The Relationship between Spot and Futures

advertisement

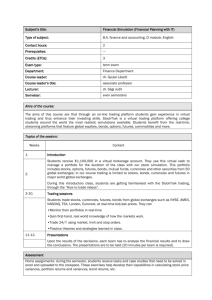

The Relationship between Spot and Futures Index Contracts after the Introduction of Electronic Trading on the Johannesburg Stock Exchange Owen Beelders1 and Jonathan Massey Department of Economics Emory University Atlanta Ga 30322-2240 March 13, 2002 1 We thank participants of the Third Annual Finance and Investment Conference of the African Center for Investment Analysis at the University of Stellenbosch, South Africa, in August 2001, for their comments on an earlier version of this paper and we thank Francisco Parodi for his research assistance. All remaining errors are ours. Abstract The objective of this paper is to analyze the interrelationship between the all share, gold and industrial indexes of the Johannesburg Stock Exchange and the corresponding index futures contracts traded on the South African Futures Exchange after the introduction of electronic trading. For the all share and industrials contracts, we find quicker information transmission between the spot and futures markets after the introduction of electronic trading. In addition, the contemporaneous correlation between the markets increases and the size and asymmetry of the volatiltiy spillovers is reduced. For the gold contract, we find slower information transmission after the introduction of electronic trading, but this result may be biased by the fact that the gold contract was discontinued. 1 Introduction The underlying principle of market efficiency is that new information is immediately reflected in asset prices. In practice market frictions such as transactions costs can impede the speed at which new information is reflected in prices. However, automated trading systems have decreased transactions costs and increased the speed at which new information can be reflected in asset prices. The objective of this paper is to analyze the speed of transmission of information flows between the Johannesburg Stock Exchange (JSE) and the South African Futures Exchange (SAFEX) after three important innovations: first, brokerage fees changed from fixed to flexible after the introduction of the new Stock Exchange Control Act in November 1995; second, the Johannesburg Equities Trading (JET) electronic trading system was introduced on the JSE in June 1996, and third, the JSE indexes underlying the futures contracts were redesigned to consist of a smaller basket of stocks. These innovations should increase the speed of transmission of information shocks between the spot and futures markets because electronic trading increases the speed at which transactions can be executed, the reduced size of the basket of stocks facilitates arbitrage and the cost of trading can be reduced by negotiating brokerage fees. We use two econometric methods to measure the speed at which information shocks are reflected in the spot and futures markets. First, using the cost-of-carry relationship as a guide, we test for cointegration and estimate a vector error correction model (VECM) for the pre- and post-JET sample periods. We then compare the speed at which a shock in one market is reflected in the other using the variance decomposition. Second, we use a bivariate EGARCH 1 model to measure the transmission of shocks to the conditional variance. In particular, we are interested in testing the following hypotheses: 1) futures markets respond more quickly to shocks than spot markets because of margin trading; 2) the transmission of shocks between the spot and futures markets is quicker after the introduction of the electronic trading system; 3) the contemporaneous correlation between the spot and futures markets increases after the introduction of electronic trading; 4) the spillover effects between the spot and futures markets are smaller in mag1 EGARCH is an acronym for exponential generalized autoregressive conditionally heteroskedastic. 1 nitude after the introduction of electronic trading because there is a larger contemporaneous response. We investigate the relationship between spot and futures markets for three index futures contracts traded on the SAFEX: the all share index, the gold index and the industrials index. The all share index is a value-weighted market index. The gold index represents the largest resource sector on the JSE and the industrials index represents the largest, aggregated non-resource index. For the futures contracts based on the all share and industrial indexes we find that the futures contracts do respond more quickly to shocks than the spot markets and that the speed of transmission of shocks between the spot and futures markets increases after the introduction of electronic trading. The contemporaneous correlation between the spot and futures markets also increases after the introduction of electronic trading and there is a reduction in the magnitude and asymmetry of the spillover effects in the conditional variance. These results do not hold for the futures contract based on the gold index because the gold contract was discontinued in 1998 due to the lack of trading volume. The paper is organized as follows. In section 2 we discuss the costs and benefits of automated trading and in section 3 we describe the electronic trading system on the JSE. We discuss the data and methodology in section 4 and report the results of our analysis in section 5. We conclude with section 6. 