The Drill and the Bill: Shale Gas Development and Property Values

advertisement

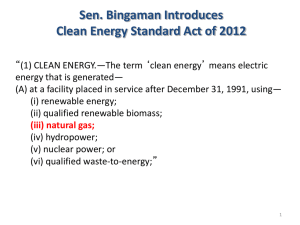

The Drill and the Bill: Shale Gas Development and Property Values Lucija Muehlenbachs Elisheba Spiller Christopher Timmins∗ May 31, 2012 Abstract Although shale gas development has been a recent economic boon to various areas across the United States, there are inherent risks in the process that could be capitalized into the prices of nearby homes. We conduct a hedonic study of the impact on property values by permitting and drilling of shale gas wells both on and near the property. This study allows us to quantify how property values change due to (1) the expectation of future drilling in the case of properties with permitted (but not yet drilled) wells; (2) the impact of having a wellhead situated on or near one's property, including area impacts such as increased road congestion, noise, and pollution; and (3) the improvement in economic conditions associated with shale gas development (such as increased immigration and employment). Using data on all housing transactions from Washington County, Pennsylvania, from 2004 to 2009, our preliminary results suggest that houses that rely on private ground water wells are negatively aected by proximity to shale wells whereas houses with piped water are positively aected by proximity. JelClassication: Q53 ∗ Lucija Muehlenbachs, Research Fellow, Resources for the Future, Washington, DC, muehlenbachs@r.org ; Elisheba Spiller, Postdoctoral Researcher, Resources for the Future, Washington, DC, spiller@r.org ; Christopher Timmins, Department of Economics, Duke University, christopher.timmins@duke.edu. Acknowledgements: We thank Jessica Chu, Carolyn Kousky, Alan Krupnick, and Lala Ma. We thank the Bureau of Topographic and Geologic Survey in the PA Department of Conservation and Natural Resources for data on well completions. We gratefully acknowledge support from the Cynthia and George Mitchell Foundation. 1 1 Introduction A recent boom in the extraction of natural gas and oil using unconventional methods has transformed communities and landscapes. The extraction of resources previously too expensive to obtain has resulted in many landowners receiving high resource rents for the hydrocarbons beneath their land. However, an increasing number of residential properties signing unconventional hydrocarbon leases are of growing concern to mortgage lenders.1 This paper focuses on shale gas extraction in Pennsylvania, which has, with staggering speed, become prevalent in thanks to developments in hydraulic fracturing and horizontal drilling. The intensity of the processes required to extract natural gas from shale rock suggest that there could also be higher risks to air, water, and health than the extraction of conventional natural gas. The perception of these risks, as well as increased truck trac or the visual burden of a wellpad, could depress property values. Given a concern that unconventional extraction will have a negative impact on housing prices, many lenders, such as Wells, First Place Bank, Provident Funding, and Bank of America, do not accept gas and oil leases on mortgaged property. Furthermore, there are many limits to property owners signing over the mineral rights to their lands. For example, Section 18 of the standard Freddie Mac/Fannie Mae Mortgage document prohibits a property owner from leasing any portion of their property without consent from the mortgage lender. This implies that a property owner who independently signs a lease with a gas company will be technically in default under the mortgage terms. Furthermore, standard mortgages do not allow the presence of hazardous materials on mortgaged property. Thus, a shale gas lease on mortgaged land would technically constitute a default under common mortgages [May, 2011]. The growing concern over leasing mortgaged land is founded on many aspects of the actual lease terms between the property owner and the gas companies. On the one hand, leases typically do not include any form of insurance or indemnication from damage to the property caused by the gas extraction. Yet the homeowner has very little control over the terms of the lease. For example, the gas lessee can sell the lease to another party without notifying the homeowner. Additionally, while the original lease is usually contracted for ve years, this can turn into an indenite, extended lease without the signing of a new lease. In fact, if the well is deemed to be in production, the rights to the gas can remain in place for decades.2 This extension of the lease can be problematic in the sec1 Radow [2011] also illustrated in recent New York Times articles "Rush to Drill for Natural Gas Creates Conicts With Mortgages", Oct. 19, 2011, and "Ocials Push for Clarity on Oil and Gas Leases", Nov. 25, 2011. 2 Furthermore, postponing environmental remediation on wells that are not in production is also common place; it has been demonstrated that many oil and gas wells that are "temporarily inactive," and hence not environmentally remediated, will likely never be brought back onto production, nor remediated [Muehlenbachs, 2012]. 2 ondary mortgage market, especially with the unwillingness of mortgage lenders to nance land that has been leased for gas exploration. If a home is considered to be technically in default, then the mortgage lender can require automatic repayment of the loan, greatly increasing the probability of loan default and foreclosure Radow [2011]. While mortgage lenders are wary of leasing for hydraulic fracturing, it is unclear whether the nancial risk involved with fracking is large enough to warrant an automatic technical default on the loan [May, 2011]. Being able to quantify the true nancial risk of allowing for the leasing of shale gas on mortgaged land is essential for mortgage lenders to make appropriate cost and benet analyses before allowing the sale of mineral rights on mortgaged property. Thus, we use a hedonic property value model to estimate eects of shale gas development in order to quantify this nancial risk. 2 Application of the Hedonic Model for NonMarket Valuation In the hedonic model, formalized by Rosen [1974]), the price of a qualitydierentiated good is a function of its attributes, and the price increases in those attributes valued by individuals. In a market that oers a continuous array of attributes to choose from, the marginal rate of substitution between the attribute level and the composite good is equal to the marginal price of the attribute level. The slope of the hedonic price function with respect to the attribute at any one individuals' optimal choice is equal to the marginal willingness-to-pay for the attribute; thus the hedonic function is the envelope of the bid functions of all individuals in the market. This implies that we can estimate the overall willingness-to-pay, or valuation, for certain attributes by looking at how the