U S C A

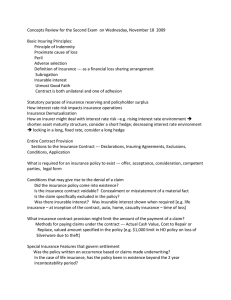

advertisement