Document 10984733

advertisement

- .".

I.

I-..--II--,:.

-"---,

I-.II- I-..1..-.

- -I..-..

,..,I.I.",.,---.,,-,I,-I---..I-.I

...I-7-,,I

,.-.-.. .I,:-II

--:I

--. ;,..,-,

", -,-.,,-i

.-..

,,- %.

.I..-.

-- I.-I.I

,,-,,.,t,.,-11,

,-,- ...-,

--., ,,

, ,:- ,-,,-.,

I -;

:`

,,I.

..--..7.-I.--,

I. ,-.I--,.- .,,I..:-,.I

,..

I,I--:.--, I.1-.

,;:

s,-i..

,., ;-.,-,--I.,,,.,-..I1.---I.

1,,-%

-,,

:-,

,- ,,I.

I ,..I ..-..11-I-,,,

-::,-..L ,--:,,I

I-,I.:",,;.11.----,,II.-.,.---.-....--.1

.,

-",I-. ..I,11

---,:.:-,----.I,..7----,:,,..I.

-,-,--,.,.

'.,, -I-,...

: ----- ,.:--I-::----.I.i-,--1:-1-,...: ::, : :. -r:---,.-i

, :"-..

'.,,--,-:,

,----.

-.,.-,,--m

-,.-.;,---:.-:,I,

.,,.II-,.

,,---"--Z

::

-I,

I-I-I.I-I,--I

--:--,

1-,

,--,-,,

---t;--11-. I-.I....

.II--.-II:,-,"-:---,-1-,,-;-,-1--,,,I...,,,.-1.--,.

,---...,.,,-.---------,,-,--.

,-.: , - .-, .--,-, -,--,,

-"

.,:"e`

:,,:' ,,

.7,;,w

..

..

.'-,

::.-;-.,....i,"-.

' :-'.

-' -,

..W ... !-I...-.,7

,---,

I,,,

-,,..-,-,--',

.,"-,::..,:--,,-:

-'.

-,-,,,.,-- ,e:,

,-----,

---,,

I ,.,, :,,',.,-.

---:-.I'..,,--,-_-I.

:-L4

----.

,--II

-:-,-- -.. -,-----' :--.:II,.I-I,,-,

.ZI,--.

",-.,

,,::-,

:-:-4, .:---:I

,,

-. 0:-I I I--ZIi.I

.

1 .-,: --- --.--.- %

.

I--,:,,r,-,

,-,,,,I,I !,---,-I.---;.-11:-.-..-I

,-,:x-II,--.-,,7-:

-'.

I--,--;,,,,-711, ,,Z.11!

----.I,,!':` '."

.i-,, :3..-.:-,-,-I

I,,,,_--I.:- .:

.-.

.,-..-17

.-,:--,..I,----IIII

,_::,,:., -.-,

;a',I.I---.

-.,,_

:%

-i,,--:.-;-:;-,

I1,.,,

..

Z

,----,..I:

,:-1,-.-.-:-- : ,,'---;Z

- ,-,,.-,,.Z,: .-," - _'-_.

,,---,

,-.:.

: ,-,:,:I..I,-11

-1,:-.-::

-_-.

. : :-Z

."

-1-,-i:I

I ,-,

:.-...--,.,",,.--! ----.-.

-4:-.I

WC

,,,,`., ',

7JT"..,.,...-.--,

,,.i.-.,-.:,,-I-',.

-.

,

,IZ..,

.:.q.-:--,-:-I----------,,-,-I,.-.,I.,.zI

-II-.II--I.-I--,,,-....,-,-.-II-I,--,,-.

.,I I

,-,-':',,-'.4

] :.:.

........,-7 ,':

,,IIIM-I---,--I"...

-.

.,

,,-II---1

,

----,-II---,--I1

--1,

.:-I,

,

-,

-,

-.

,,:.,,I,,

:I-,

,-,,.-- ,-,..-,-t,,

.--.

--.---,,-zi",,;.,,--;:I.. ---, ,--,

,.

,"

--.

.---,.-.

-,-T- .-,,11

-----,.

,.,

.---.

..

:II::..i

"-..

--.

,

-,-- - --.-..

--. ..,

-.

"

,".,

,-l !'.-I

"

, -,

"- -II.,.1.7,-.7

---r-,

.. 51

:-,,- -.

.:

r,-I- ,-:m.,

,,,, ,-1---- --,-,-,,-I-iI

Z.,,,--4-,.I--jIII-. ,-I...I

"-,,- --.

;

-k...c--7.

-,

,: 'I ,.I,:,-"-:

,...,,,;r.:---.

,.,,,I,-, ,----.-.-II1.,I.

..---:,1

I.-', --.-.

I. r...

,,---:I, .,

I,,---- - -I-..,,,-..,-,.

:-..

II:.- ,-,: ,:I..-I.-.I'-II%.,

-,

-.;.

,.::.1..;-- ,: -.

;,L:1-;

-:. -:.",..,-:;

,----..i.

7 , .I:I.

,:.":

:-.-_

..,,1.

::."..--r",."-z..,.,

-: ,.,,---,,,::,I

.I,-I,.-.--,

---..-,:

--. :,,:

.,.,.

.,

-,, ,, -,-'-.-,,,.-,, ,:,-:,-,,-,,..

,-.t--.-,I

,I.,"I ,.:.,:

,., ..

,..I,

, ".

-: , - -: r,,-. ;,------,.,..--.,o

. ,I:, .,: 4.1

-,! -,,,

,;;---'.,:..

---"-,,

:

..

'i,-I-,

,,,,.7,:-,

-,

.,

,,,

::,:,7------I,,-::.,----:

I .I,

--I.

,--.

..

I.,,

-,..,-iI:'.

411.-I--,;:`.

--I..

-,.-7

.----:,,.,,

' :,-.-.

.',,-.-,-: --.,,---:, ---.

,-'. , -..,, ,-;--.,-.

...,,"-.".:iI-11

I17.."---,-..,:,--.--.I.

,.-I-..:.,,1,,,-,.,

.-------".,

A

:", .-.,-.,..I.,I:,

'.--Im

,-- .,--.

-,,..-:

,I-.,-1I:---.-.;

: -II..-.1-,I.-II -..

:,.,

-.I-,,::,1.

......

1.,N-M

1-Z"

-,,L:-..-7,,-,..,

-;--.- ,-.

,:- -: I':.-.-I

.--.':: .,..7,-.

-i,-,,..-.I,

,---I.,-.-,-,

!",.-,"I

:I--.

,--.--,,:: -:

I--,,-,

-;;,,.,oI

:1:-I

."-t,--,-,

----,

-::-,

.-,-,t,,.---,t

:.,I,.

