Annual Report and Accounts 2004

advertisement

Annual Report and Accounts 2004

2

Annual Report and Accounts 2004

Contents of Report

01

Export Figures

03

Chairman’s Statement

08

Chief Executive’s Review

48

Corporate Statement

52

Board Membership

58

Organisation Structure

62

Report of the Comptroller & Auditor General

64

Statement of Accounting Policies

67

Income and Expenditure Account

68

Balance Sheet

69

Cashflow Statement

70

Notes Forming part of the Financial Statements

81

Marketing Finance Grant Payments 2004

DESIGN AND PRODUCED BY ZEUS CREATIVE, DUBLIN

Presentation to the Minister for Agriculture and Food

Bord Bia Annual Report2.indd 3

In accordance with Section 22 of An Bord Bia Act 1994, the Board is

pleased to submit to the Minister its Annual Report and Accounts for

the 12 month period ended 31 December 2004.

Angela Kennedy

Chairman

In accordance with the Official Languages Act 2003 this publication is available in Irish

10/08/2005 09:55:56

Exports of Irish Food & Drink (€m)

���

���

������������

��������

����

���

���

�������������������

���

���

���������

�������

���

���

�������

���

���

���

���

����

�����

�����

���������

�����

�����

�����

�����

�����

��������������

��������

�����������

�����

�

� ��

���

���

���

� ����

� �� ��

� ����

� ����

�����

� ����

� ����

�

4

01

Report

and Accounts 2004

Annual Report andAnnual

Accounts

2004

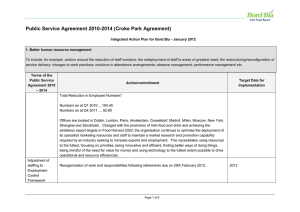

Exports of Irish Food & Drink by Sector (€m)

2003

2004 (p)

% Change

2004/2003

€m

€m

%

Dairy products & Ingredients *

1,755

1,860

+6

Prepared Foods

1,518

1,521

-

Beef *

1,300

1,400

+8

Beverages

1,077

1,016

-6

Fish

380

370

-3

Pigmeat

250

265

+6

Poultry

253

249

-2

Sheepmeat

145

165

+14

Edible Horticulture & Cereals

197

179

-9

Live Animals

147

116

-21

7,022

7,141

+1.7

16

16

-

Total Food & Drink

Amenity Horticulture

* Including Refunds

5

02

Chairman’s Statement

The value of Irish food, drink and

horticulture exports in 2004 exceeded

€7.1bn, representing an increase of 1.7%

on 2003. This was a good performance

in the context of a weakening Dollar

and Sterling, retail food price deflation

in our largest market, and a continuing

highly competitive trading environment.

Conditions are set to remain challenging

in 2005 but the industry is well

positioned to maintain its current growth.

03

6

Ireland’s Food, Drink and Horticulture

industry represents the largest area

of indigenous economic activity and

accounts for over 55% of exports from

indigenous companies. Output from

this sector contributes 9% of Gross

Domestic Product (GDP) and provides

158,100 direct jobs or 9% of total direct

employment. It is an industry comprised

of companies ranging from the very

small to the very large; from start-up

companies to established players; all of

whom make a valuable contribution to

national economic prosperity, regional

distribution of income, and sustainable

development. Furthermore, as an

indigenous sector with low-income

outflow and profit repatriation it makes

a correspondingly larger contribution

to Irish GDP and wealth creation.

Behind the statistics are the people who make

things happen and who know that the sine qua

non of success is their commitment to excellence

and a spirit of renewal and change. They know

that these values are at the centre of all successful

enterprises and that ultimately they are the

dynamics of our prosperity and achievement.

They recognise that change is not only challenge

but also opportunity; that the next plateau is a

stepping-stone to the one after and if they don’t

occupy it, somebody else will. Above all they are

aware that they operate in a highly competitive

environment where change, innovation and

new technology are the order of the day.

The landscape in which this vital industry operates

is changing rapidly and it is probably true to say

that there are more major developments than ever

Report

and Accounts 2004

Annual Report andAnnual

Accounts

2004

product labeling and environmental regulations

have to be factored into efficient consumer and

market-focused production processes. Costeffective application of new and leading-edge

technologies will be key to success and the

overall ethos will increasingly be of a knowledgebased industry. To retain efficiency, enterprises

must win the constant battle to control costs,

whatever economic environment presents itself,

and sufficient personnel with the right skills

must be available. Further appreciation of the

Euro against the US Dollar or Sterling, or any

significant increases in energy prices or in other

inputs, are risks and could place significant

competitive pressure on the enterprise.

before. Success will be contingent on our collective

ability to respond to these challenges and to take

advantage of the opportunities they bring.

The decoupling of payments from production from

1 January 2005 is the most significant Common

Agricultural Policy reform to date. EU enlargement

from 1 May 2004 during Ireland’s EU Presidency,

is a most ambitious step and will increase

competition and open up new opportunities. The

onward march of the World Trade Organisation,

resulting in greater market liberalisation, will mean

more competition at world price levels. Retail

consolidation and concentration will continue,

further driving centralisation of buying and

distribution, rationalisation of supply base, strategic

outsourcing and increasing pressure on margins.

Food safety, product traceability, quality assurance,

Interest in health and wellbeing is the dominant

trend affecting consumer choice and is playing a

major role in driving growth in food markets. Food

and drink companies have to respond with credible

solutions. Success will require a deep understanding

of consumer needs and behaviour and significant

investment in developing science-enhanced

products that deliver demonstrable and ratified

health benefits. Convenience is also a major driver

of change. Recent data suggests that in ten years

time snacking and informal meals could account for

70% of all eating occasions. More recently, we have

seen an additional consumer trend, a ‘shift to value’,

that cuts across all ages, nearly all income groups

and, to some degree, all consumer segments.

This highlights the need for focusing on quality

and nurturing strong and differentiated brand

positions in a highly competitive market, while

also recognising the major part that can be played

by our increasingly successful Small Business

and Speciality Food sector, which has a potential

market worth almost €6.1bn between Ireland

and the UK. These trends will continue to shape

04

7

both consumer demand and manufacturer and

retailer response. In order to succeed, continuous

innovation will be essential in maintaining

consumer interest and gaining retailer acceptance.

This environment in which the Irish food, drink

and horticulture industry operates is hugely

competitive. The scale and scope of change

already referred to clearly indicate that it is facing

a defining period. It is no less so for Bord Bia,

which recognises the need to adapt its strategies

and priorities so that it can continue to deliver

significant value to its stakeholders. Towards the

end of 2004, the Board initiated a comprehensive

strategy review and consultation process, the

outcome from which is the strategic repositioning

of the organisation in preparation for the next

stage of development. Bord Bia knows it cannot

stand still, that change is the only constant.

Like the industry we serve, we will continue

to strive to achieve new levels of excellence

that will ensure we stay ahead of the curve.

05

8

2004 saw the expansion of Bord Bia following

the integration of Bord Glas (the Horticultural

Development Board). This has gone well and

positions us to deliver the efficiencies and

economies that were envisaged, while ensuring

Horticulture benefits from being part of a larger

organisation. I would like to thank everybody

who contributed to this success, in particular

Dan Lenihan, former Chairman of Bord Glas.

A new subsidiary board for Horticulture was

established, which, I am pleased to say, is making

an important contribution. Decentralisation has

also been placed on the agenda and, while no

decision has been made regarding timing, we

are working closely with our parent Department

regarding this Government decision.

