SUBMISSION TO THE SENATE SELECT COMMITTEE ON STATE GOVERNMENT FINANCIAL MANAGEMENT

advertisement

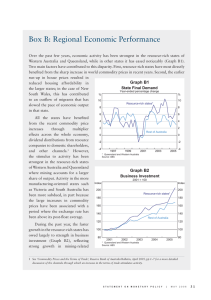

SUBMISSION TO THE SENATE SELECT COMMITTEE ON STATE GOVERNMENT FINANCIAL MANAGEMENT RECENT DEVELOPMENTS IN STATE LEVEL ECONOMIC ACTIVITY AND INFLATION RESERVE BANK OF AUSTRALIA The Australian economy is now in its 17th year of expansion, the longest uninterrupted period of economic growth since reliable records have been kept. The expansion has been broadly based across the states, with unemployment around multi-decade lows in all states and territories. While growth rates in Western Australia and Queensland have been the highest in the country in recent years, the divergences between the states narrowed somewhat over 2007, with high growth rates being recorded in most states. In aggregate, growth looks to have moderated in early 2008, and the slowdown has been broadly based across states. Over the inflation-targeting period, CPI inflation has typically varied little between the states. While inflation has generally been higher in the resource-rich states over the past few years, over the year to the March quarter 2008 it was well above the target in all capital cities. Details of recent state economic performance There are a number of different indicators of overall economic activity at the state level. Conceptually, the preferred and most comprehensive measure of state output is gross state product (GSP). However, in practice the ABS does not regularly measure the interstate trade component of GSP. In addition, GSP is only published annually and with a significant lag; the latest data currently available are for 2006/07, reducing their usefulness as a measure of recent developments in the state economies. Given the limitations of GSP estimates, this submission focuses on state final demand to analyse recent state economic performance. While there are benefits to using this measure, the most obvious of which is timeliness, it also has statistical limitations. The most significant is that final demand measures growth in spending, rather than output. This is problematic since in the states where spending is growing fastest it is likely that some of that demand is being met by output produced in other states. Given the limitations with both GSP and state final demand data, we also look at other broad indicators of state economic performance, such as employment data and business surveys, when assessing the health of the state economies. State Final Demand Spending growth in the resource-rich states has been faster than in the rest of the nation for about the past five years (Graph 1). This can partly be explained by the higher long-run population growth of those states, but mostly reflects the stimulus from the run-up in commodity prices over this period and the associated reallocation of resources. 2 Domestic demand grew rapidly in 2007, with growth remaining strongest in Western Australia and Queensland. However, the gap with the other states narrowed somewhat, with growth rates in final demand above their long-run averages in most of the non–resource states as well (Table 1). Overall, the divergence in year-ended growth in state final demand across the states returned to around its historical average in 2007 (Graph 2).1 Graph 1 State Final Demand Year-ended percentage change % % 12 12 Table 1: State Final Demand Year-ended percentage change 2007 1991–2007 average NSW 4.5 3.4 Victoria 5.2 4.3 Queensland 7.2 5.4 South Australia 2.7 3.3 Western Australia 9.7 5.4 Tasmania 7.7 3.4 Resource-rich states* 9 9 6 6 3 3 0 -3 0 Rest of Australia 1996 1999 2002 2008 2005 Source: ABS -3 * Queensland and Western Australia Sources: ABS; RBA Household sector Household consumption growth increased in all states and territories over 2007, supported by broad-based strength in employment