Comparative Analysis of Textile and Clothing Rimvydas Milašius, Daiva Mikučionienė

advertisement

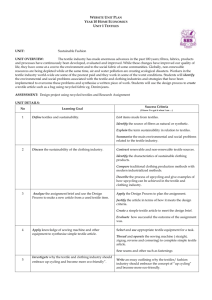

Rimvydas Milašius, Daiva Mikučionienė GENERAL PROBLEMS OF THE FIBRE AND TEXTILE INDUSTRIES Kaunas University of Technology, Department of Materials Engineering Studentu 56, LT-51424 Kaunas, Lithuania E-mail: rimvydas.milasius@ktu.lt Comparative Analysis of Textile and Clothing Industry in the EU and Turkey Abstract In this study, a comparative analysis of the textile and clothing industry in the enlarged EU27 is made with respect to the 10 Central and Eastern European countries and Turkey for the period 2011 - 2012. This period was chosen because growth in textile and clothing as well as in all European industry in 2010 was an outcome of the economic crisis of 2008 - 2009. The selection of countries was made on purpose to highlight trends for the textile and clothing industry in the 10 Central and Eastern European Union (EU-CE10) countries compared with the old EU member countries (EU15) and Turkey. The findings for the period 2011 - 2012 can be thus interpreted: Italy, France, Turkey, Germany and United Kingdom are the leaders of investments and turnover in the sector of textile and clothing in the total of millions of Euros; however, the most of the EU-CE10 countries and Turkey are leaders with respect to the percentage of investments and turnover. While the importance of the textile and clothing industry for a country’s economy is very different for the countries analysed – more than 3% of the GDP (gross domestic product) is observed only in Turkey, Bulgaria, Portugal and Italy. Key words: textile, clothing, industry. nIntroduction The textile and clothing industries play a significant role in the economic progress of many countries in the world, and in some of them they are the key industries. Over recent years, international textile and clothing industries have shown dynamic growth in the global production of textile and clothing products. A few decades ago, the manufacturing of low-value-added textile and clothing products was moved to the developing countries. Developed countries retain mainly the manufacture of high valueadded textile products based on innovation and research, as well as high-quality well-known brands of clothing products. Developing countries, especially those from the Asian region, are world’s leaders in textile and clothing export, which is one of the key levers of their rapid economic growth [1]. The textile and clothing industries continue to support the economic growth of developing countries, which have a lack of capital but have a surplus in inexpensive labour [2]. When the textile and clothing industries had reached a high level of technology and production in the most developed countries, these industries were transferred to developing countries such as China, Turkey, Bangladesh, etc., wherein they progressed and developed. China’s, with one of the cheapest labour and largest textile and clothing industries and export, entry into the WTO in 2001 provided easier access to international markets [3]. Consequently a rapid increase occurred in Chinese exports to the EU with the elimination of quotas. 8 Similar to most of the exporter countries, Turkey was concerned about losing its competitiveness in the EU market. In this global situation, Turkey’s textile and clothing exports have continued to increase in value but not in quantity [4]. Low and medium-low technology production in lower cost locations has begun to make the price of these products fall. The export of these products has increased in quantity, but the increase in value is limited. The greatest pressures for accelerated change within the EU textile and clothing industries sector come from the elimination of textile and clothing import quotas in 2005, the ongoing negotiations on import charges and other taxes and duties, and the global crisis that started in 2008, affecting most industries in developed economies [5]. A comparative analysis of textile and clothing industries in the enlarged EU27 is made with respect to the 10 Central and Eastern European Union countries (EU-CE10) and Turkey for the period 2011 - 2012. The selection of countries was made on purpose to highlight trends for the textile and clothing industry in the 10 Central and Eastern European Union (EU-CE10) countries compared with the old EU member countries (EU15) and Turkey. The textile and clothing industries in Turkey are one of the most important low-tech sectors in the Turkish economy and have been its accelerator since the early 1980’s, when Turkey was opened to foreign markets [6]. In May of 2004, the enlargement of the EU with the accession of 10 new countries had a positive con- Milašius R, Mikučionienė D. Comparative Analysis of Textile and Clothing Industry in the EU and Turkey. FIBRES & TEXTILES in Eastern Europe 2014; 22, 3(105): 8-16. The period of 2011 - 2012 was chosen not at random but because not until 2011 were relative stability and growth in textile and clothing as well as in all European industry observed after economic crisis of 2008 - 2009. The main goal of this study was to compare the situation in EU-CE10 countries with that in EU15 countries and Turkey and to analyse the differences and similarities between the textile and clothing industry of the regions presented. Textile and clothing manufacturing turnover in 2011 - 2012 EU textile and clothing manufacturing activity during the five last years has been gradually strengthening, though not consistently, but with evolutions turning to positive growth rates. However, this growth is in a large part caused by the economic crisis in 2008, when the textile and clothing industry in most EU countries underwent a downturn. For example, in Lithuania, in the period 2007 - 2009 the textile and clothing turnover declined by approx. 30%, while in 2010 around 15% growth was observed [7]. In the last three years, in separate EU countries different tendencies are observed. Our analysis was made according to data presented in official EU and Euratex sources [8 - 10]. The textile and clothing manufacturing turnover in EU27 countries was 157,369.52 million euros in 2011 and 152,911.74 million euros in 2012. The textile and clothing manufacturing turnover in EU-CE10 countries was 14,691.63 million euros in 2011 and 14,706.89 million euros in 2012, respectively. In Turkey the textile and clothing manufacturing turnover was FIBRES & TEXTILES in Eastern Europe 2014, Vol. 22, 3(105) 250000 2011 2012 Turnover in millions of euros tribution to the comparative advantage of textile and clothing products. 2005 is a significant date for Turkey’s textile and clothing industries because all textile and clothing quotas and restrictions were eliminated by the WTO. In 2008, textile and clothing products together constituted 7.1% and 10.3% of the total Turkish merchandise exports, respectively, and Turkey was ranked 7th in terms of textile exports, 4th for clothing exports in the world and was the second biggest exporter to the EU for both textile and clothing exports, following China [4]. 200000 150000 100000 50000 0 EU27 EU-CE10 Turkey EU27+Turkey Figure 1. Textile and clothing turnover in 2011 – 2012 (own presentation based on source [8]) 44,331.75 million euros in 2011 and 47,577.89 million euros in 2012, with a significant growth of 7.3% (see Figure 1) [8]. In 2011 - 2012, the textile and clothing manufacturing turnover in EU–CE10 countries barely changed (slight growth of 0.10%), whereas in EU27 countries it declined by 2.8%. However, the textile and clothing manufacturing turnover generated in the EU27 and Turkey in the period analysed practically did not change, declining by 0.6%. It is clear that the decline in textile and clothing turnover in the EU27 is hidden by the turnover growth in Turkey. The turnover in the textile and clothing sectors in different European Union countries as well as in Turkey varied differently in the period analysed. The data presented in Table 1 illustrates the differences in turnover changes in the textile and clothing sectors in the whole EU27, in the EU–CE10 and in Turkey. In Turkey, the turnover changes in 2011 - 2012 are positive in both the textile and clothing sectors, respectively, +5.81% and +9.39%. In the EU27 a significant decline (–4.53%) was observed in the textile manufacturing turnover, and