RISK MODELING: THE PAST AND THE FUTURE THE CONVERSATION ABOUT RISK

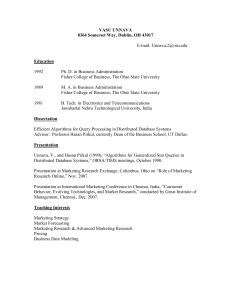

advertisement

THE RISK INSTITUTE EXECUTIVE EDUCATION SERIES: BALANCING RISK TO CREATE VALUE RISK MODELING: THE PAST AND THE FUTURE THE CONVERSATION ABOUT RISK STARTS HERE ABOUT THE RISK INSTITUTE Risk modeling is one of the essential risk management tools, not only for financial firms, but also for non financial firms. As business, regulatory and economic environments change, risk models have also evolved. The recent Financial Crisis has proven how the interconnectedness between institutions could complicate the financial system and the regulators' responses to the crises. The importance of systemic risk and liquidity risk, especially for financial firms, has taken on a much more important role in their risk models. In this session, Mila Getmansky Sherman (Isenberg School of Management, UMass Amherst), Rongsheng Gong (Huntington National Bank) and Al Schulman (Nationwide Insurance, retired) collaborate to provide insights into understanding the evolving, complex, and at times, very volatile economic conditions impacting firms' markets and operation. Overall, the session will emphasize how financial firms have adapted thier risk models to changing business, economic and regulatory environments. The Risk Institute brings together leading academics and a collection of forward-thinking companies that understand that effective risk management strategies position them to create value in a competitive and dynamic marketplace. The Risk Institute Executive Education Series arms practitioners with fresh perspectives and approaches to: Executives will learn/discuss: • Current risk models and how they have evolved, especially after the recent financial crisis. • Managing risk associated with modeling. • Research findings on the importance of systemic risk and how stress tests should include interconnectedness between institutions. • How risk models within financial institutions are used in a bank's Comprehensive Capital Analysis and Review process. • Interconnection of financial institutions through financial derivatives. • Identify, measure and manage risks critical to an organization’s success • Apply leading academic research to business strategies for more competitive and sustainable advantages • Communicate effective risk management strategies to create an integrated and enterprise-wide approach • Create an organizational culture that manages risk proactively by allowing ideas, innovation and initiatives to flourish ENGAGEMENT WITH OTHER SENIOR EXECUTIVES Executives will have the opportunity to engage in a panel discussion with our speakers and their peers about recent developments in risk modeling. Lunch will also provide participants with an opportunity to network. To register please contact: Denita Strietelmeier Program Manager The Risk Institute strietelmeier.1@osu.edu (614) 688-8289 BIOGRAPHIES OF SESSION LEADERS Mila Getmansky Sherman, Associate Professor of Finance, The Isenberg School of Management, UMass Amherst Professor Getmansky Sherman's research specializes in empirical asset pricing, hedge funds, performance of investment trading strategies, financial institutions, systemic risk, and system dynamics. She received a B.S. degree in Chemical Engineering and Minor in Economics from MIT and a Ph.D. degree in Management from the MIT Sloan School of Management. Her work is widely published and she is a recipient of numerous awards and grants including the College Outstanding Research Award. She has had numerous government appointments and affiliations being a Visiting Scholar at the U.S. Securities and Exchange Commission (SEC) and the Board of Governors of the Federal Reserve System. She was a contractor at the U.S. Commodity Futures Trading Commission (CFTC) and is currently an Expert Financial Economist with the SEC. Rongsheng Gong, Vice President, Head of Risk Modeling, Huntington National Bank Dr. Gong leads the centralized risk modeling team at Huntington National Bank. The team’s responsibilities include credit loss forecast for retail loans, commercial loans, investment securities, and derivatives, operational loss forecast, pre-provision net revenue forecast, and fair lending analytics. Prior to joining Huntington National Bank in 2012, he was working on risk modeling in residential mortgages and fraud prevention at JPMorgan Chase. He also worked on logistic strategy as an industrial engineer at Gap Inc. Dr. Gong has a PhD in Engineering from University of Cincinnati, and a BE from Xiamen University, China. He is a CFA charterholder. Al Schulman, Vice President (retired), Enterprise Risk and Capital Management, Nationwide Schulman retired as VP – Enterprise Risk and Capital Management at Nationwide in 2015. He began working at Nationwide in Corporate Finance and worked on Nationwide’s first strategic planning, net present value and capital models. He led the initial development of Nationwide’s Corporate Development function, and served as a leader in the development of Nationwide’s RAROC and economic capital modeling capabilities, as well their dynamic financial analysis and ALM capabilities. He joined Enterprise Risk Management, where he led the risk and capital modeling group. In 2010, Schulman formed a new team to develop Nationwide’s model risk management policy, processes, and model validation capabilities. Since retiring, Al has continued to work with Nationwide’s risk management team as a Consultant. Al holds a Bachelor of Science degree from the University of Rochester and a Master’s degree in Finance from the Sloan School of Management at MIT. Al is a Lecturer in Enterprise Risk Management at the Fisher College of Business at The Ohio State University. Isil Erel, Associate Professor of Finance, Academic Director of The Risk Institute at The Ohio State University Fisher College of Business Dr. Isil Erel holds a Ph.D. in financial economics from MIT Sloan School of Management. She received her Bachelor of Arts degree in economics and business administration from Koç University, Turkey. Her research spans a variety of areas within corporate finance, with particular emphasis on mergers and acquisitions, corporate governance and banking. Her research has been published in leading academic sources and she is the 2010 recipient of the Pace Setters Faculty Research Award and the 2015 recipient of the Distinguished Faculty Award at Fisher College of Business. She also received the Distinguished Referee Award from the Review of Financial Studies in 2012. She has been a Fisher Research Fellow (since 2011) and a National Center for the Middle Market Research Fellow (since 2012). In addition to assuming her role as academic director of The Risk Institute, Dr. Erel will continue to conduct high-impact research in her fields of interest and teach Financial Institutions in both MBA and undergraduate programs at Fisher. PROGRAM AT A GLANCE WHAT: Risk Modeling: The Past and the Future WHEN: Wednesday, March 30 10 a.m. – 2 p.m. WHERE: The Ohio State University The Blackwell Inn and Conference Center Pfahl Hall #302 2110 Tuttle Park Place Columbus, OH 43210 WHO: Senior executives and business unit leaders charged with driving growth and creating value while managing risk COST: $595 UPCOMING SESSIONS: Cost: $595 When: 10 a.m. - 2 p.m. May 12, 2016 The Talent War: Managing the Talent Pipeline and Succession Planning Philip S. Renaud, MS, CPCU, Executive Directors of The Risk Institute at The Ohio State University Fisher College of Business Renaud joins The Risk Institute from Risk International, where he served as a managing director and led the Columbus offices. With over 25 years of experience creating and managing several large multilocation, international risk management departments, he brings extensive expertise in the practice of risk management, direct insurance, and safety and health. In addition to his position at Risk International, Renaud managed risk programs at Deutsche Post/DHL (Supply Chain), Kmart Corporation, Limited Brands, Inc. (L Brands) and, prior to that, SCOA Industries Inc. (Shoe Corporations of America). He is a regular speaker at various national, regional and local risk management forums. He also serves on the Board of Directors for the National Kidney Foundation of Ohio, Kentucky, Middle and Eastern Tennessee and board chairman for Central Ohio. FOR MORE INFORMATION, PLEASE CONTACT: The Risk Institute The Ohio State University Fisher College of Business riskinstitute@fisher.osu.edu fisher.osu.edu/risk