DCIM Readiness on the Rise as Significant in Business-Critical Continuity

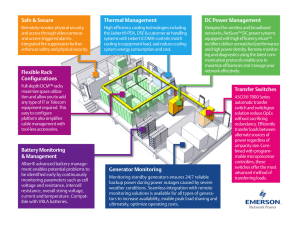

advertisement

A Research Report from the Experts in Business-Critical ContinuityTM DCIM Readiness on the Rise as Significant Data Center Capacity Remains Unused Introduction Data center management is in a stage of transition as older management practices developed during periods of rapid growth are being replaced by more efficient processes and more effective use of technology in pursuit of the data center trifecta: maintaining availability, improving efficiency and managing capacity. In almost all cases, this is happening in an environment that is changing constantly and at least partially virtualized. Only eight percent of respondents to the Emerson Network Power survey on data center management practices had not virtualized at least some of their servers. In addition, more than half will be consolidating (66 percent) and/or adding (57 percent) servers in the next three years, while 36 percent will be renovating existing facilities and 25 percent will be consolidating data centers. At the same time, the lull in capacity growth triggered by the global economic collapse of 2008 seems to have passed. Despite the high adoption of virtualization, driven at least in part by the desire to increase server utilization, 44 percent of respondents expect the number of physical servers in their primary data center to increase over the next three years. While virtualization is delivering the expected benefits for most of those who have deployed it, the side effect is “virtual sprawl,” an increase in complexity created by the need to manage both the physical layer and the virtual layer. A wide variety of software products are being used to monitor and manage physical systems, although these platforms are not integrated with one another or with the virtualization platform. Less than a quarter (24 percent) of participants had any integration between their virtual and infrastructure management solutions. While this silo approach is allowing individual systems to be managed effectively, it prohibits more comprehensive utilization of the data center investment. 0% 20% 40% 60% 80% 66% Consolidate / replace existing servers 57% Add additional servers 36% Renovate / add to existing data center 25% Consolidate multiple data centers Lease additional space 20% Build a new data center 18% Do not plan on making any changes 6% Add containerized data center(s) 5% Data Center Plans (3 years) 1 100% Currently, data center managers have no effective tools for reconciling power, cooling and IT capacity in real time. As a result, the traditional practice of operating with significant headroom continues, resulting in low utilization rates in a number of facilities. However, a substantial majority of respondents are using IT management tools that provide some insight into facility infrastructure. They are moving forward with initiatives to improve management, but still lack a unified view of data center systems that would enable real-time optimization of capacity, efficiency and availability. Significant Data Center Capacity Remains Unused Considering the lack of visibility across IT and facilities systems and the wide fluctuations in demand that occur in many data centers, it’s no surprise that few data centers are running close to what their managers consider 100 percent capacity. In terms of IT utilization, only 13 percent are operating at 80 percent or more of their capacity. The study tells a similar story on facility infrastructure utilization. While only 13 percent of respondents are operating at 80 percent of IT utilization or higher, 20 percent are operating at 80 percent or higher of UPS utilization while 23 percent are using 80 percent or more of cooling. It appears that facility inflexibility is a limiting factor in maximizing IT utilization. Despite what appears to be ample capacity in many facilities—65 percent are using 70 percent or less of their IT capacity—more than half (57 percent) plan to add additional servers in the next three years, and 20 percent plan to add capacity by leasing space from a colocation or hosting facility. Almost one in five (18 percent) have plans to build a new data center. While there are a number of reasons why significant amounts of data center capacity remain unused, a major factor is certainly the concern within many organizations of risking a shutdown by pushing systems too close to full capacity. Without real-time visibility into operating capacity, managers tend to create a false utilization ceiling under which they operate. 