Investment and Income in the Simple Hotelling Model

advertisement

Investment and Income in the Simple Hotelling

Model

Robert D. Cairns∗

Department of Economics and Cireq

McGill University

855 Sherbrooke St W

Montreal QC Canada H3A 2T7

robert.cairns@mcgill.ca

7 April 2013

∗

Thanks to Masayuki Sato for comments.

1

Investment and Income in the Simple Hotelling Model

Abstract. This paper revisits accounting methodology in the canonical, Hotelling

model of exhaustible-resource extraction. The resource is found to earn an income

that should be recorded in the firm’s and the national accounts. The income, a capital

gain, is related to the core issue of the model, the timing of extraction. Investment

of the resource, also neglected in other models, and capital gains correspond to one

another in product and income.

Key words: green accounting, exhaustible resource, investment, depreciation,

capital gains, Hotelling

JEL Classifications: Q30, M41

2

1. INTRODUCTION

A finding of the analysis of green accounting for an exhaustible resource in the simple Hotelling model is that under a certain condition the depreciation of the reserve at

any time is equal to the value of output. That condition, constant marginal extraction

cost, is frequently assumed because it permits a pure examination of the implications

of exhaustibility. Contrary to standard, financial accounting, which makes no provision for depreciation, green accounting holds that in this central case the resource

makes no contribution to net national income but is merely the realization of value

embodied in the resource (cf. Heal 2012: 148).

In contrast, the returns to manufactured capital contribute to its owners’, and to

national, net income. The asymmetry is disturbing. The Hotelling model teaches

that resources are a form of capital. The price of manufactured capital, too, is the

net present value of its contribution to social welfare. It, too, is “consumed” or used

up in production. In green accounting, resource capital appears to be in a different

category from manufactured capital, to be subject to different accounting rules.

The aim of accounting is to provide an accurate and complete, conceptual and numeric rendering of economic decisions and their consequences. For centuries standard

financial accounting has been a highly successful economic institution for recording

financial transactions. Yet green accountants find that it goes wrong in a model with

no market failure and optimal decisions.

The present paper is a study in the economics of resource accounting–that is to

say, of resource measurement–in the canonical Hotelling model. It re-examines the

conclusion that net income is zero. It differentiates between green and standard,

financial accounting. Further, it accounts for all decisions relating to the resource in

the model, implicit decisions made before exploitation begins as well as explicit ones

while the resource is being exploited. The accounting is subjected to the discipline

3

of the social-accounting matrix, used with success by Hartwick (2000) in resource

accounting. The matrix’s stress on double-entry bookkeeping helps to sort out some

salient economic issues concerning accounting and measurement.

The investigation indicates that, even in the special case of constant marginal cost,

net income is positive. Proposed divergences from financial accounting and from

conventional green accounting are the inclusion of (a) income from capital gains as the

resource price evolves to support the market equilibrium, and (b) the imputation of

the investment of the resource. The imputed investment is the necessary counterpart

of the depreciation imputed in conventional green accounting. Malinvaud (2008)

writes of a controversy in economics about anticipated capital gains but favours their

inclusion in income. These two entries complete the methodology in a way that

is consistent with the accounting and economic requirement of the equality of net

income and net product and with economic incentives and decisions.

2. A STUDY IN RESOURCE MEASUREMENT

The present paper addresses the finding of zero net income under exhaustibility.

In what is called herein the canonical model, a homogeneous reserve is exploited

in continuous time by symmetric, competitive sellers under conditions of constant

returns to scale, stationary demand and perfect knowledge. In particular, there is

no exploration or development. Rather, at an initial time t = 0 a stock S (0) = S0

is simply held by the sellers. Unit (and hence marginal) extraction cost is constant

(and occasionally zero).

Although the Hotelling model is the foundation for economists’ approach to the

problem of exhaustibility (e.g., Gaudet 2007), it is not a realistic portrayal of resource exploitation. It abstracts from several features of mineral production, such as

exploration, development, the location of different deposits, the geological, physical

and chemical properties of the resource, realistic technology, and uncertainty. The

4

conclusion that net income is zero does not survive many of these extensions. In

most, however, the Hotelling rent is still considered to measure depreciation.