,I,I- -, -,...-11

-:-,I-...I

:-f

I. .I- ..--. --,.

--.-: ,.-:,IZ"I

"",-..-,,.,--,-..

; -,--,--.I

-.. -.,.-' ...--,, .--;I,....

.I

-- ----,,,I

` ;'.II

-.. --,,..-,-I-I.I

,

:- ........,,,I.-:

- , -t.".-:;,

.

.,.d..-.

:I.

."

- ::l:- ..,

-. -,;..-1..,.I

,

:--.I.-:-,,,..,-:

,q

.,---.:I-.,:-_,'

1..---I-.--,..,..:--.:.:-11c-I

,-....-.-,

---.

,,-,,, ,..---,. .,.,:

...

,

, --.

.

,-,,,

-,II.:,--7

--,

,-:_

.,,.-,

-,, .,I4,.,-.".,...--I--.

-,-.

,

":.- -,;,_;

'-,.

-,

-,-.i.1.

, :-.,,-,,',. .-",- .1.-.:. -_","...

-I

-I,.:.,'.,1,"-I,--...-II-:r".:

,.II--,:."--,-I,

,,.,.---,1:'.

,-.1

- ..

.--..

-,.,I.:,

-1 '-.

II.-,- -,---, ,-'.I.-,,.

-.

I

:

.

-;-,"I-I'.,-,..:. .Z,I:--.,-,q

,.I-..,

:,,-,: I----,, :. , 1.,,, ,-,,.-a',-.F:',.

,.r%".:;.,,

-!- ,-.3 -'-I::--,--,---,I1.,:-,-.,.,..;,!,

,-'.

, ,.- .1,- I..

.--'. ...-:, , --.; ,-1., ,,-,,,,- ;,, :,,-t, ,.--.

;.,,.,

-,I

;...-..,'.

".

,' .-,:..

,.:,..-,,-...I-.

,I-,-:

,-:-.-"--I-I.I,'T

..

,::::':'

.. I,,t%,,.,,.

"

- ' : -.,I,.

..-.---..-,,-,-,-,.-!

---1:

-,.:-:

Z..I.I1.,,

,:I,,I,-,,. , , . .I--:-- a ".1: ,

,,,,,-.,11..I".

---;----,-,

,

.

--,

-,

!',

:7:

,

-, :;',,.--, -,;I

.,- -;, , .----_-1

,....:

-,,,,.,.,I:-.:,..:--...

,, ,--!:",-,,,,.-----,-..II.,

.,-,,,..e17-.IiI----,-..,

,,:-,-.

.- ...-.. "

;,

"---,

1,

, :,

-,,:-.:. t

.-.I-.-II.

-: ..II :.r

,I--.,

I.,-..7

1":

-.

1,

:'-,..,R....--.

-..

.z,.,."--,-,-,--:,-,.Ic:1-,,-,;,--,.,I,.

I...I-..,I,--;,,.- ,. ,,:-f. -,--.,

--:',I--:-,

."x,,. ,.,-,,1..--:1,:-,.-.-".,

.1--.--.II

I.,.I..

-,.,I,-I..-...;--i

.

I ,..:

a-- .m,i.,,iEML

.

-- it,--.

7.,.I

-..4-::

-,

,.- -,,--::,:, .

.,

,.

, -I

-:!:, -,,-E-I-.M

'..-1-4.--I&

,

,--"-, ..

I .W-.

," ,--a

.,,,,

.i,.--I

., ,-1

,.,i

,-.-.-I:

. , L.: I-'.,

,,

,

,..-'---:: --,,-.

1---,.M

..

1.

:,-.,-,,,i, rd ,b:,T,.-':I-,---:-,

-!.omw

-I -.

- -II'"

, "1". IF",-1.1',:'u

- I --..-1.I,-,----'i,,,

--:

----.-.

.--

I.:,,,.

-- .. I-

I -, I -.,. --.. :-,j-

...

-,_

-II

'...I.

I Is:

_:I

,,-:.

,- : i.::-.I

I .---...

,:,1-.1..'..-:,.--..,-,

,-.,I-,

,.,,"-..

.,.,,.

,.e, tI

', I..,

".-.

,,.

:17,,LZ..,----1,I..II.

---..,

j-.- : ,.,...

-.-.

,,

,` .,L

-, ,-,

, -,I

'.

', :!-,..,-,..I.TI1t,.I

-':I--I:-I

.3--.I1, -,.,

,'i.

.;. .-I:I-I.-I

I -.,--.,.II

--"

-..-..-,-:-I--.--,-_-,-.-.,:---.

---, --,:.,--I...%-,III,,7

,.-- ..,.--.-.

I,

'.I,--_

-'-I-Ib..--,;,%II1:7-I.-,,--,P,,7.

:._

,-,-,''',,

.,-,II

I -I-,

-I-.--I,...,--- -IZ-II.--;

II,-_

-,-.t ,,-.I-.I---.r

:.,:,;II.

-.,.-,.I-;,

..

-,I,..I.,,:",

I-1.I,.I..,-.,.--.I.I.;!;.

, .:.

,.:iI

,L

.,-.---I.-,IIII--I-1.,,-1

,---I,-;,,

-,..

,---,

.I-. 5,--,-,-,,,-,II,I-..

-..-. II-,--I II

I- --,--,

-..

,-e ,,-..:

I:-.-;I--I,,,,1,I:;i

,

-I.,

.I, :. -,.-I-:I

,,.I-II,..II--.-,,.,--I.I.-.

,- ,-L,;--; -,-I ."1,-I.-,,

II

,..-.

L.I---..:::,

,,,

-3-'-..I:7-:-.-I-.::f..

I-1::..I,

,-LpI:

11

I

.:.

.--,-.,--.---.---,,I",.

,..,.-.I1..,-I:,:

.-.7.;

-. ,----.--,

.-.I--I--I-.,I

--,

.-I.:

,I,---:1.I.-,.-..,----'-.-------_

-,.,,,I

,.t....:I .I-.

'...

.- -.-,

-, I-..

2:%--.

.

,-;:,.

.s;,.-t

.,,"

,

'

.

,.-,--,I,

--,-..."1:L':''';

,.,;w-,

,..-...I.-..

I-,,.

,.:I----:-_L-::-.--,..I.,':-:.,.,,---,.,

,:

..

,-j-,

---II--II.

,.,I..I..--I-1-"

.---.

-,.-,II..-,,I'--..I-I,..,_-.I-1.--,,.-11-.--..-.II-III

I-.-.I.I1..-.,I.