price of the good varies with these characteristics. A vast body of research has looked at the eects of a locally undesirable land use, such as hog operations [Palmquist et al., 1997], underground storage tanks [Guignet, 2012], and power plants [Davis, 2011] to name a few, in order to estimate the disamenity value of the land use (or willingness-to-pay to avoid this land use). This paper will use hedonic methods to model the eect that the presence of a nearby shale gas well has on property values in equilibrium.3 In particular, we use variation in the market price of housing with respect to changes in the proximity of shale gas operations to measure the implicit value of a shale well to home owners. As such, it should be able to pick-up the direct eect of 3 Assuming that the housing supply is xed in the short-run, any addition of a shale gas well is assumed to be completely capitalized into price and not in the quantity of housing supplied. Given that the advent of shale gas drilling is relatively recent, we would expect to still be in the "short-run". As more time passes, researchers will be able to study whether shale gas development has had a discernable impact on new development. 3 disamenities related to drilling operations (e.g., bright lights, odors, truck noise) and environmental risks (e.g. risk of water contamination and consequences of spills and other accidents), as well as dierentiate these from the amenity value of the improved economic conditions associated with shale gas development. This is analogous to the eect of a wind turbine [Heintzelman and Tuttle, 2011] where the undesirable land use is also accompanied by a payment to the property that it is located. The academic literature describing the costs of proximity to oil and gas drilling operations is small. See, for example, Boxall et al. [2005], which examines the property value impacts of exposure to sour gas wells and aring oil batteries in Central Alberta, Canada. The authors nd signicant evidence of substantial (i.e., 3-4%) reductions in housing price associated with proximity to a well. We contribute to this literature with a focus particularly on shale gas wells in Pennsylvania. We employ various estimation strategies in order to deal with issues that are prevalent when estimating a hedonic model. It could be the case that there are unobservable eects associated with the citing of a shale gas well that aect the price but are not caused directly by gas well activity. For example, shale gas wells might be located more frequently in areas with existing industrial activities, noise, or unsightliness. We therefore rst examine the eect of shale gas development on the same properties over time, in order to remove unobserved location attributes. However, because the hedonic price function is the envelope of individual bid functions it therefore depends on the distribution of characteristics in the housing stock. This means that if few of the neighborhoods in our sample are aected by increased trac and noise, then there will be a lower premium placed on quiet neighborhood location. However, if shale development is widespread and results in most of the neighborhoods being aected by heavy truck trac, then the houses located in the relatively few quiet neighborhoods would have a high premium. In the case of a widespread change in the distribution of a particular attribute in the housing stock, it is possible that the whole hedonic price function might shift, so that even the price of properties far from shale wells will be aected. Furthermore, the hedonic price function is dependent on the distribution of tastes. If households discover that shale development poses a risk to groundwater, then they would place even less value on the attribute of having shale development in their proximity. If there was a shift across all individuals in their perception of the risks to groundwater from shale development then the hedonic price function would also shift. This might have been the case after water contamination in Dimock Pennsylvania was brought to the public's attention at the beginning of 2009, as well as in the release of the documentary lm Gasland (2010). Bartik [1988] shows that if there is a discrete, non-marginal, change that aects a large area, the hedonic price function shifts, and the total change in property values serves as an upper bound estimate for the benets. Thus, to control for the possibility of shifts to the whole hedonic price function, we also estimate the 4 willingness-to-pay separately by year. There are also studies that tease out the property value eect of specic environmental disamenities, rather than an undesirable land use in general, such as the eect of air quality (see Smith and Huang [1995]) for a meta-analysis), water quality [Leggett and Bockstael, 2000] or health [Davis, 2004]. Our study is framed at estimating the overall impact of a shale gas well, but we test for whether there is a dierence for individuals that depend on their own groundwater compared to those who have access to piped water. This allows us to identify the disamenity of water risk associated with fracking separately from other disamenities as well as the amenity value of the economic boom. 3 Background on Risks Associated with Shale Gas Shale gas extraction is now viable because of advances in hydraulic fracturing (fracking) and horizontal drilling. Fracking is a process in which large quantities of fracturing uids (water, combined with chemical additives including friction reducers, surfactants, gelling agents, scale inhibitors, anti-bacterial agents, and clay stabilizers) are injected at high pressure so as to fracture the shale rock, allowing for the ow of natural gas.4 The multiple risks associated with fracking might have an impact on property values and hence mortgage lenders. First, fracking can cause a contamination of local water supply resulting from improper storage, treatment, and disposal of wastewater. Fracking also generates "owback uid", the hydraulic fracturing uids that return to the surface after fracking, often containing salts, metals, radionuclides, oil, grease, and VOC's. These uids might be recycled for repeated use at considerable cost, but may also be disposed of by land application or by treatment at public or private facilities. Mismanagement of owback uid can result in contamination of nearby ground and surface water supplies. Second, air pollution is a concernescaped gases can include NOx and VOC's (which combine to produce ozone), other hazardous air pollutants (HAP's), methane and other greenhouse gases. Third, spills and other accidents can occurunexpected pockets of high pressure gas can lead to blowouts that are accompanied by large releases of gas or polluted water. Improper well-casings can allow contaminants to leak into nearby groundwater sources. Fourth, drill cuttings and mud can also be risky. These substances are typically used to lubricate drill bits and to carry cuttings to the surface, and often contain diesel, mineral oils or other synthetic alternatives heavy metals (e.g., barium) and acids, these pollutants can also leach into nearby groundwater sources. Other negative externalities such as deterioration of roads due to heavy truck trac, minor 4 Our description of fracking and its external costs is based on the discussion in Plikunas et al. [2011]. 