The issue addressed, however, is not how to improve the model’s representation of

reality. Rather, the Hotelling model is used as the basis of a study in the economics

of resource accounting. Usage of the word “study” here is borrowed from musical,

literary and artistic terminology, entailing a direct, narrowly focused exploratory

analysis whose objective is to sharpen technique. The analysis highlights the role

of timing in decisions about resource exploitation and hence in accounting for those

decisions. The issue is that a widely held conviction, applied in green accounting by

many authors, is that a pure, exhaustible resource produces no income.

The implicit context of the model is a welfare optimization in the tradition of

Weitzman (1976, 2003). The relevant shadow prices are decentralized to a competitive

extractive industry. At these prices, the industry maximizes the net present value of

its asset, the exhaustible resource.

Let the net price (price net of marginal cost) at time t be represented by p (t),

the instantaneous discount rate by rt , and the discount factor from s to t < s by

δ (t, s) = exp {−

Us

t

r τ dτ }. Equilibrium extraction begins immediately at t = 0. To

stress the role of timing, let the value of the stock at time 0 if extraction begins at

time t ≥ 0 be represented by V (S0 , t). The objective of the industry is to produce

output q (t) , t ≥ 0, so as to maximize the net present value,

V (S0 , 0) = max

] ∞

p(t)q(t)δ (0, t) dt s.t.

0

] ∞

0

q (t) dt ≤ S0 .

(1)

The current-value Hamiltonian of this problem is

H = pq − λq.

(2)

The first-order condition is that, when q > 0,

∂H/∂q = p − λ = 0.

5

(3)

The Hamiltonian is equal to zero at all times. Since, following Weitzman and others,

the Hamiltonian has come to be the accepted definition of net product, the resource

is considered to produce no net product or income. Depreciation is defined to be

negative the value of the change in the stock, −λṠ = λq = pq.

In the Hotelling (1931) model, the price of the resource is endogenous, the result of

decisions by economic actors. A main goal of economic accounting is to elucidate how

and why an asset acquires as well as loses value (appreciates as well as depreciates).

The adjoint condition is that

λ̇ = rλ − ∂H/∂S = rλ > 0,

or ṗ = rp > 0. Since its price rises through time, the resource stock earns capital

gains. The capital gains are essential to the choice of the levels of output through time.

“What gets measured gets managed” (Heal 2012: 147). Assessing the management

of the resource for its contribution to society is the economic issue for accounting.

3. ACCOUNTING DURING PRODUCTION

The commonest perspective on the accounting for the resource is to treat the entire

stock as one large deposit to be exploited to maximize discounted profit. The value

of the remaining stock at time t > 0 is

V (S (t) , t) =

] ∞

p(s)q(s)δ (t, s) ds = p(t)

t

] ∞

q(s)ds = p (t) S (t) .

(4)

t

Negative the value of the change in the stock, λq, from the Hamiltonian is not the

pertinent definition of depreciation. Hotelling (1925) and Samuelson (1937) define

depreciation as −V̇ (S (t) , t). The left- and right-hand sides of equation (4) can be

differentiated. At t,

−V̇ = −pṠ − ṗS = pq − rpS = pq − rV < pq:

6

(5)

In Hotelling’s and Samuelson’s definition, depreciation is less than the value of

output at t, the value used in conventional green accounting based on equation (2).

The capital gain, ∂V /∂t = ṗS = rpS, is incorporated into depreciation, reducing it.

The capital gain arises because the stock becomes physically scarcer. It is another

consequence of the decrease in the stock through deliberate management. Since

−V̇ = −pṠ − ṗS, the total change in value (depreciation) is equal to the value of

the change in the stock plus the change in the value of the stock. Cairns (2009: 123)

calls equation (5) the fundamental equation of economic accounting.

If value is held constant (if V̇ = 0) then, by equation (5), pq = rpS = rV . Hicksian

income–the income which, if consumed, would leave the society exactly as well off

as before–is rV .1 In the model, pq > rV is consumed and value decreases.

By yielding benefits to holding the stock, the positive capital gain, ṗS, provides

the incentive to manage it well. Net income is

rV = pq + pṠ + ṗS = pq − λq + ∂V /∂t = ∂V /∂t.

At any time, gross output is pq. It is equal to gross consumption, gross income

rV − V̇ , and gross expenditure. Net output and expenditure are obtained by de-

ducting net depreciation, −V̇ , from the gross magnitudes. Depreciation incorporates

the capital gain, ∂V /∂t. The rental of the resource stock is rV + −V̇ , interest plus

depreciation. A rental arises because decisions are made about exploiting the stock.

