OPENNESS AND INFRASTRUCTURE PROVISION by Ujjayant Chakravorty and Joy Mazumdar

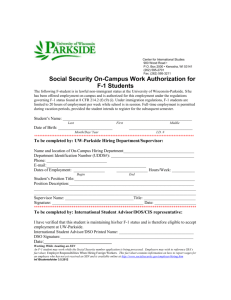

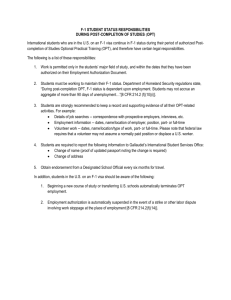

advertisement

OPENNESS AND INFRASTRUCTURE PROVISION

by

Ujjayant Chakravorty and Joy Mazumdar1

ABSTRACT

Casual empirical evidence suggests that infrastructure provision is higher in economies that are

open to world trade. We develop a model of imperfect competition to show that

governments are likely to provide more infrastructure when the country is open to trade.

Infrastructure provision is higher when the country trades with a less productive country or one

bigger in size. The effects are more pronounced in the presence of producer lobbies, i.e., lobbying

leads to greater infrastructure provision than under a social planner. These results suggest that the

stock of infrastructure in a country may depend on its openness and the size and productivity of

its trading partners. Cross-country regressions provide support for our hypothesis that more

openness leads to higher infrastructure provision.

Keywords: Economic Development, Lobbying, Public Goods, Trade and Growth

JEL Classification: F43, H11, O12

1

Respectively, Department of Economics, Emory University, unc@emory.edu; and Department of

Economics, Purdue University, jmazum@exchange.purdue.edu.

1. Introduction

It is widely acknowledged that infrastructure is critical for a nation's growth and economic

development. The World Development Report (World Bank (1994)) points out that ``the

adequacy of infrastructure helps determine one country's success and another's failure - in

diversifying production, expanding trade, coping with population growth, reducing poverty, or

improving environmental conditions.'' Many studies have found a strong correlation between

infrastructure and productivity. Hulten (1996) and Easterly and Rebelo (1993) find that the stock

of infrastructure is strongly related to economic growth in a cross-section of countries. In a study

of OECD economies, Roller and Waverman (2001) establish a significant causal relationship

between telecommunications infrastructure and aggregate economic output. Aschauer (1989) has

argued that much of the decline in U.S. productivity during the 1970s was precipitated by

declining rates of infrastructure investment. Munnell (1992) concludes from a survey that public

infrastructure has a significant, positive effect on output and growth. Fernald (1999) finds that

vehicle-intensive industries in the U.S. benefited disproportionately from road-building

suggesting that roads are productive. The significant role of infrastructure in economic

development suggests that an inquiry into the determinants of infrastructure provision may be

important for development policy.

Both in developed and especially in developing countries, the public sector provides the bulk of

infrastructure investments. In developing countries, the private sector accounted for only about 7

percent of total infrastructure investment while bilateral and multilateral aid accounted for

another 12 percent, the rest coming from the public sector (World Bank 1994). Not only does the

government finance most infrastructure, the latter also commands a significant portion of all

public investment expenditures in developing countries - rarely less than 30 percent and

sometimes as high as 70 percent (World Bank, 1994). Therefore, any analysis of the

determination of infrastructure provision will have to take into account the incentives the

government has in providing this public good.

There is anecdotal evidence to suggest that infrastructure provision is significantly higher in open

economies than closed ones. Mody (1997) suggests that infrastructure investment as a share of

GDP in six major East Asian economies2 ranges from 6 to 8 percent while it averages about 4

percent for the typical developing country. These six countries also have relatively high trade

2

They are: Hong Kong, Japan, South Korea, Malaysia, Singapore and Taiwan.

2

(exports plus imports) to GDP ratios. He argues that an important reason for this commitment to

infrastructure provision is ''to maintain the region's competitiveness in export markets.''

Evidence suggests that even within a country there may be significant differences in

infrastructure provision across sectors. Sectors exposed to international trade may exhibit higher

infrastructure investment than sectors that are closed to the international economy. For example,

in India, government expenditure in the telecommunications sector during the 1990s has grown at

a significantly higher rate than in other infrastructure sectors such as power, steel and roads.

Research by Pingle (1999) suggests that this is due to the export-oriented software industry which

relies heavily on telecommunications infrastructure.3 Under the Eighth National Five Year Plan

(1992-97), government expenditure in the telecom sector actually exceeded national plan targets,

unlike in other sectors in which expenditures trailed substantially behind target levels (Ahluwalia,

1998).

A positive relationship between infrastructure investment and openness is also evident in cross

country data, as shown in Figure1. Infrastructure investment is measured by the average share of

government expenditure on transport and communication in GDP. The openness variable is an

exogenous measure of openness that is a function of geography variables alone, originally

proposed by Frankel and Romer (1999).4 The correlation coefficient is 0.41 and is significant at

the 5% level.

The literature has focused on several key determinants of infrastructure, although none of them

directly address the relationship between infrastructure and openness. For example, Rauch (1995)

has suggested that improvements in the quality of the bureaucracy move the state away from

predatory behavior towards investing in infrastructure (e.g., road and water systems) which have

a relatively long gestation period. Alesina, Baqir and Easterly (1999) and Easterly and Levine

(1997) have shown that ethnic fragmentation leads to a lower provision of public goods. Other

studies have, more generally, attempted to isolate the determinants of ''good'' government, i.e.,

one which is conducive to the development of institutions that promote economic growth. La

Porta, Lopez-de-Silanes, Shleifer and Vishny (1998) find that countries with ethno-linguistic

homogeneity and common law regimes exhibit superior government performance, which,

according to them means the successful provision of public goods. Hall and Jones (1999) suggest

3

4

Approximately 75% of Indian software industry revenues are derived from exports (NASSCOM (2002)).

A detailed description of the data is provided in section 4 of this paper.

3

that the stock of ''social infrastructure'' - the institutional and policy environment - depends on the

extent of European influence. Rauch and Evans (2000) find that for developing countries, the

emergence of a professional bureaucracy is a key determinant of government performance as

measured by corruption and bureaucratic red tape.

These explanations have facilitated our understanding of the economic and social environments

which support infrastructure and public good provision, but they do not explain why we may

observe a positive relationship between infrastructure and openness.5 An important incentive to

provide infrastructure, as Mody suggests, may simply stem from a desire to maintain the

country's competitiveness in export markets. In particular, infrastructure investment may reduce

costs for domestic firms which compete with foreign firms in export markets. In this paper, we

develop a model of trade and infrastructure provision to show that the gains to investing in

infrastructure may be higher in an open economy, since domestic firms become more productive

and steal market share in export markets.6

Two types of comparisons are made. First, we compare infrastructure investment in the home

country when it trades with an identical foreign country and when it is closed to trade. We show

that infrastructure stocks will always be higher when the home country is open. They will be

higher when the trading partner is less productive, or has a bigger market size. However, when

the trading partner is more productive or has a smaller market size, infrastructure provision may

be lower in the open economy and higher in the closed economy. These results suggest that the

characteristics of the trading partner matter.

The above results are obtained under social planning. We then consider the case when the

government's decision to provide infrastructure is influenced by lobbying contributions from

domestic industries, as in Grossman and Helpman (1994). When the government maximizes the

sum of lobbying contributions and aggregate social welfare, we show that the stock of

5

The focus of this paper is on infrastructure, which can be defined as ''public capital stock'' (Munnell,

(1992)), i.e., public transportation and communication, roads, port facilities, and electricity and water

supply, etc. We do not focus on other publicly provided services such as law and order and national defense

which fall under the more general rubric of ''public goods.″

6

Brander and Spencer (1985) first suggested this ''rent shifting'' effect in a model of export subsidies. In

this paper, the subsidy takes the form of investment in infrastructure. We extend their analysis to include

market size and productivity of the trading partner as well as producer lobbies in the home country. Conrad

and Seitz (1997) have also used the rent shifting argument to examine infrastructure provision that reduces

costs of production. However, their focus is on tax competition, not on the relationship between

infrastructure provision and openness.

4

infrastructure may be higher in the open economy relative to the closed economy. These results

suggest that when industries face foreign competition, a government that is more responsive to

lobbying is likely to make higher investments in infrastructure.7

Finally, we run cross-country panel regressions with two different measures of infrastructure to

show that the degree of openness of an economy has a significant positive effect on infrastructure

provision. The results are generally robust to fixed effects and exogenous measures of openness.

While these tests may not necessarily constitute a complete test of our hypotheses, they suggest

that the causal link going from openness to infrastructure provision is a significant one.

Section 2 develops a simple model that compares infrastructure provision in open and closed

economies under a social planner. Section 3 extends the model to a lobbying economy. Section 4

provides empirical tests of the theory. Section 5 concludes the paper.

2. The Model

The set-up of the model is simple. Since the focus is on openness, we consider the home country

in two situations: when it is open and trades with an identical foreign country, and when it is

closed to trade. First consider the open economy, denoted by subscript ′1′, with two traded goods,

X and Z, the latter being the numeraire good. Production of good X increases with the stock of

infrastructure.8 The market for X is characterized by a duopoly, i.e., the domestic firm competes

with a foreign firm both at home and in the foreign markets, which are segmented. This

assumption of imperfect competition is reasonable since most exports, including those from

developing countries, consist of manufactured differentiated goods for which the assumption of

7

There is anecdotal evidence to suggest that lobbying leads to greater investment in infrastructure. In a

sociological study of the Indian steel, automobile and telecom sectors, Pingle (1999) concludes that higher

government investment in telecom was primarily due to the successful lobbying effort of the highly

organized Indian software industry. She documents the close interaction between the Department of

Electronics (DOE) of the Government of India and the premier industry lobbying group, NASSCOM

(National Association of Software and Service Companies). Unlike other government departments, the

DOE was always very accessible and cooperated closely with NASSCOM. Senior management of software

manufacturing firms frequently interacted with DOE officials, unlike in other industries. For example,

owners and senior managers of steel plants rarely visited the Ministry of Steel; only their liaison officers

did. Pingle points out that the DOE was highly responsive to industry needs and took the recommendations

of NASSCOM seriously. For example, it closely monitored the state of software development in other

countries, and even lobbied other departments (e.g., the Department of Telecommunications for

communication links, the Ministry of Finance for reduction of import duties, etc.) on behalf of the software

industry.

8

Implicitly, we claim that infrastructure raises the output of the X good relative to the numeraire Z good.

This is likely true of sectors such as manufacturing, which are dependent on infrastructure sectors such as

transport, communication and electricity, more than services or residential sectors.

5

perfect competition does not hold (Rauch (1999)).9 Investment in domestic infrastructure reduces

the cost of production of X, thus enabling the domestic firm to steal market share from the foreign

firm in both markets.10 The numeraire good Z is produced under perfect competition. The utility

function of each consumer is given by

U 1 = u( c1 ) + z1

where c1 and z1 denote consumption of the X and Z goods, respectively. The sub-utility function

u(•) is assumed differentiable, increasing and strictly concave. Labor is the only primary factor of

production. The per unit labor requirement of the numeraire good is unity. Let K1 denote the stock

of infrastructure capital in the home country. Infrastructure has public good characteristics.

Higher stocks of K1 reduce costs for all firms which produce X in the home country. Good X is

produced with technology given by q1 = F ( K1 )l1 , where q1 denotes production and l1 is labor used

by the firm. The production technology is concave so that F′ >0, F′′ <0.

Let K10 be the given initial capital stock for this economy. Then the total capital stock is defined

as K1=K10 +k1, where k1 denotes infrastructure investment.11 Stock K1 increases the productivity

of the domestic firm producing the X good. We assume that the government is the sole provider

of infrastructure capital. First we consider trade with a country with identical tastes so that

demand characteristics are exactly the same in both countries. Later we consider countries with

different demand characteristics. Let K1* be the corresponding capital stock in the X sector in the

foreign country. It is assumed to be constant, i.e., the stock of infrastructure capital in the foreign

country is fixed.12

9

It is not clear that infrastructure provision will be higher in open economies under perfect competition. In

that case, infrastructure investment acts like a production subsidy and leads to a terms of trade loss for a

large country if it is an exporter of the good, even though producers gain from a reduction in costs. Since

both domestic and foreign consumers benefit from this price reduction, the fall in the terms of trade will

lead to a welfare loss for the domestic economy. This is the standard trade theory result that under perfect

competition and in the absence of any distortions, export subsidies are always detrimental to the welfare of

a trading economy. In a closed economy, however, any price reduction resulting from infrastructure

investments will benefit domestic consumers only. The relative magnitude of the effects in the open and

closed economies is indeterminate.

10

Infrastructure investment, as in ports, and roads to a lesser degree, for example, will lower the cost of

production for domestic as well as foreign firms. However, as long as these investments benefit the

domestic firms more than they do foreign firms, our results will hold.

11

A minimum stock of initial capital is necessary for the cost of production to be lower than the maximum

valuation of the good, ensuring an interior Cournot solution, made precise later in this section.

12

Throughout this paper, the trading partner is assumed ''passive,'' i.e., the foreign country does not invest

in infrastructure capital. This situation may be representative of a developing country trading with an

6

Both firms, domestic and foreign, are assumed to engage in Cournot competition.13 Their Cournot

profits for good X are given by

π 1 = x1 p1 ( x1 + y1 ) −

x1

F ( K1 )

φ1 = y1 p1 ( x1 + y1 ) −

y1

(1)

*

F ( K1 )

where x1(π1) and y1(φ1) denote their output (profit) levels in the domestic market, respectively and

p1 is the output price of good X. Let x1* and y1* denote the corresponding output levels in the

foreign market. Because of symmetry, the profit functions, π1* and φ1* for the domestic and

foreign firms in the foreign market are identical to the ones for the domestic market and are not

written separately.

In the domestic market, the necessary conditions for profit maximization of the domestic and

foreign firms are

π 1x1 = p1 + x1 p1′ −

1

F ( K1 ) = 0

(2)

and

φ1 y1 = p1 + y1 p1′ −

1

*

F ( K1 ) = 0

industrialized country with a relatively high level of infrastructure provision. In that case, returns to

infrastructure investment may be ''small'' in the latter, so that assuming a fixed capital stock may be

plausible. It may be useful in later work, to consider how the results from our paper are altered when both

countries make strategic choices of infrastructure investment, possibly in a dynamic setting.

13

Bertrand price competition between firms would result in infrastructure investments such that price

equals marginal cost. In general, our results will still hold. If domestic costs fall sufficiently with

investment, domestic firms may capture the entire market. However, the assumption of a Cournot model

may be justified by the long-term nature of infrastructure investments, so that a capacity-constrained

Bertrand model will yield Cournot outcomes (see Tirole, (1988), p. 217).

7

where the derivatives are taken with respect to the subscripts x1 and y1. These conditions can be

solved to get equilibrium values of x1 and y1.14

By differentiating and solving the two necessary conditions above with respect to K1, we get the

rate of change of equilibrium output with respect to the stock of infrastructure:

− F ' ( K1 )φ1 y1 y1

dx1

=

2

dK1 [ F ( K1 )] (π 1 x1x1 φ1 y1 y1 − π 1 x1 y1 φ1 y1x1 )

(3)

− F ' ( K1 )φ1 y1x1

dy1

=

.

2

dK1 [ F ( K1 )] (π 1x1x1φ1 y1 y1 − π 1 x1 y1φ1 y1x1 )

(4)

″

′

″

′

We will assume that π 1x1 y1 ≡ p1 + x1 p1 < 0 , similarly ( φ1 y1x1 ≡ p1 + y1 p1 < 0 ).15 Then, it is easy

to establish that dx1/dK1>0 and dy1/dK1<0. That is, higher infrastructure stocks decrease domestic

production costs relative to that of the foreign firm, thereby increasing the market share of the

home firm in the domestic market, and reducing the share of the foreign firm. The change in firm

profits π1 with respect to the stock of infrastructure K1 is then obtained from (1) as16

dπ 1 ∂π 1 dx1 ∂π 1 dy1 ∂π 1

′ dy1 x1 F ′( K1 )

= x1 p1

+

.