5 earthquakes, and clearing of land to drill wells can also aect housing prices due to a lower aesthetic appeal of the region in general. 4 Method One of the more dicult problems that arises when implementing the hedonic method is the presence of house and neighborhood attributes that are unobserved by the researcher but correlated with the attribute of interest. The specications we adopt in order to demonstrate and address this problem in the context of the hedonic framework include (i) simple cross-section, (ii) xed eects, and (iii) matching. We briey review the econometric theory behind each of these approaches below. 4.1 Cross-Sectional Estimates The most naïve specication ignores any panel variation in the data and simply estimates the eect of exposure to a shale gas well by comparing the prices of houses in the vicinity of a well to those houses that are not exposed to a well. Considering the set of all houses in the study area, we run the following regression specication: Pi = β0 + β1 W ELLDISTi + Xi0 δ + Y EARi0 γ + εi (1) where Pi W ELLDISTi Xi Y EARi natural log of transaction price of house i distance of house i to nearest shale gas well at the time of transaction vector of attributes of house i vector of dummy variables indicating year in which house i is sold In this specication, the eect of exposure to a well is measured by β1 . The problem here is that W ELLDISTi is likely to be correlated with εi (i.e., houses and neighborhoods that are near wells are likely to be dierent from neighborhoods that are not near wells in unobservable ways that may aect housing prices). For example, houses located in close proximity to wells may be of lower quality than those located elsewhere in the county. One way to check for this possibility will be by comparing observable attributes of houses and neighborhoods, both located near and far from shale gas wells. Signicant dierences in observable attributes suggests a potential for dierences in unobservables, which could lead to bias in the estimation of equation (1). 6 4.2 Fixed Eects Properties that are near shale wells might dier systematically in unobservable ways from those that are not nearby wells. If properties farther from wells are associated with better unobserved characteristics, then this would create an elevated baseline to which the houses near wells would be compared, causing a downward bias in our estimate for the eect of a nearby well. As no two houses can occupy the same location, utilizing xed eects allows us to dierence away the unobservable attributes associated with the house's location. The simplest approach to dealing with unobserved house and neighborhood attributes that may be correlated with well exposure is to exploit the variation in panel data to control for time-invariant neighborhood attributes. Suppose Pit measures the natural log of the price of house i which transacts in year t. Xit is a vector of attributes of that house, and W ELLDISTit is the distance of house i to the nearest well at the time of the transaction. µi is a time-invariant attribute associated with the house that may or may not be observable by the researcher, and νit is a time-varying unobservable attribute associated with the house. Importantly, µi may be correlated with W ELLDISTit . Thus we employ a xed eects technique in order to remove µi from the equation: Pi,t = β0 + β1 W ELLDISTit + Xit0 δ + µi + νit (2) Taking the within-household means of each variable: P̄i = W ELLDIST i = X̄i = µ̄i = ν̄i = 1 X Pit Ni t 1 X W ELLDISTit Ni t 1 X Xit Ni t 1 X µi = µi Ni t 1 X νit Ni t (3a) (3b) (3c) (3d) (3e) Where Ni is the number of transactions of house i. We then generate meandierenced data: 7 P̃it = Pit − P̄i g W ELLDIST = W ELLDISTit − W ELLDIST i X̃it = Xit − X̄i ν̃it = νit − ν̄i (4a) (4b) (4c) (4d) Noting that µi − µ̄i = 0, we re-write equation (2): 0 g P̃it = β1 W ELLDIST it + X̃ it δ + ν̃it (5) Estimating this specication controls for any permanent unobservable dierences between houses that have the shale well treatment and those that do not. 4.3 Matching While xed eects controls for unobserved household and location attributes, it does not take into account the overall time trends that are occurring. This is a concern, as shale gas well drilling is often associated with an economic boom in the area. Thus, areas near shale gas wells may in fact experience an increase in housing values overall given the increase in amenities associated with drilling. These amenities are mostly driven from increased population levels and employment, leading to better neighborhood or city amenities that may be unobserved in the data. Yet this does not imply that, all else equal, being closer to a well increases housing values; instead the increasing neighborhood amenities may be driving that result. This warrants going beyond the xed eects model and conducting within-year estimation. Matching models (such as nearest neighbor and propensity score matching) allow the researcher to isolate the impact of the treatment on the outcome in a quasi-experimental fashion. Since housing prices are only observed if a property is either treated or not, but not both, matching allows us to create a counterfactual by comparing the outcome of a "treated" property with a similar "untreated" property. This allows us to estimate what would have been the price of a household had it actually been farther away from the well, all else equal. However, it is dicult in this setting to identify a treated house vs. an untreated house. For example, we would expect a house 1km away from a well to be treated, though it is not clear whether a house seven kilometers away should be treated. Thus, we employ several dierent methods in order to nd how the denition of treatment impacts the results. First, we employ a generalized propensity score (GPS) model, as detailed in Hirano and Imbens [2004], in order to nd how the impact of proximity to shale gas wells varies at dierent distances. GPS allows the treatment to vary continuously, while regular matching models assume a binary treatment. Thus, we dene 8 the treatment as the distance to the nearest well, and estimate the impact on housing values as this distance is varied. We utilize the Stata doseresponse module that estimates the GPS and the expected outcome given treatment, specifically a dierent outcome at dierent levels of treatment. We include as controls housing characteristics and census tract attributes. Ideally, we would run doseresponse on each year separately in order to eliminate