2 The Costs and Benefits of Automated Trading Prior to 1996, the Johannesburg Stock Exchange was characterized as a thinly traded market: the turnover ratio (total value traded divided by total market capitalization) averaged 6.4% per annum from 1990 to 1995 due to the highly concentrated nature of the JSE. The 20 largest firms made up 46% of the total market capitalization and the ten largest firms made up 30.2% of total market capitalization. Some of the largest firms were also characterized by pyramid structures that were designed to keep voting power in the hands of a close-knit family group (Barr, Gerson and Kantor (1995)). Although the problem of thin trading has been reduced due to the relaxation of exchange controls on South African companies, it still exists for the medium and small 2 companies. The main benefit of introducing electronic trading on the JSE is the transparency of the order book: it provides depth for the more closely-held and thinly-traded stocks. Of the more than 650 companies traded on the JSE at the end of 1999, we expect to see the greatest benefit accruing to the midsize and small companies that are closely held and have been thinly traded. The information intensity for these companies is low, trading volume is low and transactions are infrequent. For floor traders, information about the last trade of the thinly traded stocks is not very informative, the inactivity of floor traders does not reveal any information about their intentions and there is not much to be gained from conversation among traders. In contrast, the information in a limit order book is more updated and would provide a better indicator of market developments. On the other hand, electronic trading has two drawbacks for the more liquid stocks. First, the increased transparency provided by the limit order book may cause block trades to migrate to other markets. This may lead to a reduction in the trading volume of the larger firms on the JSE as volume migrates to many of the foreign markets where they are dually listed. Biais, Hillion and Spatt (1992) find empirical evidence of this cost where trades migrated from the automated Paris Bourse to London where the publication of transaction size can be delayed. Second, electronic trading introduces anonymity between traders. This can be a problem during “fast markets” when the information intensity is high (Massimb and Phelps (1994)). When information intensity is high the benefit shifts to floor trading because of the greater danger of adverse selection. Floor traders develop reputation capital for fair trading and this becomes more valuable when information intensity is high. Observation of other traders on the floor as well as their body language provides additional information about their future trades. The ability to change bid and ask prices is much easier on the floor according to Massimb and Phelps (1994) because this can be done by a simple hand signal and a brief verbal statement. In contrast, during periods of high information intensity, the anonymity of electronic trading creates opportunities for strategic trading and their is little protection against adverse selection. Traders may reduce their limit orders in the order book (Glosten (1994) or shorten the time span that an order is displayed in the order book to protect themselves. Franke and Hess (1995) hypothesize that traders preferences are revealed by the volume of activity on the floor relative to the electronic system during periods of different information intensity. For 3 the Bund futures market they find that the electronic trading system has a larger market share when volatility or information intensity is low. Martens (1998) has also shown that for ‘identical’ Bund futures contracts that are traded on the floor in London (LIFFE) and electronically in Germany (DTB), volume migrates to the LIFFE when the information intensity is high and volume migrates to the DTB when information intensity is low. When information intensity low, there is less of a concern for adverse selection and the anonymity of electronic trading is not as costly. On the other hand, when information intensity is high reputation capital that has been built up between traders on the floor of the LIFFE reduces the problem of adverse selection. Studies by Pagano and Röell (1992) and De Jong et al (1995) provide further support for this point. Madahavan (1992) reaches the same conclusion using a theoretical approach; the anonymity of the continuous auction (electronic) trading system leads to strategic behavior that distorts prices and induces inefficiency unless dealers can impose sufficient sanctions for traders to reveal their private information. In conclusion, the limit order book of an automated trading system may provide more of a market for the thinly traded stocks on the JSE, but the increased transparency and anonymity may cause larger, more highly traded companies to seek a listing elsewhere. Given that the futures contracts are based on indexes that are heavily weighted towards the large, liquid companies, electronic trading may actually impede the flow of information between the spot and futures markets. 