ARCWtiV7ES AUG 2015 LIBRARIES

advertisement

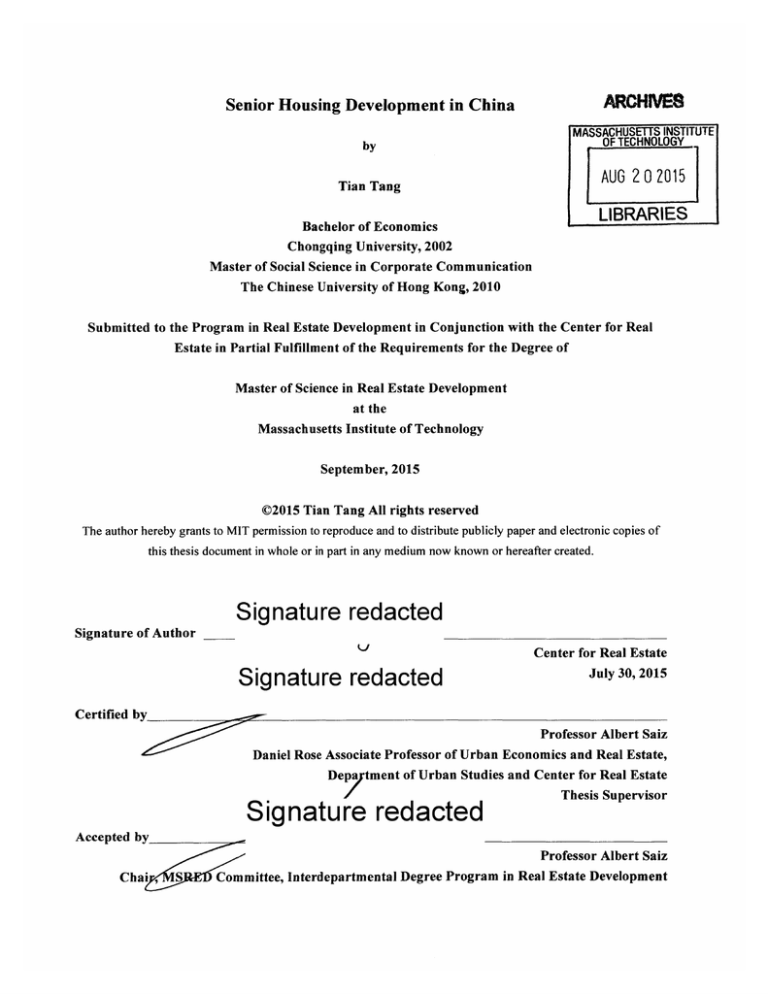

Senior Housing Development in China

ARCWtiV7ES

by

MASSACHUSETTS INSTITUTE

OF TECHNOLOGY

AUG 2 0 2015

Tian Tang

LIBRARIES

Bachelor of Economics

Chongqing University, 2002

Master of Social Science in Corporate Communication

The Chinese University of Hong Kong, 2010

Submitted to the Program in Real Estate Development in Conjunction with the Center for Real

Estate in Partial Fulfillment of the Requirements for the Degree of

Master of Science in Real Estate Development

at the

Massachusetts Institute of Technology

September, 2015

C2015 Tian Tang All rights reserved

The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of

this thesis document in whole or in part in any medium now known or hereafter created.

Signature redacted

Signature of Author

Center for Real Estate

Signature redacted

July 30, 2015

Certified by

Professor Albert Saiz

Daniel Rose Associate Professor of Urban Economics and Real Estate,

Depaytment of Urban Studies and Center for Real Estate

Signature redacted

Thesis Supervisor

Accepted by

Professor Albert Saiz

Chai

mittee, Interdepartmental Degree Program in Real Estate Development

Senior Housing Development in China

by

Tian Tang

Submitted to the Program in Real Estate Development in Conjunction with the Center for Real

Estate on July 30, 2015 in Partial Fulfillment of the Requirements for the

Degree of Master of Science in Real Estate Development

ABSTRACT

The number of Chinese citizens aged 60 years and above is predicted to reach to 440 million by

2050, accounting for roughly 34 percent of the country's total population. The one-child policy

has created a declining fertility rate. At the same time, the life expectancy of people keeps rising.

The combination of low fertility and long life spans have moved China towards a rapidly aging

society. To prepare for the aging society, the Chinese government has issued a series of policies

to enhance the senior care industry. The government encourages private and foreign enterprises

to invest and engage in senior care services in China. Chinese developers and operators are

trying to import foreign practices into the Chinese context. Foreign experts are looking for

business opportunities in this untapped market. Although China's senior housing market is

undoubtedly appealing, industry players must address several issues before stepping into this

market because it is still in infancy period compared to other developed countries. The study

examines the key factors that influence senior housing development in China, and those essential

elements that foster the industry in U.S.

Thesis Supervisor: Albert Saiz

Title: Daniel Rose Associate Professor of Urban Economics and Real Estate, Department of

Urban Studies and Center for Real Estate

2

ACKNOWLEDGEMENTS

I would like to express my deepest gratitude to my thesis advisor Professor Albert Saiz for his

guidance and comments. I also extend my sincerest gratitude to Steve Weikal, the head of

industry relations of MIT Center for Real Estate, for his help connecting me with industry

people.

Special thanks goes to Kevin Glover and Mark Erickson. Mr. Glover worked as the Senior Vice

President Development Service for Erickson Living from 1984 to 2009, responsible for the

program, design, and quality standards for Erickson Retirement Communities. Mr. Erickson was

the Chief Operating Officer of Erickson Living from 2007 to 2010, responsible for overall

operations and management of all Erickson Living's retirement communities. He also worked as

the Managing Director of Fortress Investment Group from 2011 to 2015, responsible for

Continuing Care Retirement Community development in China. Mr. Glover and Mr. Erickson

donated their time to give interviews and provided me with valuable opinions.

3

TABLE OF CONTENTS

Chapter I

Introduction

1.1 Research Motivation......................................................................................6

1.2 Research Methodology................................................................................6-7

1.3 Research Objectives...................................................................................7

Chapter II

China Senior Housing Market - An Untapped Market

2.1 Demographic Background............................................................................8-9

2.2 Social Background...................................................................................10-12

2.3 Economic Background .............................................................................

Chapter III

13-15

China Senior Housing Market - An Immature Market

3.1 Social and Cultural Obstacles......................................................................16-17

3.2 Medical Insurance.....................................................................................17

3.3 L and Policy ............................................................................................

3.4 Financing Model......................................................................................20-21

3.5 Operation Model......................................................................................21-23

3.6 Laws & Regulations.................................................................................24-28

3.7 Professional Workforce.............................................................................28-29

Chapter IV

Implications of U.S. Senior Care Industry to China

4.1 Health Care REITs...................................................................................30-33

4.2 Tailored Market.......................................................................................34-36

4.3 Laws & Regulations.................................................................................37-42

4.4 Professional Workforce..............................................................................42

4

18-20

Chapter V

Senior Housing Case Study

5.1 Case 1 - Brooksby Village Senior living Community..........................................43-55

5.2 Case 1 - Star Castle Senior living Community...................................................56-60

5.3 Case Comparison ......................................................................................

61-62

C o n clu sio n ................................................................................................

. 63

B ib liog rap hy ..............................................................................................

64-66

5

Chapter I

Introduction

1.1 Research Motivation

Declining fertility rates and increased longevity have moved China's demographic balance

towards a rapidly aging population. To prepare for the aging society, the Chinese government

has issued a series of policies to enhance the senior care industry. As an important segment of the

senior care market, senior housing is very appealing to industry players. However, China's senior

housing market remains immature and largely unregulated. Many obstacles, such as cultural

prejudices, land policies, regulations and the shortage of experienced staff limits senior housing

development in China.

