Recycling of Non-Renewable Resources and the Least-Cost-First Principle John R. Boyce

advertisement

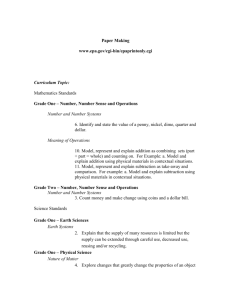

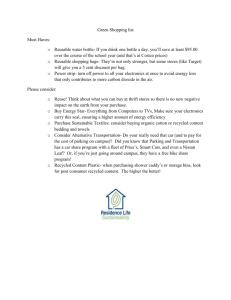

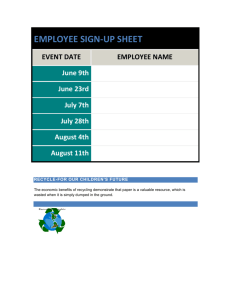

Recycling of Non-Renewable Resources and the Least-Cost-First Principle John R. Boyce∗ Department of Economics University of Calgary May 2012 Abstract This paper analyzes the economics of recycling a non-renewable resource. Recycling is two separate activities: sorting of recyclables from the waste stream into recyclable stocks, and producing final goods from recycled stocks. With constant marginal production and sorting costs, when recycled stocks are the least-cost source, a blocked interval occurs where all possible waste is recycled and a constant proportion of output is from recycled sources. When virgin stocks are the least-cost source, sorting into recycled stocks occurs as a speculative activity for use when mining stocks run out. In either case, whether all of the waste is sorted into recycled stocks depends on the cost of sorting relative to the value of the recycled stocks. The effects of landfill costs are also examined. Key Words: Recycling, Non-Renewable Resources, Least-Cost-First Principle JEL Codes: Q53, Q30, Q31, Q58. ∗ Professor of Economics, Department of Economics, University of Calgary, 2500 University Drive, N.W., Calgary, Alberta, T2N 1N4, Canada. email: boyce@ucalgary.ca; telephone: 403-220-5860. 1 Introduction When the twin towers of the World Trade Center were destroyed by al-Qaeda on September 11, 2001, left behind were approximately 300,000 tons of iron and steel scrap among the 1.2 million tons of debris. Some of this iron and steel is now in museums and in memorials to the loss, but most of it met the same fate as other scrap iron and steel, it was recycled: twenty-four tons became part of the naval warship, the USS New York ; and thousands of tons of material were shipped to China and India to be recycled. There are at least two benefits to recycling a non-renewable resource. The first is the simple and appealing notion that if proportion δ of the stock is recycled each cycle, then a stock of size S0 can be used over and over, resulting in total potential use of S0 /(1 − δ) > S0 . Recycling half of the flow doubles the stock; recycling ninety percent increases the stock ten-fold; and as the recycling rate δ approaches one, the stock effectively becomes unbounded. A second benefit of recycling a non-renewable resource is lower landfill requirements for waste (Environmental Protection Agency, 1997). But recycling uses real resources. Whether recycling is economic hinges upon the marginal costs of recycling vis-á-vis other sources of production. When a non-renewable resource is recyclable, there are three sources of raw materials for final production: producing from virgin stocks, producing from the recycled stock of pre-sorted recyclable materials, and producing recyclables directly from the waste stream. In this paper, I show that recycling of exhaustible resources may take several forms. I consider a simple partial equilibrium model of an exhaustible resource in which marginal production and sorting costs are each constant and in which there exists a backstop technology. In such a model, it is natural to consider whether the leastcost-first principle of Herfindahl (1967) holds. That principle states that when there exist two (or more) non-renewable resource stocks with different marginal production costs, it is both optimal and a market equilibrium that the least-cost stock is fully exhausted before the high-cost stock is utilized. With recycling, however, I find that the set of possible equilibrium sequences are much richer than in the standard two-stock exhaustible resource environment. This results from two features of the economics of recycling. The first is that recycling is actually two distinct economic activities: the sorting recyclable materials from the waste stream, and producing from the recycled stocks. This simple insight reveals some surprising answers to the question of when is 1 recycling economic. Second, there are two key constraints which affect the recycling equilibrium. The quantity that can be sorted from the waste stream is constrained by the rate of flow into the waste stream, and, when recycled stocks are exhausted, production from the recycled stock is constrained by the flow of recyclables from the waste stream. These constraints cause there to exist “blocked intervals” in which the demand for sorting recyclables from the waste stream or the demand for recycled production (or both) exceeds supply. These constraints play an important role in understanding recycling equilibria in non-renewable resource markets. When the virgin-stock is the least-cost source, there may exist an interval in which sorting of recyclables into recycled stocks occurs, while current production is entirely from virgin stocks. Sorting occurs because even though recycled stocks cannot currently compete with virgin stocks, they are expected to be able to compete once virgin stocks are exhausted. Thus, the sorting of recyclables during this interval occurs entirely as a rational speculative equilibrium activity. When the costs of sorting from the waste stream are sufficiently high relative to the value of the recycled stocks, however, this interval may be preceded by an interval in which neither form of recycling occurs. Thus, when the virgin stock is the least-cost source, the answer to the question of when is recycling economic hinges upon the value of the recycled stock vis-á-vis its cost of accumulation. In either case, however, production from recycled stocks occurs only after the least-cost source virgin stocks have been exhausted. In contrast, when the recycled stock is the least-cost source, recycled stocks are always used first if they exist. When the cost of sorting is sufficiently high relative to the value of the recycled stock, however, there may exist an interval in which all production comes from recycled stocks, but no sorting of waste into recyclables occurs. Thus, no matter which stock is the least-cost source, when sorting costs are sufficiently high, a portion of the waste stream is never sorted into recycled stocks. This again highlights the importance of separating the two activities of recycling, and suggests that the answer to the question of when recycling is economic may be more subtle than expected. Furthermore, when the recycled stock is the least-cost source, I find that there always exists an interval, just prior to switching to the backstop technology, in which the recycled and virgin stocks are used simultaneously. This interval occurs only after existing least-cost recyclable stocks are exhausted. Once the recyclable stocks are exhausted, production must come from virgin stock sources. But since recyclable stocks are the least-cost source, any waste that is able to be sorted into recyclables is immediately put to use, causing both stocks to be used simultaneously. 2 With linear marginal production costs, this causes the proportion of production coming from recycled stocks to be constant over time. This may explain why the rate of recycling has remained roughly constant for many of the sixteen metals for which recycling data is available in the United States over the past century. Herfindahl’s least-cost-first model has been extended in various ways by Solow and Wan (1976), Hartwick (1978), Kemp and Long (1980), Lewis (1982), Drury (1982), Swierzbinski and Mendelsohn (1989), Chakravorty and Krulce (1994), Amigues, Favard, Gaudet, and Moreaux (1998), Gaudet, Moreaux and Salant (2001), Holland (2003), Chakravorty, Magne, and Moreaux (2006) and Chakravorty, Moreaux, and Tidball (2008). With recycling, the two stocks are the virgin and recycled stocks. To my knowledge, this is the first paper to apply Herfindahl’s idea to recycling. The economic literature on recycling began with Smith (1972), who considered a model in which waste is a social bad that can be alleviated by recycling or by lowering consumption, both of which are costly. This has since been extended by Ready and Ready (1995) and Fullerton and Kinnaman (1995), who each considered models in which society cared about the cost of waste through landfill usage. There is now a large literature on the appropriate pricing strategies to encourage recycling [e.g., Baumol (1977), Fullerton and Kinnaman (1995), Palmer and Walls (1997), Conrad (1999), Walls and Palmer (2001), Calcott and Walls (2005), Takayoshi (2007)]. Slade (1980), for copper, and Sigman (1995), for lead, considered the effects of different policies for recycling in a static partial equilibrium model. None of these papers, however, examined how recycling is affected by rising scarcity rents in an exhaustible resource model nor attempted to characterize the equilibrium in an exhaustible resource market. In addition, several authors have considered the effects of recycling on economic growth. In Di Vita (2001, 2006, 2007) recycled stocks and virgin stocks have identical costs. In Pittel (2006) and Pittel, Amigues and Kuhn (2010) recycled and virgin sources are both essential in production and are imperfect substitutes. In contrast, here virgin and recycled stocks are perfect substitutes differentiated only by their relative costs — since a metal of a particular grade is that metal of that grade no matter what its source1 — and neither stock is essential, as there exists a backstop technology available at a higher cost. The remainder of the paper is organized as follows. Section 2 documents recycling 1 For example, scrap iron and steel yields a higher price than raw iron because scrap iron and steel are generally alloys. 