I1;--,.I,--.,,;I..,

.-..II...-I--II--.-.,.--.I..III---.

--:,,.I.,,,-.,-,..,.I----I.I-..1.

-..

- -..--.....:71

...I

-- ,-II-,

11I.-I.

,I.

I.,.,..---:,,-,--...

-,,.-17

I,.-,.;,.ILI-.1--:-,:.--.-.-...;. ,;--,::.-,.--.-;-.-,.-I,

".,.-i;--.-II-.--v

-.

:-...,,

,--.-,,,-"..

'!:....,I-.-I.,...

.I-1.-:I`:

.

.--,-t--m,-,..,-;,,,-,

I :-.--%I.-Z.---.-,.

."-.- .r-,-.

:,,---.-,..,

-,:I-.-..It

.--.:..i- ,.

.,---.,--;

.,LI-.I,

I..-.-I-.

1.I.I:I-:-,,,-.

-1..

,-.,

.. III.,,IIII..-----,--..,.,,-;,, '-,-.II...,

.,

.,

,I---I,.-.

.F:..I ,,,,.

s. 1.-,,-,I-3

II.

1III.....-I..---,--I,,,-f--i

,

--. ..,IIL

,,.:.I

-;.,,,-1.,I,

II-,---, --.

_,:

;,,..,----I

:-1.,-,"--....,

;--,.-I..-Z-.-...:.

..o.,,I,:-.

.,.-----I-;,,

,-1;t. 11II

-,.;., -d--I;,II

:,:II,--..-:-IIdI.,.--IIx..--L-,-IZ.,.I,.,.,.---I-.-.w-,-1:P..,....--I--,,:

I-,, I-:I...--III...,-,.r-,

I.,.

-:i.-I..-:,.

,.....,,-,-,

..

I :, .

o-,..

IwI::

:,-mI-,i

-,.-,

..

.,

,-,

.II----.,.,,,.,--,

..

--..,:

--,-.--,---"I

I,,,'...----.

.I.I--.-I...II.

-.,

:

.:

,II,--.

,-,

.,-I.

,.,..,,

, -,--I-I.I-,-.-..,J.-:

-- I,.

C:I-_-,;:-I-;..-,:;

,,:.-1.II--I1..-:,

-1 ,I::.-:-.;-_:,,

-,-,

I-.11..

,--.1IL,,

.I.I.r,-.1--II

,... -..'..,..,

-:.-,-.

,-I.,-.

.-.

.:,I.--.,,

-,-:,-- :.

7,-,

-I , ;...--..I.

,t'I d-,,,,

-.

,- e.z,...

-,.I,..-.--..,%,

,

I.:,,,-,,II ....

,,--.I--,.

I.7.-I,-,.I--Ii,..

..

,I,.,-,-.l,,.

, . .

I"i'.,:.-,..

7I--..I..qI.,-,,,--I.-.-,.,-.:-.,..---:7:

.1.-.

,,!iwl :1.,I.,-..-,-,,

`,II

L,-1I-,

,7.

I ..-,.--I,---I...m,.IiI

,,,..I"

.I.

IW...'_

.1..L..

-I,II-..-.Z,

I.,.,-,,,,.i

:,,

I'. I,

L:-::,:

...-.........I..

I-,.II,--w -I-,-.

.

,r,,.

,-.

-:"

.

I'...'

...

.W

7i-,-..I

..,.,%I-1,I.1I-%-.qI-1..-.'.

-,t-:' '

.....

-17-.,,,,II..--I

li i.:I--"I:,

I.,I'L,--..,,--.:.".

--,-,,,:.:...1I-I-IZ

,,.7---'r1.

,-I,I17

1- -,--,

,,---I-,

,,I-.I-I-.

-,..I.r,,,I.v-,-,;11".,,.-,,I.,;-11.-.II,,::

I.I.

, , ,;. I.,.,.,:-;.---.-:-,.---.I..-II-I.,-,II

''-I

,-",-,.-1,,-.-...

I,.

-.

--.

I, -.%:I-,,-,-I-, `,:---.1..1.,.II

,2.--:I I,e..,,II-1,II--I..11

-I:.-.-I-r-,-i:.

..L.-,,,.I-...,I.I

Is-`11.,

-1:-,.-I-IZ.-I.,

,:,I:

III-%,.,,

-1

,,:,,

,.i,f,

`,.:,:-I--,

",-I

-,

: ",-..,

-.-....i,--T-,-,

,

-.-I,'I

" -I,

::

I-I,I-.,

L'-.,

-,

,.-j-,II....-.-:---..:-,----,,

,-,L,

,.".';.-:

,-,,,"...

..--.:,IIj...-.---.

-.:,

..L-I..II.-.."-r-I.,': --.,

f..,,I..-.I.-..--,- : ,--,!r

..-,

-II"

:I-11.

".-.. -.

-I-r-,..-.'.I-,-I",-,-.

,-_."'Z

'.

--.-,.,,-3

-,

I-.,-...-...-.,'...

-I.I

-M._.,,

%.

...-,:

.-1 -,r..I

It..--I.I,., ""--,-.-Z-:I...--,.Ir

"i7.

F-Ii

- -"-Z,-. I - I

;17L;-:'

...

I:- :..I.I

.r-.I

-.-I..,...

,I-I.%

,...-.

--,

t--"-:I.

-,-.,'.-_.

il,-I.i-;iI-,;7--- .-....

.1::.:

I-,_.

,.'

,I LI.--.

..

,,,II-.-.

.

-,-,

---.

p,,-I.,.I.-:.,Z. .,,-I-I.I-,,

--..

--,.I,,,E;..--I-I

:1.1

,

I.I----jr

1 .--,

-.I -I.IIt..I.I.

mr.,PI";...I-I,--,-II.-.W.Ir-:

.1

If

.,..I

L.

,,-L'.I.,-.

I"

.1

.-,

I,

i;

-.---rIn.

,

I

,."-,,-4...-',---,....1,--.'.II-t

r,. ,.,I,,...-,._"-I..

Z.. -:

-,,:I,.IIW.

I

,

,.--..--I..

.....I.II-I.-,

-,I--,.

-,I:it.I." .,,,

-:-:,,,-I.I -,I,-.--7

,----,,I

I .,-I,.I.

..:...

-.- .

,,_,,,,

,II-.ZI-.-I.

I , .,,,.-II,

.I

,i ,- IW,,.--.,

. . , : ".1-, r..-L

- -..--.

,,,.

.,-,.

-1

-.-.Ik-1

,

-,,

.

