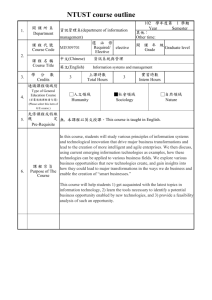

Document 10852023

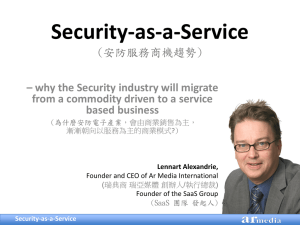

advertisement