Chapter 13 Direct Investment Abroad

advertisement

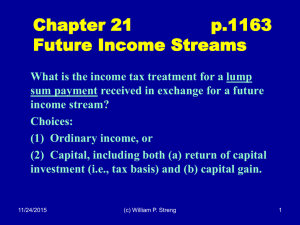

Chapter 13 Direct Investment Abroad Alternative foreign investment situations: Cf., direct vs. portfolio investment Alternative direct investment structures: 1) Foreign branch of a U.S. corporation (or a foreign branch of a U.S. subsidiary) 2) Foreign destination country subsidiary 3) Third country (foreign) subsidiary (& branch of 3rd country sub in the destination country?) 4/30/2015 (c) William P. Streng 1 Foreign Branch Options p. 1073 Use (i) U.S. parent corporation or (ii) a special purpose U.S. (or foreign) subsidiary. Branch of a U.S. corporation will enable U.S. tax deductions, e.g., (i) minerals and oil and gas exploration, and (ii) consolidated return treatment (loss utilization, but subject to later “recapture”). No limitation of commercial liability for foreign branch assets – but, use a special purpose U.S. subsidiary to hold only this investment. Use of “start-up losses” for U.S. income tax. 4/30/2015 (c) William P. Streng 2 Foreign Branch Options, cont. p. 1075 What risk of exposure to the foreign country tax system? Possible to avoid P.E. status in destination country if (1) Applicable bilateral income tax treaty, and, (2) Limited contacts with the destination country (e.g., trading activities only). 4/30/2015 (c) William P. Streng 3 Use of a Foreign Business Organization p.1076 If a foreign country corporation is used: 1) Subject to tax in that country. 2) Less complication in forming a foreign country corporation than a branch? What other local country benefits and restrictions? E.G. compliance with local corporate law, such as who are shareholders and directors. 4/30/2015 (c) William P. Streng 4 Use of a Foreign Business Organization, cont. p.1076 If a foreign corporation is used, deferral of U.S. income tax is available, assuming inapplicability of Subpart F (e.g., deferral if active business operations occur & tax holidays are available in the foreign country). Organization of a foreign corporation may accommodate foreign joint investors. What form of foreign business entity should be used to enable corporate status there? LLC? Use a “hybrid entity” or a corp. in the foreign country? Use a one owner “disregarded entity”? 4/30/2015 (c) William P. Streng 5 Problem Basic Assumptions p.1078 Western (US) is engaged in U.S. mining. Planning a mining venture in Country Z. Initial capital of $300 million in equity. Terms of the “deal” in the foreign country: 1) royalty to be paid for the mineral product; 2) foreign income tax of 30% on net profits; 3) no withholding tax on div. or royalties; 4) deduction for royalty for process patent. 4/30/2015 (c) William P. Streng 6 Problem Tax/Financial Analysis p.1078 Use a branch of the U.S. corporation or a foreign corporation? Maintain eligibility for the percentage depletion deduction for U.S. income tax purposes? Probably. Prompt profitability for the project, i.e., no need to utilize losses. 4/30/2015 (c) William P. Streng 7 Problem 2 p.1079 Setting the Royalty Amount Establish the royalty amount for the process payment at the low end ($5 million) or the high end ($10 million)? Reduction in the royalty reduces the U.S. income tax to Process by 35% of the unpaid royalty amount and the Country Z tax only increases by 30% (5% differential). I.e., “arbitraging the tax rates”? 4/30/2015 (c) William P. Streng 8 Problem 3 p.1079 High foreign country income tax rate. Other foreign branches with 25% average foreign tax rate. High royalty amount for the process patent. Foreign country project organized as a branch. Foreign tax credit effects? 4/30/2015 (c) William P. Streng 9 Problem 4 p.1079 Assume other foreign mining ventures and anticipated excess foreign tax credits for foreign source residual basket of $5 million. 