Document 10900971

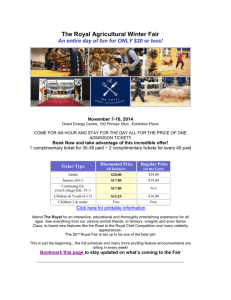

advertisement