ABA SECTION OF TAXATION 2014 LAW STUDENT TAX CHALLENGE

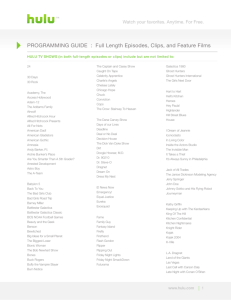

advertisement

ABA SECTION OF TAXATION 2014 LAW STUDENT TAX CHALLENGE OFFICIAL LL.M. DIVISION PROBLEM After grabbing your morning breakfast sandwich and settling into your open floor plan (what happened to associates having offices in the good old days), you open your email to start another week at the boutique law firm of Vader & Firefly, LLP. You have gained a reputation as a promising star and all the partners ask for you to help on a day-to-day basis, save one. V. Riddle has not spoken a word to you but he has walked by multiple times (it’s unclear if he knows you exist). As you sort through your email replying to the other partners, you receive an email from Riddle. Riddle is the Subchapter K heavy hitter at the firm. You open his email not quite sure what to expect... Baltar Partnership V. Riddle <vriddle@vaderfirefly.com> Sent: Mon 9/8/2014 7:07 AM To: You Person sitting in the middle of the floor, I met with one of my very important clients on Friday and this takes priority over any other work you have. If you are busy I suggest you turn your 24-hour day into a 30-hour day. My client, Baltar is an eccentric, but brilliant, robotics engineer who was involved in a partnership that is now under audit. Baltar is very concerned about the tax implications of his business venture. I received a brief version of the facts and I want you to paint a picture explaining what happened inside this partnership. Baltar is a multi-million dollar client who uses our firm for his various business enterprises and private equity deals. Please draft a memo, no more than twelve pages in length, and a brief client letter, no more than four pages, describing Baltar’s situation. Do not feel compelled to provide the maximum page numbers because they are authorized. If your work is thorough and useful, you will be in my good graces. A corresponding “payroll glitch” may happen in your favor... if your work product is useless, the “payroll glitch” will be in the firm's favor. Additionally, Baltar’s client letter should be straight forward and written in terms that a “lay person” would understand. Baltar is quite intelligent, but tax is not one of his eccentric hobbies. There will likely be some other applicable code sections when you address the calculations; however, the focus of the memo should be on Subchapter K (federal partnership taxation). All depreciable property is on a five year, straight-line basis. The LLC has adopted the remedial method. Your substantive Subchapter K analysis will be the determining factor in the outcome of the payroll glitch. I will be out sailing the seven seas until next week. See my secretary for notes from my meeting with Baltar. As you have not had a summer vacation, I don’t see why we should break that streak. Take the lead on this. I expect your memo and client letter on my desk upon my return. V. Riddle | Federal Partnership Taxation Vader & Firefly, LLP Smith Street Houston, TX 77002 Phone: Don’t bother calling, I’m sailing Cell: Never Client File No. 1998-0043 Meeting with Baltar on Friday, September 5, 2014 Baltar and three other individuals got together over a few pints to discuss the next “in” technology. Baltar was tired of the phablet fad. The four of them decided to create and build Wylons. Wylons are robots, created to “make our lives easier.” To build these Wylons, they formed an LLC, Galactica Enterprises (Galactica). For other unrelated reasons, Baltar joined Galactica Enterprises through his single member LLC, Caprica Enterprises (Caprica), which enjoys limited liability for state law purposes. The partnership was formed on January 1. There was no affirmative election under the check-the-box regulations. The partners split all items of profit and losses equally. The partners contributed the following to Galactica upon formation: Partner Asset AB FMV Adama: Land 1 Land 2 150,000 4,800,000 200,000 4,800,000 Baltar (Caprica): Cash 5,000,000 5,000,000 Cally: Cap Equip 1 Cap Equip 2 4,500,000 150,000 4,500,000 500,000 Dualla: Manu Equipment 3,500,000 5,500,000 (subject to 500,000 liability) The terms of the formation of Galactica were as follows: 1. Adama received $100,000 from Galactica upon Adama’s contribution of the two pieces of land. Land 1 was an adjacent parcel to Land 2. Further, Land 1 was unnecessary for any part of Galactica's Wylon operation. Adama did not want to keep it for unrelated reasons, but wanted to get some cash for its appreciated value. Adama had heard through “some unsavory friend” that individuals could pull money out of a partnership upon a contribution, and took his advice. 2. Cally will receive an annual distribution of $25,000 until Cally has received $500,000 before any other distributions are made. Cally’s Capital Equipment 2 is proprietary for their Wylon operation and Wylons cannot be manufactured without it. 3. Dualla contributed manufacturing equipment to Galactica. Six months before the contribution, Dualla obtained a $500,000 loan secured solely by the manufacturing equipment. Dualla used the proceeds to improve the equipment to make Galactica’s Wylons, and Galactica took the asset subject to the $500,000 security interest upon the contribution. Galactica and the partners in their individual capacity are not personally or severally liable for the security interest. However, in order to appease the creditor holding the security interest on the manufacturing equipment, Caprica agreed to guarantee $100,000 of the debt. Caprica has and will consistently have assets of $15,000,000 aside from its interest in Galactica. The four partners split liabilities according to the partnership agreement. 4. Caprica receives a $35,000 payment every year regardless of Galactica’s earnings for certain know-how related to the Wylon operation. Caprica has a separate contract from the partnership agreement regarding this payment. Over the next three years, the Wylon operation was extremely successful. Galactica generated $4 million of profit each year over these three years before depreciation. The partners then engaged in the following transactions in Year 3: 1. Galactica distributed Land 1 to Cally and Cap Equip 2 to Adama. 2. In addition, Galactica liquidated Dualla’s interest by distributing money and her share of inventory. However, Dualla wanted more Wylons as she believed they were a good investment for the future. Galactica had a basis of $5 million in the Wylons, and they have a fair market value of $15 million. Dualla wanted an extra $1 million of Wylons in lieu of cash for her interest. However, recently, Baltar, having read a lot science fiction, has decided the Wylon operation is not something he wants to be involved in anymore. The other partners agree the risk to humanity is too great for their conscience to ignore. Thus, Adama, Baltar, and Cally have agreed to sell their respective interests in Galactica to Blackstone Industries (Blackstone), an unrelated corporation. Immediately after the sale (in Year 5), Blackstone will own 100% of the interests in Galactica. Voice Message from V. Riddle – Mon 9/8/2014 12:00 PM A few more thoughts on my client before I hit the high seas… Based on the details surrounding the contributions each partner made to Galactica, I’d like for you to explain the consequences of the formation. It is important to know all the tax consequences of these four transactions in order to advise Baltar on his current situation. It would be most helpful, as a separate exhibit, to provide Galactica’s balance sheet as well as each of the partners’ outside basis and capital accounts at formation. We must explain the tax consequences to the partners of the transactions in Year 3, and you should update Galactica’s balance sheet as well as the remaining partners’ outside basis and capital accounts after these transactions. The balance sheets for both the formation and the Year 3 transactions will not count against your twelve page limit. Finally, discuss the potential U.S. tax consequences to Baltar and Blackstone from the sale of Galactica in Year 5. If you believe there are any ambiguities, please address these in your memorandum to me. END OF PROBLEM