Marketing Engineering Materials to the Bicycle Industry:

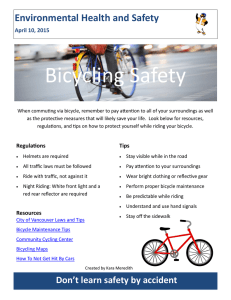

advertisement