3 The Introduction of Electronic Trading on the JSE In March 1996, the Johannesburg Stock Exchange introduced the Johannesburg Equities Trading (JET) system to improve the transparency for market participants. Since the inception of the JSE, trading was conducted on a trading floor using an open outcry system. The new electronic trading system was introduced over a three month period from March 8, 1996 to June 7, 1996. An additional benefit of the trading system are the security and fault audit trails that greatly enhance investor protection. The cornerstone of the order driven system is a central order book that is open to members via their JET workstations. Dealers enter buy and sell 4 orders which are included anonymously in the summary display and the aggregate of these orders make up the order book for all dealers to view. Previously, the Stock Exchange Control Act, No.1 of 1985 (the Act) stipulated that stockbroking firms could only act as agents on behalf of clients except under certain circumstances. The Stock Exchange Amendment Act, November 1995 and the amendments to the JSE rules now allow members the choice of dealing in a single or dual capacity. Dual trading capacity is where a member acts as either an agent on behalf of, or deals as a principal with a client. The member may therefore sell a client’s shares from its own holding of shares. The market also provides for voluntary market makers and in addition there is an Odd Lot Specialist who manages the market in odd lots, automatically trading the odd lot orders at the next round lot sale price. Round lots are the standard unit of trade (100 shares). The JET system operates from 8:25am to 6:00pm Mondays to Fridays (excluding public holidays) and the following sessions are applicable: preopening runs from 8:25am to 9:00am, the market opens at 9:00am, continuous trading takes place from 9:00am to 4:00pm and after-hours or runoff trading takes place from 4:00pm to 6pm. The transition from pre-open to open and from open to runoff fluctuates randomly within a range which is currently set at 5 minutes. This means that the market can open anywhere between 08h55 and 09h00; and can move to runoff any time between 16h00 and 16h05. The fluctuation was introduced to reduce any chance of price ramping. The trading sessions are organized as follows: during the pre-opening session, the JET system accepts limit priced orders only. “At Market” priced orders are not allowed. The JET system inserts orders into the queues of bids and offers for the Main Board which are ranked in price/time priority. Quotes are broadcast as orders are accepted during the pre-opening session. The system also calculates and broadcasts projections of the price at which each stock will open, based on the existing orders in the system and the “opening price algorithm”. No orders are matched until the opening of the market. During continuous trading, buying and selling orders at the same price level are automatically matched. “Limit” priced, “At Market”, “Fill or Kill”, “Hit and Take”, “Immediate or Cancel” are some of the order types accepted, as well as orders for the Odd Lot and Special Terms books. The run-off period can be used to report any arbitrage transactions to the system using the Report Only facility. The JSE has a Surveillance Department, responsible for the surveillance of market activities and member activities to ensure compliance with the Act, 5 JSE rules, directives and gazettes. The Department also monitors the capital adequacy requirements of members on a daily basis and conducts special investigations. The JET system provides improved transparency, security and full audit trails. Facilities also exist to “replay” the market which assists the Surveillance Department when analyzing particular market events. The main order book is the place where orders are routed, managed and matched. Orders which are received by the system and not immediately matched are stored in the order book and ranked in price/time priority. The main order book shows bids and offers where the bid represents the aggregate number of shares for each buying price level and the offer represents the aggregate number of shares for each selling price level. 4 Model and Estimation Strategy Our modelling strategy is motivated by the cost-of-carry relationship, an arbitrage relationship that links the spot and futures markets. In the absence of market frictions, the relationship holds exactly and new information is reflected simultaneously in both the spot and futures markets. However, given the presence of market frictions, we use the VECM to analyse the speed at which shocks to the spot market are reflected in the futures market, and vice versa, and we use the bivariate EGARCH model to analyze the transmission of volatility between the two markets. 4.1 The Cost-of-Carry Relationship In the absence of transactions costs, the following cost-of-carry (arbitrage) relationship holds between spot and futures prices (French (1988)): F (t, T ) = (1 + r(T, t))S(t) − D(T, t), where F (t, T ) is the futures price at time t with maturity at time T , S(t) is the spot price at time t, r(t, T ) is the T −t period riskless rate of return, where T − t is the time until the expiration of the futures contract; and D(T, t) is the value of the dividends paid over period from t to T by the stocks that make up the index. Implicit in this relationship is the arbitrage process that ensures that the equality holds via a cash-and-carry or reverse-cash-and-carry transaction. When transaction costs are present, the relationship does not hold exactly, but holds within arbitrage bounds around the true relationship. 