and average wages growth. In the non-resource states, consumption growth picked up from less than 2 per cent in mid 2006 to an average of 4½ per cent over the year to the December quarter, while in the resource states consumption grew by more than 6 per cent (Graph 3). Graph 2 Variation in State Final Demand Graph 3 Household Consumption Standard deviation across states; percentage change % % Year-ended growth 4 % 9 6 Average Resource-rich states* 120 6 100 3 4 2 2 1988 1992 Sources: ABS, RBA 1 Index, 2000 = 100 140 Year-ended change 6 0 Index 1996 2000 2004 0 2008 80 60 Rest of Australia 1992 1999 2006 1994 2001 0 -3 2008 * Queensland and Western Australia Sources: ABS; RBA The variation in gross state product growth over recent years was smaller than the variation in final state demand growth. 3 However, more timely indicators suggest that the pace of retail spending growth moderated in the first quarter of 2008 (Graph 4). The slowing in growth was particularly marked in Western Australia, which may partly reflect the significant cooling in the Perth housing market over the past 18 months. Indeed, after a period of more rapid growth than in the rest of the country, retail spending growth in the mining states was around the same as the average of the other states over the year to February. There has also been a significant fall in consumer sentiment in all states over recent months (Graph 5). Graph 4 Retail Trade Graph 5 Consumer Sentiment by State Long-run average = 100 Year-ended percentage change % 16 % Index 16 130 Resource-rich states* Index 130 Qld WA 12 12 120 8 8 110 110 4 4 100 100 0 90 0 Other states -4 1990 1994 1998 2004 80 -4 2008 Australia 1998 120 NSW Vic 2003 90 SA 2008 1998 2003 80 2008 Sources: Melbourne Institute and Westpac * Queensland and Western Australia Sources: ABS; RBA After a period of significant divergence, growth in housing investment converged somewhat over 2007, as growth in Queensland slowed, growth in Victoria picked up and conditions in NSW stabilised (Graph 6). More recent indicators of the housing market, such as new home sales and building approvals, suggest a broad-based moderation in early 2008, as the impact of tighter financial conditions is felt across all states (Graph 7). Graph 6 Dwelling Investment Index Graph 7 Private Dwelling Approvals* Year-ended growth Index, 2000 = 100 % No. No. Rest of Australia 140 30 10000 10000 120 15 8000 8000 100 0 6000 6000 -15 4000 4000 -30 2000 -45 2008 0 Resource-rich states 80 Rest of Australia 60 40 1991 1997 2003 1990 * Queensland and Western Australia Sources: ABS; RBA 1996 2002 Resource-rich states** 2000 1988 1992 1996 2000 2004 0 2008 * 13-term Henderson trend ** Queensland and Western Australia Sources: ABS; RBA There have been significant divergences in house price growth across the major capitals (Graph 8). The end of the boom in 2003 resulted in a significant slowing in price growth in all capitals. Sydney was most affected, with average prices falling by around 10 per cent between late 2003 and early 2006, before resuming modest growth in 2007. Perth prices were least affected and subsequently reaccelerated, with overall growth of around 100 per cent between mid 2003 and late 2006. Since then, prices in Perth have been broadly flat. Price growth in Melbourne, Adelaide and Brisbane was relatively subdued between late 2003 and late 2006, before picking up strongly to around 20 per cent over 2007. 