Rearrangement of equation (5) yields the fundamental capital-market equilibrium

(no-arbitrage) condition: interest on the value of the stock, rV , is equal to the dividend, pq + pṠ, plus the capital gain, ṗS. Net income is rV , the (required) return on

the (undepreciated) reserve, and

pq = rV − V̇ = rV − pṠ − ṗS = rV − d(pS)/dt:

1

Malinvaud (2008), too, argues that capital gains are included in Hicksian income.

7

The net cash flow is interest on the stock less the change in the value of the stock

(i.e., interest plus depreciation).

In comparison with the green accounting discussed in Section 2, an additional

value has been imputed on the income side of the accounts and depreciation has been

reduced on the product side. The analysis is more explicit about how the resource is

being managed, but the accounting is not yet complete.

4. COMPLETE ACCOUNTING

Thus far, it has not been explained why the resource, which has presumably existed

since time immemorial, is exploited beginning from the (normalized) date t = 0 rather

than from some other date. One possibility, if there is an extraction cost of the form

cq, is that the unit cost c falls through time until exploitation begins and remains

constant once the decision is made. The optimal choice of timing (the option to

develop) consists of waiting for the most opportune level of c. Even though the

decision is assumed to be made under conditions of certainty, the choice of an initial

date is a choice of what is known in the economics of real options as a “stopping” or

“strike” point (Cairns and Davis 2007).

Choosing a strike point is an economic decision. Optimal choice of the strike point

gives the decision maker an increase of wealth, a capital gain, as compared to a nonoptimal choice. Since the aim of accounting is to evaluate the management of the

resource, the choice ought to affect economic accounting.

Reflection suggests that any capital gain is a reward to the choice of strike time.

Because the passage of time affects decisions, additional net benefits arising from

this choice, and hence capital gains, ought to be a part of income. The timing of

extraction, as induced by the incentive of such capital gains, is the essence of decisions

in the Hotelling model.

Therefore, it is necessary to account for the fact that the reserve has attained a value

8

of V (0) = p(0)S0 at t = 0. One can imagine that the net value that can be obtained

from the stock once geological processes have put it in place remains negative for a

long time. Ultimately, however, because of technical and social advance, the so-called

intrinsic value (what can be obtained by striking immediately) becomes non-negative

as of some time t < 0 and rises to p(0)S0 at time 0. At times s ∈ (t, 0), the stock has

a greater market value than p(s)S0 because there is an option to wait to exploit it at

the optimal (equilibrium) time, normalized to 0. For t < 0, the value of the stock in

the ground rises at the rate of interest (cf. Gaudet 2007); the value inclusive of the

option to extract, is p(0)S0 δ (t, 0) > p (t) S0 . Again the action follows a deliberate

decision, in this case striking in face of exogenous changes in circumstances.

Some alternatives for recording the evolution of the value of the “free gift” of nature

are possible. If a decision is made that does not involve a transaction, there is some

leeway in when a change is recorded. Two methods that will figure in the analysis

below are the accrual and cash methods.

1. Accounting of each unit could be at the value inclusive of the option to develop

at time t = 0, namely v (t) = p (0) S0 δ (t, 0). For time t < 0 (back to −∞),

income could be considered to accrue at rate v̇ (t) = rt p (0) S0 δ (t, 0). The

accounting refers to the market value of the asset.

2. Accounting could be at the realized or cash value at time 0, so that p (0) S0

would be considered to be income at time 0. This method records the cumulated

capital gain at time 0.

These methods account for income from the resource as its value increases before

it is exploited. An income must be matched with an equal value on the product side.

The obvious type of match is an investment. An investment consists of “the transfer of a certain amount of wealth from one ownership, or employment, to another”

9

(Haavelmo 1960: 3).2 For “produced means of production” the transfer is obvious,

usually marked by an exchange or equivalent decision. It is easily recorded, for example, as investment in a typical Ramsey-type model. Likewise, if an exploration

company sells a mineral reserve to a mining company, the mining company makes a

cash investment and the exploration company shows on its balance sheet an offsetting

exchange of assets.

Economically, however, the transfer, from an asset being held to one being used, can

be subtle and need not be at arm’s length. At time 0, the stock S0 is transformed from

a latent to an active mine: It has been invested in (made available for) production.