6 Stoll and Whaley (1990) have found evidence that suggests that the cost-ofcarry relationship is sometimes violated outside of these bounds. In our empirical application, we use the cost-of-carry relationship as motivation for testing for cointegration between the spot and futures contracts, i.e. if both the spot and futures prices are integrated, the cost-of-carry relationship implies that the spot and futures prices may be cointegrated (Brenner and Kroner (1995)). 4.2 The Vector Error Correction Model The VECM has the following form for the spot and futures prices: ¶ ¶ X µ ¶ µ ¶ µ µ 10 ∆St−j Rst ∆St St−1 = Π0 + Π + + Πj ∆Ft Ft−1 ∆Ft−j Rf t (1) j=1 where St is the natural log of the spot price and Ft is the natural log of the futures price that is closest to maturity, Π0 is a 2 × 1 vector of intercepts, Π is a 2 × 2 matrix of error correction coefficients, the Πj are 2 × 2 matrices of coefficients on the lagged first differences of the spot and futures prices, and Rit , i = s, f, are the residuals of the spot and futures prices. First, we test for unit roots using the augmented Dickey-Fuller (ADF) test (Said and Dickey (1984)) and then we test for cointegration using the likelihood ratio test of Johansen (1991). If the spot and futures prices are cointegrated, we can use the VECM to analyze the speed at which shocks to the spot market are reflected in the futures market, and vice versa, by using impulse response analysis or the variance decomposition. In the absence of market frictions, new information should be reflected simultaneously in both the spot and futures market and neither Π nor any of the Πj should contain significant coefficients. However, due to market frictions we expect to find a lagged adjustment to new information, and due to the availability of margin trading, we expect the futures market to lead the spot market (Chan (1992)). After the introduction of the JET trading system, we expect to find that new information is reflected more quickly in both spot and futures prices. 4.3 The Bivariate EGARCH Model After estimating the VECM in (1), we save the residuals, (Rst, Rf t ), for use in the bivariate-EGARCH model. We use the bivariate-EGARCH model of 7 Koutmos and Booth (1995) because it captures the transmission of volatility between the two markets and the contemporaneous correlation between the two indexes. In addition, it improves the precision of the parameter estimates by extending the seemingly unrelated estimation method to the case that includes conditional heteroskedasticity (Bollerslev (1990)). The EGARCH structure also provides a number of benefits over other models of the conditional variance. It captures the asymmetric effect of ‘good news’ (positive returns) and ‘bad news’ (negative returns) on the conditional variance and does not require restrictions on the parameters to ensure a positive conditional variance. The bivariate-EGARCH model consists of the following equation for the conditional mean, Ri,t = φi,0 + φi,1 Ri,t−1 + εi,t , (2) where i = s, f and we include a lagged return to mop up any serial correlation that may still be present. We assume that the joint conditional distribution of the two errors is bivariate normal, i.e. ¶ µ εf,t |Ft−1 ∼ N(0, St ), (3) εs,t where Ft−1 is the information set containing information through period t−1, and the diagonal elements of St are given by the following equation for the conditional variance, σ 2i,t = exp (αi,0 + αi,1 (|zj,t−1 | − E |zj,t−1 |) + αi,2 zi,t−1 ¡ ¢ ¢ , +αi,3 (|zj,t−1 | − E |zj,t−1 |) + αi,4 zj,t−1 + γ i ln σ 2i,t−1 (4) σ i,j,t = ρi,j σ i,t σ j,t , i 6= j, (5) where zi,t = εi,t /σ i,t is the standardized innovation and E |zj,t−1 | = and the off-diagonal elements are given by p 2/π, for i, j = s, f . The conditional variance at time t is given in (4). Each of the four αi,j coefficients plays a specific role: αi,1 captures the effect of the magnitude of a 8 lagged innovation on the conditional variance and αi,2 captures the effect of the sign of a lagged innovation on the conditional variance, i.e. the leverage effect (Black (1976), Christie (1982)). This is shown by taking the partial derivative of (4) with respect to the standardized innovation: ∂σ 2i,t /∂zi,t = 1 + αi2 for zi > 0 ∂σ 2i,t /∂zi,t = 1 − αi2 for zi < 0. (6) If αi2j is negative and statistically significant, then we obtain an asymmetric response, i.e. if both αi2j and zi,t−1 are negative, the effect of the shock will be larger than if αi2 is positive. The relative importance of the asymmetry can be measured by the ratio, |−1 + αi2j | / |1 + αi2j |. The remaining two αij , j = 3, 4, capture the size and sign effect of a shock to market j on market i. The last term in the conditional variance contains the lagged conditional variance where the coefficient γ i is a measure of persistence. Following Booth et al. (1997) we use the γ i ’s to calculate the half-life of a shock using the formula ln(0.5)/ ln(γ i ), i.e. the half-life of a shock is the number of days it takes a shock to decay to half its initial level. Finally, we assume that the correlation coefficient is constant in (5). To accomodate the change to the JET trading system in June 1996, we replace each coefficient in (4) by αij + δ ij and we replace ρ in (5) by ρ + δ for the period after the introduction of the electronic trading system, i.e. we allow each coefficient in the conditional second moment to change after the introduction of the JET trading system. Because we are