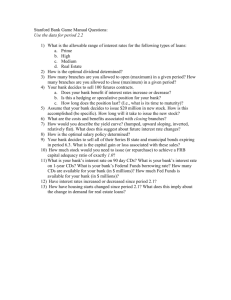

Unregulated Financial Markets and Products Consultation Report

advertisement