The timing of the initiation of extraction is the economic manifestation of the decision

to invest the resource. The value of the investment is the value of the stock at that

time, p (0) S0 .

Haavelmo’s definition applies if an investment takes place at an instant, corresponding to Method 2 above. It is a small step to allow for an accrual of investment

over time, corresponding to Method 1: Instant by instant income in the form of a

capital gain is re-invested in the resource instead of being realized. Economically,

the instantaneous decision about the option, to continue or to strike, is recorded as

investment as well as income.

In Method 1 or 2, a cumulated investment of p (0) S0 has been made by time 0.

No depreciation has been taken. Appreciation and depreciation are undiscounted

magnitudes. Cumulated net investment over all time, by either method, is

p (0) S0 −

] ∞

0

−V̇ |t dt = 0.

(6)

Equation (6) is of central importance in assessing the conclusion of green accounting.

It illustrates that depreciation equals investment: an asset is depreciated only if it

appears somewhere in the accounts as an investment.

2

Thanks to Rolf Färe for this reference.

10

If the prior investments and capital gains are not recorded, as in practice and in

the Hotelling model, then the reserve has an accounting value of zero. Depreciating

its value is not justified. Conventional green accounting, which does not envisage a

method of accounting for the attainment of the value p (0) S0 at time 0, but does

envisage depreciating that value, is only partly complete. The partial completeness

is the reason for the qualitative divergence, that is not corrected over time, of green

accounting from financial accounting. Conceptually, financial accounting “corrects”

the neglect of accruals up to time 0 by not depreciating the asset at t > 0.3

It is worthy of stress that the resource is assumed to have a market price that can be

realized at any time in a perfect capital market and is optimally exploited. Ultimately,

the incompleteness arises because the Hotelling model is a short-run model: it does

not consider what has happened before time 0, nor why a unit of the resource has the

value p (0), nor why the decision is taken to exploit it beginning at time 0. Recording

the consequences of timing resource extraction as of t = 0 completes the accounting

for the decisions about extraction.

The alternatives to Method 1 suggest that there are different, serviceable methods

of recording the attainment of the accounting value p (0) S0 .4 If depreciation of the

value p (0) S0 is contemplated, it is consistent to adopt Method 1 or 2 to recognize

appreciation of the capital value. The methodological differences wash out over time.

3

This statement is from an economic point of view. There is no transaction for either the accruals

or the depreciation, and both are imputations.

4

Accounting could, for example, be at the intrinsic value of the resource at time t < 0. The

resource could produce a value net of costs of p (t) S0 if developed immediately. The increase of

intrinsic value, ṗ (t) S0 , could be considered to be income as the value of the stock accrues through

time. The firm refrains from realizing the intrinsic value, the value of a sub-optimal option, because

it rises at a rate greater than the rate of interest until time 0 (Cairns and Davis 2007). The net

realizable value from immediate extraction, p (t) S0 , has less theoretic appeal than the market value,

v (t), but using it for accounting up to t = 0 “works”.

11

Because the accounting in Method 2 is done at a single point, t = 0, it is the

simplest method. If the prior investments and capital gains have not been recorded,

it is the only alternative to financial accounting. Method 2 is adopted by Cairns (2004,

2009) in more realistic extraction models. At time t = 0− , Method 2 simply accepts

that the value has attained p (0). It records the value as income and investment when

the capital gain is realized.5

The nature of the Hotelling model, with no division of the stock into discrete, localized reserves and with no investment in sunk assets such as mine shafts, buildings

or equipment, allows for an alternative method of accounting that treats each (infinitesimal) unit of reserve as a separate mine operated by a distinct firm identical

to the others. The holder of each unit faces the same type of decision to wait or to

extract at any instant. Suppose that the proposed equilibrium is to extract a given

owner’s unit at time t. Then the accounting for that unit individually can be done

on an accrual basis (Method 2) up to time t > 0. This method is the clearer one in

the discussion of exploitation during production below.