0% UPS capacity being used 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0% 3% 11% Cooling capacity being used 1% 1% 8% Floor space being used 0% 3% 6% Computing capacity being used Rack space being used NA - Not sure 100% 90% 12% 12% 8% 1% 3% 9% 0% 2%4% 9% 80% 14% 20% 18% 7% 10% 16% 19% 70% 60% Data Center Capacity Being Utilized 2 11% 21% 16% 2% 0% 9% 2% 2% 12% 26% 50% 5% 3%2% 7% 5% 2% 16% 18% 20% 12% 19% 22% 13% 14% 19% 14% 40% 5% 2%2% 30% 20% 10% or less Efficiency Programs Still Taking Shape Data center energy consumption has attracted the attention of the U.S. EPA, has spawned a number of innovations in data center technology, and has elevated energy costs to a significant line item on many IT budgets. According to Gartner, energy costs for an 8,000 square foot data center can now reach $1.6 million annually. Despite these drivers, 60 percent of those surveyed have no documented strategy to reduce energy use and less than a quarter have completed an analysis of the efficiency of their equipment. 0% 10% 20% Already analyzed efficiency 40% 50% 22% Currently analyzing efficiency 21% Might analyze efficiency 20% Will be analyzing efficiency 19% Not planning to analyze efficiency Don’t Know 30% 13% 5% Analysis of Efficiency of Data Center Equipment One challenge organizations clearly face is the absence of metrics that represent a comprehensive measure of data center efficiency. Individual system and operational performance is measured using a variety of metrics; including temperature, humidity, power utilization, cooling utilization and CPU utilization. However, use of the most common data center efficiency metrics—PUE and DCiE—was relatively low. This reflects both challenges in supporting these metrics and concerns that they may not accurately reflect data center performance. 3 0% 10% 20% 30% 40% 50% 60% 70% 80% Temperature 90% 100% 86% Power Utilization 80% Cooling Utilization 70% Humidity 67% Battery Health 58% Space Utilization 57% CPU Utilization 50% Network Utilization 47% Storage Utilization 47% PUE (Power Usage Effectiveness) 33% DCIE (Data Center Infrastructure Efficiency) 18% N/A - No metrics being measured 2% Other 2% Operational and Efficiency-Related Metrics Virtualization adoption is very high (88 percent) and an astonishing 88 percent of those adopting virtualization have achieved the expected benefits, which include improved power and space utilization, and faster server deployment. Added complexity was cited most frequently by those who did not achieve the benefits they expected. Most organizations will not only be dealing with the added operational complexity created by managing across a physical and virtual environment, they will also be managing environments that include both virtualized and unvirtualized servers. Only two percent of survey participants believe 100 percent of their servers will be virtualized in the next three years. Less than a quarter (24 percent) had any kind of interface between the virtualization management platform and infrastructure management solutions. 0% 10% 20% Yes 30% 40% 50% 24% No Not sure 60% 59% 17% Interface Between Virtual and Infrastructure Management Platforms 4 70% 80% 90% 100% Too Many Tools, Not Enough Features The lack of a centralized management system that can bridge IT and facilities systems has resulted in a wide range of software tools being used—20 different software tools were identified in the survey. More than half of the respondents use software tools that monitor power and cooling equipment and track IT equipment, while only 27 percent have the capability to manage IT capacity. 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Monitoring facilities equipment (PDUs, UPSs, CRACs) 65% Tracking equipment inventory and location 54% Cooling management - temperature, humidity, airflow 53% Monitoring IT equipment operations 48% Help desk / trouble ticketing (incident management) 45% Monitoring IT equipment power consumption 36% Capacity management - power, cooling, and space 34% Tracking asset information 32% Change / workflow management 29% Tracking virtual machines and virtual clusters (domains) and their dependencies 28% IT capacity management - compute, storage, and network resources 27% Equipment maintenance management (schedule coordination, service history) 24% Tracking applications, resources used by applications, and users 17% None of the above Other 9% 2% Data Center Management Software Capabilities Naturally, the features most commonly deployed are those that are also valued the highest— to a degree. While only 34 percent of respondents had deployed power, cooling and space capacity management; those capabilities were among the most highly valued. A similar disconnect occurs with IT capacity management. 