EMPLOYEE BENEFIT AND RETIREMENT PLANNING BUSINESS FINANCE 4312 Course Syllabus

advertisement

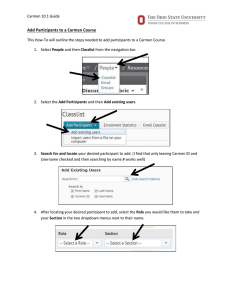

BUSINESS FINANCE 4312 EMPLOYEE BENEFIT AND RETIREMENT PLANNING Course Syllabus Spring Semester 2016 Special Meeting Schedule (Classroom Reserved MWF 4:10-5:05PM) 230 Schoenbaum Instructor: Phone: Office: E-Mail: Office Hours: Dr. Bill Rives (614) 292-2979 312 Fisher Hall rives.4@osu.edu By appointment only COURSE DESCRIPTION This course provides an introduction to the concepts and methods of employee benefit and retirement planning. While the principal focus of the course is employee benefits, it is important to understand that many employee benefit plans are concerned, at least to some extent, with retirement. The field of employee benefits has become important for two major reasons: • The high cost of recruiting, retaining, and ultimately retiring an employee mandates a careful search by an employer for the most cost-effective benefit and compensation packages to meet company objectives. • The unprecedented growth of federal legislation and regulatory activity in the area of employee compensation during recent decades has greatly complicated the process of designing benefit plans to avoid mistakes in benefit and retirement planning. This course is part of the Insurance Specialization under the Fisher Finance degree. DELIVERY FORMAT The course incorporates a self-study model commonly used in online courses. Because students will be taking other courses on the OSU Columbus campus, in-class meetings can be scheduled every 2-3 weeks to discuss study assignments and student progress. All study materials will be available through Carmen; the course will make extensive use of Carmen resources. Students should be familiar with Carmen learning tools. The National Underwriter Company, publisher of the course text, has agreed to support the course with digital application problems and cases, class discussion questions, PPT slides, and chapter test banks compiled from national certification and licensing exams. COURSE MATERIALS Required Course Text Stephan Leimberg, John McFadden and C. Frederick Reish The Tools & Techniques of Employee Benefit and Retirement Planning 14th edition, National Underwriter, 2015 (ISBN 9781941627495) Each student should own a copy of the current edition (no sharing). We DO NOT support earlier editions, which can differ significantly from the current edition. Required Calculator You will need a calculator for this course capable of performing basic time-valueof-money (TVM) calculations. Financial calculators enable you to perform these calculations using pre-programmed functions. In contrast, scientific (statistical) calculators require you to enter values manually into mathematical formulas. If you already own a scientific (statistical) calculator, there is no need to purchase a financial calculator unless you prefer the convenience of pre-programmed TVM functions. You will not be at a disadvantage without a financial calculator. COURSE REQUIREMENTS Class Contribution (course grade weight = 25%) The course will meet 8 times during the semester (roughly every other week). Meeting dates are shown in the Course Schedule (see below). Should circumstances warrant, a meeting date may be changed, with appropriate notice. The classroom is reserved on a M-W-F schedule for the entire term, which affords a range of alternate meeting dates. Most of the meeting dates in the Course Schedule (see below) are Mondays. With only 8 meeting dates, the classroom experience can be expected to play a key role in the course for students new to an online delivery format. To this end, we expect you: • to attend every class; • to notify the instructor in advance when you need to arrive late or leave early; • to provide the instructor with a written explanation for each class you miss (including appropriate supporting documentation to be determined by the instructor); • to prepare adequately for each class by completing all pre-class assignments; and • to contribute effectively to class discussion (emphasis on quality, not quantity). In the most general sense, grading class contribution provides an opportunity to assess the results of your efforts to learn the material and benefit from the course experience. Apart from simply noting