99: Ballymaloe Cookery School Poultry Instructress Mr Peter Cullen Aran Candy Ms Carol Buckley Mr Joe O’Flynn Mr Pat Walsh Lecturer in Home Economics Marketing Development Director, Irish Dairy Board Walsh Mushrooms Mr Joe O’Flynn Mr Pat Doyle Managing Director, Rye Valley Foods Ltd. Ms Gina Quin Chief Executive, Gandon Enterprises Resigned 1/7/99: Mr Tommy Murray UDV Ireland Ltd Mr Pat Given Managing Director, UDV Operations, UDV Ireland Ltd. Mr Brendan Smyth Appointed 28/10/99: Milk Advisory Manager, Glanbia Mr Pat Given Mr Con Lucey Mr Paddy Walsh Marketing Director, Cheese & Spreads, Golden Vale plc. Managing Director, Walsh Family Foods Mr Larry Murrin Managing Director, Dawn Farm Foods Mr Joe O’Flynn (re-appointment) Ms Gina Quin Mr Paddy Walsh 25 Organisation Structure as at 30/06/00 Russia, CEEC P. McSweeney Director International Markets O. Brooks Middle East, North Africa J. O’Donnell Manager Meat G. Brickley 26 Dusseldorf Office D. O’Keeffe Manager Quality J. Keane Director Operations A. Cotter European/Home Market Madrid Office C. Ruiz Manager Information Services J. Smith London Office M. Murphy Manager Marketing Finance D. Walsh Milan Office J. O’Toole Director Client Services M. Kennedy Manager Promotions & Exhibitions L. Williams Paris Office T. McCarthy Secretary/Director S. Kenny Small Business Chief Executive Michael Duffy Financial Controller G. Bailey Director Consumer Foods & Marketing J. McGrath Manager Consumer Foods Ingredients J. McGough Manager International Media M. Bracken Home Market G. O’Sullivan The Organisation The organisation structure of Bord Bia is comprised appointed by the Board with the consent of the of the Board, two Subsidiary Boards, the Chief Minister. The Chairman of each Subsidiary Board Executive and the Executive, which provide the is a member of the Board. 27 range of operational and corporate services required The following Board Committees are in place: to implement Board policy and programmes. Audit Committee, Evaluation Committee, Quality The Board is comprised of a Chairman and 14 Assurance Committee, Remuneration and Pension ordinary members appointed by the Minister for Committee and Strategy Committee. The Executive Agriculture & Food. There are two Subsidiary Boards is comprised of staff based in the Board’s head (Meat & Livestock and Consumer Foods) comprised office and overseas. of a Chairman and 12 ordinary members, who are Board Meat & Livestock Board Consumer Foods & Ingredients Board Chief Executive Administration Operations Directorate Client Services Directorate Marketing & Communications Annual Report & Financial Statements 1999 28 European Union An tAontas Eorpach Bord Bia’s marketing finance programmes are Faigheann cláracha margaíochta, tionscnaimh supported to a considerable extent by funding agus dreasachtaí airgeadais an Bhoird Bia cuid from the European Union. Most of this comes mhór tacaíochta maoinithe ón Aontas Eorpach. from the European Agricultural Guidance and Tagann a bhunáite seo ó Chiste Treorach agus Guarantee Fund under the Food Sub-Programme Ráthaíochta na hEorpa faoi Fhochlár an Chláir of the Operation for Industrial Development. Feidhme le haghaidh Forbairt Thionslaíoch. Funding is also received under the European Faightear maoiniú freisin ón Scéim Togha Quality Beef Scheme for the promotion of Mairteola faoi choinne chur chun cinn an beef consumption. tomhaltais mhairteola. The support and financial assistance of the Mar gheall ar thachaíocht agus cúnamh airgid European Union enables Bord Bia to make an Aontais Eorpaigh is féidir leis an mBord Bia available a range and level of support to the réimse agus leibhéil tacaíochta a chur ar fáil do Irish food and drink industry which would thionscal bia agus dí na héireann nach mbeadh not otherwise be possible. ar fáil dá n-uireasa. Report of the Comptroller and Auditor General I have audited the financial statements on My audit was conducted in accordance with pages 30 to 42. auditing standards which embrace the standards issued by the Auditing Practices Board and in Responsibilities of the Board and of the Comptroller and Auditor General order to provide sufficient evidence to give The accounting responsibilities of the Board are or error. I obtained all the information and set out in the Board’s Corporate Statement on explanations that I required to enable me to fulfil pages 20 and 21. It is my responsibility, under my function as Comptroller and Auditor General section 21 of An Bord Bia Act 1994 to audit the and in forming my opinion, I also evaluated the financial statements presented