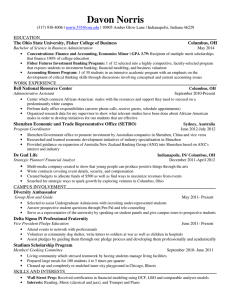

Andrew P. Jasen

advertisement

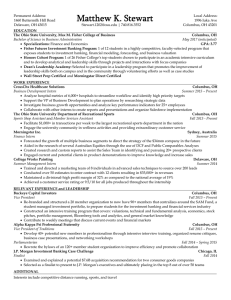

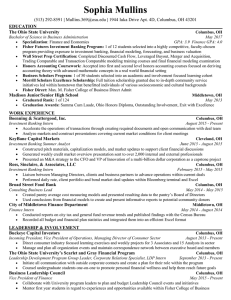

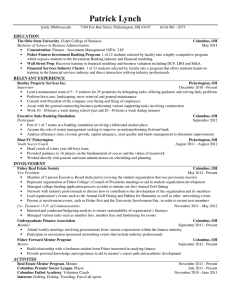

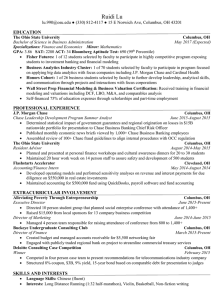

Permanent Address: 10902 Forest Ridge Terrace North Potomac, MD 20878 Andrew P. Jasen Jasen.3@osu.edu | 301.300.0702 Local Address: 1996 Iuka Ave Columbus, OH 43201 EDUCATION The Ohio State University, Max M. Fisher College of Business Bachelor of Science in Business Administration Columbus, OH May 2017 (anticipated) Specializations: Finance and Economics GPA: 3.86 Fisher Futures Investment Banking Program: 1 of 12 students in a highly competitive, faculty-selected program that exposes students to investment banking, financial modeling, forecasting, and business valuation Honors Cohort Program: 1 of 26 Fisher College’s top students chosen to participate in an academic intensive curriculum, and to develop analytical and leadership skills through projects and interactions with focus companies WORK EXPERIENCE J.P. Morgan Chase & Co. New York, NY Investment Banking Summer Analyst Summer 2015 Assessed an $11.3bn, unit-for-unit, buy-side transaction between a sponsored and unsponsored midstream MLP by building dividend discount and accretion/dilution models, as well as transaction and public comparable analyses Helped explore strategic alternatives for a utility’s subsidiary business including a spinoff and Reverse Morris Trust Assisted in exploring potential acquisition targets for a public utility by analyzing leverage capacity scenarios, and the consequential and corresponding pro forma credit ratings and EPS accretion/dilution of the combined entities Researched Independent Power Producer’s historical renewable asset acquisitions to determine purchasing patterns, asset types, operating structures, and multiples used in an idea pitch to a private equity firm Diamond Hill Capital Management Product and Sales Support Intern Columbus, OH Winter 2015 – Spring 2015 Analyzed and compared various investment funds and portfolios based on an investment and financial analyses Generated and reconciled marketing and client and investor relation materials to support the product and sales team Updated client and consultant review databases and process new entries to maintain and establish key relationships Kimpton Hotels and Restaurants Washington, D.C. Restaurant Concepts and Development Summer Intern Summer 2014 Constructed a pro forma operating model to determine revenue projections and ROI to evaluate the project development viability of an existing property making major renovations and capital intensive additions Investigated restaurant segments, market trends, competitors, pricing models, and created templates and macros to standardize and streamline the restaurant conception, development, and construction processes Collected and prepared all ongoing and upcoming development project assets and create a defined process/checklist, from project initiation to construction hand-off, that all users can collaborate in as a pooled resource RELEVANT EXPERIENCE and LEADERSHIP Buckeye Capital Investors Vice President Columbus, OH Fall 2013 – Present Re-branded and structured a 20 member organization to now have 75+ members that centralizes around the SAM Fund, a student managed investment portfolio, to prepare students for the investment banking and financial services industry Completed an intensive training program that covers: valuations, technical and fundamental analysis, economics, stock pitches, portfolio management, Bloomberg tools and analytics, and general market knowledge Buckeye Undergraduate Consulting Club Consultant Columbus, OH Fall 2013 – Present Inspected shipping automation and step busting processes to improve a Medtech company’s operational efficiency Explored the biotech industry to find trends, competitors, distributors, and new revenue streams for a firm in the space Raised $5,000+ and hosted 70+ people at a philanthropic wine tasting event to fundraise for BuckeyeThon Alpha Kappa Psi Professional Fraternity Corporate Relations Director Columbus, OH Fall 2013 – Present Acquired $6000+ of corporate sponsorships while establishing relationships with various companies Compiled a comprehensive sponsorship packet as well as a database to organize company contacts and conversations Organize and participate in service projects and professional events including Labre (feeding the homeless) J.P. Morgan Investment Banking Case Challenge Finalist Examined and explained a potential $7.6bn acquisition recommendation for two consumer goods companies Selected as a finalist to present to J.P. Morgan’s executives and ultimately placing in the top 8 out of over 50 teams Chicago, IL Fall 2014