using daily data, we expect to find greater contemporaneous correlation between the spot and futures markets and less volatility transmission between the spot and futures markets after the introduction of the JET trading system. The log-likelihood of the system is given by, L(θ) = −(1/2) T X ¡ ¢ 2 ln(2π) + ln kSt k + ε0t St−1 εt , (7) t=1 where T is the number of observations, θ is the parameter vector, εt is the 2 × 1 vector of innovations at time t and St is the 2 × 2 time-varying covariance matrix. We maximize the log-likelihood function using the Broyden, Fletcher, Goldfarb and Shanno (BFGS) algorithm. The parameter vector θ has dimension (2 × 14 + 2) ×1 and consists of two vectors, (φi,0 , φi,1 , αi,0 , αi1 , ..., αi,4 , γ i , δ i0 , ..., δ i6 ), with dimension 14 × 1 for the spot and the 9 futures contract and the two remaining parameters are the correlation coefficient and the coefficient of the dummy, δ. Because the true distribution of the errors is unknown, we estimate the model using quasi maximum likelihood estimation (QMLE) and we use the White (1980) robust covariance matrix estimator for inference. 4.4 Data The data in this study consists of daily closing prices for the value-weighted all share, industrial, and gold indexes for both the spot and futures markets. The starting date of the sample is August 1, 1990 and the ending date is August 31, 2000 for the all Share index, February 14, 2000 for the Industrial Index and March 17, 1998 for the gold index, the date when the gold futures contract was discontinued. The data were extracted from historical data files that are available on the SAFEX web page (www.safex.co.za). Only nearby futures contracts are used because they are liquid enough to justify examination. The futures market closed at 4:30pm, 30 minutes after the closing of the spot market, during the pre-JET period although trading sometimes continued to 5:30pm. During the post-JET period the SAFEX opening time is 8:30am, 30 minutes before the spot market, and the closing time is 5:30pm. A possible explanation for finding a weak linkage between these two markets is the differences in closing times. During the pre-JET period that terminates at the end of 1995, the all share (ALSI), industrial (INDI) and gold indexes (GLDI) consisted of approximately 536, 324 and 40 stocks, respectively. In the post-JET sample, these three indexes were replaced by the ALSI40, INDI25 and GLDI10 indexes where the number at the end of each contract denotes the number of stocks in the index. Given the smaller basket of highly traded stocks in each index we expect a closer relationship between the spot and futures markets after the introduction of JET. We report summary statistics for the returns of all three indexes in the pre-JET and post-Jet sample periods in Table 1. In addition, we report the results of tests of skewness and kurtosis, serial correlation and conditional heteroskedasticity. We use the GMM estimator to obtain standard errors for the tests of skewness and kurtosis because it is robust to conditional heteroskedasticity in the returns (Pagan (1996)). The key empirical regularities for the three series are that they all have excess kurtosis, all have serial correlation and conditional heteroskedasticity. The returns of the gold index spot 10 and futures prices are large and negative for the post-JET period because this period coincided with a severe downward trend in the gold price. 5 5.1 Results VECM We report the unit root tests and tests for cointegration in Table 2. We include unit root tests on the levels and first differences of the natural log of the spot and futures prices where we include 10 lagged dependent variables in the ADF test. We find that each of the spot and futures prices is integrated of order 1, i.e. the levels are non-stationary and the first differences or returns are stationary. For the Johansen likelihood ratio (LR) test for cointegration, we also include 10 lags in the VECM. We find that all six pairs of spot and futures prices, pre- and post-JET, are cointegrated at the 1% level of significance. The results in the pre-JET period are consistent with the results of Ferret and Page (1998) who also analyzed the cointegration of the spot and futures contracts in the pre-JET period. Given the cointegrating relationships, we can now turn to the variance decompositions of the vector error correction model. We report the variance decompositions of the six models in Figures 1(a) through (f) where we focus on interpreting the transmission of a shock in the spot market to the futures market, and vice versa. The market that experiences the shock is placed first in the ordering for the variance decomposition. We use the interpretation in Hamilton (1994, p. 324), for the variance decompositions, i.e., the variance decomposition of variable i converges to the percentage of the variance that can be explained by a shock to variable j. Figure 1(a) contains the variance decompositions of the spot and futures prices of the All Share Index after a one standard deviation shock to the spot price. In the pre-JET sample, the effect of a shock to the spot price decays slightly over time and explains about 80% of the variance of the spot price after 10 days. The effect of the shock to the spot price has an immediate effect on the futures price and accounts for slightly less than 40% of the variance in the futures price. In addition, there is