3 Aluminum Antimony Chromium Cobalt Copper Gold Iron & Steel Lead Magnesium Mercury Nickel Platinum Silver Tin Tungsten Zinc Percent Recycled 150 100 50 0 150 100 50 0 150 100 50 0 150 100 50 0 1900 1925 1950 1975 2000 1900 1925 1950 1975 2000 1900 1925 1950 1975 2000 1900 1925 1950 1975 2000 Year Recycled % of Consumption Recycled % of Production Graphs by Mineral Figure 1: Recycling Share of U.S. Consumption and Production for 16 Minerals, 1900-2010. statistics for the United States over the past century. Section 3 outlines the basic assumptions, and derives the necessary conditions that must hold along five subpaths which make up a competitive equilibrium. Section 4 derives the equilibria for the case where the recycled stocks have lower costs of production than mining virgin stocks. Section 5 derives the equilibria for the case where marginal mining costs are less than the marginal costs of using recycled stocks. Section 6 briefly shows how the model can be extended to include landfill costs and costs of storing recycled stocks. Section 7 concludes. 4 2 Recycling of Exhaustible Resources Fig. 1 shows the share of domestic consumption (solid line) and domestic production (dashed line) that is from recycled sources in the United States for sixteen minerals from 1900-2010.2 For minerals such as aluminum, copper, iron and steel,3 and lead, most consumption is domestically produced, so these rates are very similar. For minerals such as chromium, cobalt, tin and tungsten, there is no domestic primary production in the United States, so recycling rates are 100% of domestic production, and for nickel, tin, and platinum, most consumption is imported. The total production that comes from recycling is affected by the products in which the resource is used and decisions about when and how to retire durable goods. Iron, for example, is used in tools, appliances, automobiles, buildings, ships and bridges, among other things. Each use has a very different lifespan and even different likelihoods that the product is recycled. The iron in most buildings and bridges are eventually recycled, but many ships are either lost at sea or are sunk at the end of their useful life because the costs of recycling are too high. As the 9/11 attack showed, the proportion of production from recycling can be affected by shocks in retirement of durable goods. These are driven in part by the business cycle, as shown by the spike in silver, aluminum, and copper recycling percentage of consumption during the Great Depression and the similar spike in 2009 in aluminum, chromium, and iron & steel. They can also be driven by other factors such as technological change, war, and other factors. Copper, for example, which had much use in telecommunications and plumbing in the early Twentieth Century, has been largely replaced by fiber-optics and plastics, respectively. The recycling rates in Fig. 1 show that while there have been variations over time, the recycling of the major metals has remained relatively constant over the last century. The exceptions, lead, mercury, and aluminum, have had changes in recycling largely driven by government policy. The increase in the recycling rates of tungsten reflect a decline in domestic production. While recycling rates for iron & steel, lead, and nickel have been rising, recycling rates for antimony, copper, and platinum have been falling in recent decades. 2 The data is from the U.S. Geological Survey (Kelly and Matos 2011). For iron and steel, secondary production equals “scrap iron and steel production” and primary production equals “iron ore production.” Apparent consumption is the sum of apparent consumption of iron ore and scrap iron and steel. This recycling rate is not directly comparable to the Steel Recycling Institute’s recycling rate, although the numbers are similar, as they define the recycling rate to be the ratio of total scrap recovered to total raw steel production. See Fenton (2003). 3 5 3 Theoretical Model I now turn to the application of the Herfindahl two-stock model to recycling. This section explains the model assumptions and characterizes the five subpaths of which combinations of comprise any non-renewable resource recycling equilibrium. 3.1 Model Assumptions There are three sources of consumption: virgin stocks (the stock found in nature) from which production arises through mining; recycled stocks, which are stocks of raw materials that have been sorted from the waste stream; and the waste stream itself, which is a flow at each instant in time. The virgin stock of a recyclable material remaining at time t is St . This stock is depleted by primary production, qt , at rate dSt ≡ Ṡt = −qt , dt S0 > 0. (1) Let xt denote quantity of recycled materials that is sorted from the waste stream, and let yt denote production from recycled stocks. Thus total production is qt + yt . The recycled stock is Rt , and the equation of motion for this stock is given by dRt ≡ Ṙt = xt − yt , dt R0 ≥ 0. (2) Unlike the virgin stock, there may initially be zero recycled stock. This distinction is important when the recycled stock is the least-cost source. The maximum proportion of production that can be recovered through recycling is 0 < δ < 1. The loss of proportion 1 − δ of production can be due to rusting, to contamination from mixing with other goods in manufacturing or when introduced to the waste stream, or any other processes which renders the materials so that it is uneconomic to recover recyclable materials from the waste. Thus the effective stock is at most (R0 + S0 )/(1 − δ), which is finite.4 Therefore, the marginal costs of sorting recyclable materials from the waste stream is γ > 0, for quantities less than or equal to proportion δ of production, and is infinite for quantities greater than proportion δ 4 This ignores activities such as the painting of bridges and buildings to prevent rusting, or altering the design of goods to affect the proportion which is recoverable which may affect δ. While these are interesting issues, the assumption that δ < 1 embodies the view that it is economically, if not physically, impossible to recycle 100% of the waste stream. 6 of production. For simplicity, assume that consumers use the resource only for an instant, so that all production immediately becomes available for recycling.5 Thus the quantity that can be sorted from the waste stream is constrained to satisfy xt ≤ δ(qt + yt ). (3) Implicit in (3) is the assumption that once waste is deposited in landfills, it becomes uneconomic to mine. Thus, recyclables can only be accumulated as they pass through the waste stream. When the recycled stock is positive, production from recycled stocks, yt , is bound only by the constraint that Rt ≥ 0. When Rt = 0, however, production from the recycled stock is constrained by the rate of inflow to the recycled stock: yt ≤ x t when Rt = 0. (4) When this constraint is slack, recycled stocks grow, causing yt to be once again unbounded. These two constraints play a major role in determining the recycling equilibrium. When these constraints bind, they “block” production or sorting which would be profitable from occurring were the constraint not binding. Thus, these blocked intervals are characterized by a premium which owners of the recycled stock are willing to pay for the sorted waste. The model is partial equilibrium.6 Gross utility from consumption of the resource is given by u(qt + yt ), where u(0) = 0, u0 (.) > 0 and u00 (.) < 0. There exists a perfect substitute (a ‘backstop’ technology) which may be produced without bound at price p̄ < ∞. Therefore, the choke price on the exhaustible resource is u0 (0) = p̄. The parameters α and β, each less than p̄, are the production costs from the virgin and recycled stocks, respectively, and γ is the cost of sorting the recycled stock from the waste flow. Recycling can never be profitable when β + γ ≥ p̄. Therefore, the interesting case occurs when β + γ < p̄.7 The discount rate is r, which is taken to 5 This assumption fits for aluminum cans; less so for bridges and buildings. If durable goods, however, are of the ‘one-hoss-shay’ variety, with a lifetime of s periods, then if total production in period t is zt , and share δ can be recycled, then the quantity available for recycling in period t is δzt−s . With stationary demand, this results in greater waste flow at each instant, since production is declining. 6 Lewis (1982) showed that as long as there exists an alternative asset that yields a positive rate of return, the least-cost-first principle holds in general equilibrium. 7 If β < p̄ < β + γ, then any initial recycled stock would be used in equilibrium, but no gross accumulation 7 be the return on all other assets in the economy. Together with the assumption that 0 < δ < 1, the assumptions that α, β, and β + γ are each less than p̄ ensures that the entire resource stock is depleted in finite time. Hence T < ∞. In addition, for now landfill costs for unsorted wastes and storage costs for recycled stocks are each ignored. These considerations are reintroduced below in Section 6. 