the time-varying issues that can bias the outcome from the xed eects model. Unfortunately, our sample size is not large enough to run it with each year separately, so we have to estimate the dose response aggregated from 2006-2009. However, to control for the unobserved attributes correlated with years, we include year dummies. Our second approach utilizes propensity score matching (PSM), but takes into account the fact that we have several treatment levels. In a binary treatment case, PSM predicts the outcome of "being treated" given house characteristics in order to capture the fact that treatment is not exogenously assigned. This is calculated through a probit regression, and the probabilities are then used to match treated houses with non-treated houses. This allows two similar houses, one that was treated and one that was not, to be matched on observable characteristics, and provides our counterfactual outcome. Imbens (2000), Lechner (2001), and Lechner (2002) provide dierent ways to estimate PSM under varying treatment outcomes. One of the proposed methods is based on a series of binomial models, where each treatment level is compared to a dierent treatment. This is the approach we entail. We choose the treatment levels as buers around wells: each buer is a donut one mile wide, and we do side-by-side comparisons. For example, we compare individuals living within a mile to a well with those living within one to two miles to a well. This is demonstrated graphically in Figure 1. Here, house A is within one mile of the well, and house B is within one to two miles of the well. This implies that house A is in the treatment group and house B is part of house A's control group. We employ only side-by-side comparisons, that is, we do not compare, for example, a house that is ve miles away with a house one mile away, as we would expect the hedonic price gradient to be very dierent at these dierent treatment levels, thereby invalidating the assumption of marginal changes in amenities. Unfortunately, we do not observe whether a household has leased out its land to a gas company. The size of the lease could possibly be capitalized into the value of the home, causing an increase in housing transaction value, which if not controlled for, would appear that willingness to pay for proximity to a well is positive. Since we do not know which home pertains to a lease owner nor the quantity of that lease, we control for those most likely to be lease owners. Horizontal wells in Pennsylvania tend to extend less than a mile in diameter5 , so 5 CONSOL reports that its average lateral well length is 3,400 feet. http://shale.typepad.com/marcellusshale/2011/02/consol-energy-reports-on-marcellus-shalereserves-for-2010.html 9 Figure 1: Buer Zones Around Wells for PSM we control for houses within one mile from a horizontal permitted well as well as one mile of a horizontal producing well. As a robustness check, we repeat the PSM method but utilize nearest neighbor matching, or covariate matching (CM). CM nds the houses that are closest in terms of attribute space by utilizing a Mahalanobis distance, which is calculated as: 0 (Xs − Xr ) diag −1 X (Xs − Xr ) X Here, Xs and Xr are vectors of attributes, such as square feet, number of bedrooms, lot size, and other house attributes. We also include census tract P−1attributes so that we can match across similar areas in Washington County. X is the covariance of the matrix of housing and census tract attributes. By minimizing the distance, we nd the house that is closest in attribute space and utilize it as a control. We also test this method by choosing the four closest homes and averaging across their outcomes. However, Abadie and Imbens (2005) demonstrate that bootstrapping nearest neighbor matching techniques does not yield valid results, so these estimates should be read with caution. 10 4.4 Water Wells vs. Piped Water Much of the concern surrounding shale gas development is associated with water well owners. Houses that utilize water wells may be aected if the surface casing cracks and methane or other contaminants leak into the groundwater. Houses that receive drinking water from piped wells, on the other hand, do not face this risk. We hypothesize that this risk may be capitalized into the value of the home: households using water wells may be more adversely aected by proximity to shale gas wells than households using piped county water, and therefore would face a lower transaction value. In order to capture this dierence across houses, we adjust our methods by splitting up the sample into houses relying on groundwater and piped water. We use GIS data on the location of public water service areas and map the houses into their respective groups. When we conduct matching, we only match within water-use groups in order to capture this unobserved attribute and to estimate the dierential eect from proximity to shale gas wells in groundwater areas versus piped water areas. 5 Data Our main dataset is provided by Dataquick Information Services, a national real estate data company. These data include information on all properties sold in Washington County, Pennsylvania from 2004 to 2009. The buyers' and sellers' names are provided, along with the transaction price, exact street address, square footage, year built, lot size, number of rooms, number of bathrooms, number of units in building, and many other characteristics. We begin with 41,266 observations Washington County, PA, and remove transactions that did not list a transaction price or a latitude/longitude coordinate, had "major improvements", are described as only a land sale (a transaction without a house), or claim to be a zero square footage house. The nal cleaned dataset has 18,160 observations. In order to control for neighborhood amenities, we match the house location with census tract information, including demographics and other characteristics. The census tract data come from the American Community Survey, which is a rolling average between the years 2005 and 2009. We geocode the housing transactions data in order to match it to our second main data source: the location of wells in Washington County. We obtained data on the permitted Marcellus wells from the Pennsylvania Department of Environmental Protection. To determine whether the permit has been drilled we relied on two dierent datasets. A well is classied as drilled if there was a spud date (date that drilling commenced) listed in the Pennsylvania Department of Environmental Protection Spud Data or if there was a completion date listed in the Department of Conservation and Natural Resources Well Information System (PA*IRIS/WIS). As there were many wells not listed in both datasets, using both 11 Figure 2: Well Pad with Multiple Wells datasets allows us to have a more complete picture of drilling in Pennsylvania. Many of these wells are in very close proximity to one another, yet the data do not identify