During the year, Aidan Cotter became the new

Chief Executive. He has done a superb job ensuring

continuity and preparing Bord Bia for the next

stage of development. He has also helped me

greatly and this has been particularly important

during these early days since my appointment.

Aidan’s predecessor, Michael Duffy, was the

first Chief Executive. He had the responsibility

of getting the new organisation off the ground

and implementing Bord Bia’s new remit. He did

an excellent job, and I thank him also for his

contribution to the development of Bord Bia.

My predecessor, Philip Lynch, who served for three

terms as Chairman of Bord Bia (having previously

been Chairman of CBF – the Irish Livestock & Meat

Board), did a magnificent job in the development

of Bord Bia, bringing it to the stage where it

has built a considerable reputation and is now

a major resource for the Irish food, drink and

horticulture industry. He has earned our gratitude

and appreciation and I am delighted to celebrate

his many achievements in Bord Bia, and in the

national and international business arenas.

I would like to congratulate Mary Coughlan, T.D.,

on her appointment as Minister for Agriculture

& Food. I thank her for appointing me to the

Chair of Bord Bia and for the confidence she has

reposed in me. The Minister has articulated a

clear vision which challenges us to continue the

work of securing a diverse, competitive, exportorientated and consumer-led industry that

delivers maximum benefit to all stakeholders

and contributes to the prosperity and wellbeing

of our country. We will assist the Minister in

every way possible to meet this challenge.

Report

and Accounts 2004

Annual Report andAnnual

Accounts

2004

stakeholder organisations, with whom we work

closely, and who contribute greatly to our work.

I thank my Board colleagues for their dedication

and commitment, and for their support, which

has been particularly important in the early days

while I was getting my feet under the table, so

to speak. I appreciate this very much. I thank

the Chairmen of the Subsidiary Boards (Meat &

Livestock, Consumer Foods, Quality Assurance and

Horticulture) for their extra time and commitment,

and the Members, who are a further pool of

talent and expertise, and who carry out their

sectoral remits with great dedication and skill.

Bord Bia Chairman Angela Kennedy with outgoing Chairman

Philip Lynch.

There are many organisations and people that

assist us and contribute to our success. We

are most appreciative indeed of the support

and encouragement we receive from Minister

Coughlan and Ministers of State, John Browne

and Brendan Smith (with special responsibility

for food and horticulture); from Secretary General

Tom Moran and the officials of the Department of

Agriculture & Food; and former Secretary General,

John Malone, whom we are now fortunate to

have on the Board of Bord Bia. Without them

we could not succeed. I thank our Ambassadors

and Irish Embassy staff, with whom we have a

close and fruitful working relationship also, and

who support us and add considerable value to

our activities. I extend appreciation to all our

Corporate governance compliance requirements

have expanded considerably, bringing with them

an increased workload. Bord Bia is committed

to maintaining the highest standards of

corporate governance in accordance with the

Code of Practice for the Governance of State

Bodies. I thank the Chairman of the Board

Audit Committee and Members of the Board

Committees (Audit, Strategy, and Remuneration

& Pensions) for their important contributions

and for taking on substantial extra workloads.

In conclusion, I extend my compliments and

appreciation to our Chief Executive, management

and staff, whose professionalism and dedication

I have come to admire in the short time since my

appointment in February. It is on them that the

Board relies to deliver the strategic objectives.

Our trust is in good hands. We have finished

one decade since the establishment of Bord Bia.

We look forward with confidence to the next.

Angela Kennedy

Chairman

06

9

10

Report

and Accounts 2004

Annual Report andAnnual

Accounts

2004

Chief Executive's Review

The robust, overall export

performance of the industry last

year, with exports surpassing €7

billion, was marked by a number of

particularly encouraging features.

Firstly, the prepared foods sector,

with significant growth potential,

continued its upward path despite

a very competitive environment and

food price deflation in our largest

market. Secondly, a significant

achievement was recorded by the

beef industry when it exported 90%

of its volumes to Europe’s higher

value markets for the first time

since the late 1970s. And thirdly,

small, speciality food businesses are

performing strongly, enjoying double

digit growth, even though they are by

definition starting from a small base.

Together, the three largest sectors of the

industry, meat, dairy and prepared foods,

generated a combined growth in value

amounting to over €200 million. The net

increase however fell back to €120 million

for the year when account is taken of lower

values in other sectors, principally in beverages.

The latter was largely due to exceptional,

structural issues involving the relocation of

some production within the island of Ireland.

Almost 70% of the industry’s exports were to

destinations outside the Eurozone in 2004.

As a result, the movement of sterling and the

dollar underlined the continued significance

of currency movements to the industry. The

dollar, in particular, depreciated by ten percent

on average across the year compared with

2003, reducing competitiveness and the euro

value of sales to international markets.

Bord Bia works closely with all sectors

of the industry to build strong positions

in the marketplace through a range of

market development, promotion and

information services. The principal initiatives

undertaken in 2004 are set out below.

Highlights

• The Second European Meat Forum took

place in Dublin in May with the theme,

"A World of Opportunities". It covered topics

on consumer trends, advances in packaging

as well as developments in the retail and food

service sector. It was attended by 350 invited

guests from 17 countries, including 165 buyers

from the major European retail, foodservice

and manufacturing sectors, 25 overseas

journalists and over 100 Irish meat company

representatives and industry organisations.

• Bord Bia’s Events Services Department

organised 78 events in 2004, including the

European Meat Forum and Marketplace

along with first time participation at shows

in China-SIAL China, International Meat

08

11

Industry Show, Beijing and China Agricultural

Show. The department also organised a food

tasting and food display on the occasion

of the meeting of the EU Ministers for

Agriculture on Garinish Island in May.

• The aim of the 2004 Bord Bia Fresh Produce

Retail Awards was to reward excellence in

retail standards for fresh produce, thereby

promoting increased sales. Recognition was

given to stores where the product range,

availability and merchandising of local produce,

food safety, quality and point of sale material

were of the highest possible standards.

• Bord Bia launched its promotion of mushrooms

in association with the Irish Mushroom

Growers’ Association (IMGA). The campaign

highlighted the benefits of eating more

mushrooms, particularly to younger consumers,

in terms of the taste, ease of preparation,

versatility and nutritional value of mushrooms.

A national billboard advertising campaign

featuring a mushroom recipe appeared in key

cities and towns and on roads nationwide.

09

• The growing market demand for plants was

highlighted at Bord Bia’s first conference for the

gardening industry. Aimed at promoting greater

partnership within the gardening industry,

the event consisted of a conference and a

series of industry tours. International industry

experts from landscape design, business

development, retail and research backgrounds

provided insights into business clustering, new

product development, consumer trends and

the interaction between people and plants.

• In Italy a co-branding proposal, combining

the Irish beef mark and retailing brands

customised by markets, was developed

and presented to retail customers. The

initiative is being implemented and

promoted so far by three retailers with

further retailers set to come on stream.

• The Chef’s Irish Beef Club was launched in

the Netherlands, Britain and France with the

aim of building new market positions in the

upper end of the foodservice market and

enhancing the brand image of Irish beef. Fifteen

top chefs from France, the Netherlands and

Britain visited supplying plants in order to

build their knowledge of Irish beef produced

under the Quality Assurance Schemes.

• Bord Bia completed the revision of the

Beef Quality Assurance Scheme (BQAS).

