30 The Role of Product Management MAY

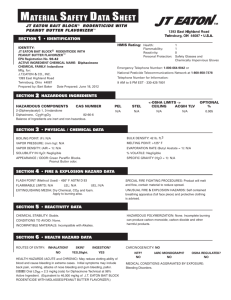

advertisement