While the senior housing industry has matured for decades in U.S. Many Chinese developers and

operators are trying to import the U.S. practices into China's context. At the same time, U.S.

senior housing professionals are looking for business opportunities in China. Will U.S. style

product be accepted in China market? There is no doubt that a successful project must meet the

needs and desires of the local market. The best practice may be to learn China's unique market

dynamic, study the essential elements that foster U.S senior housing industry, and then adapt

U.S. model to the China context with a degree of flexibility.

1.2 Research Methodology

Firstly, I conducted a literature review of books, thesis, industry reports, policies and regulations.

This literature review helps us understand the history of senior housing development and its

social background, and insures a knowledge of the broad context of senior housing.

6

Secondly, I conducted interviews with industry people, including investors, developers, operators

and other players. These interviews have helped me collect the first-hand information, and

provided an understanding of the difference between the U.S. and China's senior care industry

from a professional perspective.

Third, I did field trips to representative projects and do interviews to residents who live in senior

communities. Personal field trips helped me verify the credibility of the information I obtained

from industry players.

1.2 Research Objective

China's senior housing market is an untapped market as well as an immature one. In this paper, I

analyze the opportunities in the Chinese senior housing market, look at the strengths and

weaknesses of the whole industry, and study the feasibility of the application of the U.S model to

China's market. The objective of my study is to help industry players learn about China's senior

housing market and find a practical way to develop it.

7

Chapter 11

China Senior Housing Market - An Untapped Market

2.1. Demographic Background

As well as having the world's largest population with 1.3 billion, China also has one of the fastest

ageing rates. Declining fertility rates and increased longevity have tilted China's demographic

balance towards a rapidly aging population. By the end of 2014, the total number of Chinese

population at the mainland reached 1,367.82 million. The number of people aged 60 and above

reached 212.42 million, 15.5% of national population. The number of people aged 65 and above

reached 137.55 million, 10.1% of national population.

Figure 2.1: Population and Its Composition by the end of 2014

Populaton

(Year-end figure)

Item

10.000 persons)

23957

91583

100.0

54.77

45-23

512

48.8

175

67 0

Aged 60 and above

21242

15.5

Of which Aged 65 and above

13755

10.1

136782

74916

61866

70079

66703

National Total

Of which Urban

Rural

Of which Male

Female

Ofwhich Aged 0-15 (undertheageof16)

Aged 16-59 (under the age of 60)

Source: National Bureau of Statistics of China. February 26, 2015

The segment of people aged 60 years and above will grow very rapidly in China. The number of

"silver" population is predicted to reach to 248 million by 2020, accounting for 17 percent of the

country's total. And this number will peak to 440 million by 2050, accounting for roughly 34

percent of the country's total population.

[1]

The ratio of the population aged 65 years or over to

the population aged 15-64 was 11.4 % in 2010. This ratio will achieve a level of 23.8% in 2030,

39% in 2050, and 49.8% in 2100.

1 Data from China National Committee on Aging (CNCA)

8

Figure 2.2 China Population Dependency Ratio Prospects

2020

2015

2010

2100

2075

2050

2030

Median age (years)

34.6

36.0

37.7

42.1

46.3

47.1

46.9

Total dependency ratio (a)

36.0

38.2

42.7

47.2

63.0

71.6

76.6

Child dependency ratio (b)

24.7

25.1

26.0

23.4

24.0

25.4

26.8

Old-age dependency ratio (c)

11.4

13.1

16.7

23.8

39.0

46.2

49.8

(a) The total dependency ratio is the ratio of the population aged 0-14 and that aged 65+ to the population

aged 15-64. They are presented as number of dependants per 100 persons of working age (15-64)

(b) The child dependency ratio is the ratio of the population aged 0-14 to the population aged 15-64. They

are presented as number of dependants per 100 persons of working age (15-64)

(c) The old-age dependency ratio is the ratio of the population aged 65 years or over to the population

aged 15-64. They are presented as number of dependants per 100 persons of working age (15-64)

Figure 2.3: China Population by Age Groups and Sex

2100

2050

100

I

100

Males

Females

Males

Females

90

80

830

70

70

60

50

50

40

40

30

30

20

23

10

10

0

10

0

100

'50

50

100

100

53

0

Source: United Nations Department of Economic and Social Affairs, Population Division, World

Population Prospects: The 2012 Revision, Volume II: Demographic Profiles

9

50

1lo

2.2 Social Background

As a result of the one-child policy, Chinese fertility has kept falling since 1980s. Nowadays,

China is among the countries with lowest fertilities in the world. On the other hand, life

expectancy keeps rising as living conditions continue to improve. The combination of low

fertility and longer life spans exerts great pressure to the quality of elderly care.

Reported and projected number of births, China 1980-2050

Figure 2.4:

30

-Reponed

Proected

12000. 1suuimouj

20

2006. 16 uniflioni

10-

1990

1980

2000

2020

2010

2030

2040

2050

Sources: Fertility prospects in China, United Nations, Population Division Expert Paper No.201 1/1

Figure 2.5:

Life Expectancy at Birth by sex in China

75

r'o

Female

r5

45

40

2050

1902000

2100

World

Source: United Nations Department of Economic and Social Affairs, Population Division,

Population Prospects: The 2012 Revision, Volume II: Demographic Profiles

10

Influenced by One-Child population restrictive policy, Chinese families have been undergoing

the most dramatic change in history. A new family structure known as 4-2-1 where a family

consists of four older people (paternal and maternal grandparents), two parents, and a single

child, currently dominates most of Chinese families. As a result, young Chinese couples have to

shoulder the responsibility of supporting four seniors as well as raising one child.

In modern 4-2-1 family, grandparents often help to look after their grandchild. Both spouses in

the young couple work to pay for the high living expense in cities. Even though grandparents are

in good health now and can help with housekeeping, in the foreseeable future there will be need

of more manpower to take care of them. It is impossible for a working couples to cater to four

aging parents as well as taking care of their own child. Some 4-2-1 urban families hire maids to

help care for elders, but most of those maids are unskilled women from the countryside. They

never received professional training and are unable to care properly senior people with medical

and mental care needs. The new family structure therefore poses a new challenge for the

provision elderly care. The traditional elderly care system, which relied on family members, is

facing immense pressure.

Another social change influencing elderly care is the increased urbanization of China.

Urbanization has left more and more of the countryside's elderly population alone to take care of

themselves, as the younger generations leave their hometowns for education and employment.

Since China conducted their Reform and Opening-up Policy in 1978, the urban population has

increased from 170 million to 730 million by the end of 2010. The urbanization rate has

increased from 17.9% to 53.7%, and this number keeps growing and will reach 60% by 2020.

Millions of young people flow into cities and settle down far from their parents, resulting in an

Empty Nest phenomenon in rural areas. Even when elders move to the cities with their children,

they are not used to a metropolitan living style. Most of them are often left alone at home during

11

the day because their children are too busy to spend time with them. Nowadays, arguably,

Chinese families have become grayer and more isolated. The population of elderly people aged

80 years and above will reach to 108 million by 2050. Half of this "Silver" segment population

will live alone.

[2]

Figure 2.6:

Urbanization in China from 1978-2010

1978

2010

193

658

Of which: Cities with more than 10 million population

0

6

Of which: Cities with 5 -10 million population

2

10

Of which: Cities with 3 - 5 million population

2

21

Of which: Cities with 1 - 3 million population

25

103

Of which: Cities with 0.5 - 1 million population

35

138

129

380

2173

19410

National Total Cities Number

Of which: Cities with less than 0.5 million population

National Total Towns Number

Source: China National New-type Urbanization Plan (2014-2020)

Figure 2.7:

Proportions of urban and rural population 1950 to 2050

100

-0--

Urban

-

Rural

40

70

60

10

20

19501960

2000

1980

2020

2040 2050

Source: United Nations, Department of Economic and Social Affairs, Population Division, World

Urbanization Prospects: The 2014 Revision.