The new standard was approved by the

Irish National Accreditation Board (INAB)

as being suitable for EN 45011 certification.

Bord Bia reached agreement with the beef

industry on arrangements to implement the

BQAS. By year end all necessary measures

were in place to enable the scheme to

commence from January 2005.

• As part of the process to gain market access

for Irish meat products in China, Bord Bia

exhibited at two important trade fairs in

Beijing as well as SIAL China in Shanghai. A

senior Chinese delegation from the General

Administration of Quality Supervision,

Inspection and Quarantine (AQSIQ) visited

Ireland. The delegation met with Minister

Annual Report and Accounts 2004

Walsh and senior officials of the Department

of Agriculture and Food (DAF) and were given

formal presentations by both DAF and Bord Bia.

• Meat and livestock represented the single

largest category of exports in 2004, amounting

to an estimated €2.2 billion and an aggregate

growth rate of almost 5% over 2003 levels.

An improved price performance in beef and

pigmeat exports and increased sheepmeat

volumes, more than offset reductions in the

value of poultry and live animal exports.

At the launch of the mushroom promotion were Michael

Maloney, Director of Horticulture, Bord Bia (left) and

Michael Slattery, Chairman, Irish Mushroom Growers’

Association with model Katie French.

• A UK Retail Intelligence Package was designed

to assist Irish companies address information

requirements in the marketplace. It consisted

of a UK media report sent daily by e-mail four

to six updates per year on retailer performance,

two directories profiling both the larger

supermarket chains and the convenience and

smaller chains, along with seminars/workshops.

• Applications for funding for the Bord Bia grants

programmes for Small Business were received

from over 100 companies. These companies

were paid grants to the value of €350,000.

The grant-funded companies were primarily

in the confectionery, chilled dairy products,

food ingredients and prepared meals sectors.

• A major marketing and promotional programme

was launched to increase the awareness of

Féile Bia among consumers highlighting the

“Certified Farm to Fork” message. The campaign

included the launch of a plaque for members.

Consumer research during the year noted a

strong increase in the awareness of Féile Bia.

10

Membership continued to grow during 2004,

reaching 1350 member establishments.

• Bord Bia and Irish Egg Marketing successfully

applied to the EU for financial support worth

€150,000 for an Egg Information Campaign to

promote awareness of the newly introduced

EU egg marking programme. The financial

contribution is made up of 50% from EU,

30% from Irish Egg Marketing and 20% from

Department of Agriculture and Food.

• Bord Bia launched its healthy eating campaign

for meat and vegetables entitled "Low Fat No

Fuss". The promotion highlighted the benefits

of combining lean red meat and vegetables

as a low fat, convenient and nutritious meal

solution. The healthy eating campaign included

a national radio promotion, TV cookery

demonstrations and quick and easy recipe ideas

for preparing meat and vegetable dishes.

• Bord Bia’s public web site (www.bordbia.ie)

had over 125,000 ‘unique visitors’ during 2004.

The site was substantially revamped in order

to incorporate the content from the award

winning Bord Glas site subsequent to the

amalgamation and to reflect an analysis of a

visitor questionnaire completed on the Bord Bia

site earlier in the year.

11

• The registered user base for the two Bord Bia

extranets – the Client Portal and the Producer

Portal - passed the 500 individuals mark

during 2004. The Client Portal was revamped

in response to independent research amongst

users and usage has increased due to the

TASTE Council. At the launch of the TASTE Council were council

members Kevin Thornton, Thornton’s Restaurant, Dublin and

Darina Allen, Ballymaloe Cookery School.

Annual Report and Accounts 2004

introduction of a number of new “eAlerts”.

These eAlerts enable Bord Bia to bring relevant

news to users who have chosen to subscribe

to the individual themes. For example, one

of these eAlerts combines information on

new products, packaging, flavours and retail

trends in order to provide “inspiration” for

new product ideas or other innovations.

• Bord Bia held the fourth in a series of seminars

in June as part of its Health & Wellbeing

programme. The seminar included expert

speakers in the field of health and nutrition

and EU legislation. Papers highlighted the

health concerns in adults and children and

explored the European diet and what can be

done to improve the food we choose to eat.

• Bord Bia continued to develop farmers’

markets as an alternative marketing channel

for the speciality sector and worked with

a number of local communities around

the country assisting them in establishing

farmers’ markets in their areas. The Food at

Farmleigh events was extended to include

an Artisan Bread Award which was run in

conjunction with DIT’s National Bakery School.

• Bord Bia has agreed to sponsor the world’s

first University of Gastronomic Sciences

established in Italy by the Slow Food movement.

The new University curriculum will include

a programme on science, nutrition, history,

culture and gastronomy of Irish food.

• Bord Bia participated at the major Slow Food

exhibition in Turin, Italy. This event is staged every

two years and is a market exhibition of prime

quality food and drink as well as a school of taste,

presenting delicacies from all over the world.

• The TASTE Council established by Bord Bia,

an industry-led group representing the

full artisan and speciality food chain from

production through to marketing, distribution

and retailing, works strategically in support of

the artisan and speciality producing sector to

maximise its contribution to the Irish agri-food

economy, society, culture and environment.

The Taste Council made a number of key

submissions and presentations to Government

and Statutory bodies on the sector.

• Bord Bia deepened its relationship with

retail and foodservice buyers during the year

with a programme of supplier buyer events,

inward buyer visits and the production of

a comprehensive all-Ireland speciality food

directory profiling over 200 small food producers.

• In September 2004, Bord Bia hosted 225

International buyers at Marketplace Ireland.

Fifty four companies from the food and drinks

industry exhibited their products over two

days and 1,330 scheduled one to one meetings

were held with buyers. The estimated new

sales after six months were in excess of €9m.

• Bord Bia built on its two year agreement with

Bank of Ireland Business Banking to partner the

Brand Forum. The forum provides a centre of

excellence for brand marketing, which delivers

new skills to the industry and promotes long

term success of food and drink brands.

12

Irish beef back in Paris. Minister for Agriculture & Food, Mary

Coughlan and Aidan Cotter, Chief Executive, Bord Bia in Paris to

mark the return of Irish beef to French supermarket shelves for

the first time in eight years.

The quarterly brand fora were supported by

two regional events, a publication of all brand

fora members in an Irish brand directory

and access to exclusive market research

and insights. A trend spotlight, a monthly

information service on hot topics within the

food and drink industry, was also launched.

• Bord Bia ran a market study visit to the US in

2004. Based around Philadelphia and New York,

this extensive itinerary afforded participants

unique insights into best practice marketing

in the US. The visit incorporated presentations

from America’s largest brand owners such

as Campbell’s Soups, to the latest guerrilla

marketing tactics, a plant tour to Hershey’s New

Product Centre of Excellence and store visits.

13

• The “strategic network alliance” marks a new

departure in funding by Bord Bia for Irish

manufacturers to seek out attractive European

markets with opportunities for business

development. Research was undertaken in

2004 and was funded in equal parts by Bord

Bia and the participating companies.

• A number of Irish drinks companies participated

on a Bord Bia trade visit to meet with key

buyers from the Pennsylvania Liquor Control

Board (PLCB). The PLCB is the single largest

purchaser of alcohol in the USA with sales in

excess of $1.3bn, with 635 stores statewide.

Two PLCB representatives also visited

Ireland during Marketplace and again met

with drinks industry representatives.