4/30/2015 (c) William P. Streng 10 Tax Characterization of the Foreign Business Entity P.1079 Necessary to have limitation of liability through use of an entity? Use a corporation or a (non-corporate) LLC? Necessary to have two or more owners for an LLC? Use two special purpose subs in the U.S. to hold 50% (or 90 & 10%?) interests. Deferral is not important if the foreign tax rate is as high as or is higher than the U.S. income tax rate. 4/30/2015 (c) William P. Streng 11 Entity Choices Outside the U.S. p.1080 Foreign corporation in the host country (and similar foreign counterparts). Third country corporation. Limited liability company (LLC). Limited partnership (LP). General partnership (GP). Contractual joint venture (JV). 4/30/2015 (c) William P. Streng 12 Entity Choices Outside U.S. - Business Law Aspects 1) Limitation of liability. 2) Control arrangements. 3) Profit sharing split. 4) Foreign country tax burden. 5) Foreign tax credit: (i) availability and (ii) excess FTC position for U.S. owner. 4/30/2015 (c) William P. Streng 13 Former §7701 Entity/Corp. Characterization Regs. 1) Associates (both corp. or partnership). 2) Objective to carry on business and divide the profits (both corp or ptnship, not trust). 3) Continuity of life - death, insanity or bankruptcy not causing dissolution. 4) Centralized management - non-owner may have continuing authority to make management decisions for corporation. continued 4/30/2015 (c) William P. Streng 14 Former Code §7701 Regulations, continued 5) Free transferability of ownership interests owners have power, without the consent of other owners, to substitute others (not previously equity owners) for themselves in the organization; 6) Limited Liability - no equity owner is personally liable for the debts of or claims against the organization. 4/30/2015 (c) William P. Streng 15 Rev Rul. 88-8 p.1083 Foreign Law Criteria Applied The factual criteria specified in (former) §7701 regulations must be applied in determining the status of an entity (including foreign entity) as a corporation for U.S. tax. Inconsistent classification possible: Use of a hybrid entity - a corporation for foreign law purposes but a partnership for U.S. income tax purposes. Cf., a reverse hybrid (U.S. corp. status; foreign flowthrough status). 4/30/2015 (c) William P. Streng 16 “Check-the-box” Entity Characterization Regs. P. 1084. Elective approach of structuring entities to be a (i) corporation or (ii) partnership for U.S. tax purposes. Permits the use of “hybrid entities.” Certain business entities are automatically classified as corporations for U.S. tax purposes, including a list of specific foreign entities. Reg. §301.7701-2(b)(8). Relevant for the classification of both U.S. and foreign entities. P. 1087. 4/30/2015 (c) William P. Streng 17 Foreign Business Entity Characterization If Eligible P. 1087. Unless the foreign entity elects otherwise: 1) treated as association (and a corporation) if all members have limited liability; 2) treated as a partnership if it has two or more members and at least one member does not have limited liability; or 3) disregarded as an entity separate from its owner if only a single owner that does not have limited liability. 4/30/2015 (c) William P. Streng 18 Change in Status of the Foreign Business Entity Federal income tax effects: p.1088 1) Eligible entity (partnership or disregarded entity) elects corporate status – a §351 incorporation transaction & a partnership distribution. 2) Eligible entity treated as a corporation elects partnership status – treated as a corporate liquidation to the shareholders and a contribution of these assets to a partnership. 4/30/2015 (c) William P. Streng 19 Hybrid Entity Issues p.1089 (Corp. in Foreign Country) U.S. Corporate Parent l Foreign Corp Sub FCountry-1 (As a Holding Co. – Corp. for US Tax) l l Royalty/ Operating Co. 3 (LLC?) Finance Co. 2 pays royalty & (LLC?) interest to Finance Co. 2 (Foreign Country 2) (Foreign Country 3) (Co. 2 & 3 are conduits for U.S. income tax; no Subpart F) 4/30/2015 (c) William P. Streng 20 Hybrid Branch & Possible Limitations p.1089 Notice 98-11 - separate status for hybrids (p.1090)? Hybrid branch as a separate entity? Then, payments made are FPHC income. Temporary Regs. - T.D. 8767, withdrawn. Notice 98-35 - withdrawing these items Proposed Regs. 1.954-9, pending (next slide) Issue: Should IRS be able to promulgate a “branch rule” for FPHC income? 