[2] Data from China National Committee on Aging (CNCA)

12

2.3 Economic Background

The world has witnessed the economic miracle in China since the Chinese government

conducted their reform and opening policies in 1978. Nowadays, China is the world's

second-largest economy. In February 2015, the National Statistics Bureau of China released its

National Economic and Social Development Report. According to this report, the gross domestic

product (GDP) of 2014 reached 63,646.3 billion RMB. Compared to 365.02 billion RMB in

1978, China's GDP has multiplied by 174 times in last 36 years.

With national GDP growing, the residents' income continues to rise. In 2014, the national per

capita disposable income was 20,167 RMB, an increase of 10.1 percent, or a real increase of 8.0

percent after deflating for price growth. Per-capita disposable income of urban households was

28,844 RMB, up by 9.0 percent, or a real growth of 6.8 percent. The median per capita

disposable income of urban households was 26,635 RMB, up by 10.3 percent. The per-capita

disposable income of rural residents was 10,489 RMB, up by 11.2 percent, or 9.2 percent in real

terms. The median per-capita disposable income of rural residents was 9,497 RMB, up by 12.7

percent. The national per capita consumption expenditure was 14,491 RMB, up by 9.6 percent,

or a real growth of 7.5 percent. The per-capita consumption expenditure of urban households was

19,968 RMB, up by 8.0 percent, or 5.8 percent in real terms. The per capita consumption

expenditure of rural residents was 8,383 RMB, up by 12.0 percent, or a real growth of 10.

Social security has made great progress. By the end of 2014, a total of 341.15 million people

participated in the urban basic pension program for staff and workers, a year-on-year increase of

18.97 million. A total of 501.07 million people participated in the basic pension insurance

program for urban and rural residents, an increase of 3.57 million. A total of 597.74 million

people participated in basic health insurance program, an increase of 27.02 million, of whom,

283.25 million people participated in basic health insurance program for staff and workers, a

13

year-on-year increase of 8.82 million, and 314.49 million people participated in programs for

residents, an increase of 18.20 million.

The public health and social services continue to make progress. By the end of 2014, there were

982,443 medical and health institutions in China, including 25,865 hospitals, 36,899 township

health centers, 34,264 community health service centers, 188,415 clinics, 646,044 village clinics,

3,491 epidemic disease prevention centers and 2,975 health institutions. There were 7.39 million

health workers in China, including 2.82 million practicing doctors and assistant practicing

doctors and 2.92 million registered nurses. The medical and health institutions in China

possessed 6.52 million beds, of which, hospitals possessed 4.84 million and township health

centers had 1.17 million.

By the end of 2014, there were altogether 38 thousand social welfare institutions of various

types, of which 34 thousand were elder-caring organizations. The social welfare institutions

provided 5.865 million beds, and 5.514 million of them were for senior caring. A total of 3.046

million inmates were accommodated, of which 2.887 million were for senior caring. There were

22 thousand community service centers and 114 thousand community service stations. Minimum

living allowances were granted to 18.802 million urban residents and 52.090 million rural

residents, and 5.295 million rural residents received five-guarantees supporting. Another 13.109

million needy people in urban areas were financed to participate in urban medical insurance

system, and 41.189 million needy people in rural areas were financed to participate in new rural

cooperative medical care system.

[31

Statistical Communique of the People's Republic of China on the 2014 National Economic and Social

Development, National Bureau of Statistics of China

[31

14

Although the China economy has slowed down after 2010, its growth rate has kept above 7%.

China's Miracle Economy is transiting to a New Normal Economy. China's government is trying

to steer the economy from the high-speed path towards a more sustainable growth path. In the

following years, the national economy will perform steadily under the new normal model with an

enhanced economic quality and improved people's livelihood. In the 18th CPC National

Congress, Chinese policymakers set a new economic goal: the economy should maintain

sustained and sound development. Major progress should be made in changing the growth model

towards a more balanced and sustainable economy. On the basis of 2010 GDP, China will double

its GDP and residents' income by 2020. [4] With such an optimistic economy forecast, Chinese

residents' income is expected to continue rising in the following years. As more households can

afford senior care service, more people would like to live in senior care communities.

[4]

The 18th CPC National Congress Report

15

Chapter III

China Senior Housing Market - An Immature Market

Although the Chinese senior housing market is undoubtedly appealing, industry players must

address several issues before step into this market because it is still in its infancy period

compared to other developed countries. Current senior housing development and operation in

China are largely unregulated. The market is untapped as well as an immature.

3.1 Social and Cultural Obstacles

Societal attitudes towards institutional senior care are not positive. For thousands of years,

China's families have relied on Confucian doctrine. Filial piety has a strong influence in Chinese

culture, and the motto of "bringing up sons to support parents in their old age" has been popular

for thousands of years. Chinese tradition advocates multi-generational households. Following

traditional practice, elderly people are dependent on their descendants for care. Therefore senior

care in China is family-based. It is considered utterly shameful for young generations not to take

care of their aging parents in Chinese culture, and most elderly people think of senior care

institution as their last option.

Another concern is the reputation of senior care institutions. Many elders and their children don't

trust senior care institutions. People often read negative news in the newspapers or in television

informing that elder people are abused in such institutions. Senior housing is largely unregulated

in current China. There are few administrative or professional agencies responsible for the

oversight of senior care providers. Especially in rural areas, accidents within senior communities

happen often. A fire broke out in a Senior Nursing Home in Lushan, Henan province on May 26,

2015 and thirty-eight elderly residents were killed. The fire was reportedly a result of an

electrical circuit problem. This tragic accident alarmed the whole nation. Some people worry that

16

their parents will suffer in senior care institutions. So they would rather leave their parents at

home than send them to professional care institutions.

3.2 Medical Insurance

Medical service are the prime factors that convince elderly people to enter an institution. But in

China medical insurance only can be claimed locally or regionally. It means that people cannot

get reimbursement if they receive medical treatment in other cities. Many cities in the north of

China have suffered from serious air pollution for many years, driving people to move to

southern cities. But it's a big challenge for elderly people who plan to move to other cities

because they will have to spend extra money on medical care. In 2014, the Ministry of Human

Resource and Social Security, Ministry of Finance and National Health and Family Planning

Commission jointly issued a document to promote the reform of basic medical security.

According to this document, basic medical reimbursement will be claimed within the province

area in 2015, and will be claimed at the national level in 2016.

[5]

This is very positive news for the senior housing market. However, relevant detailed regulations

are still in the making and some potential problems need to be resolved. The most striking

problem is the difference of medical insurance level between provinces. The first-tier cities like

Beijing and Shanghai are different with respect to other cities regarding to medical coverage.

Residents in first-tier cities are covered with higher insurance standards, because the local

economy is stronger than other cities. Some small cities like Kunshan in Jiangsu Province have

better medical insurance plans than others because their economies are stronger. Different

provinces have different policies on medical reimbursement percentages and medicine categories.

Solve the differences in medical reimbursement between developed areas and undeveloped ones

is the next challenge that the central government will need to address.

[51

The Guiding Opinions on Basic Medical Insurance Cross Cities Claims, December 2014

17

3.3 Land Policy

In China, the state owns all land. Corporates and individuals are only given the right to use the

land for specific purposes for a set period of time. Land use right is classified in five categories.