• Bord Bia organised a market study visit on

behalf of the alcoholic beverages sector to the

Baltic States of Lithuania, Latvia and Estonia.

Representatives from a number of Ireland’s

leading independent drinks manufacturers

held meetings with key importers, retailers

and distributors in each country.

Annual Report and Accounts 2004

17

18

Annual Report and Accounts 2004

Meat and Livestock

In 2004, the value of meat and livestock exports

was €2.2billion, the largest for any single sector.

Beef is the single largest element by a sizeable

margin and has grown by 8% in 2004. Sheepmeat

had the second largest increase in euro terms and

the largest percentage increase. Pigmeat achieved

a smaller increase and poultry exports declined

slightly. Livestock exports had a more difficult year,

mainly due to higher Irish prices and weaker relative

demand from the Italian and Spanish markets.

Beef

Irish beef exports were valued at €1.4 billion in

2004, an increase of 8% on the previous year, even

though the volume of beef available for export was

marginally lower at 497,000 tonnes. The reduced

volume was due to lower supplies and a small

increase in domestic consumption. The higher value

of exports was due to improved market returns,

which is consistent with a 10% rise in average

cattle prices in Ireland. Almost 90% of beef exports

were within the EU, compared to 50% in 2000.

The UK market accounted for almost 55% of Irish

beef exports, reaching 269,000 tonnes - a rise

of 7% on 2003 levels. The market became more

competitive as the year progressed, reflecting

increased domestic production in advance of the

UK’s move to a single farm payment and strong

non-EU supplies, but Irish beef continued to

perform well. The market position of Irish beef in

the UK continues to improve, with over 30% – or

85,000 tonnes, valued at €350 million – going

directly to the multiple retail sector. Similarly, sales

of processed beef showed further growth, reaching

75,000 tonnes – over a quarter of total shipments.

Exports of Irish beef to other EU markets,

including the new Member States, reached

174,000 tonnes. This is a rise of 7% on 2003 levels

and marks an all-time high for such shipments.

Irish beef performed strongly in Italy and the

Netherlands, rising by 14% to 40,000 tonnes

and by 7% to 42,000 tonnes, respectively. Other

important markets that experienced growth

were Scandinavia, at 35,000 tonnes and France,

at 24,000 tonnes. In the new Member States,

strong trade development initiatives, prior to and

since accession to the EU, has led to Irish beef

exports to Hungary, Poland and the Czech Republic.

However, like the UK, the other EU markets

remained quite competitive for much of the year.

Beef exports to international markets (non-EU

markets) declined to 55,000 tonnes, down almost

a third on 2003 levels. This was due to increased

shipments of Irish beef within the EU, a 6%

strengthening of the euro against the US dollar

and increasing competition from South American

suppliers. Russia remained the principal market,

taking 47,000 tonnes, while Algeria re-emerged as

a good market for Irish beef in the final quarter.

The outlook for the Irish beef industry in 2005

remains broadly positive and the market position

of Irish beef is improving across Europe. With

consumption stable, the EU production deficit

is projected to reach 380,000 tonnes in 2005.

This should provide a solid platform for Irish

beef exports to the continent. Most of the key

markets in Europe anticipate higher imports

16

during 2005. Italian beef imports look set to rise

by almost 4%, while French imports are expected

to grow by 1%. Combined with lower export

availability from Germany, this suggests relatively

good market opportunities for Irish beef.

However, there are also a number of risks. These

include the growing presence of non-EU product in

certain market segments. Since 2000, the volume

into the EU has increased by 30% to 536,000 tonnes

in 2004. Further increases are likely in 2005 on

foot of an anticipated rise in Brazilian production.

In particular, this makes trade for hindquarter cuts

very competitive for the Irish industry, given the

prevailing prices for non-EU product. The strength of

the euro against the US dollar looks set to continue

in 2005. This has the effect of making EU beef

less competitive on international markets, while

at the same time boosting the competitiveness

of non-EU beef coming into Europe.

17

It is expected to be at least the second half of

2005 before Over-Thirty-Month beef returns to

the marketplace given the requirement of the

UK government that no changeover will take

place until the Food Standards Agency view the

proposed testing regime as sufficiently robust.

The ending of the Over Thirty Month Scheme

(OTMS) could release an additional 180,000 tonnes

of beef onto the British market in a full year. As

Ireland is the dominant import supplier of prime

beef, this decision could result in a diversion of

approximately 70,000 tonnes of Irish beef from

the UK to other EU and international markets

in a full year. A major marketing effort will be

required to ensure that this beef continues to be

targeted at the premium end of these markets.

World Food Moscow. Looking at Irish beef at the Auchan

hypermarket in Moscow on a trade visit to the World Food Fair were

(L-R) Paddy Moore, Director, International Markets, Bord Bia with

Mark du Colombier, Manager of Auchan hypermarket; Noel Treacy,

TD, Minister of State at the Department of Agriculture and Food and

Ambassador of Ireland to Russia, H.E. Justin Harman.

Key initiatives for 2005 will include an intensive

drive to develop new retail business across all

EU markets, with particular emphasis on France,

Italy, Scandinavia and the new Member States.

Co-branding and promotional drives will see

more identified ‘Irish Beef’ packs on the shelves

of the main retailers throughout this region. The

Chef’s Irish Beef Club has been established and

will expand further to major European centres.

Working with the Department of Agriculture &

Food on the critical issue of access to international

markets will continue to be a major priority.

Annual Report and Accounts 2004

European Meat Forum. Themed Beef - A World of Opportunities the

conference examined key issues facing the European meat industry,

strategies being adopted by the major European retail chains,

changing consumer trends and behaviour and new developments in

packaging and technology. Delegates included 165 buyers from the

retail and foodservice sectors throughout the EU, as well as the new

member states with a combined beef buying power of in excess of

€4 billion. Pictured at Bord Bia’s European Meat Forum was speaker

Dr. Arne Astrup, Professor of Human Nutrition, The Royal Veterinary

and Agricultural University, Frederiksberg, Denmark.

Live Animals

This trade was characterised by competition

on prices, lower feedlot demand in Spain

and Italy, increased supply of calves to the

Netherlands from both Germany and Poland

and a competitive Lebanese market. As a result,

Irish live cattle exports fell by 40% during

2004 to 130,000 head. Trade to Continental

EU markets fell by 50% to 72,000 head. On

the other hand, exports to the UK, principally

Northern Ireland, performed strongly, increasing

by almost 20% to reach 46,000 head.

Nevertheless, Irish live cattle exports are expected

to show steady growth in 2005. There is likely

to be stronger demand for live cattle in Spain

and Italy with the feedlot sector being helped

by a drop in feed costs due to a strong cereal

harvest. The Dutch market also looks set to

have a steady demand for calves for the veal

sector. Further potential for growth exists in

Northern Ireland due to the strong UK demand

for beef. The key issue from an Irish point of

view is the ability of Irish cattle to compete on

price with other suppliers. Trade to the Lebanon

will largely be determined by this factor. Bord

Bia will continue to assist live animal exporters

to grow business in the main markets.

18

Pork and Bacon

The value of Irish pigmeat exports during

2004 increased by 6% to €265 million. This

occurred despite a drop of 3% in export volumes

resulting from lower production levels and an

increase in live exports to Northern Ireland. The

rise in value of exports was due to improved

market returns, consistent with an increase

of approximately 9% in Irish pig prices.