4/30/2015 (c) William P. Streng 21 Hybrid Branch P.1091 Prop. Regs. §1.954-9 (1999) 1. Hybrid payments to a related entity reducing foreign country tax and being FPHC would be recharacterized as Subpart F income. 2. Hybrid status: fiscally transparent in the US but not fiscally transparent in the country of the payor entity. 3. “Tax disparity” test satisfied (less than 90% rate of the payor’s tax)? Regs. still remain in proposed form in 2015. 4/30/2015 (c) William P. Streng 22 International Tax Arbitrage p.1092 1. Double dip deal - interest deductible in payor country but not income in payee country (since intracompany payment). §901 credit available. 2. Subpart F is avoided. No foreign base company income through use of the branch. 3. “Check & sell.” After tax-free liquidation Co. sells assets and not stock and, therefore, no foreign personal holding company income. Tax disparity test is satisfied (less than 90% rate of payor’s tax). Dover case (on p. 552). 4/30/2015 (c) William P. Streng 23 Extraordinary Transaction Rule p.1096 Proposed “Extraordinary Transaction” Rule – Prop. Reg. §301.7701-3(h), where a transaction occurs in close proximity to an election to change an entity’s tax classification. E.g., within 12 months of the election. Note: “check and sell” transactions. Withdrawal of this rule - Notice 2003-46. 4/30/2015 (c) William P. Streng 24 JCT Staff Proposal p.1097 Single Member Co. 2005 proposal: Treat as a corporation for U.S. tax purposes the foreign entity which: 1. Is a separate business entity as organized under foreign law; and, 2. Is a separate entity having only one member. And, possible regs. to preclude the division of ownership to avoid this corp. status rule. The problem ultimately derives from too broad “check-the-box” rules. 4/30/2015 (c) William P. Streng 25 Obama Proposal p.1100 FY 2010 proposal: Treat as a corporation for U.S. tax purposes the foreign entity which: 1. Is a separate business entity organized under foreign law; and, 2. Is a separate entity having only one member. Except where organized in the same country. But, now Code §954(b)(6) enabling avoidance of Subpart F treatment (through 12-31-2014). Obama proposal abandoned for FY2011 & later. 4/30/2015 (c) William P. Streng 26 Obama Proposal FY2016 FY 2016 proposal: Restrict use of hybrid entities used to create “stateless income”, i.e., deduction in one jurisdiction and no inclusion in any other foreign jurisdiction. Greenbook, p. 35. 4/30/2015 (c) William P. Streng 27 Dual Resident Corporations & DCLs p.1102 U.S. corporation is permitted to file a consolidated tax return with its affiliated corporations. §1501. Losses of one group U.S. member can offset the income of another U.S. group member. §1504. Another country may treat a corporation as resident under the “management and control” test. Dual resident corps cannot “double dip” for losses. §1503(d). P.1105. 4/30/2015 (c) William P. Streng 28 Code §904 FTC Limitation & Planning Options p.1110 Structuring of arrangements to enable reduction of the overall effective foreign tax rate (through low/no taxed arrangements): 1) Lending money and generating interest expense deduction in foreign country and lower withholding rate imposed on the outbound interest payment. 2) Export of goods - pass title to (i) generate foreign source income and (ii) avoid any income tax in the foreign jurisdiction. cont. 4/30/2015 (c) William P. Streng 29 Code § FTC Limitation Planning Problems, cont. 3) Technology licensing arrangement with the foreign subsidiary and extraction of low/no taxed, deductible royalty, to which the look-through rules are applicable for FTC. 4) Managerial and technical services in foreign country - same planning objective, i.e., deductibility of payment for local country income tax and low/no withholding tax at source of payment. 