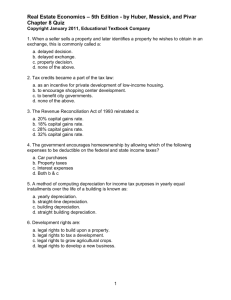

4. SOCIAL—ACCOUNTING MATRIX

The aggregate social—accounting matrix is an analytic tool used by Hartwick (2000)

to obtain many insights to national economic accounting. The purpose of the matrix

is to ensure that the accounting follows the discipline of equating net product (loosely,

consumption and net investment) and net income (loosely, wages and net returns from

property) at each point in time. In the matrix, the last entry in a column or row is

equal to sum of the preceding entries. The total levels of income and of product are

indicated in the bottom, right-hand entry.

5

It is not necessarily true that production is continuous through to exhaustion of all units. For

example, demand could drop to zero for a period and then pick up. Hotelling’s rule holds. The

accounting methods can be applied to the capital gain between the periods of production.

12

The analysis herein is confined to the sectorial (resource), rather than national,

matrices and expressed for t ≥ 0 (once extraction begins). The contributions to the

entries of such matrices can help to clarify the subtle differences in the accounting for

a nonrenewable resource among financial accounting, conventional green accounting

and the method proposed in the present paper. In these matrices, several entries

have the value pq. Having a common value renders the calculations easy but requires

attention to the various meanings in the placement.

The first matrix is for a standard financial account. Depreciation of the resource is

not recognized. Neither is a capital gain or investment of the resource. Net income

and product are pq.

Consumption = Net Product

Net Revenue

pq

pq

= Net Income

pq

pq

There is no question of the usefulness of financial accounting for recording and

interpreting commercial outcomes: It satisfies the market test. In financial accounting

the resource is not depreciated because it has not been recorded as having been

invested.

The financial accountant is interested in financial transactions and their outcomes;

an economic accountant is interested in economic decisions and their outcomes. The

question addressed by green accounting is the extension of financial accounts to noncommercial but still economic outcomes. A conventional green account can be represented in a second matrix. The value of the resource is depreciated in spite of the

fact that it has not been represented in prior accounting as having accrued to the

initial value. As in a financial account, the capital gain after exploitation begins is not

recorded. Positive depreciation (negative net investment) of −pq offsets net revenue

from sales. Both net income and net product are recorded as being nil.

13

Consumption + Net Investment = Net Product

Net Revenue

pq

0

pq

+ Change in Stock

0

−pq

−pq

= Net Income

pq

−pq

0

It is observed above that, until a transaction takes place, accounting can be done

consistently in more than one way and still satisfy economic requirements. The

method chosen here is to account on an accrual basis. In the matrix for t > 0, an

additional line appears for the capital gains on the entire stock, equal to ṗS = rpS,

and a value of −pq is again included in net investment.

Consumption + Net Investment = Net Product

Net Revenue

pq

0

pq

+ Capital Gain

0

ṗS = rpS

rpS

+ Change in Stock

0

−pq

−pq

= Net Income

pq

rpS − pq

rpS = rV

Some readers may find accounting in discrete time, which is used in reality, to be

more revealing of the content of this matrix. The q (t) units to be extracted at time t

have accrued capital gains, r (t − s) p (t − s) q (t) , s = 1, 2, 3, ... (which are “reinvested”), in periods up to and including t − 1. They sum to its value p (t) q (t) at time t.

Industry income (and investment) at t is the capital gain from the remaining, unexploited units, r (t) p (t) S (t). At time t, the prior investments that sum to p (t) q (t)

are depreciated and there is an “offsetting” net revenue of p (t) q (t) as well, as in

conventional green accounting. The income and investment, rpS, occur prior to the

decision to extract units from the remaining stock.

Some authors reason that the capital gain to owners is offset by a capital loss

to consumers, since the terms of trade move against consumers over time. This

reasoning is different from that based on the Hamiltonian in equation (2), which

14

applies to aggregate outcomes for society as a whole without distinguishing between

the interests of groups within society. The offset is argued to be why capital gains

should not “count” in macro accounts and why net income is nil. For example, Arrow

et al. (2012: 330) argue, “The rising prices of exhaustible resources are not valued in

a closed economy, such as the world as a whole, because the higher prices yield gains

to producers but losses to consumers.”

The third social-accounting matrix, however, shows consumption to be on the

product side, not the income side. The capital gain appears on the income side and

is equal to an investment on the product side. Since the objective (1) is discounted

consumption as well as profit, all decisions are made for the benefit of consumers as

well as owners. There is no externality in this model; the market “works”. Given its

size at any time, the resource stock is exploited optimally.

