IMPLEMENTING NOVEL INVENTORY CONTROLS AND

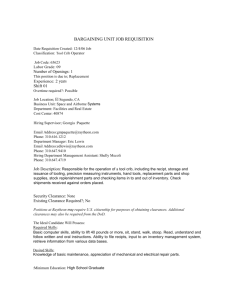

advertisement