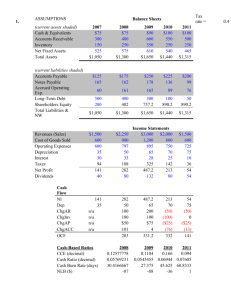

Sell-Side Liquidity and the Cross-Section of Expected Stock Returns

advertisement