There are maximum tenure period defined for granted land-use rights depending on how the land

will be used. For residential estates, the maximum term is 70 years. For land in industrial,

educational, scientific and technological, cultural, health, sports, comprehensive, or other uses,

the maximum grant period should be no longer than 50 years. For land of commercial, tourist

and recreational use, the maximum term is 40 years.

Figure 3.1: Land Usage Category and Term

Land Use Purpose

Maximum Tenure (Years)

Residential

70

Industrial

50

Educational, Scientific, Cultural, Public health and Sports

50

Commercial, Tourism or Entertainment

40

Other purposes

50

The nature and type of land use right are important because they determine development costs.

For a profit-oriented business, the developer is only allowed to acquire land-use rights by

purchase. On the contrary, a non-profit organization obtains allocated land from local

governments for free.

Figure 3.2: Land Acquisition Ways and Cost Comparison

Land Acquisition Way

Cost

Administration allocation

No cost

Agreement through consultations

Land transfer

Invitation to bid

Auction

18

Figure 3.3: Characteristics of Land Acquisition

Business

Land Cost

Possibility of

Restrictions on

acquiring

operating

Subject to market price

Less restricted

Land Tenure

Mode

Depends on land

Profit

Higher

use purpose

Subject to willingness

Non-profit

Lower

50 years

More restricted

of local governments

The cost of land transfers is, of course, significantly higher than direct land allocation. In

addition, the development cost of Senior Housing is much higher than typical residential

housing, because senior care facilities' operations require larger outlays. If profit-oriented

business developers cannot decrease their land acquisition cost, they will not be willing to

develop senior housing. For profit-oriented businesses, there are no laws and regulations to

define a separate Senior Housing land category, and therefore no specific land supply devoted to

the Senior Housing market. The acquisition cost of residential and commercial land is high, so

developers have to turn around new properties as soon as possible in order to balance their

capital structure. But the value of a senior housing project lies on service and its capital return

period is much longer. Thus, developers are not willing to develop senior communities on

residential and commercial land. The high cost of the land bids in the auctions keeps many

developers away from senior housing.

In 2014, the Ministry of Land and Resources of China issued anew set of supportive land

policies geared to promoting senior housing development. According to the new policies,

non-profit senior institutions are entitled to separate administrative allocations and zero land

cost. In the case of or-profit senior community developments, the government encourages

developers to rent land or acquire land by negotiation agreements with local governments, rather

19

than competing with other uses in the auction process. E61 The market results of this new policy

have not become obvious till now. There is no doubt that, as the government regulation and

enforcement on the new land-use policy becomes better defined, more and more developers will

get in senior housing development.

3.4 Financing Model

Lack of financing limits the growth of senior care projects. The property development costs for

senior housing are more similar to multifamily residential and 3-star hotels. The cost is higher

than typical residential or more modest hotel properties because of the infrastructure required in

a senior care facility cost and the daily operation expenses. From land acquisition to project

completion, development usually takes at least two to three years in China, and cash flow only

come from operation revenues ex post. Such a long payback period increases the investment risk.

In China, bank loans are the main capital source for real estate development. Banks often require

land use rights as the collateral. Non-profit senior housing projects are entitled to administration

land allocations and the land cost is zero. However, banks don't accept such administration

allocations of land use rights as collateral. Profit-oriented senior housing projects are not entitled

to administrative land allocations, and the land for this kind of projects is usually residential and

commercial. Banks do accept such land as collateral, but assess senior housing project at

higher-risk levels since, their investment return periods are much longer than typical residential

properties. High-risk means higher loan rates. Therefore it is difficult for developers to get

secured lending at a good interest rate from a bank, exerting great pressure for senior housing

development. Chinese developers are now looking for other financing channels alternative to

bank loans.

16]

The Guiding Opinion on Utilization of Land Use Right for Senior Care Facility, April 2014

20

Insurance capital has flown into the housing market in recent years. Tai Kang Insurance, one of

the largest insurance companies in China, is the first insurance company to develop CCRC

retirement communities in China. Ping An Insurance invests in senior housing development via

its wholly owned subsidiary Ping An Real Estate Company. In late 2014, the Ministry of

Commerce and the Ministry of Civil Affairs of China jointly issued the "Announcement on

Encouraging Foreign Investors to Establish For-Profit Senior Care Institutions and Engage in

Senior Care Services in China." Through this Announcement, the Chinese government

encouraged more foreign investors to set up for-profit senior care institutions in China. Foreign

entities will be treated equally to domestic entities in terms of tax and fee preferential treatments.

With the announcement, it is expected that foreign capital will flow into China's senior housing

market.

Although more capital sources add into senior housing market, the financing options are very

limited in public markets. As there have been no REITs in mainland China, many Chinese

developers are planning to use Crowdfunding to finance their projects. In June 12, 2015, China's

biggest commercial property developer Dalian Wanda Group launched the first commercial

property crowdfunding project in China. Dalian Wanda Group obtained US$ 508 million by

Crowdfunding to invest on its commercial project. Crowdfunding provides an alternative method

for developers to obtain equity investment, and also provides individual investors with the

opportunity for equity investment in commercial real estate. Crowdfunding is currently used in

commercial and residential projects. It is perhaps the potential way for financing senior housing

development in China.

3.5 Operation Model

Developers acquire profit from land premium, product sales, and service fees. In China, the

choice of operation model depends on the land-use right. If the land has a residential or

21

commercial use, the property sitting on the land can be sold. In terms of other types of land use,

such as industrial, with a use right with a 50 years' term, the property on the land cannot be sold.

Therefore, the land use right and its tenure decide the operation model. There are three main

types of operating models in the Chinese senior-living property market.

*

Pure Leasing

In this model, developers hold properties for the long-term. The profit comes from operational

revenue. This model requires a strong capital commitment, powerful financial support, and a

highly professional operation team. To decrease the capital pressure, operators often require

potential residents to pay entry fees as deposits. In general, the fee structure consists of two parts:

entry fee or membership fee, and a monthly service fee. Fees vary greatly depending upon the

type of contract that residents choose. This model is mostly applied in high-end senior

communities in China. The example is Star Castle Senior Living Community in Shanghai.

0

Build and Sell

Build and sell is essentially the same as an ordinary residential development from an investor's

point of view since they usually do not manage the asset. This model has the shortest payback

period. The properties are often build on residential or commercial land, and entitled to be sold to

individual buyers. Compared to typical residential communities, senior communities are

equipped with senior care facilities. This kind of property often locates on the outskirts of a city,

and potential residents typically prefer it for its natural environment. The target customers are

high-class elderly customers and some middle-age customers. The middle-age generation

purchases senior apartments for their elderly parents, as well as vacation apartments for their

own. The example is Wuzhen Graceland in Zhejiang Province, China.

22

*

Sell and Leasing

This is an operating model that is a hybrid of build and sell and pure leasing. This model offers a

quicker capital return period than pure leasing. This is a good business model for those

developers who are in transition from ordinary residential development to senior housing

development. Partial property sales relieve capital pressure and financial risk. Meanwhile,

investors can enjoy long-term cash flow. In general, 30% of the property is leased and 70% is

sold in such a project. An example of this structure is Sun City in Beijing.

Figure 3.4: Comparison of Operation Models

Operation

Advantages

Disadvantages

Model

Long-term operation revenue,

Occupy high proportion of capital, long

improve team's operating ability. In

payback period, require powerful

Pure Leasing

general, the fee structures consist of

financing support and the professional

entry fee or membership fee and

operation team, high risk.

monthly service fee.