to me by the overall adequacy of the presentation of Board and to report on them. As the result of information in the financial statements. reasonable assurance that the financial statements are free from material misstatement whether caused by fraud or other irregularity my audit I form an independent opinion on the financial statements. Basis of Audit Opinion In my opinion, proper books of account have been kept by the Board and the financial In the exercise of my function as Comptroller statements, which are in agreement with and Auditor General, I plan and perform my them, give a true and fair view of the state audit in a way which takes account of the special of the affairs of An Bord Bia at 31 December considerations which attach to State bodies in 1999 and of its income and expenditure and relation to their management and operation. cash flow for the year then ended. An audit includes examination, on a test basis, of evidence relevant to the amounts and disclosures in the financial statements. John Purcell It also includes an assessment of the significant Comptroller and Auditor General estimates and judgments made in the 31 July 2000 preparation of the financial statements, and of whether the accounting policies are appropriate, consistently applied and adequately disclosed. Annual Report & Financial Statements 1999 29 Statement of Accounting Policies (a) Basis of Accounting 30 (d) Fixed Assets and Depreciation These financial statements are prepared on Fixed assets are stated at cost less accumulated an historical cost basis. depreciation. Depreciation is calculated to write (b) Keeping of Accounts Subsidiary Boards Under the terms of the An Bord Bia Act, 1994, the Board is assisted by two Subsidiary Boards in respect of Meat & Livestock and Consumer Foods & Ingredients. All income and expenditure relating to these Subsidiary Boards is reflected in these financial statements. off the original cost less the estimated residual value of tangible assets on a straight line basis at the following annual rates: Leasehold improvements 10% Furniture and fittings 12.5% Office equipment 20% Motor vehicles 20% (e) Marketing Finance Expenditure was incurred on the Targeted Subsidiary Company Marketing Consultancy (TMC) Programme The Board operates a wholly-owned subsidiary in previous years. Under the terms of the company which does not trade. Due to the programme, a proportion of the expenditure nature of the company, it is not considered is recoverable over a 24 to 60 month period appropriate to prepare consolidated financial by way of a royalty based on sales achieved statements. by this expenditure. Income arising under the (c) Income Income shown in the financial statements under Oireachtas Grant-in-Aid represents the actual receipts from this source in the period. Income from EU Structural Funds and the EU Quality Beef Promotion Fund is released to revenue in line with related expenditure and any unexpended balance is included in Creditors. Income from the Statutory Levy is accounted for on a cash receivable basis. TMC Programme from amounts reimbursed is accounted for on the basis of cash receipts. (f) Superannuation Superannuation costs are funded over the employee’s period of service by way of contributions to a fund managed by trustees. The Board’s annual contributions are based (i) Stocks Stocks of stationery are stated at cost. (j) Provision for Bad and Doubtful Debts on actuarial advice and are charged to the Known bad debts are written off and specific income and expenditure account in the period provision is made for any amounts the to which they relate. collection of which is considered doubtful. (g) Leasing (k) Foreign Currencies The rentals under operating leases are dealt Foreign currency balances are translated at with in the financial statements as they fall the rates ruling at the balance sheet date. due. Tangible assets acquired under finance leases are capitalised and depreciated as set out in note (d) above. (h) Tangible Assets (l) Taxation Provision has been made in respect of all VAT liabilities and the PRSI contributions of Irish persons attached to overseas offices. Tangible assets are financed out of revenue. Provision is made in the income and expenditure account for a transfer to the capital account of amounts allocated for such capital purposes less credits to revenue over the life of the related assets. Annual Report & Financial Statements 1999 31 Income and Expenditure Account year ended 31 December 1999 Notes 32 1999 1998 IR£ IR£ 7,911,000 6,530,000 200,000 377,560 Income Oireachtas Grant-in-Aid