4 Over recent months, house price growth has slowed and auction clearance rates have moderated across the states, in the face of tighter financial conditions (Graph 9). Graph 8 Australian House Prices Graph 9 Auction Clearance Rates* Level $’000 $’000 Sydney 500 500 Perth 400 400 Australia Melbourne 300 Adelaide Brisbane 200 2002 2000 200 2004 2006 2008 100 % 70 60 60 50 50 40 40 % 300 100 Seasonally adjusted Sydney % 70 % Melbourne 85 85 75 75 65 65 55 55 45 Sources: APM; RBA 1996 1999 2002 2008 2005 45 * Adjusted for withdrawals where possible; interpolated for January Sources: APM; RBA; REIV Business Sector Divergences between the states have been perhaps largest in business investment spending, in large part due to the extraordinary growth in mining-related investment spending in Western Australia and Queensland. Nevertheless, business investment growth was relatively strong across all the states over 2007, with the gap between growth in the resource-rich states and the remainder of Australia narrowing as investment in NSW and Victoria recovered and growth moderated somewhat in Queensland (Graph 10). Liaison reports that growth in business investment remains strong into 2008, particularly for mining and infrastructure constructionrelated projects. Non-residential building construction activity also remains firm, although there are some signs of moderation, as uncertainty over the macroeconomic outlook and tighter financing conditions have begun to adversely affect firms’ investment plans. Business surveys provide further evidence that the strength of the economy over recent years has been broadly based among the states, with business conditions well above average in all states in 2007. However, there appears to have been a moderation over the first few months of 2008 in most states (Graph 11). Graph 10 Graph 11 Business Conditions by State Business Investment Index Index, 2000 = 100 Year-ended growth % Net balance, deviation from long-run average % % WA Vic 240 30 20 15 0 20 Resource-rich states* 180 0 Australia 120 Rest of Australia 60 0 1991 1997 2003 1990 * Queensland and Western Australia Sources: ABS; RBA 1996 2002 0 -20 -15 -40 -30 2008 -60 NSW -20 SA Qld -40 1996 Sources: NAB; RBA 2002 2008 1996 2002 -60 2008 5 Labour Market The broad strength in the economy is also evident in the state of the labour market, with aboveaverage employment growth experienced in all the states over recent years (Graph 12). Strong labour demand has seen unemployment fall to around 30–year lows in all states and territories (Graph 13). While unemployment remains lowest in the resource-rich states, the unemployment rate has also fallen to very low levels in NSW and Victoria. Continued strong labour demand has also contributed to increases in labour force participation rates (Graph 14). While the participation rate in the resource-rich states has increased the most over the past few years, it has also moved higher in all other states. Graph 12 Employment Graph 13 Year-ended growth* % Queensland Western Australia 6 6 12 4 4 10 2 2 8 0 6 -2 4 -4 2008 2 Victoria -4 South Australia 1999 2003 2007 2000 2004 8 South Australia NSW 6 4 Western Australia 1992 1998 2004 1990 1996 2002 2 2008 * 13-term Henderson trend Source: ABS * Trend series Source: ABS Graph 14 Graph 15 Participation Rates Merchandise Exports Three month ended moving average Volumes, seasonally adjusted % % $b $b Western Australia Resource-rich states* 68 68 Queensland 66 12 10 Queensland Tasmania -2 % Tasmania Victoria NSW 0 Unemployment Rates* % % 20 20 15 15 66 Victoria 64 64 South Australia 62 62 10 10 NSW 60 Rest of Australia 60 58 58 5 5 Tasmania 56 56 1990 1995 2000 2005 1991 1996 2001 Source: ABS 2006 0 1989 1992 1995 1998 2001 2004 0 2007 * Queensland and Western Australia Sources: ABS; RBA Government Spending and Exports Growth in government spending has been significantly stronger in the resource-rich states over recent years, reflecting both increased demand for infrastructure and strong revenue growth in these states. Growth in international merchandise exports has been relatively soft over the past year in most states. The exception is in Western Australia, where exports have been boosted by significant expansions in capacity, particularly that related to iron ore, LNG and petroleum (Graph 15). 