Partial property sale relieves capital

Need to maintain a liquid reserve to

pressure, less risk, long-term cash

cover both debt service and operating

flow.

expenses, middle risk

No operation risk, short payback

Cannot acquire long-term cash flow and

period, least risk in three models

project premium profit

Sell and

Leasing

Build and Sell

Although Chinese private investors are interested in senior care housing nroiects, they fhcus on

property premium rather than treating this as a service-oriented business. Many Chinese

companies that are interested in developing senior housing projects are real estate developers.

They are doing a good job in attracting clients to their facilities based on their physical appeal,

but are less based on service. They build and sell to make a quick financial return.

23

3.6 Regulations and Laws

Before 2000, the senior care industry drew less public attention in China. From land acquisition

to operation, there was not a definite set of regulations to follow. In the 2000s, China's

rapidly-aging population has driven Chinese policy makers to pay more attention to the elderly

care sector. The government promulgated a series of regulations to promote elderly care. There

were several milestones in the elderly-care regulatory framework at the national level.

Opinion for Accelerating the Development of Senior Care Industry

In 2006, the central government released the "Opinion for Accelerating the Development of

Senior Care Industry". In this document, the central government indicated the importance of the

senior care industry and proposed six goals.

* To strengthen the social welfare and develop comprehensive medical insurance

" To encourage private capital investment into senior care institutions

To develop home and community-based services for elderly

e

To develop hospice care

*

To promote senior-care facility development

* To strengthen the provision of training and education for professional staff

12th Five-Year Plan on the Development of Chinese Senior Care

In 2011, the State Council promulgated the "12th Five-Year Plan on the Development of Chinese

Senior Care". This is a national guideline and development strategy for elderly care. In this plan,

elderly mental care was added to governmental policy.

*

It relaxes norms for land usage and resources for elderly care, lowering barriers to entry

-

It provides government subsidies and allowances

24

Implementation of "Opinions on Encouraging and Guiding Private Capital to Invest in

Elderly Service Industry."

In 2011, the Ministry of Civil Affairs released the "Implementation Opinions on Encouraging

and Guiding Private Capital to Invest in Elderly Service Industry". The objectives of this

document were defines thus:

" To encourage private investors to run elderly care facilities, including senior apartments,

nursing homes and recreation centers

-

To provide government subsidies and tax preferential treatment

e

To expand the funding channels and develop innovative financial products

-

To encourage private investors to lease up currently public institutions, and reallocate and

optimize resources overall

Opinions on Accelerating the Development of the Elderly Care Industry

In 2013, the State Council promulgated the "Opinions on Accelerating the Development of the

Elderly Care Industry", and pointed out six goals.

e

To add consideration to public healthcare infrastructures in the process of city planning

e

To establish a service network for senior home care

e

To encourage private-sector players to participate in the management and operations of

elderly care institutions

-

To promote the elderly care industry in rural areas

e

To cultivate the elderly-person consumer market

e

To promote the collaboration of public hospitals and elderly care institutions, and to

develop a comprehensive medical insurance system

To achieve the above goals, the state council issued some supportive policies, including:

25

* Expansion of the funding channel for elderly care and encouragement of new financial

products/services

* Land supply support

*

Tax exemptions

*

Government subsidies

*

To strengthen the training and education for professional staff

*

To encourage charities to participate in the elderly-care industry

Announcement on Encouraging Foreign Investors to Establish For-Profit Senior Care

Institutions and Engage in Senior Care Services in China

In 2014, the Ministry of Commerce and the Ministry of Civil Affairs of China jointly issued the

"Announcement on Encouraging Foreign Investors to Establish For-Profit Senior Care

Institutions and Engage in Senior Care Services in China." The announcement is intended to:

* Treat foreign-invested company equally as domestic entities in terms of tax and fee

preferential treatments

-

Simplify the procedures to establish foreign-invested senior care institutions, clarify the

approval and registry measures

e

Approve foreign-invested senior care institutions to provide medical services

e

Encourage foreign investors to participate in the reform of state-run senior care

institutions

All these national regulations are general guidelines, without detailed provisions and standards.

In China, laws and regulations are promulgated from the central government. Local governments

are responsible for adhering to national policies. This structure provides local authorities much

room to implement policies in a flexible way that best fits local interests.

26

The most evident conflict in the current regulatory structure is on land profit. The central

government takes economic growth as the top priority, imposing great pressure on local

governments. However, the Chinese economy has been dependent on real estate investment for

decades. Local governments regard real estate as one of the most important economic engines.

Land is the base of real estate development.

In developed areas like Beijing, Shanghai and Guangzhou, local governments are reluctant to

supply land to elderly care institutions. Most elderly care institutions in China are registered as

non-profit entities in order to be exempt of business tax. Given the land scarcity in first-tier cities

and the high tax revenues coming from real estate, local governments have little incentive to

parcel land to nonprofit entities, which do not generate tax revenue and contribute little to local

GDP. Therefore, local governments are inclined to profit-oriented businesses when approving

land deals.

In less developed areas, local regulatory enforcement and supervision is weak. Developers find it

much easier to obtain land cheaply for senior care institutions. If they are entitled to

administrative allocations, some developers acquire land at almost zero cost. Actually they

sometimes end up doing residential or commercial development, not elderly-care institution

development. In order to avoid punishment, some developers add elderly facilities in residential

communities, but never provide elderly care service. A lot of "fake" elderly communities were

built in some provinces. In these areas, senior housing development becomes a gimmick to

secure cheap land.

In China, many regulations for the senior-care industry are only under discussion or being

drafted, and most of the current regulations are very broad and general, resulting in different

practices and interpretations from local authorities. Throughout the development process, from

27

land acquisition to asset management, developers and operators still have to rely heavily on

negotiations with the local governments, in order to clearly define the realm within which their

businesses will operate, as well as the potential preferential treatment to be offered.

The regulations are not transparent and enforceable. In terms of operating regulations, the

Ministry of Civil Affairs promulgated the "Standards of Social Welfare Institution for The

Elderly" in 2001, which is the only nationwide protocol available. However, this document

offers only general regulatory guidelines and the specific requirements are vague. When it comes

to enforcement, important decisions still depend on the local government's supervision.

3.7 Professional Workforce

In 2015 the Chinese elderly care market value will achieve 450 billion RMB, and the demand for

elderly care workforce will exceed 5 million.

[71

Compared to the rapidly aging population,

elderly care labor's shortage is worsening. Most frontline elderly-care workers are poorly

educated. Their knowledge and skills are not at professional standards and they are unqualified.

In the coming five to ten years, elderly service will face great pressure. The education, training,

evaluation and incentive policies for elderly-care staff will directly influence the elderly-care

industry in China.

[8]

There is a huge gap between the market demand for elderly-care

professionals and supply. China needs a huge development in the sizes of the populations of

frontline elderly care workers, and middle management of elderly-care programs and facilities.

Senior care workers work long hours and use a lot of energy every day. Unfortunately, senior

care workers' social status is still poor in China. Therefore, younger generations with more

opportunities are not willing to choose senior care as a career.

Five-Year Plan on the Development of Chinese Senior Care, 2011

Zheng, Vice Director, Department of Social Welfare and Charity, Ministry of Civil Affairs,

May 2015

[7112th

[ 81Bingliang

28

In senior care work, training is required, from basic assistance and nursing to necessary medical

support. And care providers have to learn the knowledge and skills to look after elderly's mental

health. But there is no pipeline of trained nurses, physical and rehabilitation specialists, and

doctors for senior care. The Chinese government advocates training programs in the elderly care

sector, and plans to solve workforce shortages by the means of more college education and

industry training. In 2014, the Ministry of Education and other nine departments released the

"Opinions on Accelerating the Elderly Care Education and Training". In 2015, the Ministry of

Education began to promote elderly-care education in professional colleges. These policies will

definitely increment the senior care labor pool. But the elderly care education and training is at

very early stage in China, and is weak compared to the U.S.