EU Quality Beef Promotion Fund EU Structural Funds 1a 6,342,000 5,027,000 Statutory Levy 1b 5,363,420 4,379,649 Project and Other Income 1c 2,185,690 2,067,176 22,002,110 18,381,385 54,885 96,986 22,056,995 18,478,371 Transfer from Capital Account 2 Total Income Expenditure Marketing and Promotional Expenditure 3 11,791,010 9,551,992 Marketing Finance 4 3,993,264 4,096,845 Operating Expenditure 5 6,268,176 4,818,574 22,052,450 18,467,411 4,545 10,960 Balance at 1 January 14,337 3,377 Balance at 31 December 18,882 14,337 Total Expenditure Surplus for Year The Board has no gains or losses in the financial year or the preceding financial year other than those dealt with in the Income and Expenditure Account. The results for the year relate to continuing operations. The Statement of Accounting Policies and Notes 1 to 19 form part of these financial statements. Philip Lynch Michael Duffy Chairman Chief Executive Balance Sheet as at 31 December 1999 Notes 1999 1998 IR£ IR£ Assets Employed 33 Fixed Assets Tangible Assets 6 830,747 885,632 Financial Assets 7 6,003 6,003 836,750 891,635 6,226 5,000 1,846,468 1,625,004 39,552 66,897 1,892,246 1,696,901 1,879,367 1,688,567 12,879 8,334 849,629 899,969 830,747 885,632 18,882 14,337 849,629 899,969 Current Assets Stocks Debtors 8 Cash at bank and in hand Creditors (amounts falling due within one year) 9 Net Current Assets Total Assets less Current Liabilities Financed by Capital and Reserves Capital account 2 Income and expenditure account The Statement of Accounting Policies and Notes 1 to 19 form part of these financial statements. Philip Lynch Michael Duffy Chairman Chief Executive Annual Report & Financial Statements 1999 Cash Flow Statement year ended 31 December 1999 1998 1999 Notes 34 Net cash inflow from operating activities IR£ 16 IR£ IR£ IR£ 37,822 110,752 Returns on investment and servicing of finance: Bank interest received 82,343 52,112 Interest on finance leases - Net current inflow of funds 52,112 (859) 81,484 119,306 162,864 Capital expenditure: Payments to acquire tangible assets (123,420) 190,209 Capital element of finance lease payments 18 Decrease in cash 17 - (190,209) (946) (27,345) The Statement of Accounting Policies and Notes 1 to 19 form part of these financial statements. Philip Lynch Michael Duffy Chairman Chief Executive (124,366) (5,060) Notes forming part of the Financial Statements year ended 31 December 1999 1 Income (a) EU Structural Funds have been made available to Bord Bia under Measure 4 of the Food Sub-Programme of the Operational Programme for Industrial Development 1994-99 which 35 is jointly funded by the EU and the State. (b) The An Bord Bia Act, 1994, provides for payment to the Board of a levy per head on slaughtered or exported livestock. Under section 37 of the Act, the rates were set at IR£1.50 per head for cattle, 20p per head for sheep and 20p per head for pigs. (C) Project and other income includes industry contributions to joint promotions, steak bar sales at trade fairs, and seminar and conference fees. Also included is income arising under the Targeted Marketing Consultancy (TMC) Programme. 2 Capital Account 1999 IR£ Balance at 1 January 1999 Amount capitalised in respect of purchased tangible assets 190,209 Net amount realised on disposal of assets (24,796) Amortisation in line with asset depreciation 3 885,632 (220,298) Net transfer to income and expenditure account (54,885) Balance at 31 December 1999 830,747 Marketing and Promotional Expenditure 1999 1998 IR£ IR£ Marketing Development Programmes 7,048,980 5,329,059 Trade Fairs and Exhibitions 2,067,535 2,086,762 Information Services 711,574 590,205 Quality Assurance 318,256 290,981 Trade Services 772,832 590,187 35,957 33,348 Strategic Marketing Programme Marketing Services 218,246 134,803 Communications 285,617 249,411 Nutritional Advisory Services 332,013 247,236 11,791,010 9,551,992 Annual Report & Financial Statements 1999 Notes forming part of the Financial Statements year ended 31 December 1999 4 Marketing Finance Marketing Improvement Assistance Programme 36 Strategic Marketing Development Programme 5 1999 1998 IR£ IR£ 3,804,885 3,453,287 188,379 643,558 3,993,264 4,096,845 148,124 141,179 3,745,489 2,953,210 528,961 527,313 Operating Expenditure Board and Sub-Board Members' fees and expenses Staff costs Rent, rates and insurance Telecommunications costs General business expenses Audit fee Depreciation (Note 6) Loss on disposal of tangible assets 151,665 213,556 1,440,923 754,044 7,920 7,920 220,298 206,012 24,796 15,340 6,268,176 4,818,574 Operating expenditure