a slight decline (–0.96%) in the clothing manu- facturing turnover, while in EU–EC10 countries in the textile sector +1.67% turnover growth was observed but in the clothing sector – a 1.48% turnover decline in the period analysed. These data show that the situation in the textile and clothing sectors in the old EU member countries (EU15) and in the EU–EC10 are apparently different. Moreover the growth in the textile and clothing turnover in Turkey compensated for the decline in turnover in this sector of the European Union in the period analysed. The decline in the total EU27+Turkey textile and clothing turnover in 2011 - 2012 was only 0.6%, meaning that the decline is not visible and what is more we cannot state the decline because it is in the limits of statistical error (less than 1%). The different levels of turnover in various EU countries and Turkey in 2012 are presented in Figure 2 (see page 10). In Figure 2.a, the textile manufacturing turnover in Turkey and EU countries is presented, highlighting differences in the old EU member countries (EU15), Central and Eastern European Union countries (EU-CE10) and Turkey. The obvious leader in 2012 according to turnover in the textile sector is Turkey, with a turn- Table 1. Textile and clothing manufacturing turnover (own presentation based on source [8]). Textile Country EU27 EU-CE10 Turkey in millions of euros Clothing change in % in millions of euros change in % 2011 2012 2012/2011 2011 2012 2012/2011 82 453.87 78 716.93 – 4.53 74 915.65 74 194.81 – 0.96 7 376.61 7 500.14 + 1.67 7 315.02 7 206.75 – 1.48 25 655.06 27 147.51 + 5.81 18 676.69 20 430.38 + 9.39 9 27147.51 30000 19563.10 25000 Cyprus 24.17 37.40 94.05 Malta Latvia 256.50 142.53 Ireland 320.41 Lithuania Estonia 323.69 361.40 Slovakia Bulgaria 417.0 Hungary 376.60 507.40 Slovenia 614.74 Finland Greece 805.20 1080.98 1914.61 2297.0 670.40 Denmark Sweden Romania Czech Republic 2354.90 Poland Austria 2826.06 4690.0 2715.18 Netherlands 24.08 Cyprus 59.80 34.18 Malta Ireland 148.90 Estonia 164.0 Slovenia 184.38 Latvia 293.0 239.17 Sweden Finland 312.71 Hungary 325.38 Lithuania 379.13 345.36 Slovakia Denmark 440.01 Netherlands 805.0 977.75 1010.0 608.17 Czech Republic Belgium Greece Austria 1077.77 Bulgaria 2146.08 1894.0 Poland Romania 4680.0 3426.03 2954.93 Portugal Germany Turkey France Italy 0 United Kingdom 10000 Spain 15000 9204.41 20000 5000 b) United Kingdom France 20430.38 30000 10933.57 Turnover in millions of euros Turnover in million euro 35000 31527.0 a) Germany Turkey 0 Italy 5000 Spain 10000 Portugal 6419.13 12475.86 15000 4777.60 20000 Belgium 25000 12651.02 Turnover in in million millionseuro of euros Turnover 35000 Figure 2. Textile (a) and clothing (b) turnover in EU27 countries and Turkey in 2012 (own presentation based on source [8]). over of 27145.51 million euros. The leader in the EU textile sector is Italy, with a turnover of 19,563.10 million euros. The next two EU15 countries with more than 10,000 million euros turnover in the textile sector are Germany and France, and also the United Kingdom, with more than 5000 million euros turnover. Equally we can observe that the turnover in the textile sector in Belgium and Spain was not much lower 5,000 million euros, 4,778 and 4,690 million euros, respec- 10 tively. In the Eastern European Union countries (EU-CE10), three countries can be distinguished by their turnover in the textile sector – Poland, Czech Republic and Romania. The turnovers of the remaining EU–CE10 countries are significantly lower. The obvious leader in 2012 according to turnover in the clothing sector is Italy, with a turnover of 31,527 million euros. Italy’s turnover in the clothing sector was approx. 60% higher than in the textile sector. Turkey is the second country by turnover in this sector – 20,430.38 million euros (approx. 