The availability of the resource is a benefit to both owners and consumers, and

to society as a whole. The change in the terms of trade for resources is not an

exogenous change, such as caused by a drought, but an endogenous one to which

consumers and owners are party through the market. A message of the Hotelling

model is that the outcomes are dynamic. The present paper argues that the terms of

trade are set for the life of the reserve even before extraction begins (even at “negative

infinity”). If a portion of the reserve is wiped out, both owners and consumers are

worse off. If there is an unanticipated discovery, both owners (in the aggregate) and

consumers are better off. If there is trade, the entry on the income side is as in the

paper. The export from the producing country appears on the product side of the

account. For the importing country, there are two entries on the product side, one

for consumption of the resource and one for the import of the resource. The latter

is negative (an import). The social—accounting matrix helps with the intra-temporal

accounting: it shows the appropriate double-entry items and how they appear.

The misinterpretation concerning losses to consumers may arise from the emphasis

15

in resource economics that the resource rent is an opportunity cost. The opportunity

cost is an expression of the fact that the greatest benefit is obtained from optimal

timing. Use of the resource at the optimal time is a benefit, the greatest obtainable

benefit.

The divergence between total incomes in financial accounting and the method proposed herein is the capital gain, which is not included in financial accounting. Over

time, the discrepancy is resolved, however. Conventional green accounting diverges

from financial accounting in that total depreciation is greater than total investment:

U∞

0

pqds > 0. The discrepancy is not resolved in the long run.

In conventional green accounting, net income in the form of capital gains and their

deployment as net investment do not appear. Net product and income are nil. In

symbols, green accounting takes the Hamiltonian as net product,

H = pq + λṠ = pq + pṠ = 0

and, according to a rearrangement of equation (5), accounts for net income as

H = rV − ṗS = rV −

∂V

,

∂t

(7)

i.e., as interest on the value of the stock less the capital gain. The accrual method

of accounting for income, consistently with Hotelling’s and Samuelson’s approach to

depreciation, records

H+

∂V

= rV ,

∂t

(8)

interest on the value of the stock.

Both equations (7) and (8) equate a measure of net product (H or H +

a measure of net income (rV −

∂V

∂t

∂V

∂t

) to

or rV ). Both equate income and product and

thereby satisfy that accounting and economic requirement. Both have consistent

social accounting matrices–as does financial accounting.

The analysis on which the conclusions of traditional green accounting is based,

however, does not represent all economic decisions. In particular, the decision to

16

make a unit of reserve available for extraction is neglected. Investment and capital

gain are essential to the economic decisions.

If depreciation is to be recorded, the recording of the investment indicates the

source of that depreciation. The resource has a value to be depreciated only if it is

invested for use at some point. If an investment has not been recorded, depreciation

should not be imputed.

7. CONCLUSION

It is important that accounting method apply in simple models. The Hotelling

model is a salient example of the role of timing and of the inherent capital gains in

decisions. It is especially important because Hotelling’s rule, derived in the simple

model, is being used in practice in conventional green accounting as the basis for

resource evaluation.

The difference between financial accountancy and economic accountancy lies in

their objectives, not their validity.

Financial accountancy aims for an accurate

recording of financial outcomes. Economics is the study of decisions. Its aim is

broader, to record all decisions and not just financial ones. Economic accounting

for non-renewable resources should be consistent with their contribution to social

benefits. The present paper reconsiders the lessons for accounting of the simple

Hotelling model, which over the past quarter century has been the theoretical basis for measuring income and depreciation of non-renewable resources. It completes

green accounting in the Hotelling model.

In conventional green accounting for the canonical, Hotelling model, depletion has

been viewed as a flow that constitutes liquidation of the reserve. The reserve is not

liquidated immediately, however; it is held as a stock as it is exploited. Equilibrium

encompasses both stocks and flows. The adjoint condition governs changes in price, or

capital gains. Moreover, standard mathematical models of green accounting record

17

only depreciation through extraction and neglect the important economic role of

investment.

Conventional green accounting is incomplete, deceptively so since it satisfies the test

of the social accounting matrix. It may appear to be a complete system of accounting,

but the Hotelling model is a short-run model that does not explain all attributes of

the stock, in particular, why it is exploited beginning at t = 0. Consequently, it does

not account for the long-run decisions about when to exploit the stock.