+

+

=

dK1 [ F ( K1 )]2

dK1 ∂x1 dK1 ∂y1 dK1 ∂K1

(5)

Both terms on the right most side of the above expression are positive, so that dπ1/dK1>0. That is,

infrastructure capital increases profits of the domestic firm in the domestic market.17 These

14

′

″

The sufficient condition for profit maximization can be written as π 1 x1 x1 = 2 p1 + x1 p1 < 0 where we

make the simplifying assumption that p1′′ ≤ 0 (quadratic utility functions, for example, will generate linear

derived demand functions that yield p1′′ = 0). Since p1<0 from the properties of the utility function, the

above inequality holds. Moreover φ1 y1 y1 < 0, π 1x1 y1 < 0 and φ1 y1 x1 < 0 . These assumptions imply that

π 1x1x1 φ1 y1 y1 − π 1x1 y1 φ1 y1x1 > 0 .

15

For instance, linear demand functions satisfy this inequality.

where we use the relationship ∂π 1 / ∂x1 = 0 from (2).

17

By symmetry there is a corresponding expression for profits of the same magnitude for the domestic firm

in the foreign market. That is, the domestic firm also increases its market share (and profits) at the expense

of the foreign firm in the foreign market.

16

8

incremental profits come from two sources: from a reduction in the output of the foreign firm

(rent-shifting), and from a reduction in cost due to higher investment in sector-specific capital.18

Now consider the closed economy case, denoted by the subscript ′2′ and identical to the open

economy in every way, except that there is no trading and two domestic firms compete Cournot

in the home market.19 The corresponding utility function of the representative consumer U2 is

given by

U 2 = u( c2 ) + z 2

where c2 and z2 represent consumption levels of the X and Z goods, respectively. Denote the

output of good X by each of the two domestic firms as x2 and y2. Let K2 be the stock of

infrastructure in this closed economy. The public good nature of infrastructure implies that

increases in K2 will raise the productivity of both domestic firms. As in the open economy case,

the production technology is given by q2=F(K2)l2 so that the symmetric profit function for each

firm is π 2 = x 2 p 2 ( x 2 + y 2 ) −

x2

y 2 20

and φ2 = y 2 p 2 ( x 2 + y 2 ) −

. Since the two domestic

F (K2 )

F (K2 )

firms face identical cost and demand conditions, their output and profits are identical, i.e., x2=y2

and π2=φ2. As before, the necessary conditions for profit maximization can be differentiated to

yield the change in output per firm with respect to the stock of infrastructure K2:

− F ′( K 2 )(φ2 y2 y2 − π 2 x2 y2 )

dx 2

=

dK 2 [F ( K 2 )]2 (π 2 x x φ2 y y − π 2 x y φ2 y y )

2 2

2 2

2 2

2 2

(6)

The latter is captured by the term x1 F ′( K1 ) /[ F ( K1 )]2 . Unlike in the Brander and Spencer case of an

export subsidy, in our model, the direct marginal benefits do not equal unity. If the cost of providing an

additional unit of capital is unity, there may be a net benefit from providing infrastructure even if we ignore

the ''rent shifting'' effect.

19

The symmetric nature of imperfect competition in the open and closed economy is preserved by

assuming two firms in the latter. Since infrastructure is a public good, it is invariant with respect to the

number of firms in the economy.

18

20

′

′

Differentiation yields π 2 ( x 2 ) = x 2 p 2 + p 2 −

1

″

″

′

= 0 and π 2 ( x 2 ) = x 2 p2 + 2 p 2 < 0. A

F (K2 )

similar expression obtains for the second firm.

9

Since x2 and y2 are equal by symmetry, dx2/dK2>0 and dy2/dK2>0.21 That is, each firm's Cournot

output of the non-traded good increases with stock K2. Comparing the expressions (3) and (6),

note that the additional term π 2 x2 y2 in the numerator of (6) reflects the fact that an increase in

capital stock reduces the costs of the other domestic firm as well. Output per firm increases by a

smaller amount in this closed economy, because there is no rent-shifting, i.e., both firms benefit

from infrastructure provision.

Suppose that initial capital stocks are equal in the home country (both when open and closed) and

in the foreign country, i.e., K10=K20=K1*. Since preferences are identical in the domestic and

foreign countries, the firms' Cournot problems are identical in the open and the closed economy

cases. The equilibrium quantities and prices will thus be identical. In this perfectly symmetric

case, the increase in output for the domestic firm will be larger in the open economy than for a

firm in the closed economy.22 In the open economy, the domestic firm gains from cost reductions

as well as market-stealing. In the closed economy, both firms benefit equally from cost reductions

but there is no market-stealing.

This is shown diagrammatically in Fig. 2. With slight abuse of notation, let Rx and Ry denote the

reaction functions of the domestic and foreign firm in the open economy, in the domestic market.

Infrastructure investment shifts Rx outward leading to an increase in the domestic firm's output

from x0 to x1′ and a corresponding decrease in the foreign firm's output from y0 to y1′. An identical

shift (not shown) occurs in the foreign market. Now suppose Rx and Ry denote the reaction

functions of the two duopolists in the closed economy. Then infrastructure investment shifts out

both reaction functions, leading to an increase in each firm's output from x0 to x2′ and y0 to y2′

where x2′ is less than x1, i.e., ex-post firm output in the open economy will be higher than in the

closed economy.

Differentiating π2 with respect to K2, using symmetry (y2=x2) and substituting as in (5) yields

F ′( K 2 )

dπ 2

′ dy 2

= x2 p2

+ x2

dK 2

dK 2

[ F ( K 2 )]2

21

22

(7)

φ2 y2 y2 − π 2 x2 y2 = ( y2 p2″ + 2 p2′ ) − ( x2 p2″ + p2′ ) = p2′ < 0 .

From (3) and (6), dx2/dK2< dx1/dK1 at equilibrium.

10

A comparison of (5) and (7) suggests that dπ1/dK1 is greater than dπ2/dK2 at the initial levels of

capital stock in this perfect symmetry case.23 Marginal profits from infrastructure are higher in the

open economy than in the closed economy. In the open economy, the domestic firm increases its

output while the foreign firm reduces its output, leading to a smaller reduction in price relative to

the closed economy, where both firms increase output.

Optimal Infrastructure Provision in the Open and Closed Economy

Let the stock of infrastructure be chosen by a social planner. Assume L identical individuals in

the home country with one unit of labor producing one unit of capital. First consider the open

economy. The planner's objective is to maximize aggregate utility LU1 subject to the full

employment constraint and the trade balance constraint. The full employment constraint,

assuming each individual contributes one unit of labor, is given by

*

w1 +

x1 + x1

+ k1 = L

F ( K1 )

where w1 is the output of the numeraire good in country 1. Since foreign and domestic demands

are identical, the equilibrium Cournot quantities in the domestic and foreign markets will be

equal, i.e., x1=x1*. The price of good X will be equal in both the domestic and foreign markets.

The trade balance condition is

*

p1 ( x1 − y1 ) = Lz1 − w1 .

That is, the value of net exports of good X must equal net imports of the numeraire good Z. Given

K10, the choice of infrastructure investment k1 implies the choice of an equilibrium capital stock

K1.24 The social planner chooses the capital stock to maximize the sum of consumer and producer

surplus net the cost of infrastructure capital.25 It solves

Max Ψ1 ( K1 ) ≡ Φ 1 ( K1 ) + 2π 1 ( K1 ) − k1

(8)

K1

23

The first term on the right hand side of (7) is negative since dy2/dK2>0. The corresponding term on the

right hand side of (5) is positive. The second term is positive and equal in both equations because

K1=K2=K1* implies that x1=x2.

24

Since K1=K10+k1, the derivatives with respect to K1 and k1 will always be identical and can be used

interchangeably.