6 Migration Patterns The strong economic performance of the resource-rich states over recent years has been accompanied by a significant change in Australia’s migration patterns (Graph 16). Strong labour demand has seen net inward migration to Western Australia increase significantly, primarily due to a significant increase in net inflows from overseas. While there has also been a return to positive net interstate migration, after the outflows seen in the first few years of this decade, the flow remains relatively small, possibly due to Western Australia’s geographical isolation. Queensland has also seen strong inward migration, with both interstate and overseas migration significant, although net interstate inflows have slowed a little over recent years, possibly reflecting a deterioration in housing affordability relative to New South Wales and Victoria. Net inward migration to Victoria has also been significant over recent years, reflecting both a reduction in the net loss of residents to other states and continued strong net inward overseas migration flows. Net migration into New South Wales has been smaller, with continued robust inward international migration in large part offset by significant outward interstate migration. However, the rate of outward interstate migration has slowed somewhat relative to that seen in 2005. This may, in part, reflect the significant reduction in the premium between house prices in Sydney and those in the other capital cities (Graph 17). Graph 16 Graph 17 Migration by State Sydney House Price Premium Contributions to year-ended population growth % NSW Vic Qld Ratio of Sydney Price to Rest of Australia WA Ratio Ratio 1.8 1.8 1.5 1.5 1.2 % 1.8 1.8 1.6 1.6 1.4 1.4 1.2 1.2 Total Overseas migration 1.2 0.9 0.9 0.6 0.6 0.3 0.3 0.0 0.0 Interstate migration -0.3 -0.3 -0.6 19 90 19 95 20 00 20 05 19 92 19 97 20 02 20 07 19 94 19 99 20 04 19 91 19 96 20 01 20 06 -0.6 1.0 1994 1996 1998 2000 2002 2004 2006 2008 1.0 Sources: APM; RBA Source: ABS Inflation Since 1993, there has been little variation in inflation rates across the capital cities, with average annual outcomes ranging from 2.3 per cent to 2.7 per cent (Table 2, Graph 18). Not surprisingly, over recent years inflation has been highest in the resource-rich states. However, over the year to the March quarter 2008 there was only a small gap between the resource-rich and other states, with all capital cities experiencing inflation well above the 2–3 per cent target. 7 Graph 18 Consum er Price Inflation by Capital City* Year-ended, excluding tax** Table 3: Annual CPI Inflation* % March quarter 1993 to 2008 % 5 5 Sydney 2.5 Melbourne 2.4 Brisbane 2.6 Adelaide 2.5 Perth 2.7 2 Hobart 2.4 1 1 Darwin 2.3 Canberra 2.4 0 0 All capital cities 2.5 Resource-rich states & territories 4 4 3 3 2 Rest of Australia -1 * Excludes GST, where GST adjustment is assumed equal across all capital cities Sources: ABS; RBA 1993 1996 1999 2002 2005 2008 -1 * Regional weights based on the 15th series CPI ** GST adjustment assumed equal across capital cities Sources: ABS; RBA Graph 19 Consolidated State Budget Balance Fiscal Position Based on information from the most recent MidYear Reviews, the consolidated state General Government budget balance is expected to be in deficit by around $3.2 billion (0.3 per cent of national GDP) in 2007/08 on an underlying cash basis – following a deficit of $2.6 billion in 2006/07 (Graph 19). Looking forward, in 2008/09 the deficit is forecast to narrow modestly to around $2.9 billion. General government; per cent of GDP % Forecast Underlying cash balance % 0.8 0.8 0.4 0.4 0 0 Fiscal balance -0.4 -0.4 -0.8 -0.8 -1.2 1982/83 1989/90 1996/97 2003/04 -1.2 2010/11 Sources: ABS; State Treasury Departments The return to a consolidated state General Government deficit in 