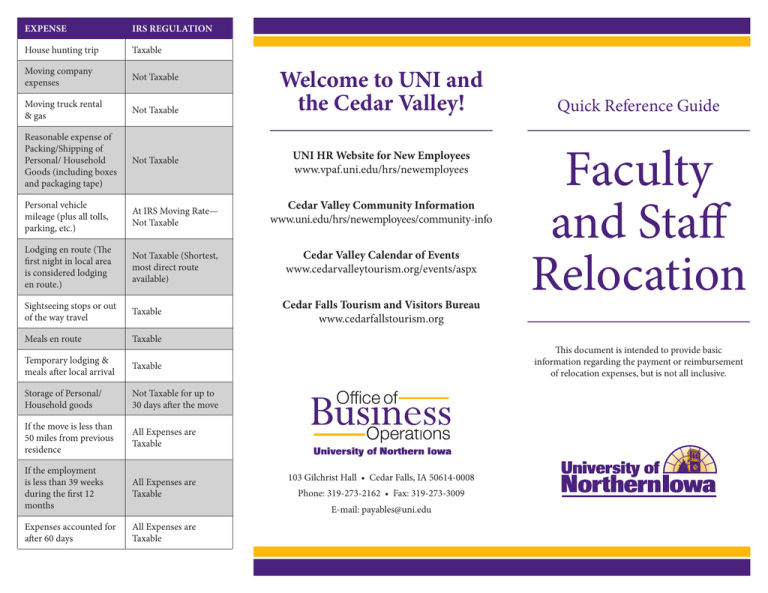

Welcome to UNI and the Cedar Valley! Quick Reference Guide

advertisement

EXPENSE IRS REGULATION House hunting trip Taxable Moving company expenses Not Taxable Moving truck rental & gas Not Taxable Reasonable expense of Packing/Shipping of Personal/ Household Goods (including boxes and packaging tape) Not Taxable Personal vehicle mileage (plus all tolls, parking, etc.) At IRS Moving Rate— Not Taxable Lodging en route (The first night in local area is considered lodging en route.) Not Taxable (Shortest, most direct route available) Sightseeing stops or out of the way travel Taxable Meals en route Taxable Temporary lodging & meals after local arrival Taxable Storage of Personal/ Household goods Not Taxable for up to 30 days after the move If the move is less than 50 miles from previous residence All Expenses are Taxable If the employment is less than 39 weeks during the first 12 months All Expenses are Taxable Expenses accounted for after 60 days All Expenses are Taxable Welcome to UNI and the Cedar Valley! UNI HR Website for New Employees www.vpaf.uni.edu/hrs/newemployees Cedar Valley Community Information www.uni.edu/hrs/newemployees/community-info Cedar Valley Calendar of Events www.cedarvalleytourism.org/events/aspx Cedar Falls Tourism and Visitors Bureau www.cedarfallstourism.org Quick Reference Guide Faculty and Staff Relocation This document is intended to provide basic information regarding the payment or reimbursement of relocation expenses, but is not all inclusive. Office of 103 Gilchrist Hall • Cedar Falls, IA 50614-0008 Phone: 319-273-2162 • Fax: 319-273-3009 E-mail: payables@uni.edu Pre-Move and Travel Expenses • Employment offer letters from the University will indicate relocation expense reimbursement provisions if it is included in the employment offer. Total reimbursement from University funds is limited to $7,500; additional reimbursement may be sought from a Foundation account if available. • New faculty and staff are encouraged to make their move using the most economical and sustainable method. • After a new faculty/staff member has accepted employment, travel expenses may be reimbursed, if specifically identified in offer letter. Up to one trip for the staff member and spouse/partner, if noted, for the purpose of arranging housing may be reimbursed. These expenses are taxable and limited to $2,000 which is part of the total moving expense award. • • Taxable items are subject to tax withholding, and UNI is required to deduct this withholding from the employee’s paycheck. Taxable and non-taxable moving reimbursements through UNI are reported on the employee’s W-2. The request for reimbursement, including documentation of expenses, e.g. itemized receipts and invoices should be submitted within 60 days of incurrence. All expenses accounted for after 60 days are taxable and may not be reimbursed. Office of Utilizing A Moving Company • • The University has selected vendors for moving services through a competitive bid process; significant discounts and other additional benefits are available to assist with the moving process. The current preferred vendors and contact information can be found on the OBO Purchasing website at www.vpaf.uni.edu/obo/purchasing/contracts.shtml. When speaking with the vendor, reference the University of Northern Iowa Agreement. Moving contracts are between the employee and the moving company. A purchase order may be created for the university’s portion of the move; contact departmental administrative staff for assistance. • Reimbursement may include moving company charges for packing, moving, insurance, and unpacking the employee’s household goods or other personal belongings. • During the move, while in travel status, the travel guidelines should be followed for reimbursement requirements. Travel guidelines can be found at www.vpaf.uni.edu/obo/accounts_payable/tguide.shtml. • Do-It-Yourself Move • When renting a trailer or other moving equipment, the employee is responsible for paying the rental agency. • Payments to friends or family for moving assistance, including loading and unloading, is not reimbursable. • Original receipts should be submitted for packaging materials (boxes, tape, bubble wrap, etc.), gas for rental vehicles used in the move, and road toll fees. • The IRS Moving Rate is used for reimbursing mileage for up to 2 personal vehicles. Moving rate can be found in travel guidelines—see link on previous page. Non-Reimbursable • Expenses associated with a home sale or lease breakage will not be reimbursed. • • IRS Publication 521—Moving Expenses www.irs.gov/publications/p521 Totes and other reusable storage bins are not reimbursable. • • UNI moving policy 4.10 http://www.uni.edu/policies/410 Reimbursement for moving expenses shall not include moving plants or animals. • Reimbursement for items moved from storage will not be reimbursed. Additional Resources: