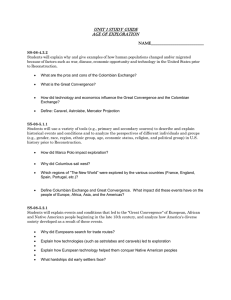

Convergence: Variation in Concept and Empirical Results

advertisement