includes the full cost of staff and office expenses in head office departments and in the overseas offices. Staff costs are comprised of: Wages and salaries 2,470,499 2,508,987 Social welfare costs 154,685 143,860 1,120,305 300,363 3,745,489 2,953,210 Pension costs The total number of employees (including part-time persons) at 31 December 1999 was 68 (1998:68). The cost of certain part-time employees is included in Marketing and Promotional Expenditure. Notes forming part of the Financial Statements year ended 31 December 1999 6 Tangible Fixed Assets Leasehold Furniture and Improvements Fittings IR£ IR£ Office Equipment Motor Vehicles Total IR£ IR£ IR£ Cost At 1 January 1999 582,034 474,797 734,531 50,518 1,841,880 Additions in year - 5,284 144,550 40,375 190,209 Disposals - (104,029) (26,518) (131,001) 775,052 64,375 At 31 December 1999 (454) 582,034 479,627 1,901,088 166,381 242,896 508,579 38,392 956,248 58,203 46,431 103,432 12,232 220,298 (85,837) (20,152) (106,205) Depreciation At 1 January 1999 Charged in year Disposals At 31 December 1999 - (216) 224,584 289,111 526,174 30,472 1,070,341 At 31 December 1999 357,450 190,516 248,878 33,903 830,747 At 31 December 1998 415,653 231,901 225,952 12,126 885,632 Net book Amounts 7 Financial Fixed Assets The Irish Food Board (An Bord Bia) France SARL is wholly-owned by An Bord Bia and its transactions are fully reflected in these financial statements. 8 Debtors 1999 1998 IR£ IR£ 1,139,801 904,362 706,667 720,642 1,846,468 1,625,004 Amounts falling due within one year: Debtors Prepayments and accrued income Annual Report & Financial Statements 1999 37 Notes forming part of the Financial Statements year ended 31 December 1999 9 Creditors 1999 1998 IR£ IR£ 1,005,264 589,054 81,367 79,230 (amounts falling due within one year) 38 Trade creditors Taxation and social welfare (Note 10) EU Structural Funds - 390,000 792,736 630,283 1,879,367 1,688,567 Accruals and deferred income 10 Taxation and Social Welfare Taxation and social welfare creditors comprise the following: Income Tax 60,802 61,440 P.R.S.I. 20,565 17,790 81,367 79,230 An Bord Bia is not liable to corporate taxes in Ireland or in the countries in which it operates because it is a non-commercial State-sponsored body. It is liable to employer taxes in Ireland and complies with related withholding and reporting and payment obligations. In some other countries in which it operates, an exemption from local taxation has been availed of under the governmental services article of the double taxation agreement. No tax liability matured during the year and no provision has been made in these financial statements. However, the possibility of a liability arising in some countries cannot be discounted. 11 Provisions for Liabilities and Charges EU Quality Beef Promotion Fund Value Added Tax At Provided At 1 January 1999 during year 31 December 1999 50,000 55,000 105,000 - 50,000 50,000 50,000 105,000 155,000 These provisions are included within Debtors and Creditors respectively. Notes forming part of the Financial Statements year ended 31 December 1999 12 Commitments (a) Capital Commitments An Bord Bia had no capital commitments at the year end. (b) 39 Financial Incentives There were no commitments in respect of Marketing Finance Programmes at the year end. (c) Operating Leases Operating leases comprise leases on premises. Leasing commitments payable during the next twelve months amounted to IR£373,270 made up as follows: Payable on leases on which the commitment expires: Within one year 20,640 Within two to five years 41,277 Within six to ten years 311,353 373,270 13 Contingent Liabilities (a) Contingent liabilities amounting to IR£491,336 exist in respect of amounts approved but unclaimed at the year end under the terms of the following Marketing Finance Programmes operated by An Bord Bia: 1998 1999 Marketing Improvement Assistance Programme Strategic Marketing Development Programme Targeted Marketing Consultancy Programme (b) IR£ IR£ 406,848 5,515,346 - 349,381 84,488 84,488 491,336 5,949,215 Litigation is in process against the organisation arising from a dispute in which it is alleged that the former CBF infringed employment rights and in which the plaintiff is seeking IR£150,000. The Board are of the opinion that the claim can be successfully resisted. The information usually required by FRS12 is not disclosed on the grounds that it can be expected to prejudice seriously the outcome of the litigation. Annual Report & Financial Statements 1999 Notes forming part of the Financial Statements year ended 31 December 1999 14 Recoverable Incentives Under the terms of the Targeted Marketing Consultancy (TMC) Programme, a total of IR£104,239 40 was due to be recovered in 2000 and subsequent years from participating companies: Estimated amount recoverable at start of year 1999 1998 IR£ IR£ 539,914 1,206,871 Repayments during year (195,257) (533,729) Unrecoverable amounts (240,418) (133,228) 104,239 539,914 Estimated amount recoverable at end of year Recoverable incentives are accounted for on a cash receipts basis and accordingly are not included in debtors. Unrecoverable amounts represent amounts due from companies which are either in liquiation or in receivership. 