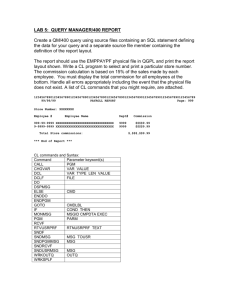

m t) Signature redacted 201q)

advertisement