The Irish market continued to account for over

50% of Ireland’s total pigmeat availability of

263,000 tonnes, with demand mainly being

driven by a trend towards convenience-style

processed pigmeat and bacon products.

Exports to the UK and Germany were strong,

with volumes increasing to 62,000 and 13,000

tonnes, respectively. Aggregate exports to the

EU-15 countries were down on 2003 levels. The

rise in sales to Germany did not compensate for

a fall in exports to France and Italy, where trade

was affected by competition from Dutch and

Danish suppliers. Following EU enlargement,

two-way trade between the EU-15 countries and

the new Member States increased considerably.

The new Member States are exporting high

value cuts and importing lower-value product.

While this increased the competition with

Irish pigmeat in existing EU markets, it also

created opportunities for manufacturing

products in the new Member States.

19

Following the absence of US beef and the

decrease of poultry supplies in the Japanese

market, Irish pigmeat exports rose by a third to

surpass 8,000 tonnes. Exports to Russia remained

stable at over 7,000 tonnes despite import

certification issues. Exports to the US eased back

to 6,000 tonnes, mainly due to the unfavourable

exchange rate with the dollar. For 2005, a

marginal increase in Irish pig supplies is forecast,

following a recovery in production as newly

stocked breeding units increase performance.

With EU production levels expected to remain

stable throughout the year, and preliminary

forecasts indicating a further rise in EU prices,

the prospects for Irish pig prices are steady.

The market outlook for exports to the EU is

stable, helped by a steady demand and lower

supplies from the new Member States. However,

with a rise in UK pig output forecast, trade is

likely to remain competitive in this market.

Annual Report and Accounts 2004

On international markets, increased competition

from non-EU suppliers such as Brazil and Canada,

and the ongoing strength of the euro against the

US dollar, will continue to challenge Irish exports

to the US, Russia and Asia. A return of US beef and

poultry supplies to the Japanese market will also

further increase competition for Irish product.

Bord Bia programmes for 2005 will focus on

improving demand on the Home Market,

developing new export opportunities in

the UK and Eastern Europe and seeking

to broaden market spread by gaining

access to new international markets.

Lamb

The value of Irish sheepmeat exports increased by

14% during 2004 to almost €165 million, reflecting a

strong rise in availability and steady market returns.

At the launch of Bord Bia’s pork campaign

entitled Discover the World of Flavour with Pork were

(L-R) Owen Brooks, Director, Home Market; Pat O’ Keeffe,

Chairman, IFA Pigmeat committee; Jack Tuite; Sophie

McCann and Scott Broderick.

The Irish market accounts for over 30% of

sheepmeat output, making it the second most

significant market after France. Lamb consumption

in Ireland increased by 2% to 21,500 tonnes this year.

The French market continues to account for

over 60% of Irish sheepmeat exports. At 33,000

tonnes, this is a rise of 4,000 tonnes, or 14%, on

2003 levels, facilitated by an increased supply of

sheepmeat in Ireland in 2004 and a rise of 2%

in France’s import requirement. However, the

competitiveness of the market was demonstrated

by the decline of 3% in French producer prices for

lamb. Irish sheepmeat exports to the UK showed

further strong growth to reach 9,500 tonnes.

Trade remains principally in the form of mutton

20

21

for the manufacturing sector. Other important

markets include Germany at 2,500 tonnes, Italy at

1,500 tonnes and Portugal at 1,200 tonnes. French

import requirements look set to be maintained

during 2005, which should provide a reasonably

steady market outlet for Irish lamb. New Zealand

is expected to remain highly price competitive

against both domestic and EU lamb and Irish

exporters will be faced with rising volumes of

New Zealand chilled product. Ireland and France

will remain the most important outlets for

Irish lamb and further development of these

markets is the continuing priority for 2005.

Poultry

The poultry sector refers to all fresh and processed

poultry products. Irish poultry meat exports in

2004 were valued at €249 million, a 2% decrease

on 2003 levels. Processed poultry meats and

prepared products accounted for nearly twothirds of 2004’s total poultry exports. The UK

continues to be the main market for Irish poultry,

accounting for approximately 80% of total exports.

Overall, EU consumption of poultry continues

to increase, with the ten new Member States

Annual Report and Accounts 2004

showing a stronger increase than the EU-15

countries. Ireland now has the highest per capita

consumption of poultry meat within the EU,

at 37kg. In 2004, total poultry meat production

in the EU-15 countries increased slightly as

productivity recovers in both Holland and Italy,

following avian influenza outbreaks in 2003.

In 2005, production in the EU-15 countries will

remain stable at approximately nine million

tonnes. The ten new Member States will see

an increase to almost three million tonnes.

Imports of cooked poultry meat products will

grow significantly, as Asian suppliers adjust

to bans placed on uncooked poultry meat due

to avian influenza outbreaks there. Brazil will

emerge as the leader in broiler meat exports;

it surpassed the US in the 2004 forecasts

and is expected to continue in 2005.

Eggs

Bord Bia at the EU Presidency workshop for caterers.

(L-R) John Howard, Consultant Master Chef; Michael Duffy, former

Chief Executive, Bord Bia and Pierre Balthazar, Head Chef, Council

of Europe. Bord Bia held a workshop for hotel and restaurant chefs

and caterers involved in preparing food for events during the EU

presidency. Bord Bia briefed chefs on how to ensure the food served

represented the best of Irish ingredients and cuisine.

The retail market for eggs increased by almost

4.5% in 2004, due largely to the trend towards

higher value free-range eggs and an increase

in volume sales. There is good potential for

further increases in sales because per capita

consumption of eggs in Ireland is well below the

EU average. Bord Bia and Irish Egg Marketing have

agreed a three year €1.5 million jointly funded

promotional programme for eggs, produced

under the Bord Bia Quality Assurance Scheme. In

2004, this involved a major advertising campaign

using TV, cinema and public transport media.

22

Annual Report and Accounts 2004

Consumer Food, Dairy and Drinks

Dairy and Food Ingredients

The consumer food, dairy, ingredients and drink

sectors accounted for a combined €4,397 million

in exports in 2004. Exports of dairy products

and ingredients are estimated to have increased

by 6% to €1,860 million in 2004. Good global

demand combined with strong prices produced

a positive export performance for the sector.

The prepared foods sector grew marginally

during the year after negative growth in 2003.

This category is made up of dairy products such

as butter and cheese as well as a variety of food

ingredients for further manufacturing processes.

The value of Irish dairy/food ingredients exports

rose to almost €1.9 billion in 2004, a rise of 6%

over 2003. This performance was very positive,

particularly in light of earlier pessimism. Worldwide

demand remained strong supported by good prices.

Despite the weakening of the US dollar, the overall

value of earnings remained firm because of good

dollar prices and Irish exporters responding well to

particularly good demand for casein. The year was

marked by two major milestones: EU enlargement

on 1st May and the implementation of the Mid

Term Review measures from 1st July, both of

which contributed to considerable uncertainty

among buyers worldwide and to cutbacks in

production in some of the EU-15 countries.

Structural adjustment in the drinks sector

precipitated a decline in beverage exports in 2004,

with values falling by an estimated 6% to €1,016

million. Most individual companies registered a

good performance and, on aggregate, exports

from the island of Ireland are likely to have

compensated for this adjustment. The sector is

set to resume growth from its new base in 2005.