whether you attend class, your contribution grade incorporates a subjective assessment by the instructor of the extent to which you “made the effort.” Business Finance 4312 Syllabus / Spring 2016 Page 2 Course Exams (course grade weight = 75% applied to the average score on 6 required exams) The course is divided into 6 segments or “content modules.” Each module covers a set of related topics. Each topic generally corresponds to a chapter from the course text. You will take an exam on each content module using the Carmen quizzing tool. Exams will consist of multiple-choice questions based on topics from each module. Exams are designed to evaluate your working knowledge of key concepts and your ability to apply basic tools to common problems. The exam on each module will be available on Carmen for a relatively short time period (“exam window”) immediately following the class at which the module is discussed. The 6 exam windows can be found in the Course Schedule (see below). Exam ground rules (additional rules may be announced at a later date): • You can take an exam any time, and from any location, during the exam window. • You can use your text and notes to help you answer exam questions. • You will certify on each exam that your answers represent your own work product (no group efforts!) • Under no circumstances will a student be excused from an exam. • Each exam has an aggregate time limit regulated by Carmen. • You are responsible for taking an exam during the exam window; a missed exam cannot be “made up” and may adversely affect your course grade. • You may take an exam up to 2 times in an effort to improve your score; if you do take an exam twice, you will earn the higher of the two scores. Because each exam consists of questions drawn at random from a large question bank, no two exams for a particular content module will be exactly the same. After you finish (submit) an exam, and the exam window has closed, go to the Quiz List and click the Submissions icon next to the exam you just completed. You will be able to review the questions you missed and your score on each attempt. The exam requirement will be discussed in greater detail in class. ACADEMIC MISCONDUCT • In accordance with University Faculty Rule No. 3333-5-487, all instances of alleged academic misconduct must be reported to the Committee on Academic Misconduct, which recommends appropriate sanctions to the Office of Academic Affairs. • We aggressively pursue violations of University standards on academic conduct. Business Finance 4312 Syllabus / Spring 2016 Page 3 WAIT-LISTED STUDENTS (undergraduate courses only) • Wait-listed students who seek to enroll in a course must attend class for that course through the first class session of the second week of the semester. After that date, any student who has not been added to the course will not be enrolled and may not continue attending the class. • Wait-listed students should contact either the Fisher Undergraduate Program Office or the Department of Finance if they have questions about the wait-list process. DISABILITY SERVICES • The Office of Disability Services (ODS) verifies students with specific disabilities and develops strategies to meet their needs. Students requiring accommodations based on identified disabilities should contact the instructor at the beginning of the term to discuss their particular needs. Students with a specific disability are encouraged to contact ODS to explore potential accommodations available to them. DISENROLLMENT • The Fisher College of Business aggressively enforces University attendance rules. • Pursuant to University Rule 3335-8-33, a student may be “disenrolled” from a course for failure to attend by the first Friday of the term, by the third instructional day of the term, or by the second class meeting, whichever occurs first. POLICY ON EXTRA CREDIT • No student will be permitted to complete “additional work” for extra credit without the permission of the instructor. POLICY ON THE USE OF ELECTRONIC DEVICES IN CLASS • Cell phones may not be used in class. • During class, your cell phone must be set to SILENT (not vibrate) or turned OFF. • Laptops and tablets may be used in class only for course business. • Lectures and other presentations may not be recorded (audio or video). • Any electronic device not mentioned