5 0.0 1.0 2.0 3.0 .0 5.0 6.0 7.0 8.0 Monitoring facilities equipment (PDUs, UPSs, CRACs) 9.0 100% 8.4 Cooling management - temperature, humidity, airflow 8.0 Capacity management - power, cooling, and space 7.8 Monitoring IT equipment operations (servers, storage, network equipment) 7.7 Tracking equipment inventory and location 7.5 Monitoring IT equipment power consumption 7.5 IT capacity management - compute, storage, and network resources 7.3 Tracking virtual machines and virtual clusters (domains) and their dependencies 7.2 Change / workflow management 7.2 Tracking asset information 7.1 Equipment maintenance management (schedule coordination, service history) 7.0 Help desk / trouble ticketing (incident management) 7.0 Tracking applications, resources used by applications, and users 6.6 Value of Data Center Management Software Features - Average Based on the absence of capacity management tools, it’s not surprising that 46 percent of survey participants responded that they cannot accurately predict when they will run out of data center space, power and cooling. As a result, they lack the visibility into real-time operating conditions to utilize more of their available capacity and the insight into current and future demand to know when additional capacity will be required. Conclusion The final picture from the survey is not just of an industry in transition, but of an industry moving forward—making effective use of the management tools available today, but still unable to optimize the capacity and efficiency of their systems. Efficiency, in particular, is an area that is lagging. While virtualization has helped the organizations operate more efficiently, most continue to operate without documented efficiency plans and are not using available metrics.They are, however, positioning to take advantage of the new generation of tools that will allow them to take the next steps in maintaining availability, improving efficiency and managing capacity. 6 Survey Methodology and Demographics More than 240 data center professionals and executives from a variety of industries participated in this online survey. To gain insight into the roles and responsibilities of the participants and the organizations, the primary role of the respondents, number of managed data centers and size of largest data center were tallied. 0% 10% 20% 30% 40% Data Center Management (IT and Facilities responsibility) 50% 48% IT Management / IT Operations 31% Facilities Management 6% Engineering 5% Other 5% C-Level Executive 2% Project Management 2% Role Not surprisingly, 48 percent of the respondents are in data center management roles, while 31 percent are involved in IT management and IT operations. The majority of the remaining survey participants are in facilities management and engineering roles. The “other” category is comprised of employees in multiple positions, including product manager/sales, production control/support, etc. 0% 10% 1 20% 40% 17% 2 26% 3 14% 4 8% 5 or more Not sure 30% 32% 2% Number of Managed Data Centers 7 50% A little less than one third of the organizations have over five data centers. Over half (58 percent) have one to three data centers. 0% 10% Less than 500 sq ft 20% 40% 50% 7% 500 - 5,000 sq ft 36% 5,001 - 10,000 sq ft 17% 10,001 - 25,000 sq ft 16% 25,001 - 50,000 sq ft 9% Greater than 50,000 sq ft Not sure 30% 13% 2% Size of Largest Data Center The largest data center for over one third (36 percent) of the organizations is between 500 – 5,000 square feet, while about 30 percent had a data center between 5,001 – 25,000 square feet. To put data center size in perspective, Emerson Network Power’s global data center in St. Louis is 35,000 square feet. 8 Emerson Network Power 1050 Dearborn Drive P.O. Box 29186 Columbus, Ohio 43229 800.877.9222 (U.S. & Canada Only) 614.888.0246 (Outside U.S.) Fax: 614.841.6022 EmersonNetworkPower.com Avocent.com While every precaution has been taken to ensure accuracy and completeness in this literature, Liebert Corporation assumes no responsibility, and disclaims all liability for damages resulting from use of this information or for any errors or omissions. Specifications subject to change without notice. ©2009 Liebert Corporation. All rights reserved throughout the world. Trademarks or registered trademarks are property of their respective owners. ®Liebert and the Liebert logo are registered trademarks of the Liebert Corporation. BusinessCritical Continuity, Emerson Network Power and the Emerson Network Power logo are trademarks and service marks of Emerson Electric Co. ©2009 Emerson Electric Co. SL-24639 Emerson Network Power. The global leader in enabling Business-Critical Continuity™.EmersonNetworkPower.com AC Power Connectivity DC Power Embedded Computing Embedded Power Monitoring Outside Plant Power Switching & Controls Precision Cooling Racks & Integrated Cabinets Services Surge Protection