The demand for qualified and experienced staff will continue to outpace supply dramatically in

the next decade. The lack of professionals is a serious concern. Currently, in China, the pay for

senior care workers is very low, so there is little incentive for workers to improve their skills or

acquire knowledge. This situation needs to change. Current education and training programs are

not enough. Chinese policymakers should make the senior-care jobs competitively attractive

compared to other occupations in terms of salary. A big workforce demand and a limited supply

will otherwise limit the senior housing industry in China. Senior housing investors and operators

should pay attention to this issue when stepping into the Chinese senior housing market.

29

Chapter IV Implications of U.S. Senior Care Industry to China

4.1 Health Care REITs

Health care REITs play an essential role in the U.S. real estate capital market. The REIT

investment vehicle was created by United States Congress in 1960 through legislation called the

Real Estate Investment Trust Act, which authorized a real estate ownership structure with tax

treatment similar to that of mutual funds; a pass-through entity that distributes most of its

earnings and capital gains.

REITs offer all investors, not just the big players, a liquid way to invest in a diversified portfolio

of commercial property. They provide a means for many investors to achieve the benefits

associated with real estate investment, for whom direct equity investment is beyond their means

or infeasible. Shares of public REITs trade on organized exchanges. Perhaps the most notable

feature of REITs as compared to most other types of stocks is that REITs are exempt from

corporate income tax. The rationale for this exemption is that REITs are viewed as investment

vehicles, similar to mutual funds. Exemption from corporate-level taxation enables REIT

shareholders to avoid the double taxation of corporate income that characterizes most stocks.

[9]

In the U.S., senior housing development conforms an ecosystem involving developers, operators,

REITs, and private equity. REITs play an essential role in this ecosystem. There are fifteen

Health Care REITs in U.S. public market as of May 2015. Like all REITs, these firms are not

subject to federal income tax so that they can distribute 90% of their taxable income to

shareholders. Therefore, these stocks offer dividend yields above the market average level.

[9] Commercial Real Estate Analysis & Investments, 2nd edition, by David M. Geltner , Norman G.

Miller, Jim Clayton , Piet Eichholtz

30

Figure 4.1: U.S. Health Care REITs Return Rate

1 Year

3 Year

5 Year

Dividend

Market Cap

Sector

Constituents Return

Return

Return

Yield

($M)

Health Care

15

10.7%

12.7%

4.87

94,072.9

9.6%

Source: FTSE NAREIT Equity Health Care (Data as of May 2, 2015)

Figure 4.2: REITs in Health Care Sector

Company Name

Ticker

Divide Yield (%)

Care Trust REIT

CTRE

2.1

HCP

HCP

5.23

Healthcare REIT

HCN

4.27

Healthcare Realty Trust

HR

4.32

Healthcare Trust Of America Inc

HTA

4.16

LTC Properties

LTC

4.43

Medical Properties Trust

MPW

5.97

National Health Investors

NHI

4.79

New Senior Investment Group

SNR

1.38

Omega Healthcare Investors

OHI

5.32

Physicians Realty Trust

DOC

5.11

Sabra Health Care REIT

SBRA

4.71

Senior Housing Properties Trust

SNH

7.03

Universal Health Rlty Income

UHT

4.52

Ventas Inc

VTR

3.17

Source: REITWatch Monthly Statistical Report on the Real Estate Investment Trust Industry (Data as of

March 31, 2015)

31

Figure 4.3: 50 Largest U.S. Seniors Housing Owners as of June 1, 2014

2014 Rank

Company

2014 Properties

2014 Units

1

Ventas Inc.

695

61,938

2

Health Care REIT Inc.

572

56,479

3

Brookdale Senior Living

555

49,342

4

HCP Inc.

444

45,580

5

Boston Capital

512

30,794

6

Senior Housing Properties Trust

217

26,671

7

Holiday Retirement

167

20,601

8

Emeritus Senior Living

211

18,207

9

Evangelical Lutheran Good Samaritan Society

124

15,650

10

Senior Lifestyle Corporation

138

14,448

Figure 4.4: 50 Largest U.S. Seniors Housing Operators as of June 1, 2014

2014 Rank

Company

2014 Properties

2014 Units

1

Brookdale Senior Living

647

66,333

2

Emeritus Senior Living

499

45,296

3

Holiday Retirement

307

37,488

4

LCS

119

31,792

5

Five Star Senior Living

226

27,348

6

Sunrise Senior Living LLC

246

22,700

7

Erickson Living

17

20,118

8

Atria Senior Living Inc.

150

17,469

9

Senior Lifestyle Corporation

163

16,811

10

Evangelical Lutheran Good Samaritan Society

132

16,336

Source: American Senior Housing Association, The 2014 ASHA 50

32

Health Care REITs own and operate properties including hospitals, senior housing facilities,

skilled nursing facilities, and other medical office buildings. Some of Health Care REITs rank in

for about

top U.S. Seniors Housing Owners and Operators. Senior housing currently accounts

half of the net operating income (NOI) of the three largest health care REITs, Ventas, Health

Care REIT and HCP.

NOI by Proprty Type'

,

M

4

IT1 P'ER

*

4

"

Ventas

e

T INC

Health Care REIT

HOSPITAL

(Data as of 3/31/2015)

OUTPA

E NT

15%

OP5RATC,

35%/

21

* HCP

(Based on Investment Portfolio as of 3/31/15

and annualized 1Q 2015 Portfolio Income)

33

28%

4.2 Tailored Market

In U.S. senior care market, real estate products are well defined and properly designed to meet

the tailored demand. Many options are available to meet the needs of target customers.

-

Independent senior living communities

Independent senior living communities cater to seniors who are self-sufficient and who do not

need hands-on care. Residents live in fully equipped private apartments. These communities

usually offer a broad range of intellectual, physical and social activities. These communities

offer a carefree lifestyle, free of many potentially difficult or burdensome responsibilities, such

as meal preparation, housekeeping and laundry and house maintenance.

* Assisted living communities

Assisted living communities provide housing and care to seniors who may need some assistance

with daily tasks, but who do not require the skilled care provided at a nursing home. Assistance

with medications, activities of daily living, meals and housekeeping are routinely provided.

Three meals per day are also served in a central dining room. Staff is available 24 hours per day

for additional safety. Social activities and scheduled transportation are also available in most

communities.

e

Residential care homes

Residential care homes are houses in neighborhoods that have been adapted to take care of a

limited number of residents. They offer personalized service to a small group of adults. They are

private homes that serve residents who live together and receive care from live-in caretakers.

These homes offer assisted care services for seniors who want a more intimate, home-like

community. Assistance with activities of daily living such as bathing and dressing are typically

provided. Amenities and nursing services vary greatly between homes.

34

0

Nursing homes

Nursing homes are for seniors who require 24-hour monitoring and medical assistance. Nursing

home patients typically suffer from severe or debilitating physical or mental illnesses, so they are

unable to care for themselves. Nursing homes offer engaging resident activities, skilled medical

attention-such as physical therapists and licensed physicians, as well as gourmet dining services.

* Respite Care

Respite care typically refers to a short-term stay at a senior community, such as an assisted living

or memory care community. This type of care can also sometimes refer to in-home caregiving

services used for only a short period.

e

Memory Care

Memory care, is often provided in a secure area of an assisted living community or nursing home

usually in a separate floor or wing. The secure aspect of memory care communities is intended to

prevent residents from wandering off and becoming lost, which is a common and dangerous

symptom of Alzheimer's disease and dementia. The security usually takes the form of alarmed

exit doors rather than locked exit doors. Residents usually live in semi-private apartments or

private rooms and have structured activities conducted by staff members trained specifically

trained to care for those with Alzheimer's or other kinds of dementia.