30% lower than in the textile sector). In terms of clothing turnover these EU15 countries follow: France (10,933.57 million euros), Germany (9,204.41 million euros) and Spain (4,680.00 million euros). The leaders by turnover in the clothing sector in Eastern European Union countries (EU-CE10) are Romania (2,146.08 million euros), Poland FIBRES & TEXTILES in Eastern Europe 2014, Vol. 22, 3(105) Textile Clothing – constant (≤ ± 1%), – declined (own presentation based 44.15 Ireland 69.22 55.97 Cyprus Sweden Poland Slovakia Latvia Greece Finland Romania United Kingdom Malta Denmark Netherlands Netherland Spain Bulgaria Lithuania Czech Republic Germany Slovenia Estonia Austria France Belgium Portugal Turkey 0 Italy 100 Hungary 110.25 110.13 123.81 136.35 141.04 148.19 156.30 151.11 200 Average in EU 172.07 188.05 196.42 188.59 202.83 240.15 214.69 300 282.59 400 267.04 500 302.54 600 357.95 700 391.68 636.71 800 548.38 505.62 900 – grew, 840.01 Turnover per citizen in euro Figure 3. Change in textile and clothing turnover in 2011 – 2012: on source [8]). Figure 4. Textile and clothing turnover per citizen in 2012 in euros (own presentation based on source [8, 9]). (1894 million euros) and Bulgaria (1,077.77 million euros), followed by the Czech Republic with a turnover of 608.17 million euros. The turnovers of the remaining EU–CE10 countries were much lower than 500 million euros. FIBRES & TEXTILES in Eastern Europe 2014, Vol. 22, 3(105) A map of changes in the textile (a) and clothing (b) turnover in 2011 – 2012 is presented in Figure 3. Growth in turnover in the textile sector was seen in Romania, Hungary, Latvia (more than 10%), Lithuania, Estonia, Turkey, Malta (5 – 10%), Slovenia, the United King- dom (1 – 5%), and Slovakia (less than 1%). Growth in turnover in the clothing sector was in Turkey, Latvia, Hungary, Malta (5 – 10%), Belgium, Romania (1 – 5%), France, the Czech Republic, and Italy (less than 1%). 11 8.20 8 7 0.13 Ireland 0.29 0.44 0.45 0.27 Sweden Cyprus Finland 0.54 United Kingdom Denmark 0.75 0.56 0.87 Average in EU Netherlands Netherland Hungary Germania Germany 0.96 0.99 0.87 Greece Spain 1.12 Malta Austria Latvia Belgium Slovenia Czech Republic Lithuania Romania Estonia Italy Portugal Bulgaria 0 Turkey 1 Slovakia 1.18 1.14 1.22 Poland 1.33 France 1.74 1.57 2 1.75 2.07 3 2.28 2.46 4 3.45 5 3.70 6 3.84 Ratio of textile&clothing turnover and GDP in % 9 Figure 5. Ratio of textile and clothing turnover and GDP in 2012 (own presentation based on source [8,10]). Over the first few months in 2013 there were signs that textile and clothing output was recovering. Indicators pointed to an upward trend during the 3rd quarter 2013: +1.5% in both the textile and clothing sectors together as compared with the same period of the previous year. Textile Importance of textile and clothing industries in particular regions and countries One of the important indices of textile and clothing industries is the turnover Clothing Figure 6. Change in textile (a) and clothing (b) turnover per employee in 2011–2012: – declined (own presentation based on source [8, 10]). 12 per citizen in euro (Figure 4). The average turnover per citizen in the textile and clothing industry in 2012 was 236 euro per citizen [8, 9]. This average value was exceeded by five EU15 countries – Italy 3.6 times (this country is the absolute leader in this comparative index), Portu- – grew, – remained constant (≤ ± 1%), FIBRES & TEXTILES in Eastern Europe 2014, Vol. 22, 3(105) 27.63 Hungary 34.63 32.06 Bulgaria 35.57 41.38 Lithuania Romania 46.71 Poland Cyprus Turkey 22.43 18.35 17.47 17.35 15.73 13.32 9.95 Slovakia Poland Latvia Lithuania Hungary Romania Bulgaria 24.34 23.68 Czech Republic 31.58 Slovenia Estonia 35.26 Portugal 44.93 38.04 Cyprus 48.24 Greece Ireland Malta Spain Italy United Kingdom Netherland Netherlands Austria Belgium Finland Germany Sweden Denmark 0 France 50 Average in EU Turkey 74.84 Slovenia Ireland 85.45 100 92.06 United Kingdom 109.15 Italy 127.84 118.78 Sweden 132.03 150 Germany Austria Finland 170.37 200 178.12 Netherlands Netherland Denmark 197.22 250 239.96 251.51 300 206.54 Belgium 50 Latvia 47.74 Slovakia 65.87 Estonia 63.10 53.12 71.27 Portugal 84.33 72.73 85.47 Greece Average in EU Czech Republic 87.79 Spain 94.20 100 Malta 102.33 145.44 113.89 149.89 155.47 175.09 150 a) Turnover per employee in thousand euro Turnover per employee in thousands of euros 187.89 200 0 b) 212.56 241.23 222.12 287.73 250 France Turnover employee thousand euro Turnover per per employee in in thousands of euros 300 Figure 7. Textile (a) and clothing (b) turnover per employee in 2012 in thousands of euros (own presentation based on source [8, 10]). gal and Belgium with more than 2 times, then Austria, France and Germany; and by three EU–CE10 countries – Estonia, Slovenia, and the Czech Republic, with very few being behind Lithuania. Turkey’s EU average value exceeded even 2.7 times. FIBRES & TEXTILES in Eastern Europe 2014, Vol. 22, 3(105) The ratio of textile and clothing turnover and GDP demonstrates the importance of this industry for the economy of a particular country (Figure 5). The average ratio of textile and clothing turnover and GDP in the EU is 1.38% [8, 10]. The leaders in the EU in terms of this ratio are Bulgaria, Portugal and Italy, with more than 3%. The ratio of textile and clothing turnover and GDP in Estonia, Romania and Lithuania is more than 2%, and Czech Republic, Slovenia and Belgium exceed the average value (1.38%) of the ratio mentioned, with Latvia be- 13 1657.66 1800 1400 1200 6.10 2.62 2.47 2.07 1.01 Malta Latvia Ireland Cyprus 7.29 Finland 7.31 Denmark 17.66 Estonia 18.54 Lithuania 14.43 11.75 20.9 Bulgaria Slovenia 28.35 Sweden Hungary 28.81 Greece 51.0 Slovakia 53.75 Netherlands Austria 81.58 76.1 Romania Portugal 105.0 Poland 148.0 109.90 Belgium 871.6 a) United Kingdom France Germany Italy 0 Turkey 200 152.73 400 Spain 220.34 600 Czech Republic 800 384.35 1000 557.55 420.44 Investment ininmillions euros Investment millionofeuros 1600 900 700 0 Malta Ireland 0.83 0.57 1.70 Finland Cyprus 2.12 Estonia Sweden 4.83 4.41 5.45 Netherlands 8.31 Denmark Slovenia 10.35 8.48 Latvia Lithuania 12.08 12.25 Slovakia 12.41 Hungary Austria Belgium 36.18 28.71 20.50 55.36 50.8 58.34 47.43 Greece Bulgaria Czech Republic b) Spain Germany France Italy 0 Turkey 100 United Kingdom 200 Portugal 300 121.79 75.0 204.46 400 Poland 500 Romania 600 122.41 468.23 Investment Investmentininmillion millionseuro of euros 800 Figure 8. Investment in textile (a) and clothing (b) manufacturing in 2012 in millions of euros (own presentation based on source [8]). ing very close to the average. The results in Figure 5 demonstrate that the textile and clothing industry for the economies of most EU–CE10 countries and two countries of the EU15 – Portugal and Italy – has an important impact. However, much more importance of the textile and clothing industry for the overall national economy is in Turkey. The ratio of textile and clothing turnover and GDP in Turkey 14 in 2012 was 8.2%, approx. 6 times higher the EU average value. The turnover per employee rate demonstrates labour efficiency. The turnover per employee in the textile sector in 2012 is presented in Figure 7.a (see page 13). The average value of the turnover per employee in the EU was 110.54 thousand euros. Ten EU15 countries exceeded this average value – France (287.73 thousand euros per employee), Belgium, the Netherlands, Denmark, Austria, Finland, Germany (more than 150 thousand euros per employee), Sweden, Italy and the United Kingdom. Only one EU–CE10 country is close to the EU average – Slovenia, with 102.33 thousand euros per employee. The labour efficiency in almost all FIBRES & TEXTILES in Eastern Europe 2014, Vol. 22, 3(105) 1.45 2 1.20 1.09 1.98 2.22 2.30 2.60 Sweden 2.69 2.63 Average in EU Latvia 2.82 3.04 3 2.85 2.85 3.16 Germany 3.37 Spain 4 3.43 4.18 3.83 4.46 5 4.61 6 5.51 7 5.13 6.11 Investment and turnover ratio in % 8 7.01 8.90 7.978 7.55 9 Denmark 0.58 Malta 0 Ireland Spain Netherlands Austria Germany Estonia Denmark Italy United Kingdom Sweden France Portugal Belgium Lithuania Cyprus Slovakia Greece Hungary Poland Turkey Bulgaria Czech Republic Slovenia 1 Finland 0.95 1.08 1.10 1.33 1.23 1.42 1.44 1.48 1.62 2 Average in EU 1.84 1.97 1.87 3 Latvia Finland Ireland Netherlands Austria Belgium Portugal Slovenia 2.55 Estonia France Italy United Kingdom 2.61 3.50 3.45 Hungary Cyprus Poland Greece 3.92 3.70 Bulgaria Lithuania 4.40 4.27 3.96 Turkey 4.72 Malta Romania 4 0 b) 5.61 5.07 5 Romania Investment and turnover ratio in % 6 Czech Republic a) 5.67 0 Slovakia 1 Figure 9. Ratio of investment in the manufacturing and turnover of textile (a) and clothing (b) manufacturing in 2012 in% (own presentation