USING THE RELATIONSHIP MANAGEMENT THEORY TO CREATE AN INTERNAL

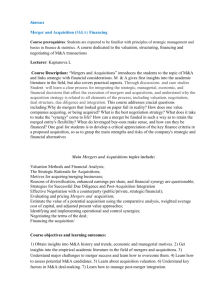

advertisement