Annual Report 2005 Bord Bia Irish Food Board

Bord Bia Irish Food Board

Annual Report 2005

Our Mission

To drive the success of a world class,

Irish food, drink and horticulture industry by providing strategic market development, promotion and information services.

Marketing

Bord Bia works with Irish companies to target routes to market - retail, foodservice or manufacturing.

Our Services

Our services to Ireland’s Food,

Drink and Horticulture industies can be broken down into four key areas.

Promoting

Bord Bia delivers a comprehensive promotional programme designed to communicate the capability of the Irish food, drink and horticulture industry to the trade and to customers.

Informing

Bord Bia is significantly expanding its information capability to provide insight and analysis on the international food and drink markets to its clients.

Developing

Bord Bia offers a range of market development services to companies in the meat, dairy, consumer food, ingredients and drinks, horticulture and small business and speciality food sectors.

Bord Bia Irish Food Board Annual Report 2005

Presentation to the Minister for Agriculture and Food

In accordance with Section 22 of An Bord Bia Act

1994,the Board is pleased to submit to the Minister its Annual Report and Accounts for the 12 month period ended 31 December 2005.

Angela Kennedy

Chairman

Highlights of the Year

4

Food & Drink exports grew by 4% to exceed € 7.3 billion.

4

Meat and livestock exports grew by just under

4% to almost € 2.2 billion, representing 30% of the total food and drink exports.

4

Dairy exports recorded a rise of almost 5% to

€ 1.95 billion in 2005.

4

Beverage exports were the best performing export category in 2005, growing by

7.4% to almost € 1.1 billion.

4

Prepared food exports showed further modest growth in

2005 at almost € 1.54 billion.

4

The Beef Quality Assurance

Scheme, was fully operational under EN45011 standards in 2005.

4

Bord Bia held its fifth

Consumer Food & Drinks

Industry Day. In total 94 clients attended the event representing 66 companies.

4

Bord Bia continued to re-position itself in response to the changing market environment. This involved reconfiguring programmes and re-prioritising resources to better match the opportunities and needs of industry.

02

46

51

53

03

04

09

43

54

56

57

58

59

60

70

Contents

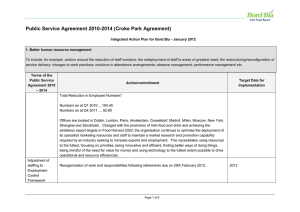

Export Figures

Regional Highlights

Chairman’s Statement

Chief Executive’s Review

Corporate Statement

Board Membership

Organisation Structure

Report of the Comptroller

& Auditor General

Statement of Accounting Policies

Income and Expenditure Account

Statement of Total Recognised

Gains and Losses

Balance Sheet

Cash Flow Statement

Notes Forming part of the Financial Statements

Marketing Finance Grant

Payments 2005

Bord Bia Irish Food Board Annual Report 2005

Export Figures

Exports of Irish Food & Drink by Sector (

€ m)

Dairy Products & Ingredients

Prepared Foods

Beef

Beverages

Fish

Pigmeat

Poultry

Sheepmeat

Edible Horticulture & Cereals

Live Animals

Total Food & Drink

Amenity Horticulture

2004

€ m

1,860

1,521

1,330

1,016

370

208

247

175

179

120

7,026

16.2

2005 (p)

€ m

1,950

1,535

1,340

1,091

348

238

257

189

226

138

7,312

16.8

% Change

2005/2004

%

+4.8

+0.9

+0.8

+7.4

-6.0

+14.4

+4.1

+8.0

+26.3

+15.0

+4.1

+3.7

Exports of Irish Food & Drink (

€ m)

500

Dairy Products & Ingredients

Prepared Foods

Beef

Beverages

Fish

Pigmeat

Poultry

Sheepmeat

Edible Horticulture & Cereals

Live Animals

0

238

208

189

175

257

247

226

179

138

120

348

370

1000

1,091

1,016

1500

1,340

1,330

1,535

1,521

2005 (p)

2004

2000

1,950

1,860

2 3

2

Regional Highlights

Ireland

The Strategic Network Alliance features leading Irish food and drink manufacturers cooperating in a joint programme with Bord Bia to identify new ways of securing sustainable business in Continental European markets. In 2005, the group completed research highlighting the relative attractiveness of EU markets and potential opportunities for

Irish exporters across markets.

UK

The Foodservice Programme focused on delivering market intelligence and offering opportunities for established suppliers to strengthen their business.

This involved four key account inward buyer itineraries and over 40 buyer presentations. In addition, Bord Bia published two comprehensive directories combined with a series of workshops dealing with the challenge of entering the € 46 billion market.

Russia

A retail promotion featuring chilled beef for the first time was launched by Mary

Coughlan TD, Minister for Agriculture & Food in St Petersburg.

United States

The first ever North/South

Innovation Network was launched in Cornell

University, New York in 2005. The initiative included a week long programme in the US, the objective of which was to look at the issues driving innovation in the US and apply them to the European marketplace.

Europe

In the autumn Bord Bia launched a € 3 million promotional campaign to raise consumer awareness and enhance the image of Irish beef. In total

40 retailers across eight countries with an estimated 100 million customers per week participated.

France

The summer lamb promotion in France was rolled out in 700

Intermarche, Match,

Hyper U and Super U outlets featuring an on-pack promotional offer.

Following the campaign an awareness level of 77% was recorded for Irish lamb.

China

Bord Bia co-ordinated the

Food & Drink Promotional

Programme on the occasion of the official trade delegation led by An

Taoiseach, Bertie Ahern TD.

Bord Bia Irish Food Board Annual Report 2005

Angela Kennedy

Chairman

Chairman’s Statement

We are facing into a period of unprecedented challenge, in a marketing environment that I think will test us beyond anything we have faced up to now. Not only are we talking about fundamental and far reaching change, but change that is taking place at an accelerating pace. What we do now and how we prepare ourselves will determine the degree to which we will succeed in dealing with these challenges.

This Report demonstrates yet again how our industry has performed in another demanding year, the obstacles and opportunities it has had to face and the emerging challenges that it must plan and prepare for.

Despite the ongoing competitive pressure faced by the sector, exports of Irish food, drink and horticulture grew by 4% to over

€ 7.3 billion in 2005. Exports of prepared foods, following a strong performance in 2004, recorded more moderate growth in 2005, rising by just 1% to almost

€ 1.54 billion. This sector, which has the highest long term growth potential, had to cope with strong downward price pressures, increased priced promotional activity, growing competition and further retail consolidation. This was a notable performance in the circumstances by our agri food industry, which is Ireland’s largest indigenous industry. It accounts for

9% of our gross domestic product and

8% of industrial employment. Its regional distribution and low import content further serve to underscore the value of the industry to the total economy. The agri food sector is more important in the Irish context than in any other EU member State. Furthermore, this segment of the national economy is relatively productive, especially in relation to other high profile sectors of the economy.

Undoubtedly a demanding year by any yardstick but this industry has shown yet again its ability to meet challenges, to change and above all to succeed.

The Irish food, drink and horticulture industry has made significant progress over the past decade, establishing itself as Ireland’s leading indigenous industry. Despite this progress, however, significant areas of potential remain to be exploited. For producers and processors with ambition and vision there lies ahead an exciting future, which includes access to, and opportunities in, existing and new markets, advances in processing technology, new product development, new routes to market – there may be challenges and perhaps obstacles on the way, but there are also opportunities.

The long term success and development of the Irish food, drink and horticulture industry will be determined by the ability of its stakeholders to anticipate, identify, interpret and on occasion to further create and respond to markets stimuli in an efficient and effective manner. Influenced by developments in policy, economics, science and consumption patterns and trends, the landscape in which this industry operates is changing rapidly.