In this highly tailored market, consulting services are also highly developed. Specialists are

available to provide expertise to help elders finding the right products to match their needs.

Senior Housing Consultants help guide builders, investors and developers through the complex

process of developing senior housing. There is a consultation process built from the ground up to

support each phase, from Market Assessment through Financial Feasibility and Business

Development to the on-going management of daily operations. Senior Care Advisors help people

35

find the senior living community that best meets their needs. Senior Financial Advisors help

people determine the monthly budget that is available for care, and decide how to pay for care

that won't be covered by medical insurance.

Figure 4.5: The Characteristics of Senior Housing Types and Care Types

Varies

Vane-

$604215

per day

$90-1250

per day

None

1+

1-3

Yes

Vane,

Vane,

Yes

Vane:

Ye:

Vanes

No

Most Yes

Ye:;

Most Ye:

Ye:

Ye;

Vane:

Yes

Ye-

Yes

Yes

Ye:

Yes

Vane,

Yes

No

Vanes

Ye-

Vane-

Vanes

Ye:

Yes

Varne,

No

No

Vane:

Vales

Vane,

Ye:

Vane-

Varie:

Vanes

No

No

Most Yes

Yes

Most Yes

Ye:

Yes

Ye-

Mot Yes

Vanes

Vane:

Most Yes

Yes

Most Yes

Ye:

Yes

Ye

Most Yes

Ye.

No

Yes

Yes

Vane:

No

Vane:

Varies

Vanes

Ye:

No

Ye:

Ye:

Yes

Yes

Ye:

No

Most Yes

No

No

Ye,

Yes

Yes

Ye:

Yes

No

MostYes

S2.000-5.000

per month

$400-Si 900

per month

Meal Plan

None

3-

3+

3+

3+

No*

No

Yes

Yes

Yes

No

No

Valie:

Vane-

No

No

Most Ye:

No'

No

No

month

80

Varies

65

Option"

80

80

75

$3.500-56,600 S1 000-48.000

$10412S13,000

per month

per month

Source: A Place for Mom

36

Vanes

S600520-539

per month

per hour

4.3 Laws & Regulations

In U.S. senior housing industry is largely regulated at the state level. The regulatory framework

of the states contains common elements, but some states regulate industry more stringently.

Taking Florida and New York as examples, two states' laws have detailed requirements on

continuing care.

2013 Florida Statutes

Chapter 651 - CONTINUING CARE CONTRACTS

651.011 - Definitions.

651.012 - Exempted facility; written disclosure of exemption.

651.013 - Chapter exclusive; applicability of other laws.

651.014 - Insurance business not authorized.

651.015 - Administration; forms; fees; rules; fines.

651.018 - Administrative supervision.

651.019 - New financing, additional financing, or refinancing.

651.021 - Certificate of authority required.

651.022 - Provisional certificate of authority; application.

651.023 - Certificate of authority; application.

651.0235 - Validity of provisional certificates of authority and certificates of authority.

651.024 - Acquisition.

651.026 - Annual reports.

651.0261 - Quarterly statements.

651.028 - Accredited facilities.

651.033 - Escrow accounts.

651.035 - Minimum liquid reserve requirements.

651.051 - Maintenance of assets and records in state.

37

651.055 - Continuing care contracts; right to rescind.

651.057 - Continuing care at-home contracts.

651.061 - Dismissal or discharge of resident; refund.

651.065 - Waiver of statutory protection.

651.071 - Contracts as preferred claims on liquidation or receivership.

651.081 - Residents' council.

651.083 - Residents' rights.

651.085 - Quarterly meetings between residents and the governing body of the provider; resident

representation before the governing body of the provider.

651.091 - Availability, distribution, and posting of reports and records; requirement of full

disclosure.

651.095 - Advertisements; requirements; penalties.

651.105 - Examination and inspections.

651.106 - Grounds for discretionary refusal, suspension, or revocation of certificate of authority.

651.107 - Duration of suspension; obligations during suspension period; reinstatement.

651.108 - Administrative fines.

651.1081 - Remedies available in cases of unlawful sale.

651.111 - Requests for inspections.

651.114 - Delinquency proceedings; remedial rights.

651.1151 - Administrative, vendor, and management contracts.

651.116 - Delinquency proceedings; additional provisions.

651.117 - Order of liquidation; duties of the Department of Children and Family Services and the

Agency for Health Care Administration.

651.118 - Agency for Health Care Administration; certificates of need; sheltered beds;

community beds.

651.119 - Assistance to persons affected by closure due to liquidation or pending liquidation.

38

651.121 - Continuing Care Advisory Council.

651.123 - Alternative dispute resolution.

651.125 - Criminal penalties; injunctive relief.

651.13 - Civil action.

651.131 - Actions under prior law.

651.132 - Amendment or renewal of existing contracts.

651.134 - Investigatory records.

NY Code

Article 46: CONTINUING CARE RETIREMENT COMMUNITIES

Section 4600 Legislative findings and purpose.

Section 4601 Definitions.

Section 4602 Continuing care retirement community council; powers and duties.

Section 4603 Commissioner; powers and duties.

Section 4603 A Residential health care demonstration facilities.

Section 4604 Certificate of authority required; application and approval.

Section 4604 A Council approval required for industrial development agency financing in

connection with continuing care retirement communities.

Section 4605 Certificate of authority; authority of operator.

Section 4606 Initial disclosure statement.

Section 4607 Annual statement.

Section 4608 Continuing care retirement contract.

Section 4609 Withdrawal, death or dismissal of person; refund.

Section 4610 Entrance fee escrow account.

Section 4611 Reserves and supporting assets.

Section 4612 Residents' organizations.

39

Section 4613 Advertisements.

Section 4614 Audits.

Section 4615 Revocation, suspension or annulment of certificate of authority.

Section 4616 Appointment of a caretaker.

Section 4617 Receiverships.

Section 4618 Civil action.

Section 4619 Criminal penalties.

Section 4620 Separability.

Section 4621 Priority reservation agreements; prior to obtaining a certificate of authority.

Section 4622 Priority reservation agreements; after obtaining a certificate of authority.

Section 4623 Long term care insurance for continuing care retirement contracts.

Section 4624 Continuing care retirement communities making assurances regarding long term

care.

By comparing continuing care regulatory requirements in Florida and New York, we can

summary the common elements of U.S continuing care regulatory framework.

* Authority To Operate

Each state requires continuing care providers to have operating certificates. The state agencies

are responsible for issuing certificates of authority. Each state requires at least one state agency

to oversee continuing care communities.

*

Financial Disclosure Requirements

States require continuing care providers to provide detailed financial statements to the pertinent

regulatory agency before they begin to operate. The statements must include any financial risks a

40

potential resident could face. The copies of these statements are also required to provide to

prospective residents.

* Ongoing Annual Report

States require continuing care providers to submit annual financial statements after opening.

The reports show the community's operating condition. The financial disclosure statements

include annual revenue and expense summaries

e

Minimum Liquid Reserves

States require continuing care providers to maintain in escrow a minimum liquid reserve to cover

both debt service and operating expenses.

e

Examinations and Inspections

State administrative agencies conduct routine examinations periodically. The results of

examinations and inspections shall be open to public.

e

Ability To Cancel Contract

States allow prospective residents to cancel their contracts within a certain amount of time and

receive all or most of their money back.