whether these wells are on the same well pad. Well pads are areas where multiple wells are placed close to each other, allowing the gas companies to expand greatly the area of coverage while minimizing surface disturbance. As fracking involves horizontal drilling, a well pad can include many wells in close proximity while maximizing access to shale gas below the surface. This can be seen in Figure 2, which demonstrates how six horizontal wells can be placed on a small well pad, minimizing the footprint relative to vertical drilling which would require 24 wells evenly spaced apart (as outlined in blue). Without being able to identify well pads, we could be overestimating the number of wells that a house is treated by: for example, a house near the well pad in Figure 2 would be identied as being treated by six wells, though presumably the impact on that house's transaction value would be more similar to a house being treated by only one well6 . Thus, we create well pads using the distance between the wells, and treat these well pads as one entity that is aecting the house. In order to create well pads, we choose all wellbores that are within one acre of each other and assign them to the same well pad.7 There are many wells that are permitted and drilled but have remained inactive. To determine whether a well has started production we obtained production data from the Pennsylvania Department of Environmental Protection. Pennsylvania only required rms to report production on an annual basis until 2009 (from 2010 to present biannual reporting is being required). We use the rst date of production from any wellbore in the wellpad to indicate that the wellpad is producing. 6 In future work we will examine this claim. vary from half an acre to ve acres in size, however the majority of wellbores in a pad are within one acre of each other. http://unnaturalgas.org/INFODROP%20What%20you%20need%20to%20know%20CBA%20v2.pdf 7 Pads 12 We match the house transactions to wells located within 20 km of the house, including permitted but not drilled wells, drilled wells, and pre-permitted wells (wells which are permitted and drilled after the time of the housing transaction). Once these wells are matched, we create variables which measure each house's Euclidian distance to the closest well that is either permitted or drilled at the time of the transaction. These are our main variables of interest, as they identify the "treatment"we want to measure how proximity to wells aects housing values. We also calculate the inverse of the distance (Inv. Dist. to Well) and use this variable as the treatment in the cross sectional and xed eects specications, allowing for an easier interpretation of the results in that an increase in inverse distance implies a closer distance to a well. In order to capture the water risks that home owners may face from shale gas extraction, we utilize data on groundwater service areas in Washington County in order to identify houses that do not have access to public piped drinking water. We obtained the GIS boundaries of the Public Water Supplier's Service Area from the Pennsylvania Department of Environmental Protection. Houses located outside of a public water service area (PWSA) most likely utilize private water wells, since the county does not provide much nancial assistance to individuals who wish to extend the piped water area to their location (personal communication with the Development Manager at the Washington Coutny Planning Commission). Given the high costs associated with extending the PWSA, we hypothesize that the majority of the individuals outside of PWSAs are water well owners. This allows us to separate the analysis by water service area into PWSA and "groundwater" areas, and we use this distinction to identify the water contamination risk that may be capitalized into the transaction value. Summary statistics of the property transactions including information on house and census tract attributes and proximity to wells is presented in Table 1. The summary statistics show that the majority of houses are within ve miles of a well, and 23% are within one mile of a well, though less than 1% are within a mile of a horizontal producing well. Individuals within a mile of a horizontal producing well are most likely those who are receiving signicant lease payments from the gas company, and are thus controlled for in most of our analysis. Since we also divide the sample into groundwater and PWSA areas, as well as properties not in a city, we include summary statistics in Table 2 of three dierent groups: groundwater, PWSA, and PWSA excluding the two largest cities in Washington County (Washington and Canonsburg). The groundwater group is quite dierent from the PWSA group in some dimensions: the houses are smaller, though the lot sizes are much larger. On the other hand, the PWSA group excluding the city is comparable to the PWSA group including the city. Figure 3 shows the map of Washington County, Pennsylvania, and shows the permitted and drilled (spudded) wells, property transactions, and the water service area. This map is a snapshot of all wells and transactions during the time of the sample, so some of these houses were not close to a well at the time of 13 Table 1: Summary Statistics Housing Characteristics: Transfer (Dollars) Ground Water Age Total Living Area (1000 sqft) No. Bathrooms No. Bedrooms Sold in Year Built Lot Size (1000 sqft) Census Tract Characteristics: Mean Income % Under 19 % Black % Hispanic % 25 w/High School % 25 w Bachelors % Same House 1 Year % Unemployed % Poverty % Public Assistance % Over 65 % HH Female Shale Well Proximity: Notes: Distance to Closest Well (m) Distance to Closest Permit (not Drilled) (m) 1 mile from Horizontal Producing Well 1 mile from a Well 1 to 2 miles from a Well 2 to 3 miles from a Well 4 to 5 miles from a Well Observations All transactions in Washington County, 2004-2009. Mean Std. Dev. Min. Max. 126113 .0896 55 1.8 1.68 2.72 .116 24.3 134570 .286 39.8 .875 1.01 1.12 .32 76.2 150 0 0 .108 0 0 0 .004 3000000 1 308 13.7 9 8 1 4643 65655 23.9 3.78 .426 39.2 16.7 88.6 6.19 7.63 2.21 17.7 10 23778 4.19 5.87 .72 10.5 7.51 6.75 2.84 6.93 2.13 4.92 5.6 28150 15.1 0 0 18.5 2.6 52.6 .8 0 0 7.1 0 120886 37 31.7 3.7 57.3 34 97.3 14.3 29.3 9.6 36 28.4 10110 10230 .00285 .233 .322 .451 .409 19310 4313 4674 .0693 .423 .468 .498 .492 146 146 0 0 0 0 0 19999 19998 4 1 1 1 1 the transaction date. The large clustering of transactions in the center part of the county corresponds to the two major cities in the county: Washington and Canonsburg. These cities fall along the major highway that cuts through the county (the 79, which connects with the 70 in Washington City). We hypothesize that houses within these major cities face important amenities due to the economic boom associated with shale gas development. Thus, we exclude these cities in certain specications in order to identify the disamenity value associated with proximity to a well separately from the amenity value associated with the economic boom. We also look at these cities separately from the rest of the county in order to identify the positive amenity value of economic development capitalized into property transactions. 