3.2 Five Subpaths Depending upon the initial conditions and the relative marginal production and sorting costs, a sequence of combinations of up to five subpaths, together with constants describing the shadow values of the stocks and the times demarcating the end of each subpath in the sequence, makes up an exhaustible resource recycling equilibrium. Each subpath is denoted with a bold-face font, with the stock being extracted indicated first (S for the virgin stock and R for the recycled stock) and an x following the stock being extracted indicating that sorting from the waste stream occurs, while the absence of an x indicates no sorting occurs. In each subpath, I show that a Hotelling r% rule holds. For all subpaths except subpath SRx, I find that the current value of the stock rises exponentially at the rate of interest. Therefore, let λ0 ert and µ0 ert denote the current-value in-situ prices of the virgin and recycled waste stocks of the resource, respectively. In subpath SRx, the current value of the recycled waste stock is written as µt ert . Subpath S: Production from Virgin Stocks; No Sorting of Waste In subpath S, there is production from virgin stocks, but no sorting of waste into recycled stocks. Thus, pt = u0 (qt ) = α + λ0 ert , pt = u0 (qt ) ≤ β + µ0 ert , (5a) for t ∈ S, (5b) and γ ≥ µ0 ert , (5c) where total production is qt = u0−1 (α + λ0 ert ). Equation (5a) ensures that virgin stock producers are indifferent between producing anywhere along subpath S. The inequality of recycled stocks would ever occur. 8 in (5b) ensures that recycled stock owners prefer to not produce during this interval. The inequality in (5c) implies that the cost of sorting from the waste stream is greater than the value of the recycled stocks. Each of these inequalities holds strictly within any subpath, but may hold as an equality at the endpoints of the subpath. Over subpath S, the virgin stock declines at rate Ṡt = −qt , while the recycled stock remains constant. The equilibrium price path in subpath S depends only on the extraction costs, α, and the current scarcity rental value, λ0 ert , of the virgin stocks. Thus, over subpath S, the following Hotelling condition holds: d dt [pt − α] = r, pt − α t ∈ S. for (6) Subpath R: Production from Recycled Stocks; No Sorting of Waste In subpath R, production is from recycled stocks, and no sorting of waste occurs. Thus subpath R is characterized by the following conditions: pt = u0 (yt ) = β + µ0 ert , pt = u0 (yt ) ≤ α + λ0 ert , (7a) for t ∈ R, (7b) and γ ≥ µ0 ert , (7c) where total production is yt = u0−1 (β + µ0 ert ). Equation (7a) ensures that recycled stock producers are indifferent between producing anywhere along subpath R. The inequality in (7b) ensures that virgin stock owners prefer to not produce during this interval. The inequality in (7c) ensures that no gross accumulations to recycling stocks occurs. In subpath R, the virgin stock remains unchanged, but the recycled stock declines at rate Ṙt = −yt . The equilibrium price path in subpath R depends only on the extraction costs, β, and the scarcity rents, µ0 ert , of the recycled costs. Thus, over subpath R, the following Hotelling condition holds: d dt [pt − β] = r, pt − β for 9 t ∈ R. (8) Subpath Sx: Production from Virgin Stocks; Sorting of Waste Subpath Sx is characterized by the following conditions: pt = u0 (qt ) = α + γδ + (λ0 − δµ0 )ert , pt = u0 (qt ) ≤ β + γδ + (1 − δ)µ0 ert , (9a) for t ∈ Sx, (9b) and φt ert = µ0 ert − γ ≥ 0, (9c) where total production is qt = u0−1 (α + γδ + (λ0 − δµ0 )ert ). Equation (9a) ensures that virgin stock producers are indifferent between producing anywhere along subpath Sx. The inequality in (9b) ensures that recycled stock owners prefer to not produce during this interval. The inequality in (9c) ensures that gross accumulations to recycling stocks occurs. For both virgin and recycled stock owners, the opportunity cost of producing includes the direct production costs as in subpath S, plus a factor δ(µ0 ert − γ), which reflects payments earned from contributing proportion δ of production from the waste stream to the accumulation of recycled stocks. Thus, over subpath Sx, the virgin stock declines at rate Ṡt = −qt and the recycled stock increases at rate Ṙt = δqt , since constraint (3) binds, implying that xt = δqt . Over subpath Sx, the following Hotelling condition holds: d dt [pt − α − γδ] = r, pt − α − γδ for t ∈ Sx. (10) Subpath Rx: Production from Recycled Stocks; Sorting of Waste Subpath Rx is characterized by the following conditions: pt = u0 (yt ) = β + γδ + (1 − δ)µ0 ert , pt = u0 (yt ) ≤ α + γδ + (λ0 − δµ0 )ert , (11a) for t ∈ Rx, (11b) and φt ert = µ0 ert − γ ≥ 0, (11c) where total production is yt = u0−1 (β + γδ + (1 − δ)µ0 ert ). Equation (11a) ensures that recycled stock producers are indifferent between producing anywhere along subpath Rx. The inequality in (11b) ensures that virgin stock owners prefer to not produce 10 during this interval. Equation (11c) ensures that no gross accumulations to recycling stocks occurs. For both virgin and recycled stock owners, the opportunity cost of producing includes the direct production costs as in subpath R, plus the payment δ(µ0 ert − γ), for each unit of proportion δ of production which can be sorted from the waste stream to the accumulation of recycled stocks. Thus, over subpath Rx, the following Hotelling condition holds: d dt [pt − β − γδ] = r, pt − β − γδ t ∈ Rx. for (12) In subpath Rx, the virgin stock remains unchanged, Ṡt = 0, while the recycled stock declines at rate Ṙt = −(1 − δ)yt , since xt = δyt . Subpath SRx: Simultaneous Production from Virgin and Recycled Stocks; Sorting of Waste Subpath SRx involves simultaneous production from both stocks plus sorting of waste. This path can only occur when Rt = 0 over the interval and when marginal production costs from recycled stocks are less than marginal production costs from virgin stocks. Thus, both stocks are utilized simultaneously in this subpath, since all recycled stock is immediately used, implying (4) binds, and since Rt = 0 implies that recycled production must come from the waste stream. Let µt ert denote the current value of the recycled stock during this interval (where µt may not be constant). Since sorting of recyclables occurs, it must be that φt ert = µt ert − γ ≥ 0. (13) For price pt , the current value of the recycled stock is the difference between the price received and the marginal cost of production, µt ert = pt − β + δ(µt ert − γ), for t ∈ SRx, (14) where the term δ(µt ert − γ) is the payment received from recycled stock owners to acquire flow from the waste stream. Since virgin stock owners are also producing during this interval, it follows that the price must obey pt = α + λ0 ert − δ(µt ert − γ), 11 for t ∈ SRx. (15) Substituting for µt ert from (14) into (15) yields pt = u0 (qt + yt ) = (1 − δ)α + δ(β + γ) + (1 − δ)λ0 ert , for t ∈ SRx, (16) where total production is qt + yt = u0−1 [(1 − δ)α + δ(β + γ) + (1 − δ)λ0 ert ]. The price is therefore equal to the weighted sum of the marginal production costs from each source, where marginal production costs from the virgin stock are α and the marginal production costs from the recycled stock are β + γ, plus the scarcity rental cost of the share of production that comes from virgin stocks, which are the only stock that is being depleted. Therefore, over subpath SRx, the following Hotelling condition holds: d dt [pt − (1 − δ)α − δ(β + γ)] = r, pt − (1 − δ)α − δ(β + γ) t ∈ SRx. for (17) Equations (14) and (15) hold because both virgin stock holders and recycled stock holders simultaneously wish to produce, given prices and costs. Because φt ert = δ(µt ert − γ) > 0, it follows that xt = δ(qt + yt ), and because µt > 0, it follows that yt = xt . Thus, in subpath SRx, the shares of production coming from each source are constant: yt = δ, qt + yt and qt = 1 − δ, qt + y t for t ∈ SRx. (18) Therefore, in subpath SRx, the virgin stock declines at rate Ṡt = −qt = −(1 − δ)(qt + yt ), while the recycled stock remains unchanged, Ṙt = xt − yt = 0, since yt = xt . In the subpath SRx, the time paths of µt and φt are determined by the condition that both qt and yt are consumed in positive proportions. Thus, µt ert = α − β + λ0 ert φt ert = α − (β + γ) + λ0 ert . and (19) The current value of additional recycled stock, µt ert , in this interval is equal to the current value of the virgin stock less the cost difference between the recycled and virgin stocks, β − α. The current value of gross accumulation to recycled stocks is equal to the value of the recycled stock less the cost of sorting. 