.I.:

.I..I.r-,Z-I

-,.I),I-.I-.-.-:I

'I..,--,,-"-:1"',-.--,i,,.I-':

1'..,:-.II

7 ,.:,-..,.:.

,':':o

-.'',:-I..,.---..- ,.,---.-- -.- ---- ..:r, _rI:

.--L,.':' _. -':.''

r '-...I..-,-.

: 'r

,'--.

,,,.:r--I.---.,I- .I-...I- ,.'-;:I.---I...-.

.'-.--,r __

__._._._. . _ 1. "_ _. ,-r

I1.

,I.1

,.

.-.1 ,,,,_.

I--..

I".--..,j

,-,-1II

-,:1,"-,,

I,.-.-,.,:,

e, - ;II",--,.,

,.

..

:.I".--,11,.-.

, i:-:

, ,I:,-,-_.,.I.",

...

'I...,"

,::--'

1..III.-;: ,.%:

.i

:,

t

:

--,,.,-,.--,,.

.-- ,'

II,r,.,,- -,.rr- ,

- ,:

-.

-..

:

-. .,:

-.

:

'L

-:,r

,

;:

. -" .q.

,:%,

- .'

,,i

.. I :- '-"-.,P..

,m:.

r.11-.

'

,,I.-,-IIi--..I

'Ir7-7'-'

;,,-..

.-..

.,:.,,

-.1..:

-,.r

-.:.-.--';-'I.,.- I.---,-,rr

-I

:r :-- -.-.

._-I

4.:-.I"

I-I.I.o.

%.,II II.- ,. I- I.-,I

.i.

,II.-I.

-II.,.I_,_..,

''r

,

;-'Z

-.

,

..'

II

)II7

..

-!

IpI..

:.I

.--:

,.. I I- ,

--1....

... rII,-IIII.

..

-..,--r

:,.-i

' I- -J

,Z;,r-.-,---,,I .I

r'.I-I: .1;. , -j,"'.',- , - , ,,

-I. ..

,

- . . -.

'.

.

z ",- - -. : . .

,"

-,-.I, r :,..I I..-L,I.,,-.

-- x:,.-I------..I,:-,,..r

I.I-,--T

rII.I.-.

, .7.:j,.I.I..I7.-,, . - -.

I. 11

,.,.-;,--,

-.-q.I--,,

,.,

-.r,

2

.:.,I-1

I,.,,r

,.--:.

-,

..

.::-1-I.

,1,,r-1.

II

I,I_-.:.-r'-,I. ,

-.

,.I,.I -.

I FI ,,,.,:Ir-,III

':-..

I .. ;, -.L

.I-:I::

r -,

---'.,,.-. ':'.r

-,

"','..'

.W-...I;III.

,: -,:

----.- , L--7-,v "':,-,-.,-,.--,,'.

-.

rI.-.,,:

-_I.,.

- ;I..,I,,..,,4,

--I-r,,o.--,.-.

:'.-I 1.-2-I

,-,,-,-.1

,

1,-r.4,

,,LI..;,,.-.-.

---.,I-I

:..:,

I.I.P.,:--,:_.-.: ..--:i,

,- -.---- ':

:,,.-'I.

"L.:-,"

I:,--.

-,.

r, :,...:-,,".--.

I.,I...

..t- ,I

.:.1:..,I.-,.

.r-.

-I..,I..I

:I,,

,,:-1.

r.,

-r-wII-:.I--1, ..,I.- I,

i.,1-1,%,"I.--,.

,

,-.,. ,,,--.

I -.-.

-.

-,--I

,.o,,-.r-1

,"

,,,--tbi,.r-I.,-,.---11..

.-.I.

... I,I....:-,,.r..

.,

I,".

I-II.

-".1.-I-Ii-.,

:-, '.,-,-.-I-'I

'I...I

_.! r,'

-".1I.:,''r.,Ir-.-I.I---.I--_L.

""

,,r, . Z.I-I,

__;'.-.,I....

_-,,-,`,.

I,,-:.

...

P.-,

,,: .

.'.,I..I-..::-'.-,

-_ r,'-:

,:: .,,,,III,.

-l....-I---"_I-I.-%,.II-r,:I,1.7,LI,;

-:

r::

IXI

-j_

..

.,.,I-:

,

:

.II.I.,..-II--I.--I

:,.

.. t...-,I

:.

,.q.:.;,I,:..Ir

,

_1I,

-r1.,`,rqI-- ..:,I-:.-.I I.-.Irl_,,...

..--.-I,I-11

,-II-,..-I.

-` - ! . I-,.:7,--,...rr

11-7-i-,..,..-_.,

',:

,..

,.III.1I-.-II.:-LI"I

..

.I

L-I I.I II.,"

. ,,II

jI.%I.,II...,.-i,

-- III -..---.

11:-, ::, .r-:,:

-III..,.,

.--,-I-,

, ...,..,I-11:",: ,: ..-I.II--II-.,.,I..II

-': -..-I..-Z.I.

.

I-- 11--.I.I-.I.III.II

.-,L...I--,,:.

-,---:

I-.,II---.-I-,i...-_

II-II-....

.-.

.I-".,:, -;,,

,,,..-,.-III:,r.

!;,--,-,,,..Ip.

"-- .,..-_I.L.. .,----'::-,,,.,:

, p--.:

':7 - :r' .:.

.--:I--t,I:__'.

.I -II.--,I__.

11

-- - -f-,,.

I:-!-,-.I'..Ii..-.I-..-,-.-.I1..-I:'...

..-.

- .. I IiIx..-.

I.

1.r..

.I.I, -cjII

,: ,.:

I ..

IL-. --IIII,:I.-I-.rI.,-iIII

,.:Ir...I,..,-.i.-..1%.

..''I..I--,I :-.II..,..4r.-.I..

Ir

:r

,_

'-,.-.-II.I._.r-,..III.-:',-_r-'.---.-.I.

__,_..-..

_

-I

.I

:..II...-.-.:--.

.-r

.,,:--.I.1:.I,..1.I11

III.,i,

..

I.I,,--.rl-,IIf.

---..II..,I1I-.II-...--. I.,I

,.,.-;.I.I-.

,-IIr..

I.

.-.

I.I

-II-III

Ir.:,i-,I.IIoII.I,-..-I. ,."r-, -I-I.IIr..--,,,".:,.I

-,...

-I,III_:....-,...--.

:....-..,

,,

-!..--.1I-I..I

I .I

I-,-I.I.:,

I .---.I.

-:r..,

.Ir,f , ,'.t:.,

-.I..--.-I.IIII...-II.;,

I-,,,I.,:,.

-Z'..I-- -:I-.II-,IrI.1

,II.

".I

,,:

; , ...