2006/07 predominantly reflected a large rise in capital spending, mainly in Queensland, New South Wales and Western Australia. This is in addition to large increases in capital expenditure by the state public trading enterprises (Graph 20). However, despite this, net state sector debt is budgeted to remain relatively small as a share of GDP over the forward estimates period (Graph 21). Graph 20 Graph 21 State Public Non-Financial Net Debt State Capital Expenditure 2007/08 mid-year budget review; fiscal basis Per cent of GDP $b % 40 40 9 30 30 $b Public trading enterprises % 9 Public trading enterprises 6 6 3 3 General government 20 Total public sector 20 0 10 10 0 0 1998-99 2000-01 2002/03 2004/05 2006/07 Sources: ABS; RBA; State Treasury Departments 2008/09 2010/11 General government 0 -3 -3 -6 -6 1992/93 1995/96 1998/99 2001/02 2004/05 2007/08 2010/11 Sources: ABS; RBA; State Treasury Departments 8 Attachment Size and Characteristics of the States As shown in Table A1, NSW accounts for almost one-third of national output, population and employment, while Victoria accounts for around one-quarter of these variables. Consequently, economic conditions in the two largest state economies generally have a significant influence on national averages. However, average annual rates of growth in real output have been much higher in Queensland and WA over the past three decades, so that the relative size of these states has increased significantly (Table A2). Table A1: Relative Size of States 2006/2007; per cent NSW Vic QLD WA SA Tas Output share 32.2 24.3 18.8 12.8 6.6 1.9 Population share 32.8 24.8 19.9 10.0 7.5 2.3 Employment share 32.1 24.7 20.4 10.6 7.2 2.2 Exports share* 24.2 15.7 21.8 29.1 4.9 1.7 * Includes goods and services exports Table A2: State GSP Growth Annualised rate; chain-volumes; per cent NSW Vic QLD WA SA Tas Aus Since 1970/71 2.9 2.9 4.7 4.5 3.1 2.3 3.2 During current expansion 3.2 3.5 4.8 4.7 2.8 2.7 3.7 1991/92 to 2002/03 3.7 3.7 4.8 4.4 3.1 2.5 3.9 2002/03 to 2006/07 1.9 3.0 4.9 5.4 2.2 3.2 3.3 2006/07 1.8 2.7 4.9 6.3 0.8 2.1 3.2 In addition to substantial variation in their size and growth rates, states vary in their industry structure. As shown in Table A3, the larger states of NSW and Victoria have a disproportionate share of business services activity, reflecting the positions of Sydney and Melbourne as large business and financial centres. Victoria is also characterised by a high share of manufacturing. Primary industries remain important to Queensland, while WA remains distinguished by its large resource sector. In South Australia and Tasmania, agriculture and manufacturing account for higher shares of output than nationally, with the public sector also accounting for a relatively large share of output in Tasmania. 9 Table A3: Industry Share of State Output Per cent; 2006/07 NSW Vic QLD WA SA Tas Aus 1.3 2.3 2.8 2.1 3.4 5.4 2.1 20.3 23.0 27.6 45.5 26.0 26.3 26.1 2.3 2.0 7.9 28.6 3.9 2.7 7.0 10.0 12.5 9.3 7.3 13.2 13.8 10.2 Utilities 1.9 2.4 1.9 2.4 2.8 4.6 2.2 Construction 6.2 6.1 8.5 7.3 6.2 5.3 6.7 Goods distribution 14.6 15.5 17.2 13.3 14.2 15.0 14.9 Agriculture Goods production Mining Manufacturing Wholesale trade 4.9 5.5 4.6 3.5 4.0 3.5 4.6 Retail trade 5.5 5.5 7.0 4.7 5.9 6.7 5.7 Transport & storage 4.2 4.5 5.6 5.1 4.3 4.8 4.6 Business services 27.1 24.3 16.8 14.4 17.9 13.7 21.6 Communications 2.6 3.2 2.3 1.9 2.3 2.2 2.5 Finance & insurance 10.2 8.0 5.2 3.5 6.2 5.7 7.3 Property & business services 14.3 13.1 9.3 9.1 9.4 5.8 11.8 15.5 15.5 16.0 11.4 17.9 19.9 15.4 Accommodation, cafes & restaurants 2.3 1.6 2.7 1.2 2.2 2.4 2.1 Education 4.1 4.6 4.3 2.8 4.8 5.1 4.2 Health 5.7 6.0 5.7 4.7 7.2 8.6 5.8 Household services Cultural & recreational services 1.6 1.6 1.2 1.0 1.5 1.6 1.5 Personal & other services 1.8 1.7 2.1 1.6 2.2 2.2 1.8 3.7 2.6 4.3 2.4 3.5 5.6 4.0 Government 30 April 2008