4/30/2015 (c) William P. Streng 30 Capitalization of the Foreign Corporation p.1112 Use debt or special class(es) of stock? Is the interest on the debt deductible for foreign country income tax purposes? Cf., §163(j). And, FTC “look-through” rule. §904(d)(3). Debt arrangement enables the tax-free repayment of principal (not treated as dividend but basis recovery) and is free of the applicability of the withholding at source rules (if treaty). Cf., stock redemption treatment under §302. 4/30/2015 (c) William P. Streng 31 Capitalization of the Foreign Corporation, cont. P. 1114. Transfer of intangibles as: 1. Contribution to capital (consider §§351 & 367(d)) (ordinary income), or 2. Intangibles sale, lease or license (consider §482). Consider (a) applicability of sourcing rules & (b) tax characterization rules - ordinary income or capital gain (e.g., sale of patent for a fixed price or for royalty payments). 4/30/2015 (c) William P. Streng 32 Capitalization of the Foreign Corporation, cont. P. 1116. Transfer of tangible property (e.g., equipment and real property: No gain recognized on the transfer, except for depreciation recapture. Generate: (1) foreign source income; (2) general limitation income (for FTC purposes). 4/30/2015 (c) William P. Streng 33 International Joint Venture Conceptual Framework P. 1117 What is a “joint venture” - two or more participants with a common business objective. Type of entity? Many choices: - corporation (foreign or domestic), including a “special purpose” subsidiary - partnership or LLC - contractual arrangement (no tax entity) What requirement for a “local partner”? 4/30/2015 (c) William P. Streng 34 International Joint Venture Documents p.1118 "Heads of Agreement” or “Memorandum of Understanding” (MOU). Accompanying documents: 1) Organizational documents for the specific entity, e.g., Articles of Incorporation; Partnership agreement; by-laws and code of regulations; organizational meeting minutes. 2) Loan agreements continued 4/30/2015 (c) William P. Streng 35 Structuring Joint Venture, cont. 3) Shareholder/owner agreements re control of entity & buy-sell agreement (use a “shotgun” buysell agreement? P. 1125) 4) Technology licensing agreements. 5) Technical assistance agreements. 6) Management contracts. 7) Employment contracts for key personnel. 4/30/2015 (c) William P. Streng 36 Control Arrangements for the Joint Venture company P. 1119. 1) U.S. minority ownership situations. Better to use a corporation because of greater participatory rights under local business entity laws (but consider U.S. tax planning re no flow-through). 2) U.S. minority but effective control. 3) U.S. participant with majority control. 4) 50-50 joint venture. 4/30/2015 (c) William P. Streng 37 Countering Foreign Control Situations Veto rights over certain actions. P.1121. Independent financial accounting required. Required dividend distributions. Limits on compensation payments allowable to controlling parties. Indirect influence through supply contracts, technology contracts, trademarks, secured debt financing, etc. 4/30/2015 (c) William P. Streng 38 Achieving Effective Control p.1123 Control over entity management through designation of the managing director. Alternatively, control achieved through the use of a management contract. Query whether local business law permits such delegation of authority. Cf., difficulties with deadlock (50-50) situations use a “shotgun” buy-sell agreement. P.1125. 4/30/2015 (c) William P. Streng 39 U.S. Tax - Organizing the Foreign Joint Venture Classification of the jointly owned foreign corporation as a CFC? P.1127 Beneficial to be treated as a CFC? Consider the Code §904 foreign tax credit baskets & look-through rules - §904(d)(3). Note, however, the FTC changes for 10-50 corps. (look-through rules for post 2002 income). What negatives of CFC status? Next slide 4/30/2015 (c) William P. Streng 40 Negatives of CFC Status p.1128-9 1) Foreign base company income (Subpart F income) possibilities. 2) Constructive dividend treatment for investment in U.S. property. §956. 