Financial accounting is incomplete as well. In contrast to green accounting, however, it is incomplete in a way that is consistent with accounting requirements and

does not misinterpret price signals. The capital gains, which are economically both

income and investment, are not recorded up to time 0. Because the investments are

not depreciated after time zero, however, it rights itself. Righting itself is demanded

of a retrospective measure and it makes financial accounting serviceable. There is

no distortion of incentives in financial accounting. It is worth stressing that, even

though it is not complete, financial accounting has had success in reporting commercial transactions, thereby providing signals of value, in a market economy and in

other economies.

There must be an income from the remaining reserve to induce and to justify

holding it as an asset. The price path adjusts to yield a return to the remaining

reserve, in the form of a capital gain. The total return on the asset is the sum

of dividends and capital gain. The capital gain motivates the decision to hold the

remaining reserve over the next instant.

The resource’s contribution to net income is positive, not nil. Its income and

productivity stem from the fact that it can be allocated over time; society can wait

to use it in its most highly valued use. The contribution manifests itself through

a capital gain. Since the capital gain is the motivation for decisions, the Hotelling

model, suitably completed to account for all decisions, provides an argument for

18

incorporating capital gains as information for management of the reserve. Moreover,

if depreciation of the value of the reserve is included the accounts, investment of the

value of the reserve should also be included, most easily at the time when the resource

is deemed to have changed uses from latent to producing mine.

The accounting method proposed has introduced two unconventional entries to

the green accounts, namely, capital gains and investments of those gains. The value

invested is equal to the capital gains cumulated to the strike point. The capital gain

is entered on the income side, the investment on the product side.

In green accounting, depreciation has been considered recognition of the fact that

extraction depletes a resource. In physical terms, investing entails extinguishing

valuable inputs, including labor and capital. For value to be depreciated at the current

price p (t), it has to be recorded as attaining p(t). It is investment (the decision to

make the resource available for social use), not existence as assumed in conventional

green accounting, that makes a stock an asset subject to depreciation. The investment

is an addition to net product. Income and investment make resource accounting

both appropriate for management of the resource and comparable to accounting for

manufactured capital.

19

REFERENCES

[1] Arrow, K., P. Dasgupta, L. Goulder, K. Mumford and K. Oleson (2012), “Sustainability and the Measurement of Wealth”, Environment and Development Economics

17, 3: 317-353.

[2] Cairns, R. (2004). “Green Accounting for an Externality: Pollution at a Mine.”

Environment and Resource Economics 27: 409-427.

[3] Cairns, R. (2009), “Green Accounting for Black Gold.” The Energy Journal 30, 4:

133-59.

[4] Cairns, R. and G. Davis (2007), “Strike when the Force is With You: Optimal Stopping with Application to Resource Equilibria.” American Journal of Agricultural

Economics 89: 461-472.

[5] Gaudet, G. (2007), “Natural Resource Economics under the Rule of Hotelling,” Canadian Journal of Economics 40, 4: 1033-1059.

[6] Hartwick, J. (2000), National Accounting and Capital, Cheltenham UK: Edward Elgar.

[7] Heal, G. (2012), “Reflections–Defining and Measuring Sustainability”, Review of

Environmental Economics and Policy 6, 1: 147-163.

[8] Haavelmo, T. (1960), A Study in the Theory of Investment, Chicago: University of

Chicago Press.

[9] Hotelling, H. (1925), “A General Mathematical Theory of Depreciation,” Journal of

the American Statistical Association 20: 340-353.

[10] Hotelling, H. (1931), “The Economics of Exhaustible Resources”, Journal of Political

Economy 39, 2: 137-175.

20

[11] Malinvaud, E. (2008), “Capital Gains and Losses”, The New Palgrave Dictionary of

Economics, Second Edition, eds S.N. Durlauf and L.E. Blume, Palgrave Macmillan, The New Palgrave Dictionary of Economics Online, accessed 05 March

2013 <http://www.dictionaryofeconomics.com/article?id=pde2008_C000031>

doi:10.1057/9780230226203.0192.

[12] Samuelson, P. (1937), “Some Aspects of the Pure Theory of Capital,” Quarterly

Journal of Economics, May: 469-96.

[13] Weitzman, M. (1976), “On the Welfare Significance of Net National Product”, Quarterly Journal of Economics

[14] Weitzman, M. (2003), Income, Wealth and the Maximum Principle, Cambridge, MA:

Harvard University Press

21