12 4 If Recycled Stocks are the Least-Cost Source When the marginal cost of extracting from the recycled stock is less than the marginal cost of extracting from the virgin stock, i.e., β < α, all equilibria in which some of the waste stream is recycled end in the blocked interval SRx where everything that can be obtained from the waste stream is sorted and recycled into final products. Thus, in this interval, both stocks must be used simultaneously, since the gross accumulations from just the recycled stock are insufficient to maintain production. Conversely, when the cost of sorting recyclable materials from the waste stream is sufficiently high, two paradoxical equilibria can arise. When the initial recycled stock is positive, it may occur that the equilibrium begins in subpath R where extraction is from the recycled stock, but the waste from the recycled stock is not sorted into recycled stocks because the cost of sorting is too high relative to the value of the stock. Alternatively, when the initial recycled stock is zero, the equilibrium may begin in subpath S, where extraction is from the virgin stock and no sorting occurs, even though the recycled stocks are lower cost, if accumulated. These equilibria highlight the important difference between production from recycled stocks and gross accumulation to recycled stocks. They also imply that the size of the initial recycled stock matters. 4.1 Equilibria with Zero Initial Recycled Stocks I first consider equilibria in which the initial recycled stock is zero. Equilibrium Sequence S → SRx Equilibrium sequence S → SRx occurs when sorting costs are sufficiently high and the initial recycled stock is zero: R0 = 0. In the initial subpath S only the virgin stock is exploited, and no sorting into recycled stocks recycling occurs. This is followed by subpath SRx in which simultaneous production from recycled stocks and the virgin stock occurs. Such an equilibrium is described by the the conditions (5) over subpath S and (13)-(15) over subpath SRx. This equilibrium has four constants, the endpoints of each subpath, TS and TSRx , and the present values of the stocks, λ0 and µ0 . These constants are found by solving for the exhaustion and no-arbitrage conditions which must hold along an equilibrium path. 13 At time TS , the conditions which must hold are µ0 erTS = γ, (20a) pTS = α + λerTS = (1 − δ)α + δ(β + γ) + (1 − δ)λ0 erTS . (20b) and The condition (20a) is what makes it possible to begin sorting into recycled stocks at time TS . The condition (20b) implies that the price path is continuous at time TS . This is necessary to ensure that no arbitrage opportunity remains, since the left-hand-side is the marginal profit at an instant before time TS and the right-hand-side is the marginal profit an instant after time TS . Neither a virgin stock producer who withheld a unit of production from the interval [0, TS ) can earn a capital gain by waiting to produce after time TS , nor a virgin stock owner who moved a unit of production forward from the interval [TS , TSRx ) to a moment before time TS can earn a capital gain. The no-arbitrage condition (20b) rules out either of these types of opportunities. The second set of equalities occur at time TSRx : pTSRx = (1 − δ)α + δ(β + γ) + (1 − δ)λ0 erTSRx = p̄, (21a) and Z TSRx (1 − δ) u0−1 (1 − δ)α + δ(β + γ) + (1 − δ)λ0 ert dt = TS Z S0 − TS u0−1 α + λ0 ert dt, (21b) 0 where the integrands equal total production at each instant in each interval. Equation (21a) ensures that demand is choked off at time TSRx , while equation (21b) ensures that at the same moment supply is also exhausted. The right-hand-side of the exhaustion condition (21b) takes account of the fact that reserves of the virgin stock extracted before sorting begins at time TS are not recoverable. Because sorting from the recycled stream began at time TS > 0, total consumption is less than the potential resource supply, S0 /(1 − δ). These two equations are two sides of a no-arbitrage condition. If demand were not choked off at time TSRx , i.e., if pTSRx < p̄ but STSRx = 0, then a producer who withheld a unit of production from sometime within the interval [TS , TSRx ) could earn a capital gain of p̄ − pTSRx at time TSRx by doing so. Similarly, if STSRx > 0 at time TSRx while pTSRx = p̄, then all producers holding stock at that 14 point in time TSRx would own an asset which earned a zero rate of return, since price cannot rise above p̄, which is less than the return of r earned on other assets. Thus, those producers would do better by selling their stock at an earlier date. When all of these arbitrage opportunities have been eliminated, equations (21) hold. This equilibrium is depicted in Fig. 2. The thick exponential curve is the equilibrium price path. The thick step-function is the relevant opportunity cost of extraction at each instant. From (19), the current value of the recycled stocks in subpath SRx, µt ert , is the difference between the curve α + λ0 ert and the marginal cost of production from the recycled stocks, β. As can be seen, this is rising at less than the rate of interest, since α > β. This is why those who accumulate recycled stocks wish to sell it immediately. The value of gross additions to recycled stocks, φert is equal to the difference between the curve α + λ0 ert and β + γ. This is zero at TS and is rising at a rate greater than r over subpath SRx, which is why recycled stock owners wish to accumulate the maximum possible from the waste stream in subpath SRx, but not before. Equilibrium Sequence SRx When sorting costs are sufficiently small relative to the values of the recycled stock, sorting from the waste stream begins immediately. Thus, when R0 = 0, the equilibrium sequence is simply subpath SRx. Since the recycled stock is held at zero throughout this equilibrium, it is the depletion of the virgin stock which dictates when the sequence ends. At time TSRx , physical and economic exhaustion occurs: Z 0 TSRx S0 , u0−1 (1 − δ)α + δ(β + γ) + (1 − δ)λ0 ert dt = 1−δ (22a) and pTSRx = (1 − δ)α + δ(β + γ) + (1 − δ)λ0 erTSRx = p̄ (22b) where the integrand of (22a) is total production over subpath SRx. The constants λ0 and TSRx are found by solving the implicit equations (22), and the equilibrium proceeds with production satisfying (18) and price and total output satisfying (16). In Fig. 2, this equilibrium occurs when virgin stocks are such that time zero occurs somewhere between time TS and time TSRx , so that only subpath SRx occurs. Because sorting from the recycled stream began at time 0, the entire potential resource supply, S0 /(1 − δ), is consumed. 15 $ p H1-∆LΑ+∆HΒ+ΓL+H1-∆LΛ0 ert Β+Γ Α+Λ0 Α Β+Μ0 H1-∆LΑ+ ∆HΒ+ΓL rt Α+Λ0 e Β+Μ0 ert Β TS TSRx t Figure 2: Equilibrium Sequence S → SRx, When Recycling is Least-Cost, Initial Recycled Stocks are Zero, & Sorting Costs are High. Impossibility of Equilibrium Sequence S → Sx → SRx No equilibrium sequence S → Sx → SRx can occur. Because extraction costs are lower for recycled stocks than for virgin stocks, if sorting to the recycled stocks were to occur, that stock immediately becomes the least-cost alternative, so subpath S is always followed by subpath SRx when β < α. Hence, the only equilibria that can occur when β < α and R0 = 0 are equilibrium sequences SRx and S → SRx. Whether equilibrium sequence SRx or equilibrium sequence S → SRx occurs depends on the size of the virgin stock, S0 , and the value of the sorting costs, γ. In the appendix, it is shown that TS in equilibrium sequence S → SRx is increasing in both S0 and γ. Thus, for small enough S0 or γ, sorting begins immediately. The reason this occurs for an increase in S0 is that an increase in S0 causes λ0 to decline, which causes TS to rise to satisfy (20b). The effect from an increase in γ is more subtle, since an increase in γ causes both λ0 and TS to increase. 16 4.2 Equilibria with Positive Initial Recycled Stocks Next, consider equilibria in which R0 > 0 when β < α. Sequence Rx → SRx When R0 > 0 and β < α, if γ or S0 + R0 is sufficiently small, sorting from the waste stream occurs from the beginning, implying equilibrium sequence Rx → SRx. In this equilibrium, there are three constants to be determined, the two ending times, TRx and TSRx , and the present value of the virgin stock, λ0 . The conditions which must hold at time TRx are pTRx = β + δγ + µ0 (1 − δ)erTRx = α(1 − δ) + (β + γ)δ + (1 − δ)λ0 erTSRx , and Z 0 TRx R0 u0−1 β + δγ + µ0 (1 − δ)ert dt = , 1−δ (23a) (23b) where the integrand of (23b) is the production rate over interval [0, TRx ), of which share δ comes from recycling the waste stream. Equation (23a) is the no-arbitrage condition which makes producers of the recycled stock indifferent between producing in subpath Rx and subpath SRx. Equation (23b) is the exhaustion condition for the recycled stocks. The conditions which must hold at time TSRx are that pTSRx = (1 − δ)α + δ(β + γ) + (1 − δ)λ0 erTSRx = p̄, and Z TSRx TRx S0 . u0−1 (1 − δ)α + δ(β + γ) + (1 − δ)λ0 ert dt = 1−δ (24a) (24b) Equation (24a) ensures that demand is choked off at the same moment that supply is exhausted, and (24b) is the supply exhaustion condition for the virgin stock. Because sorting from the recycled stream began at time 0, the full potential resource supply, (R0 + S0 )/(1 − δ), is consumed. An example of this equilibrium is depicted in Fig. 3, where time t = 0 occurs in the interval between time TR and time TRx . Again, the thick exponential growing price path is the equilibrium price path and the thick step-function shows the relevant extraction costs over each subpath. 