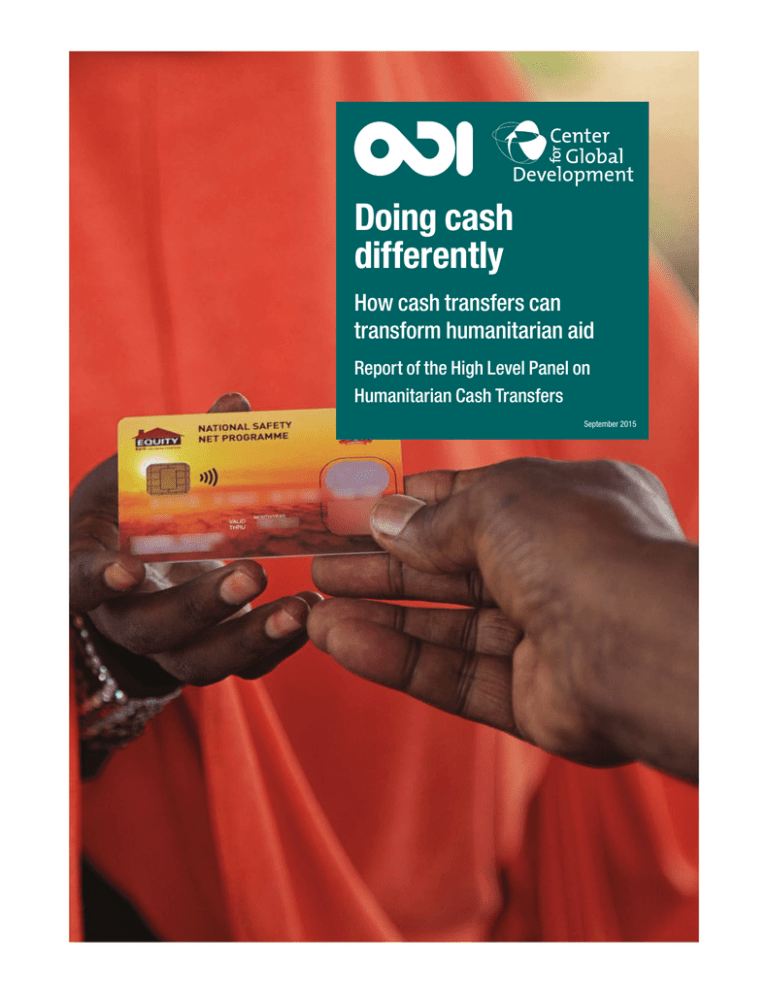

Doing cash differently How cash transfers can transform humanitarian aid

advertisement