T A : R

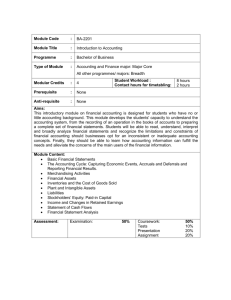

advertisement