elsewhere in this section may be used in class only with the instructor’s permission. • This policy does not apply to electronic devices used for medical reasons. • The instructor may amend this policy at any time, should circumstances warrant. Business Finance 4312 Syllabus / Spring 2016 Page 4 COURSE SCHEDULE This course employs a hybrid delivery format (see above). While the course is listed for MWF from 4:10 to 5:05 PM, class will not meet every week (although the classroom will be available as if the class did meet 3 times a week). The following schedule shows the dates on which class will meet, along with dates for testing windows associated with online course exams and University holidays during the semester. All chapter reading assignments refer to the Leimberg-McFadden-Reish course text. Class Dates Activities – Topics – Requirements WED JAN 13 Introduction and Course Administration MON JAN 18 MLK Holiday – NO CLASS MON JAN 25 MODULE 1 Introduction to Employee Benefit and Retirement Planning WED JAN 27 READ: CH01 CH10 CH11 CH35 CH43 Discussion of course topics, requirements, resources and procedures The process of employee benefit planning Designing the right retirement plan Planning for retirement needs Designing the right health benefit package Designing the right life insurance plan EXAM: Exam 1 window runs from 6:00AM JAN 28 to 11:50PM JAN 30 Remember to review the chapter PowerPoint slides posted on Carmen MON FEB 8 MODULE 2 Compensation Planning WED FEB 10 READ: CH02 CH03 CH06 CH07 CH08 Cash compensation planning Bonus plans Stock options Incentive stock options Employee stock purchase plans (Section 423 plans) EXAM: Exam 2 window runs from 6:00AM FEB 11 to 11:50PM FEB 13 Remember to review the chapter PowerPoint slides posted on Carmen Business Finance 4312 Syllabus / Spring 2016 Page 5 COURSE SCHEDULE Class Dates Activities – Topics – Requirements MON FEB 22 MODULE 3 Qualified Retirement Plans: The Ground Rules WED FEB 24 READ: CH12 CH13 CH14 CH15 CH16 Designing a qualified retirement plan General rules for plan qualification Distributions and loans from qualified plans Qualified plan investments ERISA reporting and disclosure EXAM: Exam 3 window runs from 6:00AM FEB 25 to 11:50PM FEB 27 Remember to review the chapter PowerPoint slides posted on Carmen MON MAR 7 MODULE 4 Qualified Retirement Plans: The Plan Universe WED MAR 9 READ: CH19 CH20 CH21 CH22 CH27 CH28 CH31 CH32 Section 401(k) plans Traditional IRA plans Roth IRA plans Profit sharing plans Defined benefit pension plans Cash balance plans Simplified employee pension (SEP) plans Tax-deferred annuity (TDA) plans EXAM: Exam 4 window runs from 6:00AM MAR 10 to 11:50PM MAR 12 Remember to review the chapter PowerPoint slides posted on Carmen MON MAR 14 through FRI MAR 18 Spring Break – NO CLASS Business Finance 4312 Syllabus / Spring 2016 Page 6 COURSE SCHEDULE Class Dates Activities – Topics – Requirements MON MAR 28 MODULE 5 Health and Disability Benefit Plans WED MAR 30 READ: CH36 CH37 CH38 CH39 CH40 CH41 CH42 Group health plans Alternatives to group health plans Flexible Spending Accounts (FSAs) Health Savings Accounts (HSAs) Cafeteria plans Short-term disability (sick pay) plans Long-term disability plans and long-term care insurance Medicare & You 2016 (review; posted on Carmen) MassMutual Understanding the Value of Your Income (read; Carmen) MassMutual Long-Term Care Solutions Guide (read; Carmen) MassMutual Long-Term Care Insurance Policy (review; Carmen) EXAM: Exam 5 window runs from 6:00AM MAR 31 to 11:50PM APR 2 Remember to review the chapter PowerPoint slides posted on Carmen MON APR 11 MODULE 6 Life Insurance Plans WED APR 13 READ: CH18 CH44 CH45 CH46 CH47 Life insurance in qualified retirement plans Group term life insurance Split-dollar life insurance Key employee life insurance Death Benefit Only (DBO) plans EXAM: Exam 6 window runs from 6:00AM APR 14 to 11:50PM APR 16 Remember to review the chapter PowerPoint slides posted on Carmen MON APR 27 Course Wrap and Lessons Learned We reserve the right to correct errors in this document at any time, with appropriate notice. Supplemental reading assignments can be found on Carmen. Additional reading assignments may be posted at any time during the course, with appropriate notice. Business Finance 4312 Syllabus / Spring 2016 Page 7