14 Figure 3: Transactions in Washington County 2004-2009. Includes Permitted Wells, Drilled Wells, and Water Service Areas 15 Table 2: Summary Statistics by Water Service Type Ground Std. Dev. 128445 55.23 1.813 1.701 2.729 .1217 18.78 137605 39.88 .8759 1.018 1.129 .327 34.43 123228 60.3 1.825 1.648 2.736 .09882 20.89 153178 38.91 .9456 1.008 1.113 .2984 38.14 66096 23.98 4.094 .4338 38.44 17.14 88.19 6.163 7.776 2.256 17.94 10.23 24795 4.312 6.068 .7457 10.59 7.672 6.927 2.873 7.217 2.206 5.045 5.75 67382 23.64 2.737 .4834 38.79 16.87 89.96 5.924 7.432 2.248 18.5 9.319 27670 4.164 4.158 .8215 11.66 7.992 5.78 2.566 7.089 1.767 4.463 5.228 Distance to Closest Well (m) 9520 5584 10161 4180 Distance to Closest Permit (not Drilled) (m) 9563 5535 10288 4587 1 mile from Horizontal Producing Well .01965 .1973 .001195 .03769 1 mile from a Well .3595 .4814 .183 .3872 1 to 2 miles from a Well .5537 .4985 .2853 .4518 2 to 3 miles from a Well .4051 .4922 .4566 .4983 4 to 5 miles from a Well .5088 .501 .3992 .4898 Observations 1730 17580 Notes: (1)Groundwater (2) Piped Water (3) Piped Water & Not in Two Largest Cities 10908 11042 .0011 .2188 .3521 .4988 .3499 10914 4685 5017 .0358 .4141 .478 .5003 .4771 Census Tract Characteristics: Mean Income % Under 19 % Black % Hispanic % 25 w/High School % 25 w Bachelors % Same House 1 Year % Unemployed % Poverty % Public Assistance % Over 65 % HH Female Mean 103203 53.02 1.645 1.496 2.653 .06138 78.12 97080 38.7 .8487 .8586 .9701 .2401 219.2 61343 23.46 .6862 .348 46.7 12.93 92.39 6.491 6.202 1.77 15.71 8.116 7856 2.635 1.143 .3727 5.307 4.007 2.329 2.467 2.483 1.151 2.835 3.286 Piped, Not City Mean Transfer (Dollars) Age Total Living Area (1000 sqft) No. Bathrooms No. Bedrooms Sold in Year Built Lot Size (1000 sqft) Std. Dev. Piped Std. Dev. Housing Characteristics: Mean Shale Well Proximity: 6 Results Our rst estimation technique is OLS, where we regress logged transaction prices on regression controls for house and census tract attributes and several treatment variables. These treatment variables include both inverse distance to the nearest drilled well and this variable interacted with a dummy for ground water (equals one if the house is located outside a PWSA). This allows us to separately identify the impact of proximity to a well for households living in groundwater areas. We expect this coecient to be negative, as being closer to a well causes a greater risk (and thus larger disamenity values) to households living in groundwater areas. We also include inverse distance to the nearest permitted well in order to identify whether there is a dierent impact from permitted wells relative to drilled wells. This variable is also interacted with a groundwater dummy. We run the regression for the full sample as well as the subsample excluding the cities. The results for the OLS regression are inconclusive. The coecient on inverse distance to nearest drilled wells is positive and signicant, while the interaction 16 with groundwater is negative and insignicant. Inverse distance to permitted well interacted with groundwater is positive but insignicant. The positive sign on the coecient may be picking up the fact that proximity to a permitted well implies a lease payment. In fact, these lease payments increase with the amount of land lease, and lot size in ground water areas is much larger than in the PWSA areas. Thus, the groundwater area houses may positively capitalize on the permitting of the well before the negative amenities associated with drilling occur. However, the magnitude of these coecients is very large: the interpretation of the coecient is that a one unit increase in the variable causes a 100 ∗ β% increase in the housing price. Yet a one unit increase in inverse distance is huge. For example, if a house is 5km away from a well, a one unit increase implies that the house moves 5km closer to the well. Thus, for the average household that lives approximately 10km away from a drilled well, this implies moving 10km to be directly next to the well, which is arguably not a marginal change in amenities. A 0.01 increase in inverse distance is equivalent to being 1m closer for the average house, so we can calculate this marginal change as β ∗ 0.01, though the resulting coecient is still very large: 6.26, which implies a 626% increase in housing values. This implies that there are certain unobserved attributes that are not being picked up by the regression and that may be correlated with geography or time, biasing the OLS coecients. Thus, we employ a xed eects approach in order to remove these unobservable attributes. While this specication removes all houses that are not sold more The results from the xed eect and OLS techniques are presented in Table 3. The sign of the coecients are intuitive, though the magnitudes are still very large. For the full sample (including cities), we nd a positive impact of drilled shale gas well proximity on housing values, though it is negative (and larger) for those households living in groundwater areas. This implies that shale development causes an increase in housing values given the increase in neighborhood amenities, though houses that do not have access to piped water have a larger negative impact due to fracking risks. When we exclude the cities, this eect is even more pronounced: the size of the coecient on proximity to drilled wells decreases, demonstrating that the amenity value of development is concentrated in the cities. However, the magnitude of these impacts is still much larger than we would expect. For example, for houses in groundwater areas, the overall impact of (inverse) distance to a well is 1079.430 − 1353.804 = −274.37, which implies a 274% decrease in housing values given a 1m decrease in proximity. This implies that perhaps there are unobservables that are biasing our result. Thus, we turn to matching techniques in order to account for some of these issues. Our next approach utilizes a generalized propensity score technique in order to measure the impact of proximity to shale gas wells at dierent levels of treatment. We include in the estimation controls for housing and census tract attributes and year dummies. Furthermore, in order to measure how the treatment eect varies 17 Table 3: Cross Section and Fixed Eects (1) (2) (3) (4) OLS OLS FE FE Inv. Dist. to Well 239.430** 218.115* 1079.430** 666.970** (115.111) (121.583) (464.225) (316.742) Inv. Dist. to Well*Ground Water -282.562 -394.995 -1353.804*** -1078.964** (206.421) (267.485) (413.192) (445.818) Inv. Dist. to Permitted (not Drilled) Well 197.390 -66.716 601.489 2194.478** (132.798) (216.609) (564.923) (957.259) Inv. Dist. to