AG-ECO NEWS Jose G. Peña Professor &

advertisement

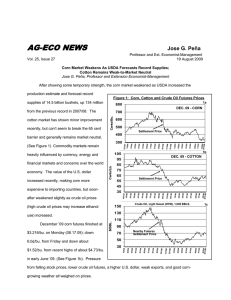

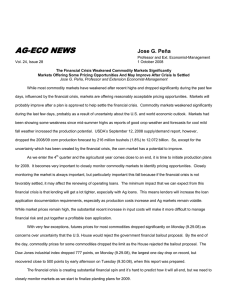

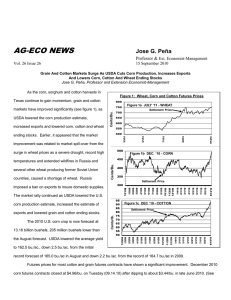

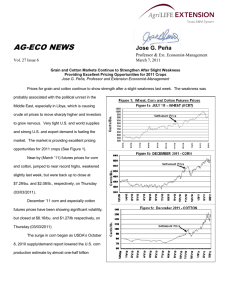

AG-ECO NEWS Jose G. Peña Professor & Ext. Economist-Management Vol. 26 Issue 30 October 28, 2010 Grain and Cotton Markets Continue to Surge Providing Excellent Pricing Opportunities for 2011 Crops Jose G. Peña, Professor and Extension Economist-Management Prices for grain and cotton continue to show significant strength. While it may be difficult for farmers to take advantage of this season’s market surge, the market Figure 1: Wheat, Corn and Cotton Futures Prices Figure 1a JULY ‘11 - WHEAT crops. (See Figure 1), Near-by futures prices for corn and cotton jumped to record highs this past week. The surge in Settlement Price Cents/Bu. is providing excellent pricing opportunities for 2011 corn began as USDA’s October 8, 2010 supply/demand report lowered the U.S. corn Figure 1b DEC. 2010 vs. Dec. 2011 - CORN 600 production estimate by almost one-half billion 560 440 400 360 10/26/10 10/1/10 9/1/10 8/2/10 7/1/10 6/1/10 5/3/10 4/1/10 3/1/10 prices, heavily influenced by concern that global 2/1/10 320 1/4/10 almost 20 cents this past week to record high futures 480 12/1/09 May 2010. Near-by cotton futures prices jumped Cents/Bu. 520 bushels after forecasting a record corn crop since December 2010 Settlement Price December 2011 Settlement Price demand, especially from China, may exceed supplies Figure 1c DEC. 2010 vs. Dec. 2011 - COTTON 120 December 2010 Settlement Price Earlier, it appeared that the market 80 70 10/26/10 10/1/10 9/1/10 8/2/10 6/1/10 5/3/10 4/1/10 3/1/10 60 2/1/10 prepared, but markets remained relatively strong. 90 1/4/10 Wednesday (10/27/10), when this report was December 2011 Settlement Price 100 12/8/09 Corn and cotton futures weakened on Cents/lb. 110 storms in the panhandle of Texas. 7/1/10 and adverse weather, including reports of heavy hail 130 improvement was related to market spill-over from the surge in wheat prices as a severe drought, record high temperatures and extended wildfires in Russia caused a shortage of wheat. Now, it appears that a much lower corn production estimate as a result of adverse weather conditions, a weaker U.S. dollar, news that China will be buying more U.S. corn, higher crude oil prices, and heavy commodity contract buying by hedge funds have all contributed to the market improvement. A weaker U.S. dollar encourages exports and higher crude oil prices affects corn prices because of the high demand for corn for ethanol production. The estimate of corn use for ethanol production will account for about 37.1 percent of USDA’s October 2010 corn production estimate of 12.664 billion bushels. Hedge funds are buying near-by commodity futures contracts as a safer investment to hedge against potential inflation. Feeder and live cattle futures prices have been showing some recovery after recent weakness, but the livestock industry, especially pork and poultry producers, continues to express serious concerns from signals of higher feed costs. Corn While the U.S. corn harvest is about 43 percent ahead of the five year average for this time of the year, USDA’s October 8, 2010 supply/demand report decreased the corn production estimate by 496 million bushels from last month’s estimate. (See Figure 2). The estimate of acres for harvest was increased by 258,000 acres, but the U.S. average yield was lowered by 6.7 bu./ac. to 155.8 bu./ac. Figure 2: U.S. Corn Production Beginning stocks were increased by 392 million and residual use was increased by 150 million bushels but the estimate of exports was lowered 13,110 12,092 12,664 10,531 10/11 09/10 08/09 07/08 06/07 05/06 8,967 04/05 9,431 03/04 9,207 10,087 02/03 reduced sharply from last month’s estimate. Feed 9,915 9,503 9,759 01/02 disappearance, the estimate of ending stocks was 11,806 11,112 00/01 forecast production and higher projected domestic 13,038 99/00 stocks, the almost one-half billion drop in the Million Bushels 98/99 estimate. But, despite the increase in beginning 14,000 13,000 12,000 11,000 10,000 9,000 8,000 7,000 97/98 bushels based on the September 2010 stock Marketing Year Source: USDA/FAS Production, Supply and Distribution Online (PS&D), October 2010 Supply/Demand Report 100 million bushels as a result of tighter available supplies, reduced demand from higher prices, and increased competition from Argentina. U.S. ending stocks are now projected lower at 902 million bushels, down 214 million bushels from last month’s estimate. The season-average farm price was projected at $4.60 to $5.40/bu., up 60 cents on both ends of the range. Cotton USDA’s October 8, 2010 supply/demand report remained virtually unchanged from last month. Production was raised marginally, as increases for the Delta and the Southwest region were nearly offset by reductions from the Southeast region. Domestic mill use and exports remained unchanged. The estimate of U.S. ending stocks at 2.7 million bales also remained unchanged from last month’s estimate, but down 25 million bales from last year. The average price received by producers was forecast at 67-79 cents per pound, about four cents above last month. The midpoint of the range, is 10 cents above the final 2009/10 marketing-year average price of 62.9 cents per pound. While the value of the U.S. dollar has been showing significant weakness since mid-June’s highs, the index showed a slight up-turn this past week and may have influenced the market weakness on Wednesday (10/27/10), but it seems likely that markets will remain relatively strong. Appreciation is expressed to Dr. Jackie Smith, Extension Economist for his contribution to and review of this article.