This is the context in which we must stay effective and endeavour to be ahead of the curve. This is the background against which we must ensure our strategic relevance so that we are in a position to assist stakeholders identify and capitalise on market opportunities, while at the same time addressing current and future marketrelated challenges. With our focus on the market, Bord Bia has a significant role to play as exemplified in our mission which is

4 5

To drive the success of a world class

Irish food, drink and horticulture industry by providing strategic market development, promotion and information services

Realising our mission will be dependent on our ability to understand the market and to assist the industry respond in those areas where it has, or can, develop a competitive advantage. In order to pursue this mission we have agreed a set of strategic objectives to guide and focus our activities in the period ahead.

Bord Bia has an acknowledged ability for delivering rapid responses and for mobilising its resources effectively. How we change and develop, so that we continue to deliver on this reputation, will determine how our stakeholders see us, and whether we will provide the leading edge capability and value for money that is rightly required of us.

Change is the only constant – we forget this at our peril. As somebody once said “to grow is to change and to be perfect is to have changed often”. Perhaps we can’t promise perfection but we must never stop trying so that what we deliver is cost effective, focused and relevant in the highly competitive ethos in which we operate.

Towards the end of 2004 we undertook a comprehensive strategy review and consultation process, which was completed in 2005. The main headline outcome of this was a significant re-positioning of the organisation, thus substantially enhancing our capacity and capability to serve the needs of our stakeholders and to continually strive to achieve new levels of excellence.

The challenges coming down the tracks are manifold and diverse. The shape of some of them is clear while we have yet to see how others will impact on us. Consumer trends are major drivers of change. We must understand them and be ready. Equally we must be ready to meet the challenges at a global level that will have a major impact on our industry and the way we do business.

The outcomes of the latest WTO round will be profound. We must assess their implications but more importantly we must work to identify the new opportunities that will also be presented and put in place appropriate strategies and programmes.

Recent Bord Bia research confirms that personal health and wellbeing continues to be a dominant driver affecting consumer choice. Convenience and the demand for quick options are catalysts behind a switch from cooking from scratch to using ready prepared ingredients and ready to eat foods.

Snacking and grazing is becoming more prevalent as the place of the traditional three “proper” meals a day declines.

One manifestation of the increased interest in health and wellbeing is a greater propensity to purchase products with natural ingredients, a category in which Ireland ought to be well positioned.

Bord Bia Irish Food Board Annual Report 2005

6 7

Bord Bia is continuing to re-position itself in the context of this rapidly changing and challenging environment. Over the past twelve months we have been re-configuring our programmes and re-prioritising resources in the marketplace to continue to match the opportunities and the needs of industry.

A selection of our priorities and initiatives for 2006 includes

• Official sponsor of the Ryder Cup

• International Speciality Food Forum

• Food Dudes (Schools) Programme

• Food Trade Delegation to India

• The Brand Forum

• Strategic Network Alliance

The Ryder Cup reaches an international audience estimated at 1 billion, making it one of the top three events in the world sporting calendar. Bord Bia will leverage its sponsorship on behalf of industry to raise the profile of “Ireland the Food Island”, attract key international buyers, showcase the best of Irish food, drink and horticulture and integrate with appropriate promotional programmes. It is intended that our association with this major event will re-enforce Irish provenance as a source of the highest quality, naturally based products.

These are just some of the highlights

I want to refer to. They are part of on-going programmes and projects being managed and delivered effectively across the organisation, both by our Head Office and Food Centre staff and by our network of Overseas Offices which give us further capability and presence in the marketplace –

Amsterdam, Chicago, Frankfurt, London,

Madrid, Moscow, Milan, Paris and more recently Shanghai.

While the Annual Report is rightly seen as an accounting for our stewardship, I also value it as an opportunity publicly to say thank you to the many people, both inside and outside the organisation, on whom we rely and who contribute greatly to our success.

It would be difficult if not impossible to articulate the support and encouragement we get from our Minister, Mary Coughlan,

TD, which I personally value very much and for which I thank her. The seal of Ministerial commitment, often in far flung markets, is an invaluable resource enabling us to deliver major projects successfully, but it often comes at the personal sacrifice of adding another major item to an already busy schedule. Like all successful captains, she has a superb team and I value the opportunity to extend our appreciation also to Ministers of State, Brendan Smith and Mary Wallace, to Secretary General,

Tom Moran, and to his officials who guide us and advise us on a daily basis and who give so generously of their time in so many different ways. The same is true of our

Ambassadors and Irish Embassy staff who add so much to our work in the marketplace and who guide us and support us in many ways. We maintain close and fruitful relationships with our stakeholder organisations and we appreciate very

Chairman’s Statement (Continued) much the reciprocal flow of ideas and recommendations that ensure we are tuned into the issues of the day and that they have a ready line of communication to us. Similarly we have built up effective informal working relationships with our colleagues in other Semi-State organisations, and we have also put in place formal working agreements and arrangements.

This gives effect to our strategic objective regarding collaboration with other

State agencies in areas relevant to marketing/market development.

The Board past and present represents a formidable pool of expertise and knowledge for the governance and guidance of the organisation. It is of course a great honour to be appointed to a State Board, but it is also a great obligation and represents a considerable commitment of time and energy. This commitment continues to be given and the organisation and the industry which the Board serves are the beneficiaries. Members serve on

Committees, ad-hoc groups, attend events on behalf of Bord Bia and make themselves available in many different ways. I thank them for their commitment and support.

The Board is assisted by four Subsidiary

Boards which collectively bring together a further pool of talent and expertise from all sectors across our industry, and which complement the work of the Board and assist Bord Bia in the implementation of its programmes. They are an important part of the working and governance of Bord Bia and I thank them also.

Board Committees represent a further call on the members’ time and expertise.

These Committees are an essential part of the governance structure of Bord Bia which assists us in maintaining the highest standards of corporate governance.

There are four Committees - Audit, Strategy,

Remuneration & Pensions and, in the year that is in it, the Board Ryder Cup Committee.

I thank the members for their very important additional contributions. In a demanding governance climate the Chairman and members of the Board Audit Committee have a particularly onerous task and

I thank them for their dedication to it.

The final and perhaps most important part of Bord Bia is our Executive, led by the Chief Executive, on whom we rely to deliver the strategic objectives and manage the organisation efficiently and effectively.

I want to compliment and thank Aidan

Cotter and his team for their continued dedication and commitment and for their support to me personally, which

I greatly value. The scope and content of the workload being carried out by a relatively small staff body continues to amaze. But it is their commitment to quality and excellence that is most impressive of all. On behalf of the Board, Subsidiary

Boards and stakeholders I thank them for bringing us through another successful year.

Angela Kennedy

Chairman

8 9

Aidan Cotter

Chief Executive

Bord Bia Irish Food Board Annual Report 2005

Chief Executive’s Review

Irish food, drink and horticulture exports recorded a robust performance in

2005 in what was a challenging trading environment. The value of exports increased by 4% to just over € 7.3 billion, despite a strong euro exchange rate against sterling and price deflation in major export markets. This was a notable performance in the circumstances by the agri-food industry which is Ireland’s largest indigenous sector, accounting for 9% of Ireland’s Gross

Domestic product and 8% of industrial employment.

Meat and livestock exports grew by just under 4% to almost € 2.2 billion in 2005, representing 30% of the total value of

Irish food and drink exports. Beef exports, which account for two-thirds of total meat and livestock exports, experienced a small increase. All other meat and livestock products also recorded an increase in 2005.

Beverage exports recovered strongly and were the best performing export category in 2005. Total exports from the sector are estimated to have grown by 7.4% to almost € 1.1 billion.

Bord Bia is committed to working with Irish food, drink and horticulture companies to help them differentiate themselves in the marketplace and exploit the opportunities that are part of a dynamic and fast-changing market.

Prepared food exports showed further modest growth in 2005 at almost € 1.54

billion, following a strong performance in the previous year. The sector, which has the highest long-term growth potential for the Irish food industry, had to cope with strong downward price pressures, increased price promotional activity, and growing competition from mainland European suppliers in its largest market, the UK.