3) §1248 – ten percent or greater shareholder of CFC has dividend treatment (rather than capital gain) when selling CFC shares (including liquidation). But. preferring §1248 treatment (since indirect FTC availability)? 4) §1249 – re patent sales to CFC. P. 1129. 4/30/2015 (c) William P. Streng 41 Control of the Foreign Corporation p. 1130 How determine if “control” status exists? 1) Several classes of stock. 2) Holding power to designate the managing director of the corporation. 3) What deadlock resolution arrangements exist? 4) Purpose of avoid CFC status? 4/30/2015 (c) William P. Streng 42 Estate of Weiskopf p. 1131 §1248 Was the foreign corporation a CFC for §1248 purposes (applicable when the stock is sold)? Creation of a U.K. company (Ininco) qualifying as an "Overseas Trade Corporation" (OTC). Court: Rejecting argument Romney (a U.K. Co.) held 50 percent of voting rights of Ininco. U.S. shareholders controlled the product. Therefore, Ininco held to be a CFC and not a “deadlock” company. Cf., Koehring case. 4/30/2015 (c) William P. Streng 43 Rev. Rul. 70-426 p. 1139 Y foreign corporation has two classes of stock: (i) 100 shares of no par value class A stock & (ii) 100 shares of $1 par class B stock Class B stock has a preference on dissolution and a preference for annual dividends (but limited amounts). Class B was foreign owned. Corporate charter for one year with 75 percent shareholder approval required to renew the charter. continued 4/30/2015 (c) William P. Streng 44 Rev. Rul. 70-426, cont. X, a domestic corporation, owns all the Class A stock. X, owning 50 percent of the total combined voting power of Y, has the power to force Y foreign corporation into liquidation. Consequently, X has necessary power and Y corporation is a CFC. Relevance? E.g., if a corp. liquidation & §1248. 4/30/2015 (c) William P. Streng 45 Problems CFC Status? p.1141 Assuring CFC status: a) Control over the manager’s continuation in office. b) Management contract. c) Right to force liquidation or terminate important licensing agreement if deadlock situation. 4/30/2015 (c) William P. Streng 46 Pass-through Treatment With a Partnership p.1144 If a corporation must be used, use a U.S. partnership to hold the stock of the foreign corporation to get CFC status. Does the foreign corporation therefore constitute a CFC? Or, will the partnership be disregarded and the partners be treated as directly holding a 50 percent interest--applying an aggregate, rather than an entity, theory of partnership? 4/30/2015 (c) William P. Streng 47 Jointly Owned Foreign Partnership p.1145 Losses and deductions will immediately flow through to the partners. Income will also flow-through, but also available will be direct foreign tax credits (which would not be available to shareholders, unless 10% or greater interest, under the deemed paid credit rules). Same treatment if a LLC is treated as a partnership. 4/30/2015 (c) William P. Streng 48 Selection of the Foreign Joint Venture Entity Check the box regulations enable choice of entity, but a problem may still exist with the foreign joint venturer who does not want to elect partnership status where all the owners have limited liability status. Solve with: 1) organizational documents? 2) subsidiary to hold partnership interest? 4/30/2015 (c) William P. Streng 49 Interposition of a 3rd Country Holding Company Wholly owned foreign corporation organized under the laws of a third country interposed between the U.S. parent company and the foreign operating company. Third country treaty network available? Dividends upstream to the foreign holding company will be recharacterized under the look through rules for FTC purposes. cont. 4/30/2015 (c) William P. Streng 50 Interposition of a Holding Company continued If the foreign operating company is not a CFC, then the dividends (and rents, royalties and interest) will be foreign base company income to the intermediate holding company (but look through when these rules became available to 10-50 corporations). Use foreign holding company to reduce taxation on the earnings when distributed from the foreign country operating sub. 4/30/2015 (c) William P. Streng 51