based on source [8]). EU–CE10 should be improved. The index of labour efficiency in Turkey is also apparently (1.75 times) lower the EU average. The turnover per employee in the clothing sector in 2012 is presented in Figure 7.b. The average value of turnover per employee in the clothing sector in FIBRES & TEXTILES in Eastern Europe 2014, Vol. 22, 3(105) the EU was 88.45 thousand euros (20% lower than in the textile sector). Eleven EU15 countries exceeded this average value – France, Denmark, Sweden (more than 200 thousand euros per employee), Germany, Finland, Belgium (more than 150 thousand euros per employee), Austria, the Netherlands, the United Kingdom, Italy and Spain. The turnover per employee in Turkey in 2012 was approx. 2 times lower than the EU average. It should be stated that labour efficiency in the clothing sector in EU–CE10 countries on average is very low as compared to the EU15, and the gap in labour efficiency in the clothing industry between the EU15 and EU–CE10 is much more evident than in the textile industry. 15 In Figure 6 (see page 12), a map of changes in the textile (a) and clothing (b) turnover per employee in 2011 – 2012 is presented. The rate of turnover per employee in the textile sector declined in Ireland (even 29%), Germany, Denmark, Italy, Cyprus, the United Kingdom, the Netherlands and Bulgaria, and the clothing sector declined in the Netherlands, Denmark, Greece (more than 10%), Slovenia, Bulgaria, Austria, Cyprus, France and Germany (1 – 6%). The turnover per employee in the textile and clothing sectors in 2011 – 2012 grew or remained constant in most EU–CE10 countries, but slightly declined in Turkey. Investments in textile and clothing industries in 2011 - 2012 Investments in the industry determine the long-term productivity growth and indicate the approach of manufacturers to industrial development. In some cases it allows the manufacturing of higher-added-value products. In Figure 8 (see page 14), the rate of investments in millions of euros in textile (a) and clothing (b) manufacturing in 2012 is presented. The absolute leader in the rate of investments in both the textile and clothing sectors in 2012 was Turkey, with 1658 and 872 million euros, respectively [8]. The most invested EU15 countries were Italy (558 million euros in the textile sector and 468 million euros in the clothing sector), France (420 million euros in the textile sector and 204 million euros in the clothing sector) and Germany (384 million euros in the textile sector and 122 million euros in the clothing sector). These countries are the overall leaders in the EU27 in terms of the investment rate in textile and clothing manufacturing. However, investment in the textile sector in Turkey was 3 times and in the clothing sector – almost 2 times higher than in Italy, the leader in the EU with respect to investments. The countries with the most investment in textile manufacturing in the EU–CE10 region were the Czech Republic, Poland and Romania, and in the clothing sector – Romania, Poland and Bulgaria. In general, investments in textile manufacturing are higher than in the clothing sector, except in Romania and Bulgaria. In Turkey, investment in the textile sector in 2012 was 90% higher than in the clothing sector. Respectively, investments in textile manufacturing in the Czech Republic was 5.5 times, in the United Kingdom and Austria – approx. 4 times, in Spain – 3 times, and in the 16 Netherlands – even 11 times higher than in clothing manufacturing. In Figure 9, the ratio of investment in the manufacturing and turnover of textile (a) and clothing (b) manufacturing in 2012 in % is presented. This ratio demonstrates what percentage of the turnover is committed to investment into manufacturing. In the textile sector in 2012, Slovakia, the Czech Republic, Romania, Malta, Turkey and Lithuania committed to investment more than 5% of the turnover, with Bulgaria, Greece, Poland, Cyprus, Hungary, the United Kingdom, France, Spain and Germany more than 3% ( average in EU27 – 3.8%). In the clothing sector, Romania, Latvia and Slovenia committed to investment more than 5% of their turnover, with the Czech Republic, Bulgaria, Turkey, Poland, Hungary, Greece, Slovakia