Further retail consolidation during the year has accentuated competition in the UK retail sector while growth in grocery sales has also moderated from previous years.

Bord Bia works closely with all sectors of the industry to build strong positions in the marketplace through a range of market development, promotion and information services. The principal initiatives undertaken in 2005 are set out below.

Dairy exports recorded a rise of almost

5% to € 1.95 billion in 2005. Exports were helped by the fact that world dairy prices were at an all time high for much of the year while volumes traded also increased.

Highlights

• Bord Bia co-ordinated the Food & Drink

Promotional Programme, on the occasion of the Official Trade Delegation to China, led by An Taoiseach, Bertie Ahern, T.D.

During the visit, the Minister for

Agriculture and Food, Mary Coughlan,

T.D. signed a Protocol with her Chinese counterpart, providing a framework to allow direct trade in pigmeat between

Ireland and China. Some 19 Irish food and drink companies participated on the programme which featured food seminars in Beijing and Shanghai attended by almost 300 people.

Bord Bia Irish Food Board Annual Report 2005

At the announcement of Bord Bia's Food/Drink/

Horticulture Export Review

2004/05 were Tara McCarthy,

Senior Manager, Consumer

Foods, Dairy & Beverages,

Bord Bia; Aidan Cotter,

Chief Executive, Bord Bia; and Paddy Moore, Chief

Operations Officer, Bord Bia.

Pictured at the launch of

Bord Bia’s marketing initiative for Irish beef in Europe were

Aidan Cotter, Chief Executive,

Bord Bia; Mary Coughlan, TD,

Minister for Agriculture and

Food; and Angela Kennedy,

Chairman, Bord Bia. The € 10 million Irish Beef campaign was designed to build sales in 8,000 retail outlets in the first ever pan-European campaign and to establish the Irish beef brand in the minds of 40 million consumers weekly.

• In the autumn, Bord Bia launched a € 3 million promotional campaign to raise awareness and enhance the image of Irish beef among European consumers.

The campaign featured in-store, on-pack promotional offers and extended across ten EU member states, from the UK to the Czech Republic, involving 40 retailers with an estimated 100 million customers per week. The promotion represents the first stage in a new, coordinated programme to assist the industry consolidate and develop its position in European markets, which now account for 93% of sales, by building a consumer franchise for Irish beef.

• The Strategic Network Alliance features leading Irish food and drink manufacturers cooperating in a joint programme with

Bord Bia to identify new ways of securing sustainable business in Continental

European markets. In 2005, the group completed research highlighting the relative attractiveness among EU markets in the context of the industry’s strengths and capabilities while also highlighting potential opportunities across markets.

• The Food Dudes Programme, which positively changes childrens’ behaviour regarding consumption of fruit and vegetables, was launched during the year. The programme was piloted in Ireland by Bord Bia in 2002/3 with significant increases in the amount of fruit and vegetables consumed by participating children. EU funding together with support from the

Department of Agriculture and Food and from industry has now been secured to extend this programme to 150 primary schools and 30,000 pupils over three years.

• Bord Bia’s Corporate Marketing Services

Department organised 69 events in 2005, including 16 trade exhibitions worldwide.

Growth in opportunities in international markets was evident during participation at SIAL China, IMS Exhibition in Beijing,

IFE Poland and IFE in New Orleans.

• PERIscope 3 was published in 2005.

Originally designed to track the purchasing and eating habits in the

Republic of Ireland, this latest research now also compares consumer attitudes across Britain and Northern Ireland.

Some 3,000 consumers were surveyed and this project was partnered for the first time by InterTrade Ireland and Invest Northern Ireland.

10 11

Chief Executive’s Review (Continued)

• Over one hundred small businesses from the food drink and horticulture sectors applied for assistance from Bord

Bia’s three marketing grants programmes.

A total of € 307,000 in grants was paid under the programmes to companies, which in the main were engaged in the confectionery, chilled dairy products, and prepared meals sectors.

• The Chelsea Flower Show and

The Hampton Court Show succeeded in highlighting top Irish garden designers, contractors and growers. Bord Bia supported the garden designed by Elma

Fenton, which was awarded a silver medal at the Chelsea Show. Bord Bia provided financial support for Oliver and Liat

Schurmann’s garden at The Hampton

Court Show. This design was awarded a silver gilt medal.

• Over 1,800 inquiries from food and drink manufacturers as well as from other interested parties were serviced during 2005. An independent survey commissioned by Bord Bia shows that this service continues to enjoy high satisfaction ratings.

• eXploratory papers, a series of reports based entirely on desk research designed to elicit interest in more substantive projects, were published on the Italian

Foodservice market and on Global

Sourcing .

Bord Bia’s Corporate Marketing

Services Department organised

69 events in 2005, including

16 trade exhibitions worldwide.

• Major market research was undertaken with key multiple and independent retail buyers to identify emerging category opportunities in the growing speciality market in Ireland. Outputs from the research were used to tailor specific approaches to individual retail accounts to obtain new listings for the sector.

• Bord Bia held its fifth Consumer Food

& Drinks Industry Day. This event brings together Irish food, drink and ingredients companies with the purpose of discussing and reviewing market trends. In total,

94 clients attended the event representing

66 companies. This year’s keynote speaker was Mr Mike Coupe, Trading Director of Sainsbury’s. Representatives from

Bord Bia’s network of overseas offices took part and 141 meetings with individual client companies took place.

• Bord Bia held the Ireland the Food

Island Food and Drink Industry Awards.

They were announced at a gala reception in the Mansion House, Dublin by Mary

Coughlan, T.D., Minister for Agriculture

& Food. The Awards were organised by Bord Bia, Food & Drink Industry

Ireland and AIB. The award categories were selected to applaud best practice in specific areas in the industry that are key to its long-term success.

• The small business programme in the UK focused on assisting speciality companies to consolidate existing listings and to develop new business.

This involved in-store promotions and a public relations campaign around Irish speciality companies’ participation in Covent Garden and at The Fine Food Fair in Earl’s Court.

• The focus for the amenity sector was on key plant buyers based in Northern Ireland for whom two inward buyer programmes were organised. The activities and a generally increased emphasis on Northern Ireland have already started to show dividends and these should result in a good uplift in sales to Northern Ireland in 2006.

Bord Bia Irish Food Board Annual Report 2005

Pictured at the launch of Brand

Finance – A practical Guide to

Justifying Marketing Spend at

Bord Bia's Brand Forum were

Maurice Breen, Speaker and

Marketing Director, Magners

Original Irish Cider; Angela

Kennedy, Chairman, Bord Bia; and John Boyle, Channel Market

Manager, Bank of Ireland

Business Banking. The guide provides advice to companies starting a new brand or growing an existing brand.

• As part of a collaborative project between Bord Bia, InterTradeIreland and the Northern Ireland Food & Drink

Association (NIFDA), the first ever

North South Innovation Network was established. The initiative was launched at

Cornell University, New York, and included an executive week-long programme in the US, followed by a networking event in Ireland. The objective was to look at the issues driving innovation in the US and apply the learning to the European marketplace.

• The Bord Bia Brand Forum continued to champion the branded route to market for Irish companies in 2005. Six events were held with keynote addresses from industry leaders including Peter

Sutherland, brand owners including

Bulmers and a number of both Irish and international entrepreneurs.

• The Beef Quality Assurance Scheme which has been accredited by INAB

(Irish National Accreditation Board) to the standard EN45011 was fully operational under these provisions in 2005. The BQAS was implemented with the support of the industry and independent inspections and certification procedures were put in place. The certification of the first farms under the revised BQAS took place in 2005.

• A New Quality Assurance Scheme was introduced in the Horticulture sector for the Prepared Vegetable

Industry and Landscape sectors.