17 Equilibrium Sequence R → Rx → SRx When γ is sufficiently large, sorting from the waste stream does not occur at the beginning, even though the recycled stock is the least-cost source. Thus, it is possible to have an equilibrium sequence R → Rx → SRx where in the initial subpath R, production occurs from the recycled stocks, but gross additions to the recycled stocks do not occur. Over this equilibrium sequence, there are five constants to be determined, the three end points of each subpath, TR , TRx , and TSRx , and the two present values of the stocks, λ0 and µ0 . The conditions which must hold at time TR are µ0 erTR = γ, (25a) pTR = β + µ0 erTR = β + δγ + µ0 (1 − δ)erTR . (25b) and Condition (25a) ensures that it becomes feasible to begin sorting the waste stream into recyclables at time TR . Equation (25b) is the no-arbitrage condition which implies that marginal profits to recyclable stock holders are equal in in present value in each subpath. The condition (25b), however, is implied by condition (25a). The conditions which must hold at time TRx are pTRx = β + δγ + µ0 (1 − δ)erTRx = α(1 − δ) + (β + γ)δ + (1 − δ)λ0 erTRx , (26a) and Z TRx (1 − δ) 0−1 u β + δγ + µ0 (1 − δ)ert dt = R0 − Z TR u0−1 β + µ0 ert dt. (26b) 0 TR Equation (26a) is the no-arbitrage condition which makes producers of the recycled stock indifferent between producing in subpath Rx and in subpath SRx. Equation (26b) is the condition ensuring exhaustion of the recycled stocks at time TRx . The conditions which must hold at time TSRx are pTSRx = (1 − δ)α + δ(β + γ) + (1 − δ)λ0 erTSRx = p̄, Z TSRx TRx S0 . u0−1 (1 − δ)α + δ(β + γ) + (1 − δ)λ0 ert dt = 1−δ (27a) (27b) Condition (27a) ensures demand is exhausted at time TSRx while condition (27b) en- 18 $ p Β+Μ0 ert Α+Λ0 ert H1-∆LΑ+∆HΒ+ΓL+H1-∆LΛ0 ert Α+Λ0 Α Β+Γ H1-∆LΑ+ ∆HΒ+ΓL rt Β+Γ∆+H1-∆LΜ0 e Β+Μ0 Β+Γ∆ Β TR TRx TSRx t Figure 3: Equilibrium Sequence R → Rx → SRx, When Recycling is Least-Cost, Initial Recycled Stocks are Positive, & Sorting Costs are High. sures that supply is exhausted at time TSRx . Because sorting from the recycled stream began at time TR > 0 rather than at time 0, the potential resource supply, (R0 + S0 )/(1 − δ), is not fully consumed in this equilibrium. An example of the equilibrium sequence R → Rx → SRx is depicted in Fig. 3. Sorting of recyclables from the waste stream occurs in both intervals [TR , TRx ) and [TRx , TSRx ]. In interval [TR , TRx ), the net value additions to the recyclables stocks, φert , is the difference between the curve β + µ0 ert and β + γ, while in interval [TRx , TSRx ] it is the difference between the curve α + λert and β + γ. In interval [TR , TRx ), the value of the recycled stocks are µ0 ert , which grows at the rate of interest. In interval [TRx , TSRx ], the gross value of the recycled stocks is α + λ0 ert − β, which grows at less than the rate of interest. This is why these stocks are not rebuilt up during interval [TRx , TSRx ]. In the appendix, I show that TR is increasing in each of the stocks and in sorting costs. 19 Impossibility of Equilibrium Sequence R → S → SRx It might be thought that when R0 > 0 that there exists an equilibrium sequence R → S → SRx if sorting costs are sufficiently high. However, this is not so. Suppose that such an equilibrium exists. Then over interval [0, TR ), the recycled stock is exploited, and at time TR , the economy switches to the higher cost virgin stock. Thus at time TR , it must be that β + µerTR = α + λ0 erTR . Then over the interval [TR , TS ), the virgin stock is exploited until it becomes profitable to sort the waste stream. Thus, at time TS , µ0 erTS = γ, which just makes it profitable to begin sorting the waste stream into recycled stock and waste. But because β < α, once recycled stock becomes available, it is immediately exploited, which implies that both stocks are exploited simultaneously. However, in order that there be no possibility of arbitrage, it must be that α + λerTS = (1 − δ)α + δ(β + γ) + (1 − δ)λ0 erTS . Subtracting α + λ0 erTS from each side and dividing by δ leaves α + λ0 erTS = β + γ = β + µ0 erTS , where the second equality uses the fact that µ0 erTS = γ, since recycling just begins at time TS . This, however, requires that TS = TR , which contradicts the assumption that an interval [TR , TS ) exists in which the virgin stock is exploited following the consumption of the recycled stock. Thus, when the initial recycled stock is positive, R0 > 0, and when the recycled stock is the least-cost source, β < α, only two possible equilibria exist, equilibrium sequence Rx → SRx and equilibrium sequence R → Rx → SRx. Which of these occurs depends upon the sizes of the two stocks and the sorting costs. The effect of sorting costs is easiest to see. Since µ0 is constrained to lie between 0 and p̄ − β, the sorting condition (25a) implies that there exists a value of γ close enough to zero such that TS = 0. Thus, as γ rises above this value, TS increases. The effects of R0 and S0 occur because an increase in either causes µ0 to decrease, which implies that TS must increase. 4.3 Summary of Equilibria when β < α Table 1 summarizes the possible equilibria when extracting from the recycled stock is the least-cost alternative. Equilibria in which subpath SRx occur yield intervals in which constant proportions of production come from recycled and virgin stocks. These proportions are related to the proportion of the waste stream that is feasible to recover, δ, since when the recycled stock has the lowest cost, it is always used immediately during subpath SRx. This may explain why Fig. 1 shows that the proportions of 20 Table 1: Equilibrium Outcomes when the Recycled Stock is Least-Cost: β < α. Sorting Cost / Stocks γ ‘low’ / ‘large’ Stocks γ ‘high’ / ‘small’ Stocks γ + β > p̄ Recycled Stock Size R0 > 0 R0 = 0 Equilibrium % Gain Equilibrium % Gain Rx → SRx 100% SRx 100% R → Rx → SRx < 100% S → SRx < 100% R→S 0% S 0% Notes: The column labeled ‘% Gain’ indicates the proportion of the difference between (S0 + R0 )/(1 − δ) and S0 + R0 which is gained by recycling. consumption from recycled stocks in the U.S. have remained roughly constant over the twentieth century. 5 If Virgin Stocks are the Least-Cost Source Consider next the equilibria which occur when the virgin stock is the least-cost source, i.e., when α < β. In these equilibria, since S0 > 0, the virgin stock is always exhausted before the recyclable stock, and if sorting of recycled stocks occurs, it occurs for the purpose of speculation, since it is not viable to produce from recycled stocks until after the virgin stocks have been exhausted. Thus, there are no blocked intervals in which the constraint (4) for production from the recycled stock binds, although there do exist intervals in which the constraint for sorting from the waste stream (3) binds, so long as it ever becomes feasible for sorting to occur, which happens when β + γ < p̄. There are three types of equilibria which occur when the virgin stock is the leastcost source. When γ is sufficiently low or stocks sufficiently low, equilibrium sequence Sx → Rx occurs, where sorting occurs from the beginning, and total consumption equals the full potential production of (R0 + S0 )/(1 − δ). For higher levels of γ or higher levels of the stocks, equilibrium sequence S → Sx → Rx occurs, where there exists a subpath at the beginning of the extraction profile in which no sorting of the waste stream into recyclables occurs. If so, then less than the full potential consumption of (R0 +S0 )/(1−δ) occurs. And when γ is very high, or stocks very high, and if R0 > 0, equilibrium sequence S → R → Rx occurs, where sorting from the waste stream into the recycled stock occurs only after all of the virgin stock and some of the recycled stock have been exhausted. Again, less than full potential use of the resource occurs. 21 These three sequences are shown to be the only possible sequences that can occur when α < β and when γ + β < p̄. Equilibrium Sequence S → Sx → Rx Consider the equilibrium sequence S → Sx → Rx. When this equilibrium sequence occurs, there are five constants to be solved for, the three ends of the subpaths, TS , TSx , and TRx , and the present values of the virgin and recycled stocks, λ0 and µ0 . Over the first interval, the equilibrium follows subpath S where only the virgin stock is exploited at rate qt = u0−1 (pt ), with pt given by (5a), and no sorting of waste into recycled stocks occurs. Therefore, total consumption is less than potential consumption, (S0 + R0 )/(1 − δ). The conditions which must hold at time TS are erTS µ0 = γ, (28a) pTS = α + λ0 erTS = α + γδ + (λ0 − δµ0 )erTS . (28b) and Equation (28a) is necessary for accumulation of recycled stocks to commence at time TS . Equation (28b) ensures that no arbitrage opportunities remain for those holding the virgin stock, given that in interval [TS , TSx ), the virgin stock has additional value δ(µ0 ert − γ), which is the equilibrium payment made by those producers who are accumulating recycled stocks. The condition (28b), however, is redundant to the condition (28a). Over the interval [TS , TSx ), the economy follows subpath Sx, with only the virgin stock exploited at rate qt = u0−1 (pt ), with pt given by (9a), but with maximum accumulation of recyclable stocks from the waste stream. This subpath continues until the virgin stock is exhausted at some time TSx , at which point production switches to the recycled stocks. Thus, at time TSx , Z TS 0−1 u 0 rt Z TSx (α + λ0 e )dt + u0−1 α + γδ + (λ0 − δµ0 )ert dt = S0 , (29a) TS and pTSx = α + γδ + (λ0 − δµ0 )erTSx = β + γδ + (1 − δ)µ0 erTSx , (29b) where