A key competitive challenge for companies

within the sector is to move up the value chain

through innovating and responding rapidly

to changing consumer demand. Currency

remains a key challenge in non euro markets,

combined with relentless pressure on margins

from both competitors and retailers. By far the

dominant trend affecting consumer choice has

been the renewed interest in personal health

and wellbeing. Convenience, a well established

trend in the food and drink industry also

continues to be a strong driver of consumer

choice. Changes in lifestyles and work habits,

and increased financial pressures have led to

a growing need for convenience in all areas.

Irish dairy production is geared towards

maximising the return from quota-controlled

milk production, which can result in considerable

variations from one year to the next in the

product mix. In 2004, overall Irish milk production

increased by 0.5%, with casein having the highest

production increase at 10.8%. Cheese production

increased by 4.5%, butteroil saw the largest

decrease at 17.1%, followed by Skimmed Milk

Powder (SMP) at 7.9%, and Whole Milk Powder

(WMP) at 3.9%. Butter production fell by 2.2%,

while chocolate crumb production fell by 2.3%.

Intervention price cuts of 7% for butter and

5% for SMP led to reluctance among buyers to

make forward commitments, resulting in steady

24

selling into intervention in the first half of the

year. However, with inventories lower than EU

market demand, and good demand internationally,

prices did not fall to the new support levels.

International demand slowed in the second

half of the year due to price resistance among

customers, the weakness of the US dollar and the

EU Commission’s policy of selling off intervention

stocks of butter at below intervention price.

However, SMP and butter both yielded returns

above intervention. World SMP prices increased

by an average of 19.7% on 2003 levels, a result

directly attributable to the reduction in SMP

world output. A similar situation arose for WMP,

with Irish exports to international markets being

up 15.9% in the first nine months of the year.

The market for casein in the US and Europe

remained very strong, further stimulated by

reduced availability from New Zealand and

Eastern Europe, resulting in consistently higher

margin returns. Although Irish cheese production

increased by 4.5%, prices on the EU market were

flat for nine months of the year, though there

were increased returns from whey. Irish exports

of cheese to International markets were up over

53% for the first nine months of the year.

25

The continuing consumer interest in health

and wellbeing has expanded the potential

for added-value exports of health, nutritional,

and functional foods. This continued to be the

focus of Bord Bia’s activities within the sector

in 2004. The programme of events included

a seminar, Health and Wellbeing — The Shape

of Things to Come, on issues such as vitamins

and minerals, dietary options and obesity, and

the regulatory impact on companies targeting

new business within this arena. Sector specific

information services and market customised

services were also provided by Bord Bia.

Concentrating on the development of value added

ingredient exports, Bord Bia organised two market

study visits covering both geographical and niche

market interests, to coincide with relevant trade

exhibitions and conferences – IFT, Las Vegas in

July and HiE, Amsterdam in November. Seven Irish

ingredients companies participated.

Prepared Foods

Defined as ‘food products that have undergone

secondary processing’, these can be sold

as intermediate products, sold into food

manufacturers or to foodservice operators, or

as convenience products for home or on-the-go

consumption. The sector makes up about 26% of

the food industry with export markets in 2004

returning €1.52 billion. Included in the sector are

foods such as frozen ready meals, pizzas, snacks,

confectionery and ambient grocery products.

The biggest challenges facing these manufacturers

are containing costs, accommodating greater

margin demands from retailers, innovating and

developing new routes to market. The sector

comprises mainly small and medium-sized

manufacturers, who supply the domestic and UK

markets. Exports to Britain were up, while exports

to the Netherlands, Italy, Belgium and Sweden

also performed strongly. The major issues facing

those companies exporting to the British market

Annual Report and Accounts 2004

were price competition from domestic UK players

and competitors from continental Europe.

The main retailers favour partnering with larger

players, which leaves small Irish producers

focusing on niche opportunities or pursuing

expansion through the introduction of new

products or through strategic partnerships.

Selfridges Promotion. At the Irish food and drink promotion in

Selfridges were (L-R) Paul Kelly, Chief Executive of Selfridges,

Michael Murphy of Bord Bia in London and Irish Ambassador to

the UK, H.E. Daithi O’ Ceallaigh

Despite some strong performances, the

continental market remains diverse and

challenging. A single market for food has yet

to emerge which means that markets must be

tackled individually. However, a number of smaller

companies are targeting niche opportunities in

selected markets. Bord Bia will be encouraging

this and driving opportunities in this area along

with pursuing opportunities in the higher

volume sectors for the larger manufacturers.

Bord Bia will continue to develop new contacts in

the retail, foodservice and manufacturing sectors

to drive new business in addition to deepening

its relationship with existing contacts in Europe.

Frozen Foods

Britain is the biggest market for the frozen food

sector. The value of Irish exports to Britain was

up by over 10%. The main frozen food products

exported were frozen ready meals and pizzas.

In response to price deflation in the sector,

manufacturers broadened their ranges of premium

offerings to try to regain lost margins. To create

further platforms for growth, manufacturers are

catering to the consumer trends towards healthier

eating, more authentic flavours and indulgence.

26

Organics

The value of the European organic market is

expected to surpass €17 billion in 2007, with dairy

(€4.6 billion), bakery and cereals (€4.5 billion),

fruit and vegetables (€3.7 billion) and meat (€3.2

billion) being the main category opportunities.

Most consumers have a positive attitude towards

organic food particularly from an environmentally

friendly perspective. Other issues that concern

them are food integrity, health and wellbeing and

local origin. Consumers buying into this category

are often concerned by issues such as genetically

modified (GM) foods, pesticides and food scares.

Although the multiple retailers in Ireland play

an important role in bringing organic goods to

market, organic farmers are more likely to sell

directly to consumers than are conventional

farmers. Selling directly to the consumer has

been greatly assisted by the growth of the

farmers’ markets. There are now over 80 in the

country. In September 2004, Bord Bia and the

Department of Agriculture and Food's Organic

Marketing Development Group launched an

information booklet for the Irish consumer. The

booklet contained basic information on organic

food, labeling requirements and existing organic

symbols, the benefits of buying organic food and a

calendar of seasonal availability of organic produce.

Confectionery

27

The confectionery sector is made up of companies

supplying products based on chocolate, sugar

and flour. As in the frozen foods sector, there has

been a trend towards ‘premiumisation’ and this

is where the real value growth is being achieved.

Exports of chocolate increased by over 54% in

2004 as a result of an aggressive roll-out of new

products and the targeting of new distribution

channels in Britain. Britain continues to be the

main market but there has been some penetration

of Continental and US markets.

Ambient Foods

The ambient sector is comprised of suppliers

operating within the cereals, sauces, soups, jams/

preserves, condiments, ambient meals and

home baking categories. These companies, in

the main, occupy leading brand positions in the

domestic market. Some are now successfully

exporting, securing notable listings with multiple

retailers in the UK. In recent years the main focus

has been on supplying to retail but there is now a

growing focus on foodservice opportunities in the

British market. There has been some penetration

into EU markets and niche ethnic markets in the

US. In addition, some suppliers met with success

when they availed of co-packing opportunities.

Information and market insights are key to helping

Irish suppliers in export markets. During 2004 Bord

Bia further developed its strategy of providing

company-specific information and services to cater

for the diverse requirements of suppliers operating

in the prepared foods sector. The Gap Analysis

service, which is a consumer-led approach, helped to

deliver new business opportunities and resulted in

new listings. The service provides a category solution

to the buyer, ensures that new product development

is driven by consumer need and, therefore, increases

the chances of success. The Brand Audit, Brand

Creation and Brand Design services were very

popular with clients during the year.