• A retail promotion featuring chilled beef products for the first time was launched by Mary Coughlan, T.D., Minister for

Agriculture and Food in St. Petersburg.

The promotion recognises the developing opportunities in the Russian market which remains the most important international outlet for Irish beef outside of the

European Union.

• The summer lamb promotion in France was rolled out in 700 Intermarché,

Match, Hyper-U and Super-U outlets, featuring an on-pack promotional offer where consumers could avail of holiday and discount hotel breaks to Ireland and France. Cora, Auchan, Carrefour and Casino also participated in the promotion. Market research following the promotion revealed a 77 per cent awareness level of Ireland as a lamb producer, compared to 64 per cent in 2004. Eighty-three per cent of buyers of Irish lamb have a positive image of the quality of meat from

Ireland and 82 per cent of buyers intend to continue buying Irish lamb.

• The Chefs Irish Beef Club, which draws its membership from Michelin star restaurants in the Netherlands, France and the UK and is designed to raise the image of Irish beef in Europe, was supported by a range of media and promotional activities. Bord Bia is also working towards establishing

Clubs in Belgium and Italy.

• The Meat Cuts CD, a directory of Irish meat cuts for trade buyers, was further developed and now incorporates a very extensive listing of offal cuts as well as three new language options – Dutch,

Mandarin and Japanese, bringing the total number of languages to nine.

The CDs have been distributed to

Irish meat processors and to key trade contacts in Europe and Asia.

• Bord Bia continued to develop its activities to leverage sponsorship of the Ryder Cup, by promoting the link with Ireland The

Food Island and with a particular focus on overseas trade promotion. This is the highest profile sporting event ever to come to Ireland and the biggest sponsorship venture Bord Bia has undertaken to date. The high profile event has been incorporated into all Bord Bia programmes for 2006.

12 13

Chief Executive’s Review (Continued)

Receiving the Bord Bia sponsored Feile Bia award at the launch of ‘Georgina

Campbell’s Ireland – the Best of the Best’ guide book were award winner Paul Deevy,

Richard House, Cappoquin,

Co Waterford; Teresa Brophy,

Ireland Market Manager, Bord

Bia; and Georgina Campbell,

Food Writer.

• Promotions of Irish cattle were organised in Spain and Italy to coincide with increasing shipments of weanlings in the autumn. The events attracted prospective purchasers to feedlots already stocking Irish cattle to demonstrate the quality and health benefits of using Irish stock. A new livestock promotional brochure was also prepared and distributed at the open day and forwarded to the 3,000 members of the Spanish Feedlot Association.

The Bord Bia Brand Forum continued to champion the branded route to market for Irish companies in 2005.

• A major consumer promotional campaign themed ‘Beef - Deliciously Convenient’ took place on the Irish market in the autumn. The objective of the campaign was to raise awareness of the flavour, convenience and versatility of beef.

Consumers were encouraged to look for the Bord Bia Quality Mark when buying beef and to choose the beef option on menus in Féile Bia restaurants.

The promotion was targeted at the younger age groups while reinforcing the benefits of eating beef among more mature consumers.

• Bord Bia ran a TV advertising campaign to increase consumer awareness of Féile

Bia and to promote dining in approved establishments. This was followed by a Beef Festival promotion which encouraged consumers to choose beef on the menu in Féile Bia restaurants with the reassurance of knowing the origin of the beef.

The Festival included consumer competitions in Féile Bia outlets.

• Bord Bia and Irish Egg Marketing launched a new campaign to raise awareness that healthy individuals can eat up to seven eggs a week as part of a healthy diet. The campaign began in April and consisted of press and outdoor advertising, a free recipe booklet and promotions that showed how to make delicious meals in minutes with eggs. It targeted consumers and students with the message that eggs are Real Good Fast Food and that

An Egg a Day is OK. Consumers werealso encouraged to look out for the Bord Bia Quality Assurance symbol on the eggs they purchase.

• In September a pilot Healthy Eating

Project was held with UCD Students.

This project ran over a week and included cookery demonstrations, student competitions and distribution of a specially produced recipe and nutrition information leaflet. Eggs were featured on the menus in the campus restaurants and special ‘Omelette Packs’ were promoted through the campus supermarket.

• Distribution was one of the key policy areas the Taste Council focused on during the year. Bord Bia In conjunction with the Taste Council put in place a distribution strategy for small business in Ireland encompassing effective supply chain and key account management.

A number of overseas distribution models were examined to determine their suitability for the Irish market.

Distribution will form a central part of Bord Bia programmes for small food and drink companies going forward.

14 15

Bord Bia Irish Food Board Annual Report 2005

Meat and Livestock

Irish Meat and Livestock Exports (

€ m)

2004

2,080 TOTAL

Of which:

Beef

Pigmeat

Sheepmeat

Poultrymeat

Live Animals

1,330

208

175

247

120

2005

2,162

1,340

238

189

257

138

% Change

+3.9

+0.8

+14.4

+8.0

+4.0

+15.0

Beef

In 2005, Irish beef exports were worth

€ 1.34 billion, marginally higher than the

2004 level, despite a slight drop in volume of 2% to 488,000 tonnes. This reflected a 7% fall in supply that was partly offset by higher carcass weights. Although export meat supply fell, it was steadier, showing that producers are increasingly aware of the requirements of key European customers for a relatively consistent supply of beef throughout the year.

Irish beef increased its share of other EU markets, despite stiff competition, with exports growing by 10%, reaching 191,000 tonnes. This follows a rise of 7% on 2004 and brings the increase in shipments since

2002 to 65%. The largest growth was seen in France where volumes jumped by 20,000 tonnes to reach 44,000 tonnes. Trade was helped by the return of Irish beef to retail outlets following a gap of nine years.

The UK remains the largest export market, accounting for € 750 million with shipments of 260,000 tonnes. Volumes eased slightly on 2004, reflecting the tighter supply situation and better returns from some continental markets. This was matched with stronger UK domestic supplies and a slightly more cautious market overall due to the re-entry of UK cow beef into the market at year-end. There were also increased volumes of non-EU beef on the market. However the partial suspension of imports from Brazil later in the year boosted demand for Irish beef.

The distribution of Irish beef across the UK market continued to strengthen, with around one third - 90,000 tonnes valued at € 300 million – moving directly through the retail sector. This is up 10% on 2004. Processed beef shipments accounted for 65,000 tonnes, marginally below last year’s level.

Shipments to Italy grew by 5% during the year to 42,000 tonnes and exports to the Netherlands remained steady, at 40,000 tonnes.

Scandinavia improved with volumes reaching

38,000, up 9% on 2004. Volumes to other markets such as Spain and Portugal were stable, while sales to the new Member States penetrated the Czech Republic and Poland.

Exports to international (non-EU) markets were 37,000 tonnes for the year, representing a fall of 34% or 20,000 tonnes on 2004 levels. This reflected the continued growth in competition, particularly from

South American suppliers, and the strong euro against the dollar. Russia remained the key international market with 27,000 tonnes in exports and Algeria was the other key non-EU market during the year.

Bord Bia Irish Food Board Annual Report 2005

The Bord Bia Beef Quality

Assurance Scheme now operates to the benchmark standard EN

45011. Pictured marking the certification of the first farmer to the Bord Bia Beef Quality

Assurance Scheme (BQAS) in

Donegal were Raymond Palmer, first certified farmer to BQAS scheme; Mary Coughlan, TD,

Minister for Agriculture &

Food; and Aidan Cotter,

Chief Executive, Bord Bia.

Pictured at the launch of Bord

Bia’s marketing initiative for Irish beef in Europe were Gerard

Brickley, Meat Division Manager,

Bord Bia and Angela Kennedy,

Chairman, Bord Bia.

Looking forward to 2006, the export market for Irish beef should remain strong. Improved cattle supplies will boost production and international sales. Forecasts for beef production in the EU-15 point to a gap of 300,000 tonnes between production and consumption in 2006. Also, most major importing countries are predicting higher beef imports during the year. However, increased cow beef supplies in the UK will reduce demand in that market for imported beef, including Irish beef.