I.r-,.I.I

-..

I1..-II

-,...-..I-,:,

,.....II

-,-:", .I'r

,, .,......I..II-I...I-II...,rI

.: -: --1.:

-.I-Ir-.r-.1

...

-- ,II.rI

"r--r.I

.-.II-.

I.II,:.IiI

-I-I.-III-I--::_ .IIr-.--r-..

.-mI--.

..

r_,,,: ,..X

-1.

..II...I...i,..I.-.I,;

-]",.: .,II.

I--.Ir...,.I

Z ,-I

-. ...-.

: .. II-.77.II.--...-...

.-1,

: :I

...I-I..:

.III

IT,-.-,I

II

,III.-I:-..-I-L

.,I

,,

.,,,-.,4,...I-.III.I..-I..-II-I'I

It,I...,;7I-,.-II-.1

I.-.I.,,,III

I.I-I.I-II.,'r.1.,.I

-.I.-I.-....-III,

.

-Lr..:I.--.rII.-.

.-...-.III,I1.

-I.I-r--I.-I..I.

rZ.Ir.,-1._

,r..,.-r...-I..Ir.I1,.r-..-.,I

Ir

..I

.-..----...

I.

.II:-,..-.I,,,

I-,,

..I,.-,,--.71

'.I.

.Z.I7..-:-,

.T,..1I..I_I.;-I.I-,IrI

,,.I%r:'..

,,-.-.

.,.. -I.1

,,-.--..;--..I..

-':,

I..I-1.,..L-r..

I,..II,.-I-.I

I.III-I

-.

,-,--I.,:.:I-.,.-:,--Ir-I.-.

,-:

,.I:.I-,-I.::.-..L.I.-.

--..

,-I-.:I.-,I-I..

,,.,-3--

::

:....

.'.--

-.

-. I..

o r:1

I,.-,I-1r-..er

pap-.-

". '' :-,: ,,:'' -..-..

, -.' , ,-,--

STEEPEST ASCENT DECOMPOSITION METHODS FOR

MATHEMATICAL PROGRAMMING/ECONOMIC EQUILIBRIUM

ENERGY PLANNING MODELS

by

J.F. Shapiro

OR 046-76

February 1976

Supported in part by the U.S. Army Research Office (Durham) under

Contract No. DAHC04-73-C-0032.

ABSTRACT

A number of energy planning models have been proposed for combining

econometric submodels which forecast the supply and demand for energy

commodities with a linear programming submodel which optimizes the

processing and transportation of these commodities. We show how convex

analysis can be used to decompose these planning models into their

econometric and linear programming components. Steepest ascent methods

are given for optimizing the decomposition, or equivalently, for computing

economic equilibria for the planning models.

1.

Introduction

A number of energy planning models have recently been implemented

or proposed which combine (1) econometric submodels for forecasting supply

and demand for energy commodities as functions of the prices on these

commodities with (2) a linear programming submodel for optimizing the

processing and transportation of the

commodities.

Specific models

include, for example, the FEA Project Independence Evaluation System

(Hogan (1974)), the world oil market model of Kennedy (1974), and a

proposed integration of the Brookhaven Energy System Optimization Model

(Hoffman (1973)), with econometric models developed by Data Resources,

Inc. (Jorgenson (1975)).

The models are equilibrium models because

prices, commodities supplied and demanded, and process and transporation

activity levels are all variables to be determined simultaneously in a

generic time period in equilibrium.

The equilibrium conditions can be

interpreted as necessary and sufficient Kuhn-Tucker optimality conditions

for a related concave programming problem which has its own interpretation.

The purpose of this paper is to discuss how mathematical programming

methods can be used to decompose

and solve the concave programming

problem, and thereby the equilibrium model, into its linear programming

and econometric parts.

The linear programming submodel

communicates

with the econometric submodels by passing to them vectors of shadow prices

on the energy commodities.

The shadow prices are optimal for the linear

programming submodelwith fixed commodity levels.

submodels compare

The econometric

the shadow prices with the vector of commodity prices

required to produce the fixed commodity levels assumed in the linear

programming solution.

If these two price vectors are equal, then an

2

equilibrium solution has been reached.

Equivalently, the equilibrium

conditions establish optimality of the prices, commodity levels and

processing and distribution levels in the implied concave programming

problem.

Although we will focus our attention on the analysis and solution

of mathematical programming/economic equilibrium models arising in energy

planning, the approach is appropriate to similar models in other areas.

Included are agriculture models such as the U.S. energy sector model of

Hall et. al. (1975), the world wheat market model of Schmitz and Bawden

(1973), and the water resources planning model of Flinn and Guise (1971).

The plan of this paper is the following.

Section two contains a

statement of the basic concave programming problem to be analyzed,

plus a discussion of how it has been used in energy modeling.

The

following section contains the Kuhn-Tuckeroptimality conditions for the

mathematical programming problem which we interpret as economic equilibrium

conditions.

Two of these optimality conditions cstitute the interface

between econometric forecasting of supply and demand for energy commodities

and optimization of processing and transporting of these commodities.

Section four discusses decomposition methods, based on the optimality

conditions, for computing an optimal solution to the concave

programming problem, or equivalently, for computing an economic equilibrium.

The final section, section five, discusses a number of future areas of

research.

Strict equality is not required between the shadow and commodity price

for a commodity at a zero level.

3

2.

Mathematical Programming/Economic Equilibrium Models

In its mathematical programming form, the basic problem we

wish to analyze and solve is

(la)

+* = max{f(d) - g(s) - cx}

s.t. Ax - s < 0

(lb)

A x - d > O

(lc)

s > O, d > 0, x > 0

(ld)

where f and -g are concave differentiable functions. It is assumed that

(1) has an optimal solution.

The vector d is the demand for energy

commodities and the vector s is the supply of these commodities.

For

reasons that will become clear later, we assume that the inverse

functions -Vf1

and Vg

1

exist on the non-negative orthant.

According

to the inverse function theorem (e.g. Apostol, 1957; p. 144), Vf 1

and Vg 1 will exist on the non-negative orthant if Vf and Vg

have

continuous first partials and non-vanishing Jacobians on that region.

These assumptions appear reasonable for our model.

As we shall see

in the following section, the econometric specification of f and g

will actually be given by Vf

and Vg.

For the moment, the intuitive

justification that f is concave is that the social benefit f(d) due to

satisfied demand d increases monotonically, but at a decreasing rate.

Conversely, the function g is convex because the cost g(s) of delivering

the supply s increases monotonically, but at an increasing rate since

the less expensive quantities are supplied first.