25

To prevent tax-induced distortions, we assume that capital investment is financed by lump sum taxes.

11

where Ψ1(•) is the net social surplus in the open economy and Φ1 is the consumer surplus in

sector X. By symmetry, total producer surplus in the X sector is twice the surplus earned in each

market (domestic and foreign). Consumer surplus is given by Φ 1 = Lu( c1 ) − p1 Lc1 . Therefore,

dΦ 1

dc

dc

dp

dy

′ dx

= Lu ′( c1 ) 1 − p1 L 1 − Lc1 1 = − Lc1 p1 ( 1 + 1 )

dK1

dK1

dK1

dK1

dK1 dK1

(9)

since u′(c1)=p1 from utility maximization of the consumer. Differentiating Ψ1 with respect to K1

and using (9) and (5) gives

dy

dΨ1

′ dx

′ dy1 x1 F ′( K1 )

= − Lc1 p1 ( 1 + 1 ) + 2 x1 p1

+

−1.

dK1 [ F ( K1 )]2

dK1 dK1

dK1

(10)

Similarly, for the closed economy, the net social surplus Ψ2 is maximized as:

Max Ψ2 ( K 2 ) ≡ Φ 2 ( K 2 ) + 2π 2 ( K 2 ) − k 2

(11)

K2

so that differentiating Ψ2 with respect to K2 and using Lc2=x2+y2=2x2 from the symmetric

duopoly structure in the market for the X good, we get

dΨ2

F ′( K 2 )

′ dx

= − Lc2 p2 ( 2 ) + 2 x 2 (

) −1.

dK 2

dK 2

[ F ( K 2 )]2

(12)

If initial capital stocks are equal in the domestic and foreign country, that is, K10=K20=K1*, then

dΨ1/dK1 > dΨ2/dK2.26 That is, the marginal return is higher in the trading economy relative to the

26

Adding (3) and (4) yields

− F ' ( K1 )(φ1 y1 y1 − φ1 y1x1 )

dx1

dy

. By symmetry,

+ 1 =

dK1 dK1 [ F ( K1 )]2 (π 1 x1x1φ1 y1 y1 − π 1x1 y1φ1 y1x1 )

φ1 y1 y1 = φ2 y 2 y2 ,φ1 y1x1 = π 2 x2 y2 , and all the corresponding second partials will be equal. Using (6) we get

d ( x1 + y1 ) dx 2

. Next compare (10) and (12). The right hand side is the same except for an additional

=

dK1

dK 2

12

non-trading economy. Producer surplus goes up by a bigger margin in the open economy case.

This happens for two reasons: the market stealing effect in the open economy; and the larger

decrease in output price in the closed economy since both firms increase their output. The latter

effect results in a decline in producer surplus which is exactly compensated by the larger increase

in consumer surplus in the closed economy relative to the open. What is left then is the effect of

market stealing, which results in a higher return to social welfare in the open economy case.

Investment in the open economy enables the domestic firm to gain market share at the expense of

the foreign firm, while investment in a closed economy yields no such benefit for the domestic

duopolists.27

In order to examine whether a higher marginal return to investment in the open economy leads to

a higher capital stock, let us assume that pi′′=0, i=1,2. This assumption is restrictive, but the

mathematics becomes quite simple. It implies linear demand for the X good with parameters

pi=a-b(xi+yi), i=1,2. First consider the open economy. We assume that consumer preferences are

identical in the domestic and the foreign country so that a(=u′(0)) is the same. However, different

population sizes in the domestic and foreign country would imply a different b. We first consider

an identical population size, i.e., L=L* (and therefore, b=b*).28

Define the unit cost of production for the domestic firm in the open economy as v1(K1)=1/F(K1)

so that v1′<0 and v1′′>0. Similarly, the cost of the foreign firm is v1*(K1*). We will assume that K1*

and therefore v1* is fixed.29 Let g(K1)=F′(K1)/(F(K1))2>0.30 Aggregate consumption of the X good

is given by Lc1=x1+y1. Substitution of the relevant terms in (10) yields the following expression

for the net marginal return to capital:

*

dΨ1 [10( a − v1 ) + 7( v1 − v1 )]g ( K1 )

=

−1.

dK1

9b

(13)

term 2x1p1′dy1/dK1 in the former. Since p1′<0, and dy1/dK1 <0, this term is positive, and therefore dΨ1/dK1 >

dΨ2/dK2.

27

Implicitly we take the ''world'' level of infrastructure to be given. In a model with multiple countries, our

logic implies there may be too much infrastructure globally, since no individual country internalizes the

externality that their infrastructure investment leads to a loss in market share by other country firms.

28

Since pi=u′(ci)=u′((xi+yi)/L) and therefore b=-dpi /d(xi+yi)=-u′′(ci)/L. A higher L* would mean a lower b*.

29

Output and prices for the linear Cournot model are x1=(a+v1*-2v1)/3b, y1=(a+v1-2v1*)/3b, and

p1=(a+v1+v1*)/3. Similarly, x1*=(a+v1*-2v1)/3b, x2=y2=(a-v2)/3b, and p1′=p1*′=p2′=-b. For an interior

Cournot solution, we require a>max {v1,v2,v1*}, i.e., maximum valuation must exceed unit production costs.

30

Then dx1/dK1=2g(K1)/3b, dy1/dK1=-g(K1)/3b, dx2/dK2=dy2/dK2=g(K2)/3b and v1′=-g(K1).

13

The same analysis can be repeated for the closed economy for which Lc2=2x2. Substituting the

relevant terms in (12) yields

dΨ2 8( a − v 2 ) g ( K 2 )

=

−1.

dK 2

9b

(14)

Comparing (13) and (14) yields dΨ1/dK1>dΨ2/dK2 for all K if K10=K20=K1*.31 That is, the graph

of dΨ1/dK1 lies everywhere above the graph of dΨ2/dK2 (see Fig. 3). Since returns to

infrastructure investment are higher in the open economy relative to the closed economy, the

equilibrium stock is higher in the former starting from identical initial stocks of capital, as shown

in the figure. Both Ψ1′(K1) and Ψ2′(K2) can be shown to be downward sloping under fairly

plausible conditions.32 We can summarize:

Proposition 1. The equilibrium stock of infrastructure in the open economy will be higher than in

the closed economy under identical demand and cost conditions.

However, this result may not hold once we introduce asymmetry between the two trading

partners, as shown below.

Trading with a More Productive and Larger Country

We model trading with a more productive country by assuming a higher initial stock of

infrastructure K1* in the foreign country. This will result in lower unit costs of production in the

foreign country, i.e., a smaller v1*. Since the domestic firm will now have a higher unit cost than

the foreign firm, its market share in both the home and foreign markets will be lower in an open

economy. This in turn will lead to a decline in the marginal returns from capital dΨ1/dK1 (check

(13). A smaller v1* will shift down the graph of Ψ1′(K1) in Fig. 3 leading to a smaller equilibrium

31

In this case investment in the stock of infrastructure beyond the initial level will imply v1*-v1>0 since v1

falls with K1. If K1=K2, then v1=v2, so that 10(a-v1)>8(a-v2).

32

The dΨi/dKi (i=1,2) functions are downward sloping, i.e., Ψi′′(Ki )<0 if we assume that vi′/vi′′ is constant,

which is true for cost functions such as e-zk, where z is a constant. From (13) observe that Ψ1′′(K1 )<0 if

′

*

10a + 7v1 − 17v1 v1

. If the inequality is satisfied at K10, then it is easy to check that it will be

<

′

″

17v1

v1

′

a − v2 v2

satisfied for all K1>K10. Similarly, Ψ2′′(K2 ) will be negative if

<

holds. Again, this inequality

′

″

v2

v2

will be satisfied for all K2>K20 if it is satisfied at K20.

14

K1. It implies that if a developing country trades with an infrastructure-rich industrialized nation

then it is likely to have a lower stock of infrastructure. We can state:

Proposition 2. The equilibrium stock of infrastructure in the open economy will be smaller if the

trading partner is more productive.