The volume of beef being imported into the

EU-15 stabilised in 2005 at 530,000 tonnes.

Shipments were running four per cent higher to September before easing considerably following the outbreak of foot and mouth in key producing regions of Brazil, which accounts for more than half of the EU’s total beef imports.

The re-emergence of UK cow beef combined with stable EU consumption may also reduce the EU’s import requirement during 2006.

Strong EU beef consumption should provide the basis for stable trading conditionsin 2006. However, the extent of the current EU restrictions on Brazilian beef and suspension of Argentinean exports will largely determine the market returns from Europe. The resumption of UK beef exports also has the potential to increase competition in other EU markets although volumes are likely to be well below historical levels.

With the exception of the UK, most major

EU import markets are expected to have higher import requirements during 2006 which should provide opportunities for

Irish exporters.

The return of UK cow beef to the food chain is expected to reduce UK imports of chilled and frozen beef by 25% or

75,000 tonnes. This will impact on Irish exports. However, the market position held by Irish beef and the reduced presence of South American product is expected to result in Irish exports for the year declining by less than 20,000 tonnes.

16 17

Chief Executive’s Review (Continued)

Japan was the best-performing international market with Irish

In 2006, Bord Bia will continue to assist live animal exporters to grow business in the major mainland European markets.

Bord Bia coordinated Feedlot Open Days in Spain and Italy in 2005 and will extend this programme in 2006.

pigmeat exports rising by 20% to 12,000 tonnes.

Pork and Bacon

The value of Irish pigmeat exports during

2005 increased by over 14% to € 238 million.

This reflects a similar rise in export volumes.

Pictured in Scoil na mBrathar,

North Brunswick Street, Dublin

7 enjoying fruit and vegetables as part of Bord Bia’s Food

Dudes Programme were Mary

Hanafin TD., Minister for

Education; Angela Kennedy,

Chairman, Bord Bia; Mary

Coughlan TD., Minister for

Agriculture and Food; Vincent

Dolan, Secretary, Fresh Produce

Ireland; and Scoil na MBrathar pupils. The programme is being expanded to 150 primary schools nationwide and aims to permanently increase consumption of fruit and vegetables amongst primary school children.

The European Beef Promotion will be rolled out for its second year. It will build on the successful promotion in 2005 when

40 retailers in 10 EU markets, reaching some 100 million consumers participated in a focused promotion, featuring on-pack offers, designed to build sales and loyalty to the Irish beef brand. The clear identification of this beef as Irish affords an opportunity to communicate the story of its distinctive production.

Live Animals

Irish live cattle exports increased by 25% to € 81 million, reaching 185,000 head during 2005, which represents a rise of over

38% in volume on 2004. Trade to mainland

European markets doubled during the year to 147,700 head. This trade was helped by increased demand for veal calves from Holland and greater import demand in Spain and Italy.

The Spanish market remains the principal destination for Irish cattle with exports reaching 50,000 head in 2005, which compares to 21,000 head in 2004. Exports to Italy more than doubled reaching 47,000 head. However, exports to the UK fell by over 40% to just under 28,000 head, with the majority of these destined for Northern

Ireland. Irish live cattle exports are expected to remain relatively strong in 2006. There is likely to be a continuing strong demand for cattle in Spain and Italy and the Dutch market also looks set to remain stable with a steady demand for calves for theveal sector. The key issue for Ireland is the ability of Irish cattle to compete on price with other suppliers. Trade will also be dependent on continued shipping access to Europe, which worked very well in 2005.

The UK and Germany remain the two most important export markets for Irish pigmeat exports, with volumes increasing to an estimated 52,000 and 12,000 tonnes respectively. The UK continues to account for around 50% of shipments. Trade to the UK remained competitive during 2005 reflecting continued competition from Dutch and Danish suppliers. Despite this shipments increased by almost 10% on 2004 levels.

Exports to Continental EU markets performed strongly during the year rising by 26% to 29,000 tonnes. Germany accounted for almost 45% of the total reflecting a steady trade in sow carcasses to the market throughout the year. The EU market remained relatively well supplied particularly in France and Italy where Irish exports showed little change. However, exports to Denmark and Belgium showed some growth.

Japan was the best-performing international market with Irish pigmeat exports rising by 20% to 12,000 tonnes due to an expansion in the range of products

Ireland is selling into Japan. Exports to Russia were significantly down on 2005 levels to an expected 3,000 tonnes in 2005.

The fall in exports to Russia was the result of certification issues encountered with

EU pigmeat at the beginning of the year which have now been resolved. Competition from Brazil and Canada also affected Irish exports to Russia. Exports to the US showed marginal growth, with export volumes amounting to 5,000 tonnes.

Bord Bia Irish Food Board Annual Report 2005

George Dykemans, Dawn

Meats Group, Grannagh,

Co. Waterford; Owen Brooks,

Director, Bord Bia; Paul Nolan,

Dawn Group, Grannagh,

Co. Waterford; and Luc Van der Weëën, Carrefour, Belgium.

Irish pig supplies are forecast to decline by up to 3% in 2006 with export meat plant throughput standing at around

2.54 million head. With EU production levels expected to remain stable throughout the year and preliminary forecasts indicating a slight strengthening in EU prices, the outlook for Irish pig prices remains reasonably positive.

Lamb

Irish sheepmeat exports increased by eight per cent during 2005 to € 189 million.

Increased volumes helped boost the value of exports. The market diversification seen in 2004 was continued in 2005, reducing dependency on the French market, which took an estimated 58% of total shipments.

The outlook for the Irish market is that demand levels are likely to remain reasonably steady. Imports are likely to continue to play a role in meeting demand from both domestic and export customers.

The domestic market is expected to account for around 50% of Irish output in 2006.

Overall production levels grew to 77,500 tonnes for the year, a rise of almost 8% on 2004. Sheepmeat consumption improved in Ireland to exceed 22,000 tonnes on the back of stronger retail sales. Irish sheepmeat exports to France were largely maintained during 2005, reaching 32,700 tonnes with a value of around € 120 million.

Approximately 70% of Irish lamb sold to France is destined for the retail trade with the remaining 30% sold through the wholesale sector.

Bord Bia programmes for 2006 will focus on improving domestic market returns by promoting the Quality Assurance Scheme to pork and bacon carrying the origin mark and further developing new export opportunities in the UK (manufacturing and second tier retail). Bord Bia will once again coordinate the Catering Colleges Pork

Cookery Competition with six Institutes of Technology.

Increased cull ewe supplies lead to a further rise in sales to the UK. This has proven a good market for bone-in and boneless mutton withan estimated 14,000 tonnes shipped for the year as a whole. This is a rise of 17% on 2004 levels. Sales to Sweden,

Denmark and Holland were all strong during

2005, providing good markets for both cuts and carcasses. This complements the cutting of lamb and mutton which increased further during 2005.

18 19

Chief Executive’s Review (Continued)

The retail egg market increased by over 12% in volume and value terms in 2005.

Outbreaks of Avian Influenza, which were confirmed in Turkey, Romania and Croatia in October 2005, had a destabilising effect on the European market. Consumption in a number of EU markets fell by 10-20 per cent for a period, following widespread fears of a human influenza pandemic. The Irish market remained relatively stable and the industry, together with relevant authorities, implemented measures to prevent an outbreak occurring here.

The Irish and French markets remain the most important for Irish lamb and further development of these markets continues to be a priority for 2006.

In France, the consumer promotional offer will be further developed with identified Irish lamb promoted in a wider geographicalspread than previous years.

The ban on Asian imports of poultry meat will continue into the foreseeable future as Avian Influenza continues to be a problem in the region. This will continue to ease the pressure of imports in the domestic market.