Small Business and Speciality Foods

Smaller Irish companies in the speciality food

sector have seen strong sales growth over the

past year targeting the two key markets of Ireland

and Britain. Speciality foods now have a total

output value of €430m at factory gate prices,

a 13% increase on 2003. The sector continues

to expand and there are over 330 small food

producers successfully marketing their products to

independent and multiple retailers. Trade listings

have increased and distribution broadened to

reach a wider consumer base. The growth is being

driven by increased consumer demand for variety,

convenience and the perceived health benefits of

speciality products. From a low base, this segment

continues to build incremental sales.

Britain and Ireland continue to be the core

geographic markets for the sector, although

certain categories such as farmhouse cheeses sell

in over 25 geographic territories worldwide. The

USA is a growth market for Irish farmhouse cheese

and, more recently, France, Australia and Japan

have emerged as markets for the category.

During 2004, Bord Bia’s Small Business programme

focused its trade marketing on identifying emerging

opportunities, securing new listings and sustaining

existing business. A number of events on managing

key accounts and distribution were organised to

help build the capability of small companies.

29

Bord Bia worked with a number of local authorities

and rural communities to establish a network of

farmers’ markets around the country. As an alternative

route to market, these markets provide small

producers with a valuable outlet for local produce,

assist new start-ups and maintain local employment.

The TASTE Council, co-ordinated by Bord Bia,

continued to build awareness for the speciality

and artisan sector and made a number of policy

submissions to government committees about the

role and importance of the sector.

Bord Bia, in conjunction with Slow Food Ireland, will

sponsor the first University of Gastronomic Science

in Italy. The curriculum will include a programme

on the science, history, culture and gastronomy of

Irish food, and participants will be from all over

the world. Slow Food is a growing consumer food

movement with over 100,000 members.

Annual Report and Accounts 2004

In conjunction with the Irish Exporters Association,

Bord Bia was partner in the True Marketing

Programme, an export market entry programme

for small food companies which focused on the UK

market involving the Welsh Development Agency.

Beverages

The beverage sector in Ireland includes both

multinational and indigenous companies involved

in the production and marketing of a wide

range of brands including spirits, liqueurs, beers,

carbonates, fruit juices and bottled waters. In

2004, exports of beverages (including all alcoholic

and non-alcoholic beverages and juices) declined

by 5% to just over €1 billion. This fall was due to

some structural changes within the industry and

on the island of Ireland, and disguises the fact

that some companies reported strong growth in

sales throughout the year.

Exports of Irish cream liqueurs registered

excellent growth in the key UK and US markets.

The production of cream liqueurs is the most

important category in the spirits sector,

accounting for approximately 50% of total sector

exports. Irish whiskey distillers and marketers

reported a very successful year with growth in

exports valued at 11%. Irish whiskey continued to

be one of the fastest growing segments among

premium whiskeys worldwide. Markets that

showed good growth potential for Irish whiskey

include Spain, Eastern Europe, South Africa, Russia

and Latin America. As a result of difficult trading

conditions in European markets, and consumer

trends towards seeking out alternative, lighter

products, exports of malt beer declined.

30

Issues facing the overall alcohol beverage industry

continue to be focused on concerns about

responsible drinking, health and lifestyle issues.

On the domestic market, the introduction of the

smoking ban and the increased level of duties were

accompanied by a decrease of 6.3% in on-trade sales.

Currency fluctuations had an adverse effect on

companies selling their products in key US and UK

markets. During 2004, Bord Bia organised a series

of activities specifically designed for companies in

the drinks industry. This programme was developed

in consultation with the industry and included

participation at international trade shows such

as WSWA, Las Vegas; Tax-Free World Association,

Cannes and Marketplace Ireland, Dublin.

Britain remained the largest market for Irish

beverage products accounting for approximately

40% of exports. The US is the next most

important single market, at 19%, and its potential

for development has caused many companies to

take an increased interest in it.

31

Meeting new industry contacts and identifying

new market opportunities is a key focus for the

Irish drinks industry. A buyer contact event was

held in Harrisburg, Pennsylvania, USA with key

personnel from the Pennsylvania Liquor Control

Board (the largest single purchaser of alcohol

in the US). Subsequently, representatives from

six US Liquor Control Boards and two Canadian

Liquor Control Boards visited Marketplace Ireland

in Dublin in September 2004 and met with Irish

company representatives. This buyer-supplier

event has resulted in new and expanded listings

Winner of the Farmleigh Gold medal for artisan bread.

Jean Baptiste Kapral, La Maison des Gourmets, Dublin (centre);

Muiris Kennedy, Client Services Director (left), Bord Bia and David

Byers, Commissioner of the Office of Public Works (right). The idea

of the Award for artisan bread emerged from the Food at Farmleigh

markets and was developed in collaboration with Bord Bia and the

National Bakery School at DIT.

for several companies. Building on study visits

carried out in 2003 to the Czech Republic, Poland

and Hungary, Bord Bia organised study visits to

Lithuania, Latvia, and Estonia. As a result of these

visits, several companies are now doing business,

are beginning to build brand awareness for their

products and also for Ireland as a source of quality

beverage products.

Annual Report and Accounts 2004

Foodservice

are tending towards gourmet home cooking or

The Irish foodservice market was valued at €5.7

billion (€3.2 billion beverages, €2.5 billion food) in

2004. Dramatic changes in consumer eating habits

in the last ten years have resulted in strong growth

in the foodservice market. Food consumed outside

the home is predicted to continue to take a larger

share of overall food expenditure. A number of

factors have contributed to this trend, in particular,

increased consumer affluence, growth in eating out

as an everyday activity and an emerging grab-andgo and feed-me-now food culture. The snacking

revolution and increased occasions for on-the-go

food consumption are important market drivers.

is also benefiting from the consumer shift from

The low-carb trend fell back in 2004. There were

just 3.6% of US consumers reportedly on lowcarb diets at the end of 2004, compared with

9% at the end of 2003. Consumer interest in

nutritious menu options while dining out continues

to increase. There is a move away from mass

produced foods and a demand for unique flavours

at all levels of dining. Fast food with style and

healthy better-for-you options, such as the new

salad range at McDonalds, is a growing trend.

high quality takeaways. The foodservice market

materialistic purchases to experiential spending.

In the UK, one meal in five is now eaten outside

of the home. UK retailers are investing more time

and resources into foodservice, with new formats

incorporating food-to-go and there are also an

increasing number of partnerships between

retailers and foodservice operators. Bord Bia held

45 meetings with UK foodservice buyers and

development chiefs to present the Irish food

industry; organised three inward buyer visits by

the major operators, the Spirit Group, Greene King

and Brammer Dixon; facilitated four workshops

for companies looking to enter the market; held 24

individual client consultations to assist companies

develop or fine tune their market strategy;

produced 52 news reviews on market trends and

developments; published one report providing

an overview of the market and a planning guide

on how to enter it and held a seminar featuring

speakers from Mitchells & Butler, 3663 and Subway.

Bord Bia also published two market directories

Diners are also looking for smaller portions and

a greater variety of food. Spanish tapas, Chinese

dim sum and Greek meze are all appearing more

on menus and tap into the quick dining trend.

comprising information on routes to market and

As consumers dine out more frequently, they are

increasingly likely to have set expectations as to

how a dish should look and taste. Meanwhile,

general cooking ability is in decline. To replicate

the restaurant experience at home, consumers

the Irish foodservice market, and commentary on

key operators in the major market segments.