the integrands in (29a) are the rates of production during subpaths S and Sx, 22 respectively. Equation (29a) is the exhaustion condition for the virgin stock. The equality in (29b) holds because at time TSx , production from the recycled stocks begin, and the price path must be continuous in order that there be no arbitrage opportunities. Observe that (29b) implies that α + λ0 ert = β + µ0 ert , since a common δ(γ − µ0 erTSx ) can be canceled from each side. Again, this highlights the importance of the separation of the recycled stock production decision from recycled stock accumulation decision. Over interval [TSx , TRx ], the equilibrium follows subpath Rx, with yt = u0−1 (pt ), where pt follows (11a). This ends at time some time TRx , when the recycled stock is exhausted. Thus at TRx , Z TSx R0 + δ u0−1 α + γδ + (λ0 − δµ0 )ert dt TS Z TRx = (1 − δ) (30a) 0−1 u rt β + γδ + (1 − δ)µ0 e dt, TSx and pTRx = β + γδ + (1 − δ)µ0 erTRx = p̄, (30b) where the integrands in (30a) are the production during subpaths Sx and Rx, respectively. The left-hand-side of (30a) is the initial recycled stock plus the proportion of virgin stock that was recycled over interval [TS , TSx ). This is equated with net reductions to the recycled stock over the interval [TSx , TRx ]. While (30a) ensures exhaustion of supply at time TRx , the (30b) ensures that economic exhaustion also occurs at time TRx in the sense that demand is just choked off at the moment when supplies give out. The equilibrium sequence S → Sx → Rx is depicted in Fig. 4. The thick continuously rising lower-envelope of the price paths depicts the equilibrium price path, and the thick discontinuous step-function shows which costs are relevant in each interval. The vertical difference between the curve labeled α + λ0 ert and the equilibrium price path, pt = α + δγ + (λ0 − δµ0 )ert , in the interval [TS , TSx ) is equal to δφt ert , which is the current net return to the owner of the recycled stock of being able to purchase from the waste flow. Similarly, in the interval [TSx , TSRx ), the vertical difference between the curves β + µ0 ert and the equilibrium price path pt = β + δγ + (1 − δ)µ0 ert equals δφt ert , which again is the net return an owner of the recycled stock earns per unit waste flow. Thus, δφt ert is the current price a recycled stock owner is willing to pay for access to sorting the waste stream, and φt ert is the current purchase price of recycled waste. In interval [0, TS ), this price is zero, since the cost of sorting is greater than the future sales value of the recycled stock. 23 $ p Β+Μ0 ert Β+Γ∆+H1-∆LΜ0 ert Β+Γ Α+Γ∆+HΛ0 -∆Μ0 Lert Β+Γ∆ Β+Μ0 Α+Λ0 Α+Γ∆ Α+Λ0 ert Β Α TS TSx TRx t Figure 4: Equilibrium Sequence S → Sx → Rx When Virgin Stock is Least-Cost and Sorting Cost Is Medium. In this equilibrium sequence, recycling occurs as a speculative activity in subpath Sx. The waste stream that is sorted into recycling stocks is not immediately used; rather, it is stored for later use. During subpath Sx, holders of the recycled stock must content themselves to earning only capital gains on their investment. Furthermore, their cash-flow is negative during this interval since they must pay price φt ert for each unit of the waste stream that is sorted into recyclables. It is only in subpath Rx that recycling turns into immediate production and positive cash-flow for the owners of the recycled stock. In equilibrium, recycling firms earn normal rates of return, but only over the whole sequence taken together. Not all of the virgin stock is recycled in sequence S → Sx → Rx. It is economically rational to allow some of the waste stream to be lost forever because the costs of sorting are too high relative to the value of the sorted stock. As shown in the appendix, this occurs either because sorting costs are very high or because there is great abundance of the virgin and recycled stocks. 24 Equilibrium Sequence Sx → Rx When sorting costs are sufficiently small, equilibrium sequence Sx → Rx occurs, where sorting from the waste stream begins at time zero. The necessary condition to be in this sequence is that the initial (endogenous) marginal value of an additional unit of the recycled stock is greater than the cost of sorting: µ0 > γ. In the sequence Sx → Rx, there are four constants to be determined, the two endpoints of the subpaths, TSx and TRx , and the two values of the stocks, λ0 and µ0 . During the initial subpath Sx the virgin stock is utilized at rate qt = u0−1 (pt ), with pt given by (9a), and sorting of the waste stream into recyclables occurs. Thus, at time TSx , the following conditions must hold: Z TSx u0−1 α + γδ + (λ0 − δµ0 )ert dt = S0 , (31a) 0 and pTSx = α + γδ + (λ0 − δµ0 )erTSx = β + γδ + (1 − δ)µ0 erTSx , (31b) where the integrand in (31a) is production in subpath Sx. Equation (31a) is the exhaustion condition for the virgin stock. Equation (31b) is the no-arbitrage condition, which ensures that the price at time TSx is continuous so that neither a virgin stock producer who withheld a unit of production from the interval [0, TSx ) would earn a capital gain by waiting to produce at time TSx , nor a recycled stock owner who moved a unit of production forward from the interval [TSx , TRx ) to a moment before time TSx would earn a capital gain. Then over subpath Rx, the recycled stock is exhausted. Exhaustion must occur because the quantity produced, yt , is greater than the quantity added to recycled stocks, xt = δyt , so the recycled stocks decline at rate Ṙt = −(1 − δ)yt . Thus, the conditions which must hold at time TRx are Z TRx TSx R0 + δS0 , u0−1 β + γδ + (1 − δ)µ0 ert dt = 1−δ (32a) pTRx = β + γδ + (1 − δ)µ0 erTRx = p̄, (32b) From (32a), total production during subpath Rx equals the total possible consumption starting at time TSx , (R0 +δS0 )/(1−δ). Because stock S0 was consumed in subpath Sx, total consumption is (S0 + R0 )/(1 − δ), so the maximum total possible consumption given the initial stocks and the feasibility of recycling occurs. From (32b), at the 25 moment of physical exhaustion, demand is also choked off. Again, these equations have a no-arbitrage interpretation. Unlike equilibrium sequence S → Sx → Rx, in equilibrium sequence Sx → Rx the potential stock is utilized to the maximum extent possible: none of the waste enters landfills or is otherwise lost. But in subpath Sx, only the sorting part of recycling occurs. The recycled stock itself is not used for production after time TSx . Thus, the motivation for recycling is again a speculative motivation. In Fig. 4, this equilibrium sequence occurs when the stocks are small enough or sorting costs are sufficiently small so that time zero occurs between TS and TSx , so that subpath S does not exist. Equilibrium Sequence S → R → Rx A third possible equilibrium occurs when R0 > 0 and either γ is sufficiently high or stocks are sufficiently high that accumulation to the recycled stock does not occur until after the virgin stock is completely exhausted. Of course, when α < β, R0 would be greater than zero only by mistaken actions of overly enthusiastic amateurs or due to some misguided public policy. In this equilibrium, the virgin stock is consumed over subpath S, which lasts from [0, TS ), and then the recycled stock is consumed in subpath R over interval [TS , TR ), followed finally by a subpath Rx over interval [TR , TRx ), during which sorting from the waste stream occurs and production is from the recycled stock, which is all that remains. Thus, at time TS , the virgin stock is exhausted, and production switches to the recycled stock. Thus, at time TS , Z TS u0−1 (α + λ0 ert )dt = S0 , (33a) 0 pTS = α + λ0 erTS = β + µ0 erTS . (33b) The equality in (33a) is the exhaustion condition for the virgin stock. The equality in (33b) holds because at time TS , production from the recycled stocks begin, and the price path must be continuous in order that there be no arbitrage opportunities for either virgin or recycled stock owners. Over subpath R, which occurs in the interval [TS , TR ), production occurs from the recycled stock, but it still does not pay recycled stock owners to accumulate stock by sorting from the waste stream. At time TR , it finally becomes profitable for recycled 26 stock owners to begin accumulating recycled stocks from the waste stream. erTR µ0 = γ, (34a) pTR = β + µ0 erTR = β + γδ + (1 − δ)µ0 erTR . (34b) and Condition (34a) is what causes accumulation through sorting the recyclables from the waste stream to finally be profitable for owners of the recycled stock. Equation (34b) is the no-arbitrage condition, which ensures that recycled stock owners do not which to move production from subpath R to subpath Rx or visa-versa. This equation, however, is redundant to (34a). In the final subpath Rx, extraction occurs from the recycled stock and all of the waste stream that can be sorted into recycled stock is accumulated. Finally, at time TRx physical and economic exhaustion occurs: Z TRx (1 − δ) 0−1 u β + γδ + (1 − δ)µ0 ert dt = R0 − Z TR u0−1 β + µ0 ert dt, (35a) TS TR and pTRx = β + γδ + (1 − δ)µ0 erTRx = p̄. (35b) Equation (35a) implies that net extraction over the interval [TR , TRx ) equals the reserves remaining at time TR , since those reserves are continually sorted into recycled stocks and reused. Equation (35b) is the no-arbitrage equation which implies that demand is choked off at the instant supply is exhausted. An example of this equilibrium is shown in Fig. 5. The equilibrium price path is again the lower envelope of the four possible price paths (shown as the thicker rising curve) and the relevant opportunity cost at which the Hotelling condition varies is depicted as the thick step-function. This Figure shows clearly why the condition that β + γ < p̄ is required in order that there exist an equilibrium sequence that involves recycling, since sorting of the waste stream does not occur until the price reaches β + γ. 5.1 Summary of Equilibria when α < β Together, Figs. 4 and 5 show the range of possible equilibrium paths for the case where the virgin stocks are the least-cost source and when recycling eventually becomes feasible. 