15 Superannuation The Board operates a defined benefits superannuation scheme for certain eligible employees, for which the approval of the Minister for Agriculture, Food and Rural Development and the Minister for Finance has been received. The contributions of employees and An Bord Bia are paid into a fund managed by the trustees and the total funding rate is in accordance with actuarial recommendations. The last actuarial review took place as at 1 January 1998, and the funding was deemed adequate, on a discontinuance basis, to meet liabilities arising under the scheme. In 1995, a number of personnel transferred from An Bord Tráchtála and contributions are being paid into the fund in respect of these individuals. During the year, an amount of IR£850,000 by way of a specific allocation of Grant-in-Aid was paid to An Bord Bia and transferred to the fund in respect of the estimated underfunding relating to the past service of the personnel who transferred from An Bord Tráchtála. Notes forming part of the Financial Statements year ended 31 December 1999 16 Reconciliation of Surplus to Net Cash Inflow from Operating Activities 1999 Surplus for year Increase in Investment 1998 IR£ IR£ 4,545 10,960 - (435) Net interest receivable (52,112) (81,484) Depreciation 220,298 206,012 Capital account transfer (54,885) (96,986) 24,796 15,340 (221,464) (284,855) Loss on disposal of tangible fixed assets Increase in debtors (Increase)/decrease in stock Increase in trade creditors Increase in taxation and social welfare (Decrease)/increase in accruals and deferred income Net cash inflow from operating activities (1,226) 2,389 414,130 60,308 2,137 887 (225,467) 205,686 110,752 37,822 17 Reconciliation of Net Cash Flow to Movement in Net Funds 1999 1998 IR£ IR£ 66,897 71,957 Net cash outflow (27,345) (5,060) At 31 December 39,552 66,897 In creditors due within one year - 946 In creditors due after more than one year - - Total obligations - 946 Lease payments - (946) At 31 December - Cash at bank and in hand At 1 January 18 Finance Leases Obligations under finance leases At 1 January - Annual Report & Financial Statements 1999 41 Notes forming part of the Financial Statements year ended 31 December 1999 19 Board Members - Disclosure of Transactions In the normal course of business the Board may approve grants and may also enter into other 42 contractual arrangements with undertakings in which Bord Bia Board Members are employed or otherwise interested. The Board adopted procedures in accordance with the guidelines issued by the Department of Finance in relation to the disclosure of interests by Board Members and these procedures have been adhered to by the Board during the year. Grants totalling IR£18,000 were approved and grants totalling IR£381,309 were paid during the year to companies with which Board Members are associated. The Members and the Board complied with Department of Finance guidelines covering situations of personal interest. The Members did not receive Board documentation on the proposed grant assistance nor did the Members participate in or attend any Board discussion relating to the matter. 43 Annual Report & Financial Statements 1999 Website http://www.bordbia.ie 44 Office Network Dublin Düsseldorf London Madrid Clanwilliam Court Lower Mount Street Dublin 2, Ireland Rolandstrasse 44 D40476 Düsseldorf Germany 2 Tavistock Place London WC1H 9RA United Kingdom Tel: +353 1 668 5155 Fax: +353 1 668 7521 Tel: +49 211 452 090 Fax: +49 211 453 353 Tel: +44 207 833 1251 Fax: +44 207 278 7193 Casa de Irlanda, Paseo de la Castellana. 46-planta 3 28046 Madrid, Spain Tel: +34 91 435 6572 Fax: +34 91 435 6211 Milan Moscow Paris Via S. Maria Segreta 6 20123 Milano Italy Orlikov per 3B Moscow 107804 Russia 33, rue de Miromesnil 75008 Paris France Tel: +39 02 7200 2065 Fax:+39 02 7200 4062 Tel: +7 095 207 8150 Fax: +7 095 207 8460 Tel: +33 1 42 66 22 93 Fax: +33 1 42 66 22 88 Annual Report & Financial Statements 1999