This result may seem counter-intuitive since trade with a more productive (and wealthier) country

could be beneficial: higher incomes may mean larger markets. This is because our quasi-linear

utility specification exhibits no income effects. However, one can incorporate market size by

varying the population in the foreign country. It can be easily shown that the result stated in

Proposition 2 is reversed if the foreign country has a sufficiently large population.33 That is,

trading with a more productive country may result in a lower stock of capital, but trading with a

bigger country may offset that effect.34

Even though the infrastructure stock in the open economy is likely to be smaller when trading

with a more productive nation, will it still be higher than in the closed economy? The possible

solutions are shown in Figure 4. The graph of Ψ1′(K1) will lie below Ψ2′(K2) at low levels of

capital stock. When the stock of capital in the home country is low compared to that in the

foreign country, the market share (and therefore output) of the domestic firm in the open

economy case is small since the foreign country is relatively more productive. So investment in

the open country yields lower returns compared to the closed economy. However, the marginal

return to investment in the open economy falls at a lower rate with increases in capital. This is

because with higher capital, the domestic firm is able to capture market share from the foreign

firm. This effect is absent in the closed economy. Therefore, the graph of Ψ1′(K1) will ultimately

33

A larger population in the foreign country implies b*<b, where b* represents the population parameter in

the foreign country. Then

dΨ1

=

dK1

*l

( 2a − v1 − v1 ) + 4

(b + b* )

*l

( a + v1 − 2v1 )]g ( K1 )

b*

− 1 , where v1*l

9b

<v1 denotes the unit cost in the more productive foreign country. The results in Proposition 2 will be

reversed if the condition 4(

b

*

*

*l

− 1)( a + v1 − 2v1 ) > 7( v1 − v1 ) is satisfied. The right hand side of the

*

b

inequality is strictly positive. Then a sufficiently large population in the foreign country (high b/b*) will

lead to a higher stock of infrastructure at home.

34

This result may not hold in a dynamic set-up, in which countries, realizing the advantage of having

higher infrastructure than their future trading partners, may build additional infrastructure today. In that

case, they will not only gain competitive advantage in future periods but its competitors will invest less. We

thank an anonymous referee for this comment.

15

cross Ψ2′(K2). There are two potential outcomes, as shown. The solid lines show the scenario in

which the equilibrium stock of infrastructure in higher in the open economy relative to the closed

one, i.e., K1H>K2H.

However, the equilibrium capital stock may also be higher in the closed economy, as shown by

the dashed lines, yielding K1L<K2L . Several factors may lead to this outcome. Low demand from

a smaller value of a (maximum valuation of the good) or a small population (high b) will reduce

domestic demand, shifting both graphs Ψ1′(K1) and Ψ2′(K2) to the left, so that they intersect below

the x-axis. Also, lower costs in the foreign country will shift the graph of Ψ1′(K1) down and

increase the likelihood that the stock is higher in the closed economy.35 We can summarize as

follows:

Proposition 3. A smaller population, lower demand and higher productivity in the foreign country

may result in a larger infrastructure stock in the closed economy.

Effect of Infrastructure Provision on Trade

We now consider the effect of infrastructure provision on the value of trade in the open economy.

First consider the symmetric case, i.e., when the domestic and foreign countries are equally

productive so that their costs of production for the X good are equal. This will imply an equal

market share for the domestic and the foreign firm. Then the exports and imports of good X are

exactly equal and there is no trade in the numeraire good. Investment in infrastructure at home

implies that domestic firms will capture market share from the foreign firm both in the home and

foreign markets and the equilibrium price of good X will fall. Exports of the home country x1*

increase while imports y1 decrease, leading to a trade surplus that must be compensated by a

matching increase in imports of the numeraire good. The home country only exports good X.

Given balanced trade, we can compute the value of trade from the value of home country exports.

With increase in exports, the price of the export good falls. Differentiating the value of exports

p1x1*, gives

′

*

d ( p1 x1 ) − ( a + v1 + 4v1 )v1

=

> 0.

dk1

9b

35

For the infrastructure stock to be smaller in the open economy, it is easy to check that the condition

a − vE <

7 E

*

( v − v1 ) must be satisfied, where vE=v(KE) and K E = {K dΨ2 / dK 2 = 0}.

2

16

That is, trade increases. This is also true when the home country is initially more productive.

However, if the home country is initially less productive than the foreign country, the latter would

start out as a net exporter of the X good and will only export this good. Infrastructure investment

at home would reduce the price and the quantity of exports from the foreign country. A decrease

in the value of exports of good 1 from the foreign country would reduce the value of trade.

Summarizing, we obtain

Proposition 4: Infrastructure investment increases (decreases) trade if the home country is a net

exporter (importer) of the good.

Infrastructure Provision in a Lobbying Economy

We ask if the above results hold when special interest groups make political contributions that

influence the government's decision to invest in infrastructure. We assume that only the producers

of the consumption good X lobby the government. Following Grossman and Helpman (1994), this

lobbying decision can be modeled in reduced form by assuming that the government considers

the total level of political contributions and aggregate well being. It maximizes a linear objective

function G given by

Gi = Ci ( K i ) + βΨi ( K i )

(15)

where i=1,2 denote the open and closed economies, respectively, as before; Ci represents the

contribution offered by the producers of good X and the parameter β denotes the weight the

government attaches to aggregate welfare. As Grossman and Helpman have shown, producers'

contributions equal the sum of their producer surplus and their share of the consumer surplus.

Lobbying contributions to the government can then be written as

C i ( K i ) = Π i ( K i ) + α [Φ i ( K i ) − k i ]

(16)

where Πi denotes aggregate producer surplus from good X, and α≤1 represents the fraction of the

population represented by the lobby. Differentiating Gi using (8) and assuming that demand

conditions are identical in the two countries, we obtain (for i=1,2)

17

dGi 1 1 + β

=

dK i α + β α + β

dπ i

2 dK

i

dΦ i

+

−1.

dK i

(17)

The right hand side of (17) is just a modified version of dΨi/dKi with a weight W =

1+ β

α+β

attached to the producer surplus component (check (8) and (11). Since α≤1, W is at least unity.

The government, therefore, attaches a greater weight to producer surplus under lobbying. At

equilibrium values of Ki, the right hand side of (17) must equal zero. Comparing this to the social

planner's case (obtained by differentiating (8) and (11)), it is clear that the equilibrium

infrastructure stock will be higher under lobbying relative to the socially optimal solution in both

open and closed economies. Because producer surplus has more weight under lobbying, the

returns to investment for a government receiving lobbying contributions increases, but the cost of

this investment (the cost of infrastructure capital) remains the same.

To compare the marginal return to investment in the open economy relative to the closed one,

consider the simplest case in which initial cost and demand conditions are identical (that is,

K10=K20=K1* and b=b*). Then, as shown earlier, marginal returns to investment are higher for the

open economy (relative to the closed one) under social planning. That is, from (8) and (11), the

following inequality

2

dπ 1 dΦ 1

dπ

dΦ 2

+

>2 2 +

dK1 dK1

dK 2 dK 2

must hold, which can be written as

dπ

dπ 2 dΦ 2 dΦ 1

>

.

2 1 −

−

dK1 dK 2 dK 2 dK1

(18)

18

The left hand side of the last inequality is positive because the marginal increase in profits in the

open economy are higher than in the closed economy, due to market-stealing.36 Since W≥1 and

the left hand side of (18) is positive, we get

dπ

dπ dΦ 2 d Φ 1

2W 1 − 2 >

−

.

dK1 dK 2 dK 2 dK1

(19)

But inequality (19) just implies that dG1/dK1 is greater than dG2/dK2. If (18) holds, so does (19).

Under lobbying, the marginal return to investment is higher in the open economy relative to the

closed one. Since the increase in the producer surplus is greater in the open economy a larger

weight on the producer surplus component increases the marginal return to investment in the open

economy compared to the closed.

Next we compare the stock of infrastructure in the open and closed economies under lobbying.