27 $ p Α+Γ∆+HΛ0 -∆Μ0 Lert Β+Γ Β+Γ∆+H1-∆LΜ0 ert Β+Γ∆ Β+Μ0 ert Α+Γ∆ Β+Μ0 Α+Λ0 Β Α+Λ0 ert Α TS TR TRx t Figure 5: Equilibrium Sequence S → R → Rx, When Virgin Stock is Least-Cost and Sorting Cost Is High. When α < β, no equilibrium can occur in which the recycled stock is utilized before the virgin stock. This is both individually rational for the owners of the respective stocks and is socially optimal. In every sequence, the implied price received by owners of the recycled stock by waiting to sell their stocks in the subpaths R or Rx is higher than the price that prevails while the virgin stock is being extracted in intervals S or Sx. Similarly, once the virgin stock is exhausted, the prevailing equilibrium price in intervals R or Rx is lower than what owners of the virgin stock received by selling their stock in the intervals S or Sx. Thus, no other equilibria can occur other than these three. These are summarized in Table 2. The critical values of γ depend upon the size of the two initial resource stocks. When R0 = 0, for high γ, note that it is not possible to switch to recycled stock before commencing accumulating recycled stock from the waste stream. When γ + β > p̄, no accumulation of recycled stock is feasible. While there exist exhaustible resources for which no significant recycling occurs, I can find no evidence of an equilibrium subpath Sx occurring. This could be because 28 Table 2: Equilibrium Outcomes when the Virgin Stock is Least-Cost Sorting Cost / Stocks γ ‘low’ / ‘high’ Stocks γ ‘medium’ / ‘medium’ Stocks γ ‘high’ / ‘low’ Stocks γ + β > p̄ Recycled Stock Size R0 > 0 R0 = 0 Equilibrium % Gain Equilibrium % Gain Sx → Rx 100% Sx → Rx 100% S → Sx → Rx < 100% S → Sx → Rx < 100% S → R → Rx < 100% S → Sx → Rx < 100% S→R 0% S 0% Notes: The column labeled ‘% Gain’ indicates the proportion of the difference between (S0 + R0 )/(1 − δ) and S0 + R0 which is gained by recycling. there exists a potential market failure when α < β. When sorting of the recycled stock from the waste stream occurs in an Sx interval, the owners of the recycled stock hold an asset which is appreciating in value at a sufficient rate to yield an equivalent rate of return to other assets in the economy, but unlike the virgin stock, which yields both a cash flow today and capital gains tomorrow, the promise of the recycled stock is always far into the future. Furthermore, during the subpath Sx of recycling stock accumulation, the cash-flow of the recycled stock firm is negative since in addition to the costs of sorting, γ, they must also pay the costs of acquiring access to the waste stream, δφt ert . Thus, accumulating recycled stocks requires steely nerves and an excellent credit rating. Capital market imperfections could easily undo this perfect foresight equilibria. This may explain why such markets are not observed. 6 The Effect of LandFill and Storage Costs Let the rental cost on land be σ per unit of land-fill and τ per unit of recycled stock. Then the purchase price on land is σ/r per unit of waste which goes into land-fill space, and is τ /r for each unit of recycled stock that is stored. Landfill additions are qt +yt −xt and additions to recycled stocks are xt − yt at each instant in time. Thus, one effect of landfill and recycled stock storage costs is to raise the cost of utilizing virgin stocks from α to α + σ/r. In addition, each unit of recycled stocks produced now has costs β + (σ − τ )/r, and each unit of waste stream sorted into recycled stocks now has costs γ − (σ − τ )/r. Thus, the effect of landfill and storage costs is to unambiguously raise the cost of utilizing the virgin stock, but the effect on sorting and production from recycled stocks depends upon the relative value of σ − τ . When σ > τ , the cost of utilizing recycled stocks rises, while the cost of sorting into recycled stocks falls. When 29 σ < τ , the cost of utilizing recycled stocks falls, while the cost of sorting the waste stream into recycled stocks rises. Thus, all of the analysis above holds, with virgin stock production costs of α + σ/r, recycled stock production costs of β + (σ − τ )/r, and with sorting costs of γ − (σ − τ )/r. 7 Conclusions This paper considers a simple partial equilibrium model of recycling using a Herfindahl least-cost-stock-first exhaustible resource model. Recycling is separated into two distinct activities: the accumulation of the recycled stock by sorting recyclable materials from the waste stream, and the conversion of recycled materials into final products. When the costs of converting recycled materials into final products is greater than the cost of converting virgin stocks into final products, the equilibrium always consumes the virgin stock first. In this case, when sorting recyclables from the waste stream occurs, it is of a purely speculative nature, since stocks are accumulated in anticipation of exhaustion of virgin stocks. How soon it becomes profitable for speculators to begin accumulating recyclable stocks depends upon the costs of sorting recyclable materials from the waste stream relative to the scarcity of the virgin stock. If the virgin stock is relatively scarce or if sorting costs are low, speculators commence building recycled stocks earlier. For quantities of the virgin stock sufficiently low, it may be that sorting of recycled stocks occurs immediately. In any case, when the virgin stock is the least-cost source, sorting of recyclables from the waste stream is a purely speculative activity, and one which is fraught with difficulties, since negative current cash flows are compensated only by capital gains based on future expectations of exhaustion of virgin stocks. Perhaps this is why such equilibria have not been observed. When the costs of converting the recycled stock into final goods is less than the cost of mining virgin stocks, it always pays to use recycled stocks before virgin stocks, if such stocks exist. Whenever costs of converting recyclables into final goods is less than the cost of mining virgin stocks, there exists a final interval in which both recycled stocks and virgin stocks are used simultaneously. This occurs because the accumulation of recycled stocks is bounded by the rate of flow of the waste stream, so that as long as 100% recycling is not economically attainable, recycling cannot sustain itself without an inflow of virgin stock. In such an equilibrium, the share of total production from virgin and recycled stocks remains constant over time. This may explain why recycling percentages of materials used in final goods production have remained roughly constant 30 over the last century. Finally, I showed that when the recycled stock is the least-cost and sorting costs are high two paradoxical equilibria may arise. The higher cost virgin stock may be utilized because recycled stocks do not exist, or if recycled stocks exist, production from those recycled stocks may occur, but no sorting of recyclables from the waste stream into recyclables occurs. References [1] Amigues, Jean-Pierre, Pascal Favard, Gerard Gaudet, and Michel Moreaux (1998), “On the Optimal Order of Natural Resource Use When the Capacity of the Inexhaustible Substitute is Constrained,” Journal of Economic Theory, 80, 153-70. [2] Baumol, William J. (1977), “On Recycling as a Moot Environmental Issue,” Journal of Environmental Economics and Management, 4, 83-87. [3] Calcott, Paul, and Margaret Walls (2005), “Waste, recycling, and ‘Design for Environment”: Roles for markets and policy instruments,” Resource and Energy Economics, 27, 287-305. [4] Chakravorty, Ujjayant, Michel Moreaux and Mabel Tidball (2008), “Ordering the Extraction of Polluting Nonrenewable Resources,” American Economic Review, 98 (June), 1128-1144. [5] Chakravorty, Ujjayant and Darrell L. Krulce (1994), “Heterogeneous Demand and Order of Resource Extraction,” Econometrica, 62 (Nov.), 1445-1452. [6] Chakravorty, Ujjayant, Bertrand Magne, and Michel Moreaux (2006), “A Hotelling Model with a Ceiling on the Stock of Pollution,” Journal of Economic Dynamics and Control, 30 (12): 2875-2904. [7] Conrad, Klaus (1999), “Resource and Waste Taxation in the Theory of the Firm with Recycling Activities,” Environmental and Resource Economics, 14, 217-242. [8] Di Vita, Giuseppe (2001), “Technological change, growth and waste recycling,” Energy Economics 23 (5), 549-567. [9] Di Vita, Giuseppe (2006), “Natural resources dynamics: Exhaustible and renewable resources, and the rate of technical substitution,” Resources Policy 31, 172-182. 