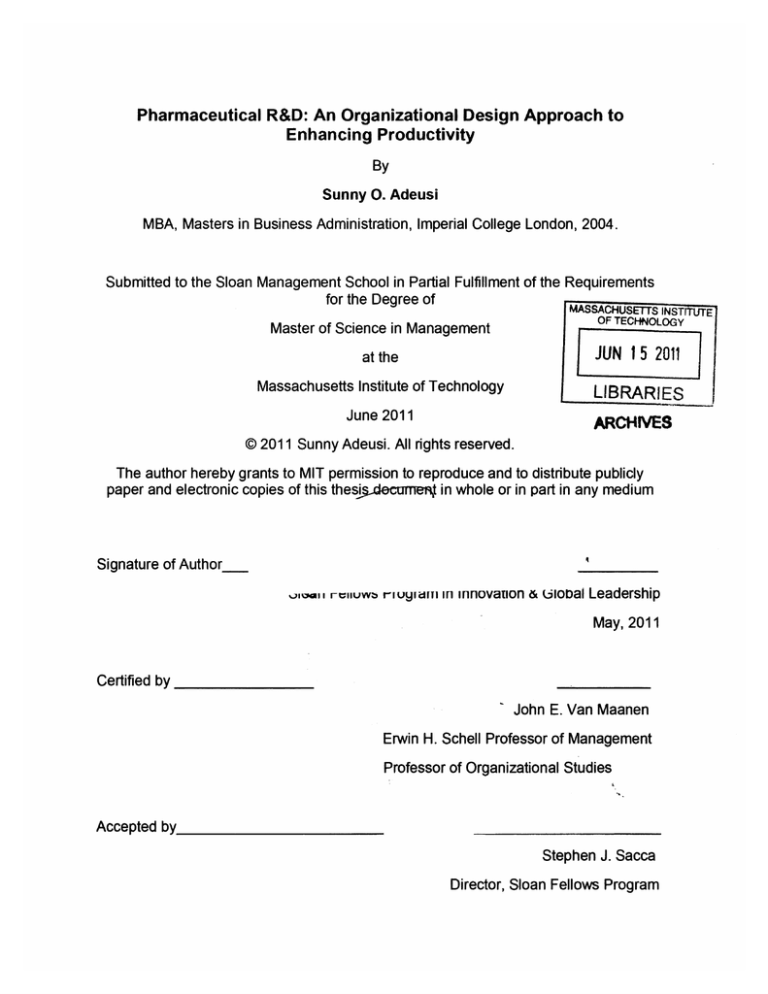

Pharmaceutical R&D: An Organizational Design Approach to

advertisement