Consider the case with linear demand and different costs of production in the two trading

countries. Then (16) becomes

1

α + β

*

dG1 2( 4W + 1)( a − v1 ) + (8W − 1)( v1 − v1 )

g ( K1 ) − 1

=

9b

dK1

(20)

dG2 4(W + 1)( a − v 2 )

=

g(K2 ) − 1 .

9b

dK 2

(21)

and

1

α + β

Since W≥1, the right hand sides of (20) and (21) are greater than the right hand sides of (13) and

(14), respectively. Under lobbying, the graphs for the marginal return to investment for both

countries shift to the right (check Fig.4). This makes it more likely that the infrastructure stock is

higher in the open economy case.37 To summarize:

36

37

See discussion following equation (7).

It can be shown that the equilibrium stock is higher in the open economy in the lobbying case if

a − v E′ >

dG

8W − 1

*

( v E ′ − v1 ) where, vE′=v(KE′) and K E ′ = K

= 0 . If W=1, we obtain the

2( 2W − 1)

dK 2

19

Proposition 5. Infrastructure stocks are more likely to be higher in the open economy under

lobbying than under social planning.

The higher the stock of infrastructure capital, the more likely it is for the marginal return to

investment to be higher in the open economy. This is because a higher stock of capital results in a

larger market share for the domestic firm in the open economy case. Under lobbying, the

government attaches a greater weight to producer surplus and therefore tends to invest more in

both economies. Thus marginal returns are likely to be higher, leading to a higher capital stock in

the open economy relative to the closed one.

Higher investments in infrastructure under lobbying implies that overall trade could be higher

(see proposition 4). The trade-enhancing role of lobbying may seem contrarian, given that the

literature on the political economy of trade policy seems to suggest that lobbying increases

protectionism and reduces trade. However, as Grossman and Helpman (1994) and Rodrik (1995)

point out, lobbying may also result in trade-enhancing policies such as export subsidies.

However, when the home country is a net importer of the X good, lobbying may result in higher

investment which in turn leads to lower trade, as implied by proposition 4. Thus when the home

country does not have comparative advantage in the X good and is a net importer of it,

infrastructure investment acts like a trade barrier.38

3. Empirical Tests

In this section we provide empirical evidence for the theory. We test whether openness leads to

higher provision of infrastructure. We use cross country panel data for developing countries for

the period 1980-2000 on measures of government spending on infrastructure and the level of

infrastructure provision. We only consider developing countries because they exhibit significant

heterogeneity in their degree of openness, while industrialized nations have fairly open trade

regimes. Pooling developing and industrialized countries together may be inappropriate because

of the significant differences between them. These two groups of countries may also differ in

social planning solution (then vE′=vE). Since W≥1 and vE′<vE , this condition is weaker than the

corresponding condition under the social planner's case.

38

More generally, one would expect a similar outcome in the case of trade policies. That is, lobbying is

likely to lead to trade barriers and reduced trade when the home country does not have comparative

advantage in that good.

20

their sensitivity to infrastructure investments and stocks. Most industrialized nations already have

adequate infrastructure provision, and the marginal returns may therefore be relatively low.39

Within the developing countries, we first consider the full sample, and then exclude the

developed economies of East Asia from the sample to see how much, if any, of the results are

being driven by their presence.

The main equation to be estimated is as follows

I = b0 + b1 * Open + b2 * Income + γV + ξ

where I is the measure of the rate of infrastructure investment, Open and Income are openness

and per capita income, respectively, b0, b1 and b2 are the regression intercept and slope

coefficients, γ is the vector of regression coefficients attached to V , which in turn represents the

vector of other control variables, and ξ is the random error term. The motivation behind this

specification is an equation that relates the growth rate of capital stock to the initial capital stock

and factors that determine the steady state stock.40 Investment is higher if steady state capital is

higher once we control for the initial stock of capital. Due to diminishing returns to capital, a

higher initial capital stock will reduce the return to investment, and therefore the investment rate.

The Open variable and the elements of V constitute the various determinants of the steady stock

of capital. Since good data on measures of total infrastructure stock do not exist, we use

investment rate and lagged per capita income to capture the growth rate of capital and initial

capital stock, respectively. We expect b1 to be positive and b2 to be negative.

We also estimate another set of equations using measures of physical stocks of specific types of

infrastructure. This equation takes the same form as the equation above except for the fact that the

dependent variable is now a stock (not a flow) measure. In the theoretical model, the results hold

for both stock and flow variables. The coefficient on the income variable b2 will now be positive

39

Heterogeneity among institutions and political culture may also imply a very different relationship

between infrastructure and openness in developed and developing countries. The more sophisticated

political institutions in the former may provide their citizens a greater degree of control over the provision

of public services. Therefore, governments in those countries may be more responsive to the demands of

their citizens and provide higher levels of infrastructure regardless of the degree of openness.

The equation would be of the form ln( k t ) − ln( k t −1 ) = (1 − e − b ) ln( k * ) − (1 − e − b ) ln( k t −1 ) where k is

per capita capital stock, e denotes the exponential function, b captures the rate of convergence and k* is the

steady state capital stock (e.g., see Barro and Sala-i-Martin 1995).

40

21

since higher incomes should imply higher stocks of infrastructure, although, growth rates should

be smaller, as discussed above.

Description of Data

All variables and sources of data are listed in Table 1. The mean values of variables used are

reported in Table 2. The rate of investment in infrastructure (the flow variable), transcomshare,

is an aggregate measure of the share of central government expenditure on transport and

communication in GDP. It was compiled from IMF Government Finance Statistics.41 Government

expenditures on transport include the construction of roads, water, air and rail transport

infrastructure, but do not include expenditures on power generation.42 Expenditure on

communications includes postal, telephone, telegraph, cable and wireless systems and satellites

but excludes radio and television broadcasting systems (IMF, 1986). It does not include

expenditures at the state and local levels, accurate measures of which are generally not available.

This variable conforms closely to the investment variable used in the theoretical model of this

paper. An advantage of using a flow measure relative to a stock measure is that the latter is more

likely to be influenced by income.

The physical stock of infrastructure capital is measured using the following variables: (i)

electricity production per capita, measured in kilowatt hours. Electricity production, especially in

the developing countries, is still overwhelmingly in the public domain, as efforts to privatize

electricity generation and distribution are still in its infancy (OECD/IEA, 1999); (ii) the number

of telephone lines per 1000 population; and (iii) kilometers of roads per square km of land area.

These are measures that are among the most important components of infrastructure capital.

There are other types of infrastructure, e.g., port facilities, which could be important. However,

international data on these were not available.

The degree of openness is measured by the share of trade, i.e., the fraction of imports plus exports

in GDP. Table 3 (a,b) lists the countries in our sample used for the baseline regressions. They

were selected on the basis of availability of data over the 1980-2000 period since a number of

countries had significant missing data problems before this time period. Countries that had less

41

The Easterly and Rebelo (1993) data set, which reports data on different categories of public investment,

also includes infrastructure expenditures by public enterprises. However, it covers only three periods

(decadal averages) for each country and therefore cannot be used.

42

The data on government spending for electricity generation is under the broad category of fuel and

energy which includes non-infrastructure related items such as exploration, extraction, processing and

distribution of petroleum, natural gas, coal and other fuels etc.

22

than 5 years of data or did not have a continuous time series over several years were dropped.

Very small countries with populations of less than 2 million as well as former socialist countries

which underwent major structural changes during the period studied were excluded. The tables

show some broad patterns in the data. Table 3(a) lists countries with low and high openness (in

the top and bottom panels, respectively). Countries below (above) the median average openness

during the sample period were grouped as low (high) openness countries. Not surprisingly, all the

East Asian countries in the sample were found to be highly open. It is easy to check that the

average (over the entire period) share of expenditure on transport and communication is higher

for the countries with high openness compared to those with low openness. The former have

shares greater than 1% while most countries in the latter group spend less than 1% of their GDP

on transport and communication. The mean share is about 1.8% for highly open countries and

less than 1% for low open countries. Table 3(b) replicates this exercise with the Frankel and

Romer measure of openness that depends upon exogenous country characteristics such as

distance from other countries, size (measured by population and area), whether or not they are

landlocked and borders shared with other countries43. We see a similar pattern. Half the countries

in the low openness category have shares less than 1% while most countries in the high openness

group have shares greater than 1%. The mean share spent on infrastructure for the highly open

countries is also higher, although the difference is smaller compared to the regular openness

measure.