This provided profiles of some 170 foodservice

operators in both the profit and cost sectors

throughout the island of Ireland, an overview of

key trends and market dynamics. Two seminars,

attended by over 70 companies, were organised

to present the information, one focusing on

the profit sector, one on the cost sector.

32

Annual Report and Accounts 2004

Horticulture

Bord Bia supported businesses in their initiatives

to maintain and grow domestic market share

for horticultural produce through its Business

Development Programme. This programme also

develops the business skills required to meet the

changing needs of industry. Business management

training courses were organised for the nursery

stock, vegetable and mushroom sectors. These

courses included modules on marketing and sales,

strategy and planning and financial management.

Bord Bia’s domestic Nursery Stock Programme

identified import displacement opportunities

and promoted substitutes. A review estimated

that nurseries, garden centres and the landscape

sector import €20 million worth of nursery

stock annually and identified the type of plant,

country of origin and the value of plant lines

being imported. Almost 75% of all imports are

from the Netherlands. The review recommended

a number of import substitution opportunities for

the Irish nursery sector. Bord Bia will work with

the sector in 2005 to pursue these opportunities.

Two workshops aimed at reducing the growing

reliance of Irish garden centres on foreign plant

imports were organised by Bord Bia. The focus of

these workshops was on market-led new product

development. In association with the Irish Hardy

Nursery Stock Association, Bord Bia organised and

financed four trolley fairs in 2004. A trolley fair is

an event at which growers display and sell their

plants, enabling garden centres and landscapers to

view and buy a large range of Irish products at a

single location. Both buyers and growers can build

business relationships at trolley fairs and Bord Bia

will continue to support this initiative in 2005.

Bord Bia organised a two day amenity conference,

The Plant(ed) World, in October. International

and Irish experts from landscape design,

business development, retail and research

backgrounds addressed the conference,

and highlighted the social, health and

environmental importance of horticulture

in addition to its economic contribution.

Bord Bia was actively involved with a number

of other state agencies and government

departments in addressing environmental

issues impacting on the horticultural

industry such as waste management, carbon

energy tax and the nitrates directive.

Bord Bia continues to work closely with the

Department of Enterprise, Trade & Employment

to meet the labour shortages in the horticultural

sector. This was achieved through two schemes:

the Work Permit Scheme for migrant workers

in horticulture and the Seasonal Horticultural

Workers Scheme (SHWS), which matched seasonal

labour demands with an adequate supply of

suitable skilled labour. With EU enlargement

in May 2004, the requirement for the Work

Permit Scheme ceased. However, the SHWS

continues to play an important role in meeting

demand. Over 200 students from Poland,

Lithuania and the Ukraine were placed with

60 host growers between May and October.

Bord Bia, in recognition of the multicultural

nature of the horticultural workforce, joined

34

with the Health & Safety Authority to

produce an Essential Health & Safety Guide

for Horticulture in five languages – English,

Latvian, Lithuanian, Polish and Russian.

Promotions

Bord Bia promotions for the fruit and vegetable

sector continued to focus on under 35 year olds

because consumer research indicates that their

consumption of fruit and vegetables is lower than

average. There were a number of promotional

campaigns, including a national radio advertising

campaign to promote Irish potatoes and a national

billboard campaign promoting the convenience of

mushrooms.

The mushroom campaign is in its second year of a

three year programme funded by the EU, producers

and the Department of Agriculture and Food. New

recipes were developed for fresh produce and

posted on the Bord Bia website. Sixty seven retail

outlets took part in the Bord Bia Fresh Produce

Retail Awards for promotion and merchandising of

fresh produce.

35

First-time homebuyers were the main target

group for amenity promotions. The focus was

on the benefits of plants/flowers in the home

and garden, and as gifts for special occasions. A

national billboard campaign, featuring high profile

garden designer Diarmuid Gavin, encouraged

novice gardeners at the start of the gardening

season in Spring. Bord Bia sponsored a number

of events that raised the profile of horticulture

– these included the Rare and Special Plant Fair,

the Young Horticulturalist of the Year Award

and the Tidy Towns and Entente Florale Awards.

A public relations campaign highlighting ‘real’

Christmas trees was conducted in early December.

A submission for the promotion of plants

co-ordinated by Bord Bia, was approved for funding

by the EU. This programme, co-funded by the EU,

the industry and the Department of Agriculture

and Food, begins in 2005.

Amenity Export Programme

In 2004 the Amenity Export Programme focused

on a group of 11 nursery owners, delivering a

specific pre-export programme to them through

site visits, workshops, telephone and email

consultancy. The profile of exporters was updated

and published on CD-ROM for distribution to

the trade.

Bord Bia organised a study tour for plant retailers,

nurseries and cash-and-carry suppliers to the

landscape trade and large plant importers in

the UK. The Irish nursery owners and managers

used this opportunity to establish business

relationships and promote their products. A

second tour to the Netherlands was held in

November and incorporated visits to wholesale,

retail and cash-and-carry outlets, as well as a tour

of the Dutch Plant and Flower Auction’s operation.

Research into opportunities in Continental

European markets, commissioned by Bord Bia,

was presented to exporting companies and made

available to clients via Bord Bia’s Client Portal.

Although this research identified a number of

excellent opportunities for potential exports, it

also warned that the challenges presented by

Annual Report and Accounts 2004

Quality

Christmas tree presentation to An Taoiseach, Bertie Ahern, TD.

(L-R) Noel Moran, Managing Director, Emerald Group (Winner of

the National Christmas Tree Award 2004) and Aidan Cotter, Chief

Executive, Bord Bia.

logistical, language, and climatic issues will have

to be addressed in order to exploit this potential.

Irish nurseries exhibited plant material at GLEE,

the annual trade show for the garden and leisure

industry in Birmingham. Bord Bia co-ordinated

the Irish presence, now in its fourth year. Irish

Christmas tree growers also used the opportunity

to display their products, with a view to

developing a co-ordinated approach to exporting

Christmas trees to the UK in the future.

Promoting quality within the fresh produce

supply chain continued to be a priority for

Bord Bia. The Bord Bia Quality Programme

for horticulture includes both the food and

non-food sectors, and actively promotes the

achievement of the highest standards of quality

in the production, handling, packing, storing

and transporting of fresh produce and plants.

Key to the Quality Programme continues to be

the independence of the National Standards

Authority of Ireland (NSAI). When inspecting

and certifying producer and packer adherence

to the Bord Bia Specification for Horticultural

Producers. In 2004, approximately 500 enterprises

participated in the inspection programme. The

NSAI facilitated the inspection of mushroom

farms to check if they adhered to the EUREP

GAP standard, as required by certain sectors of

the export market. This was highly significant,

ensuring that Irish mushroom marketing

companies could continue to supply the UK

market. The Quality Scheme for the Prepared

Vegetable Sector was introduced in 2004.

Inspections to this new standard begin in 2005.

The development and expansion of the

Quality Programme in the non-food sector

continued. The annual Garden Centre Quality

Awards attracted 45 entries and 18 nursery

stock producers participated in a customised

inspection and certification programme.

Quality schemes are also being developed in

the bulb and landscape sectors, with progress

also being made in the development of a

quality manual for the Christmas tree sector.

36

Edible Horticulture

2004 was a difficult year for horticultural growers.