Extending the supply chain: Integrating operations and Kenneth K. Boyer ,

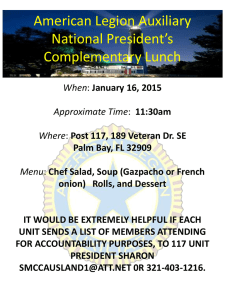

advertisement