The transcomshare equation has several variables as controls. Lagged per capita GDP is included

for reasons mentioned above. Marginal returns to infrastructure investment, and therefore

investment rates, may be lower in countries with a high per capita income and therefore high

existing stocks of capital. An example is S. Korea, which has relatively low rates infrastructure

spending (0.74%), although it would be classified as highly open according to our criterion. It has

a relatively high per capita income compared to other developing countries (S. Korea was not

eventually included in our sample due to lack of data on all control variables). GDP per capita,

therefore, should have a negative effect on infrastructure investment. However, using the same

argument, this variable should have a positive effect on the physical stock of infrastructure,

namely, per capita electricity production, phone lines and roads.

43

Frankel and Romer estimate a bilateral trade equation with the exogenous variables mentioned above as

regressors. They then aggregate the fitted values of the bilateral trade shares to come up with the overall

trade share for a country that depends only on exogenous characteristics.

23

The population variable is used as a control in order to capture the size of the country. If there is a

minimum level of infrastructure investment necessary, regardless of size, we expect the

coefficient for population to be negative.

Two other types of control variables are used. The first includes factors other than the quality of

government that could influence the provision of public goods. In this group we consider (a)

Illiteracy: educational attainment of the population may have a positive effect on public good

provision in general and infrastructure in particular (Alesina, Baqir and Easterly (1999)) since an

educated population may be more effective in procuring public goods from the government. The

illiteracy rate is used as a measure of educational attainment. This coefficient is expected to be

negative; (b) Lagged Foreign Capital Share: availability of foreign capital may increase the

government's ability to invest in infrastructure. We use gross international capital flows as a share

of GDP to capture access to foreign capital. We expect the coefficient to be positive; and (c)

Ethnic fragmentation: ethnic heterogeneity has been shown to have a negative effect on public

good provision (Easterly and Levine (1997)). This variable (from La Porta et. al. (1998))

computes the probability that two randomly selected persons from a given country will not belong

to the same ethno-linguistic group. This coefficient is expected to have a negative sign.

The second group of controls measures the quality of government. A more effective government

may opt for both infrastructure investment and open trade policies since they are both welfareimproving. This will lead to a positive correlation between these two variables without there

being a causal relationship. The control variables considered are an index of government policies

that encourage productive activities and discourage unproductive ones: They are GADP

(government anti-diversionary policies): we use this measure of Hall and Jones (1999), which is

based on data compiled to provide country risk assessments to international investors. This

measure is an average of the ratings of governments according to five different criteria: (i) law

and order (ii) bureaucratic quality (iii) corruption (iv) risk of expropriation and (v) government

repudiation of contracts. We expect this variable to have a positive sign. The other three controls

in this group are measures of sound fiscal policy (lagged share of deficit in GDP) monetary

policy (inflation rate) and exchange rate policy (lagged black market premium) which are

important aspects of government performance. All three variables are expected to be negatively

related to infrastructure investment. Besides these variables, illiteracy, included in the first group,

may also capture an important aspect of government performance, i.e., its emphasis on education.

24

Two additional control variables are used. Gallup et al.(1999) suggest an alternative mechanism

by which trade could lead to higher infrastructure investments. Trade may lead to higher

productivity and a lower price of investment goods. This in turn, may induce higher returns to all

investment including infrastructure. We therefore include the log of total factor productivity

(TFP) and the relative price of investment goods as additional control variables. Total factor

productivity is computed using the method employed by Hall & Jones, taking into account human

capital.44 The relative price of investment goods was obtained from the Penn World Tables as the

ratio of price of investment goods to the price of GDP. We expect the log of TFP to have a

positive sign and the relative price of investment goods to have a negative sign.

We include a time trend to eliminate any correlation that may exist if the degree of openness and

investment in infrastructure have both increased over time. Some countries in the sample have

experienced excessively high inflation rates, black market premia and deficit rates. We include

dummies for these countries so that they do not influence the results.45 All control variables,

including openness, are lagged by one year to avoid reverse causality. The only exceptions are

illiteracy and population which do not change appreciably from year to year.

One problem with using OLS to estimate the regression equations is endogeneity. Better

infrastructure can affect both imports and exports, and hence openness. We employ instrumental

variables to address this problem. The instruments are (i) the Frankel and Romer measure of

openness described earlier, which is based on exogenous variables (ii) trade-weighted growth

rates of OECD trading partners and (iii) trade-weighted growth rates of non OECD partners. The

motivation behind the last two instruments is that high growth among trading partners could lead

to both high exports as well as imports from them, leading to increased trade shares for the

Hall and Jones use a Cobb-Douglas production function of the form Y=Kα(AH)1-α, where Y is output, K is

capital, H is human capital augmented labor and A is TFP. They assume that H takes the form H=eΦ(E)L

where Φ(E) captures the efficiency of labor with E years of schooling. The derivative Φ′(E) denotes returns

to schooling. They assume Φ(E) to be piecewise linear. The rate of return is 13.4% for the first 4 years,

10.1% for the next 4 years and 6.8% beyond the eighth year. The rates of return are based on cross-country

estimates on returns to schooling. We used the Penn World Tables and the Barro and Lee education dataset

to compute TFP. Education data for the years in which it was not available was estimated through

interpolation. The capital stock data is calculated from investment data using the perpetual inventory

method and assuming a depreciation rate of 6%.

45

The high inflation countries are Mexico, Uruguay and Turkey (above 100% in one or more years). The

high black market premium countries are Costa Rica, Zambia, Dominican Republic and Zimbabwe (above

100% in one or more years). The high deficit countries are Morocco, Sri Lanka and Zambia (above 10% in

one or more years).

44

25

country. These changes in the trade share are not brought about by policy changes or other factors

in the domestic country.

Results of Estimation

We report several sets of regressions. Table 4(a-c) report OLS and IV results for the different

measures of infrastructure for the entire sample. Table 5 reports the results for the investment

measure without the East Asian economies. All the results are reported with and without the

control suggested by Gallup et al (1997), namely log of TFP and the relative price of investment

goods.

Table 4(a) shows the regressions for the transcomshare variable. The left two columns report the

OLS and IV results. Lagged openness is positive and highly significant in both regressions. The

OLS results imply that a 10 percentage point increase in openness would increase the share of

government expenditure in transport and communication (in GDP) by 0.13 percentage points,

which is about 10% of the mean government expenditure share. Population has the right sign but

is not significant in the OLS regression. But per capita GDP has the expected sign and is also

significant in both the OLS and IV regressions. Inflation, ethnic fragmentation and lagged foreign

capital inflow all have the correct signs and are significant at the 10% level. Illiteracy has the

right sign and is highly significant. The GADP measure, deficit share and black market premium

do not have the correct signs but are not significant. By and large the IV results track the OLS

results quite closely, as far as the signs are concerned with a few exceptions like population

which does not have the right sign but is also insignificant in the former. The coefficient for the

openness variable in the IV is much higher than in the OLS estimate.

The last two columns include the two additional controls due to Gallup et al. We show the OLS

and IV results. All significant variables have the right signs as before. Log of TFP has the right

sign and is highly significant in both regressions. The relative price of investment has the correct

sign although it is not significant. The openness variable continues to be significant. Population

has the right sign and is significant in the OLS regression while lagged foreign capital share is

significant in the IV regression. The size of the point estimate is smaller in the OLS regression

with the two additional variables but it is still significant.

Tables 4(b) and 4(c) report the results for the stocks of different kinds of infrastructure as the

dependent variable. The reverse causality problem is likely to be more severe in the case of the

26

stock of infrastructure (investment today may not affect costs of firms so much but the stock of

infrastructure would certainly influence export and imports). We present both the OLS and IV

results in these tables. The left two columns in Table 4(b) report results for electricity per capita.