Poultry

The value of Irish poultry exports in 2005 increased by an estimated € 10 million to

€ 257 million. Nearly two-thirds of the total poultry exports during the year were made up of processed poultry meats and prepared products. The UK continues to be the main market for Irish poultry exports, accounting for approximately 80% of total exports.

Imports continue to keep the sector very competitive. However, there was a slight fall in imports during 2005 which slightly eased the pressure on the domestic market.

The decline in imports was mainly due to the EU ban imposed on imports from many

Asian markets in 2004, following outbreaks of Avian Influenza. Prices were steady in

2005 but increasing costs, such as oil prices, have kept margins very tight for growers.

Bord Bia has drafted a standard for a turkey quality assurance scheme which will be implemented in 2006 and the bi-annual

Poultry & Egg Conference will be coordinated in conjunction with the industry.

Eggs

The retail egg market increased by over

12% in volume and value terms in 2005.

Driven by a combination of more buyers coming into the market and more frequent purchasing of eggs, sales were estimated at € 53 million and this upward trend is expected to continue. On average, 90% of households buy eggs every two to three weeks which is equivalent to 248 million eggs over a year.

Bord Bia egg promotions focused on building consumer awareness of the recommended daily consumption allowance for eggs and repositioning them as a healthy and convenient meal option. This was achieved through a combination of outdoor and press advertising and press activities.

The campaign also highlighted the Quality

Mark on eggs and what it means.

20 21

Bord Bia Irish Food Board Annual Report 2005

Consumer Foods, Dairy and Drinks

In 2005, combined exports for the consumer food, dairy, ingredients and drink sectors reached almost € 4.6 billion. Strong world dairy markets and increased volumes helped boost the value of dairy product exports by almost 5% to € 1.95 billion in 2005.

Exports of prepared foods, following a strong performance in the previous year grew by just under 1% in 2005 to € 1.54 billion. The sector which has the highest long term growth potential had to cope with strong downward price pressures, increased price promotional activity and growing competition from Continental European suppliers in its largest market, the UK. Further retail consolidation during the year has accentuated competition in the UK retail sector while growth in grocery sales has also moderated by comparison with previous years.

Dairy Food and Ingredients

This category covers dairy products such as butter and cheese, dairy ingredients such as casein, and various other ingredients used in the manufacture of consumer food and drink products worldwide. The rise of almost 5% in the value of exports highlights the generally positive nature of EU and international markets for dairy products and ingredients during much of 2005.

Though international prices generally held strong, there were variations depending on such factors as cuts in CAP supports and subsidies, intervention activity, global demand and supply, and exchange rates. EU exporters benefited from a fall in milk production in Oceania, and in competitiveness from improved exchange rates against the

US dollar and the New Zealand dollar.

As Irish dairy production is geared towards the maximisation of the return from quota controlled milk production, the balance of product mix in 2005 was especially important. For the period from April

1st 2005 to March 31st 2006, Irish milk production is estimated to have come in at around 1% under quota. Within the product mix, butter production for 2005 is estimated to have increased slightly. Estimates also show that production of casein remained at the same level as 2004, and whole milk powder increased by just under 20%. Irish cheese production is estimated to have increased marginally, mainly as a result of reduced milk availability for cheese. Irish production of skim milk powder, which has dropped significantly in recent years, is estimated to have reduced by over 11%, with chocolate crumb also reducing somewhat.

World milk production has continued to increase, with China being a major contributor, followed by India. Their production increased by about 25% and 5% respectively. Both the US and Brazil are estimated to have increases this year of 3% and 7% respectively. Australia will only record around 0.5%, with New Zealand showing a decline of over 3%. EU quota controlled milk production for 2005 is estimated to have come in at around plus

1%, which represents over one quarter of the world’s total milk production.

The strengthening advances in consumer awareness and demand for health, nutritional and functional foods continued to provide growing opportunities for Irish dairy/ingredient companies to increase their export returns through value added ingredients. This continued to be a priority for Bord Bia in 2005, working closely with the industry. We provided up-to-date market information and intelligence through our

Information and Customised Services

Bord Bia Irish Food Board Annual Report 2005

Pictured at Bord Bia's Consumer

Food & Drinks Industry Day at the IMI, Dublin were keynote speaker Mike Coupe, Trading

Director, Sainsburys UK; Mary

Coughlan TD., Minister for

Agriculture and Food; and

Aidan Cotter, Chief Executive,

Bord Bia. Opportunities for

Irish companies to increase their € 250 million trade with Sainsbury’s UK were highlighted at the event. and a specialised Nutrition & Health Claims workshop. Marketing and promotional support and new customer introductions were also provided at industry specific trade exhibitions. These included the Institute of

Food Technologists Show in the US, ANUGA, and Food ingredients Europe.

The continental market remains challenging because of its diversity and size.

However, companies are primarily targeting niche opportunities in selected markets.

In addition, Bord Bia is driving opportunities in higher volume sectors and developing new contacts in the Retail, Foodservice and

Manufacturing sectors, while deepening its relationship with existing European contacts.

Prepared Foods

These foods are defined as products that have undergone further processing and can be sold as intermediate products, into Retail,

Foodservice and Manufacturing. The sector makes up 21% of total food and drink exports accounting for almost € 1.54 billion.

Included in the sector are foods such as, frozen pizza, frozen ready meals, frozen and chilled hand held snacks, prepared vegetables, fruit, confectionery and ambient grocery products.

The key issues facing the prepared foods sector are: price deflation across the sector, the growth of competition from local,

UK and mainland European players into the UK market and difficult trading conditions in mainland European markets.

Margins are continually being squeezed by retailers and by more product being sold under promotion. A key challenge for the companies who operate in this sector, mainly small and medium sized manufacturers, is to innovate supply chains and to develop new routes to market.

For those companies supplying the UK the major challenges are to counter the price competition from domestic UK players and tackle the greater price competition from European competitors.

Frozen Foods

Britain remains the biggest market for frozen foods. Exports of frozen foods were stagnant. This was due to a number of factors including the growth of chilled convenience products, price deflation in the sector, the Sudan 1 scare early in the year and greater awareness of health and obesity issues among British consumers. The main frozen food products exported were pizzas, ready meals and hand held snacks.

Manufacturers are continuing to develop more premium offerings to counter price deflation in the sector. These offerings include bigger pack sizes for a more substantial meal, offering more authentic flavours and catering to the growth in the consumers need for indulgence.

Organics

In 2005 Bord Bia market research estimated that the organic food market in Ireland was worth € 75.3 million. Some € 65.5

million of this market was accounted for by the main retail multiples, while direct sales of organic food amounted to € 5.5 million. Trade channel interviews indicated significant optimism for the continued growth of this market.

22 23

Chief Executive’s Review (Continued)

Pictured at the launch of

National Organic Week with young Eva were Mary Coughlan

TD Minister for Agriculture and

Food; and Aidan Cotter, Chief

Executive, Bord Bia. National

Organic Week was Ireland's first and largest nationwide celebration of organic food and farming. The campaign was designed to raise consumer awareness of organic food and where to buy it.

Organic farming represents the most environmentally friendly agricultural production system, generating alternative food options for consumers with health or environmental concerns.

Confectionery

The confectionery sector is made up of companies supplying products based on chocolate, sugar and flour.

Bord Bia is actively involved in collaborative approaches to the development of the organic sector and market in Ireland and continued to work closely with the

Department of Agriculture and Food National

Steering Group which is fully representative of organic sector stakeholders. Bord Bia also holds the Chair for the Group’s organic sub-committee on marketing – the Organic

Market Development Group (OMDG).

Bakery

Growth in the bakery category is driven by consumer interest in foreign and ethnic breads and willingness to trade up to more premium priced products. Although bread consumption overall is falling in volume terms, there is still continued growth in the revenue generated by these sales.