The Project Independence Evaluation System Integrating Model of

the FEA (Hogan (1974)) is a U.S. energy sector model for the year 1985

rery similar to problem (1).

The supply commodities in that model are

coal, oil, gas, synthetics and imports in different regions of the

4

United States.

The commodities demanded are the same physical

co)llmO)d it i'S for in di,it rin

l,

(ornmerr i;l I nn

different regions of the United States.

resit!dent nl use, again in

The FEA model also considers,

at least implicitly, cross cut constraints of the form Bx < b involving

scarce national resources such as steel and capital availability.

The

world oil market model of Kennedy (1974) is an equilibrium model derived

from a problem of the form (1) where the functions f and g are quadratic.

The Brookhaven Energy System Optimization Model (Hoffman (1973)) of the

U.S. energy sector assumes supply and demand in problem (1) are

exogeneously set, and the objective is to minimize the cost of processing

and transportation.

There is a project underway to combine this model

with the interindustry economic model developed by Data Resources, Inc.

(Jorgenson (1975)).

It is hoped that the methodology discussed here

will aid in that integration.

3.

Optimality/Equilibrium Conditions

The interpretation of the Kuhn-Tucker optimality conditions for

a variety of economic models as the embodiment of market equilibrium

conditions has long been recognized (e.g., see Karlin (1959), Intrilligator (1971)).

These models are generally theoretical and the optimality

conditions are used to study existence, uniqueness and stability of the

equilibrium solution.

The difference with the energy planning

models discussed in the previous section is that they are empirical

models consisting of two distinctly different types of submodels which

need to be hooked together; namely, econometric and linear programming

submodels.

In this context, the Kuhn-Tucker optimality conditions

provide a practical mechanism for integrating these diverse models.

Moreover, the purpose of an implemented energy model similar to

(1) is to provide numerical answers.

The optimality conditions are used

in the following section to derive decomposition solution methods for

numerically optimizing problem (1).

Let p and q be vectors of shadow prices on the constraints (lb)

The optimality conditions are:

and (lc), respectively.

The solution

s, d, x is optimal in problem (1) if and only if there exist shadow

prices p, q satisfying

Vg(s) - p > 0

with equality if si > 0

(2a)

Vf(d) - q < 0

with equality if dj > 0

(2b)

-1

-2

c + pA - qA

> 0 with equality if xk > 0

(2c)

1-

(3a)

p(A x - s) = 0

-

2-

-

(3b)

q(A x - d) = 0

1-

-

2-

-

(4a)

A x - s <0

A2x - d > 0

(4b)

s > 0, d > 0, x > 0, p > 0, q > 0

(4c)

The connection between the econometric forecasting submodels

and the linear programming submodel is effected by the conditions (2a)

and (2b).

To see this, let u = Vg(s) and v = Vf(d) denote vectors of

commodity prices on supply and demand, respectively.

Then if s. > 0,

1

condition (2a) states that ui = Pi; that is, the commodity price

for supply commodity i equals the shadow price for that commodity and

they are in equilibrium.

If s

= O, then we permit ui > Pi because a

6

further lowering of the supply price on commodity i would not induce the

supply to increase from 0.

A similar argument holds for the optimality

condition (2b) on the equilibrium between prices on demand commodities

and the relevant shadow prices.

An equilibrium interpretation of the

other optimality conditions is well known and straightforward and is

therefore omitted.

Note, however, that this interpretation does not

depend on the sufficiency of the Kuhn-Tucker conditions due to the concavity of f and -g.

If for some reason these functions were not concave,

then some solutions to the optimality conditions might not be optimal

for problem (1) although they could still be interpreted as equilibrium

solutions.

Thus far we have not considered the computational and empirical

consequences of trying to establish the optimality conditions.

Before

entering into a discussion about solution methods, it is important to

emphasize that typical econometric submodels are designed to compute s

from u and d from v, rather than the inverse relation as we have stated

it in (2a) and (2b).

In other words, the econometric submodels consist

of the functions Vg

and Vf

d = Vf

(v).

which are used to compute s = Vg

(u) and

This implies that in order to hook up the econometric

submodels with the linear programming submodel, we must assume that the

econometric mappings G = Vg

1

and F = Vf

-1

points to give us the values of Vg = G

can be inverted at various

-1

and Vf = F

for use in testing the optimality conditions.

at these points

This might be done

functionally, or by some iterative procedure which exploits the

-1

monotonicity and continuity of Vg -1monotonicity

and Vf

7

4.

Steepest Ascent Decomposition Methods

In this section, we discuss how problem (1) can be solved by

decomposing it into econometric and linear programming submodels.

For s > 0, d > 0, define the function

c(s,d) = f(d) - g(s) + max - cx

Alx < s

s.t.

2

A x > d

x >

It can easily be shown that

(5)

.

is a concave function.

(s,d)

Moreover,

it is continuous, but not everywhere differentiable on the convex

subset of the non-negative orthant where it is finite.

programming duality (ruling out the case that 4(s,d) = +

By linear

since (1) is

assumed to have an optimal solution, but permitting 4(s,d) = -)

4(s,d) = f(d) - g(s) + min ps - qd

s.t. c - pA1 + qA2

>

(6)

p > 0, q > 0.

We assume the convex polyhedral set

i ={(p,q)jc - pAl + qA2 > 0,

is nonempty.

In general,

p > 0, q > 0}

(7)

will be unbounded because we expect there

to be s,d combinations in (5) which do not admit feasible linear programming solutions.

The issue of infeasible s,d combinations could and

8

probably should be handled directly in our subsequent development by

r

r

the generation and use of constraints of the form p s - qrd

rays (pr,qr) of the polyhedron

.

>

0O for

For expositional reasons, however,

we choose to eliminate the possibility that

is unbounded by assuming

that we know a value M > 0 such that all p,q satisfying the optimality

conditions (2), (3), (4) also satisfy

P+

i

M

(8)

j

i

The addition of the constraint (8) to (7) bounds the dual feasible

region and implies that for all s > 0, d > 0,

p(s,d) = f(d) - g(s) +

t

t

min

p s -q d

t=l,...,T

where the (pt,qt) are the dual extreme points.

(9)

Of course, the addition

of the contraint (8) to (6) is equivalent to the addition of an activity

in (5) that permits a feasible linear programming solution to always be

found, but possibly at a very high cost.

The original mathematical programming problem (1) is equivalent

to

'* = max

(sd)

(10)

s.t. s > O, d > 0,

where

(s,d) is given by (9).