Permitted* Ground Water 349.608 626.896 334.152 269.448 (250.607) (481.129) (831.945) (1821.669) Ground Water -.164** -.163* (.068) (.088) 1 mile from Horiz. Producing Well -.050 -.023 -.530 -1.044* (.154) (.179) (.477) (.528) 1 mile from Horiz. Permitted (not Drilled) Well -.391* -.106 -1.241 -3.009** (.204) (.256) (1.244) (1.373) Age -.014*** -.013*** (.000) (.001) Total Living Area (1000 sqft) .274*** .280*** (.019) (.025) No. Bathrooms .073*** .061** (.021) (.030) No. Bedrooms -.016 -.026 (.018) (.024) Sold in Year Built -.197*** -.358*** (.040) (.067) Lot Size (1000 sqft) .003*** .003*** (.001) (.001) Lot Size Squared (1000 sqft) -.000** -.000** (.000) (.000) % 25 w/High School -.010*** -.008** (.002) (.004) % Black -.005 -.032*** (.003) (.007) % Hispanic -.112*** -.086*** (.019) (.027) % Unemployed -.033*** -.035*** (.006) (.009) Mean Income .000*** .000*** (.000) (.000) 2006 -.069* -.102 .336 .320 (.039) (.063) (.208) (.358) 2007 -.102** -.057 .700*** .673** (.040) (.063) (.196) (.333) 2008 -.258*** -.244*** .845*** .851** (.042) (.065) (.205) (.336) 2009 -.512*** -.510*** 1.386*** 1.493*** (.059) (.083) (.260) (.357) n 10,834 5,848 11,087 6,070 Mean of Dep. Var. 11.09101 10.94333 11.06106 10.89657 Notes: Robust standard errors clustered at the census tract (102 census tracts). Columns (3) and (4) include property xed eects. Columns (2) and (4) do not include the two largest cities in Washington County (Washington and Canonsburg). *** Statistically signicant at the 1% level; ** 5% level; * 10% level. 18 11.2 Groundwater Area (Full Sample) 11 10.6 10.8 E[log price] 11.4 11.2 10.4 11 10.8 E[log price] 11.6 11.8 Water Service Area (Full Sample) 0 2000 4000 6000 8000 10000 0 Dose Response 2000 4000 6000 8000 10000 Distance (m) Distance (m) Dose Response 95% Confidence 95% Confidence Figure 4: Impact on Housing Values from Proximity to the Nearest Shale Gas Well across dierent water service areas, we separate the estimation into two groups: groundwater and PWSA houses. Figure 4 demonstrates the impact of proximity to shale gas wells for the entire sample (including cities), and it appears that the treatment eect of proximity varies substantially with water service. For houses in a PWSA, being closer to a well actually increases housing values. This implies that the local amenities associated with shale development can boost the housing market substantially, but only if the house is protected in some way from the environmental impacts. For houses without piped water, being closer to a shale gas well signicantly decreases housing values. Thus, we see strong evidence for a contrasting impact across dierent water service areas. Figure 4 also shows that the impact of proximity to shale wells tapers o after approximately 6km, demonstrating that the impacts of shale development are signicantly localized. While the results until now indicate that there exist both positive and negative impacts of shale gas development on housing values, the positive and increasing coecients on the year dummies in the xed eects specication demonstrate that there are unobserved attributes that vary across the years, which could be biasing our results. There was a lot of change in the area over the time period. For instance, the number of wells that were drilled in Washington County increased dramatically between 2005 and 2009. Table 4 shows the increase in wells over time, and demonstrates that the average distance to a well decreased by almost 50%. Thus, it is important to restrict the analysis to within-year so that the changes over time do not bias the results or distort the actual disamenity value of well proximity. We are not able to run the dose response model on each year 19 Table 4: Shale Gas Activity Over Time in Washington County, PA Year 2005 2006 2007 2008 2009 No. Wells 5 25 80 188 188 No. Permitted 9 32 116 221 268 Dist. To Nearest Wells 11952.9 11879.44 9370.836 7336.622 6326.31 Distance to Nearest Permit 11952.87 11883.63 7806.528 7329.301 6323.57 Notes: Wells and permits refer to the wellpad (there may be multiple wellbores on each wellpad). separately given small sample sizes, so we instead utilize a dierent matching technique. We employ propensity score matching in order to nd the impact of moving closer to a well on housing values. In order to allow for varying treatment eects, we divide the sample into groups of houses that are located at dierent distances to a well. The rst group of individuals is located nearest to a well: within 1 mile of a well. As we cannot identify lease holders or payments but those within 1 mile may be receiving payments, we group these individuals together. The second group of individuals is located between 1 and 2 miles of a well; the third is between 2 and 3 miles; and so on. We do side-by-side propensity score estimations to see what happens, for example, when someone in the second group moves into the rst group, or someone in the third group moves into the second. This allows us to test the impact on housing values of moving one mile closer to a well. Since there are not many houses that are located in each group, we need to use a mile buer in order to allow for enough matches across groups. The matching process is restricted to two types of exact matches: within years and water service areas. By matching within these groups, we capture both the separate eect on groundwater houses as well as remove the time-varying unobservables that can aect housing prices. We dene the comparisons in the following way: inner-circle (group 2 moves into group 1), donut 1 (group 3 moves into group 2), donut 2 (group 4 moves into group 3), and so on. Within the exact match, we match on the propensity score to be in a group, depending on observable housing and census tract characteristics. We also control for whether any households might have signed a lease by also matching on the number of permitted (not yet drilled) horizontal wells within one mile of the house. Our results demonstrate a variety of impacts on housing values from proximity to well. First of all, we nd no impact on houses within PWSAsthe coecients are insignicant. This provides some evidence that houses with piped water are able to benet from the amenity value of growth more than they are negatively aected by the environmental impact of shale gas development. Given that we do not have information on the lease payments to the home owners, it is not surprising that we do not nd an impact at the nearest area to the well (within 20 Table 5: Eect on Log Housing Price when Moving Closer to A Well Piped Water Groundwater mi. 1-2 mi. 2-3 mi. 3-4 mi. <1 mi. 1-2 mi. 2-3 mi. 3-4 mi. -1.550 1.066 0.040 -0.296 -1.128 -0.212 -0.247 0.057 (.) (.) (0.504) (0.396) (.) (0.334) (0.833) (0.757) 2007 3.696 -0.771 -0.121 -0.087 -0.918 0.258 -0.111 -0.016 (2.049) (0.582) (0.231) (0.183) (.) (1.179) (0.812) (0.999) 2008 0.349 -0.097 0.039 0.272 0.176 1.061* -0.267 -0.819* (0.876) (0.365) (0.172) (0.174) (1.724) (0.643) (0.983) (0.424) 2009 1.170 -0.159 0.078 -0.044 0.148 -1.277* -0.737 -1.435 (1.072) (0.322) (0.247) (0.241) (0.731) (0.714) (1.291) (3.297) Notes: Each column represents the dierence between matches within the closest area to the well and the next closest area to the well. For example, Inner-circle refers to the dierence in the treatment eect on houses within 1 mile of a well and the treatment eect on houses between 1 and 2 miles from a well. Donut1 is the dierence in the treatment eect on houses between 1 and 2 miles and the treatment eect on houses between 2 and 3 miles (standard errors in parenthesis). * 10% Signicance level. Year 2006 <1 one mile). It may be that these houses within a mile are capitalizing on the lease payments, which may overshadow the (presumably large) negative impact from being located very close to a well. Thus, it is dicult to draw conclusions at that proximity without information on lease payments. However, farther away from the well (outside of one mile proximity), we do nd some evidence that houses that have groundwater appear to be more negatively aected by proximity to wells. For example, moving from 2 miles to 1 mile away from a well (donut 1) raises the housing value in 2008, though lowers it in 2009. This may be due to the increase in public knowledge about the water risks associated with fracking during 2009, along with a signicant increase in number of overall wells in the area. An increasing intensity of exposure to wells may have caused the housing values to react more negatively in 2009, while the houses in 2008 were capitalizing on the positive amenity value associated with shale development impact on the local economy. However, we also nd a negative and signicant impact of moving from 4 miles to 3 miles (donut 3) in 2008. This could be due to positive amenities being quite a bit more localized and at 4 miles these benets are not felt as strongly as they are at 1 mile of proximity. On the other hand, this may also be picking up on the fact that we have small sample sizes. In any case, the coecients are larger and more negative in 2009, lending some evidence that the disamenity of shale gas development increased in that year. The results indicate that proximity to shale gas well decreased the log of housing prices in 2009 by 1.277 for houses in groundwater areas and 1 to 2 miles away from a well compared to houses 2 to 3 miles away from a well. The average housing price in 2009 for this group of houses was $80,140, implying an overall decrease of 28% in housing values, which is a more reasonable number than the xed eects results. 21 7 Conclusion We nd that shale gas development has some positive and negative impacts on housing values. On the one hand, shale gas activity is an economic boom and increases the amenity values of households living near wells. This is especially true for houses in the cities and in PWSAs, as they are able to capitalize on the increased amenities, possibly due to increased immigration and employment. On the other hand, the environmental disamenities, including water risks, decrease the value of nearby homes, especially for those who live in groundwater areas. Thus, being able to mitigate the risk of fracking (through utilization of piped water) allows houses to benet from the increased amenities in their neighborhood without having to bear the cost of the environmental risks. This implies that there could be important welfare benets from increasing access to piped water in areas with a lot of shale gas development. Though we nd some evidence that the value of shale development is positive for those in PWSAs, this does not imply a positive valuation of fracking. Instead, the positive impact of development on housing values may overshadow the negative environmental impacts of fracking. Being able to tease out these two preferences for individuals with piped water in order to evaluate their willingnessto-pay is a matter of ongoing research. Our current data source is quite limited, given both the geographic range and dates of transactions. This implies that our analysis (especially for matching) relies on few observations in the treatment group, which can cause our results to be skewed. Future steps in research involve acquiring newer data (including some data from 2012) on the entire state of Pennsylvania, and information on property boundaries in order to identify those houses that have a shale gas well situated on their property. Furthermore, we will incorporate information on road construction and water withdrawals in Pennsylvania to account for increased truck trac due to shale gas development, which may cause an impact on housing values. 22 References T.J. Bartik. Measuring the benets of amenity improvements in hedonic price models. Land Economics, 64(2):172183, 1988. P.C. Boxall, W.H. Chan, and M.L. McMillan. The impact of oil and natural gas facilities on rural residential property values: a spatial hedonic analysis. Resource and Energy Economics, 27(3):248269, 2005. L.W. Davis. The eect of health risk on housing values: Evidence from a cancer cluster. The American Economic Review, 94(5):16931704, 2004. L.W. Davis. The eect of power plants on local housing values and rents. Economics and Statistics, 93(4):13911402, 2011. Review of D. Guignet. What do property values really tell us? a hedonic study of underground storage tanks. NCEE Working Paper Series, 2012. M.D. Heintzelman and C.M. Tuttle. Values in the wind: A hedonic analysis of wind power facilities. Land Economics, 2011. K. Hirano and G.W. Imbens. The propensity score with continuous treatments. Applied Bayesian Modeling and Causal Inference from Incomplete-Data Perspectives, 7384, 2004. pages C.G. Leggett and N.E. Bockstael. Evidence of the eects of water quality on residential land prices. Journal of Environmental Economics and Management, 39(2):121144, 2000. Greg May. Gas and oil leases as they relate to residential leasing, 2011. URL http://www.toxicstargeting.com/sites/default/files/pdfs/ TTC-Gas-Res-Lend-HL.pdf. L. Muehlenbachs. Testing for avoidance of environmental obligations. 2012. RB Palmquist, FM Roka, and T. Vukina. Hog operations, environmental eects, and residential property values. Land Economics, 73(1):114124, 1997. S. Plikunas, B.R. Pearson, J. Monast, A. Vengosh, and R.B. Jackson. Considering shale gas extraction in north carolina: lessons from other states. Accepted for publication in Spring 2012 issue of Duke Environmental Law and Policy Forum, 2011. Elizabeth Radow. Homeowners and gas drilling leases: Boon or bust? Bar Association Journal, 83(9):121, 2011. New York State S. Rosen. Hedonic prices and implicit markets: product dierentiation in pure competition. The Journal of Political Economy, 82(1):3455, 1974. V.K. Smith and J.C. Huang. Can markets value air quality? a meta-analysis of hedonic property value models. Journal of Political Economy, 103(1):209227, 1995. 23