* Violation

States establish penalties for violations, including both civil and criminal remedies

e

Residents Rights

Some states establish bills of rights for senior residents. No resident of any facility shall be

deprived of any civil or legal rights, benefits, or privileges guaranteed by law, by the State

41

Constitution, or by the United States Constitution solely by reason of status as a resident of a

facility.

4.4 Professional Workforce Supply

U.S. also faces a shortage in its senior care workforce. Facing such care worker shortage, U.S.

policymakers and employers are working together to make the care occupations competitively

attractive compared to other occupations. In 2013 the U.S. Department of Labor announced a

final rule extending the Fair Labor Standards Act's minimum wage and overtime protections to

workers who provide home care assistance to elderly people and people with illnesses, injuries or

disabilities. The rule has been effective since Jan. 1, 2015. Nearly two million home health and

personal care workers benefit from this policy. This change will result in direct care workers

receiving the same basic protections already provided to most U.S. workers. It will also help

guarantee that those who rely on the assistance of direct care workers have access to consistent

and high-quality care from a stable and increasingly professional workforce.

42

Chapter V Senior Housing Cases Study

5.1 Brooksby Village

Address: 100 Brooksby Village Drive,

Peabody, Massachusetts, USA 01960

General Information

[10]

Brooksby Village is a full-service retirement community managed by Erickson Living.

It was opened in June 2000, located on Boston's North Shore, near to North Shore Mall,

units

Brooksby Farm and golf courses. Brooksby Village consists of a mix of independent living

ranging from studios to large two bedrooms. It also offer a range of assisted living units and

skilled nursing units that target specific needs.

Community Type

Units

Occupancy

Independent Community

1350

98%

Assisted Community

96

100%

Skilled Nursing Community

104

99%

Erickson Living is a nation-leading developer and manager of continuing care retirement

communities, ranking No. 7 in the largest U.S. Seniors Housing Operators in 2014. Erickson

Erickson

Living operates 19 communities in 10 states. 11 Continuing Care facilities managed by

Living have received the highest overall rating of five stars in U.S. News & World Report's

seventh annual Best Nursing Homes. Brooksby Village is one of these five stars rated

communities.

[101

43

*

Master Plan

Brooksby Village includes three residential neighborhoods, three clubhouses and Continuing

Care neighborhood.

win Court

*g

Cor

,snite way I

It

Cortdandcf

-r..

IN I

Iw

-m ----

Guest Pat kin

U"

.w

Guest Parking

,A

I

44

' Guest Parking

*

Floor Plan

Source: Brooksby Village

The Brighton (One bedroom, one bath)

I

I

Bedroom

11'11" x 12'10"

Living Area

12'0" x 17'8"

C

'P

C

Walk-In

Closet

DW

Bath

Kitchen

8'7" x 8'1"

W/D

45

The Georgetown (One bedroom, one bath with den)

1

F-

6

;V

4

Living Area

12'3" x 253"

Bedroom

11 '11" x 12'10"

CD

Den

11'2" x 8'11"

Walk-In

Closet

Kitchen

Bath

12'4" x 8'4"

.DW

-

W/D

46

The Gilbert (Extra large one bedroom, one bath with den)

I

-.

.I

I>

F_

Den

8'6" x 11'5"

Living Area

12'0" x 25'10"

Bedroom

11'10" x 14'5

-iW/D~

Walk-in

Closet

Kitchen

8'6" x 11'9"

Bath

Linen

47

The Fairmont (Large two bedroom, one bath)

I

-~

Bedroom

12'0" x 10'6"

Living Area

12'10" x 211"

Bedroom

12'1" x 13'0"

DW

K itchen

11'9" x 8'5"

ii

Walk-in

Closet

Bath

t

/

---------

48

W/D

The Jackson (Corner two bedroom, two bath)

Patio

Bedroom

11'6" x 14'10"

Living Area

13'1" x 19'0

Kitchen

128" x 10 1

Walk-In

Closet

DW

W/D

Bath

Bedroom

12'1" x 11'10"

Bath

49

The Kingston (Large two bedroom, two bath with recessed balcony)

~ET

Recessed Balcony

(Patio Unit Available)

V ~~ixA

I-

I~

r'

IF

Living Area

13'1" x 23'6"

Bedroom

11 7" x 11 2"

Bedroom

11'6" x 17'4"

I.

DW

SI

W/D

I

Kitchen

8'7 x8'1

Bath

Walk-in

Closet

Bath

50

The Lancaster (Corner two bedroom, two bath with sunroom and bay window)

Bedroom

17'1" x 11'4"

Bedroom

12'1" x 12'4"

*1

Walk-in

Closet

Walk-In

Closet

T*W/D

Sunroom

77" x 17'2"

Bath

Baf

-

4L

Kitchen

9B1" x 84"

IStorage

Living Area

25'1 "x 11 8

-74-

II

J

51

Studio

Studio

Deluxe Studio

-

-

rn-r~"

I

a edroom

8 ' x9'-10"

6

Bedroom

8'-1"x 13'-1

Living Room

8' x 9'-10"

Living Room/Dining Room

8'-1" x 13'-1

4.

4

1

U

41Bathroom

C

N

{_

BathroomX

N

Source: Brooksby Village Brochure

52

e

Pricing

90% Refundable Entrance Deposit

Monthly Service Package

(1) If residents decide to leave the

A Monthly Service Package covers all

community, 90% of deposit will be returned

regular bill, including:

to residents.

(2) If residents decide to spend the rest of

their life here, 90% of entrance deposit will

-

Utilities (except telephone)

-

Flexible dining plans

* Heating and air-conditioning costs

be returned to their heirs

-

Property taxes

-

Scheduled shuttle service to area

shopping and attractions

-

24-hour security and emergency first

response

-

Professional lawn care and grounds

upkeep

Figure 5.1: Brooksby Village 2015 Pricing Guideline 1

Assisted Care

Monthly packages range from $4,500 to $8,700

Entrance Deposit ranges from $119,000 to $250,000

Short-Term Rehabilitation

Medicare typically pays for short-term rehabilitation costs

Long-Term Care

$441 a day. Entrance Deposit $119,000

Respite Care

Cost depends on the services and the length of the stay

Memory Care

Monthly packages range from $7,120 to $7,470

Entrance Deposit ranges from $119,000 to $250,000

53

Figure 5.2: Brooksby Village 2015 Pricing Guideline 2

Studio

Starting at $114,000

$1,648

One bedroom, one bath

Starting at $170,000

$1,950

Extra large one bedroom, one bath

Starting at $210,000

$2,084

One bedroom, one bath with den

Starting at $263,000

$2,267

Two bedroom, one bath

Starting at $244,000

$2,380

Two bedroom, one and a half bath

Starting at $316,000

$2,534

Two bedroom, two bath

Starting at $336,000

$2,742

Extra large two bedroom, two bath

Starting at $455,000

$2,992

Second Person Monthly Service Package-$858. NO second person entrance deposit.

-

Level of Care

Brooksby Village is a full-service retirement community, providing a full of care on campus.

Figure 5.3: Brooksby Village Service

Rehab in Neighborhood

Offers inpatient and outpatient rehabilitation in campus

Continuing Care neighborhood. Therapists create the

customized plan to help residents achieve optimal results

and maintain the highest level of independence.

Assisted Care

Offers extra assistance with daily tasks like bathing,

meal planning and medication management.

Offers home care, respite care, long term nursing care

Customized Care

and memory care in Continuing Care neighborhood.

Individuals in these settings are supported by

professional staff members.

54

*

Medical Care

Brooksby Village provides medical care on campus. A full-time medical team services its

residents.

Figure 5.4: Brooksby Village Medical Service

On-Site Medical Center

The full-time medical staff at Brooksby. Village includes

board certified doctors and nurse practitioners. All are