The solution of (1) by solving (10) is

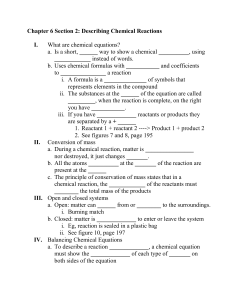

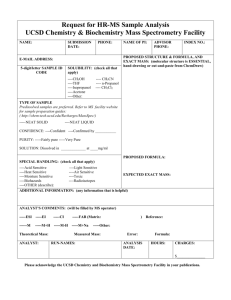

a decomposition approach which is illustrated schematically in figure 1.

The computation alternates between the linear programming submodel and

the supply and demand submodels.

A feasible solution s,d,x, to (1) is

generated each time the LP submodel is solved.

As mentioned above, the

9

Fix initial values

s>O, d>O

.!

s,d

.

k4

LP submodel

, .

.

_

s,d, fixed

compute p,q,x

q,d

p,s

-

_

L

if

,I

.

I

_

,

. . .

supply submodel

demand submodel

p,s fixed

q,d fixed

compute y = Vf(d)-q

compute a = p-Vg(s)

.....

.

CT

y

/,y satis

;

optimality

7

Yes - terminate with

optimal s,d,x

conditions

(,

No

-·J

_

,

ascent step

use a,y to

change s,d

.

_

s,d

Figure 1

10

manner of computing a and y in the supply and demand submodels, respectively,

depends upon their structure.

If (o,y) does not satisfy the optimality

conditions for problem (1) (equivalent to and derivable from the optimality

conditions (2), (3), (4)), the s and d in the LP submodel are changed by

taking an ascent step with respect to the function

(s,d).

The steepest

ascent approach to large scale linear programming decomposition is

discussed by Grinold (1972); see also Fisher, Northup and Shapiro (1975).

The algorithmic approaches to be discussed below use the same ideas,

but our main reason for decomposing (1) is to overcome the incompatabilities of

econometric

and linear programming submodels and their realizations as

computer systems.

Steepest ascent

decomposition methods use concepts of convex

analysis which we briefly review.

Rockafellar (1970) gives a thorough

mathematical treatment of convex analysis.

Its relation to decomposition

methods is developed in detail in Shapiro (1976).

of

at (s,d) is a vector satisfying

p(s,d) <

(s,d) +

(s-s) + y(d-d)

If there is a unique subgradient of

of

A subgradient (a,y)

.

for all s,d

(11)

at s,d, then it is the gradient

Any subgradient at (s,d) can be tried as a direction of ascent in

maximizing

(s,d) because it points into the half space containing all

optimal solutions.

The difficulty with this approach is that

may not

acutally increase in a subgradient direction from (s,d) although (s,d)

is not optimal and the function does increase in another subgradient

direction.

11

The difficulty due to multiple subgradients can be overcome by

procedures capable of generating, if necessary, the set af(s,d) of all

subgradients, called the subdifferential.

Define the index set

T(s,d) = {tl(s,d) = f(d) - g(s) + p s - q d}.

Then it can be shown that ai(s,d) is a bounded convex polyhedron with

extreme points (at,yt) = (-Vg(s) + pt, Vf(d) - qt) for some of the

t

T(s,d).

The Kuhn-Tucker optimality conditions (2),

be restated as follows:

(3), (4) can

The solution (s,d) > 0 is optimal in (10)

if and only if there exists

t, t

T(s,d) (equivalently (a,y) e a4(s,d))

satisfying

=

(s)4 t

--i

i

t)T(s,d)

tT(sd)

-0

if d>

1

if s.

< 0

teT(s,d)

Xt -> 0, t

>0

(12)

t

t

if s

O

=

0

=

0

T(s,d)

The optimality conditions (12) for problem (10) are the basis for

solution methods including

(a) subgradient optimization

(b) primal-dual ascent algorithm

(c) simplicial approximation.

12

These methods are not mutually exclusive but complementary, and they

could be integrated, at least conceptually, into a hybrid algorithm.

Space does not permit us to give a great deal of detail about the

application of these methods to (10).

Reference is given to more

detailed treatments of the methods.

(a) subgradient optimization

This is the simplest to implement but it can require considerable

experimentation with parameter settings and could require knowledge

about (10) which we do not have.

It has worked well for nondifferentiable

concave programming problems closely related to (1) the traveling

salesman problem (Held and Karp (1971)) and (2) machine scheduling

problems (Fisher (1976)).

The idea is to generate a sequence of non-negative solutions

{(s ,d )}= to (10) by the rule

k=l

si

= max{si + 0 ai, 01

for all i

(13)

=max{d

d

j

where (

but

¢

J

+

Yj, 01

for all j

,y ) is any subgradient and the scalars

but

e

- 0.

satisfy

0

ncio=l

he

ot tht n atemt i mde o garnte tht 2O.

Note that no attempt is made to guarantee that the function

actually increases from point to point.

Polyak (1967) shows that if

Vg(s ) and Vf(d ) are uniformly bounded, then the (s ,d ) given by (13)

13

will converge to an optimal solution to (10).

The theoretical and

practical rates of convergence may be slow, however,

Thus, Polyak

(1969) suggests the rule

||(

=

4(s' ,

(14)

-

I( ° z

where 0<

< 2 -

l

1 <

ya)jI 2

2 < 2 which has proven superior.

the formula (14) involves knowledge of the maximal value

we do not know, and the functional value

Note that

*,

which

(s ,d ), which we do not

know explicitly but may be able to compute.

Figure 1 is an accurate

description of how subgradient optimization would work on problem (10).

(b)

primal-dual ascent algorithm

This algorithm is given for the piecewise linear case by Fisher

and Shapiro (1974) and Fisher, Northup and Shapiro (1975), and in the

general case by Lemarechal (1974).

algorithm, we must settle for an

any (s,d) > 0 such that

* <

In order to construct a convergent

e-optimal solution (

(s,d) +

.

The algorithm of Lemarechal

(1974) about to be described converges finitely, and

reduced if necessary.

> 0) which is

The algorithm works with

can be successively

E-subgradients of

which are any vectors (a,y) at (s,d) satisfying

~(s,d) <

The set of all

polyhedron.

(s,d) + a(s-s) + y(d-d) +

for all s,d.

-subgradients is denoted by a3 (s,d) and it is a convex

If we let

T (s,d) = {tlf(d) - g(s) + p s - q d

C

<

(s,d) +

l,

14

then the extreme points of

f c(s,d) are included among the points

(ot,yt ) = (-Vg(s) + pt , Vf(d) - q ) for t

(12) with T(s,d) replaced by

for

T(s,d).

The conditions

T (s,d) are necessary and sufficient

-optimality.

