INFORMING DESIGN DECISIONS: AN by University of Cincinnati

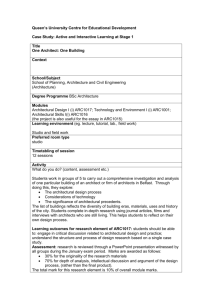

advertisement