31 [10] Di Vita, Giuseppe (2007), “Exhaustible resources and secondary materials: A macroeconomic analysis,” Ecologlical Economics, 63, 138-148. [11] Drury, Robert C. (1982), “Exploitation of Many Deposits of an Exhaustible Resource: Comment,” Econometrica, 50 (3), 769-774. [12] Fenton, Michael D. (2003), “Iron and steel recycling in the United States in 1998,” in Flow Studies for Recycling metal commodities in the Unites States, United States Geological Survey, Circular 1196-A-M, edited by Scott F. Sibley, pp. G1-G7. [13] Fullerton, Don, and Thomas C. Kinnaman (1995), “Garbage, Recycling, and Illicit Burning or Dumping,” Journal of Environmental Economics and Management, 29, 78-91. [14] Gaudet, Gérard, Michel Moreaux, and Stephen W. Salant (2001), “Intertemporal Depletion of Resource Sites by Spatially Distributed Users,” American Economic Review, 91: 1149-1159. [15] Gaudet, Gérard, Michel Moreaux, and Cees Withagen (2006), “The Alberta dilemma: Optimal sharing of a water resource by an agricultural and an oil sector,” Journal of Environmental Economics and Management, 52, 548-566. [16] Hartwick, John M. (1978), “Exploitation of Many Deposits of an Exhaustible Resource,” Econometrica, 46 (Jan.), 201-217. [17] Herfindahl, Orris C. (1967) “Depletion and Economic Theory.” In Extractive Resources and Taxation, ed. Mason Gaffney, 63-90, University of Wisconsin Press. [18] Holland, Stephen P. (2003), “Extraction capacity and the optimal order of extraction,” Journal of Environmental Economics and Management, 45, 569-588. [19] Kamien, Morton I., and Nancy L. Schwartz (1991), Dynamic Optimization: The Calculus of Variations and Optimal Control in Economics and Management, Amsterdam: North Holland. [20] Kelly, Thomas D., and Grecia R. Matos (2011), Historical Statistics for Mineral and Material Commodities in the United States, U.S. Geological Survey, Data Series 140 (http://minerals.usgs.gov/ds/2005/140/). [21] Kemp, Murray C. and Long, Ngo V. (1980) “On Two Folk Theorems Concerning the Extraction of Exhaustible Resources,” Econometrica 48, 663-673. [22] Lewis, Tracy R. (1982) “Sufficient Conditions for Extracting Least Cost Resource First,” Econometrica 50: 1081-1083. 32 [23] Palmer, Karen, and Margaret Walls (1997), “Optimal policies for solid waste disposal: taxes, subsidies, and standards,” Journal of Public Economics 65, 193205. [24] Pittel, Karen (2006), “A Kuznets Curve for Recycling,” Economics Working Papers Series 06/52, ETH Zurich. [25] Pittel, Karen, J.-P. Amigues, T. Kuhn (2010), “Recycling under a Material Balance Constraint,” Resource and Energy Economics 32, 379-394. [26] Ready, Mark J., and Richard C. Ready (1995) “Optimal Pricing of Depletable, Replaceable Resources: The Case of Landfill Tipping Fees.” Journal of Environmental Economics and Management, 28 (May), 307-323. [27] Solow, Robert M., and Frederic Y. Wan (1976), “Extraction Costs in the Theory of Exhaustible Resources,” Bell Journal of Economics and Management, 7 (Autumn), 359-370. [28] Shinkuma, Takayoshi (2007) “Reconsideration of an advance disposal fee policy for end-of-life durable goods,” Journal of Environmental Economics and Management, 53, 110-121. [29] Sigman, Hilary (1996), “A Comparison of Public Policies for Lead Recycling,” RAND Journal of Economics 26 (Autumn), 452-478. [30] Slade, Margaret M. (1980), “An Econometric Model of the U.S. Secondary Copper Industry: Recycling versus Disposal,” Journal of Environmental Economics and Management, 7, 123-131. [31] Smith, Vernon L. (1972), “Dynamics of waste accumulation: Disposal vs. Recycling,” Quarterly Journal of Economics, 86(4): 600-616. [32] Joseph E. Swierzbinski, and Robert Mendelsohn (1989), “Exploration and Exhaustible Resources: The Microfoundations of Aggregate Models,” International Economic Review, 30 (Feb.), 175-189. [33] Walls, Margaret, and Karen Palmer (2001), “Upstream Pollution, Downstream Waste Disposal, and the Design of Comprehensive Environmental Policies,” Journal of Environmental Economics and Management, 41, 94-108. [34] United States Environmental Protection Agency, Landfill Reclamation, EPA530F-97-001 (July 1997). 33 Appendix Equilibrium Sequence S → SRx Comparative Statics In this equilibrium, α > β, but R0 = 0. The total differential of the system of equations (20) and (21) with the endogenous variables TS , TSRx , µ0 , and λ0 and exogenous variables S0 and γ, is rµ erTS 0 rλ erTS 0 0 δQTS 0 erTS 0 0 0 erTS r(1 − δ)λ0 erTSRx 0 0 0 dTS dT SRx dµ0 (1 − δ)erTSRx R RT T dλ0 (1 − δ)2 TSSRx ert D0 dt + 0 S ert D0 dt 1 0 1 0 = dγ + dS0 , 0 −δ R TSRx 0 −(1 − δ)δ TS D dt 1 where D0 < 0 is the derivative of output with respect to price, and QTS is production at time TS . The determinant of the Jacobian matrix is |J| = e rTS r(1 − δ)λ0 e rTSRx (1 − δ) Z 2 TSRx ert D0 dt TS Z TS rt 0 e D dt − e + rTS rδ(1 − δ)QTS λ0 e rTSRx < 0. 0 Thus, by Cramer’s rule, dTS = −|J|−1 e2rTS r(1 − δ)λ0 erTSRx > 0, dS0 and Z TSRx dTS −1 rTS rTSRx 2 = |J| e r(1 − δ)λ0 e (1 − δ) ert D0 dt dγ TS Z TS Z rt 0 rTS + e D dt + e (1 − δ)δ 0 TSRx TS 34 0 D dt > 0. Equilibrium Sequence R → Rx → SRx Comparative Statics In this equilibrium, α > β, but R0 > 0. The total differential of the system of equations (25), (26) and (27) in the endogenous variables TR , TRx , TSRx , µ0 , and λ0 , and exogenous variables S0 , R0 , and γ, is rγ 0 δQTR 0 0 0 0erTR 0 r(α − β) 0 erTRx −erTRx (1 − δ)QTRx 0 A 0 −r(1 − δ)λ0 erTSRx 0 −(1 − δ)erTSRx R TSRx rt 0 −(1 − δ)QTRx 0 0 (1 − δ)2 TRx e D dt dTR 0 0 10 dTRx 0 0 0 R × dTSRx = 1 dR0 + 0 dS0 + −δ(1 − δ) TTSRx D0 dt dγ. Rx dµ 0 0 δ 0 R TSRx 0 dλ0 0 1 −δ(1 − δ) TRx D dt 0 where QTRx is total production at time TRx , and A = (1−δ)2 R TRx TR ert D0 dt+ R TR 0 ert D0 dt. The determinant of the Jacobian matrix is |J| = −erT SRx r(1 − δ)2 λ0 Z TR Z rt 0 2 rT Rx e D dt + (1 − δ) × e QTRx rγ Z × r(α − β) rγ 0 TR ert D0 dt + (1 − δ)2 0 Z TRx TR TRx rt 0 e D dt − e rT R Z TSRx δQTR − (1 − δ) 0 TRx rt 0 rT R rT Rx e D dt − e δQTR − e rγ(1 − δ)QTRx > 0. TR Thus, by Cramer’s rule, dTR = |J|−1 erT R +rT Rx +rT SRx r(1 − δ)2 QTRx λ0 > 0, dS0 Z TSRx dTR −1 rT R +rT SRx 2 rt 0 rT Rx = |J| e r(1−δ) −r(α − β)(1 − δ) e D dt + e QTRx λ0 > 0, dR0 TRx 35 e D dt rt and Z TRx Z TSRx dTR rT Rx rT R −1 rT SRx 2 0 0 QTRx e (−1 + δ)δ = −|J| e r(1−δ) λ0 −e D dt + D dt dγ TR TRx Z TSRx Z TRx Z TR rt 0 2 rt 0 rt 0 − e D dt + (1 − δ) e D dt − (1 − δ) e D dt TR 0 TRx TRx Z × r(α − β) erT R (1 − δ)δ D0 dt + TR −(1 − δ)2 TRx Z Z TR ert D0 dt 0 ert D0 dt + erT Rx (−1 + δ)QTRx > 0. TR Equilibrium Sequence S → Sx → Rx Comparative Statics In this equilibrium, α < β. The total differential of the system (28), (29), and (30) in the endogenous variables TS , TSx , TRx , µ0 , and λ0 , with exogenous variables S0 , R0 and γ, is rγ 0 erTS 0 −erTSx erTSx 0 dTS dTSx dTRx 0 −r(1 − δ)µ0 erTRx (1 − δ)erTRx 0 RT dµ B 0 −δ TSSx ert D0 dt QTSx 0 RT −QTSx 0 C −δ TSSx ert D0 dt dλ0 0 0 1 0 0 0 = 0 dR0 + 0 dS0 + dγ, δ R T 0 1 −δ TSSx D0 dt R R TSx TRx 0 0 2 2 1 0 −(1 − δ) TSx D dt − δ TS D dt 0 0 0 −δQTSx r(β − γ) 0 RT RT where QTSx is production at time TSx , B = 0 S ert D0 dt + δ TSSx ert D0 dt, and C = R TRx rt 0 RT (1 − δ) TSx e D dt + δ TSSx ert D0 dt. The determinant of the Jacobian matrix is rT Rx |J| = e Z TSx r(1−δ)µ0 r(α − β) Z 2 e D dt rγ(1 − δ) 0 rt TS +e rT Sx 2 Z TSx QTSx rγ(1 − δ) rt 0 TSx Z TRx e D dt + rt 0 rt 0 e D dt − e rT S δQTS TSx TS Z 2 × (α − β) rγδ TRx Z rT S e D dt − e δQTS +r rt 0 TSx e D dt + rγ(1 − δ) 2 Z TS rt 0 e D dt 0 TRx rt 0 e D dt − e TSx 36 TS rT S δQTS +e rT Sx γQTSx < 0. Thus, by Cramer’s rule, Z TSx dTS −1 rT Rx +rT S rt 0 rT Sx = |J| e r(1 − δ)µ0 r(α − β)δ e D dt + e QTSx > 0. dS0 TS Z TS Z TSx dTS −1 rT Rx +rT S rt 0 rt 0 rT Sx e D dt + e D dt − e QTSx > 0. = |J| e r(1−δ)µ0 r(β − α) dR0 TS 0 and Z TSx Z TS dTS rt 0 2 −1 rT Rx e D dt ert D0 dt = |J| e r(1 − δ)µ0 r(α − β) δ dγ 0 TS Z TS Z TRx Z TSx rt 0 rt 0 2 rt 0 e D dt + e D dt +(1 − δ) e D dt 0 rT Sx +e Z TS rt 0 2 Z TS TSx e D dt + (1 − δ) QTSx 0 Z 0 rt Z × r(α − β) (1 − 2δ)δ TS Z rT S e D dt +e e D dt + TS TSx TRx ert D0 dt + (1 − δ)δ rt 0 TSx Z TSx TSx D dt 0 TS rt 0 rT Sx e D dt + 2e (1 − δ)δQTSx . TS 0 The condition δ < 1/2 is sufficient to ensure that dTS dγ is positive. Equilibrium Sequence S → R → Rx Comparative Statics In this equilibrium, α < β. The total differential of the system (33), (34), and (35) in the endogenous variables TS , TR , TRx , µ0 , and λ0 , with exogenous variables S0 , R0 and γ, is r(β − α) 0 QTS 0 0 rγ 0 0 −QTS δQTR 0 −erT S 0 0 0 erT R erT Rx r(1 − δ)µ0 0 erT S R TS 0 dT S ert D0 dt dT R dT Rx 0 dµ 0 0 0 dλ0 erT Rx (1 − δ) R RT T (1 − δ)2 TRRx ert D0 dt + TSSx ert D0 dt 0 0 0 0 1 0 = 0 dS0 + 0 dR0 + dγ, 1 0 0 −δ R TRx 0 −(1 − δ)δ TR D dt 1 0 37 where QTS is production at time TS and QTR is production at time TR . The determinant of the Jacobian matrix is |J| = −erT Rx r(1 − δ)µ0 Z TS Z rt 0 2 × r(β − α) e D dt rγ (1 − δ) 0 +e rT S Z QTS −rγ TS rt 0 2 TRx rt Z 0 TSx e D dt + TR Z TRx e D dt + (1 − δ) rt Z 0 TS TSx e D dt + TR 0 rT R e D dt − e δQTR rt 0 rT R e D dt + e δQTR < 0. 0 rt TS Thus, by Cramer’s rule, Z TRx Z TSx dTS ert D0 dt + ert D0 dt − erT R δQTR > 0, = |J|−1 erT Rx +rT S r(1−δ)µ0 rγ (1 − δ)2 dS0 TR TS dTS = −|J|−1 erT Rx +rT S r2 γµ0 (1 − δ) dR0 Z TS rt 0 e D dt < 0, 0 and dTS = −|J|−1 erT Rx +rT S r(1 − δ)δµ0 dγ Z TS Z e D dt −rγ(1 − δ) rt 0 TRx TR 0 which is ambiguous in sign. 38 0 D dt − QTR ,