Moving Expenses

advertisement

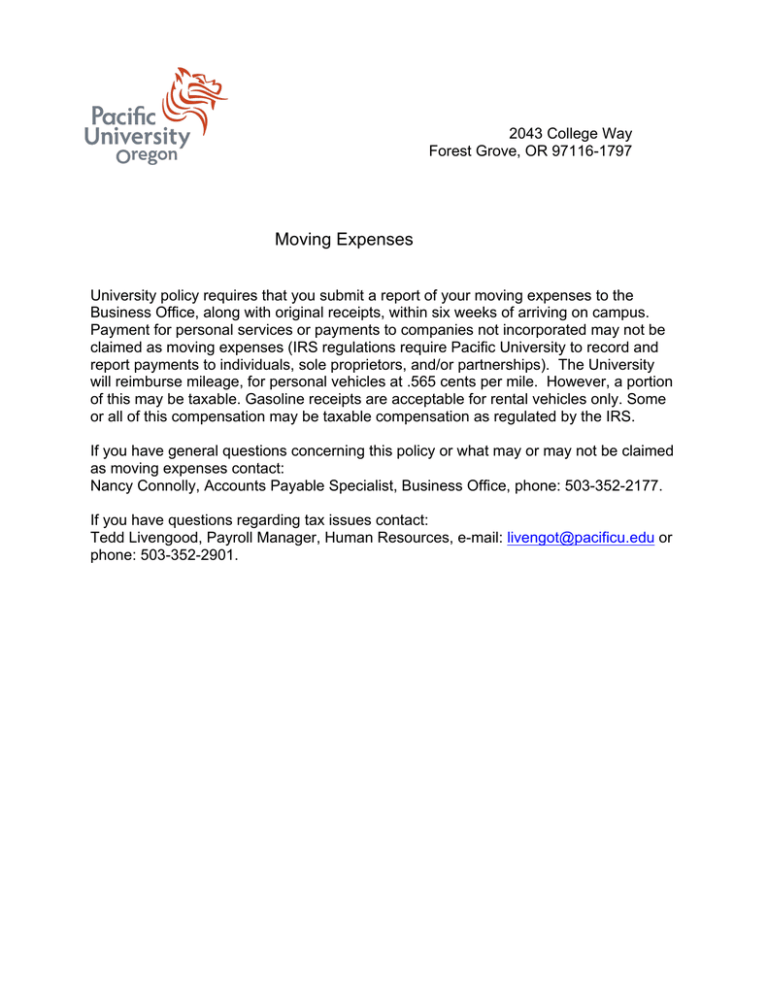

2043 College Way Forest Grove, OR 97116-1797 Moving Expenses University policy requires that you submit a report of your moving expenses to the Business Office, along with original receipts, within six weeks of arriving on campus. Payment for personal services or payments to companies not incorporated may not be claimed as moving expenses (IRS regulations require Pacific University to record and report payments to individuals, sole proprietors, and/or partnerships). The University will reimburse mileage, for personal vehicles at .565 cents per mile. However, a portion of this may be taxable. Gasoline receipts are acceptable for rental vehicles only. Some or all of this compensation may be taxable compensation as regulated by the IRS. If you have general questions concerning this policy or what may or may not be claimed as moving expenses contact: Nancy Connolly, Accounts Payable Specialist, Business Office, phone: 503-352-2177. If you have questions regarding tax issues contact: Tedd Livengood, Payroll Manager, Human Resources, e-mail: livengot@pacificu.edu or phone: 503-352-2901.

![C. [ ] Sent: Wednesday, August 13, 2014 1:58 PM To: Berlin, Steve](http://s2.studylib.net/store/data/017661172_1-cc9c70534f024ce62324efe66c483f48-300x300.png)