no decay in the effect across the 10-day horizon. In the post-JET period, a shock to the spot price has a much bigger initial effect on the futures price: 80% of the variance is 11 explained from day one and there is no decay after 10 days. This result is consistent with our expectation that electronic trading leads to a closer link between the spot and futures markets. Turning to Figure 1(b), we consider a shock to the futures price of the All Share Index and its effect on the spot and futures prices. Here we find a big difference between the pre- and post-JET behavior of the variance decompositions. Before the introduction of JET, a shock to the futures price initially explains about 40% of the variance in the spot price and then increases to 70% after 10 trading days. However, after the introduction of JET, a shock to the futures price has a much bigger initial effect of 80% and then continues to increase to 95%. Once again, this result is consistent with our expectations that the electronic trading system has increased the contemporaneous response and the speed of information transmission between the markets. Figures 1(c) and (d) contain the variance decompositions of the gold index. In Figure 1(c) we see that a shock to the spot market explains about 80% of the variance in the futures market with no decay over the 10-day horizon, prior to the introduction of JET. However, in the post-JET period we find that the initial response is only 60% and increases to 90% after 10 days. These results are not consistent with an improvement in the information transmission between the spot and futures markets. In Figure 1(d) we find that the transmission of a shock from the futures to the spot market has also deteriorated and the variance decomposition has shifted down. In the pre-JET period, the initial effect of a shock to the futures market explained 80% of the variance in the spot market and this increases to slightly more than 90% after 10 days. However, in the post-JET period, the initial response is only 60% and after 10 days, only 70% is explained. These results are consistent with the fact that the gold index contract was discontinued in 1998 due to the lack of trading volume. Figures 1(e) and 1(f) contain the variance decompositions of the Industrial index. In Figure 1(e) we find little difference between the transmission of a shock in the spot market to the futures market, however in Figure 1(f) we find that a shock to the futures market has a uniformly stronger effect on the spot market. In the pre-JET period, we find that a shock to the futures market initially explains 50% of the variance in the spot market and this increases to 85% after 10 days. In the post-JET period, the initial response is stronger: it begins at 60% and increases to 95% after 10 days. We conclude that the introduction of the electronic trading system has had a positive effect on the speed of information transmission between the 12 spot and futures markets for the contracts based on the all Share index and the industrial Index. There was no benefit to the contract based on the gold index although this result may simply reflect the fact that the contract was unsuccessful and was discontinued in 1998. These results are consistent with Ferret and Page (1998) who analyzed the pre-JET period, i.e. there is bi-directional feedback between both spot and futures markets for all three contracts. 5.2 The Bivariate EGARCH Model The parameter estimates of the bivariate EGARCH model for the all share index are contained in Table 3. We find that neither the LB test of the standardized residuals or squared residuals are significant thus confirming that the model captures the serial correlation and conditional heteroskedasticity that is present in the data. The likelihood ratio test statistic of the null hypothesis that each of the dummy coeficients equals zero is highly significant. Prior to the introduction of the JET trading system, we find that the spot contract on the all share index has no asymmetry in its conditional variance with respect to its own shocks, but the shocks from the futures market do have an asymmetric effect. The effect of a negative shock to the futures market on the conditional variance of the spot market is 50% bigger than a positive shock. In addition, the coefficient of the lagged conditional variance is 0.9478 and implies that shocks to the spot market have a half-life of 13 days. Turning to the futures contract, we find significant asymmetry with respect to its own shocks, but no volatility spillovers from the spot market. The coefficient on the lagged conditional variance implies that shocks to the futures market have a half-life of 6 days. When we consider the coefficients of the dummies on the conditional variance that allow for parameter changes after the introduction of electronic trading, we find that shocks to the spot market have an asymmetric effect on the variance of the spot contract and the asymmetric effect of the futures market on the spot market has been considerably reduced. The effect of a negative shock from the futures market on the spot market has a been reduced from 1.5 to 1.01. For the futures market, we find a reduction in the asymmetry of the effect of its own shocks on its own conditional variance and shocks to the spot market now do have an effect on the conditional variance of the futures market. Finally, we find that the contemporaneous correlation between the two markets has increased from 0.6657 in the pre-JET period to 13 0.8514 in the post-JET period. In summary, the introduction of electronic trading has led to a much stronger contemporaneous correlation, a reduction in the spillovers from the futures to the spot market and an increase in the spillovers from the spot to the futures market. The parameter estimates of the bivariate EGARCH model for the industrial index are contained in Table 4. We find that neither the LB test of the standardized residuals or squared residuals are significant thus confirming that the model captures the serial correlation and conditional heteroskedasticity that is present in the data. The likelihood ratio test statistic of the null hypothesis that each of the dummy coeficients equals zero is highly significant. For the spot contract there is no asymmetric effect for its own shocks and no spillovers from the futures market before or after the introduction of the JET system. For the futures contract,we find no asymmetric effect of its own shocks prior to the introduction of electronic trading, but we do find a small asymmetric effect from the spot market after the introduction of electronic trading. In the post-JET period, the futures contract has significant asymmetric effects from its own shocks and the asymmetric effect of its own shocks on the spot market are eliminated. For both the spot and futures contracts we find a significant increase in the coefficient of the lagged conditional variance. For the spot contract, the coefficient increases from 0.6501 to 0.9706 while for the futures contract it increases from 0.8251 to 0.9754. Finally, we find that the contemporaneous correlation increases from 0.7552 to 0.8055. The general conclusions that we can draw from this section are that the contemporaneous correlation between the spot and futures markets increases after the introduction of electronic trading and there is a reduction in the magnitude of the asymmetric spillovers. We did not estimate the model for the gold index because of the estimates would be biased by the fact that the gold index futures contract was discontinued. 6 Conclusion The objective of this paper was to analyze the interrelationship between the all share, gold and industrials indexes of the JSE and their corresponding index futures contracts on the SAFEX. We find that the three indexes and their futures prices are cointegrated. In addition, using a VECM we find 14 that after the introduction of electronic trading the spot and futures markets respond more quickly to their own shocks and shocks from the other market. In particular, using a bivariate-EGARCH model we find that the contemporaneous corelation increases, the spillover and asymmetric effects decrease in size. Despite the fact that the indices are heavily weighted towards the large, highly traded stocks on the JSE, the electronic trading system does not hamper the price response as suggested by some of the theories in section 2. Future analysis of the introduction of JET can be conducted at a microstructure level by looking at the changes in the volume of trading of small and large companies as well as their bid-ask spreads. If electronic trading is good for small companies, we expect to see an increase in trading volume and a decrease in their bid-ask spreads, but if it is bad for large companies, we expect to see a decline in volumes and an increase in their bid-ask spreads. In addition, for the large companies that are listed in London and/or New York we expect to see a migration of block trades away from the JSE. Finally, it would be better to analyze the relationship between the spot and futures markets using intra-day as opposed to a daily data. References [1] Affleck-Graves, J.P and A.H. Money (1975) “A Note on the Random Walk Model and South African Share Prices,” South African Journal of Economics, 43, 3, 382-388. [2] Barr, G.D.I., J. Gerson and B. Kantor (1995) “Shareholders as Agents and Principals: The Case for South Africa’s Corporate Governance System,” Journal of Applied Corporate Finance, 8, 1, 18-31. [3] Biais, Bruno, Pierre Hillion, and Chester Spatt (1995) “An Empirical Analysis of the Limit Order Book and the Order Flow in the Paris Bourse” Journal of Finance, 50, 5, 1655-89. [4] Chan, K. (1992) “A Further Analysis of the Lead-lag Relationship Between the Cash Market and Stock Index Futures.” Review of Financial Studies, 5, 123-152. 15 [5] Engle, R.F., Granger, C.W.J. (1987) “Cointegration and Error Correction, Representation, Estimation, and Testing.” Econometrica 55, 251276. [6] Ferret, A., M.J. Page, (1998) “Cointegration of South African Index Futures Contracts and their Underlying Spot Market Indices,” Journal of Studies in Economics and Econometrics, 22, 69-89. [7] French, K.R. (1988) “Pricing Financial Futures Contracts: An Introduction.” Financial Markets and Portfolio Management, 2, 51-59. [8] Harrison, M.J. and D. M. Kreps, (1979) “Martingales and Arbitrage in Multiperiod Security Markets,” Journal of Economic Theory, 2, 3, 381-408. [9] Johansen, Soren (1991) “Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models,” Econometrica, 59, 1551-1580. [10] Koutmos, G. and G. Booth (1995) “Asymmetric Volatility Transmission in International Stock Markets,” Journal of International Money and Finance, 14 (1):747-762. [11] Martens, Martin (1998) “Price discovery in high and low volatility periods: open outcry versus electronic trading,” Journal of International Financial Markets, Institutions and Money, 8, 243-260. [12] Massimb, Marcel N., Phelps, Bruce D. (1994) “Electronic Trading, Market Structure and Liquidity,” Financial Analysts Journal, 1, 39-50. [13] Pagan, Adrian R. (1996) “The Econometrics of Financial Markets,” Journal of Empirical Finance, 3, 15-102. [14] Said, S.E. and D.A. Dickey, (1984) “Hypothesis Testing in ARIMA(p,1,q) models,” Journal of the American Statistical Association, 80, 369-374. [15] Stoll, H.R., Whaley, R.E. (1990) “The Dynamics of Stock Index and Index Futures Returns.” Journal of Financial and Quantitative Analysis, 25, 441-468. 