and Cyprus committing more than 3% ( average in EU27 in clothing sector – 2.6 %). In total in the EU27, the ratio of investment in the textile sector and turnover is more than 80% higher than that in the clothing sector; in Turkey it is more than 90% higher. The data in Figure 9 (see page 15) show that EU–CE10 countries and Turkey commit a higher percentage of turnover to manufacturing than the average value in the EU27, whereas the percentage ratio of investment and turnover in the old EU15 countries is less than the average of the EU27. This analysis suggests that the textile and clothing industry in Turkey and the EU–CE10 is progressing and gradually creating competition for EU countries with its old and strong textile and clothing tradition. nConclusions The analysis shows that the decline in the EU textile and clothing industry is compensated by Turkey, and in the last few years in the region analysed (EU+Turkey) this industry has not undergone significant changes. The old EU members (EU15) are still the leaders in the EU textile and clothing industry, but the gap with some EU-EE10 countries is decreasing, especially in the textile sector. The development of clothing and textile sectors in the majority of countries differs, therefore it is not correct to analyse these two sectors together – separate analysis of these sectors gives more information about trends of development of countries and the importance of these sectors in each country. Despite the old EU15 countries mostly being the textile and clothing industry leaders in the EU, the ratio of turnover and GDP as well as that of investment and turnover show much higher results in EU-CE10 countries, meaning that the gap between these two regions of the EU has the tendency to decrease more and more. Herewith it is necessary to note that the economical indexes mentioned for Turkey are much higher than the EU average and sometimes a few times higher than in the case of EU textile and clothing industry leaders. For example, investment in both the textile and clothing sectors in 2012 in Turkey was approx. 2.5 times higher than in Italy, which is the absolutely leader in the EU. Thus it can be stated that if this tendency remains, in the next decade the growth of Turkey’s textile and clothing industry will be more and more. The analysis also demonstrates that the textile and clothing industry in the EU–CE10 is progressing and this EU region in the future will be more and more important for the EU textile and clothing industry. References 1. Corovic E, Jovanovic P, Ristic L. Current Trends on the World Textile Market and the Competitiveness of the Serbian Textile Industry. Fibres & Textiles in Eastern Europe 2013; 21, 5: 8-12. 2. Karaalp HC, Yilmaz ND. Comparative Advantage of Textiles and Clothing: Evidence for Bangladesh, China, Germany and Turkey. Fibres & Textiles in Eastern Europe 2013; 21, 1: 14-17. 3. Chi T, Kilduff P. An Assessment of Trends in China’s Comparative Advantages in Textile Machinery, Man-Made Fibres, Textiles and Apparel. Journal of the Textile Institute 2006; 97, 2: 73-191. 4. Karaalp HC, Yilmaz ND. Assessment of Trends in the Comparative Advantage and Competitiveness of the Turkish Textile and Clothing Industry in the Enlarged EU Market. Fibres & Textiles in Eastern Europe 2012; 20, 3: 8-11. 5. Pomykalski P. Assessing the Impact of the Current Financial and Economic Downturn on the Textile and Apparel Industry in Poland. Fibres & Textiles in Eastern Europe 2013; 21, 5: 13-18. 6. Eryuruk SH, Kalaoğlu F, Baskat M. Logistics as a Competitive Strategy Analysis of the Clothing Industry in Terms of Logistics. Fibres & Textiles in Eastern Europe 2011; 19, 1: 12-17. 7. http://db1.stat.gov.lt/statbank/default. asp?w=1152 (accessed 08.01.2014). 8. Adinolfi R. Textile and Clothing Structural Data – Euratex Members 2011-2012, www.euratex.eu 2013. 9. h t t p : / / e p p . e u r o s t a t . e c . e u r o p a . e u / statistics (accessed 08.01.2014). 10. h t t p : / / d a t a . w o r l d b a n k . o r g / d a t a catalog/GDP-ranking-table (accessed 09.01.2014). Received 14.01.2014 Reviewed 13.03.2014 FIBRES & TEXTILES in Eastern Europe 2014, Vol. 22, 3(105)