Openness has a significant positive effect on the stock of electricity in the OLS regression but not

in the IV regression. Inflation, however, has a positive significant effect throughout, which is

difficult to explain.

In the case of phone lines, openness has a positive significant effect in both the OLS and IV

regressions. However, some variables such as illiteracy, deficit share and foreign capital share

have the wrong sign. The regression results are quite consistent across the OLS and IV

regressions.

Table 4(c) shows the effect of openness on roads provision. Openness has a positive effect on the

stock of roads but is not significant. The fact that per capita income has a negative sign is also

troublesome. Other variables such as GADP and deficit share also have the wrong signs.

The results from the regressions involving the stock of infrastructure are, therefore, problematic.

Although openness has a positive coefficient in all these regressions, the variable is sometimes

not significant and other variables do not have the expected signs. One possible reason for this is

that there may be significant measurement problems associated with these stock variables.

One issue is whether our results are being driven by the East Asian countries. The experience of

these countries is, however, part of the motivation behind our hypothesis. So, it may not be

appropriate to exclude these countries from our sample. However, it may be a good robustness

check to see if the results still hold if these countries are excluded (we exclude Indonesia,

Malaysia and Thailand). Table 5 presents these results with transcomshare as the dependent

variable. As one can see, openness continues to be positive and significant in the OLS regression

if TFP and relative price of investment goods are not included. It does become insignificant once

these two additional variables are included. However, it is significant in the instrumental variable

regressions both with and without these two variables. We do not present the results with the

stock variables since the results are problematic, as we discussed earlier.

27

4. Concluding Remarks

This paper suggests that the degree of openness may be an important determinant of the level of

infrastructure provision. Governments may have a higher incentive to provide infrastructure when

domestic firms compete with foreign firms both at home and in the foreign market. We use a

simple model of imperfect competition to demonstrate this effect and show empirically that

openness leads to higher infrastructure investment in a cross-section of countries.

An important implication of this paper is that the size and productivity of the trading partner is

important in infrastructure provision. Trading with nations that are less productive or larger in

size may result in higher infrastructure provision. Future empirical work could examine how

infrastructure provision is correlated with the productivity and size of the trading partner or

whether a government that is more responsive to business interests is more likely to invest in

infrastructure. Future theoretical work can focus on the relationship between openness and

infrastructure provision when all trading partners make strategic infrastructure choices possibly

over multiple periods.

There is a sizeable literature that has examined the relationship between openness and corruption

(e.g., Ades and di Tella (1999), Treisman (2000) and Wei (2000)). Their basic premise is that

openness can reduce corruption by either influencing the incentives to engage in corruption or the

incentives to fight it. They focus on the role of openness in curtailing the negative aspects of

government intervention. Our results suggest that trade liberalization may lead to a more

constructive role for government, i.e., in providing infrastructure and public goods. This tendency

is stronger under producer lobbies.

In general, the interaction between trade and growth has received considerable attention in recent

years. This literature has focused mainly on how the private economy responds when it comes

into contact with the international market. There has been less discussion on how governments

respond to this process and how those responses, in turn, affect growth and development. This

paper is an effort towards bridging this gap.

28

REFERENCES

Ades, A., and Di Tella, R., (1999) ''Rents, Competition and Corruption,'' American Economic

Review, 89(4), 982-93.

Ahluwalia, Montek S. (1998), ''Infrastructure Development in India's Reforms,'' in Isher J.

Ahluwalia and I.M.D. Little, eds., India's Economics Reforms and Development: Essays for

Manmohan Singh, Oxford University Press, 87-121.

Alesina, Alberto, Reza Baqir and William Easterly (1999), ''Public Goods and Ethnic Divisions,''

Quarterly Journal of Economics, 1243-84.

Aschauer, David (1989), ''Is Public Expenditure Productive?'' Journal of Monetary Economics,

23, 177-200

Barro, Robert and Xavier Sala-i-Martin (1998), Economic Growth, Cambridge: The MIT Press.

Brander, James A. and Barbara J. Spencer (1985), ''Export Subsidies and International Market

Share Rivalry,'' Journal of International Economics 18, 83-100.

Conrad, Klaus, and Helmut Seitz (1997), ''Infrastructure Provision and International Market Share

Rivalry,'' Regional Science and Urban Economics 27, 715-34.

Easterly, William and Ross Levine (1997), ''Africa's Growth Strategy: Policies and Ethnic

Divisions,'' Quarterly Journal of Economics 112, 1203-50.

Easterly, William and Sergio Rebelo (1993), ''Fiscal Policy and Economic Growth - an empirical

investigation,'' Journal of Monetary Economics, 32, 417-458.

Fernald, John G. (1999), ''Roads to Prosperity? Assessing the Link Between Public Capital and

Productivity,'' American Economic Review 89(3), 619-38.

Frankel, Jeffrey, and David Romer (1999), ''Does Trade Cause Growth?'' American Economic

Review, 89(3), 379-99.

Gallup, John, Jeffrey Sachs and Andrew Mellinger (1999), ''Geography and Economic

Development'' International Science Review, 22(2), 179-232.

Grossman, Gene M., and Elhanan Helpman (1994), ''Protection for Sale,'' American Economic

Review 84(4), 833-50.

Hall, Robert E. and Charles I. Jones (1999), ''Why Do Some Countries Produce So Much More

Output per Worker than Others?'' Quarterly Journal of Economics, February, 83-116.

Hulten, Charles R. (1996), ''Infrastructure Capital and Economic Growth'', Working Paper 5847,

Cambridge: NBER.

International Monetary Fund (1986), A Manual on Government Finance Statistics. Washington,

D.C.

29

La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Schleifer and Robert Vishny (1998), ''The

Quality of Government,'' Working Paper 6727, Cambridge: NBER.

Mody, Ashoka (1997), Infrastructure Strategies in East Asia: the Untold Story, Washington, D.C.:

The World Bank.

Munnell, Alicia (1992), ''Infrastructure Investment and Economic Growth,'' Journal of Economic

Perspectives, 6(4), 189-98.

NASSCOM (2002), ''Indian Software Exports Grow by 65% in 2000-01,''

http://www.nasscom.org, National Association of Software and Service Companies.

OECD/IEA (1999), Electricity Reform: Power Generation Costs and Investment, Paris:

Organization for Economic Cooperation and Development and the International Energy Agency.

Pingle, Vibha, (1999), Rethinking the Developmental State, St. Martin's Press.

Rauch, James (1995), ''Bureaucracy, Infrastructure, and Economic Growth: Evidence from U.S.

Cities During the Progressive Era'', American Economic Review 85, 968-79.

Rauch, James (1999), ''Networks versus Markets in International Trade, '' Journal of International

Economics 48, 7-35.

Rauch, James and Peter B. Evans (2000), ''Bureaucratic Structure and Bureaucratic Performance

in Less Developed Countries,'' Journal of Public Economics 75, 49-71.

Rodrik, Dani (1995), ''Political Economy of Trade Policy,'' in Gene Grossman and Kenneth

Rogoff, eds., Handbook of International Economics, vol. 3. Amsterdam: North Holland.

Rodrik, Dani (1998), ''Why Do More Open Economies Have Bigger Governments?'' Journal of

Political Economy 97, 905-26.

Roller, Lars-Henrik, and Leonard Waverman (2001), ''Telecommunications, Infrastructure and

Economic Development: A Simultaneous Approach,'' American Economic Review 91(4), 909-23.

Tirole, Jean, (1988), The Theory of Industrial Organization, Cambridge: The MIT Press.

Treisman, Daniel (2000), ''The Causes of Corruption: A Cross-National Study,'' Journal of Public

Economics 76(3), 399-457.

Wei, S., (2000), ''Natural Openness and Good Government,'' Working Paper 7765, Cambridge:

NBER.

30

Table 1 Data Sources

Variables

Source

Transcomshare

Government Finance Statistics

(IMF)