16 Table 1: The Descriptive Statistics of the Daily Returns Pre-JET Mean Std. Dev. Skewness Kurtosis LB (10) LB2 (10) Sample Size All Share Spot Futures 0.0462 0.0499 1.0024 1.2351 -0.6513 1.2620 22.746c 14.966c 14.622 10.077 218.81c 3.805 1404 1404 Gold Spot Futures 0.0104 0.0076 2.3743 2.4748 0.3832 0.3358 2.390c 2.1045c 11.391 5.106 48.880c 19.692c 1404 1404 Industrials Spot Futures 0.0709 0.0704 0.7962 1.0439 -0.3478 -0.2211 6.997c 4.6125c 50.877c 17.566a 203.92c 52.834c 1404 1404 0.0229 1.4962 -1.2394 12.121c 30.710c 274.30c 1061 -0.2233 2.0608 0.4924 2.068c 18.375b 70.449c 443 0.0212 1.9899 0.0738 44.742c 31.281c 237.24c 928 Post-JET Mean Std.Dev Skewness Kurtosis LB(10) LB2 (10) Sample Size 0.0128 1.7371 -1.1503 10.194c 34.534c 222.24c 1061 -0.2288 2.4140 -0.0559 2.412c 12.865 65.482c 443 0.0196 1.7900 -0.5959 6.142c 17.837a 356.26c 928 a b c , , denote significance at the .10, .05 and .01 level, respectively. The mean, standard deviation, skewness and kurtosis and their standard errors are estimated using the GMM estimator because it is robust to the presence of conditional heteroskedasticity. LB(.) and LB2 (.) are the Ljung Box tests for serial correlation in the returns and squared returns, respectively. JET is the acronym for Johannesburg Equities Trading electronic trading system that was introduced on the Johannesburg Stock Exchange from March to June 1996. 17 Table 2: Unit Root Tests and Tests for Cointegration All Share Spot Futures Gold Spot Futures Pre-Jet Industrials Spot Futures -2.727 -2.840 -1.994 -1.964 -2.566 -2.601 Changes -11.345c -11.602c -11.937c -10.830c -10.830c -11.468c LR Test 19.41b Levels 32.128c 46.25c Post-JET Levels -1.660 -1.824 -3.082 -3.069 -1.135 -1.391 Changes -9.187c -9.073c -7.513c -7.513c -8.706c -8.864 LR Test 57.648c 32.35c 39.634c The LR Test refers to the likelihood ratio test for cointegration following Johansen (1991). The null of no-cointegration is tested against the alternative of cointegration. The pre-Jet period refers to the period from August 1990 to May 31, 1996 and the post-Jet period from June 10, 1996 to the respective ending date of each contract. 18 Table 3: The Parameter Estimates of the Bivariate EGARCH Model for the All Share Index Spot Futures Parameter Pre Dummy Pre Dummy φi,0 0.0389b (0.0212) 0.0402a (0.0314) φi,1 0.0868c (0.0227) 0.0122 (0.0278) αs,0 0.0124 (0.0151) 0.0353a (0.0280) 0.0678a (0.0418) 0.0233 (0.0632) αs,1 0.081 (0.0685) 0.0979 (0.0967) 0.4629c (0.1703) -0.3823b (0.1895) αs,2 0.1265b (0.0547) -0.2207c (0.0818) -0.1771c (0.0715) 0.1718a (0.1092) γ 0.9478c (0.0246) -0.0475 (0.0542) 0.8906c (0.0627) 0.0008 (0.8200) αs,3 0.2872c (0.0843) -0.1181 (0.1133) -0.1210 (0.1025) 0.3346c (0.1245) αs,4 -0.2083c (0.0581) 0.2019c (0.0791) 0.1010 (0.1007) -0.2245a (0.1474) ρ12 0.6657c (0.0433) 0.1857c (0.0440) Note: Robust standard errors in parenthesis. a b c , , denote significance at the 10%, 5% and 1% level, respectively. 19 Table 3 (continued): Misspecification Tests for the All Share Index Spot Futures LR Test 6598.205c LB(10) 7.177 10.878 LB2 (10) 6.941 4.283 LB(.) and LB2 (.) are the Ljung Box tests for serial correlation in the standardized residuals and squared residuals, respectively. The LR Test denotes the likelihood ratio test statisic of the hypothesis that all the coefficients of the dummies equal zero, i.e. there is no change in the parameters of the EGARCH model after the introduction of electronic trading. 20 Table 4: The Parameter Estimates of the Bivariate EGARCH Model for the Industrial Index Spot Futures Parameter Pre Dummy Pre Dummy φi,0 -0.0233 (0.0203) -0.0268 (0.0277) φi,1 0.1134c (0.0251) 0.0765c (0.0257) αs,0 -0.1936b (0.0922) 0.2255c (0.1001) 0.0288 (0.0369) 0.0009 (0.0488) αs,1 0.4738a (0.0970) -0.3331b (0.1620) 0.1568c (0.0729) -0.1421a (0.1026) αs,2 -0.0347 (0.0605) 0.0275 (0.1100) -0.0160 (0.0482) -0.1021a (0.0773) γ 0.6501c (0.0938) 0.3205c (0.0973) 0.8251c (0.0675) 0.1503b (0.0733) αs,3 0.0639 (0.1218) -0.0646 (0.1757) 0.1825∗∗∗ (0.0774) -0.0810 (0.0998) αs,4 -0.0062 (0.0655) -0.0758 (0.1287) -0.0636a (0.0483) 0.1156a (0.0716) ρ12 0.7552c (0.0263) 0.0503a (0.0382) Note: Robust standard errors in parenthesis. a b c , , denote significance at the 10%, 5% and 1% level, respectively. 21 Table 4 (continued): Misspecification Tests for the Industrial Index Spot Futures LR Test 5882.932c LB(10) 10.921 7.399 LB2 (10) 4.125 13.195 LB(.) and LB2 (.) are the Ljung Box tests for serial correlation in the standardized residuals and squared residuals, respectively. The LR Test denotes the likelihood ratio test statisic of the hypothesis that all the coefficients of the dummies equal zero, i.e. there is no change in the parameters of the EGARCH model after the introduction of electronic trading. 22