The standard white bread market segment is contracting in favour of other more exotic varieties. Research undertaken by Bord Bia in the UK in 2005 into the bakery category identified opportunities for artisan, flavoured and healthy breads.

The organic manufacturing sector is at an early stage of development and at present there are only a small number of Irish organic companies of sufficient scale, with established quality product ranges geared to supply the domestic and export market. The whole emphasis at sector level is to develop the supply side, to an extent where there is sufficient volume of raw material and consumer products, to meet domestic demand and eventually develop export opportunities in international markets.

The continued promotion of Ireland as The Food Island, building up a strong association between the natural and wholesome environment of Ireland and the food products/ingredients it provides, fits well for both conventional and organic food. It also offers a distinct point of differentiation in international markets. The emergence of organic food surpluses for export would work to further build confidence with organic buying consumers in foreign markets.

The Organic Market Development Group and Bord Bia were involved in several initiatives in 2005, including: National

Organic Week 2005; Bord Bia / WDC / DAF

National Organic Conference; the National

Production Census 2002; Sector

Development Plans for meat and horticulture; and an Organic Market Channel Study.

In addition, the Bord Bia and Department of Agriculture and Food websites now have dedicated Organics sections.

Innovation is key to the future development of this category, as consumers demand more adventurous offerings.

Chocolate/Sugar

An increasingly sophisticated consumer and the demand for indulgent products have driven a trend towards Super Premium products at the top end of the market, where real value growth has been achieved.

While Britain is the main market for Irish confectionery exports, there is some penetration of continental EU markets and the US.

Bord Bia carried out research on the UK luxury chocolate market in 2005 to fully understand its dynamics in terms of brands, competitors and consumers and to identify potential opportunities for Irish producers.

It was evident from this research that there is a continued consumer desire for indulgence and quality. The challenge going forward will be to bring new products to market, which will exploit increased consumer demand for convenience, snacking, indulgence and authenticity.

Bord Bia Irish Food Board Annual Report 2005

Pictured at the Chelsea Flower

Show 2005 were supermodel

Jasmine Guinness; Elma Fenton and Michael Maloney, Director of Horticulture, Bord Bia.

Ambient Foods

The ambient food sector is comprised of suppliers operating within the cereals, sauces, soups, jams/preserves, condiments, ambient meals and home baking categories.

Mainly occupying leading brand positions in the domestic market, many of the companies within this sector are now successfully exporting. Many have secured notable listings with major multiple retailers in Britain.

The sector is typically dominated by small to medium size manufacturers operating in different channels such as foodservice, co-packing, supply to manufacturing and retail. Though the main export market is

Britain, there has been some penetration in continental EU and into the US in mainly niche, ethnic markets.

In volume terms, cream liqueurs’ share of the UK off-trade is down from 7.4% in

2004 to 6.9% in 2005, with Irish whiskey stable at 0.7% share of volume. Multiple retail grocery outlets continue to take share from the on-trade and drive volume performance. Heavy discounting was a feature of the drinks sector, especially in the lead up to the Christmas holiday period. Exports of malt beer performed very well in 2005, showing an increase of 22% over 2004.

The US is the second most important market accounting for 20% of exports.

It is the largest export market for Irish whiskey and continued to perform very well with sales growth of approximately

21%. Other developing markets such as

Russia and South America reported growth in exports following increased marketing and promotional activities.

Bord Bia has undertaken a number of multiple retailer promotions across categories in the ambient fixture to raise awareness of the availability of Irish food and drink products, and to drive incremental sales.

Beverages

The beverage sector had a very successful year in 2005, with exports recovering strongly over 2004. It was the best performing export category in 2005, with total exports growing by 7.4% to almost € 1.1 billion. The sector includes all alcoholic and non-alcoholic beverages, waters, carbonates and juices manufactured by both multinational owners and indigenous

Irish manufacturers. Cider, beer, spirits and water exports were all up in 2005.

The top export destination for drinks products remains the UK, accounting for approximately 28% of total exports.

However, Irish whiskey and cream liqueurs lost volumes in the off-trade, while US whiskey, vodka and non-cream liqueur markets grew at the fastest rates.

Issues facing the overall alcoholic beverage industry continue to be focused on concerns about responsible drinking, health and lifestyle issues. Also, increased consolidation with the sector resulted in changes in distribution arrangements. Consequently, manufacturers and brand owners invested resources in accommodating these changes during the year. Increased investment in innovation and branding were still key concerns for companies anxious to drive growth in 2006.

Identifying new market opportunities and meeting new industry contacts and buyers is a key focus for the Irish drinks industry.

To assist companies in these activities,

Bord Bia planned a tailored programme of activities for the industry and included participation at international trade shows and conferences such as WSWA Orlando,

Vinexpo, Bordeaux; IMPACT Drinks

Seminar, London; and Tax Free World

Association, Cannes.

24 25

Chief Executive’s Review (Continued)

Pictured at Bord Bia's

Regional Brand Forum in Cashel, partnered by Bank of Ireland

Business Banking, were Tara

McCarthy, Senior Consumer

Food & Drinks Manager, Bord

Bia; Jacqui Marsh, The Butler’s

Pantry; Wilfred Emmanuel-Jones,

The Black Farmer, Devon; and

John Boyle, Channel Market

Manager, Bank of Ireland

Business Banking.

A market study visit was also organised to Bulgaria and Romania in October 2005.

This gave participants the opportunity to learn about these markets and to meet with potential importers and distributors.

As part of the ongoing business development programme with the National Alcohol

Beverage Control Association USA, buyer-supplier events were also held in

Washington, Virginia and North Carolina.

Two events were also hosted by Bord Bia in Dublin and Limerick with these buyers and Irish supplier companies.

Foodservice

The UK Foodservice Programme continued to focus on the twin objectives of delivering market intelligence and offering opportunities for established suppliers to strengthen their business through this channel. Throughout 2005, four inward buyer itineraries were organised with

Compass Group, midlands based Hardy &

Hansons pub group, distributor MJ Baker

Foodservice and contract catering specialist

ISS Eaton. In addition, over 40 buyer presentations by Bord Bia took place throughout the year, which included leading operators like Whitbread, Prêt a Manger and Mitchells & Butler. Covering the market intelligence objective, Bord Bia published two comprehensive directories dealing with the market and also a series of workshops dealing with the challenge of entering the € 46 billion foodservice market.

In Europe, Bord Bia continued with its strategy of actively developing new markets for Foodservice for Irish companies.

In 2005 reports on The Route to Foodservice were compiled for the Swedish and Dutch markets. These included information on the size and structure of the market and profiles of the main distributors. The publication of these reports was supported by market study visits to each respective market which were attended by 21 representatives in total.

Pictured at Bord Bia’s UK foodservice seminar in Dublin were David Mulcahy, Compass

Group UK; Simon Muschamp,

Lakeland Pritchitts and Paul

Donegan, Trade Marketing

Specialist, Bord Bia. The seminar focused on the growing importance of the eating out of home sector in the UK which is valued at over £30 billion per annum. Speakers addressed opportunities for Irish food suppliers in this growing foodservice sector where consumers are now spending more eating out than any of their European counterparts.

26 27

Bord Bia Irish Food Board Annual Report 2005

Small Business and Speciality Foods

The speciality food market continued its strong performance in 2005 and turnover for the sector is estimated at € 475 million, which represents a 10% year-on-year growth.

Key drivers affecting the market included consumer demand for variety, provenance and authentic taste. There is also an increasing awareness about regional and local food, as consumers seek assurance about traceability and the origin of products and how they are produced.

Pictured at the Food Month at Farmleigh in association with Bord Bia were Paul Flynn

The Tannery Restaurant,

Waterford, Aidan Cotter,

Chief Executive, Bord Bia and Mr. Brendan Smith,

T.D, Minister of State at the Department of Agriculture

& Food. Over forty traders participated in the food market.