The idea of the algorithnis to try at each point (s,d) to

establish the optimality conditions by solving a phase one linear

programming problem.

Since the set T (s,d) can be quite large, the

procedure begins with a small subset.

If the optimality conditions

are not established, then a direction of possible ascent is indicated.

If this direction contains a solution (s',d') such that p(s',d') >

4(s,d) + E, then a step is taken.

Otherwise, the subset of T (s,d)

is augmented by an e-subgradient and the phase one linear programming

is reoptimized.

The primal-dual ascent algorithm has the advantage over

subgradient optimization that it does not require knowledge of

4*,

and the sequential values of ~(s,d) increase by at least e at each

steD.

It has the disadvantage that it does more work at each point

(s,d), and it is more complex to program.

In terms of figure 1, if

the e-subgradient (a,y) does not satisfy the optimality conditions,

then the LP submodel may be resolved, perhaps several times, before

an ascent step is taken.

15

(c)

simplicial approximation

This method has been applied to related types of economic

equilibrium problems by Scarf and Hansen (1973).

In effect, the

method performs a very special type of search over a compact set of non-negative

(s,d) known to contain an optimal solution to (10). The idea is to approximate

(12) by subgradients calculated at distinct, but close together points (s,d).

Space does not permit a fuller development of this method.

details are given by Fisher, Northup and Shapiro

Complete

(1975) for a mathe-

matical programming problem that is sufficiently similar to (10) for

the approach there to be applicable here.

In terms of figure 1, the

simplicial approximation test for termination is the indicated

approximation of the optimality conditions.

If these conditions

are not satisfied, then instead of the ascent step, we have the

exchange of one of the current points in the approximating set for a

new point (s,d) for which a subgradient (,y)

is calculated as shown.

The number of commodities which can be efficiently handled by simplicial

approximation is not yet known.

For the moment, this number appears

to be less than 100, perhaps substantially so.

16

5.

Conclusions and Areas for Future Research

The proposed decompostion scheme for mathematical programming/

economic equilibrium energy planning models is conceptual but fully

implementable.

At the M.I.T. Energy Lab, we are currently considering

an integration of the Brookhaven Energy System Optimization Model

with some of the econometric models developed at M.I.T.

This integration

should provide the ideas given above with a rigorous test.

On the other hand, there remain a number of conceptual questions

to be studied in greater detail.

Hogan (1974) is concerned with the

integrability of the functions Vf and V g, a property which we have

assumed throughout.

This point needs further.

A possibly related

construct which might provide some insight is the Legendre transform

(Rockafellar (1970; chapter 26)) which relates convex properties of

a function to the inverse of its gradient.

An important area of future research is the identification,

analysis and solution of dynamic models derived from (1) whose solutions converge to an optimal solution

to (1).

The econometric supply

aTd demand models are naturally dynamic, and dynamic mathematical

programming submodels can also be constructed (see Shapiro (1975) for

some ideas about how to do this).

In terms of the decomposition approach,

Grinold (1972) gives an ascent algorithm for solving dynamic linear

programming problems as they would arise in this context.

The idea

would be to fix supply and demand levels over the planning horizon,

solve the dynamic linear programming problem, and then adjust the

supply and demand levels in the same spirit as given above.

The

17

dynamic linear programming energy model of Nordhaus (1973) which has

fixed supply and demand levels could be a candidate for this type of

extension.

_II____

References

T. M. Apostol (1957) Mathematical Analysis, Addison-Wesley.

M. L. Fisher and J. F. Shapiro (1974) "Constructive duality in integer

programming", SIAM J. for Applied Math., 27, 31-52.

M. L. Fisher, W. D. Northup and J. F. Shapiro (1975) "Using duality

theory and computational

to solve discrete optimization problems:

experience", Mathematical Programming Study 3, 56-94, North-Holland.

M. L. Fisher (1976) "A dual algorithm for one machine scheduling problems",

to appear in Mathematical Programming.

J. C. Flinn and J. W. B. Guise (1970), "An application of spatial

equilibrium analysis to water resource allocation", Water Resources

Research, 6, 398-409.

R. C. Grinold (1972) "Steepest ascent for large scale linear programs",

SIAM Review, 14, 447-464.

H. H. Hall, E. O. Heady, A. Stoedker and V. A. Sposito (1975), "Spatial

equilibrium in U.S. agriculture: a quadratic programming analysis",

SIAM Review, 17, 323-338.

M

Held and R. M. Karp (1971) "The traveling salesman problem and

minimum spanning trees: Part II", Math. Prog., 1, 6-25.

K. C. Hoffman (1973), "A unified frameword for energy system planning",

pp. 110-143 in Searl, Energy Modeling, Resources for the Future,

Inc., Washington, D.C.

W. W. Hogan (1974), "Project independence evaluation system integrating

model", Office of Quantitative Methods, Federal Energy Administration.

M. D. Intrilligater (1971) Mathematical Optimization and Economic Theory,

Prentice-Hall.

D. Jorgenson (1975) "An integrated reference energy system and interindustry model for the U.S. economy", pp. 211-221 in Notes on a

workshop on energy systems modelling, Tech Report SOL 75-6, Systems

Optimization Laboratory, Stanford U.

S. Karlin (1959), Mathematical methods and theory in games, programming

and economics, Vol. 1, Addison-Wesley.

M. Kennedy (1974) "An economic model of the world oil market", Bell J.

of Econ. and Man. Sci., 5, 540-577.

C. Lemarechal (1974) "An algorithm for minimizing convex functions",

Proceeding IFIP Congress (Stockholm, 1974), 552-556, North Holland.

W. Nordhaus (1973) "The allocation of energy resources", prepared for

the Brookings Panel, November, 1973.

B. T. Polyak (1967) "A general method for solving extremal problems",

Soviet Mathematics Doklady, 8, 593-597.

L. T. Polyak (1969) "Minimization of unsmooth functionals", USSR

Computational Mathematics and Mathematical Physics, 9, 509-521.

T. R. Rockafellar (1970) Convex Analysis, Princeton U. Press.

H. E. Scarf and T. Hansen (1973), Computation of Economic Equilibria,

A. Schmitz and D. L. Bawden (1973) "A spatial price analysis of the

world wheat economy: some long-run predictions", chapter 25 in

G. G. Judge and T. Takayama, Studies in Economic Planning Over

Space and Time, North Holland.

J. F. Shapiro (1975) "OR models for energy planning", Working Paper

WP 799-75, Sloan School of Management, MIT, July, 1975 (to appear

in Computers and Operations Research).

J. F. Shapiro (1976) Fundamental Structures of Mathematical Programming,

(in preparation for Wiley and Sons).

__~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

_-