This growing trend has attracted the attention of multiple retailers as well as the independent specialists who have traditionally dominated the channel.

In addition, the farmer’s market concept has caught the imagination of the public, reflecting changing consumer preferences for fresh local produced foods. There are now over 100 farmer’s markets operating on the island of Ireland. They have encouraged new start-ups for local products and they bring farmers and consumers together to enrich the fabric of rural life in towns and villages throughout Ireland. of Agriculture and Food, highlighting the importance of small food entrepreneurship and their contribution to the local and regional economy.

Bord Bia also continued to work with strategic partners including the Irish Leader

Network and County Enterprise Boards.

Bord Bia joined forces to showcase over

60 speciality food companies at IFEX, a major food exhibition in Dublin which attracts key retail and foodservice buyers.

Bord Bia’s programme of farmers’ markets, in conjunction with the Office of Public

Works (OPW) at Farmleigh, has gone from strength to strength and has now been extended to include other OPW sites around the country. An export dimension was added last year with an All Ireland Specialty Food

Market in Covent Garden in London. This saw over 40 Irish producers north and south coming together to showcase their produce around St Patrick’s Day.

North-South co-operation continued to develop during the year with Northern companies participating in our UK retail and foodservice programme. Co-operation was extended into the market research area which examined changing consumer behaviours and attitudes to food in the UK and Ireland. A joint North-South exhibition was staged at the Fine Food Fair in Earls

Court in London which attracted over

4,000 British and Irish buyers.

Bord Bia continued to deepen its relationship with the sector and extended its small business programme to focus on building marketing capabilities through a series of best practice marketing workshops and seminars throughout the country. A major regional seminar in the North West was held in conjunction with the Department

The work of the Taste Council continued to influence policy during the year and a number of detailed submissions were made to Oireachtas and government committees on the role and importance of speciality foods and their contribution to the rural economy.

28 29

Bord Bia Irish Food Board Annual Report 2005

Horticulture

Bord Bia strongly supported the horticulture industry throughout 2005, a year that held mixed fortunes for the industry. The Business Development programme continued to assist businesses to increase their competitiveness in relation to domestic and foreign markets through various training courses and workshops. It is aimed at nursery growers, landscape contractors and the Golf Superintendents Association. Workshops in 2005 included topics such as Innovation, Debt Collection, Time Management and Leadership Skills, Goal Setting, and a Business to Business Master Class. In addition, two workshops were held for retail and specialist nurseries.

The Business Support Programme continued to provide financial support for companies with projects involving: new market entry; new product development; packaging design and development; and marketing activities.

In 2005, 10 applicants from the amenity sector were granted financial assistance through the Business Support Programme with the majority seeking grants towards marketing their product through brand identity strategies, packaging and website development.

Bord Bia supported the garden designed by Elma Fenton at the 2005 Chelsea

Flower Show. This garden was awarded a silver medal and received substantial

TV coverage both in the UK, and in Ireland.

Bord Bia also provided financial support for Oliver and Liat Schurmann’s garden at the Hampton Court Show. This design was awarded the second highest accolade, a silver gilt medal. These shows succeeded in highlighting top Irish designers, contractors and growers. Our substantial brand coverage also generated great awareness of Bord Bia’s close association with amenity horticulture throughout Ireland.

GLEE, the Garden and Leisure exhibition, is the main trade show for horticulture in the UK and 30 Irish producers were represented at the show in 2005. The GLEE

Show Planner, branded with Horticulture

Ireland and Bord Bia, was distributed to over

70,000 potential show visitors which drew a number of visitors to the stand. Despite the difficult year in the UK and a distinct lack of enthusiasm among many UK exhibitors, the show’s attendance of

25,000 trade visitors matched last year’s visitors and feedback from exhibiting nurseries has been positive.

Bord Bia organised and facilitated a media panel at the Teagasc National Hardy Nursery

Stock Conference which is run annually in association with Bord Bia. This session explored the use of the media to promote the sector. The key message was that the industry is not pro-active enough in using the media to promote itself. The panel included horticultural journalists and media personalities such as Gerry Daly, Helen

Rock and Dermot O’Neill and also Dr Chris

Morash, media expert from NUI Maynooth.

The session was very well received and pointed to promotional opportunities to be exploited.

Bord Bia Irish Food Board Annual Report 2005

Pictured at the launch of two recipe booklets for the speciality food trade in Bord Bia were

Declan Ryan, Arbutus Breads,

Cork, Muiris Kennedy, Marketing

Director, Bord Bia and John

McKenna, Food Writer.

Pictured at the launch of New

Season potatoes in Dublin were

Aidan Cotter, Chief Executive,

Bord Bia; Mary Coughlan TD,

Minister for Agriculture & Food and a young potato fan. Figures released by Bord Bia at the launch indicated consumers were spending € 145.4million on potatoes in retail outlets annually.

Waste and Environmental

Management

Throughout 2005, Bord Bia worked with the Department of the Environment, Heritage and Local Government and various industry stakeholders, including Race Against Waste, the Irish Farm Film Plastics Association and local authorities. The aim was to identify and prioritise some of the more critical waste issues affecting the Irish horticulture Industry.

These issues include the handling of the SMC

Nitrate Directive and initiatives concerning

Race Against Waste.

Horticultural Promotions

EU State Aid Regulations require that marketing supports for the horticulture sector be co-funded by that sector by at least

50% of the total cost. Bord Bia undertook exploratory studies during the year into possible industry funding options.

In follow-up, Bord Bia submitted a report to the Department of Agriculture and Food outlining the future labour skills needs of the horticultural sector. Some of the key recommendations arising from our submission were noted in a Future Skills

Needs report entitled Skills Needs in the

Irish Economy: The Role of Migration.

Over the past four years, Bord Bia has, in association with Macra na Feirme, implemented the Seasonal Horticultural

Workers Scheme (SHWS). The 2005 SHWS programme fulfilled its objectives of ensuring that seasonal labour demands were matched with an adequate supply of suitably skilled labour. The scheme also provided students from Eastern and Central European countries an opportunity to gain practical work experience in the Irish horticultural industry.

As part of the consultation process with industry, a series of meetings were organised with representatives from the fruit, field vegetable, protected crop, mushroom, potato and ornamental sectors.

A total of 220 SHWS students from the

Ukraine and new accession state countries were placed across a variety of horticultural enterprises over an eight month period.

Horticulture Labour Issues

Bord Bia continues to tackle the shortage of labour in the horticulture sector in close collaboration with the Department of Enterprise, Trade and Employment.

Bord Bia participated in discussions on the issue with the Department of Agriculture and Food, Teagasc, Forfás and Department of Enterprise, Trade and Employment.

Promotions

A series of public relations and promotional activities took place nationwide to highlight the availability in store of new season potatoes, British Queen. The campaign included a product launch and photocall with

Mary Coughlan, TD, Minister for Agriculture

& Food, and regional radio competitions.

30 31

Chief Executive’s Review (Continued)

In May 2005, the Irish Potato

Federation hosted the 57th Europatat

Congress in Killarney, with Bord Bia as one of the key sponsors.

A floriculture promotion programme to promote plants and flowers on the home market took place under funding from the EU, the industry and the Department of Agriculture & Food. It contained two main elements: The production of a series of 20

Gardening Leaflets with the support of the

Garden Centre sector; and plant promotion for outdoor plants in collaboration with the Nursery Stock industry.

The Food Dudes Programme positively changes children’s behaviour regarding consumption of fruit and vegetables.

The programme, which was developed in Wales, was piloted in Ireland by Bord Bia in 2002-3 with significant increases in the amount of fruit and vegetables consumed by participating children. Bord Bia applied to the EU commission for funding to extend this programme to a larger number of primary schools and in May 2005 confirmation of funding was received to extend the programme to 150 primary schools over three years. This funding is matched by an equal contribution from national government and the fresh produce industry. The roll-out of the programme commenced in October